Professional Documents

Culture Documents

ACCOUNTANCY CLASS NOTES

Uploaded by

praveenpv7Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCOUNTANCY CLASS NOTES

Uploaded by

praveenpv7Copyright:

Available Formats

ACCOUNTANCY

Class :XII B

Time: 2 Hr Marks : 50

Each Question carry one mark :-

1 How an unrecorded assets is treated which is sold at the time of dissolution?

2 Why partners loan is not transferred to Realization a/c

3 When realization expenses are paid by a partner, which account should be

credited?

4 which account is debited when assets are sold for cash?

5 Name the part of Authorised capital offered to public for subscription

6 What is the Name given to person who holds share of company?

Each Question Carry three Marks

7 X, Y and Z are partners in a firm. They decided to dissolve the firm. Give

journal entries if a computer which was completely written off from books:

1 Realized Rs. 5,200

2 taken over by B at Rs. 4500

8 A ,B and C were partners in a firm sharing profits and losses in the ratio of

2:2:1. They decided to dissolve their firm on 31

st

dec 2012. On that date

profit and loss account showed a debit balance of Rs 2,00,000 and general

reserve showed a balance of Rs 3,00,000 pass necessary journal entries.

9. Zec company ltd. Invited application for 5000 shares of the value of Rs 20

each . The amount of payable as Rs 5 on application as Rs 7 on Allotment

and balance as and when required . The whole of above issue was applied

for and cash duly received . Give the journal entries for the above

transactions.

10. On 1.1.2013 Z ltd. Received in advance the first call of Rs 3 per share on

10000 equity shares. The first call was due on 01.04.2013. The subscribed

capital was 50,000 share of Rs 20 each. Journalese the above transition.

11 P ltd invited application for 8000 equity shares of Rs 10 each at a premium

of Rs 4 per share . The whole amount was payable on application . Issued

was fully subscribed . Pass necessary journal entries. Also shows the balance

sheet. (1x4=4)

Each question carry 6 marks

12. Anjaly ltd issued 10000 shares @ Rs10 at a premium of Rs2.5 per share

payable as follows

Rs4 on application

Rs 3.5 on Allotment (including premium)

Rs 2 on first call and the balance as and when required.

Applications were received for 12000 shares .Full allotment was made to

10000shares, 2000shares were rejected and money was refunded to them

.All money due was duly received with exceptions of 150 shares on first call

Journlise.

13. What journal entries would be passed for the following transaction on the

dissolution of a firm , after various assets( other than cash) and third parties

liabilities have been transferred to realisation account ?

1. A took over the stock worth Rs 80,000

2. Firm paid Rs 40000 as compensation to employees

3. Sundry creditors amount to Rs 36000 which was settled at a discount of

15%

4. There was on unrecorded Bike of Rs 40,000 which was taken over by B at

Rs 30,000

5. Profit on retaliation of Rs 42,000 was to be distributed between A and B in

the ratio of 4:3

Each questions carry eight marks

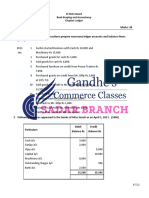

14. Black, White and Brown are partners sharing as 2:1:1 . On 31

st

March 2012

the firm was decided to be dissolve their balance sheet stood as follows

Balance sheet

As at 31

st

March 2012

Liabilities Amount Assets Amount

Bill Payable

Bank loan

Capitals

Black:24800

White :12400

Brown:12400

8000

2400

49600

Bank

Debtors 25000

Less provision 1000

Inventory

Furniture

Land

4000

24000

10000

2000

20000

60,000 60,000

It was agreed that

i. Inventory is taken over by Black at Rs 9000

ii. White took debtors of Rs 23000 and took the responsibility of

discharging the Bank Loan

iii. Other assets released as follows

Land Rs 18000

Furniture Rs 3500

iv. Bills payable were settle for Rs 7600

v. Realization expenses were Rs 400 show realization account, partners

capital accounts and bank account

15. R Ltd invited applications for 2000 equity shares of Rs 100 each, payable as

follows

Rs 25 on application

Rs40 in Allotment

Rs 35 on First and final call

Applications were received for 2500 shares It was decided to allot the

shares as under

A. who applied for 500 shares was allotted 300 shares

B. Who applied 1200 shares, was allocated 1000 shares

C. Who applied for 800 shares was allotted 700 shares.

All money was received except1 from B who did not pay anything

after application.

Accountancy

Class : XI Time : 2 Marks

Time : 2 Hr

1. What is meant by journal

2. Define ledger

3. Give one objective of accountancy (3x1=3)

4. What do you meant by contra entry? How will you deal contra entry while

preparing Double column cash bank Give examples (3)

5. State the accounts to be debited or credited in the following transactions

a) Purchased furniture from Mohit on credit

b) Cash deposited into bank

c) Paid rent by cheque

d) Paid interest on Loan (4)

6. State any three limitations of trail balance (3)

7. Following is the list of account, find out which are assets, liabilities, Capital,

revenue and expenses

1 Machinery 2. Mohan (proprietor)

3. Interest received 4. Bank over draft

5. Unsold stock 6. Furniture

7. Sales 8. Purchases (4)

8. Enter the following transactions in two column cash book and find out the

cash and bank balance 2006

Jan 1. Started business with cash Rs. 20,000

Jan 2. Openel a current account Rs.8,000

Jan3. Bought goods by cheque Rs. 150

Jan4.Recieved cheque from Ram Rs. 200

Jan5. Sold goods for Cash rs.40

Jan 7 Paid into bank:

(i)Cash Rs 30

(ii) cheque Rs 200

Jan 8.Paid shyam by cheque Rs.345

Jan8. Paid carriage by cheque Rs. 180

Jan10. Drew cash from bank for office use Rs.200

Jan.30. Paid wages by cheque Rs.60 (5)

9. Verma Bros carry on business as wholesale cloth dealers. From the following

transactions write up a purchase book:

2006

April 1 Bought from M/s Birla Mills on credit

100 pieces long cloth @ Rs80

50 pieces shirting @Rs.100

April 8 purchased for cash from M/s Ambika Mills

50pieces muslin @ Rs 120

April 15 purchased on credit from M/s Aravind Mills

20 pieces coating @Rs.1000

10 pieces shirting @Rs. 90

April 20 purchased 5typewriters on credit from M/s Bharath Type writers

Ltd @Rs 1400/- each. (4)

10.The following Trail balance has ben prepared by a nearly appointed accountant.

You are required to prepare the Trail Balance in a correct form

SL No Name of Accounts LF Debit Credit

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

Cash in hand

Fixed assets

Capital

Purchase

Sails

Discount allowed

Return onward

Return outward

Wages

Debtors

Creditors

Drawings

Discount received

Bills Received

Bill payable

Rent

Interest paid

55000

60000

35000

1000

800

20,000

5000

200

40000

144200

250

2500

16000

15000

100

28,00

350

Total 1,77,000 2,21,200

(7)

11. Enter the following transactions in Sales Book and post them into Ledger

2005

January 4 Sold goods to Gupta & Co on credit Rs 50,000 at 5% discount

January 14 Sold goods for cash to Mohan for Rs 8000

January 22 Sold goods to Ajay of the list price of Rs 65,000 at trade discount

of 10% ( 7)

12. Journilise the following transaction 2005

Mar 1 Manish commenced business with cash 1,00,000

Mar 3 Purchased goods for cash 60,000

Mar 5 Furniture purchased for cash 12000

Mar 7 Sold goods to Rakesh for 15000

Mar 9 Rakesh returned goods for 4500

Mar 13 Purchased goods : from Ali 22000

From Keshav 38000

Mar 15 Returned goods to Keshav 7,000

Mar. 17 Paid cash to Keshav in full settlement of their

account after deducting 5% cash discount

Mar.19 Sold goods for cash 22,000

Mar. 20 Manish withdrew from business for his personal use 15,000

Mar. 22 Paid to Ali 20,000

Discount received 1,000

Mar. 24 Sold goods for cash to Leena 90,000

Mar. 26 Paid for rent 600

Mar. 31 Received for commission 1,500

(10)

You might also like

- Sales Basics PDFDocument75 pagesSales Basics PDFJamaila jimeno Dagcutan100% (1)

- The Opportunity Analysis CanvasDocument186 pagesThe Opportunity Analysis Canvasjose inacio100% (7)

- Just-in-Time and Backflushing Costing TechniquesDocument6 pagesJust-in-Time and Backflushing Costing TechniquesClaudette ClementeNo ratings yet

- Faction IM ScribdDocument32 pagesFaction IM ScribdAlex HoyeNo ratings yet

- Kent Institute Australia: Software Engineering: SENG205Document8 pagesKent Institute Australia: Software Engineering: SENG205Manzur AshrafNo ratings yet

- Class 11 AccountsDocument3 pagesClass 11 Accountssamarthj.9390No ratings yet

- 11 AccDocument6 pages11 AccPushpinder KumarNo ratings yet

- Class 11 Accounts SP 1Document6 pagesClass 11 Accounts SP 1UdyamGNo ratings yet

- SUTLEJ PUBLIC SR SEC SCHOOL ANNUAL EXAMINATION ACCOUNTANCYDocument4 pagesSUTLEJ PUBLIC SR SEC SCHOOL ANNUAL EXAMINATION ACCOUNTANCYmnmehta1990No ratings yet

- Class 11 Accounts Half Yearly SPDocument9 pagesClass 11 Accounts Half Yearly SPRakesh AgarwalNo ratings yet

- 11 Accountancy SP 2Document17 pages11 Accountancy SP 2Vikas Chandra BalodhiNo ratings yet

- Xi Accountancy 80 Marks General InstructionsDocument5 pagesXi Accountancy 80 Marks General InstructionsJash ShahNo ratings yet

- Form Three AssignmentDocument5 pagesForm Three AssignmentKennedy Odhiambo OchiengNo ratings yet

- Corporate Accounting - I Semester ExaminationDocument7 pagesCorporate Accounting - I Semester ExaminationVijay KumarNo ratings yet

- 11th Accountancy Practice PaperDocument5 pages11th Accountancy Practice PaperPrachi RustagiNo ratings yet

- Class 11 Accountancy Worksheet - 2023-24Document17 pagesClass 11 Accountancy Worksheet - 2023-24Yashi BhawsarNo ratings yet

- Class Xi SP 1Document17 pagesClass Xi SP 1Priya NasaNo ratings yet

- Accounting for Partnership Admission & DissolutionDocument5 pagesAccounting for Partnership Admission & DissolutionPranit PanditNo ratings yet

- Inter May, 2008Document4 pagesInter May, 2008M JEEVARATHNAM NAIDUNo ratings yet

- ZR Ics Oray WFF 4 o YVGRi 7Document46 pagesZR Ics Oray WFF 4 o YVGRi 7RahulNo ratings yet

- Nov - 19 - Question and AnswersDocument15 pagesNov - 19 - Question and AnswersVidhi AgrawalNo ratings yet

- 11th BK Final Exam Quesiton Paper March 2021Document5 pages11th BK Final Exam Quesiton Paper March 2021Harendra Prajapati100% (1)

- TallyDocument27 pagesTallyRonak JainNo ratings yet

- 12 C BK Mock Board PraveenaDocument4 pages12 C BK Mock Board PraveenaAdvanced AcademyNo ratings yet

- March, 2007 QuestionssDocument4 pagesMarch, 2007 QuestionssM JEEVARATHNAM NAIDUNo ratings yet

- UCO1501Document4 pagesUCO1501PRIYA LAKSHMANNo ratings yet

- Assigment BBM Finacial AccountingDocument6 pagesAssigment BBM Finacial Accountingtripathi_indramani5185No ratings yet

- BPS Class XI Pre Board Examination Question Papers Jan 2015 All Subjects Scce CommerceDocument53 pagesBPS Class XI Pre Board Examination Question Papers Jan 2015 All Subjects Scce CommercelembdaNo ratings yet

- Blossems Convent School CLASS: 11 Commerce Group Subject: Accoutancy Holidays AssignmentDocument3 pagesBlossems Convent School CLASS: 11 Commerce Group Subject: Accoutancy Holidays AssignmentPawanpreet KaurNo ratings yet

- Government Boys Degree College Accounting Paper 1Document4 pagesGovernment Boys Degree College Accounting Paper 1Arshad KhanNo ratings yet

- Good Shepherd International School, Ooty: Winter Holiday Homework 2018 - 19Document4 pagesGood Shepherd International School, Ooty: Winter Holiday Homework 2018 - 19Aaryaman ModiNo ratings yet

- 11-Acc PP1Document11 pages11-Acc PP1adityatiwari122006No ratings yet

- Faculty of Commerce: Code No. 10001Document4 pagesFaculty of Commerce: Code No. 10001Madasu BalnarsimhaNo ratings yet

- CLASS TEST-I ACCOUNTANCY EXAM REVIEWDocument4 pagesCLASS TEST-I ACCOUNTANCY EXAM REVIEWshaurya kapoorNo ratings yet

- Model Question Paper - 2011 Class - XII Subject - AccountancyDocument6 pagesModel Question Paper - 2011 Class - XII Subject - AccountancyKunal AggarwalNo ratings yet

- MBA I Semester Supplementary Examinations December/January 2018/19Document2 pagesMBA I Semester Supplementary Examinations December/January 2018/19Chandra SekharNo ratings yet

- Paper 5Document4 pagesPaper 5hbyhNo ratings yet

- Accountancy Model QP I Puc 2023-24 PDFDocument7 pagesAccountancy Model QP I Puc 2023-24 PDFsyedsaadss008No ratings yet

- NCERT solutions, CBSE sample papers, notes for classes 6 to 12Document4 pagesNCERT solutions, CBSE sample papers, notes for classes 6 to 12NameNo ratings yet

- 2015 Accountancy Question PaperDocument4 pages2015 Accountancy Question PaperJoginder SinghNo ratings yet

- 11 Com Pre-ExamDocument4 pages11 Com Pre-ExamObaid Khan50% (2)

- B.Com Financial Accounting Single Entry ConversionDocument91 pagesB.Com Financial Accounting Single Entry ConversionJ RajputNo ratings yet

- Karnataka I PUC Accountancy 2019 Model Question Paper 1Document7 pagesKarnataka I PUC Accountancy 2019 Model Question Paper 1Lokesh Rao100% (1)

- MTP 8 28 Questions 1684909524Document5 pagesMTP 8 28 Questions 1684909524quest.diamond9158No ratings yet

- Tally Repor1Document74 pagesTally Repor1Ronak JainNo ratings yet

- Show Your Working Clearly.: AccountancyDocument8 pagesShow Your Working Clearly.: AccountancyYash SardaNo ratings yet

- Mock Paper - 2017-18 Class-Xi: General InstructionsDocument6 pagesMock Paper - 2017-18 Class-Xi: General InstructionsMukul YadavNo ratings yet

- Revision Test FinalDocument4 pagesRevision Test FinalRitaNo ratings yet

- Cbse Class 11 Accountancy Sample Paper Sa1 2014Document3 pagesCbse Class 11 Accountancy Sample Paper Sa1 2014Ranjeet KumarNo ratings yet

- Karnataka Ist PUC Accountcancy Sample Question Paper 4 PDFDocument4 pagesKarnataka Ist PUC Accountcancy Sample Question Paper 4 PDFNeha BaligaNo ratings yet

- XI AccountancyDocument5 pagesXI Accountancytechnical hackerNo ratings yet

- Vidya Mandir Public School Accountancy QuestionsDocument4 pagesVidya Mandir Public School Accountancy QuestionsPatanjal kumarNo ratings yet

- 11th Book Keeping and AccountingDocument2 pages11th Book Keeping and AccountingAlefiya BurhaniNo ratings yet

- Nava Bharath National School Annur Annual Examination - 2021 AccountancyDocument5 pagesNava Bharath National School Annur Annual Examination - 2021 AccountancypranavNo ratings yet

- Test Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingVinithaNo ratings yet

- UntitledDocument269 pagesUntitledvijaypeketiNo ratings yet

- Fundamentals of Accounting 2019Document4 pagesFundamentals of Accounting 2019sreehari dineshNo ratings yet

- Question Paper Accounting (3702) : January 2004: Answer Any Two From The Four Questions Given BelowDocument16 pagesQuestion Paper Accounting (3702) : January 2004: Answer Any Two From The Four Questions Given BelowRaveendra KJNo ratings yet

- 1bba FOA Prep QPDocument2 pages1bba FOA Prep QPSuhail AhmedNo ratings yet

- Dissolution Practice Questions. PDFDocument8 pagesDissolution Practice Questions. PDFUmesh JaiswalNo ratings yet

- Test Series: March, 2019 Foundation Course Mock Test Paper Paper - 1: Principles and Practice of AccountingDocument4 pagesTest Series: March, 2019 Foundation Course Mock Test Paper Paper - 1: Principles and Practice of AccountingabhimanyuNo ratings yet

- Test PaperDocument27 pagesTest PaperAnand BandhuNo ratings yet

- Model Paper, Accountancy, XIDocument13 pagesModel Paper, Accountancy, XIanyaNo ratings yet

- ACCOUNTANCY+2 B0ardDocument12 pagesACCOUNTANCY+2 B0ardlakshmanan2838No ratings yet

- Nisha JohneyDocument6 pagesNisha Johneypraveenpv7No ratings yet

- JijoDocument27 pagesJijopraveenpv7No ratings yet

- AiiroDocument19 pagesAiiropraveenpv7No ratings yet

- Tomy BikeDocument16 pagesTomy Bikepraveenpv7No ratings yet

- 4G BroadbandDocument39 pages4G Broadbandpraveenpv7No ratings yet

- Smart Cities Is A Domain of Great Interest in The Modern SocietyDocument38 pagesSmart Cities Is A Domain of Great Interest in The Modern Societypraveenpv7No ratings yet

- ITS in India: Benefits and Applications of Intelligent Transportation SystemsDocument23 pagesITS in India: Benefits and Applications of Intelligent Transportation Systemspraveenpv70% (1)

- ITS in India: Benefits and Applications of Intelligent Transportation SystemsDocument23 pagesITS in India: Benefits and Applications of Intelligent Transportation Systemspraveenpv70% (1)

- Seismaic Behaviour of Isloated BridgesDocument41 pagesSeismaic Behaviour of Isloated Bridgespraveenpv7100% (1)

- SBSPDocument30 pagesSBSPpraveenpv7100% (1)

- Self Curing ConcreteDocument26 pagesSelf Curing Concretepraveenpv7No ratings yet

- Piezoelectric It yDocument39 pagesPiezoelectric It ypraveenpv7No ratings yet

- Seismaic Behaviour of Isloated BridgesDocument41 pagesSeismaic Behaviour of Isloated Bridgespraveenpv7100% (1)

- Curing Is The Maintenance of A Satisfactory Moisture ConDocument21 pagesCuring Is The Maintenance of A Satisfactory Moisture Conpraveenpv7No ratings yet

- Abin K Paul: ObjectiveDocument3 pagesAbin K Paul: Objectivepraveenpv7No ratings yet

- Leaf SheetDocument11 pagesLeaf Sheetpraveenpv7No ratings yet

- Piezoelectric It yDocument39 pagesPiezoelectric It ypraveenpv7No ratings yet

- AffidavitDocument2 pagesAffidavitpraveenpv7No ratings yet

- GurobusDocument24 pagesGurobuspraveenpv7No ratings yet

- PiezoelectricityDocument16 pagesPiezoelectricitypraveenpv7No ratings yet

- JoyalDocument1 pageJoyalpraveenpv7No ratings yet

- Wireless Battery ChargerDocument21 pagesWireless Battery Chargerpraveenpv7No ratings yet

- A Study On Labour Welfare With Reference To Nagarjuna Herbal Concentrate LTDDocument2 pagesA Study On Labour Welfare With Reference To Nagarjuna Herbal Concentrate LTDpraveenpv7No ratings yet

- Docof5penpctechnology 120302125342 Phpapp01Document39 pagesDocof5penpctechnology 120302125342 Phpapp01Shedrach_007No ratings yet

- Recruitment ReportDocument62 pagesRecruitment Reportpraveenpv7No ratings yet

- Common Frend Page2Document7 pagesCommon Frend Page2praveenpv7No ratings yet

- Recruitment ReportDocument62 pagesRecruitment Reportpraveenpv7No ratings yet

- AjeesaDocument31 pagesAjeesapraveenpv7No ratings yet

- SpectDocument31 pagesSpectapi-1993758480% (5)

- BSBPMG430 Undertake Project Work: Task SummaryDocument21 pagesBSBPMG430 Undertake Project Work: Task SummaryGabrieleNo ratings yet

- Quiz 4Document2 pagesQuiz 4Romell Ambal Ramos100% (1)

- Employee STSFCTNDocument3 pagesEmployee STSFCTNMitali KalitaNo ratings yet

- Metorex Ar Dec10Document148 pagesMetorex Ar Dec10Take OneNo ratings yet

- Sample Quiz QuestionsDocument2 pagesSample Quiz QuestionsSuperGuyNo ratings yet

- Sean Vosler Matt Clark (PDFDrive)Document80 pagesSean Vosler Matt Clark (PDFDrive)RadwinNo ratings yet

- DFS AgMechanization Aug2017Document69 pagesDFS AgMechanization Aug2017KaziNasirUddinOlyNo ratings yet

- Nazila Azizi CV FinalDocument7 pagesNazila Azizi CV FinalulearnasaidshahtestNo ratings yet

- Economics 101: Interactive BrokersDocument11 pagesEconomics 101: Interactive BrokersDennys FreireNo ratings yet

- MAMDocument13 pagesMAMKevin T. OnaroNo ratings yet

- Measuring Resources For Supporting Resource-Based CompetitionDocument6 pagesMeasuring Resources For Supporting Resource-Based CompetitionI Putu Eka Arya Wedhana TemajaNo ratings yet

- CiplaDocument19 pagesCiplaTulika AggarwalNo ratings yet

- Financial Evaluation of Debenhams PLCDocument16 pagesFinancial Evaluation of Debenhams PLCMuhammad Sajid SaeedNo ratings yet

- Revised Questionnaire - HuaweiDocument11 pagesRevised Questionnaire - HuaweiKomal AlamNo ratings yet

- New Microsoft Office Word DocumentDocument4 pagesNew Microsoft Office Word DocumentMilan KakkadNo ratings yet

- Module 7 CVP Analysis SolutionsDocument12 pagesModule 7 CVP Analysis SolutionsChiran AdhikariNo ratings yet

- Front Office Staff Roles & ResponsibilitiesDocument4 pagesFront Office Staff Roles & ResponsibilitiesVamshidhar ReddyNo ratings yet

- CAMPOSOL Reports 121% Increase in EBITDA for 2016Document24 pagesCAMPOSOL Reports 121% Increase in EBITDA for 2016Albert PizarroNo ratings yet

- The Theory and Practice of Investment ManagementDocument17 pagesThe Theory and Practice of Investment ManagementTri RamadhanNo ratings yet

- WEEK15-17 ENTR 6152 Entrepreneurial Leadership in An Organization 2 PDFDocument29 pagesWEEK15-17 ENTR 6152 Entrepreneurial Leadership in An Organization 2 PDFMoca ΔNo ratings yet

- SALN FormDocument3 pagesSALN FormBalubad ES LagunaNo ratings yet

- Private Organization Pension Amendment ProclamationDocument8 pagesPrivate Organization Pension Amendment ProclamationMulu DestaNo ratings yet

- CH - 3 - Question BankDocument22 pagesCH - 3 - Question BankEkansh AgarwalNo ratings yet

- Mcom Sales QuotaDocument14 pagesMcom Sales QuotaShyna aroraNo ratings yet

- Substantive Procedures (1-Page Summary)Document2 pagesSubstantive Procedures (1-Page Summary)Alizeh IfthikharNo ratings yet