Professional Documents

Culture Documents

Annonymous Report 2012

Uploaded by

giakhanh3989Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annonymous Report 2012

Uploaded by

giakhanh3989Copyright:

Available Formats

Release Date: April 24, 2012

Huabao International

Smoke and Mirrors

Ticker: 0336:HK

Recent Price: HK$4.33

Market Cap: HK$14 billion

Dividend Yield: HK$3.66%

Target Price: HK$7.80

Implied Return: 80.0%

Strong Sell

You should have expected us

anonanalytics@neomailbox.net

www.anonanalytics.com

1

Any investment involves substantial risks, including complete loss of capital. Any forecasts or estimates

are for illustrative purpose only and should not be taken as limitations of the maximum possible loss or

gain. Any information contained in this report may include forward-looking statements, expectations,

and projections. You should assume these type of statements, expectations, and projections may turn

out to be incorrect.

All facts, figures, and opinions are as at the last practicable date. This document has been prepared for

informational purposes only. This document is not an offer, or the solicitation of an offer, to buy or sell a

security or enter into any other agreement. We have made every effort to ensure that all information

contained herein is accurate and reliable, and has been obtained from public sources we believe to be

accurate and reliable, and who are not insiders or connected person of the stock or company covered

herein or who may otherwise owe any fiduciary duty to the issuer. However, we do not represent that it

is accurate or complete and should not be relied on as such. Anonymous Analytics is not a registered

investment advisors.

Do not assume that any company mentioned herein has reviewed our report prior to its publication. We

make no representation or warranty, expressed or implied, in respect to the information contained in

this report and accept no liability whatsoever for any loss or damage arising from any distribution or

reliance on this report or its contents.

Anonymous Analytics holds no direct or indirect interest or position in any of the securities profiled in

this report. However, you should assume that certain contributors to this report, as well as their

members, partners, affiliates, colleagues, employees, consultants, muppets clients and investors, as well

as our clients have a short position in the stock of Huabao International Holdings Limited (HK:336,

Huabao or the Company) and/or options of the stock, and therefore stand to gain substantially in

the event that the price of the stock declines. You should further assume that following the distribution

of this report, the aforementioned individuals and entities may continue transacting in the securities

covered therein, and may be long, short or neutral at any time hereafter regardless of this reports initial

recommendation.

We waive our right to copyright protection laws as they pertain to redistribution. Accordingly, any part

of this report may be reproduced in context without our consent.

Disclaimer

2

We see Huabao International as a pump and dump scheme with the primary objective of enriching its

Chairwoman, Chu Lam Yiu and her proxies at the expense of shareholders. Since the inception of

Huabao, Ms. Chu has sold nearly US$1.2 billion in stock, bringing her ownership of the Company from

97.6% to 37.7%

News searches prior to the founding of Huaba in 2004 reveal no history of Ms. Chu, yet her sudden

accumulation of wealth has not gone unnoticed. Last year Ms. Chu was ranked the 8

th

richest woman in

China at the age of 41 on Huruns list of Self-Made Women Billionaires. Notably, Hurun also published a

Cashout List, which lists billionaires who have been cashing out of their own companies. The list places

Ms. Chu at No. 2, having cashed out of US$549 million last year alone. The sum was so large that she

was dubbed the Queen of Cashout by the Shanghai Daily.

As detailed in this report, Huabao International came public via a reverse merger into a defunct

company ( Leaktek Ltd.) which had failed due to fraud. Shortly thereafter, Huabaos auditor (Deloitte

Touche Tohmatsu) resigned. Among its peers, Huabao reports the highest margins and the highest

revenue growth, while maintaining some of the industrys lowest R&D expense. While all industry peers

report gross margins in the 40-50% range, Huabao reports consistent margins upwards of 70%. Further,

following the shell entitys acquisition of the core Huabao business in 2006, the margins of the target

increased dramatically despite there being no notable synergies or change in management.

From inception until August 2011, Huabaos Audit Committee Chairman was Mr. Mak Kin Kwong.

Mr. Mak was forced to resign following a trifecta of fraud charges and investigations from securities

regulators in each of mainland China, Hong Kong, and the US. In each case, Mr. Mak was involved as a

director or CFO of a publicly listed company which was delisted or halted due to fraud. The companies

include: A-Power (formerly Nasdaq: APWR) delisted due to fraud; Chengdu Unionfriend (formerly

SHZ:000693) delisted due to fraud; Real Gold Mining (HKG:0246) halted due to fraud.

Huabao has made efforts to conceal its operations by using such tactics as substantially reducing its

public disclosures in financial reporting and using Photoshop to hide the location of one its facilities.

Undeniably, Huabaos greatest shield against market scrutiny has been its large dividends. Management

makes a point of noting that Huabao has paid out HK$2.4 billion in dividends since inception. What

management declines to mention is that throughout this period, half of all dividends have circled back

to the Chairwoman due to her interest in Huabao. With the Chairwoman having sold out the majority of

her stake, Huabao has managed dividend expectations significantly lower by entering a highly capital

intensive industry.

Reducing dividend expectations was crucial because we have evidence that Huabao is not nearly as

profitable as it claims. Huabaos Chinese filings show large discrepancies from Hong Kong filings. Many

of Huabaos supposed customers do not consider themselves customers or have simply never heard of

Huabao. Furthermore, as evidenced in this report, we believe Huabao has undertaken massively inflated

related party transactions in an attempt to avoid paying dividends when possible and to explain to

auditors why their bank account is empty.

Executive Summary

3

Huabao International is undisputedly Chinas largest flavour & fragrance (F&F) company. With gross

margins of 75%, some have quoted its dominance of the Chinese industry as a near monopoly.

The F&F industry supplies flavours and fragrance that are used in a wide array of products: foods &

beverages, cosmetics, detergents, and tobacco products, to name a few.

As presented in Exhibit 1, there are several major or otherwise relevant F&F companies we have used as

comparables in this report.

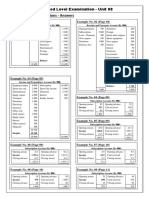

Exhibit 1

Peer Comparables

Company Ticker Market Cap (US$) Geography Focus

Huabao International 0336:HK 2,000M China Tobacco

China Flavors & Fragrances 3318:HK 95M China Tobacco

International Flavors & Fragrances IFF:NYSE 4,740M Global F&B, Consumer

Symrise SYX:GER 3,341M Global F&B, Consumer

Givaudan GIVN:VTX 8,870M Global F&B, Consumer

As shown, International Flavors & Fragrances (IFF), Symrise, and Givaudan are global industry players

that primarily supply flavouring to the consumer market, specifically food & beverages, cosmetics, and

household products. On the other hand, Huabao and China Flavors & Fragrances (CF&F) are domestic

companies that primarily supply Chinas tobacco industry.

Flavours & Fragrances in Cigarette Manufacturing

While F&F in consumer products should be intuitively understood, its use in tobacco products may not

be. So, here we give an overview of the tobacco flavoring application and process, specifically as it

pertains to cigarettes:

The manufacturing of a cigarette stick goes through several stages. One of these stages is called casing

or topping. In the casing process, loose tobacco leaves are sprayed with flavoring agents such as cocoa,

licorice, glycerin, and other additives. This process helps mask the smell of tobacco, enhances overall

flavour during smoking, and can provide the distinctive signature of a brand. Sometimes cigarette

filters can also be dipped in flavouring, but these are generally considered specialty cigarettes and are a

very small portion of the overall cigarette market.

In China, the manufacturing of tobacco products is strictly controlled by the State Tobacco Monopoly

Administration (STMA). The STMA is a government body that is responsible for enforcing the tobacco

monopoly in China. Under the STMA, there are several state-owned enterprises (SOE) that manufacture,

market, and distribute all the cigarettes and tobacco products consumed in China. As a result, Huabaos

primary customers are government-controlled entities.

</primer>

Flavours and Fragrances: Industry Primer

4

Over the last five months, we have expended considerable resources and time analyzing Huabao. We

have pored over every public filing since Huabaos reverse merger. We have pulled 23 sets of SAIC

documents covering all of Huabaos relevant subsidiaries. We have made over 150 phone calls to the

SOE dominated tobacco industry, resulting in conversations with representatives from all the major

cigarette manufacturers. We have spoken with customers, competitors, and industry experts. We have

gone to unbelievable lengths to locate facilities and shadow figures that management had hoped to

keep secret. We have dispatched teams to multiple locations spanning three continents. We have a

better understanding of Huabao, its operations and its associates than any bank, analyst, or institution.

This is not a statement of opinion. This is a statement of fact.

This report presents our evidence and conclusion. We review Huabaos backdoor listing, its history of

related party transactions, massive insider selling, and suspiciously strong financial metrics. We also

detail our business diligence findings gathered from a large number of calls and site visits. Altogether,

we present evidence of a pump and dump operation that is misleading its shareholders and grotesquely

exaggerating its business.

Introduction

5

We lay the groundwork for our analysis by providing a summary of Huabaos colorful history.

April 30, 2004 Huabao International goes public through a backdoor listing.

It should be noted that backdoor listings, by definition, are designed to circumvent listing rules and

avoid independent scrutiny of business operations and corporate governance. They are also significantly

more prone to issues of fraud and corruption. It is utterly inappropriate for a company that deals

primarily with state-owned enterprises (SOEs) to go public in such a manner.

It should also be noted that Huabao went public through Leaptek Limited, a company whose business

operations primarily consisted of consumer electronics, computer products, and fraud. To be perfectly

clear, Leaptek was not merely a shell entity or capital pool company type vehicle awaiting a backdoor

listing. It had a highly questionable history consisting of auditor resignations, director resignations,

management firings, and cooked books deserving of its own investigative report. Despite all this, it took

Huabao over two years to slowly wind down Leapteks phantom business before eventually discarding

it for HK$1.

March 28, 2006 Deloitte Touche Tohmatsu resign as the firms auditors.

The Event: Within two years of the backdoor listing, Huabaos auditors resign.

Managements Response: In a released statement, management claims the resignation of Deloitte was

a result of fee disputes.

1

The Truth: As we mentioned in a previous report, auditors rarely resign as a result of fee disputes. There

is sufficient competition among the Big Four and second tier audit firms to ensure they dont nickel and

dime clients. Fee disputes are almost exclusively used as a means for auditors to resign without being

forced to bring attention to uncovered financial irregularities.

In fact, a paper released in 2010 by the Hong Kong Institute of Certified Public Accountants states the

following:

The Stock Exchange of Hong Kong Limited (SEHK) and the Securities and Futures Commission (SFC) have

raised concerns with the Hong Kong Institute of Certified Public Accountants concerning announcements

made by listed issuers of the SEHK of the reasons for changes in auditors. In many cases, fee disputes are

stated to be the reason for the change. Concern has been expressed that certain auditors have been

relying on purported fee disputes to disguise the real reasons for the change. As a result, potentially

significant and fundamental matters about the listed issuer may not be disclosed to investors and

creditors and the market is not therefore being kept fully informed. It is important that the situation

concerning the change of auditors should be disclosed in full to avoid the possibility of the market being

misled.

2

1

http://www.hkexnews.hk/listedco/listconews/sehk/2006/0329/LTN20060329082.pdf

2

http://app1.hkicpa.org.hk/ebook/HKSA_Members_Handbook_Master/volumeI/COE.pdf

History [sec 1]

6

Clearly, Huabaos origins are consistent with excellence in corporate governance and transparency.

But a backdoor listing and questionable auditor resignation are not the only red flags in Huabaos

opaque history, which also involves absurd related party transactions, massive insider selling, and

awkward executive resignations. A discussion of these issues follows:

Related Party Transactions 1.1

August 1, 2006 Huabao acquires substantial assets through the Chairwoman, part I

The Event: Huabao, as a shell company, acquires Chemactive Investments Limited, a flavor and

fragrance supplier to the tobacco industry.

The acquisition price was HK$4 billion (US$513M) in convertible preferred shares, based on 13.6 times

the targets net income of HK$294 million (US$37M)

3

. To put that number in perspective, the net

income for Huabao during the same time period was a loss of HK$7 million (US$0.9M). This massive

acquisition of a highly profitable company was by way of an asset injection through its then 36 year-old

CEO and Chairwoman, Ms. Chu Lam Yiu.

Our Take:

(i) The share dilution and new convertibles effectively gave Ms. Chu 97.57% ownership of the

combined entity.

(ii) Based on its financials, Chemactive claimed net income of HK$294M, total assets of

HK$869M, and net equity of HK$498M. Thats an ROA of 35% and ROE of 61%.

Okay, well play along.

(iii) We certainly do believe Chemactive had a legitimate operating business in tobacco

flavoring, as is evidenced by their JV with Hongta Tobacco Group, a prominent SOE tobacco

company. But as we show in this report, we also believe that the extent of the business was,

and continues to be, exaggerated.

(iv) Chemactive was in the business of providing flavoring to the tobacco industry, a very

mature, very established field controlled entirely by SOEs. We find it improbable that a 36

year-old was able to break into this field and build a multi-billion dollar empire. In fact, a

search on Factiva and Lexis-Nexis for Chu Lam Yiu displayed no articles or news information

prior to 2004, the year she purchased Leaptek.

(v) As part of the acquisition, Ms. Chu signed a non-compete agreement. This agreement

stipulated that Ms. Chu no longer owned any business or interest that would compete with

Huabao.

3

http://www.hkexnews.hk/listedco/listconews/sehk/2006/0629/LTN20060629078.pdf

7

The acquisition of Chemactive provided the backbone of Huabaos current business operations. As we

demonstrate throughout this report, we also believe this acquisition was the basis of what would

become a materially exaggerated business operation designed to benefit insiders and their proxies.

July 30, 2007 Huabao acquires substantial assets through the Chairwoman, part II

The Event: Huabao acquires Win New Group Limited and its subsidiaries, a flavor and fragrance supplier

to the tobacco and food industry. The acquisition price was HK$652 million (US$84M) in cash, based on

a whopping 21 times the targets net income of HK$31 million (US$4M). This acquisition was also by way

of an asset injection through Ms. Chu.

Our Take:

(i) Remember the non-compete clause that was signed by Ms. Chu 11 months earlier when she

sold Chemactive to Huabao? The one that stated she had no interest in a competing

business? Well, within 11 months she managed to buy this tobacco flavor company from a

third party only to resell it to Huabao for HK$652 million. No lack of transparency here.

(ii) There is absolutely no legitimate reason for the Chairwoman to privately buy a company

only to resell it to Huabao. Acquisition by asset injection through a related party rather than

M&A through independent parties is completely inappropriate and should immediately raise

red flags with investors.

We believe the absurd acquisition price combined with the nature of the acquisition was

simply a way to transfer fake earnings/cash out of the Company. More on this later.

July 7, 2008 Huabao acquires substantial assets through the Chairwoman, part III

The Event: On March 26, 2008, Ms. Chu privately acquired Wealthy King Investments and its subsidiaries

(a tobacco flavoring company) from a third party. She paid for the acquisition by transferring HK$451

million (US$58M) worth of her share holdings in Huabao to the vendor, plus an undisclosed amount of

cash.

4

Three months later (July 7, 2008), she turned around and resold Wealthy King Investments to Huabao

for HK$871 million (US$112M). This price was based on 12 times the targets unaudited net income of

HK$70 million (US$9M).

Our Take:

(i) It speaks volumes that such a significant, yet opaque, transaction went through unaudited.

(ii) We challenge investors and the analysts that are promoting this stock to answer the

following questions: Is this how a transparent management team operates? Is there any

legitimate reason for these types of transactions to be taking place?

4

http://www.hkexnews.hk/listedco/listconews/sehk/2008/0326/LTN20080326439.pdf

8

November 20, 2009 Huabao acquires substantial assets through the Chairwoman, part IV

The Event: Huabao acquires F&G Botswana, an African-based raw materials supplier to Huabao, which is

100% owned by Ms. Chu.

The acquisition price was HK$29 million (US$3.8M) in cash, implying 7.3 times multiple on the Targets

approximate net income of HK$4 million (US$0.5M).

5

Our Take: We found this acquisition somewhat peculiar given managements modus operandi. The

acquisition price seemed reasonable enough to not raise any attention, but we found it strange that

Huabao would establish such a remote base which management claims is in the business of production

and sales of natural extracts and provides the Company with an established upstream raw material

extraction base.

Our initial thoughts were that perhaps Botswana was home to a unique species of flora which Huabao

used extensively in its flavouring business. But this theory began to make little sense when one

considers that importing raw materials would likely be much less costly than establishing and manning

an extraction base in such a remote location.

Furthermore, it appears that management has gone to great lengths to hide the location of the

Botswana base. We say this for several reasons:

First, as shown in Exhibit 2, management provides country and city locations of all their facilities in their

annual report. They even provide the city where their German R&D base is. However, they make no

mention of the city where F&G Botswana is located.

Exhibit 2

Source: Company report

5

http://www.hkexnews.hk/listedco/listconews/sehk/2009/1120/LTN20091120367.pdf

9

Second, as shown in Exhibit 3, management went through the unusual step of photoshopping the only

publically available picture of the Botswana facility (shown in the 2009-2010 annual report). This

photoshop job removed the address of the facility again, an unusual move given that management

was more than willing to provide the exact facility addresses in the circulars they released as part of

their acquisitions of Win New Group and Wealthy King Investments.

Exhibit 3

Altered picture from Huabaos annual report Picture we took

As we said, it appears management has gone to extreme lengths to hide the facility.

But thats okay, we found it anyway.

This operation was not an easy task. But perhaps the only thing more difficult than finding the location,

was traveling to it, which took us three days of air travel. And our commute only happened to be so

short because the construction of a domestic airport had recently been completed.

So, what reason would management have to build a raw material extraction base in such a remote

location and go to unusual efforts to hide its coordinates?

As we found out, the business of natural extracts has little to do with it. The base is used for a

different sort of business entirely, which we will forego discussing in this report. Instead, we will leave

the details to Huabao and allow management to explain. Moreover, it might be more interesting to hear

from Huabao who their end clients are.

That said, we believe if management were forthcoming with the operations of the Botswana facility, it

would very likely throw into questions Huabaos margins, and possibly cause investors to re-risk the

Company.

10

Chairwomans Share Disposal 1.2

As will become evident throughout this report, Huabao is surrounded by a level of opacity rarely seen in

a public company. But one point that the public filings make perfectly clear is the tremendous amount of

money that Ms. Chu has made by selling out of Huabao.

Ms. Chu initially held 97.6% of Huabaos outstanding shares following the backdoor listing. After years of

share placements, share transfers and even an acquisition completed personally by Ms. Chu and paid for

by Huabao stock, her interest has dwindled to 37.7%.

Below is a summary and timing of Ms. Chus share disposition:

Ms. Chus starting stake: 97.6%

August 3, 2006 The Chairwoman disposes of her shares, part I

The Event: Within two days of closing the Chemactive acquisition, Ms. Chu converts and dumps her

newly acquired shares. This disposal was of 690 million shares at HK$2.20 per share, a 22% discount to

the previous days closing price.

6

The disposal represented 23% of the Companys issued share capital

and netted Ms. Chu proceeds of HK$1.5 billion (US$195M).

Ms. Chus remaining stake: 74.89%

January 17, 2007 The Chairwoman disposes of her shares, part II

The Event: Ms. Chu converts and dumps another 277 million shares at HK$4.56 per share, at a 7.51%

discount to the previous days closing price.

7

The disposal represented 9.1% of the Companys issued

share capital and netted Ms. Chu proceeds of HK$1.3 billion (US$162M).

Ms. Chus remaining stake: 65.78%

April 7, 2009 The Chairwoman disposes of her shares, part III

The Event: Ms. Chu converts and dumps another 191 million shares at HK$6.10 per share, at a 12.5%

discount to the previous days closing price.

8

The disposal represented 6.2% of the Companys issued

share capital and netted Ms. Chu proceeds of HK$1.2 billion (US$149M).

Ms. Chus remaining stake: 56.46%

6

http://www.hkexnews.hk/listedco/listconews/sehk/2006/0804/LTN20060804024.pdf

7

http://www.hkexnews.hk/listedco/listconews/sehk/2007/0117/LTN20070117030.pdf

8

http://www.hkexnews.hk/listedco/listconews/sehk/2009/0403/LTN20090403003.pdf

11

October 8, 2009 The Chairwoman disposes of her shares, part IV

The Event: Ms. Chu converts and dumps another 150 million shares at HK$7.75 per share, at a 5.7%

discount to the previous days closing price.

9

The disposal represented 4.2% of the Companys issued

share capital and netted Ms. Chu proceeds of HK$1.2 billion (US$149M).

Ms. Chus remaining stake: 51.28%

April 12, 2010 The Chairwoman disposes of her shares, part V

The Event: Ms. Chu converts and dumps another 204 million shares.

10

Curiously, the required notice

filed by the Company does not provide information on the disposal price, but based on market activity,

we suspect Ms. Chu netted HK$2 billion (US$250M) from this transaction.

Ms. Chus remaining stake: 44.24%

January 28, 2011 The Chairwoman disposes of her shares, part VI

The Event: Ms. Chu converts and dumps another 200 million shares at HK$11.00 per share, at a 7.8%

discount to the previous days closing price.

11

The disposal represented 4.2% of the Companys issued

share capital and netted Ms. Chu proceeds of HK$2.2 billion (US$282M).

Ms. Chus remaining stake: 37.71%

For those keeping count, the cumulative proceeds of her disposals amount to approximately

HK$9.4 billion (US$1.2 billion). Its unclear why Ms. Chu has decided to drastically reduce her stake in

Huabao. For the past five years, revenue, profit, and book value have steadily trended higher with awe

inspiring gross margins. Management commentary shows no decline in optimism, projecting confidence

in Huabaos Big customers, Big brands strategy. We have difficulty imagining Ms. Chu was short of

cash following her initial share placement in 2006 which yielded HK$1.5 billion.

In light of the research presented in this report, we are confident the drastic decline in her holdings was

motivated by her desire to cash out of Huabao before the share price reflected the organizations true

value.

9

http://www.hkexnews.hk/listedco/listconews/sehk/2009/1008/LTN20091008013.pdf

10

http://www.hkexnews.hk/listedco/listconews/sehk/2010/0412/LTN20100412693.pdf

11

http://www.hkexnews.hk/listedco/listconews/sehk/2011/0128/LTN20110128017.pdf

12

Executive Resignations 1.3

So far, we have a backdoor listing, an auditor resignation, absurd related party transactions, and a

company founder who cant sell off her shares fast enough. The only box left to check on our list of red

flags is executive resignations:

December 5, 2007 The Corporate Secretary resigns

The Event: Mr. Henry Chu resigns as the Company Secretary and Authorized Representative of the

Company.

Managements Response: In a released statement, management claims the resignation is due to

personal career development.

12

The Truth: Mr. Henry Chu is a fellow member of the Association of Chartered Certified Accountants and

an associate member of the Hong Kong Institute of Certified Public Accountants with a career spanning

several auditing positions.

Our search indicates that after resigning from Huabao, Mr. Chu joined Westminister Travel Ltd., an

operator of a travel agency. Westminister Travel is listed on the Singapore Exchange (5OF:SES) with a

market cap of US$22 million. We are hesitant to believe personal career development was the real

reason Mr. Chu resigned as an executive of a purported multi-billion dollar tobacco enterprise to join a

penny stock company offering discount travel.

It is more plausible that as Corporate Secretary, Mr. Chu found irregularities with Huabaos books and

resigned to distance himself from the Company.

July 31, 2011 An independent director is forced to resign due to fraud charges

The Event: Mr. Mak Kin Kwong was one of three independent directors at Huabao. He was also the

Chairman of the Audit Committee as well as the Chairman of the Remuneration Committee before being

forced to resign in disgrace.

In addition to being investigated by the SEC, he was recently charged with fraud by the China Securities

Regulatory Commission. These charges relate to his work as an independent director of Chengdu

Unionfriend, a company listed on the Shenzhen Exchange. The charges included overstating revenue,

non-disclosure of related party transactions, and false and misleading disclosures.

13

Unfortunately, these events were not isolated incidents. Mr. Mak was also

12

http://www.hkexnews.hk/listedco/listconews/sehk/2007/1204/LTN20071204270.pdf

13

http://www.hkexnews.hk/listedco/listconews/sehk/2011/0802/LTN201108021068.pdf

13

the CFO of A-Power (NASQ: APWR), a company that until recently traded on the Nasdaq

before being delisted last summer due to issues of fraud.

14

an independent director and Chairman of the Audit Committee of Real Gold Mining

(HK:0246), a company that in May 2011 was halted on the Hong Kong Stock Exchange relating to

allegations of mass fraud and auditor resignations.

15

Our Take: It does not inspire confidence that this legendary character not only served as an independent

director at Huabao, but has been in charge of its audit committee since inception.

Its almost like management is playing a game of chicken with analysts, like theyre

trying to see how many red flags they can raise and still get buy recommendations.

-Associated Analyst

14

http://online.wsj.com/article/BT-CO-20110926-710598.html

15

http://www.hkexnews.hk/listedco/listconews/advancedsearch/search_active_main.asp

14

In this section, we look at Huabaos financial statements and compare the Company to industry peers

with regards to gross margins (2.1), research & development spending (2.2), sales growth (2.3) and

reporting transparency (2.4).

Margins 2.1

Exhibit 4 shows gross margins as reported by the industry. Note that while all F&F players report

margins in the 40-50% range, Huabao has somehow managed to command consistent margins upwards

of 70%. In most industries, even single digit deviations are considered extraordinary. So, what happened

between 2005 and 2006 that helped Huabaos margins explode?

Exhibit 4

Industry Gross Margin

The proximate cause seems to have been the acquisition of Chemactive. Prior to this acquisition,

Huabao was more or less a shell company with de minimis operations reporting annual losses. On the

other hand, Chemactive was a highly profitable company enjoying margins of 48% based on the pre-

acquisition financial statements.

But still, 48% is a long way from 70+%. So what happened between the acquisition and the following

year when management released their annual results showing margins had skyrocketed? We arent

actually sure. You see, management only dedicated a few lines in their entire 2006 Annual Report to

explaining the jump in gross margins:

As the raw material structure of many of the continuous developing products were being optimized as

well as the capacity of relevant production accessories increased, the gross margin rose from 47.3% of

last year to 69.5%, which further improved the operating results.

16

16

http://huabao.todayir.com/attachment/2010122112592617_en.pdf (page 8)

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

60.0%

70.0%

80.0%

2005 2006 2007 2008 2009 2010

Huabao CF&F Symrise Givaudan IFF

Financial Statement Analysis [sec 2]

15

From our reading of this explanation, management did two things to significantly improve margins:

1) optimized the raw material structure; and

2) Increased relevant production accessories.

If youre confused, youre not alone. We dont understand this vague explanation either. Moreover, we

do not believe that management was able to re-engineer Chemactive within a year to become some sort

of super-profitable money machine.

First, this transformation didnt even take a year. As presented in the interim 2006 report, gross margins

had already improved to 65.4% within 6 months of the Chemactive acquisition. Just so our readers dont

think theyre missing something:

March 31, 2006 (Chemactive prior to acquisition): Gross Margins 48.0%

September 30, 2006 (Huabao interim report post-acquisition): Gross Margins 65.4%

March 31, 2007 (Huabao annual report post-acquisition): Gross Margins 69.5%

Second, what type of re-engineering/cost cutting/synergies could management possibly have pulled out

of their hat? Prior to acquiring Chemactive, Huabao was just a shell. Its not like there was a second

material operating business that was merged with Chemactive to cut costs or increase efficiencies. In

fact, the same person who had run Chemactive prior to the acquisition was still running Chemactive

after the acquisition Huabaos Chairwoman, Ms. Chu.

Given managements dubious explanation, we turned to the most obvious source of confirmation

documents Huabao filed with the SAIC.

17

It took nearly three months, but we didnt just get documents

related to the Chemactive acquisition, we got documents related to the entire Company nearly all of

its principal operating subsidiaries representing 99.5% of Huabaos production capacity. In total, we are

in possession of SAIC documents for 23 different Huabao subsidiaries.

Based on our analysis of these documents, it appears that the overwhelming majority of Huabaos

subsidiaries report gross margins around 40-50%, in line with industry standards but a far cry from the

74% reported by the Company in 2010. It should be noted that since these results are not consolidated,

it becomes difficult to calculate an exact gross margin figure. But in either case, 40%+ and 70%+ are a

world apart.

To get more clarity on industry margins, we contacted several private F&F companies located in China.

In our discussions with them, no representative was able to understand how gross profit margins of

70%+ could be achieved in this industry. Moreover, one representative mentioned that his company

supplies tobacco flavors and fragrances for several foreign brands and that the gross profit margin of

their business is quite low. When pushed further, he relented that it *may* be possible for the gross

profit margin of some new products to reach up to 70 or 80%, but was unlikely for older products.

Looking back at Exhibit 4, a simple analysis of China Flavors and Fragrances gross margins confirms this

statement. This point was also reaffirmed by a contact at a different F&F company, who went on to

state that potentially better margins on new products is why all of the companies in the industry

continue to develop new products through R&D.

17

All businesses operating in China must file annual financial statements with the State Administration for Industry

and Commerce (SAIC).

16

Research & Development 2.2

And so it seems that R&D is vital to the industrys profitability and staying power. However, as Exhibit 5

shows, for Huabao this issue raises more questions than it answers simple questions such as:

How is Huabao able to maintain its leadership position and gross margins by spending less on R&D than

most of its peers?

Exhibit 5

R&D as a percent of sales

This chart is baffling when one reads through Huabaos annual reports and sees the following gem:

The R&D capability of a flavours and fragrances company reflects its overall strength. After continuous

investment, the Group has set up a leading R&D team which is top-notch in China and up to international

standards. The State-recognized technology centre, the overseas R&D centre in Germany and the

professional R&D departments in Yunnan, Guangdong and Fujian together formed a vertically integrated

platform for R&D in areas ranging from fundamental research to application. The R&D strategy of the

Group is market-driven so as to closely follow the latest global industry trends and to accelerate the

mastering of technologies in key raw materials. With such strengths, the Group is able to develop

products and technologies that meet market demands, deliver comprehensive technical services to

customers and remain dedicated to maximizing value for clients, while the Groups overall

competitiveness is greatly elevated.

18

Based on these type of statements, Huabao seems quite dedicated to cutting-edge, international caliber

R&D. So much so that to aid its efforts in internationalizing its R&D capabilities, in 2006, Huabao set up

an R&D center in Holzminden, Germany, a town famous for its F&F industry and the proud headquarters

of Symrise, an industry powerhouse.

18

http://www.hkexnews.hk/listedco/listconews/sehk/2011/0629/LTN20110629303.pdf

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

2005 2006 2007 2008 2009 2010

Huabao CF&F Symrise Givaudan IFF

17

The German research facility stands out as an important jewel in Huabaos R&D initiative, because:

Its located in a logistically out-of-the-way place for a company that does all its business in

China.

Internationalized R&D seems to be a key strategy for the Company.

Management considers it a world-class R&D center.

Huabaos Chief Technical Officer for Tobacco Flavors, Mr. Alan Davies, is posted at the

Holzminden facility.

Given the apparent importance of this facility, we decided to give it a closer look to get a better feel for

Huabaos R&D work.

At the prompting of our contacts, our sources at Anonymous Germany agreed to take a road trip to

Holzminden and put the R&D center under surveillance for three days.

Minimal Activity

Our contacts told us that during their investigation several points struck them as notable, especially in

contrast with activity at the Symrise facility, which they also visited:

Most of the lights in the complex were off.

There was minimal noticeable staff activity.

There was no security protecting the research facility.

When neighbours were questioned, they either did not know what business was being carried

out at the facility or assumed the facility belonged to Symrise.

It should be noted that the R&D center is not actually located in Holzminden, but in a very small village

called Neuhaus, which is a twenty minute drive out of town. We were told there was no public

transportation to speak of and it was during the winter season, making it difficult to ride a bicycle. This is

relevant because over the three days, our contacts did not see more than six vehicles in the parking lot

of the research center.

We are not sure what type of multi-billion dollar, research driven enterprise operates like this, but it

seems that the Holzminden facility has no more than half a dozen staff members.

18

Concluding on R&D Expenses

So, here we have a company with questionably low R&D spending that reports absurdly high margins,

which industry sources say should not be possible. How do we bridge this divide?

We have come across various explanations. However, the best ones can be summarized as follows:

Huabao has established relationships with several prominent SOE tobacco manufacturers. Cigarette

smokers are sensitive to their preference of cigarette brands and manufacturers are hesitant to change

ingredients/suppliers in their blend. Accordingly, there is no need for major R&D as once Huabao is

contracted to supply flavoring to a brand, that relationship will continue until the tobacco brand is

terminated. Consumer preference for their favorite brand creates a natural moat for Huabao, ensuring

lofty margins and low R&D expenditure.

This is actually a very logical, very good explanation.

The idea behind this explanation is that in a mature industry, there really is no need for R&D. The

Company already has its flavours, it already has its connections, and it already has its committed

cigarette brands. All the work is done.

And this makes sense. Except when it doesnt.

The problem with this explanation is that the math cuts both ways. It may be possible for low R&D

expenses to co-exist with high profit margins in a mature industry, but then we should be seeing

correspondingly low revenue growth. Growth implies new markets, new opportunities, and therefore

new R&D initiatives. If a company is not incurring substantial R&D costs because it benefits from being

the leading player in a mature industry, we should not then be also witnessing high revenue growth that

appears to be far surpassing the growth of its customer base.

Despite this, Huabao has also inexplicably experienced the fastest sales growth in the industry, as we

discuss next.

19

Revenue Growth 2.3

Exhibit 6 shows Huabaos compounded average growth rate (CAGR) between 2005 and 2010. Compared

to its peers, a 30% annual growth rate is nothing short of awe-inspiring.

Exhibit 6

5-Year CAGR Sales Growth

Huabao 29.6%

CF&F 25.0%

Symrise 6.5%

Givaudan 8.8%

IFF 5.6%

Source: Company financials

To deliver this revenue growth, management has targeted 10% growth through acquisitions, and 20%

organic growth. To be perfectly clear, growing revenue 20% organically year after year is no small feat,

especially when one understands that Chinas tobacco industry as measured by volume has only grown

4% per annum between 2005 and 2010.

19

So, how was this growth rate achieved? Management attributes most of this to industry consolidation:

Over the last decade, Chinas tobacco industry has been undergoing a major restructuring that includes

the consolidation of cigarette producers. The number of cigarette companies under the STMA has

dropped from 185 in 2001 to 30 in 2010, while the number of brands has decreased from more than

1,800 to 133 over the same period. The STMA reduced the number of cigarette factories and brands in

an effort to create economies of scale and to focus production on a limited number of Chinese brands

that could better compete on the international market.

20

Management explains that as a key supplier to the top cigarette brands, Huabao stands to benefit from

industry consolidation as popular brands replace obscure ones. On the surface this might make sense,

and certainly we believe Huabao has experienced some benefits found in industry consolidation but a

steady 20% organic growth over five years? We dont think so.

There are two mathematical issues with Huabaos explanation of its organic growth: (i) the uniformity

problem, and (ii) the cannibalization problem, as discussed next.

19

http://www.tobaccofreecenter.org/files/pdfs/en/TI_Profile_China_Dec%202011.pdf

20

Ibid

20

The Uniformity Problem

Over the last decade, there has indeed been some significant industry consolidation. However, this

consolidation was a long-tailed event, with most of the activity occurring during the first part of the

decade. Exhibit 7 presents data from Huabaos own annual report. Whats evident here is that by 2005,

industry consolidation had slowed considerably as most of the obscure cigarette brands had already

been crowded out or discontinued.

Exhibit 7

Consolidation

Source: 2007 Annual Report

Between 2005 and 2010, the industry continued to consolidate, but at a markedly decreasing rate. To

show this, we have presented the growth rate of the top five Chinese cigarette brands in Exhibit 8,

which we have used as a proxy for industry consolidation. Side by side, we have also presented the

organic growth rates reported by Huabao.

Exhibit 8

Market Dominance of Top Five Chinese Cigarette Brands

Source: Euromonitor, analyst estimates, our estimates

*Note that no organic growth rate is available for 2006

What is evident here is that while industry consolidation slowed rapidly in the latter part of the decade,

Huabao continued to post relentless growth over the same time period. Against this backdrop, Huabaos

reported growth is highly suspect, especially when you consider the next issue.

0.0%

10.0%

20.0%

30.0%

40.0%

2006 2007 2008 2009 2010

Growth Rate of Top Five Brands Huabao Organic Growth Rate

21

The Cannibalization Problem

Huabao supplies flavouring to approximately 50% of the top ten cigarette brands. In terms of

consolidation, this is a positive factor for the Company. As the top brands consolidate smaller players, by

proxy Huabao increases its market share and grows accordingly.

However, Huabao also supplies approximately 50% of the overall market, which implies that on average

it also supplies 50% of brands and suppliers that are being or have been phased out. And as surely as

Huabao gains from its biggest customers consolidating the industry, it also loses equally as its smaller

clients are squeezed out. The result is a near zero-sum game.

Given these factors, we question Huabaos growth story as a result of industry consolidation. In

sections 3 and 4, we follow up this macro analysis by providing a granular look at Huabaos revenue

streams and client relationships.

22

Reporting Transparency 2.4

Public companies are obligated to provide a certain level of corporate and operational information to

investors in their financial reports as stipulated by the stock exchange they trade on. Huabao is

governed by the disclosure requirements of the Hong Kong Exchange, but even here Huabao appears to

only be disclosing the minimum required and in at least one case, even less than that.

Looking through Huabaos financial reports, we can see that starting in 2010, management stopped

disclosing pertinent information which would otherwise aid analysts in the due diligence process.

Specifically, management removed three key pieces of information from their annual reports as

presented in Exhibit 9:

1) Departmental breakdown of personnel.

2) List of selected direct sales customers.

3) Segment information between its three business lines:

- tobacco flavours

- food flavours

- fragrances

Exhibit 9

Source: 2009 annual report

23

With the removal of this information, analysts cant get a clear picture of personnel changes, nor who

the Companys customers are. Far more concerning however is that management decided to combine

the Tobacco Flavours and Food Flavours segments into one opaque segment simply called Flavours.

While the first two omissions should raise eyebrows, it pales in comparison to the egregious act of

combining two of the Companys biggest and distinct businesses into one reporting segment. Frankly,

we cant believe the auditors (PricewaterhouseCooper) have been so docile as to allow this gross

violation of Hong Kong reporting standards to continue.

21

This simple, but crucial change has made it impossible for analysts and investors to determine where

revenue and sales growth is coming from. It has turned the whole due diligence process into a joke of a

guessing game. Because now, instead of getting a clear picture of the Huabaos revenue break-down,

you get something like this:

Exhibit 10

New Segment Reporting

What is the purpose of changing the reporting so that one segment effectively accounts for all of the

Companys sales? What is achieved by a change like this? What is the net benefit?

Make no mistake these changes were implemented with the intent of limiting proper analysis of

Huabaos operations and revenue streams, a topic we discuss next.

21

PwC would be wise to freshen up on HKFRS 8 and relearn the meaning of substance over form.

http://www.hkiaat.org/images/uploads/articles/Operating.pdf

24

The Food Flavouring segment contributes to approximately 15% of Huabaos revenue. This segment

supplies flavouring to various food, beverage, and cosmetic products. In fact, Exhibit 11 presents some

of the segments customers as at Fiscal 2009. We presented this list earlier in the report, with an

explanation that this was the last list Huabao made public before management stopped providing the

name of its clients.

Exhibit 11

Huabao Clients (Fiscal 2009)

Source: Company financials

Well leave it up to investors to decide why Huabao stopped providing a client list. But in the meantime,

we went ahead and contacted the companies on the list, and were able to get in touch with

representatives from Danone, Heinz, Totole, Yurun, Huiyuan Juice, Bright Dairy and Dali Group.

Certain representatives confirmed that Huabao was indeed a supplier. But just as well, there were a

number of other companies that informed us that Huabao was not a supplier of any material form.

For example, we contacted Heinzs corporate office in the US and were placed in contact with the

Procurement Department. We provided the department Huabaos name, along with the names of all its

food and flavor subsidiaries. The department ran the names through their system and confirmed that

they have no relationship with any of the names we had given them. We were informed that it may be

possible that their Chinese factory sources directly from Huabao, in which case the Corporate office

wouldnt be aware. They therefore provided us with the contact information of the person in charge of

procurement at the Chinese factory.

We contacted the individual who confirmed that they were in the best position to provide information

regarding Heinzs suppliers. When asked about Huabao, the individual wasnt convinced Huabao could

be classified as a supplier to Heinz because, to quote:

We didnt purchase much *from Huabao+ we didnt really use them, previously we only

purchased from them once. It was very little.

Food Flavouring [sec 3]

25

Admittedly, the presented client list is dated. What about current clients? While Huabao stopped

providing a client list, Shanghai H&K Flavor, one of Huabaos food and flavoring subsidiaries does have a

website where it lists products that it evidently provides flavouring for.

On its website (http://www.hbkq.com.cn/en/) under the tab Market > Product Information, there is a

list of various products from flavoured yogourt to flavoured peanuts. This list was updated as recently as

October 20, 2011, so we can assume its relevant.

From this list, we picked two products at random and contacted their manufacturers to confirm a

client/supplier relationship with Huabao or its subsidiary.

The first product we picked was Harris Teeter Simply Clear Water, as shown in Exhibit 12.

Exhibit 12

We contacted Harris Teeter, a grocery store chain based in the US. Harris Teeter put us in contact with

Cott Beverages, the company that manufactures and bottles the Simply Clear product. When asked

about Huabao, Cott simply confirmed that they are not using any Chinese based company to supply

flavouring ingredients for this product.

26

The second product we picked was HyVees Vanilla Flavoured Almond Milk, as shown in Exhibit 13.

Exhibit 13

We contacted HyVee who put us in touch with the account manager and the third party broker

responsible for this product. Both individuals confirmed that no Chinese company is sourced for

flavouring in the production of the milk.

Confused, we asked our contacts if they knew any reason why their products were displayed on

Huabaos website. Their simple response: No.

Bill Gates (questioning Homer Simpsons fake business): Your internet ad was brought

to my attention, but I cant figure out what, if anything CompuGlobalHyperMegaNet

does

-The Simpsons

27

Huabao is exaggerating the scope of its food flavouring business this is self-evident. But food

flavouring is only 15% of their revenue. The other 85% comes from tobacco flavouring. Tobacco

flavouring is the backbone of the Company and the reason that at the time of writing, this company was

worth over HK$17 billion.

However, it also appears Huabao is embellishing their tobacco flavouring business.

Straight from its 2008 annual report is a list of Huabaos customers. This impressive list not only shows

that Huabao is a supplier to all of the top ten cigarette brands sold in China, but also a core supplier to

nearly all of them. The Company defines core supplier as supplying more than 50% of each companys

tobacco flavour purchase.

Exhibit 14

Source: Company financials

The top ten cigarette brands are manufactured by 8 different companies across a spectrum of factories.

Exhibit 15 presents a list of the companies and their associated top ten brands.

Exhibit 15

Company Brands

China Tobacco Hubei Industrial LLC

Hongjinlong

China Tobacco Henan Industrial LLC

Hongqiqu

China Tobacco Hunan Industrial LLC

Baisha

Yuxi Hongta Tobacco (Group) Co Ltd.

Hongmei, Hongtashan

China Tobacco Guangdong Industrial Co. Ltd.

Shuangxi

China Tobacco Shandong Industrial Corporation

Hatamen

China Tobacco Guizhou Industrial Corporation

Huangguoshu

Hongyun Honghe Group

Honghe, The Scarlet Camellia

Tobacco Flavouring [sec 4]

28

Penetrating the SOE dominated tobacco industry was a time consuming effort. We made over 150

phone calls to various factories, companies, and procurement departments in an effort to verify

Huabaos business claims. We are confident this is the most exhaustive effort any researcher or analyst

has undertaken in this regard. We were successful in making contact with at least one factory from each

of the 8 major tobacco companies listed above.

Some of the representatives were happy to speak to us but citing factory regulation were not

forthcoming with regards to quantity and pricing. However, many of the representatives were willing to

give us qualitative information. In our conversations, Huabao was generally acknowledged to be Chinas

leading tobacco flavouring supplier. However, we found some material inconsistencies with Huabaos

claims. Some factories confirmed that Huabao was indeed a core supplier, while others denied using

Huabao as a supplier at all.

For instance, we contacted three of the six factories that manufacture Huangguoshu cigarettes. Huabao

lists itself as a core supplier to the Huangguoshu brand. Two of the factories claimed they do not

purchase goods from Huabao, and the third mentioned that Huabao is one of numerous suppliers and is

not a core supplier.

In the case of Hongyun Honghe Group (Hongyun Honghe), we spoke with a representative at one of its

key factories. The representative acknowledged that Huabao is a core supplier to the company, but said

that the entire Honghe Group only purchases tens of millions of RMB of flavours from Huabao. It helps

to understand that Hongyun Honghe is the second largest Chinese tobacco company and accounted for

9.4% of the Chinese retail volume, according to a 2011 Euromonitor International report

22

. So despite

Hongyun Honghe controlling nearly one-tenth of the Chinese retail tobacco market, a representative

from the cigarette maker attributed only tens of millions of RMB of purchases from Huabao, a figure

that pales in comparison to the approximate HK$2.3 billion annual sales claimed by Huabao.

Another notable conversation we had was with a flavouring company called Shanghai Peony Flavours &

Fragrances Co. Ltd. (Peony). Peony as it turns out is a subsidiary of, and sole flavour supplier to

Shanghai Tobacco Group.

And who is Shanghai Tobacco Group? Well let Huabao explain. Here is an excerpt from their annual

report justifying the Win New Group acquisition we introduced on page 7:

Win New Group is mainly engaged in the production and sales of tobacco and food flavours as well as

fragrances in China, with its tobacco flavor and fragrance business mainly targeting at large and quality

tobacco groups in Eastern and Central China, such as Shanghai Tobacco Group Corporation which is the

tobacco manufacturer of various famous cigarette brands, including Panda, Chunghwa, Shanghai

and Peony etc.

Huabao boasts of being a major flavour supplier to Shanghai Tobacco Group. But Peony, Shanghai

Tobacco Groups own subsidiary claims to be its only flavour supplier. We contacted Peony to get some

clarity on these conflicting statements.

22

http://global.tobaccofreekids.org/files/pdfs/en/TI_Profile_China_Dec%202011.pdf

29

Our contact confirmed that Peony is indeed the only flavour supplier to Shanghai Tobacco Group. When

asked about Huabao, the contact stated that Huabao is one of many suppliers but only supplies Peony

one kind of raw material for the latter to use in the manufacturing of tobacco flavours.

We should reiterate that Huabao no longer discloses who their tobacco clients are, and the client list we

are relying on is several years old. However, managements claim that the tobacco flavouring industry is

highly sticky, combined with the results of our Hongyun Honghe and Peony channel checks give us great

cause for concerns regarding Huabaos reported profitability.

The Tobacco Industry in China

When we take a step back from specific purported customer relationships and focus on the overall

cigarette market in China, we find it impossible that Huabao earns the revenue it claims.

In 2010, Huabao reported revenue of HK$2.9 billion (US$366M). The overwhelming majority of this

revenue came from their tobacco flavouring segment. How does this amount compare to the tobacco

market in China? The diagram on the next page puts the industry into context.

31

So, is the realm of 2.4% a reasonable cost component of flavouring when it comes to the manufacturing

of cigarettes? We had no idea, but intuitively it seemed somewhat high. Anecdotally, when you bake a

cake, the few drops of flavouring extract you include as part of the recipe dont cost anywhere near

2.4% of all the ingredients. But then again, none of us have ever baked a cake before, just like weve

never manufactured cigarettes and anecdotes arent exactly facts.

In the absence of personal knowledge, we referred to a research paper titled Cost Analysis of Options

for Self-Extinguishing Cigarettes

23

which was prepared in 1987 for the US National Bureau of Standards.

The paper disaggregates an earlier research paper by James Morris titled This Tobacco Business Part

XIII: Manufacturing Costs of Cigarettes

24

which was first published in Tobacco International Magazine in

1980. These two research papers are the most comprehensive and granular bodies of work on cigarette

manufacturing, in what is otherwise a secretive and complex industry.

Exhibit 16 presents the relevant information for our analysis.

Exhibit 16

23

http://tobaccodocuments.org/rjr/508510047-0116.html

24

http://legacy.library.ucsf.edu/tid/nfa17a99/pdf;jsessionid=B620A702E193AA125D371204AD393E34.tobacco03

32

Based on this work, we can see that the casing process (flavouring) only accounts for $0.016 of $5.64 in

material costs per 1,000 non-flavour tipped sticks

25

. Thats less than 0.3% of all costs!

For Huabao to sell the amount of flavouring it claims, it would need to supply more than 50% of the

tobacco market in China. In fact, it would need to supply more than 100% of the global cigarette market.

Cigarette Flavouring: Then and Now

Admittedly, the research papers were relying on are over 25 years old, and a lot has changed during

that time. And while we believe that given tar content and manufacturing capabilities, older western

standards actually represent the manufacturing of Chinese style cigarettes more accurately, we decided

to cover all bases. So, we contacted Altria and British American Tobacco to ask about their flavouring

costs. Altria is a tobacco company that exclusively sells cigarettes within the US, so we didnt put much

weight on what they had to say. British American Tobacco however, has a large market in Asia, which we

were willing to pay more attention to. Regardless of their respective markets however, both said pretty

much the same thing about their flavouring costs, which we have boiled down to a few key quotes

presented here:

Flavourings are irrelevant to us.

Not very much at all.

*Flavouring is+ so negligible that we dont keep track of it.

Virtually irrelevant.

The more things change, the more they stay the same.

You see, Huabao would have investors believe that its found a niche market that no one else has. That

despite Symrise, IFF and Givaudan operating in China since the 1990s, they have overlooked a market

that grows 20% year after year, with 75% margins and little need for R&D. But the truth is that all these

companies have looked at the economics of the tobacco flavouring market and it sucks.

There simply isnt enough demand for flavouring in cigarette manufacturing to make it a worthwhile

principal market. Thats why most of the global companies focus on food and cosmetics. And thats why

the only other company to focus on tobacco flavouring (China Flavours & Fragrances) has been

languishing on the stock market as a micro-cap stock over the last five years.

Other F&F companies dont break out a tobacco flavour segment in their annual reports because its

such a small market that it doesnt matter. Huabao doesnt break it out because someone might realize

their numbers cant possibly make sense.

25

Non-flavour tipped sticks are just regular cigarettes as opposed to specialty cigarettes that have plugs dipped in

flavouring.

33

No report would be complete without acknowledging that Huabao pays large dividends. In fact, over the

last number of years, the Company has paid out between 30-50% of its earnings to shareholders. And as

management notes in their most recent report, that amount to date equals HK$2.4 billion since its

backdoor listing. More impressively, this was all done without the Company raising any money, either

through equity or through debt.

These numbers speak for themselves and paint a rosy picture. But of course, its not the whole picture.

In this section of our report, we present what we believe has been managements blueprint to reap

personal wealth at the expense of public shareholders and investors. We believe this section will bring

full circle many loose ends, and add some sense to managements otherwise erratic behavior. We give

particular attention to managements past actions, and focus on the issue of dividends.

For ease of reading, we have split this section into four parts:

1) The Chemactive Injection

2) The Chairwomans Share Sell Down

3) Other Related Party Acquisitions

4) Dividend Payouts

The Dividend Story [sec 5]

34

Part 1: The Chemactive Injection 5.1

As we mentioned at the beginning of our report, Huabao did not go public through a traditional IPO. It

went public through a backdoor listing via a shell company. In an IPO setting, you hire investment

bankers and outside consultants with their own reputations on the line to vet through your business

operations, look through your financial statements, and then sell your shares to the public. And while

this outside scrutiny in no way guarantees that your business is legitimate, it doesnt hurt.

In a backdoor listing, you can be as shady as you want. No one is really there to question your business

or inspect it. In fact, most people will just assume youre doing something sketchy. Backdoor listings

have that certain je ne sais quoi grease-ball quality to them.

After Huabao took over Leaptek, management effectively had a shell company available. They then

bought the Chemactive assets from the Chairwoman and injected it into the shell, essentially taking

Chemactive public. This is when we believe management first began to misstate their financials.

As we mentioned on page 14, Chemactives reported gross margins rose drastically immediately after

the injection. Based on the evidence previously presented, we believe management simply fabricated

their numbers. But of course, if you begin to lie about your gross margins, its going to affect reported

net income as well.

Exhibit 17 shows the difference in 2010 net income between Huabaos public filings and its SAIC

documents. The net income of the SAIC documents are based on the sum of Huabaos disclosed

principal operating subsidiaries representing 99.5% of its production capacity, plus several ancillary

subsidiaries that have some form of business operations. There appears to be a 36% difference in

earnings between these two sources.

Exhibit 17

(HK$ millions) Difference

Public Filings 1,632

SAIC Documents ~1,200 36%

Reported R&D Expense 122

R&D Expense net of taxes 105

SAIC Documents less R&D ~1,095 49%

Source: Company financials and SAIC documents

It should also be noted that in calculating the SAIC net income, we did not included any cost centers,

such as R&D facilities. However, Huabao claims to have spent HK$122 million on R&D in 2010. If we

subtract this expense on an after tax basis from the SAIC net income, then we get an even larger

discrepancy.

So, what reason did management have to inflate the financial figures?

35

Part 2: The Chairwomans Share Sell Down 5.2

Better financial figures bring a higher share price. And thats exactly what the Chairwoman wanted when

she began dumping her shares. In order to understand the Huabao story, its important to understand

that Huabao and its Chairwoman are inextricably linked. It helps to think of the Chairwoman as

Huabaos off-balance sheet entity. So yes, its true that Huabao as a company has never raised any

money. But through the years, the Chairwoman has raised HK$9.4 billion (US$1.2 billion) on the back of

inflated share prices.

Exhibit 18

Date (HK$ millions)

3-Aug-2006 1,500

17-Jan-2007 1,300

7-Apr-2009 1,200

8-Oct-2009 1,200

12-Apr-2010 2,000

28-Jan-2011 2,200

To Date: 9,400

In most instances of fraud, management will usually issue shares/debt through the company and

abscond with the proceeds. However, this creates certain problems. For instance, when the auditors do

their annual cash verification, management will need to explain what happened to the money. To cover

the theft, management has to create lies such as claiming the money was spent on expanding/improving

the business. This lie leads to other lies, such as inflated asset balances. Unfortunately, these inflated

assets stay on the balance sheet where they can eventually be uncovered. Then theres the issue of

trust. If management repeatedly raises money to expand business, people are going to start asking

questions. The market will begin to suspect foul play. The whole process can become very messy.

We believe Chairman Chu avoided these complications. Instead of raising money through the Company,

she simply inflated the value of Huabao, and then sold her personal shares into the market, generating a

small fortune in the process.

The Queen of Cashout

Well, small fortune may be a bit of an understatement. Last year Ms. Chu was ranked the 8

th

richest

woman in China at the age of 41 on Huruns list of Self-Made Women Billionaires.

But thats not the only list that Ms. Chu made. Hurun also released a Cashout List which lists billionaires

who have been cashing out of their own companies.

26

According to the list, Ms. Chu was the second

biggest inside-seller in China, cashing out US$549 million in the last year alone. This sum was so large

that she has been dubbed Queen of Cashout by The Shanghai Daily.

Disregarding everything in this report, at the most basic level shareholders should ask themselves: Why

am I an investor in this company when the Chairwoman cant sell her shares fast enough?

26

http://www.china.org.cn/business/2011-10/14/content_23626245.htm

36

Part 3: Other Related Party Acquisitions 5.3

Of course, overstating a companys earning power has its own issues. For instance, auditors expect to

see a commensurate cash balance as proof of income. Sales receipts and expense receipts can easily be

forged or faked. However, bank cash balances are slightly more difficult to fake slightly.

We know that Ms. Chu disposed of a large portion of her shares two days after the Chemactive

acquisition, and once more before fiscal year end. Together, these two share sales gave her proceeds of

approximately HK$2.5 billion.

With this amount, it would have been easy enough to pad Huabaos bank accounts, which at the end of

Fiscal 2007 (one year after the Chemactive acquisition) were reported to be approximately HK$ 900

million and still have enough money left over to grease the palms of third parties and their proxies

working behind the curtain and as a result of our investigation we certainly have reason to believe

there are a multitude of outside players who are involved in this game Huabao is playing.

Of course, one does not perpetuate a scheme to simply leave money in the bank for the auditors.

Moreover, as each year goes by and fake earnings continue to accumulate, it becomes more difficult to

maintain sufficient cash in the bank. Ms. Chu could have sold down her holdings at a faster rate to

continue to pad Huabaos bank account, but then that would likely attract scrutiny. So what to do?

The answer was to transfer these earnings out of Huabao. Enter Win New Group and Wealthy King

Investments.

Recall from the beginning of this report that these two companies were injected into Huabao through

Chairwoman Chu as related party transactions. More dubiously, the Chairwoman acquired these assets

from third parties and resold them to Huabao within months. Not only that, but the price paid for these

acquisitions were absurdly high, as shown in Exhibit 19.

Exhibit 19

Net Income Acquisition Price P/E Ratio

Win New Group

31 652 21.0

Wealthy King Investments

70 870 12.4

Average P/E

101 1522 15.1

Xiamen Amber

5.7 62 10.9

Maoming Kebi

20 117 5.9

Qingdao Qingda

2.5 12 4.8

Yunnan Huaxiangyuan

0.4 4.3 12.2

Average P/E

29 195 6.8

Source: Company disclosures

This Exhibit contrasts the valuation of the transactions between Huabao and the Chairwoman, and the

transactions between Huabao and third parties. What is evident here is that the transactions involving

the Chairwoman were valued at more than twice the transactions involving third parties.

Acquisitions

through the

Chairwoman

Acquisitions

through third

parties

37

So, was the Chairwoman just greedy and looking to make money by flipping these businesses to

Huabao? Yes and No.

We believe that these subsequent acquisitions were carried out at inflated valuations for the purpose of

removing fake earnings from Huabaos balance sheet. That way, management had an excuse when the

auditors found Huabaos bank accounts empty. Put another way, these transactions were used to clean

up the theft that had already occurred.

And this is exactly why the Chairwoman took the awkward step of buying these assets from third parties

only to resell them to Huabao.

We do not believe Huabao paid the reported price to acquire Win New Group and Wealthy King

Investments from the Chairwoman. The reported acquisition price consisted of imaginary

money/earnings that needed to be removed from Huabaos balance sheet. It would have been

impossible to do this through an arms length transaction, since a third party would be publically

questioned regarding the value of the transactions. However, since the Chairwoman acquired the assets

quietly from a third party, she was free to resell them to Huabao at any price with impunity.

Take the acquisition of Win New Group as an example. When Win New Group was acquired by Huabao

from the Chairwoman, it had three operating subsidiaries as listed below:

Exhibit 20

Win New Group 2007

(In millions of RMB)

Subsidiaries

Revenue % of Total Net Profit % of Total

Shanghai Zhezhan

35.8 18% 26.2 80%

Huasheng Qinghua

30.8 15% -0.1 0%

Zhaoqing Fragrances

134.1 67% 6.7 20%

Total

200.7 100% 32.8 100%

Huabao acquired Win New Group for HK$650 million, or 21 times earnings. Its vital to note that this

acquisition included 100% of Shanghai Zhezhan and Huasheng Qinghua, but only 72.1% of Zhaoqing

Fragrances. A third party owned the other 27.9% of Zhaoqing Fragrances. This is important, because

according to filings, Huabao would later acquire this outstanding portion of Zhaoqing Fragrances for only

HK$21 million. This transaction from an independent third party implied a valuation of only 10.6 times

earnings, for the same business Huabao bought at twice that valuation from Ms. Chu. Its interesting

how Huabao only pays reasonable prices for acquisitions that are not through the Chairwoman.

Over the years, Huabao has continued to grow and overstate its earnings. The share price has continued

to grow as well, giving the Chairwoman more opportunities to sell down her stake. However, this growth

has come with a price: Huabao is so large now that it has become difficult to conduct additional related

party transactions of significant size to be meaningful in removing earnings from its balance sheet.

Moreover, as Huabaos reported cash balance grew, calls from investors and analysts to declare

dividends intensified.

And so, management began declaring dividends.

38

Part 4: Dividend Payouts 5.4

Here we return to the stated amount of HK$2.4 billion the cumulative amount Huabao has paid out in

dividends all these years, the amount that regardless of how shady management has been in the past,

should remove any doubts about Huabaos brilliant and legitimate business.

But theres a problem with this number: its a red herring.

Over the relevant period, the Chairwoman has had anywhere between 66% to 38% ownership in

Huabao. Due to this interest, a significant amount of the dividends that have been paid out have never

actually been paid out they have just circled back to the Chairwoman. In fact, as Exhibit 21 shows,

only half of the HK$2.4 billion has actually made it to public shareholders.

Exhibit 21

(In HK$ 000)

2007H1 2007H2 2008H1 2008H2 2009H1 2009H2 2010H1 2010H2 2011H1 2011H2 2012H1 Total

Dividends per share 1.80 3.80 2.30 6.00 5.00 8.80 8.80 12.28 7.20 7.98 12.98

Declared dividends 54,773 116,382 70,451 184,147 154,100 271,463 274,970 384,219 226,789 251,374 409,467 2,398,135

Chairwoman's stake 65.78% 65.35% 62.96% 62.80% 62.64% 51.28% 50.87% 44.10% 37.71% 38.43% 38.40%

Dividends paid out 18,743 40,326 26,095 68,503 57,572 132,257 135,087 214,767 141,267 154,776 252,232 1,241,625

To put this all into perspective:

Over the last six years, the Chairwoman has raised HK$9.4 billion from the public. Over that same time

period, Huabao has paid HK$1.2 billion back to the public in the form of dividends. Thats 13% of what

was raised over six years.

Based on our time weighed calculation, the Chairwoman could have put the money she raised in a bank