Professional Documents

Culture Documents

Cs 5 Final Worksheet 12

Uploaded by

ksbanwarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cs 5 Final Worksheet 12

Uploaded by

ksbanwarCopyright:

Available Formats

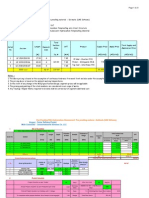

Line Item Bid Amount Actual Cost Underrun/(Overrun)

Labor for formwork, placing and finishing concrete $3,300,000 $4,210,500 ($910,500)

Material: forms, concrete, rebar, etc. $1,100,000 $1,067,000 $33,000

Subcontracts: piling, electrical, paving, etc. $1,600,000 $1,583,000 $17,000

Construction equipment $1,000,000 $1,087,000 ($87,000)

Engineering and design $300,000 $323,000 ($23,000)

Site supervision and administration $400,000 $553,500 ($153,500)

Total Project Costs (excluding G&A) $7,700,000 $8,824,000 ($1,124,000)

CONTRACT COST UNDERRUNS AND OVERRUNS

Line Item Amount

Extended home office costs $79,500

Extended jobsite overhead costs $47,580

Labor disruption and inefficiency costs $910,500

Additional construction equipment costs $121,256

Subtotal $1,158,836

Profit @ 10% $115,884

Total amount claimed $1,274,720

Plus withheld liquidated damages $120,000

Total claim request $1,394,720

Herb's Curb and Gutter Company - Claim Summary

Name: Date: Revision 12 - 1/1/11

CASE STUDY 5

SUMMARY OF EVENTS THAT RESULTED IN DELAYS AND DISRUPTIONS

RESULTS OF SCHEDULE ANALYSIS

Calendar

quarter ending

Event - Identify the specific

event(s) from the case study and

list each in the appropriate

calendar quarter Start Date End Date Duration

# days

Excusable/

NOT

Compensable

# days NOT

Excusable/ NOT

Compensable

# days

Excusable/

Compensable

Total Days

Claimed

3/31/1991 0

0

6/30/1991 0

0

0

9/30/1991 0

; 0

12/31/1991 0

0

3/31/1992 0

0

6/30/1992 0

0

9/30/1992 0

0

12/31/1992 0

0

Total Days based on schedule

analysis of causation 0 0 0 0

Delay Days (Round all numbers to the nearest "5" - thus, 89 days becomes 90 days)

Name: Date: Revision 12 - 1/1/11

Line Item Claimed Amount Adjustments Adjusted Claim Amount

Extended home office costs $79,500 $79,500

Extended jobsite overhead costs $47,580 $47,580

Labor disruption and inefficiency costs $910,500 $910,500 EXTRA CREDIT

Additional construction equipment costs $121,256 $121,256

Subtotal $1,158,836 $0 $1,158,836

Profit @ 10% $115,884 $0 $115,884

Total amount claimed $1,274,720 $0 $1,274,720

Liquidated damamages $120,000 $120,000

Total claim request $1,394,720 $0 $1,394,720

Enter adjustments in the YELLOW (shaded) boxes.)

Enter INCREASES in Adjustments as a POSITIVE number.

Enter DECREASES (or DEDUCTIONS) in Adjustments as a NEGATIVE number.

Accuracy required is within +/- $750 of the correct number

Herb's Curb and Gutter Company - Claim Summary

Name: Date: Revision 12 - 1/1/11

Discussion of Extended Home Office and Overhead Costs

Note: Herb has decided to use an Eichleay (total cost) type formula to calculate home office costs even though other methods are available.

Line Item (from 2/1/1991 to 12/30/1992) Amount Adjustment Amount approved Explanation of adjustment

Officers salaries $502,300 $502,300

HC&G Europa, Inc. costs $298,900 $298,900

Executive department - other $41,900 $41,900

Corporate engineering $43,700 $43,700

FICA on home office employees $144,100 $144,100

Unemployment and disability taxes $46,200 $46,200

Major medical group plan $88,000 $88,000

Employee pension plan $168,100 $168,100

Corporate office utilities $54,200 $54,200

Repairs and maintenance on buildings $141,900 $141,900

Rent $399,600 $399,600

Stationery and printing $17,500 $17,500

Telephone $229,500 $229,500

Advertising $7,600 $7,600

Promotion $43,800 $43,800

Entertaining (including Orioles and Ravens Tickets) $75,500 $75,500

Office supplies $31,200 $31,200

Postage $8,900 $8,900

Dues and subscriptions $65,100 $65,100

Contributions $20,100 $20,100

Data Processing $81,600 $81,600

Equipment rental - home office $62,200 $62,200

Company airplane $34,700 $34,700

Depreciation on Project machinery and equipment $77,800 $77,800

Repairs on Project machinery and equipment $18,100 $18,100

Estimating department salaries $186,000 $186,000

Estimating department supplies $13,400 $13,400

Contract administration salaries $333,600 $333,600

Contract administration supplies $31,500 $31,500

Purchasing department salaries $104,200 $104,200

Purchasing department supplies $5,300 $5,300

Accounting department salaries $400,800 $400,800

Accounting department supplies $9,700 $9,700

General office salaries $59,600 $59,600

TOTAL HOME OFFICE OVERHEAD COSTS $3,846,600 $0 $3,846,600

Total revenue from ramp contract $10,000,000 $10,000,000

Total revenue received from 2/1/1991 to 12/30/1992 $41,650,000 $41,650,000

Ratio of ramp contract revenue to total revenue 24.01% 24.01%

Total Home office overhead x ratio $923,553 $923,553

Days between 2/1/1991 and 12/30/1992 698 698

Daily Overhead Rate $1,323.14 $1,323.14

Claimed Overhead (Daily Overhead Rate x period of delay) $79,389 $0

Claimed Days Delayed 60 days

Approved Days Delayed days

2/1/1991

12/30/1992

TOTAL ADJUSTMENT (Enter on Final CS Worksheet)

Name: Date: Revision 12 - 1/1/11

Discussion of Extended Jobsite Overhead Costs

Additional site support cost due to extension of contract performance period (time-related costs)

Line Item (from 2/1/1991 to 12/30/1992) Amount Adjustment Amount approved Explanation of adjustment

Project Manager $96,000 $96,000

General Superintendent $90,000 $90,000

Assistant Superintendents $72,000 $72,000

Field Engineer $31,500 $31,500

Purchase of Project Manager vehicle $11,300 $11,300

Purchase of trailer $54,000 $54,000

Trucking expense $19,300 $19,300

Telephone (fixed=$500; variable=$6500) $7,000 $7,000

Field office supplies $825 $825

Concrete testing $4,500 $4,500

Compaction testing $2,600 $2,600

Inspection and other testing $3,600 $3,600

Travel expenses to and from home office $5,800 $5,800

Photographs $100 $100

Winter weather protection $6,100 $6,100

Temporary heat $8,000 $8,000

Temporary water $2,400 $2,400

Purchase of water cans $100 $100

Temporary power and light $1,500 $1,500

Temporary toilets $1,600 $1,600

Temporary elevator operation and maintenance $4,200 $4,200

Dust control $1,600 $1,600

Inspectors $46,200 $46,200

Purchase of trailer $20,400 $20,400

Repairs to equipment and tools $25,400 $25,400

Miscellaneous small tools $4,500 $4,500

Fuel and lubricants $12,700 $12,700

General clean up $5,700 $5,700

Final clean up $4,600 $4,600

Trash pickup $2,200 $2,200

Safety supplies $3,000 $3,000

Purchase of street barricades $4,000 $4,000

$0

$0

TOTAL JOBSITE OVERHEAD COSTS $552,725 $0 $552,725

Days between 2/1/1991 and 12/30/1992 698 698

Daily Jobsite Overhead Rate $792 $792

Claimed Overhead (Daily Overhead Rate x period of delay) $47,512 $0

Claimed Days Delayed 60 days

Approved Days Delayed days

2/1/1991

12/30/1992

TOTAL ADJUSTMENT (Enter on Final CS Worksheet)

DISCUSSION OF ADDITIONAL CONSTRUCTION EQUIPMENT COSTS Revision 12 - 1/1/11

HERB'S CURB AND GUTTER CONSTRUCTION EQUIPMENT CLAIM

Costs claimed for 2 months (60 days) of delay.

Quantity Description

Useful Life

(months)

Ownership

Costs over

Useful Life (per

unit)

Published Monthly

Rate

Months of

delay

Amount

Claimed

Amount

Approved

2 Concrete pumps 60 $145,000 $4,673 2 $18,692 $0

2 Cranes with buckets 120 $425,000 $11,364 2 $45,456 $0

2 Compressors 60 $60,000 $1,133 2 $4,532 $0

2 Generators 60 $13,000 $1,072 2 $4,288 $0

2 Scaffold sets 120 $130,000 $2,100 2 $8,400 $0

2 Conveyor sets 72 $55,000 $3,022 2 $12,088 $0

2 Fuel Pumps 60 $10,000 $290 2 $1,160 $0

2 Truck and trailer rig 72 $31,000 $3,360 2 $13,440 $0

6 Pick up trucks 72 $14,000 $1,100 2 $13,200 $0

Total $121,256 $0

CONSTRUCTION EQUIPMENT COSTS WORKSHEET C= A/B E= C*D

A B C D E

Quantity Description

Ownership

Costs over

Useful Life

Useful Life

(months)

Estimated monthly

cost of ownership

Actual

additional

useage

period

Estimated

additional

equipment

costs Adjustment

2 Concrete pumps 0 $18,692

2 Cranes with buckets 0 $45,456

2 Compressors 0 $4,532

2 Generators 0 $4,288

2 Scaffold sets 0 $8,400

2 Conveyor sets 0 $12,088

2 Fuel Pumps 0 $1,160

2 Truck and trailer rig 0 $13,440

6 Pick up trucks 0 $13,200

Approved days of delay Total Equipment Adjustment (Enter on Final CS Worksheet)

Discussion of Labor Disruption & Escalation Issues

Planned and Actual Craft Jobhours and Concrete Quantities

Period 1 2 3 4 5 6 7 8

Period Ending 3/31/1991 6/30/1991 9/30/1991 12/31/1991 3/31/1992 6/30/1992 9/30/1992 Subtotal 12/31/1992 Total

Quantities

Estimated concrete to be placed 0 500 2,000 3,000 2,000 2,000 500 10,000 0 10,000

Actual concrete placed 0 200 2,000 3,000 1,400 1,000 1,700 9,300 700 10,000

Difference 0 -300 0 0 -600 -1,000 1,200 -700 700 0

Unit Rates-concrete in place

Estimated jobhours per CY 0 10 10 10 10 10 10 10

Actual jobhours per CY* 0 11 11 11 13 14 13 11

Estimated jobhours 0 5,000 20,000 30,000 20,000 20,000 5,000 100,000 0 100,000

Actual jobhours 0 2,200 22,000 33,000 18,200 14,000 22,100 111,500 7,700 119,200

Difference 0 -2,800 2,000 3,000 -1,800 -6,000 17,100 11,500 7,700 19,200

Actual craft wage rate (by quarter)** $35 $35 $35 $35 $35 $35 $35 $40

Wage rate per bid $33 $33 $33 $33 $33 $33 $33 $0

Difference $2 $2 $2 $2 $2 $2 $2 $40

Total Actual Labor Costs $0 $77,000 $770,000 $1,155,000 $637,000 $490,000 $773,500 $3,902,500 $308,000 $4,210,500

*Include all concrete related hours for formwork, placing and finishing

**Wage rate is fully burdened to include base wage, additives, taxes, worker's comp, union dues, travel and subsistence.

Also included is a mark up related to certain variable or activity related costs such as small tools, consumables and personnel testing

LABOR DISRUPTION & ESCALATION SUMMARY

Estimated Labor

Origninal

Scope

jobhours

Disrupted

jobhours (pre-

11/1/1992)

Disrupted

jobhours (post

11/1/1992) Totals

Concrete Jobhours 100,000 100,000 11,500 7,700 19,200

Estimated wage rate $33 $0 $0 $0 $0

Actual wage rate $0 $35 $35 $40 $0

Total ESTIMATED labor cost $3,300,000 $0 $0 $0 $3,300,000

Total ACTUAL labor cost $0 $3,500,000 $402,500 $308,000 $4,210,500

Total HC&G labor claim $200,000 $402,500 $308,000 $910,500

LABOR DISRUPTION AND ESCALATION WORKSHEET

Disruption Period Actual Unit Rate

Unimpacted

Unit rate Difference

Quantities

Installed Jobhours Wage Rate

Allowable

Additional

Labor Cost

Period 6 0 $0

Period 7 0 $0

Wage Escalation Period

Period 8 $0

Total $0

LABOR DISRUPTION AND EXCALATION SUMMARY

Totals Adjustment description/ expalanation

Total Labor Claim $910,500 Hints (all are deducts):

Adjustment 1 Difference between Bid and Actual Wage Rates on bid hours only

Adjustment 2 Difference between estimated unit rate and unimpacted unit rate (Difference x CY x Actual wage rate)

Adjustment 3 Labor inefficiencies during period 5 (1Q92) non-compensable (Actual UR-Unimpacted UR x CY x Actual wage rate)

Allowable Adjusted Labor Cost $910,500

TOTAL LABOR ADJUSTMENT (Enter on Final CS Worksheet)

NOTE:

Actual Labor Cost

You might also like

- Mile High Cycles cost analysis identifies $203K in unexpected lossesDocument7 pagesMile High Cycles cost analysis identifies $203K in unexpected lossesprasgopalaNo ratings yet

- Southern Marine Engineering Desk Reference: Second Edition Volume IFrom EverandSouthern Marine Engineering Desk Reference: Second Edition Volume INo ratings yet

- 2021JULB02014 Kamakshi Gupta MA ABCDocument15 pages2021JULB02014 Kamakshi Gupta MA ABCKamakshi GuptaNo ratings yet

- Acctg523-B1-Practice Midterm-W2022-SolutionDocument8 pagesAcctg523-B1-Practice Midterm-W2022-Solutionmakan94883No ratings yet

- Estimate detaildUnitPriceDocument32 pagesEstimate detaildUnitPriceNeco Carlo PalNo ratings yet

- Managing Successful Projects with PRINCE2 2009 EditionFrom EverandManaging Successful Projects with PRINCE2 2009 EditionRating: 4 out of 5 stars4/5 (3)

- Assgnment 2 (f5) 10341Document11 pagesAssgnment 2 (f5) 10341Minhaj AlbeezNo ratings yet

- Fire Proofing Estimate for Sohar Refinery ProjectDocument21 pagesFire Proofing Estimate for Sohar Refinery ProjectDkPrince100% (5)

- Miles High Cycles Katherine Roland and John ConnorsDocument4 pagesMiles High Cycles Katherine Roland and John ConnorsvivekNo ratings yet

- Solutions To ProblemsDocument33 pagesSolutions To ProblemsggjjyyNo ratings yet

- Chapter 5 Financial Study (Part1) : A. Major AssumptionsDocument9 pagesChapter 5 Financial Study (Part1) : A. Major AssumptionsAnne XxNo ratings yet

- Course_Exam___ACCO_503_Managerial_and_Financial_Accounting.docx (1)Document20 pagesCourse_Exam___ACCO_503_Managerial_and_Financial_Accounting.docx (1)mauricio ricardoNo ratings yet

- Exercises - Chapter08 - Decision Making - GUI LOPDocument8 pagesExercises - Chapter08 - Decision Making - GUI LOPQuỳnh ChâuNo ratings yet

- Latihan Akt MGT Lanjutan - Ppak Untar Genap 21-22 HTDocument18 pagesLatihan Akt MGT Lanjutan - Ppak Untar Genap 21-22 HTCalvin HadikusumaNo ratings yet

- Ma PHD01003 Harshad Savant Term2 EndtermDocument8 pagesMa PHD01003 Harshad Savant Term2 EndtermHarshad SavantNo ratings yet

- Indicative Answers:: N12405 MAD II Seminar 3 Activity-Based CostingDocument2 pagesIndicative Answers:: N12405 MAD II Seminar 3 Activity-Based CostinganalsluttyNo ratings yet

- Method of Costing (I)Document8 pagesMethod of Costing (I)anon_672065362No ratings yet

- 4-18 Page 125 Laguna Mission Actual Costs Model ModelDocument9 pages4-18 Page 125 Laguna Mission Actual Costs Model ModelMisty Dawn BancroftNo ratings yet

- PA1 Group1 Week8Document8 pagesPA1 Group1 Week8Phuong Nguyen MinhNo ratings yet

- Financial Management Assignment, HCC, PUDocument12 pagesFinancial Management Assignment, HCC, PUMuhammad MoazNo ratings yet

- Strategic cost management self-testDocument7 pagesStrategic cost management self-testAlyssa CaddawanNo ratings yet

- Mile High Cycles CaseDocument6 pagesMile High Cycles CaseShubh TanejaNo ratings yet

- CMA April - 14 Exam Question SolutionDocument55 pagesCMA April - 14 Exam Question Solutionkhandakeralihossain50% (2)

- Solutions to Chapter 8 questions on incremental analysisDocument10 pagesSolutions to Chapter 8 questions on incremental analysisSaurabh SinghNo ratings yet

- ACCT 1003 Worksheet 3 Solutions2010!11!2Document3 pagesACCT 1003 Worksheet 3 Solutions2010!11!2HimshowaNo ratings yet

- Colorscope, IncDocument16 pagesColorscope, IncRajneeshNo ratings yet

- Case Study Sample Write UpDocument4 pagesCase Study Sample Write UpMark Roger Huberit IINo ratings yet

- 7-28 7-29 The Direct MethodDocument5 pages7-28 7-29 The Direct MethodJohn Carlo AquinoNo ratings yet

- Exhibit 1 Results of Operation - 1985: Ovens Stoves TotalDocument27 pagesExhibit 1 Results of Operation - 1985: Ovens Stoves TotalcandratriutariNo ratings yet

- Waterway Continuous Problem WCPDocument17 pagesWaterway Continuous Problem WCPAboi Boboi50% (4)

- Absorption (Total) Costing: A2 Level Accounting - Resources, Past Papers, Notes, Exercises & QuizesDocument4 pagesAbsorption (Total) Costing: A2 Level Accounting - Resources, Past Papers, Notes, Exercises & QuizesAung Zaw HtweNo ratings yet

- Analyzing Adjusting Entries and Financial StatementsDocument12 pagesAnalyzing Adjusting Entries and Financial StatementsTuba AkbarNo ratings yet

- Meaford Haven Proforma Sept 2013Document7 pagesMeaford Haven Proforma Sept 2013api-204895087No ratings yet

- Suggested Answers Certificate in Accounting and Finance - Autumn 2014Document6 pagesSuggested Answers Certificate in Accounting and Finance - Autumn 2014IrfanNo ratings yet

- Managerial Accounting Homework on Costing MethodsDocument5 pagesManagerial Accounting Homework on Costing MethodsOvidiaNo ratings yet

- Analyze manufacturing costs and variances for Marston, IncDocument11 pagesAnalyze manufacturing costs and variances for Marston, IncCharles GohNo ratings yet

- BQ Civil Maintenance ServiceDocument75 pagesBQ Civil Maintenance ServiceiwanNo ratings yet

- Quiz For Cost AccountingDocument2 pagesQuiz For Cost AccountingNico Bicaldo100% (2)

- Kerjakan 4-12 Dan 4 - 17: 1. "Plantwide"Document4 pagesKerjakan 4-12 Dan 4 - 17: 1. "Plantwide"natan. lieNo ratings yet

- SolutionDocument4 pagesSolutionAshish BhallaNo ratings yet

- Lakeside Jawaban CaseDocument40 pagesLakeside Jawaban CaseDhenayu Tresnadya HendrikNo ratings yet

- Soultions - Chapter 3Document8 pagesSoultions - Chapter 3Naudia L. TurnbullNo ratings yet

- PA1 Group1 P10Document8 pagesPA1 Group1 P10Phuong Nguyen MinhNo ratings yet

- Improvement to Ampara-Uhana-Mahaoya Road Project Payment CertificateDocument18 pagesImprovement to Ampara-Uhana-Mahaoya Road Project Payment CertificateMohamed Ismath KalideenNo ratings yet

- Standard (I Unit Produced) ParticularsDocument11 pagesStandard (I Unit Produced) ParticularsForam Raval100% (1)

- Sample Project Profile On P.P Air Thight ContainersDocument9 pagesSample Project Profile On P.P Air Thight ContainersThirumoorthi ChellappanNo ratings yet

- Two Wheeler Repairing ShopDocument4 pagesTwo Wheeler Repairing Shoppradip_kumarNo ratings yet

- CMA JUNE 2021 EXAM P1 PROCESS COSTING SOLUTIONSDocument5 pagesCMA JUNE 2021 EXAM P1 PROCESS COSTING SOLUTIONSTameemmahmud rokibNo ratings yet

- Instructions: Please Complete All 3 Multi-Part Problems For This Week's AssignmentDocument4 pagesInstructions: Please Complete All 3 Multi-Part Problems For This Week's AssignmentMike FasanoNo ratings yet

- Input Form: Input For Venture Guidance AppraisalDocument7 pagesInput Form: Input For Venture Guidance AppraisalgenergiaNo ratings yet

- HDPE Pipes Guide for Water, Gas & Sewer ProjectsDocument9 pagesHDPE Pipes Guide for Water, Gas & Sewer ProjectsnoeNo ratings yet

- Solutions To Multiple Choice Questions, Exercises and ProblemsDocument41 pagesSolutions To Multiple Choice Questions, Exercises and ProblemsJan SpantonNo ratings yet

- Acca f5 Question BankDocument98 pagesAcca f5 Question Banknguyenphuongthao.04012003No ratings yet

- Question - Parallel Quiz - Final Term - Cost Accounting 22 - 23Document6 pagesQuestion - Parallel Quiz - Final Term - Cost Accounting 22 - 23Gistima Putra JavandaNo ratings yet

- Wooden Steel Items Manufacturing Unit FeasibilityDocument7 pagesWooden Steel Items Manufacturing Unit FeasibilityGlobal Law FirmNo ratings yet

- Chapter 6 Coverage of Learning Objectives and Relevant DecisionsDocument72 pagesChapter 6 Coverage of Learning Objectives and Relevant Decisionsmanunited83100% (1)

- COST MANAGEMENT AND FINANCIAL INFORMATIONDocument7 pagesCOST MANAGEMENT AND FINANCIAL INFORMATIONSamuel DwumfourNo ratings yet

- ManagingDocument2 pagesManagingksbanwarNo ratings yet

- Cs 5 Final Worksheet 12Document8 pagesCs 5 Final Worksheet 12ksbanwarNo ratings yet

- Factors Affecting Construction Projects in GazaDocument12 pagesFactors Affecting Construction Projects in GazaksbanwarNo ratings yet

- EfDocument4 pagesEfksbanwarNo ratings yet

- Implementing Schedule Delay Analysis Methodology On Project Management SystemDocument8 pagesImplementing Schedule Delay Analysis Methodology On Project Management SystemShowki WaniNo ratings yet

- z4 BreakdownDocument2 pagesz4 BreakdownksbanwarNo ratings yet

- How To Convert 10 Amps To Watts (W)Document4 pagesHow To Convert 10 Amps To Watts (W)ksbanwarNo ratings yet

- FapDocument1 pageFapksbanwarNo ratings yet

- Convert EPS to Project Activity Codes in P6Document1 pageConvert EPS to Project Activity Codes in P6ksbanwarNo ratings yet

- Salary Jan-14 4500 65% 3200 100% 3500 50% 5000 35% 9400 8000 8000 TotalDocument2 pagesSalary Jan-14 4500 65% 3200 100% 3500 50% 5000 35% 9400 8000 8000 TotalksbanwarNo ratings yet

- Salary Jan-14 4500 65% 3200 100% 3500 50% 5000 35% 9400 8000 8000 TotalDocument2 pagesSalary Jan-14 4500 65% 3200 100% 3500 50% 5000 35% 9400 8000 8000 TotalksbanwarNo ratings yet