Professional Documents

Culture Documents

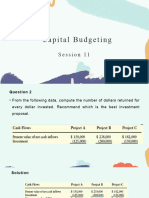

Project Analysis: Principles of Corporate Finance

Uploaded by

Samuel サム VargheseOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project Analysis: Principles of Corporate Finance

Uploaded by

Samuel サム VargheseCopyright:

Available Formats

Chapter

Brealey,Myers,andAllen

PrinciplesofCorporateFinance

11thEdition

PROJECTANALYSIS

10

Copyright 2014 by The McGraw-Hill Companies, Inc. All rights reserved. McGraw-Hill/Irwin

10-2

101THECAPITALINVESTMENTPROCESS

Capital Budget

List of investment projects under consideration

by a firm

Do not add fudge factors to cost of capital

Postaudit

Review of project to see if met forecasts

10-3

102SENSITIVITYANALYSIS

Types of Analysis

Sensitivity

Analyzes effects of changes in sales, costs, etc., on project

Scenario

Project analysis given particular combination of

assumptions

Simulation

Estimates probabilities of different outcomes

Break Even

Level of sales (or other variable) at which project breaks

even

10-4

102SENSITIVITYANALYSIS

Example

Given expected cash-flow forecasts for Otobai

Companys Motor Scooter project, determine

the NPV of project given changes in cash- flow

components using 10% cost of capital. Assume

constant variables, except the one you are

changing.

10-5

102SENSITIVITYANALYSIS

Example, continued

10-6

102SENSITIVITYANALYSIS

Example, continued

10-7

102SENSITIVITYANALYSIS

Example, continued

NPV calculationsOptimistic scenario

10-8

102SENSITIVITYANALYSIS

Example, continued

10-9

TABLE10.3NPVOFELECTRICSCOOTER

10-10

TABLE10.3ELECTRICSCOOTERASSUMPTIONS

10-11

TABLE10.4ELECTRICSCOOTERSCENARIOS

10-12

TABLE10.5ELECTRICSCOOTERACCOUNTING

PROFIT

10-13

TABLE10.1ELECTRICSCOOTERCASHFLOW

FORECASTS

10-14

FIGURE10.1BREAKEVENCHART

Point at which NPV=0 is break-even point

Otobai Motors has a break-even point of 85,000

units sold

Sales, thousands

PV (Yen)

Billions

400

200

19.6

85 200

Break-even

NPV = 0

PV inflows

PV

Outflows

10-15

FIGURE10.2ACCOUNTINGBREAKEVEN

Accounting break-even does not consider time

value of money

Otobai Motors has accounting break-even point

of 60,000 units sold

60 200

Sales, thousands

Accounting

revenue and

costs (Yen)

Billions

60

40

20

Break -even

Profit =0

Revenues

Costs

10-16

102SENSITIVITYANALYSIS

Operating Leverage

Degree to which costs are fixed

Degree of Operating Leverage (DOL)

Percentage change in profits given 1% change

in sales

10-17

102SENSITIVITYANALYSIS

Example

Using the data from the Otobai scooter project,

calculate the DOL

10-18

103MONTE CARLOSIMULATION

Modeling Process

Step 1: Model Project

Step 2: Specify Probabilities

Step 3: Simulate Cash Flows

Step 4: Calculate Present Value

10-19

FIGURE10.3SIMULATIONOFCASHFLOWS

10-20

104REALOPTIONSANDDECISIONTREES

Decision Trees

Diagram of sequential decisions and possible

outcomes

Help companies analyze options by showing

various choices and outcomes

Option to avoid a loss or produce extra profit

has value

Ability to create option has value that can be

bought or sold

10-21

FIGURE10.4FEDEXS EXPANSIONOPTION

10-22

FIGURE10.4FEDEXS EXPANSIONOPTION

Real Options

Option to expand

Option to abandon

Timing option

Flexible production facilities

10-23

FIGURE10.6DECISIONTREE

$700 (.80)

$ 0 (.20)

$ 300 (.80)

$ 0 (.20)

$ 100 (.80)

$ 0 (.20)

Invest

Yes / No

NPV= ?

- $18

- $130

- $130

- $130

.25

.50

.25

$ 0

.44

.56

10-24

FIGURE10.6DECISIONTREE

$700 (.80)

$ 0 (.20)

$ 300 (.80)

$ 0 (.20)

$ 100 (.80)

$ 0 (.20)

560

240

80

Invest

Yes / No

NPV= ?

- $18

- $130

- $130

- $130

.25

.50

.25

$ 0

.44

.56

10-25

FIGURE10.6DECISIONTREE

$700 (.80)

$ 0 (.20)

$ 300 (.80)

$ 0 (.20)

$ 100 (.80)

$ 0 (.20)

560

240

80

Invest

Yes / No

NPV= ?

- $18

- $130

- $130

- $130

.25

.50

.25

$ 0

.44

.56

10-26

FIGURE10.6DECISIONTREE

$700 (.80)

$ 0 (.20)

$ 300 (.80)

$ 0 (.20)

$ 100 (.80)

$ 0 (.20)

560

240

80

Invest

Yes / No

NPV= ?

- $18

- $130

- $130

- $130

.25

.50

.25

$ 0

.44

.56

NPV = $295

10-27

FIGURE10.6DECISIONTREE

$700 (.80)

$ 0 (.20)

$ 300 (.80)

$ 0 (.20)

$ 100 (.80)

$ 0 (.20)

560

240

80

Invest

Yes / No

NPV= ?

- $18

- $130

- $130

- $130

.25

.50

.25

$ 0

.44

.56

NPV = $295

NPV = $52

NPV = - $69

(do not invest, so NPV =

0)

10-28

FIGURE10.6DECISIONTREE

$700 (.80)

$ 0 (.20)

$ 300 (.80)

$ 0 (.20)

$ 100 (.80)

$ 0 (.20)

560

240

80

Invest

Yes / No

NPV= ?

- $18

- $130

- $130

- $130

.25

.50

.25

$ 0

.44

.56

NPV = $295

NPV = $52

NPV = - $69

(do not invest, so NPV =

0)

NPV = $83

10-29

FIGURE10.6DECISIONTREE

$700 (.80)

$ 0 (.20)

$ 300 (.80)

$ 0 (.20)

$ 100 (.80)

$ 0 (.20)

560

240

80

Invest

Yes / No

NPV= $19

- $18

- $130

- $130

- $130

.25

.50

.25

$ 0

.44

.56

NPV = $295

NPV = $52

NPV = - $69

(do not invest, so NPV =

0)

NPV = $83

10-30

FIGURE10.6DECISIONTREE

$700 (.80)

$ 0 (.20)

$ 300 (.80)

$ 0 (.20)

$ 100 (.80)

$ 0 (.20)

560

240

80

Invest

Yes / No

NPV= $19

- $18

- $130

- $130

- $130

.25

.50

.25

$ 0

.44

.56

NPV = $295

NPV = $52

NPV = - $69

(do not invest, so NPV =

0)

NPV = $83

You might also like

- Project Analysis For Business Consulting Firms1Document7 pagesProject Analysis For Business Consulting Firms1Besbes IyadhNo ratings yet

- Great Plan PDFDocument136 pagesGreat Plan PDFLucy PevensieNo ratings yet

- Michael Simpson NHS THIS ProjectsDocument26 pagesMichael Simpson NHS THIS Projectsspringwood emediaNo ratings yet

- Pre Project AnalysisDocument7 pagesPre Project AnalysisSanket BhagwateNo ratings yet

- StoryBoard TemplateDocument2 pagesStoryBoard TemplateDillanNo ratings yet

- EXCEL FormuleDocument77 pagesEXCEL Formulecosta59dac9242No ratings yet

- Steps To Create LinkedIn ProfileDocument4 pagesSteps To Create LinkedIn Profileswapnil pandeNo ratings yet

- APQCDocument20 pagesAPQC1983BNo ratings yet

- The Business Process Model: An Introduction To UMLDocument9 pagesThe Business Process Model: An Introduction To UMLbluelampz2467No ratings yet

- Engineering Economics: Overview and Application in Process Engineering IndustryDocument13 pagesEngineering Economics: Overview and Application in Process Engineering Industrynickhardy_ajNo ratings yet

- Introducing Financial Analysis: T.Venkataramanan. Ficwa - FcsDocument43 pagesIntroducing Financial Analysis: T.Venkataramanan. Ficwa - Fcsvenkataramanan_thiru100% (1)

- Session 14-Capital Budgeting and RiskDocument22 pagesSession 14-Capital Budgeting and RiskNANCY BANSALNo ratings yet

- 11W-Ch 10&11 Capital Budget Basics & CF Estimation-2011-12-SkraćenoDocument38 pages11W-Ch 10&11 Capital Budget Basics & CF Estimation-2011-12-SkraćenoRachel PalosNo ratings yet

- Capital Investment DecisionsDocument23 pagesCapital Investment DecisionsLindinkosi MdluliNo ratings yet

- Chapter 8 Corporate FinanceDocument34 pagesChapter 8 Corporate FinancediaNo ratings yet

- Ins3007 S4 SVDocument32 pagesIns3007 S4 SVnguyễnthùy dươngNo ratings yet

- INCREMENTAL ANALYSISDocument10 pagesINCREMENTAL ANALYSISBrillian ZajugoNo ratings yet

- Techniques of Risk AnalysisDocument22 pagesTechniques of Risk AnalysisSandeep_Varma_9362No ratings yet

- PDF Document CF 4-1Document49 pagesPDF Document CF 4-1Sarath kumar CNo ratings yet

- How Firms Organize InvestmentDocument28 pagesHow Firms Organize InvestmentontykerlsNo ratings yet

- Discounting and Investment DecisionDocument14 pagesDiscounting and Investment DecisionMerel Rose FloresNo ratings yet

- Ca Inter FM Icai Past Year Q Ca Namir AroraDocument193 pagesCa Inter FM Icai Past Year Q Ca Namir AroraPankaj MeenaNo ratings yet

- Chapter 12Document33 pagesChapter 12phuphong777No ratings yet

- Chap 006Document32 pagesChap 006eaktaNo ratings yet

- ABC MedTech ROIDocument27 pagesABC MedTech ROIWei ZhangNo ratings yet

- Concepts and Techniques: Capital BudgetingDocument66 pagesConcepts and Techniques: Capital BudgetingAMJAD ALINo ratings yet

- Analyze Capital Projects Using NPV, IRR, Payback for Highest ReturnDocument10 pagesAnalyze Capital Projects Using NPV, IRR, Payback for Highest Returnwiwoaprilia100% (1)

- Financial Management Session 11Document17 pagesFinancial Management Session 11vaidehirajput03No ratings yet

- Discounted Cash Flow - 082755Document3 pagesDiscounted Cash Flow - 082755EuniceNo ratings yet

- Incremental Analysis for Engineering Project DecisionsDocument25 pagesIncremental Analysis for Engineering Project DecisionsDejene HailuNo ratings yet

- IPPTChap 010Document30 pagesIPPTChap 010Aragaw BirhanuNo ratings yet

- Ty SPM L7Document15 pagesTy SPM L7sanilNo ratings yet

- Chapter 10 - Making Capital Investment DecisionsDocument30 pagesChapter 10 - Making Capital Investment Decisionsفيصل ابراهيمNo ratings yet

- Ise 307Document56 pagesIse 307Hussain Ali Al-HarthiNo ratings yet

- ECO 101 Problem Set #4 Short-Run Costs & Factor InputsDocument6 pagesECO 101 Problem Set #4 Short-Run Costs & Factor InputsSanaa2510No ratings yet

- Project Investment TimingDocument3 pagesProject Investment TimingIrene CheronoNo ratings yet

- BMA Ch3.8 HLSL Investment - AppraisalDocument15 pagesBMA Ch3.8 HLSL Investment - AppraisalandreaNo ratings yet

- Incremental AnalysisDocument25 pagesIncremental AnalysisMobin NasimNo ratings yet

- The Art and Science of Estimating Project Cash FlowsDocument33 pagesThe Art and Science of Estimating Project Cash FlowsferahNo ratings yet

- Managerial Accounting An Introduction To Concepts Methods and Uses 11th Edition Maher Solutions ManualDocument38 pagesManagerial Accounting An Introduction To Concepts Methods and Uses 11th Edition Maher Solutions Manualc03a8stone100% (17)

- Managerial Accounting An Introduction To Concepts Methods and Uses 11Th Edition Maher Solutions Manual Full Chapter PDFDocument38 pagesManagerial Accounting An Introduction To Concepts Methods and Uses 11Th Edition Maher Solutions Manual Full Chapter PDFKimberlyLinesrb100% (9)

- Financial Management Session 10Document20 pagesFinancial Management Session 10vaidehirajput03No ratings yet

- Making Capital Investment Decisions: Mcgraw-Hill/IrwinDocument23 pagesMaking Capital Investment Decisions: Mcgraw-Hill/IrwinMSA-ACCA100% (2)

- The Basics of Capital Budgeting: Business Studies Department, BUKCDocument42 pagesThe Basics of Capital Budgeting: Business Studies Department, BUKCjasonred956No ratings yet

- Capital Budgeting: Most Important in Corporate FinanceDocument35 pagesCapital Budgeting: Most Important in Corporate Financevibhu01No ratings yet

- Incremental AnalysisDocument25 pagesIncremental AnalysisAngel MallariNo ratings yet

- ECO 610: Lecture 3: Production, Economic Costs, and Economic ProfitDocument35 pagesECO 610: Lecture 3: Production, Economic Costs, and Economic ProfitMelat TNo ratings yet

- Lec 17 NPV, IRR, Profitability IndexDocument29 pagesLec 17 NPV, IRR, Profitability Indexsuryatrikal123No ratings yet

- IRR - Sensitivity AnalysisDocument10 pagesIRR - Sensitivity AnalysissiyagNo ratings yet

- Capital Budgeting: Investment RulesDocument37 pagesCapital Budgeting: Investment RulesDaniele MazzaliNo ratings yet

- Lampiran Lampiran 1. Investasi Dan Penyusutan Jenis Investasi Jumlah (Unit) Harga (RP) Umur (Tahun) Nilai Awal (RP)Document14 pagesLampiran Lampiran 1. Investasi Dan Penyusutan Jenis Investasi Jumlah (Unit) Harga (RP) Umur (Tahun) Nilai Awal (RP)HusnisastraNo ratings yet

- Chap010 - Student EditionDocument20 pagesChap010 - Student EditionSmile2000No ratings yet

- Financial Management (FIN401) : Capital BudgetingDocument34 pagesFinancial Management (FIN401) : Capital BudgetingNavid GodilNo ratings yet

- CHAPTER - 5 Capital Budgeting & Investment DecisionDocument40 pagesCHAPTER - 5 Capital Budgeting & Investment Decisionethnan lNo ratings yet

- Managerial Economics Key ConceptsDocument33 pagesManagerial Economics Key Conceptschandel08No ratings yet

- Project Analysis: Principles of Corporate FinanceDocument16 pagesProject Analysis: Principles of Corporate FinancechooisinNo ratings yet

- The Basics of Capital Budgeting: Should We Build This Plant?Document24 pagesThe Basics of Capital Budgeting: Should We Build This Plant?remus007No ratings yet

- Biruk Zewdie AFM AssignmentDocument3 pagesBiruk Zewdie AFM AssignmentBura ZeNo ratings yet

- LectureDocument34 pagesLectureAshish MalhotraNo ratings yet

- Spmunit 2 UpeerDocument36 pagesSpmunit 2 UpeerMayank TutejaNo ratings yet

- How To Prepare Squash Specimen Samples For Microscopic ObservationDocument3 pagesHow To Prepare Squash Specimen Samples For Microscopic ObservationSAMMYNo ratings yet

- Fiber Optic Communication PDFDocument2 pagesFiber Optic Communication PDFluisperikoNo ratings yet

- NIT JRF OpportunityDocument4 pagesNIT JRF Opportunitybalaguru78No ratings yet

- Ice Cream: Uses and Method of ManufactureDocument6 pagesIce Cream: Uses and Method of ManufactureMari LizNo ratings yet

- I&C Engineer or Automation EngineerDocument3 pagesI&C Engineer or Automation Engineerapi-79304330No ratings yet

- Growing Up Psychic by Chip Coffey - ExcerptDocument48 pagesGrowing Up Psychic by Chip Coffey - ExcerptCrown Publishing Group100% (1)

- (MCQ) - Arithmetic ProgressionDocument5 pages(MCQ) - Arithmetic Progressionrahul aravindNo ratings yet

- LuberigthDocument24 pagesLuberigthEnrique BarriosNo ratings yet

- Solar PV Array Modelling PDFDocument13 pagesSolar PV Array Modelling PDFsunilkumarece100% (1)

- ATP Draw TutorialDocument55 pagesATP Draw TutorialMuhammad Majid Altaf100% (3)

- Failure Reporting, Analysis, and Corrective Action SystemDocument46 pagesFailure Reporting, Analysis, and Corrective Action Systemjwpaprk1100% (1)

- Lesson Rubric Team Group (Lesson Plan 1)Document2 pagesLesson Rubric Team Group (Lesson Plan 1)Yodalis VazquezNo ratings yet

- Circle Midpoint Algorithm - Modified As Cartesian CoordinatesDocument10 pagesCircle Midpoint Algorithm - Modified As Cartesian Coordinateskamar100% (1)

- Energy Efficient Solar-Powered Street Lights Using Sun-Tracking Solar Panel With Traffic Density Monitoring and Wireless Control SystemDocument9 pagesEnergy Efficient Solar-Powered Street Lights Using Sun-Tracking Solar Panel With Traffic Density Monitoring and Wireless Control SystemIJRASETPublicationsNo ratings yet

- Cellulose StructureDocument9 pagesCellulose Structuremanoj_rkl_07No ratings yet

- Radical Candor: Fully Revised and Updated Edition: How To Get What You Want by Saying What You Mean - Kim ScottDocument5 pagesRadical Candor: Fully Revised and Updated Edition: How To Get What You Want by Saying What You Mean - Kim Scottzafytuwa17% (12)

- Subject and Power - FoucaultDocument10 pagesSubject and Power - FoucaultEduardo EspíndolaNo ratings yet

- Fazlur Khan - Father of Tubular Design for Tall BuildingsDocument19 pagesFazlur Khan - Father of Tubular Design for Tall BuildingsyisauNo ratings yet

- PLC 2 Ladder DiagramDocument53 pagesPLC 2 Ladder DiagramAnkur GuptaNo ratings yet

- Roman Questions II PDFDocument738 pagesRoman Questions II PDFjlinderski100% (3)

- Royal DSMDocument16 pagesRoyal DSMSree100% (2)

- 4idealism Realism and Pragmatigsm in EducationDocument41 pages4idealism Realism and Pragmatigsm in EducationGaiLe Ann100% (1)

- Grillage Method Applied to the Planning of Ship Docking 150-157 - JAROE - 2016-017 - JangHyunLee - - 최종Document8 pagesGrillage Method Applied to the Planning of Ship Docking 150-157 - JAROE - 2016-017 - JangHyunLee - - 최종tyuNo ratings yet

- 3D Holographic Projection Technology SeminarDocument28 pages3D Holographic Projection Technology Seminarniteshnks1993No ratings yet

- Excellence Range DatasheetDocument2 pagesExcellence Range DatasheetMohamedYaser100% (1)

- Table of Specification ENGLISHDocument2 pagesTable of Specification ENGLISHDonn Abel Aguilar IsturisNo ratings yet

- Science 10 3.1 The CrustDocument14 pagesScience 10 3.1 The CrustマシロIzykNo ratings yet

- How to trade forex like the banksDocument34 pagesHow to trade forex like the banksGeraldo Borrero80% (10)

- MBA Study On Organisational Culture and Its Impact On Employees Behaviour - 237652089Document64 pagesMBA Study On Organisational Culture and Its Impact On Employees Behaviour - 237652089sunitha kada55% (20)

- Laxmi Thakur (17BIT0384) Anamika Guha (18BIT0483) : Submitted byDocument6 pagesLaxmi Thakur (17BIT0384) Anamika Guha (18BIT0483) : Submitted byLaxmi ThakurNo ratings yet