Professional Documents

Culture Documents

ACCTG 201 - Financial Accounting & Reporting Part I

Uploaded by

Rahul Humpal0 ratings0% found this document useful (0 votes)

132 views17 pagessyllabus for financial accounting part 1

Original Title

ACCTG 201_Financial Accounting & Reporting Part I

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsyllabus for financial accounting part 1

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

132 views17 pagesACCTG 201 - Financial Accounting & Reporting Part I

Uploaded by

Rahul Humpalsyllabus for financial accounting part 1

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 17

156 M.L.

Quezon Avenue, Antipolo City

IMS-VPED-007

1

QR-VPED-007

Rev.01

6

TH

June 2012

COLLEGE OF ACCOUNTANCY

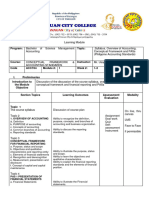

COURSE CODE : ACCTG 201

COURSE TITLE : Financial Accounting and Reporting Part I

CURRICULAR AREA : 2

ND

Year, College of Accountancy

COURSE DESCRIPTION : This course introduces the nature, functions, scope, and limitations of the broad field of accounting theory. It deals with the

study of the theoretical accounting framework objectives of financial statements, accounting conventions, and generally

accepted accounting principles (national concepts and principles as well as international accounting standards), the conditions

under which they may be appropriately applied, their impact or effect on the financial statements; and the criticisms

commonly leveled against them. The course covers the detailed discussion, appreciation, and application of accounting

principles covering the asset accounts. Emphasis is given on the interpretation and application of theories of accounting in

relation to cash, temporary investments, receivables, inventories, prepayments, long-term investments, property, plant and

equipment, intangibles, and other assets, including financial statement presentation and disclosure requirements. The related

internal control, ethical issues, and management of assets are also covered. Exposure to computerized system in receivables,

inventory, and lapsing schedules is a requirement in this course.

COURSE OBJECTIVE/S :

TIME ALLOTMENT : 6 hours

UNIT CREDIT : 6 units

PREPARED BY : Ms. Ilene Padilla

ADOPTED BY (if applicable) :

REVIEWED BY (Chair / Co-Chair) :

APPROVED BY (Dean) :

DATE REVISED/UPDATED :

156 M.L. Quezon Avenue, Antipolo City

IMS-VPED-007

2

QR-VPED-007

Rev.01

6

TH

June 2012

SUMMARY OF SUBJECT MATTER/TOPICS AND COURSE REQUIREMENTS

INCLUSIVE

WEEKS

SUBJECT MATTER COURSE REQUIREMENTS

MONITORIN

G

STATUS

REMARKS

C NC

1

st

WEEK to

6

th

WEEK

I. Accounting Standards Council and Conceptual Framework for the

Preparation and Presentation of Financial statements

II. Accounting for Cash

III. Accounting for Receivables

1. Class Participation thru

Class Recitations.

2. Quizzes/Assignments

at the end of each chapter

topic(s).

3. Field-Market-Store Visits

Report (written & oral

presentations)

4. Written Research Reports

from business-related

magazines, internet source

materials by each student.

5. Reaction Paper to special

educational film/video material

6. Time Management discipline

(punctuality & attendance)

7. Major Exams (Prelim,

Midterm, Final)

TEXTBOOKS:

Financial Accounting Volume 1 by

Conrado Valix, 2012

7

th

WEEK to

12

th

WEEK

IV. Accounting for Inventories

V. Accounting for Prepayments

VI. Accounting for Property, Plant and Equipment

13

th

WEEK

to 18

th

WEEK

VII. Accounting for Intangible Assets

VIII. Accounting for Investments in Equity and Debt Securities

IX. Accounting for Other Types of Investments

* C - Complied; NC Not Complied

156 M.L. Quezon Avenue, Antipolo City

IMS-VPED-007

3

QR-VPED-007

Rev.01

6

TH

June 2012

PRELIMINARY GRADING PERIOD

Timetable Specific Objectives

Subject

Matter/Topic

Teaching-Learning/

Strategies

Tools and Aids References

Values

Integration/

Issues

Evaluative

Measures

1

st

Week

. Accounting

Standards Council

and Conceptual

Framework for the

Preparation and

Presentation of

Financial statements

1. Accounting

Standards

Council

a. Creation,

objectives and

functions

b.

Membership

/ composition

c. Standard

setting process

2. Conceptual

Framework for

the Preparation

and Presentation

of Financial

Statements

a. Users and

their information

needs

b. Objective of

financial statements

Lecture and

Discussions

Computer Audio-Video

Equipment (Powerpoint)

Financial Accounting

Volume 1 by Conrado

Valix, 2012

Recitations

156 M.L. Quezon Avenue, Antipolo City

IMS-VPED-007

4

QR-VPED-007

Rev.01

6

TH

June 2012

c. Underlying

assumptions in the

preparation of

financial statements

d. Qualitative

characteristics of

financial statements

Understan

dability

Relevance

Reliability

Comparab

ility

e. Principles of

Recognition and

Measurement

Measurement base

2nd Week

f. Elements of

financial statements

and their definition

Assets

Liabilities

Equity

Income

Expenses

g. Recognition

and measurement of

the elements of

financial statements

h. Concepts of

capital and capital

maintenance

Financial

concept

Physical

concept

Group Discussions, and

Individual Activities

Computer Audio-Video

Equipment (Powerpoint),

Financial Accounting

Volume 1 by Conrado

Valix, 2012

Quiz

156 M.L. Quezon Avenue, Antipolo City

IMS-VPED-007

5

QR-VPED-007

Rev.01

6

TH

June 2012

3

rd

Week

II. Accounting for

Cash

Definition, nature

and composition of

cash and cash

equivalents

1. Recognition and

measurement of

cash

2. Compensating

balance

requirement

3. Management

and control of

cash

Accounting of

petty cash

fund

Bank

reconciliation

at a single

date

Financial statement

valuation,

presentation and

disclosure

Lectures,

Group Activities

Computer Audio-Video

Equipment (Powerpoint),

Hand-Out, Internet and

prescribed textbook

Financial Accounting

Volume 1 by Conrado

Valix, 2012

Seat works

4

th

Week

III. Accounting for

Receivables

1. Definition,

nature and

classification of

receivables

2. Accounting for

accounts

receivables

a. Recognition

b. Initial

Lectures, Discussions

Internet and prescribed

textbook

Financial Accounting

Volume 1 by Conrado

Valix, 2012

Quizzes

Assigments

156 M.L. Quezon Avenue, Antipolo City

IMS-VPED-007

6

QR-VPED-007

Rev.01

6

TH

June 2012

measurement

and valuation

at net

realizable

value

c. Approaches to

recognizing

methods of

uncollectible

receivables

Direct write

off method

Allowance

method

d. Methods of

estimating

uncollectible

accounts

Percentage

of sales

method

Percentage

of accounts

receivable

method

Aging of

accounts

receivable

3. Accounting for

notes

receivable

a. Definition and

types of

promissory

notes

b. Recognition

c. Initial

156 M.L. Quezon Avenue, Antipolo City

IMS-VPED-007

7

QR-VPED-007

Rev.01

6

TH

June 2012

measurement

and valuation

at present

value

5

th

Week

General rule

Special rules

4. Receivable

financing

arrangements

d. Accounts

receivable

Pledging

(general

assignment

of

receivables)

Factoring

Assignment

of specific

receivable

e. Notes

receivable

Discounting

5. Financial

statement

presentation and

disclosure

6. Internal control

measures for

receivable

Class Discussions,

Problem Solving

Activities

Computer Audio-Video

Equipment (Powerpoint),

Hand-Out,

Financial Accounting

Volume 1 by Conrado

Valix, 2012

Presentation

Recitations

6

th

Week

PRELIMINARY EXAMINATION

156 M.L. Quezon Avenue, Antipolo City

IMS-VPED-007

8

QR-VPED-007

Rev.01

6

TH

June 2012

MIDTERM GRADING PERIOD

Timetable Specific Objectives Subject Matter/Topic

Teaching-Learning/

Strategies

Tools and Aids References

Values

Integration/

Issues

Evaluative

Measures

7

th

Week

IV. Accounting for

Inventories

1. Definition, nature

and classes of

inventories

2. Recognition

3. Initial measurement

at cost

4. Inventory recording

systems

a. Periodic inventory

system

b. Perpetual inventory

system

5. Inventory costing

methods

a. Items not ordinarily

interchangeable

Specific

identification

b. For items that are

interchangeable:

Benchmark

treatment First

in, First out

method or

weighted average

cost methods

Allowed

Lectures, Discussions

Computer Audio-Video

Equipment (Powerpoint),

Financial Accounting

Volume 1 by Conrado

Valix, 2012

Recitations

Presentations

156 M.L. Quezon Avenue, Antipolo City

IMS-VPED-007

9

QR-VPED-007

Rev.01

6

TH

June 2012

alternative

treatment Last-

in, First-out

method

8

th

Week

1. Inventory

estimation

methods

a. Gross profit

method

b. Retail inventory

method

(excluding peso

value and retail

info)

2. Valuation at lower

of cost and net

realizable value

a. Write-down to net

realizable value

b. Reversal of write-

down

3. Other Inventory

Issues

a. Purchase

commitment

b. Inventory valued

at selling price

c. Use of more than

one cost method

d. Borrowing costs

e. Lump-sum

acquisition

f. Inventory errors

4. Financial

statement

presentation and

Lectures, Group

Discussions and

Activities

Hand-Out, Internet and

prescribed textbook

Financial Accounting

Volume 1 by Conrado

Valix, 2012

Quizzes

156 M.L. Quezon Avenue, Antipolo City

IMS-VPED-007

10

QR-VPED-007

Rev.01

6

TH

June 2012

disclosures

5. Internal control

and management

of inventory

9

th

Week

V. Accounting for

Prepayments

1. Nature

2. Source of

payments

Fieldwork,

Case Analysis

Computer Audio-Video

Equipment (Powerpoint),

Internet and prescribed

textbook

Financial Accounting

Volume 1 by Conrado

Valix, 2012

Recitations

Presentations

10

th

Week

VI. Accounting for

Property, Plant and

Equipment

1. Definition, nature and

classes

2. Recognition

3. Initial measurement

a. Cash purchase

b. Purchase on a

deferred payment

contract

c. Issuance of securities

d. Donation or discovery

e. Self-construction

Exchanges of non-

monetary assets

Group and Individual

activities, Fieldwork

Computer Audio-Video

Equipment (Powerpoint)

Financial Accounting

Volume 1 by Conrado

Valix, 2012

Quizzes

Assignments

11

th

Week

4. Expenditures

subsequent to

acquisition

a. Capital

expenditures

b. Revenue

expenditures

5. Valuation or

measurement

subsequent to initial

recognition

Fieldwork, Case

Analysis

Internet and prescribed

textbook

Financial Accounting

Volume 1 by Conrado

Valix, 2012

Recitations

Presentations

156 M.L. Quezon Avenue, Antipolo City

IMS-VPED-007

11

QR-VPED-007

Rev.01

6

TH

June 2012

a. Benchmark

method cost less

accumulated

depreciation and

accumulated

impairment losses

b. Allowed alternative

method

revaluation at fair

value less

accumulated

depreciation and

accumulated

impairment losses

6. Depreciation of

assets

a. Definition, nature

and causes

b. Factors affecting

depreciation

c. Methods of

depreciation

Straight-line

method

Declining balance

method

Sum-of-the-years

digits method

Group and

composite

depreciation

7. Depletion of wasting

assets

8. Accounting changes

affecting depreciation

Revaluation of property,

plant and equipment

12

th

Week

MIDTERM EXAMINATION

156 M.L. Quezon Avenue, Antipolo City

IMS-VPED-007

12

QR-VPED-007

Rev.01

6

TH

June 2012

FINAL GRADING PERIOD

Timetable Specific Objectives Subject Matter/Topic

Teaching-Learning/

Strategies

Tools and Aids References

Values

Integration/

Issues

Evaluative

Measures

13

th

Week

a. Recording on

date of

revaluation

b. Frequency of

revaluation

c. Revaluation

increase

d. Revaluation

decrease

e. Realized

revaluation

9. Impairment of

assets

a. Definition

b. When to

recognize and

how to measure

impairment loss

c. Measurement of

recoverable

amount

d. Impairment loss

for an individual

asset

e. Impairment loss

for cash-

generating unit

f. Reversal of

previously

recognized

impairment loss

10. Retirement and

Lecture, and

Discussions

Computer Audio-Video

Equipment (Powerpoint),

Financial Accounting

Volume 1 by Conrado

Valix, 2012

Recitations

Seatworks

156 M.L. Quezon Avenue, Antipolo City

IMS-VPED-007

13

QR-VPED-007

Rev.01

6

TH

June 2012

disposals

11. Financial statement

presentation and

disclosures

12. Internal control and

management of

property, plant and

equipment

14

th

Week

VII. Accounting for

Intangible Assets

1. Definition,

nature, and

classes

2. Recognition

criteria

3. Initial

measurement

and Accounting

for Intangibles

a. Patents

b. Copyright

c. Trademarks

and Trade

names

d. Franchise

rights

e. Leaserights

f. Computer

software

g. Goodwill

h. Research

and

development

costs

i. Other

intangible

Lectures, Discussions,

Group and Individual

activities

Computer Audio-Video

Equipment (Powerpoint),

Internet and prescribed

textbook

Financial Accounting

Volume 1 by Conrado

Valix, 2012

Quizzes

156 M.L. Quezon Avenue, Antipolo City

IMS-VPED-007

14

QR-VPED-007

Rev.01

6

TH

June 2012

assets

4. Subsequently

incurred costs

5. Measurement

subsequent to

initial recognition

a. Benchmark

method

b. Allowed

alternative

method:

Revaluation

6. Amortization

7. Impairment of

the value of

intangible assets

8. Reversal of

impairment loss

9. Retirements and

disposition

10. Financial

statement

presentation and

disclosures

11. Internal control

measures for

intangibles

15

th

Week

VIII. Accounting for

Investments in Equity

and Debt Securities

1. Definition of

Investment

2. Classification of

Investment in

Equity and Debt

Securities

Trading

Lectures, Discussions,

Fieldwork

Computer Audio-Video

Equipment (Powerpoint),

Hand-Out, Internet and

prescribed textbook

Financial Accounting

Volume 1 by Conrado

Valix, 2012

Quizzes

156 M.L. Quezon Avenue, Antipolo City

IMS-VPED-007

15

QR-VPED-007

Rev.01

6

TH

June 2012

Available for

Sale

Held-to-

maturity

3. Determining

Method of

Accounting for

Investments

4. Accounting

Methods

Applicable to

Investment in

Equity and Debt

Securities

Fair Value

Method

Cost Method

Equity Method

16 Week

5. Accounting for

Changes in

Classification of

Investment in

Securities

6. Additional Issues

in Investment in

Equity Securities

Revenue from

investments in equity

securities

Stock

dividends and

splits

Stock rights

7. Accounting for

impairment and

uncollectability of

investment in debt

and equity

securities.

Impairment in

Discussions,

Group and Individual

activities

Computer Audio-Video

Equipment (Powerpoint),

Financial Accounting

Volume 1 by Conrado

Valix, 2012

Quizzes

Oral Reports

156 M.L. Quezon Avenue, Antipolo City

IMS-VPED-007

16

QR-VPED-007

Rev.01

6

TH

June 2012

value of

trading and

available-for-

sale

securities

Impairment in

value of held-

to-maturity

investment

Reversal of impairment

17

th

Week

IX. Accounting for Other

Types of

Investments

Investment

Derivatives (only

a basic

appreciation of

the nature of

derivatives may

be taken up

since this topic

will be discussed

in detail in

Advanced

Accounting)

Investment in

Cash Surrender

Value of Life

Insurance

Investment in

Funds

Investment

Property

Interests in Joint

Ventures

Investments in

Associates

Discussion,

Case Analysis

Computer Audio-Video

Equipment (Powerpoint),

Hand-Out, Internet and

prescribed textbook

Financial Accounting

Volume 1 by Conrado

Valix, 2012

Recitations

Oral Reports

Seatworks

Quizzes

18

th

Week FINAL EXAMINATION

156 M.L. Quezon Avenue, Antipolo City

IMS-VPED-007

17

QR-VPED-007

Rev.01

6

TH

June 2012

POLICIES

1. All students are expected to attend classes regularly and to complete the academic work of the subject.

2. Latecomers are allowed, five minutes after the class time.

3. Class Participation and Discussion are graded

4. Cheating is not allowed wherein standard WCC or CHED policy will be applied.

5. Missed Major Exams are per standard WCC policy.

TEXTBOOKS AND REFERENCES

Financial Accounting Volume 1 by Conrado Valix 2012

GRADING SYSTEM

50% Major Exams

20% Oral Reports/Presentation, Written Reports

20% Quizzes, Seat-work, and Assignment

10% Class Participation

You might also like

- Learning Mod 1 CfasDocument20 pagesLearning Mod 1 CfasKristine CamposNo ratings yet

- Syll Fin Acc MBADocument3 pagesSyll Fin Acc MBAmakNo ratings yet

- 1.1 Course Outline Accy206Document3 pages1.1 Course Outline Accy206bsaccyinstructorNo ratings yet

- Learning Mod 1 Financial Acct Rep 2Document15 pagesLearning Mod 1 Financial Acct Rep 2FERNANDEZ BEANo ratings yet

- ACC111 Course CompactDocument2 pagesACC111 Course CompactKehindeNo ratings yet

- BA 123 Public Accounting CourseDocument9 pagesBA 123 Public Accounting CourseMargery BumagatNo ratings yet

- Assets Accounting Course OutlineDocument3 pagesAssets Accounting Course OutlineKelvin mwaiNo ratings yet

- I208 GP235 Financial ManagmentDocument3 pagesI208 GP235 Financial Managmentleo rojasNo ratings yet

- Online - Accounting and Financial ManagementDocument2 pagesOnline - Accounting and Financial ManagementPranav KompallyNo ratings yet

- Financial Reporting and AnalysisDocument5 pagesFinancial Reporting and AnalysisPiyush AgarwalNo ratings yet

- ACC 211 Course CompactDocument2 pagesACC 211 Course CompactKehindeNo ratings yet

- Department of Business Administration: Course DescriptionDocument4 pagesDepartment of Business Administration: Course DescriptionSadia FarahNo ratings yet

- ACC203Document7 pagesACC203waheedahmedarainNo ratings yet

- INS3001 - IFRS Financial Accounting 1Document6 pagesINS3001 - IFRS Financial Accounting 1JF FNo ratings yet

- Financial Reporting & AnalysisDocument6 pagesFinancial Reporting & AnalysisrakeshNo ratings yet

- DCP Financial AccountingDocument9 pagesDCP Financial AccountingIntekhab AslamNo ratings yet

- Intermediate Financial Accounting IntroductionDocument14 pagesIntermediate Financial Accounting Introductionyicunz8No ratings yet

- BUS 1B Accounting Principles - ManagerialDocument4 pagesBUS 1B Accounting Principles - ManagerialAngus SadpetNo ratings yet

- Principles of Accounting Course OutlineDocument4 pagesPrinciples of Accounting Course OutlinefuriousTaherNo ratings yet

- SLU SAMCIS Course Guide on Financial MarketsDocument6 pagesSLU SAMCIS Course Guide on Financial MarketsFernando III PerezNo ratings yet

- Principles of Financial Accounting 1Document6 pagesPrinciples of Financial Accounting 1Amonie ReidNo ratings yet

- Accounting for Managers Course HandoutDocument14 pagesAccounting for Managers Course HandoutMonchai DasNo ratings yet

- FABM1 - DLLDocument7 pagesFABM1 - DLLAmur Jessica FuentesNo ratings yet

- Accounting Theory ConceptsDocument5 pagesAccounting Theory Conceptseny setiawatiNo ratings yet

- FA MBA Quarter I SNU Course Outline 2020Document7 pagesFA MBA Quarter I SNU Course Outline 2020Kartikey BharadwajNo ratings yet

- Advanced Accounting SyllabusDocument7 pagesAdvanced Accounting Syllabusapi-323483989No ratings yet

- Principles of AccountingDocument4 pagesPrinciples of AccountingjtopuNo ratings yet

- RPS - Akuntansi International - Id.enDocument9 pagesRPS - Akuntansi International - Id.enVanilla ClairNo ratings yet

- Intermediate Accounting 2 Syllabus 2015Document5 pagesIntermediate Accounting 2 Syllabus 2015Altea ZaimanNo ratings yet

- AC201 Intermediate Accounting IntroDocument2 pagesAC201 Intermediate Accounting IntroCosta Nehemia MunisiNo ratings yet

- IFRS - ManualDocument4 pagesIFRS - ManualLawin HassanNo ratings yet

- Finance and Accounting Agenda Fall2016Document2 pagesFinance and Accounting Agenda Fall2016khannisarNo ratings yet

- Fall2015-Financial Reporting and AnalysisDocument8 pagesFall2015-Financial Reporting and AnalysisASIMLIBNo ratings yet

- Acct 1002 - Course Outline Sem 2 22.23Document11 pagesAcct 1002 - Course Outline Sem 2 22.23RinNo ratings yet

- Raya University Financial Accounting ModuleDocument4 pagesRaya University Financial Accounting ModuleFantayNo ratings yet

- Accounting for Managers SyllabusDocument2 pagesAccounting for Managers SyllabusBibek BasnetNo ratings yet

- BBDocument9 pagesBBChreann RachelNo ratings yet

- Toaz - Info Instructional Material Auditing Theory 2020 PRDocument169 pagesToaz - Info Instructional Material Auditing Theory 2020 PRVeronica Rivera100% (1)

- FA - SNU - Course Outline - Monsoon 2023Document6 pagesFA - SNU - Course Outline - Monsoon 2023heycontigo186No ratings yet

- Acn 301Document4 pagesAcn 301Bangla cartoonNo ratings yet

- PTS - CBLMDocument7 pagesPTS - CBLMDeex Agueron83% (6)

- ACCT 100 POFA Course Outline Fall Semester 2022-23Document6 pagesACCT 100 POFA Course Outline Fall Semester 2022-23MuhammadNo ratings yet

- Acctg 150 Course Guide 1st Sem 21 22 Fin. Acctg. ReportingDocument19 pagesAcctg 150 Course Guide 1st Sem 21 22 Fin. Acctg. ReportingVivian TamerayNo ratings yet

- Course Outline AFS Fall 2023Document5 pagesCourse Outline AFS Fall 2023ASIMLIBNo ratings yet

- Course Outline AFS Fall 2023Document5 pagesCourse Outline AFS Fall 2023ASIMLIBNo ratings yet

- ACC 202 Financial Reporting UpdatesDocument25 pagesACC 202 Financial Reporting UpdatesherueuxNo ratings yet

- AC516 Syllabus StudentsDocument14 pagesAC516 Syllabus StudentsRodney CabandoNo ratings yet

- Principles of Accounting Course Outline Based On Weekly LecturesDocument4 pagesPrinciples of Accounting Course Outline Based On Weekly LecturesShumailNo ratings yet

- 2022-23 - CFRA - IIMC Course Outline - SentDocument10 pages2022-23 - CFRA - IIMC Course Outline - SentAnanya DevNo ratings yet

- Financial Accounting PGP 2015 Course OutlineDocument7 pagesFinancial Accounting PGP 2015 Course OutlineNNo ratings yet

- Accounting and Financial Analysis.Document3 pagesAccounting and Financial Analysis.athirah binti shazaliNo ratings yet

- 2005 - ACCTG 14-02 - Auditing ProblemsDocument5 pages2005 - ACCTG 14-02 - Auditing ProblemscutieaikoNo ratings yet

- Principles of Financial AccountingDocument7 pagesPrinciples of Financial Accountinghnoor94No ratings yet

- B.Com Structure and Courses at Kuvempu UniversityDocument79 pagesB.Com Structure and Courses at Kuvempu UniversityPragathi PraNo ratings yet

- Accounts Volume 1Document503 pagesAccounts Volume 1Utkarsh100% (1)

- BUS120 Unit Outline 2021T2Document11 pagesBUS120 Unit Outline 2021T2cloudella byrdeNo ratings yet

- Accounting Principles ACC111Document5 pagesAccounting Principles ACC111Mohamed MagedNo ratings yet

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- Navigating Professional Paths: A Guide to CA, MBA, UPSC, SSC, Banking, GATE, Law, and UGCFrom EverandNavigating Professional Paths: A Guide to CA, MBA, UPSC, SSC, Banking, GATE, Law, and UGCNo ratings yet

- Signature Card SampleDocument1 pageSignature Card SampleRahul HumpalNo ratings yet

- Business Letter StylesDocument3 pagesBusiness Letter StylesRahul HumpalNo ratings yet

- Vons Dining Room Menu 2019Document4 pagesVons Dining Room Menu 2019Rahul HumpalNo ratings yet

- Ra 9178Document11 pagesRa 9178Rahul HumpalNo ratings yet

- Technical Writing byJMDocument3 pagesTechnical Writing byJMRahul HumpalNo ratings yet

- Anger PresentationDocument14 pagesAnger PresentationRahul HumpalNo ratings yet

- Budget Summary ProposalDocument1 pageBudget Summary ProposalRahul HumpalNo ratings yet

- Case Study 187 - Quiz ReviewerDocument2 pagesCase Study 187 - Quiz ReviewerRahul HumpalNo ratings yet

- HDC Member CertificationDocument1 pageHDC Member CertificationRahul HumpalNo ratings yet

- System Analysis and DesignDocument35 pagesSystem Analysis and DesignRahul HumpalNo ratings yet

- JPI BYLAWS HighlightsDocument7 pagesJPI BYLAWS HighlightsRahul HumpalNo ratings yet

- DMX OperatorDocument12 pagesDMX OperatorRahul HumpalNo ratings yet

- ACCTG 1 SyllabusDocument8 pagesACCTG 1 SyllabusRahul HumpalNo ratings yet

- Statement of The Problem and ObjectivesDocument1 pageStatement of The Problem and ObjectivesRahul HumpalNo ratings yet

- Developing A Project Plan - SADDocument33 pagesDeveloping A Project Plan - SADRahul HumpalNo ratings yet

- Business LettersDocument3 pagesBusiness LettersRahul HumpalNo ratings yet

- Basic NutritionDocument46 pagesBasic NutritionRahul Humpal100% (2)

- Cost estimates and comparison of traditional vs innovated walletsDocument2 pagesCost estimates and comparison of traditional vs innovated walletsRahul HumpalNo ratings yet

- ErgonomicsDocument35 pagesErgonomicsRahul HumpalNo ratings yet

- Deed of Sale Stall Angono MarketDocument1 pageDeed of Sale Stall Angono MarketRahul HumpalNo ratings yet

- Auditing - RF-12 Quiz BowlDocument12 pagesAuditing - RF-12 Quiz BowlWilson CuasayNo ratings yet

- Classes of Shares of StocksDocument29 pagesClasses of Shares of StocksRahul HumpalNo ratings yet

- Segmentation PrinciplesDocument78 pagesSegmentation PrinciplesRahul HumpalNo ratings yet

- ConsumerologyDocument10 pagesConsumerologyRahul HumpalNo ratings yet

- BA Sales As A CareerDocument33 pagesBA Sales As A CareerRahul HumpalNo ratings yet

- Pre Spanish Philippine LiteratureDocument15 pagesPre Spanish Philippine LiteratureRahul Humpal33% (3)

- Feasibility Study Explains Business Idea ViabilityDocument41 pagesFeasibility Study Explains Business Idea ViabilityRahul HumpalNo ratings yet

- Module 3 Paired and Two Sample T TestDocument18 pagesModule 3 Paired and Two Sample T TestLastica, Geralyn Mae F.No ratings yet

- Book 7 More R-Controlled-VowelsDocument180 pagesBook 7 More R-Controlled-VowelsPolly Mark100% (1)

- BL3B User Manual PDFDocument142 pagesBL3B User Manual PDFRandy VanegasNo ratings yet

- ROM Magazine V1i6Document64 pagesROM Magazine V1i6Mao AriasNo ratings yet

- Roll Covering Letter LathiaDocument6 pagesRoll Covering Letter LathiaPankaj PandeyNo ratings yet

- Amma dedicates 'Green Year' to environmental protection effortsDocument22 pagesAmma dedicates 'Green Year' to environmental protection effortsOlivia WilliamsNo ratings yet

- North American Countries ListDocument4 pagesNorth American Countries ListApril WoodsNo ratings yet

- Case Study, g6Document62 pagesCase Study, g6julie pearl peliyoNo ratings yet

- Mercury QCDocument23 pagesMercury QCMarcus MeyerNo ratings yet

- Carbapenamses in Antibiotic ResistanceDocument53 pagesCarbapenamses in Antibiotic Resistancetummalapalli venkateswara raoNo ratings yet

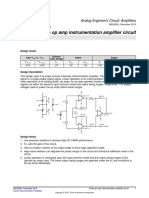

- Opamp TIDocument5 pagesOpamp TIAmogh Gajaré100% (1)

- Online Music QuizDocument3 pagesOnline Music QuizGiang VõNo ratings yet

- Matador - : Medical Advanced Training in An Artificial Distributed EnvironmentDocument25 pagesMatador - : Medical Advanced Training in An Artificial Distributed EnvironmentNauman ChaudaryNo ratings yet

- ACM JournalDocument5 pagesACM JournalThesisNo ratings yet

- EE114-1 Homework 2: Building Electrical SystemsDocument2 pagesEE114-1 Homework 2: Building Electrical SystemsGuiaSanchezNo ratings yet

- PSAII Final EXAMDocument15 pagesPSAII Final EXAMdaveadeNo ratings yet

- tsb16 0008 PDFDocument1 pagetsb16 0008 PDFCandy QuailNo ratings yet

- AI Search Iterative DeepeningDocument4 pagesAI Search Iterative DeepeningNirjal DhamalaNo ratings yet

- Destroyed Inventory Deduction ProceduresDocument7 pagesDestroyed Inventory Deduction ProceduresCliff DaquioagNo ratings yet

- Appendix B, Profitability AnalysisDocument97 pagesAppendix B, Profitability AnalysisIlya Yasnorina IlyasNo ratings yet

- Chapter 1Document2 pagesChapter 1Nor-man KusainNo ratings yet

- TESTIS PHYSIOLOGY Spermatogenic Cell Syncytium Makela and Toppari 2018Document10 pagesTESTIS PHYSIOLOGY Spermatogenic Cell Syncytium Makela and Toppari 2018LudimilaNo ratings yet

- Gas Chromatography - COLIN F. POOLE 2012 PDFDocument743 pagesGas Chromatography - COLIN F. POOLE 2012 PDFVo Manh Tien100% (1)

- Machine Tools Cutting FluidsDocument133 pagesMachine Tools Cutting FluidsDamodara MadhukarNo ratings yet

- Women Safety AppDocument18 pagesWomen Safety AppVinod BawaneNo ratings yet

- Relation of Jurisprudence With Other Social Sciences - LLB NotesDocument4 pagesRelation of Jurisprudence With Other Social Sciences - LLB NotesPranjaliBawaneNo ratings yet

- IS 2848 - Specition For PRT SensorDocument25 pagesIS 2848 - Specition For PRT SensorDiptee PatingeNo ratings yet

- Government of The Punjab Primary & Secondary Healthcare DepartmentDocument3 pagesGovernment of The Punjab Primary & Secondary Healthcare DepartmentYasir GhafoorNo ratings yet

- Corporate GovernanceDocument35 pagesCorporate GovernanceshrikirajNo ratings yet

- Löwenstein Medical: Intensive Care VentilationDocument16 pagesLöwenstein Medical: Intensive Care VentilationAlina Pedraza100% (1)