Professional Documents

Culture Documents

Adv Accountssums

Uploaded by

masdram_918491407Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adv Accountssums

Uploaded by

masdram_918491407Copyright:

Available Formats

Problem 1:

Receipts and payments account of a club for one year is given below 31.03.1991:

RECIPTS AMOUNT AMOUNT PAYMENTS AMOUNT AMOUNT

To balance b/d 3,000.00 By salaries 1,500.00

To subscription 20,000.00 By electricity 300.00

To donation 5,000.00 By sports expenses 1,000.00

To entrance fees 1,000.00 By sports goods purchased 9,000.00

To interest 100.00 By books purchased 5,000.00

To charity show receipts 2,400.00 By miscellanous expenses 700.00

By charity show expenses 2,000.00

By investment made 8,000.00

By Balance c/d 4,000.00

31,500.00 31,500.00

Adjustments:

1. subscription received inclue Rs. 500 for 89-90 and Rs. 600 for 91-92 but Rs. 100 due for 90-91.

2. entrance fees to be capatilized

3. salary due Rs. 300 and interest due Rs. 500.

4. opening asset - sports goods Rs. 3000 Books - Rs. 2000 and Investment Rs. 6000.

prepare Income and Expenditure account.

EXPENDITURE AMOUNT AMOUNT INCOME AMOUNT AMOUNT

To salaries 1,500.00 By subscription 20,000.00

Add: salaries due 300.00 1,800.00 Less: 89-90 500.00

To electricity 300.00 Less:91-92 600.00

To sports expenses 1,000.00 18,900.00

To miscellanous expenses 700.00 Add: 90-91 100.00 19,000.00

To charity show expenses 2,000.00 By interest 100.00

To surplus 16,200.00 Add: interest due 500.00 600.00

By charity show recipts 2,400.00

22,000.00 22,000.00

NON-PROFIT ORGANISATION

Lakshmi Page 1 Income Expenditure

Problem 2:

Receipts and payments account as on 31.03.96

RECIPTS AMOUNT AMOUNT PAYMENTS AMOUNT AMOUNT

cash in hand 50.00 Salary 2,400.00

cash at bank 565.00 Rent 720.00

subscription 4,550.00 Postage 30.00

Interest on investment 2,000.00 Printing and stationery 255.00

bank interest 25.00 Electricity charges 300.00

sale of furniture 300.00 Meeting expenses 150.00

Libaray books purchased 1,000.00

Investment in bonds 1,000.00

cash in hand 155.00

Cash in bank 1,480.00

7,490.00 7,490.00

Adjustments:

1. Subscription for 94-95 Rs. 100, 96-97 Rs. 150

2. On 1.4.95, investment - Rs. 40000, Furniture - Rs. 3000, Liabrary books - Rs. 5000 Outstanding rent - Rs. 60,

Outstanding salary - Rs. 200.

3. On 31.03.96 Rent outstanding - Rs.60, Salary - Rs. 200.

4. Book value of furniture sold - Rs. 250.

Prepare income and expenditure account and Balance Sheet.

Opening balance sheet as on 1.4.95:

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Outstanding rent 60.00 Investment 40,000.00

Outstanding salaries 200.00 Furniture 3,000.00

Capital fund (Balance) 48,455.00 Library books 5,000.00

Salaries outstanding 100.00

Cash at bank 565.00

Cash in hand 50.00

48,715.00 48,715.00

Lakshmi Page 2 Income Expenditure

EXPENDITURE AMOUNT AMOUNT INCOME AMOUNT AMOUNT

To Salaries 2,400.00 By Subscription 4,550.00

To Rent 720.00 Less: 94-95 100.00

To Postage 30.00 Less: 96-97 150.00 4,300.00

To Printing & Stationery 255.00 By Bank interest 25.00

To Electricity 300.00 By Interest on Investment 2,000.00

To Meeting Expenses 150.00 By Profit on Sale of furniture 50.00

To Surplus 2,520.00

6,375.00 6,375.00

Closing Balance sheet as 31.03.96

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Capital fund 48,455.00 Investment 40,000.00

Add: Surplus 2,520.00 50,975.00 Add: Additional investments 1,000.00 41,000.00

Outstanding rent 60.00 Laibrary books 5,000.00

Outstanding salries 200.00 Add: Additional books 1,000.00

Subscription outstanding 150.00 6,000.00

Furniture 3,000.00

Less: Book value 250.00 2,750.00

Cash in bank 1,480.00

Cash in hand 155.00

51,385.00 51,385.00

Problem 3:

Cash book as on 31.12.95

RECIPTS AMOUNT AMOUNT PAYMENTS AMOUNT AMOUNT

By Balance b/d 2,350.00 Salaries 1,200.00

By Entrans fees 300.00 Electricity 120.00

By Subscription Newspapers and Journals 525.00

94 50.00 Fixed deposits 2,500.00

95 3,500.00 Utensils 200.00

96 75.00 3,625.00 Payment to creditors 1,000.00

By Profit from refreshment 100.00 Balance carried to next year 1,150.00

By Locker rents 200.00

By Sundry income 120.00

6,695.00 6,695.00

Lakshmi Page 3 Income Expenditure

The assests and liabilities on the 1st january 1995 were utensils - Rs. 800, Furniture - Rs. 2500, consumable

stores - Rs. 350, and creditors - Rs. 1200

On 31.12.95 value of consumbles sores was Rs. 700, creditors amounted to Rs. 550, the subscriptions outstanding

were Rs. 75, and the interest accured on fixed deposit was Rs. 25.

Opening Balance sheet as on 1.1.95:

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Creditors 1,200.00 Furniture 2,500.00

Capital fund (balance) 4,850.00 Utensils 800.00

Consumable stores 350.00

Subscription accured 50.00

Cash balance 2,350.00

6,050.00 6,050.00

Creditors account

PARTICULARS AMOUNT AMOUNT PARTICULARS AMOUNT AMOUNT

To Cash 1,000.00 By Balance b/d 1,200.00

To Balance c/d 550.00 By Purchase 350.00

1,550.00 1,550.00

EXPENDITURE AMOUNT AMOUNT INCOME AMOUNT AMOUNT

To Salaries 1,200.00 By Subscriptions 3,500.00

To Electricity 120.00 Add: outstanding 75.00 3,575.00

To News papers and Journals 525.00 By Profit from refreshment 100.00

2,175.00 By Locker rent 200.00

By Interest accrued 25.00

By Sundry Income 120.00

4,020.00 4,020.00

Utensiles:

Consumbles stores = opening stock+purchases-closing stock

0.00

So, there is no consumption of consumable stores during the year.

Lakshmi Page 4 Income Expenditure

Balance sheet as on 31.12.95:

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Capital fund 4,850.00 Consumble stores 700.00

Add: Surplus 2,175.00 Fixed deposit 2,500.00

7,025.00 Cash Balance 1,150.00

Add: Entrance fees 300.00 7,325.00 Interest accured 25.00

Creditors 550.00 Outstanding subscription 75.00

Subscription received 75.00 utensils 800.00

Add: Furniture 200.00 1,000.00

Furniture 2,500.00

7,950.00 7,950.00

Problem 4:

From the following particulars related to venkatasamy charitable hospital, prepare an income and expenditure

account for the year ended 31st december 1995 and balance sheet as on that date

RECIPTS AMOUNT AMOUNT PAYMENTS AMOUNT AMOUNT

Balance in hand on 1.1.95 7,130.00 Payment for Medicines 30,950.00

Subscription 48,000.00 Honarium to medical staff 9,000.00

Donations 14,500.00 Salaries to house staffs 27,500.00

Interest on investment at 7% 7,000.00 Petty expenses 460.00

Proceeds from annual day 10,450.00 Equipment purchase 15,000.00

Expenses for annual day 751.00

Closing balance 3,779.00

87,080.00 87,080.00

Additional Information:

31.12.94 31.12.95

Subscription due 240.00 280.00

Subscription recived in advance 65.00 100.00

Stock of medicine 8,810.00 9,740.00

Value of equipment 21,200.00 31,600.00

Buildings 40,000.00 38,000.00

Outstanding liability to medicine

suppliers 10,000.00 8,000.00

Lakshmi Page 5 Income Expenditure

Opening balance sheet as on 1.1.95

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Creditors 10,000.00 Cash in hand 7,130.00

Subscripition received in advance 65.00 Value to equipment 21,200.00

Capital fund 167,315.00 Buildings 40,000.00

Value of medicine stock 8,810.00

Subscription due 240.00

Investment 100,000.00

177,380.00 177,380.00

EXPENDITURE AMOUNT AMOUNT INCOME AMOUNT AMOUNT

To Honoarium to medical staff 9,000.00 By Subscription 48,000.00

To Salaries to house staff 27,500.00 Add: Due(beginning) 280.00

To Petty expenses 460.00 Less:Advance (beginning) 240.00

To Expenses for annual day 751.00 Add:Advance(end) 65.00

To Depriciation for equipment 4,600.00 Less: due (end) 100.00 48,005.00

To Depriciation to buildings 2,000.00 By Interest on investment 7,000.00

To medicine consumed 27,660.00 By proceeds from annual day 10,450.00

6,516.00

71,971.00 71,971.00

Creditors account(medicine)

PARTICULARS AMOUNT AMOUNT PARTICULARS AMOUNT AMOUNT

To payment to medicine 30,590.00 By Balance b/d 10,000.00

To Balance c/d 8,000.00 By purchase 28,590.00

38,590.00 38,590.00

Closing balance sheet:

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Capital fund 167,315.00 Building 40,000.00

Less: Deficit 6,516.00 Less: Depriciation 2,000.00 38,000.00

Add: Donations 14,500.00 175,299.00 Equipment 21,200.00

Subscripiton advance 100.00 Add: Additional equipment 15,000.00

Creitors 8,000.00 Less: Depriciation 4,600.00 31,600.00

Subscripition due 280.00

Stock 9,740.00

Lakshmi Page 6 Income Expenditure

Cash in hand 3,779.00

Investment 100,000.00

183,399.00 183,399.00

Problem 5:

The Literary society showed the following position on 31st December 1995 balance sheet as at 31st December 1994

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Capital fund 79,300.00 Electrical fittings 15,000.00

Outstanding expenses 700.00 Furniture 5,000.00

Books 40,000.00

Investment in securities 15,000.00

Cash at bank 2,500.00

Cash in hand 2,500.00

80,000.00 80,000.00

Receipts and payments for the year ending 31.12.95:

RECIPTS AMOUNT AMOUNT PAYMENTS AMOUNT AMOUNT

To balance b/d By Electricity charges 720.00

Cash at bank 2,500.00 By postage and stationery 500.00

Cash in hand 2,500.00 By Telephone charges 500.00

To Entrance fees 3,000.00 By Books purchased(1.1.95) 6,000.00

To Membership subscription 20,000.00 By Outstanding expenses 700.00

To Sale proceed of old newspapers 150.00 By Rent 8,800.00

To Hire of lecture hall 2,000.00 By Investment in securities(1.7.95) 4,000.00

To Interest on securities 800.00 By Salaries 6,600.00

By Balance c/d

Cash at bank 2,000.00

Cash in hand 1,130.00

30,950.00 30,950.00

You are required to prepare income and expenditure account for the year ending 31.12.95:

1. Membership subscription included Rs. 1000 received in advance

2. Provide for outstanding Rent - Rs. 400 and Salaries - Rs. 300

3. Books to be deperciated @ 10% including additions. Electrical fittings and furniture are also to be depreciated

at the same rate.

4. 75% of the entrance fees to be capitalized

5. Interest on securities to be calculated at 5% p.a

Lakshmi Page 7 Income Expenditure

EXPENDITURE AMOUNT AMOUNT INCOME AMOUNT AMOUNT

To Electricity charges 720.00 By Subscription 20,000.00

To Postage and Stationery 500.00 Less: advance 1,000.00 19,000.00

To Telephone charges 500.00 By Entrance fees 750.00

By Interest on securities 850.00

To Rent 8,800.00 By Sale proceed of old newspaper 150.00

Add: Outstanding Rent 400.00 9,200.00 By Hire of lecture hall 2,000.00

To Salaries 6,600.00 By Deficit 1,670.00

Add: Outstanding salaries 300.00 6,900.00

To Deperciation

Books 4,600.00

Electricals 1,500.00

Furniture 500.00 6,600.00

24,420.00 24,420.00

Balance sheet as on 31.12.1995:

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Opening balance 79,300.00 Electrical fitting 15,000.00

Less: Deficit 1,670.00 Less: Deperciation 1,500.00 13,500.00

Add: Entrance fees 2,250.00 79,880.00 Books 40,000.00

Outstanding rent 400.00 Add: Additional books purchased 6,000.00

Outstanding salaries 300.00 Less: Deperciation 4,600.00 41,400.00

Subscription advance 1,000.00 Investment on securities 15,000.00

Add: additional investment 4,000.00 19,000.00

Interest accured 50.00

Cash in hand 1,130.00

Cash at bank 2,000.00

Furniture 5,000.00

Add: Deperciation 500.00 4,500.00

81,580.00 81,580.00

Problem 6:

On 1.4.95 the financial position of Babu sangshad, a clutural club

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Capital fund 4,200.00 Equipments 1,640.00

Creditors for expenses 160.00 Furniture 1,160.00

Bar stock 880.00

Outstanding subscripiton for 94 & 95 240.00

Cash 440.00

4,360.00 4,360.00

Lakshmi Page 8 Income Expenditure

The receipts and payments for the year ended 31.3.96:

RECIPTS AMOUNT AMOUNT PAYMENTS AMOUNT AMOUNT

To Opening balance 440.00 By Creditors for 94-95 160.00

To Subscripitions By General expenses 9,240.00

1994-95 160.00 By Printing and satationery 600.00

1995-96 8,160.00 By Equipment purchases 31.6.96 640.00

1996-97 120.00 By Lighting and rent 1,080.00

ToBar Sales 10,240.00 By purchase of bar goods 5,840.00

To Receipts from annual day 800.00 By Annual day expenses 1,280.00

By closing expenses 1,080.00

19,920.00 19,920.00

1. Rs. 264 is yet to be received as subscrition for the year 1995-96.

2. Bar Stock as on 31.3.96 - Rs. 840, furniture to be written down by Rs. 100.

3. Deperciation on equipments to be provided at 25% p.a.

Prepare bar trading account and income and expenditure account for the year ended 31.3.96 and balance sheet

as on that date.

Bar trade account:

PARTICULARS AMOUNT AMOUNT PARTICULARS AMOUNT AMOUNT

To opening bar stock 880.00 By Bar sales 10,240.00

To purchases for bar 5,840.00 By closing bar stock 840.00

To Gross profit 4,360.00

11,080.00 11,080.00

EXPENDITURE AMOUNT AMOUNT INCOME AMOUNT AMOUNT

To General Expenses 9,240.00 By Subscripition 8,160.00

To Printing and stationery 600.00 Add: Outstanding subscripition 264.00 8,424.00

To Lighting and Rent 1,080.00 By receipts from annual day 800.00

To Annual day expenses 1,280.00 By Gross profit of bar sales 4,360.00

To Deperciation

Equipment 410.00

Furniture 100.00 510.00

To Surplus 874.00

13,584.00 13,584.00

Balance sheet as on 31.3.96

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Capital fund 4,200.00 Equipment 1,640.00

Lakshmi Page 9 Income Expenditure

Add: surplus 874.00 5,074.00 Add: Additions 640.00

Subscripition received in advance 120.00 Less: Depreciation 410.00 1,870.00

Furniture 1,160.00

Less: Depreciation 100.00 1,060.00

Outstanding subscription 264.00

Cash 1,080.00

Outstanding subscription 94-95 80.00

Closing Bar Stock 840.00

5,194.00 5,194.00

Problem 7:

The following is the receipt and payment account for Tamil Mandalam for the year ended 31.3.1996.

RECIPTS AMOUNT AMOUNT PAYMENTS AMOUNT AMOUNT

To balance c/d 12,500.00 By Salaries 2,500.00

To Subscription 52,500.00 By Printing and Stationery 1,250.00

To Annual day receipts 26,800.00 By Annual day expenses 1,500.00

Symposium receipts 22,500.00 By Symposium expenses 10,000.00

To Dividends on shares 2,500.00 By Telephone charges 2,500.00

By Sundry expenses 2,000.00

By Shares purchased 75,000.00

By Postage and Telegrams 2,200.00

By Building Maintance 6,340.00

By Cash at bank 13,510.00

116,800.00 116,800.00

Additional information:

1. The value of builing owned by the society stood at Rs. 50000 on 1st April 1995. Depreciation @ 5% p.a is to be

provided.

2. There are 200 members paying subscripition @ 250 per annum each

3. As on 1st April 1995 no subscription had been received in advance but subscripition were outstanding to the

extent of Rs. 1000. As at 31st March 1996 subscriptions outstanding were Rs. 1500

4. Postage stamps worth Rs. 250 were with the secretary at the beginning of the year and the stamps at the end

of the year were of the value of Rs. 150.

5. The investment in shares at the beginning of the year were to the extent of Rs. 5000.

6. An amount of Rs. 250 in respect of the annual day reciepts was yet to be received

7. Hire of telephone paid in advance Rs. 300

8. Outstanding amount of symposum receipts on 31.3.1996 Rs. 2500. Prepare the income and expenditure account

for the year ended 31st March 1996 and the Balance sheet as on that date.

Lakshmi Page 10 Income Expenditure

Opening Balance Sheet as on 01.04.1995:

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Capital Fund (Balance) 68,750.00 Building 50,000.00

Investment on shares 5,000.00

Outstanding subscripition 1,000.00

Postage and stamps 250.00

Cash 12,500.00

68,750.00 68,750.00

EXPENDITURE AMOUNT AMOUNT INCOME AMOUNT AMOUNT

To Salaries 2,500.00 By Subscripitions 50,000.00

To Printing and Stationery 1,250.00 By Annual day receipts 26,800.00

To Annual day expenses 1,500.00 Add: outstanding 250.00 27,050.00

To Symposium expenses 10,000.00 By Symposium receipts 22,500.00

To Sundry Expenses 2,000.00 Add: outstanding 2,500.00 25,000.00

To Building Maintainance 6,340.00 By Dividend on shares 2,500.00

Add: Additions during the year 2,500.00

Less: Prepaid expenses 300.00 2,200.00

To Postage and stamps

Opening 250.00

Add: Additions during the year 2,200.00

Less: Closing 150.00 2,300.00

To Deperciation 2,500.00

To Surplus 73,960.00

104,550.00 104,550.00

Subscripition account:

PARTICULARS AMOUNT AMOUNT PARTICULARS AMOUNT AMOUNT

To Outstanding at beginning 1,000.00 By Cash collected 52,500.00

To income 50,000.00 By Outstanding at end 1,500.00

To Received in advance 3,000.00

54,000.00 54,000.00

Closing Balance Sheet as on 31.03.96:

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Capital fund 68,750.00 Investment 5,000.00

Add: Surplus 73,960.00 142,710.00 Add: Additional investment 75,000.00 80,000.00

Subscripition received in advance 3,000.00 Buildings 50,000.00

Less: Deperciation 2,500.00 47,500.00

Annual day receipts due 250.00

Prepaid telephone charges 300.00

Closing postage and stamps 150.00

Lakshmi Page 11 Income Expenditure

Bank Balance 13,510.00

Subscripition outstanding 1,500.00

Symposium expenses due 2,500.00

145,710.00 145,710.00

Problem 8:

The Baalance sheet of New City College as at 31st March 2003 was as follows:

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Capital Fund 2,100,000.00 Land & Buildings 2,000,000.00

Building Construction Fund 800,000.00 Furniture 300,000.00

General Fund outstanding 640,000.00 Labouratory equipment 250,000.00

Salaries (teachers) 160,000.00 Library books 360,000.00

Investments 650,000.00

Accrued tution fees 10,000.00

Cash and Bank 130,000.00

3,700,000.00 3,700,000.00

RECIPTS AMOUNT AMOUNT PAYMENTS AMOUNT AMOUNT

To Opening balance (1.4.2003) 130,000.00

By Salaries & Allowance - teachers

and staffs 4,200,000.00

To Govt. grants - revenue 5,000,000.00 By Non- teaching staffs 2,000,000.00

To Donation for building

construction 200,000.00 By Printing and stationery 80,000.00

To Tution fees and session charges 1,820,000.00 By Laboratory expenses 60,000.00

To Investment income 70,000.00 By Laboratory equipments 120,000.00

To Rental income - college hall 40,000.00 By Library books 250,000.00

By Office expenses 60,000.00

By Electricity & Telephones 75,000.00

By Audit fees 2,000.00

By Municipal taxes 1,000.00

By Building repairs 40,000.00

By Purchase of furniture 80,000.00

By Games and sports 20,000.00

By Welfare expenses 30,000.00

By New investments 150,000.00

By Closing Balance - 31.03.2004 92,000.00

7,260,000.00 7,260,000.00

Lakshmi Page 12 Income Expenditure

Other Information:

1. Tution fee outstanding as on 31.03.2004 - Rs. 40000

2. Salary of teaching staff outstanding for March 2004 - Rs. 250000

3. Books received as donations from various parties - Rs. 30000 (valued)

4. Outstanding building repair expenses as on 31.03.2004 - Rs. 15000

5. Applicable depreciation rates:

Land and Buildings 2%

Furniture 8%

Laboratory equipment 10%

Library books 20%

You are required to prepare the Income and Expenditure account for the year ended 31st March 2004 and a Balance

sheet as on that date.

EXPENDITURE AMOUNT AMOUNT INCOME AMOUNT AMOUNT

To Teaching staff salary 4,200,000.00 By Tution fees 1,820,000.00

Add: Outstanding 250,000.00 Add: outstanding 40,000.00

Less: last year liability 160,000.00 4,290,000.00 Less: Accrued last year 10,000.00 1,850,000.00

To Non- teaching staff salaries 2,000,000.00 By Govt.grants 5,000,000.00

To Printing and stationery 80,000.00 By Rental income 40,000.00

To Laboratory expenses 60,000.00 By Investment income 70,000.00

To Office expenses 60,000.00 By Valued book donations 30,000.00

To Electricity and telephones 75,000.00

To Audit fees 2,000.00

To Municipal taxes 1,000.00

To Building repairs 40,000.00

Add: Outstanding 15,000.00 55,000.00

To sports and games 20,000.00

To Welfare expenses 30,000.00

To Deperciation

Land and building 40,000.00

Furniture 30,400.00

Laboratory equipments 37,000.00

Liabrary books 128,000.00 235,400.00

To surplus 81,600.00

6,990,000.00 6,990,000.00

Lakshmi Page 13 Income Expenditure

Balance sheet New City College:

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Capital fund 2,100,000.00 Building 2,000,000.00

Building contruction fund 800,000.00 Less: Depreciation 40,000.00 1,960,000.00

Add: Donation 200,000.00 1,000,000.00 Laboratory equipments 250,000.00

General fund 640,000.00 Add: Additions during the year 120,000.00

Add: Surplus 81,600.00 721,600.00 Less: Depreciation 37,000.00 333,000.00

Outstanding teacheers salary 250,000.00 Furniture 300,000.00

Outstanding building repairs 15,000.00 Add: Additions during the year 80,000.00

Less: Depreciation 30,400.00 349,600.00

Liabrary books 360,000.00

Add: Additions during the year 250,000.00

Add: Books donation 30,000.00

Less: Depreciation 128,000.00 512,000.00

Investment 650,000.00

Add: New investments 150,000.00 800,000.00

Cash 92,000.00

Accrued income 40,000.00

4,086,600.00 4,086,600.00

Income and Expenditure - Section 2:

Problem 1:

From the following, prepare an Income and Expenditure Account for the year ended 31st March 2000

Particulars Amount Amount Particulars Amount Amount

1-Apr-99 31-Mar-00

To Balance By Salaries 360,000.00

Cash at Bank 45,500.00 By Rent 60,000.00

Cash in Office 5,500.00 51,000.00 By Printing and Stationery 14,500.00

2000, March 31: By Postage and Telegrams 2,500.00

To Subscription (including Rs. 20000 By Purchase of Bicylce 9,500.00

for 2000-2001) 300,000.00 By Purchase of Government Bonds 68,000.00

To Interest on Investments 150,000.00 By Balance:

To Bank Interest 1,000.00 Cash in Office 1,200.00

To Sale Proceeds of Car 25,000.00 Cash in Bank 11,300.00 12,500.00

527,000.00 527,000.00

Income and Expenditure Account for the year ended 31st March 2000:

Expenditure Amount Amount Income Amount Amount

To Salaries 360,000.00 By Subscription 300,000.00

To Rent 60,000.00 Less: Received in advance 20,000.00 280,000.00

To Printing and Stationery 14,500.00 By Interest on Investments 150,000.00

To Postage and Telegrams 2,500.00 By Bank Interest 1,000.00

By Deficit - excess of expenditure 6,000.00

Lakshmi Page 14 Income Expenditure

437,000.00 437,000.00

Problem 2:

The following is the Receipts and Payments Account of the Bombay Sports Club for the year ending 31st March 2000:

Receipts Amount Amount Payments Amount Amount

To Balance 1st Apirl 1999 3,000.00 By Rent 52,000.00

To Entrance Fees 5,500.00 By Stationery Expneses etc 30,680.00

To Subscriptions, 1998-99 2,000.00 By Wages 53,300.00

To Subscriptions, 1999-2000 169,000.00 By Billards Table 39,000.00

To Subscriptions, 2000-2001 3,000.00 By Repairs and Renewals 8,060.00

To Locker Rents 5,000.00 By Interest 15,000.00

To Special Subscriptions for Governor's By Balance, 31st March 2000 23,960.00

Party 34,500.00

222,000.00 222,000.00

Locker Rent Rs. 600 referred to 1998-99 and Rs. 900 is still owing; Rent Rs. 13000 pertained to 1998-99 and Rs. 13000 is still due; Stationery expenses etc

Rs. 3120 related to 1998-99, still owing Rs. 3640 . Subscriptions upaid for 1999-2000, Rs. 4680 special subscription for Governor's party outstanding

Rs. 5500.

From the above information you are required to make out an income and expenditure account of the club for the year ending 31st March 2000.

Income and Expenditure Account of Bombay Sports Club for the year ending 31st March 2000:

Expenditure Amount Amount Income Amount Amount

To Rent 52,000.00 By Entrance Fees 5,500.00

Less: Relating to 1998-99 13,000.00 By Subscription 169,000.00

39,000.00 Add: Outstanding 4,680.00 173,680.00

Add: Outstanding 13,000.00 52,000.00 By Locker Rent 5,000.00

To Stationery Expneses 30,680.00 Less: Related to 1998-99 600.00

Less: Relating to 1998-99 3,120.00 4,400.00

27,560.00 Add: Outstanding 900.00 5,300.00

Add: Outstanding 3,640.00 31,200.00

To Wages 53,300.00

To Repairs and Renewals 8,060.00

To Interest 15,000.00

To Surplus - Excess Income over Exp. 24,920.00

184,480.00 184,480.00

Problem 3:

From the following information relating to Indian Cricket Club, prepare Income and Expenditure for the year ending 31st March 2000 and Balance

Sheet as at that date, abstract of Hon. Secretary's Cash Book for the year is as follows:

Particulars Amount Amount Particulars Amount Amount

To Member's subscription 80,000.00 By Upkeep of Field and Pavilion 20,000.00

To Member's admission fees 3,000.00 By Expenses regarding Tournament 37,000.00

To Sale of old balls, bats etc 500.00 By Rates and Insurance 2,000.00

To Hire of ground 3,000.00 By Telephone 4,500.00

To Subscription for Tournament 40,000.00 By Printing and Stationery 1,000.00

To Bank Drawn 40,000.00 By General Charges 2,200.00

To Donation 100,000.00 By Secretary's Honnorarium 5,000.00

By Grass Seeds 1,300.00

Lakshmi Page 15 Income Expenditure

By Bats, Balls etc 27,000.00

By Bank Lodged 166,500.00

266,500.00 266,500.00

Assets as on 1st Apirl 1999: Amount

Cash at Bank 30,000.00

Stock of Bats, Balls etc 15,000.00

Printing and Stationery 2,000.00

Subscription due 5,000.00

Liabilities as on 1st Apirl 1999 Nil

Donation and Surplus on account of tournament should be kept in Reserve for a permanent Pavilion. Subscription due at 31st March 2000 Rs. 7500

write off 50% on Bats, Balls account and 25% of Printing and Stationery Account.

Income and Expenditure Account of Indian Cricket Club for the year ending 31st March 2000:

Expenditure Amount Amount Income Amount Amount

To Upkeep of Field and Pavilion 20,000.00 By Subscription 80,000.00

To Rates and Insurance 2,000.00 Less: Relating to 1999-2000 5,000.00

To Telephone 4,500.00 75,000.00

To Printing and Stationery 750.00 Add: Outstanding 7,500.00 82,500.00

To General charges 2,200.00 By Admission fees 3,000.00

To Secretary's Honnorium 5,000.00 By Old Balls, Bats 500.00

To Bats, Balls etc 27,000.00 By Hire of Ground 3,000.00

Add: Stock as on 1st April 1999 15,000.00

42,000.00

50% written off 21,000.00

To Grass seeds 1,300.00

To Surplus - Excess of Income 32,250.00

89,000.00 89,000.00

Balance Sheet of Indian Cricket Club as on 31st March 1999:

Liabilities Amount Amount Assets Amount Amount

Capital (Balance) 52,000.00 Cash at Bank 30,000.00

Stock of Balls, Bats etc 15,000.00

Printing and Stationery 2,000.00

Subscription due 5,000.00

52,000.00 52,000.00

Reserve for permanent pavilion 100,000.00

Add: Subscription for tournament 10,000.00

110,000.00

Less: Expenditure regarding tornament 7,000.00 103,000.00

Add: Bank Lodged 30,000.00

166,500.00

196,500.00

Less: Bank Drawn 40,000.00

156,500.00

Balance Sheet of Indian Cricket Club as on 31st March 2000:

Liabilities Amount Amount Assets Amount Amount

Capital 52,000.00 Cash at Bank 156,500.00

Add: Surplus for the year 32,250.00 84,250.00 Stock of Balls, Bats etc 21,000.00

Lakshmi Page 16 Income Expenditure

Reserve for permant pavilion 103,000.00 Printing and Stationery 2,250.00

Subscription due 7,500.00

187,250.00 187,250.00

Problem 4:

The Mahant Club's accounts on 31st March 1999 showed that annual subscription outstanding were Rs. 5000 from 50 memebers and that subscriptions

had been received for 1999-2000 from 20 members. The total number of members on 31st March 1999 was 1500 . During the year ended 31st March

2000, 25 members left or died (5 of which were those who owed subscription on 31st March 1999) and 40 others were admitted; they paid Rs. 150 as

admission fee; 15 of these paid subscriptions for 1999-2000 as well. The total amount received during 1999-2000 as subscription were Rs. 147000

Prepare the subscriptions account and show the amount to be credited or debited to the income and expenditure account for the year ended 31st

March 2000 in respect of the above.

Working Notes:

Subscription outstanding on March 31 2000

No. of memebers on March 31 1999 1,500.00

New Admission 40.00

1,540.00

Less: Withdrawls and deaths:

No. of memebers on 31st March 2000 25.00

No. of memebers on 31st March 2000 1,515.00

Total amount receivable @ Rs.100 for

1515 memebers 151,500.00

Add: Received in advance on 31st March 2000 1,500.00

Outstanding on 31st March 1999 4,500.00

157,500.00

Less: Received cash during the year 147,000.00

Received in advance in March 1999 2,000.00 149,000.00

8,500.00

Subscription Account:

Particulars Amount Amount Particulars Amount Amount

To Subscription outstanding By Subscription received in advance 2,000.00

Account - Transfer 5,000.00 By Bank 147,000.00

To Subscription Received in advance 1,500.00 By Subscription irrecoverable 500.00

To Income and Expenditure A/C- By Subscription Outstanding 8,500.00

Transfer of subscriptions pertaining to

the year 151,500.00

158,000.00 158,000.00

Problem 5:

The Misguided Club has a research endownment of Rs. 1800000 which it has invested in 15% debentures of a company, purchased at 90. Besides the

endownment, the club had on Apirl 1, 1999 Rs. 45000 relating to research during 1999-2000, the club under took a project which cost Rs. 167000 in cash

besides time devoted by the general staff of the club which would be valued at Rs. 12000. Show how you would recommeded the above to be

treated in the accounts of the club for the year ended 31st March 2000.

The club should prepare the Researh Endownment Income Expenditure Account as follows:

Reasearch Endownment Income and Expenditure Account:

Particulars Amount Amount Particulars Amount Amount

To Expenditure on Research - Cash 167,000.00 By Interest on 15% Debentures @

By Expenses 12,000.00 Rs. 2000000 300,000.00

Lakshmi Page 17 Income Expenditure

By Surplus 121,000.00

300,000.00 300,000.00

Working Note:

Calculation of Cash at end:

Cash in hand on 1st April 1999 45,000.00

Add: Net surplus 121,000.00

Cash in hand on 1st April 1999 166,000.00

The balance sheet of the Misguided club:

Liabilities Amount Amount Assets Amount Amount

Reasearch endownment fund: Reasearch endownment fund investment

Balances on 1 Apirl 1999 1,845,000.00 15% Debentures (face value Rs.2000000) 1,800,000.00

Add: Net surplus 121,000.00 Cash 166,000.00

1,966,000.00 1,966,000.00

1,966,000.00 1,966,000.00

Problem 6:

From the following particulars, calculate the amount of subscriptions to be credited to the income and expenditure account for the year ended 31st March 2001

31-Mar-00 31-Mar-01

Rs Rs

Outstanding subscriptions 15,000.00 12,000.00

Subscription received in advance 9,000.00 5,400.00

A sum of Rs. 146700 was received as subscriptions during the year ended 31st March 2001.

Calculation of subscription income:

Subscription received during the year 146,700.00

Less: Outstanding subscription as March 2001 15,000.00

131,700.00

Add: Outstanding subscription as on March 2000 12,000.00

143,700.00

Add: Subscription received in advance

as on March 31st 2000 9,000.00

152,700.00

Less: Subscription received in advance

as on March 31st 2001 5,400.00

147,300.00

Problem 7:

From the following particulars, prepare subscriptions Account for the year ended 31st March 2001:

1. Subscriptions in arrear on

31st March 2000 1,500.00

2. Subscription received in advance as

on 31st March 2000 for the year 2000-01 3,300.00

3. Total subscription received during

the year (including Rs. 1200 for the

year 2000-01 and Rs. 3600 for the year

2001-2002 117,900.00

4. Subscription in arrear on 31st

March, 2000 for the year 2000-01 1,200.00

Lakshmi Page 18 Income Expenditure

Subscription Account:

Particulars Amount Amount Particulars Amount Amount

To Subscription in arrear on By Subscription Received in Advance

1st April 2000 1,500.00 on 1st April 1999 3,300.00

To Subscription Received in Advance By Bank/Cash 117,900.00

on 31st March 2001 3,600.00 By Subscription in arrear on

31st March 2000:

To Income and Expenditure 117,600.00 For 1999-2000 300.00

For 2000-2001 1,200.00 1,500.00

122,700.00 122,700.00

Problem 8:

On the basis of the following information, calculate the amount that will be shown against the item Sports Material Used in the Income and Expenditure

Account of a sports club for the year ended 31st March 2000:

Stock of Sports Mateial on 1st April 1999 60,000.00

Creditors for Sports Material on 1st April 1999 40,000.00

Amount paid for sports Material during

the year ended 31st March 2000 216,000.00

Stock of Sports Material on 31st March 2000 26,000.00

Creditors for Sports Material on 31st March 2000 10,000.00

Amount paid for Sports Material during

the year ended 31st March 2000 216,000.00

Add: Creditors for Sports Material

on 31st March 2000 10,000.00

226,000.00

Less: Creditors for Sports Material on

1st April 1999 40,000.00

Sports materials purchased during the year 186,000.00

Add: Stock of Sports Materials on

1st April 1999 60,000.00

246,000.00

Less: Stock of Sports Materials on

31st March 2000 26,000.00

Sports Materials used to be shown in 220,000.00

Income and Expenditure Account

Problem 9:

From the following particulars, prepare income and expenditure account:

Fees collected, including Rs. 80000 on account of the previous year 380,000.00

Fees for the year outstanding 10,000.00

Salary paid including Rs. 8000 on account of the previous year 98,000.00

Salary Outstanding at the end of the year 9,000.00

Entertainment expenses 3,000.00

Tournament expenses 42,000.00

Meeting Expneses 18,000.00

Travelling expneses 6,000.00

Purchase of books and periodicals, including Rs. 19000 for purchase of books 29,000.00

Rent 18,000.00

Lakshmi Page 19 Income Expenditure

Postage, Telegrams and Telephones 15,000.00

Printing and Stationery 4,000.00

Donations received 20,000.00

Income and Expenditure Account:

Expenditure Amount Amount Income Amount Amount

To Salaries 98,000.00 By Fees 380,000.00

Add: Outstanding Salaries at the end Add: Outstanding during the year 10,000.00

of the year 9,000.00 390,000.00

107,000.00 Less: Outstanding during the previous

Less: Outstanding during pervious year 80,000.00 310,000.00

year 8,000.00 99,000.00 By Donation 20,000.00

To Entertainment expenses 3,000.00

To Tournament Expenses 42,000.00

To Meeting Expenses 18,000.00

To Travelling Expenses 6,000.00

To Rent 18,000.00

To Postage 15,000.00

To Printing and Stationery 4,000.00

To Books and Periodicals 29,000.00

Less: Books Capitalised 19,000.00 10,000.00

To Surplus - Excess of expenditure 115,000.00

330,000.00 330,000.00

Problem 10:

Gvaskar Cricket Club gives you that the following Receipts and Payments Account for the year ended 31st March 2000:

Receipts Amount Amount Payments Amount Amount

To Balance of Cash on By Salaries and Wages 12,000.00

1st April 1999: By Sports Equipment 46,785.00

At Office 150.00 By Stationery and Printing 1,220.00

At Bank 14,200.00 14,350.00 By Maintenance of Ground 6,000.00

To Subscription 61,100.00 By Prizes 1,060.00

To Admission Fees 350.00 By Balances of Cash on 31st March 2000

To Interest on Investment @ 9% At Office 380.00

per annum for full year 9,000.00 At Bank 17,355.00 17,735.00

84,800.00 84,800.00

The following additional information is provided to you:

1-Apr-99 31-Mar-00

Subscriptions due 480.00 560.00

Subscriptions Received in Advance 80.00 40.00

Sports Equipment 21,800.00 29,700.00

Land and Buildings (cost less

Depreciation) 80,000.00 76,000.00

Prepare Income and Expenditure Account for the year ended 31st March 2000 and Balance Sheet as at that date.

Calculation of Sports Equipment Used:

Stock of Sports Equipment on 1st April 1999 21,800.00

Add: Sports Equipment Purchased during the

year 1999-2000 46,785.00

68,585.00

Less: Stock of Sports Equipment as on 31 Mar 2000 29,700.00

Lakshmi Page 20 Income Expenditure

38,885.00

Calculation Income on Account of Subscriptions:

Amount Received during the year 61,100.00

Add:

Subscription received in advance on

1st Apirl 1999 80.00

Subscripiton due on 31st April 2000 560.00 640.00

61,740.00

Less:

Subscription received in advance

on 31st March 2000 40.00

Subscription due on 1st April 1999 480.00 520.00

61,220.00

Balance Sheet of Gavaskar Cricket Club as on 1st April 1999:

Liabilities Amount Amount Assets Amount Amount

Subscription Received in Advance 80.00 Land and Building 80,000.00

Capital (Balance) 216,550.00 Investment 100,000.00

Stock of Sports Equipments 21,800.00

Subscription due 480.00

Cash at Bank 14,200.00

Cash at Office 150.00

216,630.00 216,630.00

Income and Expenditure Account:

Expenditure Amount Amount Income Amount Amount

To Salaries and Wages 12,000.00 By Subscription 61,220.00

To Sports Equipment Used 38,885.00 By Admission Fees 350.00

To Stationery and Printing 1,220.00 By Interest on Investment 9,000.00

To Maintance of Ground 6,000.00

To Prizes 1,060.00

To Depreciation 4,000.00

To Surplus 7,405.00

70,570.00 70,570.00

Balance Sheet of Gavaskar Cricket Club as on 31st March 2000:

Liabilities Amount Amount Assets Amount Amount

Capital 216,550.00 Sports Equipments 29,700.00

Add: Surplus 7,405.00 223,955.00 Land and Building 80,000.00

Subscription received in advance 40.00 Less: Depreciation 4,000.00 76,000.00

Investment 100,000.00

Subscription due 560.00

Cash at Bank 17,355.00

Cash at Office 380.00

223,995.00 223,995.00

Problem 11:

Lakshmi Page 21 Income Expenditure

The Kolkatta Association submits to you its Recipts and Payments Account for the year ending on 31st March 2000. You are required to prepare the

Income and Expenditure Account and the Balance Sheet relating to the year

Receipts Amount Amount Payments Amount Amount

Opening Balance: Establishment (includes Rs. 4000 for

Cash in Hand 2,500.00 2000-2001) 60,000.00

Balance at Bank 205,500.00 Telephone Charges 5,400.00

Subscription (including Rs. 7500 for Electric Charges 2,500.00

2000-2001) 212,500.00 Stamps and Stationery 6,000.00

Hall Rent 12,500.00 Travelling 1,500.00

Interest on Securities 10,000.00 Meeting Expenses 5,000.00

Donation Received 100,000.00 Rent 55,000.00

Telephone Receipts 500.00 Library 30,000.00

Donation Given 50,000.00

Closing Balances:

Cash in Hand 3,100.00

Balance at Bank 325,000.00

543,500.00 543,500.00

The association also gives the following information:

1. The association holds 10% Government Securities amounting to Rs. 200000 on 1st April 1999 . The securities were purchased at par.

2. The Library account stood at Rs. 200000 as on 1 April 1999.

3. Half of the donation received is to be transferred to the capital fund

4. Rent Rs. 5000 is still payable.

5. Provide Rs. 23000 as depreciation on Library Account.

Working Notes:

Balance Sheet as on 1st April 1999:

Liabilities Amount Amount Assets Amount Amount

Capital (Balance) 608,000.00 Library Account 200,000.00

10% Government Securities 200,000.00

Cash at Bank 205,500.00

Cash in Hand 2,500.00

608,000.00 608,000.00

The Kolkatta Association Income and Expenditure Account for the year ended 31st March 2000:

Expenditure Amount Amount Income Amount Amount

To Establishment 60,000.00 By Subscription 212,500.00

Less: Paid in Advance 4,000.00 56,000.00 Less: Received in Advance 7,500.00 205,000.00

To Telephone Charges 5,400.00 By Hall Rent 12,500.00

To Electric Charges 2,500.00 By Interest on Securities 10,000.00

To Stamps and Stationery 6,000.00 Add: Interest accured on 31st March 00 10,000.00 20,000.00

To Travelling 1,500.00 By Telephone Receipts 500.00

To Meeting Expneses 5,000.00 By Donation Received 100,000.00

To Rent 55,000.00 Less: 50% transferred to Capital fund 50,000.00 50,000.00

Add: Outstanding 5,000.00 60,000.00

To Depreciation on Library Account 23,000.00

To Donation Given 50,000.00

To Surplus 78,600.00

288,000.00 288,000.00

Lakshmi Page 22 Income Expenditure

Balance Sheet as on 31st March 2000:

Liabilities Amount Amount Assets Amount Amount

Capital 608,000.00 Liabrary 230,000.00

Add: Donation 50,000.00 Less: Depreciation 23,000.00 207,000.00

Add: Surplus 78,600.00 736,600.00 10% Govt. Securities at Par 200,000.00

Subscription received in advance 7,500.00 Add: Interest accured 10,000.00 210,000.00

Rent Outstanding 5,000.00 Establishment Advance Expenses 4,000.00

Cash at Bank 325,000.00

Cash in Hand 3,100.00

749,100.00 749,100.00

Problem 12:

From the following Trial Balance and the necessary information given below for a public school, prepare Income and Expenditure Account for the year

1999-2000 and a Balance Sheet as at 31st March 2000.

Debit Balances Amount Amount Credit Balances Amount Amount

Buildings 250,000.00 Admission Fees 5,000.00

Furniture and Fittings 40,000.00 Tution and Other Fees received 200,000.00

Library Books 60,000.00 Creditors for Supplies 6,000.00

Investment @ 9% 200,000.00 Rent for the Hall 4,000.00

Salaries 200,000.00 Miscellaeous Receipts 12,000.00

Stationery 15,000.00 Government Grant 140,000.00

General Expenses 8,000.00 General Fund 400,000.00

Annual Sports Expenses 6,000.00 Donation (Received for purchase

Cash at Bank 20,000.00 of Library Books) 25,000.00

Cash in Hand 1,000.00 Sale of Furnture 8,000.00

800,000.00 800,000.00

Tution and Other Fees yet to be received for the year are Rs. 10000 . Salaries yet to be paid amount to Rs. 12000 . Furniture costing Rs. 15000 was

purchased on 1st October, 1999 . The book value of the furniture sold (on 30th September, per annum on Library Books and @ 5% per annum on

Buildings).

Working Notes:

Calculation of Loss on Sale of Furniture:

Book Value on 1st April 1999 of 30th

September, 1999 20,000.00

Less: Depreciation on Rs. 20000 for

6 months 1,000.00

19,000.00

Less: Sale of Furniture 8,000.00

Loss 11,000.00

Depreciation on Furniture and Fittings:

Full year 500.00

For 6 months 750.00

For 6 months 1,000.00

Total Depreciation 2,250.00

Depreciation for items in use 1,250.00

Expenditure Amount Amount Income Amount Amount

To Salaries 200,000.00 By Admission Fees 5,000.00

Lakshmi Page 23 Income Expenditure

Add: Outstanding 12,000.00 212,000.00 By Tution and Other Fees 200,000.00

To Stationery 15,000.00 Add: Outstanding 10,000.00 210,000.00

To General Expenses 8,000.00 By Rent for Hall 4,000.00

To Annual Sports Expenses 6,000.00 By Miscellanous Receipts 12,000.00

To Loss on Sale of Furntiure 11,000.00 By Government Grant 140,000.00

To Depreciation: By Income from Investment 18,000.00

Furniture and Fittings 2,250.00

Library Books 9,000.00

Buildings 12,500.00 23,750.00

To Surplus 113,250.00

389,000.00 389,000.00

Balance Sheet as on 31st March 2000:

Liabilities Amount Amount Assets Amount Amount

General Fund 400,000.00 Buildings 250,000.00

Add: Surplus 113,250.00 513,250.00 Less: Depreciation 12,500.00 237,500.00

Donation for purchase of books 25,000.00 Furniture and Fittings 20,000.00

Creditors for Suppliers 6,000.00 Less: Depreciation 1,250.00 18,750.00

Rent Outstanding 12,000.00 Library Books 60,000.00

Less: Depreciation 9,000.00 51,000.00

Investments 200,000.00

Interest on investment due 18,000.00

Tution and Other Fees due 10,000.00

Cash at Bank 20,000.00

Cash in Hand 1,000.00

556,250.00 556,250.00

Lakshmi Page 24 Income Expenditure

Lakshmi Page 25 Income Expenditure

Lakshmi Page 26 Income Expenditure

Lakshmi Page 27 Income Expenditure

Lakshmi Page 28 Income Expenditure

Lakshmi Page 29 Income Expenditure

Lakshmi Page 30 Income Expenditure

Lakshmi Page 31 Income Expenditure

Lakshmi Page 32 Income Expenditure

Lakshmi Page 33 Income Expenditure

Lakshmi Page 34 Income Expenditure

Lakshmi Page 35 Income Expenditure

Lakshmi Page 36 Income Expenditure

Lakshmi Page 37 Income Expenditure

Lakshmi Page 38 Income Expenditure

Locker Rent Rs. 600 referred to 1998-99 and Rs. 900 is still owing; Rent Rs. 13000 pertained to 1998-99 and Rs. 13000 is still due; Stationery expenses etc

Rs. 3120 related to 1998-99, still owing Rs. 3640 . Subscriptions upaid for 1999-2000, Rs. 4680 special subscription for Governor's party outstanding

From the above information you are required to make out an income and expenditure account of the club for the year ending 31st March 2000.

From the following information relating to Indian Cricket Club, prepare Income and Expenditure for the year ending 31st March 2000 and Balance

Lakshmi Page 39 Income Expenditure

Donation and Surplus on account of tournament should be kept in Reserve for a permanent Pavilion. Subscription due at 31st March 2000 Rs. 7500

Lakshmi Page 40 Income Expenditure

The Mahant Club's accounts on 31st March 1999 showed that annual subscription outstanding were Rs. 5000 from 50 memebers and that subscriptions

had been received for 1999-2000 from 20 members. The total number of members on 31st March 1999 was 1500 . During the year ended 31st March

2000, 25 members left or died (5 of which were those who owed subscription on 31st March 1999) and 40 others were admitted; they paid Rs. 150 as

admission fee; 15 of these paid subscriptions for 1999-2000 as well. The total amount received during 1999-2000 as subscription were Rs. 147000

Prepare the subscriptions account and show the amount to be credited or debited to the income and expenditure account for the year ended 31st

The Misguided Club has a research endownment of Rs. 1800000 which it has invested in 15% debentures of a company, purchased at 90. Besides the

endownment, the club had on Apirl 1, 1999 Rs. 45000 relating to research during 1999-2000, the club under took a project which cost Rs. 167000 in cash

besides time devoted by the general staff of the club which would be valued at Rs. 12000. Show how you would recommeded the above to be

Lakshmi Page 41 Income Expenditure

From the following particulars, calculate the amount of subscriptions to be credited to the income and expenditure account for the year ended 31st March 2001

Lakshmi Page 42 Income Expenditure

On the basis of the following information, calculate the amount that will be shown against the item Sports Material Used in the Income and Expenditure

Lakshmi Page 43 Income Expenditure

Lakshmi Page 44 Income Expenditure

Lakshmi Page 45 Income Expenditure

The Kolkatta Association submits to you its Recipts and Payments Account for the year ending on 31st March 2000. You are required to prepare the

1. The association holds 10% Government Securities amounting to Rs. 200000 on 1st April 1999 . The securities were purchased at par.

Lakshmi Page 46 Income Expenditure

From the following Trial Balance and the necessary information given below for a public school, prepare Income and Expenditure Account for the year

Tution and Other Fees yet to be received for the year are Rs. 10000 . Salaries yet to be paid amount to Rs. 12000 . Furniture costing Rs. 15000 was

purchased on 1st October, 1999 . The book value of the furniture sold (on 30th September, per annum on Library Books and @ 5% per annum on

Lakshmi Page 47 Income Expenditure

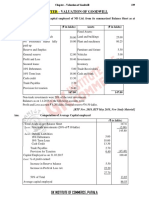

VALUVATION OF GOODWILL:

Average profit Method:

Goodwill = FMAPxNo. Of years of purchase

Weighted average profit Method:

Weighted average profit = Total of products/ Total of weights

Goodwill = Weighted average profit x No. of years of purchase

Super profit Method:

Super profit = FMAP - Normal profit

Normal profit = Average capital employed x NRR

Goodwill = Super profit x No. of years of purchase

Note:

NRR - Normal Rate of Return

FMAP - Future Maintaainable Average Profit

Capitalise Method:

Goodwill = Capitalized value - Average capital employed

Capitalized value = FMAP/NRR

Capitalization of super profit Method:

Goodwill = Super profit / NRR

Annuity Table:

Goodwill = Super profit x Annuity factor.

FUTURE MAINTAINABLE AVERAGE PROFIT (FMAP)

Profits given xxx

Less: Non-recurring incomes xxx

Add: Non-recurring expenses xxx

VALUATION OF GOODWILL AND SHARES

Lakshmi Page 48 Valuation of Goodwill and Shares

Less: Anticipated increase in expenses in future xxx

Add: Anticipated increase in income in future xxx

Less: Non-business income(income from investments) xxx

FMAP xxx

Notes:

1. If adjustments are given for a particular year, adjust the profit of that year.

2. Adjustments are given on average or for future, adjust after calculating average profit

Average capital employed:

Assets:

Take assets at revised vlue except investments and iscellanous expenditure

Liabilities:

Less the external liabilities such as secured loans, unsecure loans, current liabilities and provisions.

Closing capital employed:

closing capital employed xxx

Less: 50% of the current year average profit xxx

Average capital xxx

Notes:

Do not deduct the 50% of the current year profit if:

1.Dividends were distributed

2. When NRR is given on closing capital

3. When NRR is given on net tangible capital (closing capital)

Problem 1:

The following particulars are avialable in respect of the business carried on by a trader:

1. Profits earned for the years:

1998 - 1999 50,000.00

1999-2000 60,000.00

2000 - 2001 55,000.00

2. Normal rate of return is 10%

3. Present value of annuity of one rupee for 5 years at 10% is Rs. 3.78

4. Average capital employed is Rs. 300000

5. The profit included non-recurring profits on an average basis of Rs. 3000

Lakshmi Page 49 Valuation of Goodwill and Shares

You are required to calcualte the value of goodwill:

1. As per five year purchase of super profit.

2. As per capitalization of super profit method

3. As per annuity method,

4. 2years purchase of average profit.

Average profit 55,000.00

Less: Non-recurring

profit 3,000.00

FMAP 52,000.00

FMAP 52,000.00

Less: Normal profit(300000x10%) 30,000.00

Super profit 22,000.00

Goodwill at:

Super profit 44,000.00

Capitalization of super profit 220,000.00

Annuity method 83,160.00

Average profit method 104,000.00

Problem 2:

Profits of S Ltd., for last six years are as follows:

1975 12,000.00

1976 14,000.00

1977 15,000.00

1978 16,000.00

1979 20,000.00

1980 25,000.00

Year Profits Weights Product

1975 12,000.00 1 12,000.00

1976 14,000.00 2 28,000.00

1977 15,000.00 3 45,000.00

1978 16,000.00 4 64,000.00

1979 20,000.00 5 100,000.00

1980 25,000.00 6 150,000.00

21 399,000.00

Weighted average profit 19,000.00

Goodwill 95,000.00

Lakshmi Page 50 Valuation of Goodwill and Shares

Problem 3:

A firm earned a profit of Rs. 8000, Rs. 10000, Rs. 12000, and Rs. 18000 during 1999, 2000 , 2001 and 2002

respectively. The firm has average capital investment of Rs. 50000. Pure rate of return on investment

is 10% p.a and risk premium expected is 5%. Calculate the goodwill of the firm based on three years of

purchase of average super profit of last four years. Also calculate goodwill by Capitalization Method.

Assume that the landlord has decided to increase rent of building by Rs. 500p.a

Year Profits Weights Product

1999 8,000 1 8,000

2000 10,000 2 20,000

2001 12,000 3 36,000

2002 18,000 4 72,000

10 136,000

Average profit 13,600.00

Less: Increase in rent 500.00

FMAP 13,100.00

Less: Normal profit 7,500.00

SUPER PROFIT 5,600.00

Super profit Method:

Goodwill 16,800.00

Capitalization of super profit

Goodwill 37,333.33

Capitalization Method:

Capitalized value 87,333.33

Goodwill 37,333.33

Problem 4:

The summarized balance sheet of the company as on 31st March 2001 is as follows:

Lakshmi Page 51 Valuation of Goodwill and Shares

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Share capital 6500 equity shares

of Rs. 100 each 650,000.00 Goodwill 50,000.00

1500 6% preference share of Rs. 100 150,000.00 Freehold property 375,000.00

profit and loss account 450,000.00 Plant and Machinery

5% debentures 300,000.00 (less depreciation) 350,000.00

Sundry Creditors 239,250.00 Current assets:

Stock 370,000.00

Debtors 399,250.00

Bank 245,000.00

1,789,250.00 1,789,250.00

Profit after tax for the 3 years 1998-99, 1999-2000 and 2000-01 after charging debentures interst were Rs. 220500,

Rs. 322500 and Rs. 240000 respectively. Mr. X is interested in buying all the equity shares and requires you to let

him to know proper price. You get the following information.

1. The normal rate or return is 10% on net assets attributed.

2. Goodwill may be calculated at 3 times of the adjusted average super profit of 3 years referred to abov e.

3. The value of freehold property is to be ascertained on the basis of 8% return. The current rental value is Rs.50400

4. Rate of tax applicable is 50%

5. 10% of profits for 1999-2000 referred to above is arose from a transaction of a non-recurring nature.

6. A provision of Rs. 15750 on sundry debtors was made in 2000-2001 which is no longer required, profit for the

year 2000-2001 is to be adjusted for this item

7. A claim of Rs. 8250 against the company is to be provided and adjusted profit for the year 2000-2001. Ascertain

the value of goodwill of the company. The capital employed may be taken as on 31st March 2001.

Average cpaital Employed:

ASSETS

Freehold property 375,000.00

Plant and Machinery 350,000.00

Stock 370,000.00

Bank 245,000.00

Debtors 399,250.00

Add: Provisions of debtors 15,750.00 415,000.00

1,755,000.00

Less: LIABILITIES

Debentures 300,000.00

Sundry creditors 239,250.00

Claim to be provided 8,250.00 547,500.00

CAPITAL EMPLOYED 1,207,500.00

Lakshmi Page 52 Valuation of Goodwill and Shares

FMAP

1998-1999 220,500.00

1999-2000 322,500.00

Less: 10% @ 322500 32,250.00 290,250.00

2000-2001 240,000.00

Less: Provisions required no longer 15,750.00

Less: 50% Tax 7,875.00

Less: Claim 8,250.00

Less: 50% Tax 4,125.00 235,500.00

746,250.00

Average profit 248,750.00

Less: Normal profit @ 10% on 1207500 120,750.00

SUPER PROFIT 128,000.00

Goodwill 384,000.00

Problem 5:

Balance sheet as on 31 March 2006:

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Equity share capital 500,000.00 Land and building 600,000.00

Preference share capital 400,000.00 Plant and Machinery 500,000.00

General Reserve 200,000.00 Investment 300,000.00

Workmen compensation fund 100,000.00 (Face value Rs. 400000)

Staff provided fund 300,000.00 Debtors 400,000.00

Debentures 300,000.00 Stock 100,000.00

Creditors 100,000.00 Prepaid Expenses 50,000.00

Other current liabilties 200,000.00 cash balance 100,000.00

preliemenary expenses 50,000.00

2,100,000.00 2,100,000.00

1. Profits of 2002-2003, 2003-2004, 2004-2005 & 2005-2006 after tax of Rs. 300000, Rs. 250000, Rs. 400000, & Rs. 300000

respectively.

2. Investments represents 10% government securities made during 2001-2006

3. Tax rate applicable @ 40%

4. Expected increase in managerial expenses Rs. 40000

5. NRR on average capital employed is 10%

Calculate goodwill.

Calculation of Average Capital Employed:

ASSETS:

Prepaid Expenses 50,000.00

Land and Building 600,000.00

Lakshmi Page 53 Valuation of Goodwill and Shares

Plant and Machinery 500,000.00

Debtors 400,000.00

Stock 100,000.00

Cash Balance 100,000.00

1,750,000.00

Less: LIABILITIES

Debentures 300,000.00

Creditors 100,000.00

Staff providend fund 300,000.00

Other current liabilities 200,000.00 900,000.00

Capital Employed 850,000.00

Closing average capital:

Current year profit 300,000.00

Less: Investments 400000 @ 10% 40,000.00

Less: Tax @ 40% 16,000.00

244,000.00

Less: 50% on 244000 122,000.00

Average Capital Employed 728,000.00

FMAP

Average profit 312,500.00

Less: Managerial expenses 40,000.00

Less: Tax @ 40% 16,000.00 24,000.00

288,500.00

Capitalized value 2,885,000.00

Less: Capital Employed 728,000.00

Goodwill 2,157,000.00

Problem 6:

The Balance sheet of a company as at 30.06.2001 as at 30.06.2001 as follows:

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Share capital (Rs. 100 each) 150,000.00 Goodwill at cost 25,000.00

Profit and Loss a/c 193,500.00 Land and Building 110,000.00

Bank overdraft 21,500.00 Plant and Machinery 100,000.00

Creditors 90,500.00 Current assets and adv. 240,000.00

Provision for taxation 19,500.00

475,000.00 475,000.00

Following additional information was available:

1. Profit after tax at 50% were as follows:

1996-97 20,000.00

1997-98 44,000.00

Lakshmi Page 54 Valuation of Goodwill and Shares

1998-99 51,500.00

1999-2000 58,000.00

2000-2001 65,000.00

2. Dividend was distributed at 10% in the years 1997-98, 1998-99 and 15% in the year 1999-2000 and 2000-2001.

Market price of the share ruiling on 30.06.2001 was Rs. 125.

3. Profits given above were calculated after charging Rs. 20000 for managerial renumeration but it is to be

increased to Rs. 30000 on 01.07.2001.

4. The company has secured a contract and the advantage of it ahs been valued at Rs. 20000 p.a for next 5 years.

You are required to calculated goodwill at 5 years purchase of expected future earnings in excess of normal return

on capital employed during the year 2000-2001

Dividend 12.50

Market price 125.00

NRR 10%

ASSETS:

Land and Building 110,000.00

Plant and Machinery 100,000.00

Current assets 240,000.00

450,000.00

Less: LIABILITIES

Bank overdraft 21,500.00

Creditors 90,500.00

Provision for taxation 19,500.00 131,500.00

Capital Employed 318,500.00

Calculation of FMAP:

Year Profit Weights Product

1997 44,500.00 1 44,500.00

1998 51,500.00 2 103,000.00

1999 58,000.00 3 174,000.00

2000 65,000.00 4 260,000.00

219,000.00 10 581,500.00

Average profit 58,150.00

Less: Increase in Expenses 10,000.00

Add: Increase in Profit 20,000.00

68,150.00

Less Normal profit @ 10% on 318500 31,850.00

Super profit 36,300.00

Goodwill 181,500.00

Lakshmi Page 55 Valuation of Goodwill and Shares

Problem 7:

The balance sheet of X Ltd., as on 31.03.78:

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

8% preference shares of Rs. 10 each 50,000.00 Goodwill 10,000.00

10000 Equity shares of Rs. 10 each 100,000.00 Fixed assets 180,000.00

Reserves (including Prov. Tax Rs.10000) 100,000.00 Investments(5% govt. loan) 20,000.00

8% Debentures 50,000.00 Current assets 100,000.00

Creditors 25,000.00 Preliemenary Expenses 10,000.00

Discount on debentures 5,000.00

325,000.00 325,000.00

The average profit of the company (after deducting interest on debentures and taxes) is Rs. 30000. The market value

of the machinery included in fixed asset is Rs. 5000 more. Expected rate of return is 10% evaluate goodwill of the

company at five times of the super profit.

ASSETS

Fixed assets 180,000.00

Add: Machinery value 5,000.00 185,000.00

Current assets 100,000.00

285,000.00

Less: LIABILITIES

Debentures 50,000.00

Creditors 25,000.00

Taxation 10,000.00 85,000.00

Capital Employed 200,000.00

Less: 50% of current year profit 15,000.00

Average Capital employed 185,000.00

FMAP

Profit 30,000.00

Less: Normal profit @ 10% 0n 185000 18,500.00

Super profit 11,500.00

Goodwill 57,500.00

Lakshmi Page 56 Valuation of Goodwill and Shares

VALUVATION OF SHARES

Assets Based Value/Internsic Values:

Internsic value = (Assets available for equity share holders)/No. of equity shares

Computation of Assets available:

Assets:

All assets are at revised value including goodwill and investments but excluding miscellanous expenditure.

Liabilities:

Less all external liabilites and preference shares.

Earnings Based Value: (yield Value)

Earnings Based Value = (ERR/NRR) x paid up value per share.

ERR - Expected Rate of Return

NRR - Normal Rate of Return

PUV - Paid up value

ERR = (profit available for equity share holders / paid up capital) x 100

Profit available for equity share holders:

Average profit after tax (including

income from investments) xxx

Less: Dividend on non-preference shares xxx

Less: Transfer to reserve xxx

Profit available for equity share holders xxx

Fair Value:

Problem 1:

Following is the Balance sheet of x ltd.,

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Share capital 1000

6% preference share of Rs. 10 each 10,000.00 Fixed assets 30,000.00

3000 Equity Share of 10 each 30,000.00 Current assets 25,000.00

7% Debentures 10,000.00 Preliemenary Expenses 2,000.00

Debenture redemption fund 5,000.00 Discount on debtors 3,000.00

Deperciation Fund 10,000.00 Profit and Loss a/c 12,000.00

Sundry Creditors 7,000.00

72,000.00 72,000.00

Lakshmi Page 57 Valuation of Goodwill and Shares

1. Debentures interest is owing for one year.

2. Book debts included in current assests are doubtfull to the extent of Rs. 2000 for which no provisions have

made.

3. Market value of investment included in current asset is Rs. 2000 while asset has been shown at cost of

Rs. 3500.

Find the value of equity shares.

Internsic value method:

Assets available for equity shareholders:

ASSETS:

Fixed Assets 30,000.00

current Assets 25,000.00

Less: Bad debts 2,000.00

Less: Investments 1,500.00 21,500.00

51,500.00

Less: LIABILITIES

Prefrence shares 10,000.00

Debentures 10,000.00

Depreciation fund 10,000.00

Sundry Creditors 7,000.00

Debentures Interest 700.00 37,700.00

13,800.00

Internsic value 4.60 per share.

Problem 2:

Following is the Balance Sheet of XYZ Ltd.,

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Preference share capital of Rs. 10 200,000.00 Fixed assets 400,000.00

Equity share capital of Rs. 10 each 300,000.00 current assets 248,000.00

General reserve 5,000.00 preliemenary expenses 10,000.00

Debenture reedemption fund 25,000.00 Discount not written off 5,000.00

Investment fluctuaation fund 10,000.00 Profit and Loss a/c 27,000.00

5% debentures 50,000.00

Depreciation fund 10,000.00

Creditors 90,000.00

690,000.00 690,000.00

1. Current assets included investment of Rs. 50000 market price of which is Rs. 48000. Debtors included in current

assets are doubtful to the extent of Rs. 5000, for which no provision has been made so far.

2. Stock at end did not include a return of Rs. 1000 though transaction was prperly recorded and posted.

3. Debtors interest woing for one year and preference share dividend are in arrears for 2 years. Assuming that

other assets are woth book value, find the value of equity share.

Lakshmi Page 58 Valuation of Goodwill and Shares

ASSETS:

Fixed assets 400,000.00

Current assets 248,000.00

Less: Bad debts 5,000.00

Less: Investments 2,000.00 241,000.00

641,000.00

Less: LIABILITIES

Preference shares 200,000.00

Debentures 50,000.00

Depreciation fund 10,000.00

Creditors 90,000.00

Debentures interest 2,500.00 352,500.00

288,500.00

Interensic value 9.62 per share

Problem 3:

The following is the Balance sheet of a company as on 31-12-1986.

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Share Capital:

6% Preference share of Rs. 10 140,000.00 Fixed Assets 400,000.00

30000 Equity shares of Rs. 10 300,000.00 Investment (non-trading) 50,000.00

General Reserve 50,000.00 Current Assets 200,000.00

Profit and Loss a/c 40,000.00 Preliemenary Expenses 10,000.00

5% Debentures 100,000.00

Bills Payable 30,000.00

660,000.00 660,000.00

Average annual profit (including Rs. 5000 non- trading income) is Rs. 50000. Goodwill is to be valued at 3 years

purchase of super profit. Normal return on cpaital employed is 10%. Calculate fair value of each equity share.

Capital Employed:

ASSETS:

Fixed Assets 400,000.00

Current Assets 200,000.00

600,000.00

Less: LIABILITIES

Debentures 100,000.00

Bills Payable 30,000.00 130,000.00

470,000.00

Less: 50% of Current year profit 22,500.00

Lakshmi Page 59 Valuation of Goodwill and Shares

Capital Employed 447,500.00

Average profit 45,000.00

Less: Normal profit at 10% on 447500 44,750.00

250.00

Super Profit

Goodwill 750.00

Valuation of Shares:

Net assets for goodwill 470,000.00

Add: Goodwill 750.00

Add: Investments 50,000.00

Less: Preference shares 140,000.00

380,750.00

Interensic value per share 12.69 per share.

Yield value of share:

Average profit 50,000.00

Less: Dividend of prefrence shares 8,400.00

Profit available for equity share holders 41,600.00

ERR 13.87%

Yield value 13.87 Per share

Fair value of share 13.28 Per share.

Problem 4:

The Balance sheet of a company as on 31-03-2001 are as follows:

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Share Capital

2000 Shares of Rs.100 each 200,000.00 Land and Buildings 110,000.00

General Reserve 40,000.00 Plant and Machinery 130,000.00

Profit and Loss a/c 32,000.00 Patents and Trademarks 20,000.00

Sundry creditors 128,000.00 Stock 48,000.00

Income tax 60,000.00 Debtors 88,000.00

Bank Balance 52,000.00

Preliemenary Expenses 12,000.00

460,000.00 460,000.00

The expert valuer vlued the land and building at Rs. 240000 goodwill at Rs. 160000 and plant and machinery at

Rs. 120000. Depreciation is charged at 15% on plant and 10% on buildings. Out of the total debtors , it is found

Lakshmi Page 60 Valuation of Goodwill and Shares

that debtors of Rs. 8000 are bad. The profits of the company have been as follows:

1998-99 80,000.00

1999-2000 90,000.00

2000-2001 106,000.00

The company follows the pratice of transferring 25% of profit to general reserve. Similare typer of companies

earn 10% of the value of their shares. Ascertain the companies shares under

1. Interensic value per share

2. Yield value per share

3. Fair value of share.

1. Interensic value per share

Profits avilable for equity share holders:

Assets:

Land and Buildings 240,000.00

Goodwill 160,000.00

Plant and Machinery 120,000.00

Patents and Trademarks 20,000.00

Stoc k 48,000.00

Bank balance 52,000.00

Debtors 88,000.00

Less: Bad Debts 8,000.00 80,000.00

720,000.00

Less: LIABILITIES

Sundry Creditors 128,000.00

Income Tax 60,000.00 188,000.00

532,000.00

Interensic value of share 266.00 per share

2. Yield value per share

1998-99 80,000.00 1 80,000.00

1999-2000 90,000.00 2 180,000.00

2000-2001 98,000.00 3 294,000.00

6 554,000.00

Average profit 92,333.33

Less: Transfer to reserve 25% 23,083.33

profits avialble to equity shareholders 69,250.00

ERR 0.35

Yield vlaue of share 346.25 per share

3. Fair value of share.

Fair value of share 306.13 per share.

Lakshmi Page 61 Valuation of Goodwill and Shares

Problem 5:

The following is the Balance Sheet of Modern cool Ltd, as on 31-03-1998:

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Share capital Land and Buildings 270,000.00

Authorised and Issued Plant and Machinery 100,000.00

6000 shares of Rs. 100 each full paid 600,000.00 Stock 360,000.00

Profit and Loss a/c 40,000.00 Sundry Debtors 160,000.00

Bank overdraft 10,000.00

Creditors 80,000.00

Provision for taxation 100,000.00

Proposed Dividend 60,000.00

890,000.00 890,000.00

The net profits of the company after deducting usual working expenses before providing for taxation:

1992-1993 200,000.00

1991-1992 220,000.00

1990-1991 180,000.00

1989-1990 220,000.00

1988-1989 170,000.00

On the 31 st March 1993 Land and Buildings were valued at Rs. 280000 and Plant and Machinery at Rs. 120000.

Sundry debtors on the same date of included Rs. 4000 as irrecoverable

Having regard to the nature of the business a 10% return, on net tangible capital invested, is considered reasonable

You are required to value the companys shares ex dividend, your own valuation of goodwill may be based on five

years purchase of the annual super profits (the tax rate s to be assumed at 50%).

Valuvation of Goodwill:

Capital Employed

Assets:

Land and Buildings 280,000.00

Plant and Machinery 120,000.00

Stock 360,000.00

Sundry Debtors 160,000.00

Less: Bad Debts 4,000.00 156,000.00

916,000.00

Less: Liabilities

Bank Overdraft 10,000.00

Creditors 80,000.00

Provision for taxation 100,000.00

Lakshmi Page 62 Valuation of Goodwill and Shares

Provision for dividend 60,000.00 250,000.00

Capital Employed 666,000.00

Average profit 986,000.00

197,200.00

Less: Profit at 50% tax 98,600.00

FMAP 98,600.00

Less: Normal Profit @ 10% 66,600.00

32,000.00

Goodwill 160,000.00

Valuation of Shares:

Net assests based for goodwill 666,000.00

Add: Goodwill 160,000.00

826,000.00

Internsic value 137.67 per share

Problem 6:

The Balance sheet of Diamond Ltd, as on 31-03-2001:

(Rs. In lakshs)

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

Share capital of fully paid up shares Land and Building 110.00

of Rs. 100 each 200.00 Plant and Machinery 130.00

General reserve 40.00 Patent and Trademarks 20.00

Profit and Loss account 32.00 Stock 48.00

Sundry creditors 128.00 Sundry debtors 88.00

Provision for income tax 60.00 Bank Balance 52.00

Preliemenary Expenses 12.00

460.00 460.00

The expert valuer valued the land and building at Rs. 240 lakshs, goodwill at Rs. 160 lakshs and plant and machinery

at Rs. 120 lakhs. Out of the total debtors it is found that debtors for Rs. 8 lakhs are bad. The profits of the company

are as follows: (Rs. In lakshs)

1998-1999 92.00

1999-2000 88.00

2000-2001 96.00

The company follows the practice of transferring 25% to general reserve. Similar types of companies earn at 10%

of the value of their shares. Plant and machinery and land and building depreciated at 15% and 10% respectively.

Ascertain the value of shares of the company under

1. Interensic value

2. Yield value

3. Fair value.

Lakshmi Page 63 Valuation of Goodwill and Shares

1. Interensic value

Assets:

Land and Building 240.00

Plant and Machinery 120.00

Patents and Trademark 20.00

Stock 48.00

Bank balance 52.00

Goodwill 160.00

Sundry debtors 88.00

Less: Bad debts 8.00 80.00

720.00

Less: Liabilities

Creditors 128.00

Provision for income tax 60.00 188.00

532.00

Interensic value 266.00

2. Yield value

Average profit 268.00

89.33

Less: Transfer to Reserve 22.33

67.00

ERR 0.34

Yield value 335.00 per share

Fair value of share 300.50 per share

Problem 7:

The Balance sheet as on 31-12-2001:

LIABILITIES AMOUNT AMOUNT ASSETS AMOUNT AMOUNT

5000 equity shares of Rs. 100 each 500,000.00 Goodwill 100,000.00

Calls in arrears at Rs. 25 50,000.00 450,000.00 Land and Building 300,000.00

12% Prefrence shares 1,000,000.00 Plant and Machinery 900,000.00

General reserve 500,000.00 Loose tools 150,000.00

Reserve fund 50,000.00 Investment 500,000.00

Pension fund 300,000.00 Stock 350,000.00

Workmens compenstion fund 200,000.00 Debtors 300,000.00

Staff welfare fund 100,000.00 Bank balance 200,000.00

10% debentures 200,000.00 Prepaid expenses 100,000.00

Creditors 100,000.00 Preliemenary expenses 200,000.00

Other liabilities 200,000.00

Lakshmi Page 64 Valuation of Goodwill and Shares

3,100,000.00 3,100,000.00

Adjustments:

1. Profits of past 4 years given below after tax at the rate of 50%

2004 400,000.00

2005 300,000.00

2006 400,000.00

2007 400,000.00

2. Investment represent 10% government securities having a face value of Rs. 600000 and market value of

Rs. 550000 (purchase in 2000)

3. Tax from next year is going to be 40%

4. A Building was acquired in 2005 for Rs. 200000 was charged to wages account (depreciation 20% wdv)

5. Profits of 2006 includes as abnormal loss of Rs. 50000

6.Of the debtors of 40000 are bad

7. Land and building appreciated by 30% and plant and machinery reduced by 20%

8. Claim for damages Rs. 10000 is yet to be provided

9. NRR @ 10% on net tangible assets

10. Calculate the fair value for both the categories of shares by incorporting your own value of goodwill.

Valuation of Goodwill:

working notes

Land and building at 2005 200,000.00

Less: depreciation at 20% 40,000.00

Land and building @ 2005 160,000.00

Less depreciation @ 20% for 2006 32,000.00

Land and building at end of 2006 128,000.00

Less depreciation @ 20% for 2007 25,600.00