Professional Documents

Culture Documents

Venture Capital Valuation Methods Chapter Explains Key Techniques

Uploaded by

bia070386Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Venture Capital Valuation Methods Chapter Explains Key Techniques

Uploaded by

bia070386Copyright:

Available Formats

Chapter 10: Venture Capital Valuation Methods

CHAPTER 10

VENTURE CAPITAL VALUATION METHODS

TrueFalse Questios

F. 1. The venture capital valuation method estimates the ventures value by

projecting both intermediate and terminale!it "lo#s to investors.

T. $. Venture investors returns depend on the ventures ability to generate cash

"lo#s or to "ind an ac%uirer "or the venture.

F. &. The value o" the ventures e%uity is e%ual to the value the "inancing

contributed in the "irst venture capital round.

F. '. ( direct application o" the earnings)per)share ratio to venture earnings is

*no#n as the direct comparison valuation method.

T. +. The venture capital valuation method #hich capitali,es earnings using a cap

rate implied by a comparable ratio is *no#n as direct capitali,ation.

T. -. Failure to account "or any additional rounds o" "inancing and its

accompanying dilution in order to meet projected earnings #ill result in the

investors not receiving an ade%uate number o" shares to ensure the re%uired

percent o#nership at the time o" e!it.

T. .. (lmost #ithout e!ception/ pro"essional venture investors demand that some

e%uity or de"erred e%uity compensation be structured into any valuation.

F. 0. 1" a venture issues debt prior to the e!it period/ the initial e%uity investors

#ill still receive "irst claims on the ventures net #orth at e!it time.

F. 2. The utopia discount process allo#s the venture investors to value their

investment using only the business plans e!plicit "orecasts/ discounting it at a

ban* loan interest "actor.

F. 10. The internal rate o" return is the simple 3non)compounded4 interest rate

that e%uates the present value o" the cash in"lo#s received #ith the initial

investment.

T. 11. The venture capital 3VC4 method estimates the ventures value using only

terminale!it "lo#s to investors.

T. 1$. 5ost)money valuation o" a venture is the pre)money valuation plus money

injected by ne# investors.

-.

Chapter 10: Venture Capital Valuation Methods

T. 1&. 6taged "inancing is "inancing provided in se%uences o" rounds rather than

all at one time.

F. 1'. The capitali,ation rate is the sum o" the discount rate and the gro#th rate

o" the cash "lo# in the terminal value period.

T. 1+. The internal rate o" return 31774 is the compound rate o" return that

e%uates the present value o" the cash in"lo#s received #ith the initial

investment.

T. 1-. The discount rate that one applies in a multiple scenario valuation #ill

usually be lo#er than the discount rate that #ould be applied to the business

plan cash "lo#s.

F. 1.. (ll o" the scenarios in a multiple scenario analysis must have e!it cash

"lo#s in the same year.

T. 10. The discount rate applied in an 8!pected 5V approach should be the same

rate across scenarios.

For t!e Leari" Su##le$ets%

T. 12. The Venture Capital 6hortCut 3VC6C4 method is a post)money version o"

the 9elayed 9ividend (ppro!imation 399(4.

F. $0. The V6C6 and 99( methods are :just)in)time; capital methods #hich do

not assess capital charges "or idle cash.

T. $1. ( price)earnings ratio is related to the level and gro#th o" earnings.

T. $$. For the typical business plan having current and early cash out"lo#s and

later)stage cash in"lo#s/ the VC6C and 99( methods #ill typically give lo#er

valuations than the M9M and 59M.

T. $&. The V6C6 is li*e a post)money version o" the 99(.

F. $'. For the typical business plan having current and early cash out"lo#s and

later)stage cash in"lo#s/ the V6C6 #ill give a higher valuation than the 99(.

T. $+. The 99( and VC6C methods give the same valuation.

-0

Chapter 10: Venture Capital Valuation Methods

Multi#le&C!oi'e Questios

d. 1. The return to venture investors directly depends on #hich o" the "ollo#ing<

a. ventures ability to generate cash "lo#s

b. ability to convince an ac%uirer to buy the "irm

c. the amount o" its short)term liabilities

d. both a and b

e. all o" the above

b. $. To obtain the percent o#nership to be sold in order to e!pect to provide the

venture investors target return/ one must consider the:

a. cash investment today and the cash return at e!it multiplied by the

venture investors target return/ then divide todays cash investment by

the ventures =5V

b. cash investment today and the cash return at e!it discounted by the

venture investors target return/ then divide todays cash investment by

the ventures =5V

c. cash investment today and the cash return at e!it multiplied by the

venture investors target return/ then divide todays cash investment by

the ventures =5V

d. cash investment today and the cash return at e!it discounted by the

venture investors target return/ then multiply todays cash investment

by the ventures =5V

a. &. The value o" the e!isting venture #ithout the proceeds "rom the potential

ne# e%uity issue is *no#n as<

a. pre)money valuation

b. post money valuation

c. staged "inancing

d. the capitali,ation rate

b. '. The value o" the e!isting venture plus the proceeds "rom the potential ne#

e%uity issue is *no#n as<

a. pre)money valuation

b. post money valuation

c. staged "inancing

d. the capitali,ation rate

-2

Chapter 10: Venture Capital Valuation Methods

c. +. Financing provided in se%uences o" rounds rather than all at one time is

*no#n as<

a. pre)money valuation

b. post money valuation

c. staged "inancing

d. the capitali,ation rate

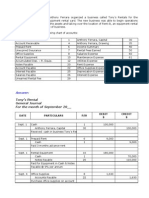

Use the following information for the next six (6 through 11) problems.

( potential investor is see*ing to invest >+00/000 in our venture/ #hich

currently has 1/000/000 million shares held by us "ounders. ?e e!pect our

venture to produce hal" a million dollars in income per year "or the ne!t "ive

years. ?e *no# that a similar venture produced >1/000/000 in income and

sold shares to the public "or >10/000/000.

b. -. ?hat is the percent o#nership o" our venture that must be sold in order to

provide the venture investors target return<

a. &&.&&@

b. .+.2'@

c. 1$..-@

d. 1+.00@

a. .. ?hat is the number o" shares that must be issued to the ne# investor in

order "or the investor to earn his target return<

a. &/1+-/$.-

b. 1/+.0/1&0

c. '/1+-/$.-

d. $/+.0/1&0

d. 0. ?hat is the issue price per share<

a. >0.12&2

b. >0.1$0&

c. >0.&1-0

d. >0.1+0'

c. 2. ?hat is the pre)money valuation<

a. >1$0/&00

b. >&1-/000

c. >1+0/'00

d. >12&/200

.0

Chapter 10: Venture Capital Valuation Methods

a. 10. ?hat is the post)money valuation<

a. >-+0/&+'

b. >'22/2+'

c. >'00/&..

d. >$'2/2..

b. 11. ?hat is the value o" the venture in year "ive using direct capitali,ation<

a. >+00/000

b. >+/000/000

c. >1/000/000

d. >100/000

d. 1$. For early stage ventures/ #hich o" the "ollo#ing is a strong reason "or

having an e%uity component in employee compensation<

a. the e!pected de"erred and ta!)pre"erred compensation allo#s the

venture to pay a lo#er current compensation to employees

b. as a #ay to motivate employees to strive "or the same goal o" high

e%uity value

c. because any dividends received as part o" the e%uity compensation

reduces ta!able income

d. both a and b

e. all o" the above

c. 1&. 9uring the e!it period/ #hich o" the "ollo#ing #ill have last crac* at the

ventures #ealth<

a. ban*s giving loans to the venture

b. convertible debt holders o" the venture

c. initial e%uity investors o" the venture

d. participating pre"erred e%uity holders

d. 1'. 6uppose your ventures e!pected mean cash "lo#s are >30+/0004 initially/

"ollo#ed by e!pected mean cash "lo#s at the end o" the "irst/ second/ and third

years o" >'0/000/ >'0/000/ and >&+/000. ?hat is the internal rate o" return<

a. 1&.2@

b. 1'..@

c. 1-.$@

d. 1..$@

e. 12.$@

b. 1+. ( 58 multiple re"ers to:

a. pricee!pectations multiple

b. priceearnings multiple

c. pro"it8A1T multiple

d. pro"itearnings multiple

e. price8A1T9( multiple

.1

Chapter 10: Venture Capital Valuation Methods

c. 1-. 8stimate the value o" a privately)held "irm based on the "ollo#ing

in"ormation: stoc* price o" a comparable "irm B >$0.00C net income o" a

comparable "irm B >$0/000C number o" shares outstanding "or the comparable

"irm B 10/000C and earnings per share "or the target "irm B >&.00.

a. >10.00

b. >$0.00

c. >&0.00

d. >'0.00

e. >+0.00

b. 1.. 8stimate the value o" a privately)held "irm based on the "ollo#ing

in"ormation: total mar*et value 3or capitali,ation value4 o" a comparable "irm

B >$00/000C net income o" a comparable "irm B >'0/000C number o" shares

outstanding "or the comparable "irm B $0/000C net income "or the target "irm B

>1+/000C and number o" shares outstanding "or the target "irm B 10/000.

a. >+.00

b. >..+0

c. >10.00

d. >1$.+0

e. >1+.00

c. 10. 9etermine the mar*et value o" a :comparable; "irm based on the

"ollo#ing in"ormation: value o" target "irm B >'/000/000C net income o" target

"irm B >$00/000C and net income o" :comparable; "irm B >+00/000.

a. >' million

b. >..+ million

c. >10 million

d. >1$.+ million

e. >1+ million

a. 12. 9etermine the net income o" a :comparable; "irm based on the "ollo#ing

in"ormation: value o" target "irm B >'/000/000C net income o" target "irm B

>$00/000C stoc* price o" :comparable; "irm B >&0.00C and &00/000 shares o"

stoc* outstanding "or the comparable "irm.

a. >'+0/000

b. >+00/000

c. >++0/000

d. >-00/000

e. >.00/000

c. $0. 9etermine the "uture value o" a target venture #hich has net income

e!pected to be >'0/000 at the end o" "our years "rom no#. ( comparable "irm

currently has a stoc* price o" >$0.00 per sharesC 100/000 shares outstandingC

and net income o" >+0/000.

.$

Chapter 10: Venture Capital Valuation Methods

a. >1.0 million

b. >1.' million

c. >1.- million

d. >$.0 million

For t!e Leari" Su##le$ets%

d. $1. The t#o :just)in)time; capital methods are:

a. 99( and VC6C

b. 99( and 59M

c. V6C6 and M9M

d. M9M and 59M

a. $$. ?hen a "irm has gro#th that only meets/ rather than e!ceeds/ the cost o"

capital/ #e #ould e!pect its price)earnings multiple to be appro!imately e%ual

to:

a. the reciprocal o" its re%uired return on e%uity

b. its earnings per share

c. its boo*)to)mar*et ratio

d. its debt)to)value ratio

b. $&. For the typical venture investing project/ the valuation #ill be highest

under:

a. 99(

b. 59M and M9M

c. VC6C

d. initial boo* value o" e%uity

.&

You might also like

- Tony's Rentals General Journal For September 20Document17 pagesTony's Rentals General Journal For September 20Rehan Mehmood63% (8)

- Mahindra and Mahindra AnalysisDocument17 pagesMahindra and Mahindra Analysisrahul_raj198815220% (2)

- GolfGamez Agung - Alan - ToshiDocument2 pagesGolfGamez Agung - Alan - ToshiWidyawan Widarto 闘志No ratings yet

- How Much Should a Firm Borrow? Key Factors and TradeoffsDocument8 pagesHow Much Should a Firm Borrow? Key Factors and TradeoffsCecilia MontessoroNo ratings yet

- BB Dashboard Template SolutionDocument4 pagesBB Dashboard Template SolutionMavin JeraldNo ratings yet

- Risk, Cost of Capital, and Valuation: Multiple Choice QuestionsDocument34 pagesRisk, Cost of Capital, and Valuation: Multiple Choice QuestionsDũng Hữu0% (1)

- Test Bank For Entrepreneurial Finance 5th Edition By-Leach Part 1Document7 pagesTest Bank For Entrepreneurial Finance 5th Edition By-Leach Part 1Christian Villahermosa ToleroNo ratings yet

- Test Bank Chapter 9Document10 pagesTest Bank Chapter 9Rebecca StephanieNo ratings yet

- Chapter 19 - Financing and ValuationDocument49 pagesChapter 19 - Financing and Valuationnormalno100% (1)

- Test Bank For Entrepreneurial FinanceDocument13 pagesTest Bank For Entrepreneurial FinancePaolo Nicolo OpeñaNo ratings yet

- Chapter 05 Intercompany Profit Transactions INVENTORYDocument24 pagesChapter 05 Intercompany Profit Transactions INVENTORYCresca Castro100% (1)

- Color - XXX Pitch DeckDocument55 pagesColor - XXX Pitch DeckAlexia Bonatsos100% (5)

- IFFSSAFinal Report 2 May 22Document133 pagesIFFSSAFinal Report 2 May 22Tom CochranNo ratings yet

- Types and Costs of Financial Capital: True-False QuestionsDocument8 pagesTypes and Costs of Financial Capital: True-False Questionsbia070386No ratings yet

- Leach TB Chap09 Ed3Document8 pagesLeach TB Chap09 Ed3bia070386No ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- Harvesting the Business Venture InvestmentDocument8 pagesHarvesting the Business Venture Investmentbia070386No ratings yet

- Security Structures and Deterimining Enterprise Values True-False QuestionsDocument6 pagesSecurity Structures and Deterimining Enterprise Values True-False Questionsbia070386No ratings yet

- Evaluating Financial Performance: True-False QuestionsDocument9 pagesEvaluating Financial Performance: True-False Questionsbia070386100% (1)

- Leach TB Chap12 Ed3Document7 pagesLeach TB Chap12 Ed3bia070386No ratings yet

- Financial Planning: Short Term and Long Term: True-False QuestionsDocument8 pagesFinancial Planning: Short Term and Long Term: True-False Questionsbia070386No ratings yet

- Leach TB Chap11 Ed3Document7 pagesLeach TB Chap11 Ed3bia070386No ratings yet

- FINANCE FOR ENTREPRENEURSDocument12 pagesFINANCE FOR ENTREPRENEURSJoshua TengNo ratings yet

- CH 5Document10 pagesCH 5Miftahudin MiftahudinNo ratings yet

- CH06 Testbank HIH9e MCDocument19 pagesCH06 Testbank HIH9e MCGanessa RolandNo ratings yet

- Chap 8 SolutionsDocument8 pagesChap 8 SolutionsMiftahudin MiftahudinNo ratings yet

- Questions Chapter 16 FinanceDocument23 pagesQuestions Chapter 16 FinanceJJNo ratings yet

- Test BankDocument15 pagesTest BankBWB DONALDNo ratings yet

- Ethics Business TBChap006Document31 pagesEthics Business TBChap006Thuhoai Nguyen50% (2)

- Ross 9e FCF SMLDocument425 pagesRoss 9e FCF SMLAlmayayaNo ratings yet

- Payout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Document4 pagesPayout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Gian RandangNo ratings yet

- Chapter 10 The Financial Plan: True/False QuestionsDocument10 pagesChapter 10 The Financial Plan: True/False QuestionsSalman BaigNo ratings yet

- Chapter 7 Exercise Stock ValuationDocument3 pagesChapter 7 Exercise Stock ValuationShaheera Suhaimi100% (3)

- Testbank Chapter5 NewDocument13 pagesTestbank Chapter5 NewAhmadYaseenNo ratings yet

- Applied Corporate FinanceDocument7 pagesApplied Corporate FinanceGyana SahooNo ratings yet

- Company and Marketing Strategy: Partnering To Build Customer RelationshipsDocument32 pagesCompany and Marketing Strategy: Partnering To Build Customer RelationshipsRydel CuachonNo ratings yet

- Case 2.2 and 2.5 AnswersDocument4 pagesCase 2.2 and 2.5 AnswersHeni OktaviantiNo ratings yet

- Fin 455 Fall 2017 FinalDocument10 pagesFin 455 Fall 2017 FinaldasfNo ratings yet

- MIS10E Testbank CH11Document19 pagesMIS10E Testbank CH11Kristi HerreraNo ratings yet

- Chapter01 TestbankDocument40 pagesChapter01 TestbankDuy ThứcNo ratings yet

- OM CH6,7,8,10 QuestionsDocument17 pagesOM CH6,7,8,10 Questionsxuzhu5100% (1)

- Fabozzi Chapter01Document18 pagesFabozzi Chapter01Syed Imtinan AhmedNo ratings yet

- Multiple Choice Questions: Mergers and AcquisitionsDocument153 pagesMultiple Choice Questions: Mergers and AcquisitionsRimpy SondhNo ratings yet

- Chapter 5 Financial Markets and Institutions AnswersDocument3 pagesChapter 5 Financial Markets and Institutions AnswersTommy Jing Jie NgNo ratings yet

- Chapter 6 Answer SheetDocument7 pagesChapter 6 Answer SheetJoan Gayle BalisiNo ratings yet

- A Template For Structural Analysis of IndustriesDocument5 pagesA Template For Structural Analysis of IndustriesSachin MenonNo ratings yet

- Chapter 15Document2 pagesChapter 15Faizan ChNo ratings yet

- Case Study Disney The Partnership Side of Global Business Model InnovationDocument13 pagesCase Study Disney The Partnership Side of Global Business Model InnovationMuhammad HanifNo ratings yet

- Chap 018Document53 pagesChap 018saud1411100% (2)

- FSA3e HW Answers Modules 1-4Document39 pagesFSA3e HW Answers Modules 1-4bobdole0% (1)

- FMGT 3510 Midterm Exam Review Questions MC Summer 2019Document38 pagesFMGT 3510 Midterm Exam Review Questions MC Summer 2019Jennifer AdvientoNo ratings yet

- Macsg 08Document30 pagesMacsg 08JudithNo ratings yet

- Chapter 03Document80 pagesChapter 03raiNo ratings yet

- Capital Budgeting Test Bank CompressDocument30 pagesCapital Budgeting Test Bank CompressBiancaNo ratings yet

- Advertising & IMC Research TypesDocument40 pagesAdvertising & IMC Research TypesMaria Zakir100% (2)

- Chapter 19 Financial Statement Analysis AnswerDocument53 pagesChapter 19 Financial Statement Analysis AnswerHằngNo ratings yet

- R26 Understanding Cash Flow Statements Q BankDocument19 pagesR26 Understanding Cash Flow Statements Q BankCarlos Jesús Ponce AranedaNo ratings yet

- Chapter 5Document33 pagesChapter 5Abdelnasir HaiderNo ratings yet

- Chapter 01 The Importance of Business EthicsDocument14 pagesChapter 01 The Importance of Business Ethicsfbm2000No ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Financial Risk Modelling and Portfolio Optimization with RFrom EverandFinancial Risk Modelling and Portfolio Optimization with RRating: 4 out of 5 stars4/5 (2)

- Growth Strategy Process Flow A Complete Guide - 2020 EditionFrom EverandGrowth Strategy Process Flow A Complete Guide - 2020 EditionNo ratings yet

- 8Document11 pages8bia070386No ratings yet

- VC Valuation Methods SummaryDocument9 pagesVC Valuation Methods Summarybia070386No ratings yet

- 7Document9 pages7bia07038650% (2)

- Leach TB Chap08 Ed3Document9 pagesLeach TB Chap08 Ed3bia070386No ratings yet

- EFim 05 Ed 3Document23 pagesEFim 05 Ed 3bia070386100% (1)

- 12Document8 pages12bia070386No ratings yet

- Leach TB Chap12 Ed3Document7 pagesLeach TB Chap12 Ed3bia070386No ratings yet

- EfDocument8 pagesEfbia070386No ratings yet

- Evaluating Financial Performance: True-False QuestionsDocument9 pagesEvaluating Financial Performance: True-False Questionsbia070386100% (1)

- Chap 1Document7 pagesChap 1bia070386No ratings yet

- Leach TB Chap12 Ed3Document7 pagesLeach TB Chap12 Ed3bia070386No ratings yet

- Leach TB Chap11 Ed3Document7 pagesLeach TB Chap11 Ed3bia070386No ratings yet

- Leach TB Chap01 Ed3Document9 pagesLeach TB Chap01 Ed3bia070386No ratings yet

- Leach TB Chap04 Ed3Document8 pagesLeach TB Chap04 Ed3bia070386No ratings yet

- EF New Venture StrategyDocument5 pagesEF New Venture Strategybia070386No ratings yet

- Leach TB Chap03 Ed3Document10 pagesLeach TB Chap03 Ed3bia070386No ratings yet

- Financial Planning: Short Term and Long Term: True-False QuestionsDocument8 pagesFinancial Planning: Short Term and Long Term: True-False Questionsbia070386No ratings yet

- CH 05 Evaluating Financial PerformanceDocument42 pagesCH 05 Evaluating Financial Performancebia070386100% (1)

- CH 06 Financial Planning Short Term and Long TermDocument27 pagesCH 06 Financial Planning Short Term and Long TermshaahmookhanNo ratings yet

- Chapter 3 IHRM NewDocument38 pagesChapter 3 IHRM Newbia070386No ratings yet

- The Principles of Successful Project ManagementDocument5 pagesThe Principles of Successful Project Managementbia070386No ratings yet

- SapmDocument3 pagesSapmAbhijit GogoiNo ratings yet

- Cohen Finance Workbook FALL 2013Document124 pagesCohen Finance Workbook FALL 2013Nayef AbdullahNo ratings yet

- Klabin S.ADocument4 pagesKlabin S.AKlabin_RINo ratings yet

- FM Leverage SailDocument19 pagesFM Leverage SailMohammad Yusuf NabeelNo ratings yet

- Assignment On BaringsDocument10 pagesAssignment On Baringsimtehan_chowdhuryNo ratings yet

- Nature and Classes of Corporations 1Document4 pagesNature and Classes of Corporations 1Emyrose Capones CalgoNo ratings yet

- TiECON Ahmedabad 2017 highlights entrepreneurship summit's successDocument17 pagesTiECON Ahmedabad 2017 highlights entrepreneurship summit's successKavit ThakkarNo ratings yet

- A Comparative Study of Non Performing Assets in Indian Banking IndustryDocument11 pagesA Comparative Study of Non Performing Assets in Indian Banking IndustryIJEPT Journal67% (6)

- Rajiv Gandhi Equity Saving Scheme RGESSDocument8 pagesRajiv Gandhi Equity Saving Scheme RGESSTradewell SecuritiesNo ratings yet

- Limitations of Balance SheetDocument6 pagesLimitations of Balance Sheetshoms_007No ratings yet

- Rasio Sheet v1.0Document10 pagesRasio Sheet v1.0Yulianita AdrimaNo ratings yet

- Capital Structure, Cost of Capital and Value-Question BankDocument8 pagesCapital Structure, Cost of Capital and Value-Question Bankkaran30No ratings yet

- MBA507Document10 pagesMBA507pheeyonaNo ratings yet

- BTR Investor PresentationDocument28 pagesBTR Investor PresentationkaiselkNo ratings yet

- ESOP Repurchase Liability and LiquidityDocument56 pagesESOP Repurchase Liability and Liquidityno nameNo ratings yet

- Ambit - Strategy - India's Best and Worst Capital AllocatorsDocument32 pagesAmbit - Strategy - India's Best and Worst Capital Allocatorsinvestmentcalls100% (1)

- Lec 01Document22 pagesLec 01Hamid KhurshidNo ratings yet

- Strategic Corporate Finance - Re-Examination AssignmentDocument5 pagesStrategic Corporate Finance - Re-Examination AssignmentSukrit NagpalNo ratings yet

- Quiz II (Chapters 3 and 4) Consolidated Financial StatementsDocument5 pagesQuiz II (Chapters 3 and 4) Consolidated Financial Statements820090150% (2)

- Differences between Private and Public CompaniesDocument7 pagesDifferences between Private and Public CompaniesBilawal MughalNo ratings yet

- Welcome To: AMFI Mutual Fund Testing ProgramDocument279 pagesWelcome To: AMFI Mutual Fund Testing ProgramswadeshsarangiNo ratings yet

- 10 Types of InvestmentsDocument6 pages10 Types of InvestmentsRameezNo ratings yet

- Aof Form GrowwDocument15 pagesAof Form GrowwSouradipta ChowdhuryNo ratings yet

- Free Accounting Notes Accounting Best Notes in Pakistan. Accounting Accounting Best Ofxford NotesDocument2 pagesFree Accounting Notes Accounting Best Notes in Pakistan. Accounting Accounting Best Ofxford Noteshammad016No ratings yet