Professional Documents

Culture Documents

ACCY200 Tutorial Solutions Week 8

Uploaded by

duraton940 ratings0% found this document useful (0 votes)

413 views10 pagesACCY200 Tutorial Solutions Week 8

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentACCY200 Tutorial Solutions Week 8

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

413 views10 pagesACCY200 Tutorial Solutions Week 8

Uploaded by

duraton94ACCY200 Tutorial Solutions Week 8

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 10

1

ACCY200: Financial Accounting IIA

School of Accounting and Finance

Autumn 2014

Week 8 Tutorial Solutions: Chapter 13, Ex 13.10, Ex 13.15, Ex 13.16

In-class activity: Ex 13.14

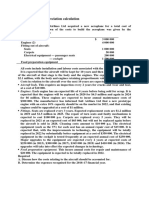

Exercise 13.10 REVALUATION OF ASSETS

Required

1. Prepare any necessary entries to revalue the building and the vehicle as at 30 June

2013.

2. Assume that the building and vehicle had remaining useful lives of 25 years and 4

years respectively, with zero residual value. Prepare entries to record depreciation

expense for the year ended 30 June 2014 using the straight-line method.

KOOKABURRA LTD

General Journal

1.

Accumulated depreciation Building Dr 100 000

Building Cr 100 000

(Writing down to carrying amount)

Loss on revaluation of building (P&L) Dr 20 000

Loss on revaluation of building (OCI) Dr 20 000

Building Cr 40 000

(Revaluation downwards of building)

Deferred tax liability Dr 6 000

Income tax expense (OCI) Cr 6 000

(Tax-effect of revaluation decrement on

previously revalued asset)

2

Asset revaluation surplus - Building Dr 14 000

Income tax expense (OCI) Dr 6 000

Loss on revaluation of building (OCI) Cr 20 000

(Reduction in accumulated equity due to

revaluation decrement on building)

Accumulated depreciation Vehicle Dr 40 000

Vehicle Cr 40 000

(Writing down to carrying amount)

Vehicle Dr 10 000

Gain on revaluation of vehicle (OCI) Cr 10 000

(Revaluation to fair value)

Income tax expense (OCI) Dr 3 000

Deferred tax liability Cr 3 000

(Tax-effect of revaluation increment)

Gain on revaluation of vehicle (OCI) Dr 10 000

Income tax expense (OCI) Cr 3 000

Asset revaluation surplus - vehicle Cr 7 000

2.

Depreciation expense Building Dr 6 400

Accumulated depreciation Building Cr 6 400

($160 000/25)

Depreciation expense Vehicle Dr 22 500

Accumulated depreciation Vehicle Cr 22 500

($90 000/ 4)

3

Exercise 13.15 ACQUISITIONS, DISPOSALS, DEPRECIATION

Required

Prepare general journal entries to record the transactions and events for the period 1

July 2012 to 30 September 2015. (Narrations are not required.) (Show all workings and

round amounts to the nearest dollar.)

SWAN LTD GENERAL JOURNAL ENTRIES

DATE DETAILS Dr Cr

2012

1 J uly Equipment 39 800

Cash 39 800

5 J uly Equipment 4 200

Cash 4 200

2013

30 J une Depreciation Equipment 4 220

Accumulated depreciation - Equipment 4 220

($44 000 $1 800/10 = $4 220)

2014

30 J une Depreciation Equipment 12 900

Accumulated depreciation - Equipment 12 900

($44 000 $1 200/5 = $8 560

+ adjustment for change in estimates [$8 560 4 220]

= $4 340) Alternatively, and in line with AASB108 not

covered in ACCY200, there should be no retrospective

adjustment for a change in estimate. What should have

been done was to use CA @ 1 July 2013 deducting new

RV and spread over remaining new useful life, ie 39780-

1200/4 = 9645) This issue of a change in estimate will

not be examined as we have not covered AASB108.

30 J une Accumulated depreciation Equipment 17 120

Equipment

(Write down to carrying amount)

17 120

4

Equipment 3 120

Gain on revaluation of equipment (OCI) 3 120

(Fair value $30 000; Carrying amount $26 880;

Revaluation increase $3 120)

Income tax expense (OCI) 936

Deferred tax liability

(Tax-effect of revaluation increment)

Gain on revaluation of equipment (OCI)

Income tax expense (OCI)

Asset revaluation surplus

(Transfer to accumulated equity subsequent to

revaluation of asset)

3 120

936

936

2184

2015

30 J une Depreciation Equipment 9 600

Accumulated depreciation Equipment 9 600

($30 000 $1 200/3 = $9 600)

Accumulated depreciation Equipment 9 600

Equipment 9 600

(Write down to carrying amount)

Loss on revaluation of plant (OCI)

Loss on revaluation of plant (P&L)

Plant

(Fair value $16 000; Carrying amount $20 400;

Revaluation decrease $4 400)

Deferred tax liability

Income tax expense (OCI)

(Tax effect on decrement relating to prior increment)

Asset revaluation surplus

3120

1280

936

2 184

4 400

936

Income tax expense (OCI) 936

Loss on revaluation of plant (OCI)

(Reduction in accumulated equity due to devaluation of

plant)

3 120

5

2015

30 Sept Depreciation expense Equipment 1 850

Accumulated depreciation - Equipment 1 850

(3/12[$16 000 $1 200/2])

Accumulated depreciation Equipment 1 850

Carrying amount of Equipment 14 150

Equipment 16 000

Cash 8 400

Proceeds on sale Equipment 8 400

Exercise 13.16 REVALUATION MODEL

Required

Prepare the journal entries in the records of Peewee Ltd to record the described events

over the period 1 July 2013 to 30 June 2015, assuming the ends of the reporting periods

are 30 June 2014 and 30 June 2015.

PEEWEE LTD

1 July 2013

Machine A Dr 100 000

Machine B Dr 60 000

Cash Cr 160 000

30 June 2014

Depreciation expense Machine A Dr 20 000

Accumulated depreciation Cr 20 000

(1/5 x $100 000)

Depreciation expense Machine B Dr 20 000

Accumulated depreciation Cr 20 000

(1/3 x $60 000)

Accumulated depreciation- Machine A Dr 20 000

Machine A Cr 20 000

(Writing down to carrying amount)

Machine A Dr 4 000

Gain on revaluation of Machine A (OCI) Cr 4 000

(Revaluation increment: $80 000 to $84 000)

6

Income tax expense (OCI) Dr 1 200

Deferred tax liability Cr 1 200

(Tax effect of revaluation increment)

Gain on revaluation of Machine A (OCI) Dr 4 000

Income tax expense (OCI) Cr 1 200

Asset revaluation surplus Machine A Cr 2 800

(Accumulation of net revaluation gain in equity))

Accumulated depreciation Machine B Dr 20 000

Machine B Cr 20 000

(Writing down to carrying amount)

Expense revaluation decrement (P&L) Dr 2 000

Machine B Cr 2 000

(Revaluation to fair value at 30/6/14)

1 January 2015

Machine C Dr 80 000

Cash Cr 80 000

(Acquisition of machine C)

Depreciation expense Machine B Dr 9 500

Accumulated depreciation Cr 9 500

(1/2 x /1/2 x $38 000)

Cash Dr 29 000

Proceeds on sale of Machine B Cr 29 000

(Sale of Machine B)

Carrying amount of Machine B Sold Dr 28 500

Accumulated depreciation Dr 9 500

Machine B Cr 38 000

(Carrying amount of machine sold)

General reserve Dr 8 000

Asset revaluation surplus Machine A Dr 2 000

Share Capital Cr 10 000

7

30 June 2015

Depreciation expense Machine A Dr 21 000

Accumulated depreciation Cr 21 000

(1/4 x $84 000)

Depreciation expense Machine C Dr 10 000

Accumulated depreciation Cr 10 000

(1/4 x x $80 000)

Accumulated depreciation Machine A Dr 21 000

Machine A Cr 21 000

(Writing down to carrying amount)

Loss on revaluation of Machine A (OCI) Dr 2 000

Machine A Cr 2 000

(Write down of plant from $63000 to $61000)

Deferred tax liability Dr 600

Income tax expense (OCI) Cr 600

(Tax-effect on downward revaluation

subsequent to upward revaluation)

Asset revaluation surplus Machine A Dr 800

Income tax expense (OCI) Dr 600

Loss on revaluation of plant (P&L) Dr 600

Loss on revaluation of plant (OCI) Cr 2 000

(Accumulation of revaluation loss to equity)

Accumulated depreciation Machine C Dr 10 000

Machine C Cr 10 000

(Writing down to carrying amount)

Loss on revaluation (P&L) Dr 1 500

Machine C Cr 1 500

(Revaluation to fair value at 30/6/15)

8

In-class activity:

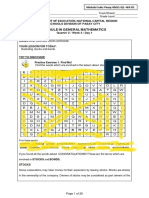

Exercise 13.14 ACQUISITION AND SALE OF ASSETS, DEPRECIATION

Required

Prepare general journal entries to record the transactions and events for the reporting

period ended 30 June 2014.

LARKS TURF FARM

Part 1 General Journal Entries

DATE DETAILS

Dr Cr

10/08/13 Irrigation equipment

Cash

37 000

37 000

16/08/13 Irrigation equipment

Cash

500

500

03/09/13 Repairs and maintenance expense

Cash

800

8 00

19/09/13 Irrigation equipment

Cash

9 600

9 600

01/12/13 Depreciation Turf cutter

Accumulated depreciation Turf cutter

($65 000 $3 200/5 x 5/12 = $5 150)

5 150

5 150

01/12/13 Carrying amount Turf cutter ($65 000 $47 517)

Accumulated depreciation Turf cutter ($42 367 + $5

150)

Turf Cutter

17 483

47 517

65 000

01/12/13 Turf cutter

Cash

Proceeds on sale Turf cutter

80 000

61 000

19 000

28/03/14 Depreciation - Building

Accumulated depreciation - Building

($150 000 $40 000/20 x 9/12 = $4 125)

4 125

4 125

9

28/03/14 Accumulated depreciation Building ($23 375 + $4

125)

Office building

27 500

27 500

28/03/14 Office building

Cash

49 000

49 000

30/06/14 Depreciation expense Turf cutter

Accumulated depreciation Turf cutter

($80 000 $5 000/6 x 7/12 = $7 292)

7 292

7 292

30/06/14 Depreciation expense Water desalinator

Accumulated depreciation Water desalinator

($189 000 $18 000/9 = $19 000)

19 000

19 000

30/06/14 Depreciation expense Irrigation equipment

Accumulated depreciation Irrigation equipment

($47 100 0/4 x 9/12 = $8 831)

8 831

8 831

30/06/14 Depreciation expense Building

Accumulated depreciation - Building

($150 000 $27 500 + $49 000 = $171 500

$171 500 [$40 000 + $5 000)/{20 -5 + 4} = $6 658 p.a.

$6 658 x 3/12 = $1 665)

1 665

1 665

30/06/14 Accumulated depreciation Water desalinator

Water desalinator

(Writing down to carrying amount)

Loss on revaluation of desalinator (OCI)

Water desalinator

(Revaluation downwards from carrying amount of $170 000

(being $189 000 - $19 000) to fair value of $165 000)

19 000

5000

19 000

5 000

10

30/06/14

Deferred tax liability

Income tax expense (OCI)

(Tax-effect of revaluation decrement subsequent to previous

increment)

Asset revaluation surplus

Income tax expense (OCI)

Loss on revaluation of desalinator (OCI)

(Reduction in accumulated equity due to revaluation

decrement on land)

1500

3500

1 500

1500

5000

You might also like

- hw1 AnsDocument7 pageshw1 AnsMingyanNo ratings yet

- Homework For Chapter 8Document6 pagesHomework For Chapter 8Pramit Singh0% (1)

- ACCT2201 Chapter 9Document8 pagesACCT2201 Chapter 9erinNo ratings yet

- Mpu3123 Titas c2Document36 pagesMpu3123 Titas c2Beatrice Tan100% (2)

- Income Statements 2010Document10 pagesIncome Statements 2010Shivam GoelNo ratings yet

- Applied Auditing by CabreraDocument25 pagesApplied Auditing by CabreraClarize R. Mabiog67% (9)

- Tutorial Chapter 8Document3 pagesTutorial Chapter 8fitrieyfiey0% (1)

- Chapter 7 Market Structure: Perfect Competition: Economics For Managers, 3e (Farnham)Document25 pagesChapter 7 Market Structure: Perfect Competition: Economics For Managers, 3e (Farnham)ForappForapp100% (1)

- Assignment Advance Fin AccountingDocument12 pagesAssignment Advance Fin AccountingAdrian ChrissanjayaNo ratings yet

- Topic 4 Revaluation Property Plant and EquipmentDocument6 pagesTopic 4 Revaluation Property Plant and Equipmentjinman bongNo ratings yet

- Chapter 10Document89 pagesChapter 10kazimkoroglu100% (1)

- Tutorial Week 4 Homework Chapter 7 & 9 QuestionsDocument4 pagesTutorial Week 4 Homework Chapter 7 & 9 QuestionsShek Kwun HeiNo ratings yet

- Capital Allowances Lecture Summary (Third) 2020Document19 pagesCapital Allowances Lecture Summary (Third) 2020Tatenda RamsNo ratings yet

- Tutorial 3 Tutorial 3Document13 pagesTutorial 3 Tutorial 3Andrei Nicole RiveraNo ratings yet

- Tutorial 4 SolutionsDocument5 pagesTutorial 4 SolutionsnaboumilikaNo ratings yet

- AF210 Unit 4 Tutorial SolutionsDocument5 pagesAF210 Unit 4 Tutorial SolutionsChand DivneshNo ratings yet

- Depreciation CalculationDocument29 pagesDepreciation CalculationRavineahNo ratings yet

- Depn Ch11IDocument3 pagesDepn Ch11Isamia.aliNo ratings yet

- IAS 36 Additional Question SolutionsDocument9 pagesIAS 36 Additional Question SolutionsTatenda Webster MushaurwiNo ratings yet

- Analyzing Adjusting Entries and Financial StatementsDocument12 pagesAnalyzing Adjusting Entries and Financial StatementsTuba AkbarNo ratings yet

- Fabrisio LTD General Journal 1 Ref/Date Particulars Amount (DR) Amount (CR)Document5 pagesFabrisio LTD General Journal 1 Ref/Date Particulars Amount (DR) Amount (CR)Dan GallagherNo ratings yet

- Audit Property, Plant and Equipment AssignmentDocument2 pagesAudit Property, Plant and Equipment AssignmentDan Andrei BongoNo ratings yet

- Impairment PDFDocument7 pagesImpairment PDFKhensaniNo ratings yet

- FAC2601 Assignment 02Document4 pagesFAC2601 Assignment 02SibongileNo ratings yet

- j14 F7int AnsDocument10 pagesj14 F7int AnsSajidZiaNo ratings yet

- Dipifr Int 2010 Dec A PDFDocument11 pagesDipifr Int 2010 Dec A PDFPiyal HossainNo ratings yet

- CA IPCC Accounts Group I Nov 14 Guideline Answers 08.11.2014Document16 pagesCA IPCC Accounts Group I Nov 14 Guideline Answers 08.11.2014anupNo ratings yet

- 4 5807634410916285735Document5 pages4 5807634410916285735magwazagroup33No ratings yet

- 2.1 Suggested Solutions Impairment 2020Document12 pages2.1 Suggested Solutions Impairment 2020lameck noah zuluNo ratings yet

- ACCT6005 COMPANY ACCOUNTING ASSESSMENT 2 CASE STUDYDocument8 pagesACCT6005 COMPANY ACCOUNTING ASSESSMENT 2 CASE STUDYRuhan SinghNo ratings yet

- Asset Depreciation and Revaluation ReportDocument10 pagesAsset Depreciation and Revaluation ReportAaliyah ManuelNo ratings yet

- 10 Non-Current AssetsDocument25 pages10 Non-Current AssetsDayaan ANo ratings yet

- 13.4 IAS 21 - SolutionsDocument21 pages13.4 IAS 21 - SolutionsStaid LynxNo ratings yet

- REVISED SS CT FAR270 May 2021 With ExplanationDocument4 pagesREVISED SS CT FAR270 May 2021 With Explanationsharifah nurshahira sakinaNo ratings yet

- Chapter 26 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document31 pagesChapter 26 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- FAC3761 - Exam Prep - Mock Question Paper - Suggested SolutionDocument9 pagesFAC3761 - Exam Prep - Mock Question Paper - Suggested SolutionRene EngelbrechtNo ratings yet

- Final Account QuestionsDocument52 pagesFinal Account QuestionsAhmad Taimoor RanjhaNo ratings yet

- Handbook - IFRS Financial Accounting 2021 - II OnlineDocument47 pagesHandbook - IFRS Financial Accounting 2021 - II OnlineDany DanielNo ratings yet

- Capital and Tax Accounting BasicsDocument22 pagesCapital and Tax Accounting BasicsNorjjay ManNo ratings yet

- Answer BE9-2 Explanation:: Calculation of Book Value and Accumulated Depreciation For Each of The AssetsDocument2 pagesAnswer BE9-2 Explanation:: Calculation of Book Value and Accumulated Depreciation For Each of The AssetsYousuf SiyamNo ratings yet

- F7uk 2011 Dec AnsDocument10 pagesF7uk 2011 Dec Ansahsan_zeb_1No ratings yet

- CMA April - 14 Exam Question SolutionDocument55 pagesCMA April - 14 Exam Question Solutionkhandakeralihossain50% (2)

- Chapter 9 Solutions - Inclass ExercisesDocument5 pagesChapter 9 Solutions - Inclass ExercisesSummerNo ratings yet

- Accounting Treatment of DepreciationDocument5 pagesAccounting Treatment of Depreciationwebsurfer755100% (3)

- Memorandum Question 3 Carlie LTD 2021Document10 pagesMemorandum Question 3 Carlie LTD 2021NOKUHLE ARTHELNo ratings yet

- Management Accounting: Page 1 of 6Document70 pagesManagement Accounting: Page 1 of 6Ahmed Raza MirNo ratings yet

- 0452 w15 Ms 22 PDFDocument10 pages0452 w15 Ms 22 PDFAnonymous ustYBQOaEB100% (2)

- 9706 Accounting: MARK SCHEME For The May/June 2015 SeriesDocument6 pages9706 Accounting: MARK SCHEME For The May/June 2015 SeriesMahad UmarNo ratings yet

- Financial Accounting and Reporting: IFRS - 2015 December MSDocument18 pagesFinancial Accounting and Reporting: IFRS - 2015 December MSMarchella LukitoNo ratings yet

- Unit 5 - Depreciation - Chat Session 8 (Spring 2020)Document5 pagesUnit 5 - Depreciation - Chat Session 8 (Spring 2020)RealGenius (Carl)No ratings yet

- ACW2491 Financial Accounting Tutorial Solution Semester 2 2018 Topic 5: Property, Plant and Equipment-RevaluationDocument8 pagesACW2491 Financial Accounting Tutorial Solution Semester 2 2018 Topic 5: Property, Plant and Equipment-RevaluationAhsan MasoodNo ratings yet

- Acct 217 Q &aDocument17 pagesAcct 217 Q &aLeroyNo ratings yet

- Specific Financial Reporting Ac413 MAY2016Document5 pagesSpecific Financial Reporting Ac413 MAY2016AnishahNo ratings yet

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- 7110 Principles of Acounts: MARK SCHEME For The October/November 2006 Question PaperDocument6 pages7110 Principles of Acounts: MARK SCHEME For The October/November 2006 Question Papermstudy123456No ratings yet

- Swinburne University ACC10007 Discussion QuestionsDocument5 pagesSwinburne University ACC10007 Discussion QuestionsRenee WongNo ratings yet

- Comprehensive Audit of Balance Sheet and Income Statement AccountsDocument25 pagesComprehensive Audit of Balance Sheet and Income Statement AccountsJin KyNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Presentation QUESTION SOLUTIONSDocument1 pagePresentation QUESTION SOLUTIONSduraton94No ratings yet

- Values & System ThinkingDocument4 pagesValues & System Thinkingduraton94No ratings yet

- Week 2 Tutorial SolutionsDocument5 pagesWeek 2 Tutorial Solutionsduraton94No ratings yet

- EOQ decision model issuesDocument5 pagesEOQ decision model issuesduraton94No ratings yet

- ACCY312 Week 3 Tutorial SolutionsDocument4 pagesACCY312 Week 3 Tutorial Solutionsduraton94No ratings yet

- ACCY312 Week 4 Tutorial SolutionsDocument3 pagesACCY312 Week 4 Tutorial Solutionsduraton94No ratings yet

- InvictusDocument3 pagesInvictusduraton94100% (1)

- Effect of Agricultural Transformation Agenda Support Program Phase 1 Atasp 1 On Farmers' Performance in Southeast, NigeriaDocument12 pagesEffect of Agricultural Transformation Agenda Support Program Phase 1 Atasp 1 On Farmers' Performance in Southeast, NigeriaEditor IJTSRDNo ratings yet

- JPIM GanjilDocument8 pagesJPIM GanjilNanda Juragan Sandal JepitNo ratings yet

- Outlook Money - May 2018 PDFDocument84 pagesOutlook Money - May 2018 PDFSenthil KumarcNo ratings yet

- Risks in Foreign ExchangeDocument19 pagesRisks in Foreign ExchangeDivya BhadriNo ratings yet

- DHL's Strengths, Weaknesses, Opportunities and ThreatsDocument2 pagesDHL's Strengths, Weaknesses, Opportunities and ThreatsDulanji Imethya YapaNo ratings yet

- Mental Models For SustainabilityDocument25 pagesMental Models For Sustainabilitywjr123100% (1)

- 03 Stem 11 Pasay Genmath q2 w4Document20 pages03 Stem 11 Pasay Genmath q2 w4Jay Kenneth Baldo0% (1)

- Business TaskDocument2 pagesBusiness TaskBlanca Bescós CalderónNo ratings yet

- Ph.D. Viva Voce on Derivatives Risk ManagementDocument51 pagesPh.D. Viva Voce on Derivatives Risk ManagementAbhijeet BirariNo ratings yet

- Promotion: Personal SellingDocument25 pagesPromotion: Personal Sellinghardik08No ratings yet

- M-127244 Nea 361Document2 pagesM-127244 Nea 361Lonely NessNo ratings yet

- Solution Manual For Cfin2 2nd Edition by BesleyDocument5 pagesSolution Manual For Cfin2 2nd Edition by BesleyAmandaHarrissftia100% (79)

- Review of The Legal and Institutional Framework For Market Competition in EthiopiaDocument130 pagesReview of The Legal and Institutional Framework For Market Competition in EthiopiaerenaNo ratings yet

- 3250 NoteDocument186 pages3250 Noterooney_hunterxhunterNo ratings yet

- Module4 - Export Distribution ChannelsDocument26 pagesModule4 - Export Distribution ChannelsDexter Dela PazNo ratings yet

- Emerging Trends of Online Shopping Retails by Branded RetailersDocument31 pagesEmerging Trends of Online Shopping Retails by Branded Retailersanushi guptaNo ratings yet

- Finance AssignmentDocument11 pagesFinance AssignmentMaral KorpeyevaNo ratings yet

- 66 GazetteDocument26 pages66 GazetteanhthyanhNo ratings yet

- CLF 2nd Grading Cycle 1Document10 pagesCLF 2nd Grading Cycle 1SEM06-G32-Velasco, Geryne D.No ratings yet

- Assignments 24 March - March 31 2015Document2 pagesAssignments 24 March - March 31 2015Alex HuesingNo ratings yet

- Full Text of Federal Reserve Chairman Ben Bernanke's Speech in Jackson Hole, Wyo.Document8 pagesFull Text of Federal Reserve Chairman Ben Bernanke's Speech in Jackson Hole, Wyo.lawrenceNo ratings yet

- Strategies For Competing in International MarketsDocument59 pagesStrategies For Competing in International MarketsMI chowdhuryNo ratings yet

- Nirmal Bang Securities Pvt. LTD Company ProfileDocument7 pagesNirmal Bang Securities Pvt. LTD Company ProfileTeja Choudhary Medarametla100% (2)

- Supertraderx Academy Crash CourseDocument78 pagesSupertraderx Academy Crash CourseAnonymous jCmzKg5bNo ratings yet

- Finance MCQSDocument30 pagesFinance MCQSShakeelNo ratings yet

- Wrapping Desires Business PlanDocument42 pagesWrapping Desires Business PlanDanish IqbalNo ratings yet

- Cost & Management Accounting - Lec 2Document30 pagesCost & Management Accounting - Lec 2Agnes JosephNo ratings yet

- Marketing Strategies of Ufone For MBA StudentsDocument7 pagesMarketing Strategies of Ufone For MBA StudentsShaun BhattiNo ratings yet