Professional Documents

Culture Documents

Summary - IAS 16 PPE

Uploaded by

jayrjoshuavillapandoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Summary - IAS 16 PPE

Uploaded by

jayrjoshuavillapandoCopyright:

Available Formats

IAS 16 Property, Plant and Equipment

Characteristics:

1. Tangible

2. Used in business

3. To be used more than one year

Does not apply to:

a. ppe classified as held for sale

b. biological assets related to AGRICULTURAL activity

c. exploration and evaluation assets (mineral resources)

d. mineral rights and reserves (oil, natural gas, non regenerative resources)

Entity Specific Value PV of all cash flows including cash flow from disposal

Property, Plant and Equipment

1. held for use in the

production/supply of goods/services

for rental to others

for administrative purposes

2. to be used for more than one period

Recoverable amount higher of FV less costs to sell and value in use

Recognition of PPE Criteria:

1. Probable future economic benefits

2. Costs can be measured reliably

Spare Parts and Servicing Equipment

carried as inventory

recognized in P/L when consumed

MAJOR Spare Parts and Stand-by Equipment

when used for more than one period PPE

when it can only be used ONLY in connection with PPE PPE

INITIAL COSTS

PPE acquired for safety/environmental reasons are recognized as PPE.

SUBSEQUENT COSTS

Day-to-day costs of servicing of the PPE (repairs and maintenance) NOT

capitalized, outright expense

Parts that are replaced capitalized; the replaced parts are derecognized

MAJOR inspection is performed capitalized as a replacement

INITIAL MEASUREMENT

- recognized at COST

ELEMENTS OF COST

Cost of PPE comprises:

a. purchase price, import duties, nonrefundable taxes, net of discounts and

rebates

b. cost to bring the asset at location AND condition for it to be capable of

operating

c. cost of dismantling/removing the item

d. restoration costs

e. obligations incurred for purposes OTHER than to produce inventories

Directly attributable costs:

a. employee benefits

b. cost of site preparation

c. initial delivery and handling costs

d. installation and assembly costs

e. cost of testing, net of proceeds from sale of prototype

f. professional fees

Obligations incurred for dismantling/removing/restoring as a consequence

of production of inventories apply IAS 2, inventories NOT IAS 16

NOT COSTS OF PPE:

a. cost of opening a new facility

b. cost of introducing new product/service (advertising/promotion)

c. conducting business in new location or to new customers

d. administration/overhead

When capitalization of cost to PPE CEASES?

- when the item is in the location and condition necessary for it to be capable

of operating

e.g.

a. costs incurred while item is capable of operation but NOT yet brought

into use OR operated in less than capacity

b. initial operating losses

c. cost of relocation/reorganizing OPERATIONS

Incidental Operations

- its nature being unnecessary to bringing the asset to condition and location

necessary for operation; hence, NOT CAPITALIZED, recorded separately as

regular income and expense

Self-Constructed Assets

- internal profits deducted to arrive at net cost

Abnormal Waste

- NOT capitalized

MEASUREMENT OF COST

Cash Basis: Cash price equivalent

Installment: At Cash price equivalent, difference between total payment and

cash price recognized as interest

Acquired Asset through exchange

- measured at FAIR VALUE

- unless

a. LACKS commercial substance

b. FV or asset received nor given up is RELIABLY measurable

- if not measured at FV, measured at CARRYING amount of asset GIVEN up,

NO GAIN OR LOSS IS RECOGNIZED WHEN THERE IS NO COMMERCIAL SUB

WHEN IS THERE COMMERCIAL SUBSTANCE?

a. configuration risk (risk, timing and amount) of cash flows of asset

received and given up differ

b. entity-specific-value affected by the transaction changes

c. difference in A and B is significant relative to FV of assets exchanged

- CASH FLOWS REFERRED TO ARE POST-TAX

WHEN FAIR VALUE MEASURABLE EVEN IF NO COMPARABLE MARKET

TRANSACTIONS EXISTS

a. INsignificant variability of reasonable FV estimates

b. Probability of various estimates are reasonably assured

FV of asset given up is PREFERRED over FV of asset of acquired

Except: when FV of acquired is MORE RELIABLE/CLEARLY EVIDENT

Cost of PPE under Finance Lease is determined with IAS 17

IAS 16 Property, Plant and Equipment

CARRYING AMOUNT of PPE may be REDUCED by government grants

SUBSEQUENT MEASUREMENT

Choose between:

a. Cost model

b. Revaluation Model

COST MODEL

- Cost less accumulated depreciation and accumulated impairment losses

REVALUATION MODEL

- revalued amount less SUBSEQUENT accumulated depreciation and

SUBSEQUENT impairment losses

Fair Market Value Determined by APPRAISAL

If no market-based evidence of FV due to specialized nature/rarely sold, an

entity may use:

a. income /depreciated replacement cost approach

Frequency of revaluation depends of frequency of changes in FV.

Significant changes ANNUAL

Insignificant every 3-5 years

TREATMENT OF ACCUMULATED DEPRECIATION when revaluing PPE

a. restated proportionately (used when determining depreciated

replacement cost) PROPORTIONAL APPROACH

b. eliminated against gross carrying amount, then gross amount revalued

(commonly used for buildings) ELIMINATION APPROACH

If an item of PPE is revalued, the entire class is revalued

Classes of PPE

a. Land

b. Land and building

c. Machinery

d. Ships

e. Aircraft

f. Motor vehicles

g. Furniture and fixtures

h. Office equipment

GR: Items must be revalued simultaneously

E: Rolling basis is allowed if it revaluation will be completed within a short

period

INCREASE as a result of revaluation

a. Apply to previously recognized revaluation loss

b. Apply to revaluation surplus

DECREASE as a result of revaluation

a. Apply to previously recognized revaluation surplus

b. Recognize as expense/loss

TREATMENT OF REVALUATION SURPLUS

a. May be transferred to RE upon DISPOSAL/RETIREMENT

b. May be transferred to RE through DEPRECIATION *Piecemeal

Realization

DEPRECIATION

- Each item of PPE is depreciated SEPARATELY

- Parts of the same useful life and depreciation method may be

depreciated in groups

- An entity may choose to depreciate separately items that have

INSIGNIFICANT costs

- GR: Depreciation recorded in P/L

E: when it forms part of another asset

WHEN RESIDUAL VALUE REVIEWED?

- annually

- changes in residual value accounted for as change in ESTIMATE

- Repair and maintenance does not negate the need to

depreciate PPE.

- In practice, residual value of an asset is OFTEN INSIGNIFICANT

- When RESIDUAL VALUE > CARRYING AMOUNT, deprecation is 0

WHEN DOES DEPRECIATION BEGIN?

- When asset is in the location and condition for it to be capable of

operating in the manner intended by management

WHEND DOES IT CEASE?

Earlier of:

a. date of classification as held for sale

b. date of derecognition

Depreciation DOES NOT cease when asset becomes idle or is

retired from active use UNLESS fully depreciated.

HOWEVER, depreciation may be 0 if there is no production under

the usage method of depreciation.

- the useful life of an asset may be shorter than its economic life

- land and building are accounted for SEPARATELY

- if cost of land includes cost of site dismantlement, removal and

restoration, that portion is depreciated

WHEN SHOULD DEPRECIATION BE REVIEWED?

- annually

COMPENSATION FOR IMPAIRMENT FROM THIRD PERSONS

- shall be recognized when RECEIVABLE @ FV in OCI, if not, P/L

DERECOGNITION

When:

a. disposal

b. when no future economic benefits are expected

Gains and Losses recorded in P/L.

GAINS SHALL NOT BE CLASSIFIED AS REVENUE.

Previously rented out assets reclassified to inventory, gains on sale shall be

classified as REVENUE.

Disposal may occur through

a. sale

b. disposal

c. lease out under finance lease

d. donation

When an item is replaced, the replaced item is derecognized at its carrying

amount. If the item was not previously recognized at a separate cost, the

replacing item may serve as the estimate of the probable cost of the replaced

item.

IAS 16 Property, Plant and Equipment

CHANGES in estimates may arise from changes in:

a. residual value

b. estimated costs of dismantling, removing, restoring

c. useful lives

d. depreciation methods

ENCOURAGED ISCLOUSRES

a. idle PPE

b. fully depreciated PPE

c. retired from active use

d. FV of PPE when cost model is used

You might also like

- Pas 36 Impairment of AssetsDocument2 pagesPas 36 Impairment of AssetsR.A.No ratings yet

- Module1 - Foreign Currency Transaction and TranslationDocument3 pagesModule1 - Foreign Currency Transaction and TranslationGerome Echano0% (1)

- Investment in AssociateDocument2 pagesInvestment in AssociatebluemajaNo ratings yet

- Prelims Ms1Document6 pagesPrelims Ms1ALMA MORENANo ratings yet

- Chapter 13 Property Plant and Equipment Depreciation and deDocument21 pagesChapter 13 Property Plant and Equipment Depreciation and deEarl Lalaine EscolNo ratings yet

- Module 9 - Nonfinancial Assets II - StudentsDocument9 pagesModule 9 - Nonfinancial Assets II - StudentsLuisito CorreaNo ratings yet

- This Study Resource Was: Profit Loss Profit LossDocument9 pagesThis Study Resource Was: Profit Loss Profit LossrogealynNo ratings yet

- 2.1 Trade and Other ReceivablesDocument4 pages2.1 Trade and Other ReceivablesShally Lao-unNo ratings yet

- IAS23 Borrowing CostDocument2 pagesIAS23 Borrowing Costmichaelaang100% (1)

- Financial Asset at Fair Value ModuleDocument5 pagesFinancial Asset at Fair Value ModuleNorfaidah Didato GogoNo ratings yet

- Topic 1: Statement of Financial PositionDocument10 pagesTopic 1: Statement of Financial Positionemman neri100% (1)

- Chapter 13 - Audit Property, Plant and EquipmentDocument21 pagesChapter 13 - Audit Property, Plant and EquipmentEarl Lalaine EscolNo ratings yet

- PSBA - GAAS and System of Quality ControlDocument10 pagesPSBA - GAAS and System of Quality ControlephraimNo ratings yet

- 21 x12 ABC DDocument5 pages21 x12 ABC DAnjo PadillaNo ratings yet

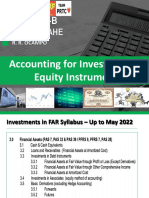

- Investments in Equity Instruments - LPU-B Lecture by Rey OcampoDocument35 pagesInvestments in Equity Instruments - LPU-B Lecture by Rey OcampoBernadette PanicanNo ratings yet

- tAX FINALSDocument8 pagestAX FINALSAmie Jane MirandaNo ratings yet

- NF Jpia Mas Cup PDF FreeDocument6 pagesNF Jpia Mas Cup PDF FreeAnne Marieline BuenaventuraNo ratings yet

- Cost Concepts and ClassificationsDocument15 pagesCost Concepts and ClassificationsMae Ann KongNo ratings yet

- PAS 8 Accounting Policies Changes Estimates ErrorsDocument4 pagesPAS 8 Accounting Policies Changes Estimates ErrorsJanine WayanNo ratings yet

- Cash and RecDocument30 pagesCash and RecChiara OlivoNo ratings yet

- Ias 23 - Borrowing CostDocument11 pagesIas 23 - Borrowing CostATIFREHMANWARRIACHNo ratings yet

- CVPDocument8 pagesCVPThe ChamplooNo ratings yet

- Module 06 - PPE, Government Grants and Borrowing CostsDocument24 pagesModule 06 - PPE, Government Grants and Borrowing Costspaula manaloNo ratings yet

- Pfrs 2 Share-Based PaymentsDocument3 pagesPfrs 2 Share-Based PaymentsR.A.No ratings yet

- Investment Property: Investment Property Is Defined As Property (Land or Building or Part of A Building or Both) HeldDocument7 pagesInvestment Property: Investment Property Is Defined As Property (Land or Building or Part of A Building or Both) HeldMark Anthony SivaNo ratings yet

- Cost Accounting ReviewerDocument2 pagesCost Accounting ReviewerHenry Cadano HernandezNo ratings yet

- Chapter 10 PAS 28 INVESTMENT IN ASSOCIATESDocument2 pagesChapter 10 PAS 28 INVESTMENT IN ASSOCIATESgabriel ramosNo ratings yet

- Afar ToaDocument22 pagesAfar ToaVanessa Anne Acuña DavisNo ratings yet

- Theory of Accounts - 1Document9 pagesTheory of Accounts - 1Joovs JoovhoNo ratings yet

- MAS CVP Analysis HandoutsDocument8 pagesMAS CVP Analysis HandoutsMartha Nicole MaristelaNo ratings yet

- University of San Jose-Recoletos Theory of AccountsDocument9 pagesUniversity of San Jose-Recoletos Theory of AccountsChelseyNo ratings yet

- AICPA Code of Conduct Multiple Choice QuestionsDocument8 pagesAICPA Code of Conduct Multiple Choice Questionsjembot dawaton0% (1)

- Quennie V.Centino Accounting For Governance and Non-Profit Organizations TTH 5:00PM - 6:30PM Bsma - 3 Assessment: Week 1 - Module 1 Multiple ChoiceDocument3 pagesQuennie V.Centino Accounting For Governance and Non-Profit Organizations TTH 5:00PM - 6:30PM Bsma - 3 Assessment: Week 1 - Module 1 Multiple Choicequennie vilchezNo ratings yet

- National Federation of Junior Philippine Institute of Accountants Financial AccountingDocument8 pagesNational Federation of Junior Philippine Institute of Accountants Financial AccountingWeaFernandezNo ratings yet

- PRELEC1 Final ExamDocument4 pagesPRELEC1 Final ExamAramina Cabigting BocNo ratings yet

- Practical Accounting 1Document3 pagesPractical Accounting 1Angelo Otañes GasatanNo ratings yet

- Financial Asset MILLANDocument6 pagesFinancial Asset MILLANAlelie Joy dela CruzNo ratings yet

- False or True BudgetingDocument6 pagesFalse or True BudgetingJessa Swing Dela Cruz100% (1)

- Audit Procedures for Testing Existence, Completeness, Valuation and Allocation of LiabilitiesDocument4 pagesAudit Procedures for Testing Existence, Completeness, Valuation and Allocation of LiabilitiesJohn Francis IdananNo ratings yet

- DLSU REVDEVT - TOA Revised Reviewer - Answer Key PDFDocument16 pagesDLSU REVDEVT - TOA Revised Reviewer - Answer Key PDFabbyNo ratings yet

- ch11 Doc PDF - 2 PDFDocument39 pagesch11 Doc PDF - 2 PDFRenzo RamosNo ratings yet

- Toa - Preboard - May 2016Document11 pagesToa - Preboard - May 2016Kenneth Bryan Tegerero Tegio100% (1)

- Government Accounting Quiz 8 Write The Letter Pertaining To Best AnswerDocument5 pagesGovernment Accounting Quiz 8 Write The Letter Pertaining To Best AnswerAlizahNo ratings yet

- FAR - DerivativesDocument1 pageFAR - DerivativesralphalonzoNo ratings yet

- Module 9 SHAREHOLDERS' EQUITYDocument3 pagesModule 9 SHAREHOLDERS' EQUITYNiño Mendoza MabatoNo ratings yet

- Ppe IntDocument6 pagesPpe IntlouvelleNo ratings yet

- Practical Accounting Problems SolutionsDocument11 pagesPractical Accounting Problems SolutionsjustjadeNo ratings yet

- IAS 16 PPE NotesDocument3 pagesIAS 16 PPE NotesKatreena Mae Constantino100% (2)

- IAS 16 PPE - LectureDocument11 pagesIAS 16 PPE - LectureBeatrice Ella DomingoNo ratings yet

- Property Plant and Equipment Adacp Outline Chapter 10Document9 pagesProperty Plant and Equipment Adacp Outline Chapter 10raderpinaNo ratings yet

- PPE Asset Accounting GuideDocument5 pagesPPE Asset Accounting GuideWertdie stanNo ratings yet

- Name:-Akash Jaiswal ROLL NO.:-0645 ROOM NO.:-045 SESSION:-2014-2017 Topic:-Accounting For FixedDocument6 pagesName:-Akash Jaiswal ROLL NO.:-0645 ROOM NO.:-045 SESSION:-2014-2017 Topic:-Accounting For FixedAKASH JAISWALNo ratings yet

- Pas 16Document8 pagesPas 16Maxyne Dheil CastroNo ratings yet

- Accounting For PPE - PAS 16Document39 pagesAccounting For PPE - PAS 16Marriel Fate Cullano100% (1)

- Chapter 15 - Pas 16 PpeDocument36 pagesChapter 15 - Pas 16 PpeMarriel Fate CullanoNo ratings yet

- SBR - Chapter 4Document6 pagesSBR - Chapter 4Jason KumarNo ratings yet

- LESSON3Document19 pagesLESSON3Ira Charisse BurlaosNo ratings yet

- Philippine Accounting Standards 16 & 23 (PPE and Borrowing Cost)Document32 pagesPhilippine Accounting Standards 16 & 23 (PPE and Borrowing Cost)Ecka Tubay33% (3)

- Fixed Assets AccountingDocument24 pagesFixed Assets Accountingjayti desaiNo ratings yet

- (H) - 3rd Year - BCH 6.4 (DSE-4) - Sem-6 - Financial Reporting and Analysis - Week 4 - Himani DahiyaDocument19 pages(H) - 3rd Year - BCH 6.4 (DSE-4) - Sem-6 - Financial Reporting and Analysis - Week 4 - Himani DahiyaARGHYA MANDALNo ratings yet

- P1 - Property, Plant and EquipmentDocument2 pagesP1 - Property, Plant and EquipmentjayrjoshuavillapandoNo ratings yet

- Constitution and By-Laws of FEU JPIADocument11 pagesConstitution and By-Laws of FEU JPIAjayrjoshuavillapandoNo ratings yet

- PSA 120 Framework of Philippine Standards on AuditingDocument9 pagesPSA 120 Framework of Philippine Standards on AuditingMichael Vincent Buan SuicoNo ratings yet

- Process Costing (Questionnaires)Document9 pagesProcess Costing (Questionnaires)Aimee Therese AguilarNo ratings yet

- NFJPIA Election Code FY 1415Document10 pagesNFJPIA Election Code FY 1415jayrjoshuavillapandoNo ratings yet

- TB Raiborn - Activity-Based Management and Activity-Based CostingDocument31 pagesTB Raiborn - Activity-Based Management and Activity-Based Costingjayrjoshuavillapando100% (1)

- Quiz BowlDocument3 pagesQuiz BowljayrjoshuavillapandoNo ratings yet

- NFJPIA EOs Election CodeDocument9 pagesNFJPIA EOs Election CodejayrjoshuavillapandoNo ratings yet

- RMIN 4000 Exam Study Guide Ch 2 & 9Document13 pagesRMIN 4000 Exam Study Guide Ch 2 & 9Brittany Danielle ThompsonNo ratings yet

- Geoff Gannon's 1st Letter To Bancinsurance's Board of DirectorsDocument4 pagesGeoff Gannon's 1st Letter To Bancinsurance's Board of DirectorsscimonoceNo ratings yet

- RMC Plant Manufacturing Project ReportDocument84 pagesRMC Plant Manufacturing Project ReportHarshada Hikare100% (1)

- Revaluation of Fixed AssetsDocument5 pagesRevaluation of Fixed Assetsroberto_phlipinoNo ratings yet

- Risk and Rates of Return Homework SolutionsDocument5 pagesRisk and Rates of Return Homework Solutionssujumon23No ratings yet

- The Common-Sense Path To Financial FreedomDocument20 pagesThe Common-Sense Path To Financial Freedomclarkpd6100% (3)

- Examiner's Report: MA2 Managing Costs & Finance December 2012Document4 pagesExaminer's Report: MA2 Managing Costs & Finance December 2012Ahmad Hafid Hanifah100% (1)

- Multiple Choice QuestionsDocument82 pagesMultiple Choice QuestionsJohn Rey EnriquezNo ratings yet

- BM Dec 2004Document13 pagesBM Dec 2004Vinetha KarunanithiNo ratings yet

- 2010 Excel Advanced Manual As of March 2010 PDFDocument175 pages2010 Excel Advanced Manual As of March 2010 PDFBacila MirceaNo ratings yet

- 7th Economic Summit - UpdateDocument40 pages7th Economic Summit - Updateadmin866100% (2)

- Accounting For ManufacturingDocument6 pagesAccounting For ManufacturingAlbert MorenoNo ratings yet

- Cheat Sheet TaxDocument6 pagesCheat Sheet TaxShravan NiranjanNo ratings yet

- PgcilDocument3 pagesPgcilKaran BajpaiNo ratings yet

- 01 - Ishares 7-10 Year Treasury Bond FundDocument0 pages01 - Ishares 7-10 Year Treasury Bond FundRoberto PerezNo ratings yet

- Econ Macro Ia Ib SampleDocument6 pagesEcon Macro Ia Ib SampleAditya ShahNo ratings yet

- Lista Empresas PanamaPapers PDFDocument8 pagesLista Empresas PanamaPapers PDFChristopher André DíazNo ratings yet

- Bond ValuationDocument52 pagesBond ValuationDevi MuthiahNo ratings yet

- AFA® (Accredited Financial Analyst®) Is One of The Most Highly Valued Qualifications AvailableDocument3 pagesAFA® (Accredited Financial Analyst®) Is One of The Most Highly Valued Qualifications AvailableLina Dela Pena FurucNo ratings yet

- Capm DerivationDocument12 pagesCapm DerivationAbdulAzeemNo ratings yet

- AML and KYCDocument36 pagesAML and KYCSamaksh Kumar100% (1)

- CF-Unit 4 Company Valuation PDFDocument79 pagesCF-Unit 4 Company Valuation PDFA.D. Home TutorsNo ratings yet

- TheDefinitiveDrucker PDFDocument4 pagesTheDefinitiveDrucker PDFBatipibeAdriancho100% (1)

- Final Report On Bio-Link ProjectDocument93 pagesFinal Report On Bio-Link ProjectJerusalemInstituteNo ratings yet

- Prospectus Axway English Version FinalDocument187 pagesProspectus Axway English Version FinalhpatnerNo ratings yet

- SEC BS File 3Document137 pagesSEC BS File 3the kingfishNo ratings yet

- Hashoo Foundation's Credit and Enterprise Development (CED) For Social Entrepreneurship Program (UST SEP)Document28 pagesHashoo Foundation's Credit and Enterprise Development (CED) For Social Entrepreneurship Program (UST SEP)Cristal MontanezNo ratings yet

- Arbitrage in India: Past, Present and FutureDocument22 pagesArbitrage in India: Past, Present and FuturetushartutuNo ratings yet

- QuestionsDocument6 pagesQuestionsSrinivas NaiduNo ratings yet

- Accounting Partnership & CorporationDocument4 pagesAccounting Partnership & CorporationLin Ying Ying33% (3)