Professional Documents

Culture Documents

Intro To Equities Hand Out

Uploaded by

Hernandez Tejada AlexOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intro To Equities Hand Out

Uploaded by

Hernandez Tejada AlexCopyright:

Available Formats

Copyright Licensed Securities Training Solutions 2014 720 771-4386 1

Equities

Chapter 1

Securities License Training Solutions

Calvin Plummer plum2@q.com

Home 360 666-1234 (8:30 am 5:00 pm pacific time)

Cell 720 771-4386 (any time)

Copyright Licensed Securities Training Solutions 2014 720 771-4386

$1000

ABC Bond

2017 6%

$30

$30

$30

$30

$30

$30

$30

$30

$30

Current Yield = Annual income YTM = _____________ YTC = ______________

Price

Settlement

Corps + Munis T+3 30/360

Gov + Options T+1

actual/actual

Cash Same day

Reg T T+ 5

Starter Cheat Sheet

I P Y

Settlement Date

Last Coupon Date

Time Period of

Accrued Interest

Accrual Formula

Formulas

Acronyms

Memory points

1 pt = $10

P N C Y Y = (Price Nominal CY YTM YTC)

Corps + Munis = 1/8 Gov = 1/32

2

25% Reg T

Maintenance

CMVL

50% Reg T

Restricted

CMV

30% Reg T

Maintenance

CMVs

Low Coupon * High Coupon

Short Maturity Long Maturity *

Discount * Premium

Small Discount Large Discount *

Small Premium Large Premium *

Bond Volatility

Copyright Licensed Securities Training Solutions 2014 720 771-4386 3

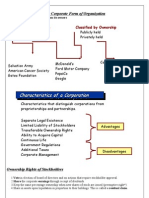

$ Capital $

Capital = Money

Capitalization = raising money

Corporations publicly raise capital

two ways:

Take on more owners (sell stock)

Not required to repay investment or

dividends

Take on debt (sell bonds)

Must repay investment and pay interest

Earnings = profits

Copyright Licensed Securities Training Solutions 2014 720 771-4386 4

Common Stock

Part owner of Corporation

Entitled to part of

distributed profits

Last in line

Dividend payment

Company dissolution

ABC

Common Stock

$1.00 Par value

Investment Vehicles

___________

Copyright Licensed Securities Training Solutions 2014 720 771-4386 5

Common Stock

Selling stock = selling ownership in the company

Limited liability

Stock ownership entitles an investor to a:

Certificate of ownership (a stock certificate)

Right to any distributed profits

Distributed profits = Dividends

Corporations dont always distribute $

Not a right to dividends/earnings

Who decides?

T.Q. Shareholders cant vote for div

______________________________

Inspect company books records

Annual report card

Right to vote

Preemptive right to maintain proportional ownership position

Stock

Certificate

Copyright Licensed Securities Training Solutions 2014 720 771-4386 6

Common Stock

Stock = equity = ownership

If it has stock in the name...

Incorporation requires common stock

Privately held or sold to public

Taxed on the number of shares authorized

Transferability - you can sell it to someone

else

__________Shares authorized in the

corporate charter

Corp must file state charter specifying

initial number of shares

Issued Shares authorized stock sold

at least once

Stock

Certificate

100 shares

Starbucks

Corp

Copyright Licensed Securities Training Solutions 2014 720 771-4386 7

Common Stock

Outstanding Shares issued stock

currently in the hands of the public

____________Stock stock which

has been bought back by the

corporation

No dividends

No voting rights

Still considered issued but not

outstanding

Not included in computation of

EPS

Stock

Certificate

100 shares

Starbucks

Corp

Copyright Licensed Securities Training Solutions 2014 720 771-4386 8

Common Stock Pricing

Car prices vary by make and model

Least expensive vehicle?

Most expensive vehicle?

Price is driven by supply and demand

Current Market Value = CMV

Stock prices vary by company

Least expensive stock?

Penny stocks - 5, 25

Most expensive stock?

Berkshire Hathaway about $100,000 per share

Par value is an arbitrary value

ABC

Common Stock

$1.00 Par value

Growth

Copyright Licensed Securities Training Solutions 2014 720 771-4386

Stock Bid/Ask Prices

Customer will ________ stock from the brokerage

firm at the Ask price (retail)

Customers will _________ their stock to the

brokerage firm at the BID price (wholesale)

Subject quote Subject of further checking

Its about 16-16.5, Its quoted at 16-16.5

Firm quote A Broker/Dealers actual price

It is 17.25-18.50 B/D must honor this price for 1

st

100

shares (round lot)

Bid

$12.85

Ask

$13.50

Spread = $.65

9

Copyright Licensed Securities Training Solutions 2014 720 771-4386 10

Voting Rights

100 shares = 100 votes

Position 1 Position 2 Position 3

Bill / Bob Mike / Mary John / Jane

100 votes 100 votes 100 votes

Statutory voting

100 votes per position

0 votes 0 votes 300 votes

______________voting

300 votes any way you

choose

T.Q. favors the small

shareholder

Proxies for absentee voting

Stock splits

Issuance of new stock

Convertible bonds

Mergers

Copyright Licensed Securities Training Solutions 2014 720 771-4386 11

Stock Splits and Stock Dividends

Total

Change #Shares Price Value

Originally 100 $60 $6,000

2:1 Split (2/1) 200 (1/2) $30 $6,000

3:1 Split (3/1) 300 (1/3) $20 $6,000

3:2 Split (3/2) 150 (2/3) $40 $6,000

20% Stock

Dividend 120 $50 $6,000

Copyright Licensed Securities Training Solutions 2014 720 771-4386 12

Part owner of the corporation

Preferred treatment

Dividend payment

Company dissolution

$100

ABC Preferred Stock

6%

_________$100

Annual rate based on par value

$6 stated if no par value is given

6% of $100 = $6/year

Preferred Stock

Income

Usually give up voting rights

Entitled to part of distributed

profits

If common gets a dividend...

Copyright Licensed Securities Training Solutions 2014 720 771-4386 13

Preferred Stock

$100

Straight Preferred

Stock

5%

No back payments

$100

Cumulative Preferred

Stock

4%

Back payments

3% first round, up to any

level allowed by BOD

$100

Participating

Preferred Stock

3% and up

Copyright Licensed Securities Training Solutions 2014 720 771-4386 14

Cumulative Preferred Stock

= $4 per year

Dividends are paid quarterly or

semi annually

$1.00 per quarter

Paid before common gets anything

Entitled to Back payments or payment in arrears

$100

Cumulative Preferred

Stock

4%

1

st

quarter $ 1.00

2

nd

quarter $ .75

3

rd

quarter ---------

4

th

quarter

Copyright Licensed Securities Training Solutions 2014 720 771-4386 15

Current Yield (CY) = annual income/price

Tells an investor what they are making on their $

$100

ABC Preferred

Stock

6%

Preferred Stock

CMV $115

$6/$115 = .052 = 5.2%

Income $6/year

Copyright Licensed Securities Training Solutions 2014 720 771-4386 16

Investment Banking

Public investors

Starbucks

$10,000,000 for expansion

1 million shares common stock

Investment Bankers

Misnamed, not really bankers

No loans or other banking functions

Help issuers raise capital (stock, bonds)

AKA Sponsor, Underwriter, Distributor

Copyright Licensed Securities Training Solutions 2014 720 771-4386 17

Common Stock

Authorized 1,000,000 shares

Initial Primary offering (IPO) 600,000 shares

1st time a company sells stock

Considered issued and outstanding

Primary offering 100,000 shares

2nd, 3rd, 49th time a company sells stock

Total shares outstanding 700,000 shares

Primary offering means the issuer is getting the $

Secondary offering (large blocks of stock)

Sold by one or more wealthy investors

Issuer is usually not getting the $

Stock

Certificate

100 shares

Pen Corp

Copyright Licensed Securities Training Solutions 2014 720 771-4386

18

Prospectus - the new Car brochure

Only new car buyers get a new car brochure

Prospectus

Issuers are required to produce and give to investors before they invest

Must include Material facts

Any fact an investor should know before purchasing

Litigation, significant events, facts

No highlighting, underlining info

Issuers include GM, Starbucks, investment companies

Primary Market

Prospectus only required on a primary (new car) offering

When an investor buys a security from an issuer

Secondary Market

No prospectus required on secondary transactions

When investors buy /sell to each other

SEC requirement

No approval or SEC disclaimer statement on cover or first page

Copyright Licensed Securities Training Solutions 2014 720 771-4386 19

Special Securities

Copyright Licensed Securities Training Solutions 2014 720 771-4386 20

American Depository Receipts

(ADRs)

Facilitates overseas trading of _

Banks in U.S. and foreign countries

Trading of foreign company stock on U.S.

exchanges e.g. NYSE

Trade with U.S. dollars

Dividends paid in U.S. dollars

After foreign tax with holding

No voting rights

No preemptive rights

ADR

100 shares

Nokia Corp

Copyright Licensed Securities Training Solutions 2014 720 771-4386 21

Breyers Ice Cream

CMV $5.00/box

Breyers Ice Cream

Coupon $2.50

Starbucks Stock

CMV $35.00/share

__________term

_________Share holders only

Preemptive right

Proportional ownership can be

diluted if not exercised

Subscription Price

_________market price

No voting / Dividend rights

Starbucks Stock

Right

Subscription price

$31.00/share

Rights vs Warrants

Copyright Licensed Securities Training Solutions 2014 720 771-4386 22

Rights vs Warrants

Breyers Ice Cream

CMV $5.00/box

Breyers Ice Cream

Coupon $15.00

Starbucks Stock

CMV $35.00/share

Starbucks Stock

Warrant

Subscription price

$42.00/share

__________term

Anyone can buy

Subscription Price

_________market price

No voting / Dividend rights

Sweetener w/bonds

Detachable

Copyright Licensed Securities Training Solutions 2014 720 771-4386 23

Preemptive Right

Cum With Rights. Before Ex-Rights Date

Value = M S

N+1

Ex-Rights Without rights. After Ex-Rights Date

Value = MS

N

M = Market Price e.g $34

S = Subscription Price e.g $31

N = Number of Rights required to buy one share

e.g.10 rights to buy each share

Preemptive Rights

Formula for determining theoretical value of a

right

$ = /right

Copyright Licensed Securities Training Solutions 2014 720 771-4386 24

Stock Capitalization

Capitalization = # shares

outstanding x current market

price

E.g.

50,000,000 shares x $25 per share

market price = $1.25 Billion

______ Cap (Capitalization)

$300 million -$2 Billion

____________growth

Hi risk/hi reward

Small relatively unknown

companies

Papa Johns $564 Million

Linens and Things $766 Million

PetsMart $742 Million

Revlon $131 Million

Copyright Licensed Securities Training Solutions 2014 720 771-4386 25

Capitalization

Mid Cap

$2 - 10 Billion

Moderate growth

Medium risk/reward

Medium sized companies

PepsiCo $83 Billion

Coca Cola $124 Billion

Microsoft $309 Billion

General Electric $390 Billion

Target Stores $28 Billion

Wal-Mart $236 Billion

Toys R Us $3.9 Billion

Williams Sonoma $3.98 Billion

Barnes and Noble $2.4 Billion

Wendys $3 Billion

___________Cap

Above $10 Billion

______growth

Low risk/reward

Large, well known companies

Copyright Licensed Securities Training Solutions 2014 720 771-4386 26

Dow Jones Industrial Average (DJIA)

AT&T

American Express

Boeing Company

Caterpillar

Chevron

Cisco

Coca Cola

DuPont

Exxon Mobil

General Electric

Goldman Sachs

Home Depot

3M

Intel

IBM

Johnson & Johnson

J.P. Morgan/Chase

McDonalds

Merck

Microsoft

Nike

Pfizer Inc

Procter & Gamble

Travelers

United Healthcare

United Technologies

Verizon

Visa

Wal-Mart Stores

Walt Disney Company

Copyright Licensed Securities Training Solutions 2014 720 771-4386 27

Stock Indices

Dow Jones

Composite 65

Industrials 30

Transportation 20

Utilities 15

Standard & Poor's 500 (400 are industrials, most

on NYSE, some on AMEX and Nasdaq)

Standard & Poor's 100

Russell 2,000- Benchmark for ___________stocks

Wilshire 5,000- Approximately 5,000 stocks

(includes NYSE, AMEX and OTC)

Copyright Licensed Securities Training Solutions 2014 720 771-4386 28

Dividend Distributions for Stocks

1 Declaration date - the day the company declares the dividend

2 Ex-dividend date - day the stock trades without the dividend

Two days before the record date

Stock price _________by the amount of the dividend

3 Record date - the date on which ownership changes

4 Payment Date- Date the check is mailed

5 Must settle by close of business on record date to get dividend

Sept

xxxxxxxx

xxxxxxxx

xxxxxxxx

Nov

xxxxxxxx

xxxxxxxx

xxxxxxxx

Oct

S M T W T F S

1 2 3 4 5 6

7 8 9 10 11 12 13

14 15 16 17 18 19 20

20 22 23 24 25 26 27

28 29 30 31

D

R Ex

P

CMV

Bid Ask

$13.21 $14.00

Price on Ex date

$12.71 - $13.50

50

DERP

Copyright Licensed Securities Training Solutions 2014 720 771-4386 29

Share Price After Stock Dividend

Just prior to ex-date CMV = $48

20% stock dividend declaration

Assume

100 shares prior to dividend

Total value of holding dividend

100 x $48 = $4800 total value

100 shares x 20% = 20 additional share

New total after dividend 120 shares

$4800/120 shares = $40 New share price!

Total value of holding dividend

120 x $40 = $4800 total value

You might also like

- Chapter 3 Stock ValuationDocument51 pagesChapter 3 Stock ValuationJon Loh Soon Weng50% (2)

- 15 - Chapter 19 - Dividends E10Document34 pages15 - Chapter 19 - Dividends E10VÂN HỒ BÙI NGỌCNo ratings yet

- Af210 WeekDocument30 pagesAf210 WeekAvisha SinghNo ratings yet

- Different Types of Payouts: - Many Companies Pay A Regular Cash DividendDocument27 pagesDifferent Types of Payouts: - Many Companies Pay A Regular Cash DividendMuhammad Mazhar Younus100% (1)

- Venture Capital Financing: MBA 6314/TME 3413 October, 2003Document66 pagesVenture Capital Financing: MBA 6314/TME 3413 October, 2003Ashwin ShettyNo ratings yet

- VC Financing Methods and ValuationDocument66 pagesVC Financing Methods and ValuationJaved KhanNo ratings yet

- Different Types of Dividends and Factors Influencing Dividend PolicyDocument26 pagesDifferent Types of Dividends and Factors Influencing Dividend PolicyDavid Jamwa ChandiNo ratings yet

- Series-7-Handout Review PDFDocument84 pagesSeries-7-Handout Review PDFAmber LambertNo ratings yet

- Topic 2Document24 pagesTopic 2andy033003No ratings yet

- Dividend PolicyDocument51 pagesDividend PolicydawarameerNo ratings yet

- Dividend PolicyDocument52 pagesDividend PolicyANISH KUMARNo ratings yet

- The Corporate Form of OrganizationDocument7 pagesThe Corporate Form of OrganizationRabie HarounNo ratings yet

- Investing 101: How To Make Your Money Work For YouDocument49 pagesInvesting 101: How To Make Your Money Work For YouTeodorescu Ana MariaNo ratings yet

- Engineering EconomicsDocument49 pagesEngineering EconomicsOwen MatareNo ratings yet

- Far410 Chapter 3 Equity EditedDocument32 pagesFar410 Chapter 3 Equity EditedWAN AMIRUL MUHAIMIN WAN ZUKAMALNo ratings yet

- Shares: Definition, Types, Features and Methods of Raising CapitalDocument21 pagesShares: Definition, Types, Features and Methods of Raising CapitalPooja TripathiNo ratings yet

- Acct 100 Chapter 11 S22Document16 pagesAcct 100 Chapter 11 S22Cyntia ArellanoNo ratings yet

- Sources of FinanceDocument9 pagesSources of FinanceDinesh kumar JenaNo ratings yet

- Sources of Long Term Finance TypesDocument26 pagesSources of Long Term Finance TypesmittuuuuuuuuuNo ratings yet

- Ch5 Stock SDocument78 pagesCh5 Stock SK60 NGUYỄN THỊ HƯƠNG QUỲNHNo ratings yet

- Accounting Terms Share Capital and OthersDocument47 pagesAccounting Terms Share Capital and OthersAnukriti VidyarthiNo ratings yet

- Sources Of Capital: Owner’s Equity, Forms Of Business OrgsDocument26 pagesSources Of Capital: Owner’s Equity, Forms Of Business OrgsBidyut SonowalNo ratings yet

- Raising CapitalDocument43 pagesRaising CapitalMuhammad AsifNo ratings yet

- Dividend PolicyDocument52 pagesDividend PolicyKlaus Mikaelson100% (1)

- 06 - Raising Equity CapitalDocument46 pages06 - Raising Equity CapitalAnurag PattekarNo ratings yet

- Financing Corporate Actions Through Debt and Equity InstrumentsDocument23 pagesFinancing Corporate Actions Through Debt and Equity InstrumentsAbhishekNo ratings yet

- CFMP - Bloomberg Course: Your GuideDocument47 pagesCFMP - Bloomberg Course: Your GuideWilliam BoschNo ratings yet

- The Role of StockbrokersDocument32 pagesThe Role of StockbrokersSaif AliNo ratings yet

- Dividend DecisionsDocument26 pagesDividend DecisionsRemonNo ratings yet

- Owners' Equity Chapter SummaryDocument29 pagesOwners' Equity Chapter SummaryTNo ratings yet

- Kebijakan Dividen 1Document69 pagesKebijakan Dividen 1M. Rizqi HasanNo ratings yet

- Dividend PolicyDocument36 pagesDividend Policyarun1qNo ratings yet

- Session 08-09 - Dividend Policy & Firm ValueDocument37 pagesSession 08-09 - Dividend Policy & Firm ValueMohit KhokharNo ratings yet

- Shareholders' EquityDocument120 pagesShareholders' EquitySsewa AhmedNo ratings yet

- Dividend Policy and Firm ValueDocument40 pagesDividend Policy and Firm ValueDamilola iloriNo ratings yet

- Corporate Finance: Dividends and Dividend PolicyDocument21 pagesCorporate Finance: Dividends and Dividend PolicyUsama NawazNo ratings yet

- Cost of CapitalDocument27 pagesCost of CapitalMadhukant KumarNo ratings yet

- w11 3 Investing, Taxation and Debt Part 1 SVDocument26 pagesw11 3 Investing, Taxation and Debt Part 1 SVZhong MattNo ratings yet

- Dividend Policy: Financial Management Theory and PracticeDocument33 pagesDividend Policy: Financial Management Theory and PracticeSamar KhanzadaNo ratings yet

- EBF 2054 Capital StructureDocument38 pagesEBF 2054 Capital StructureizzatiNo ratings yet

- Strategic Capital Group Workshop #1: Investment FundamentalsDocument24 pagesStrategic Capital Group Workshop #1: Investment FundamentalsUniversity Securities Investment TeamNo ratings yet

- VC PRIVATE EQUITY SESSIONDocument25 pagesVC PRIVATE EQUITY SESSIONMary Williams100% (1)

- Hybrid Financing: Understanding Preferred Stock, Leasing, Warrants and ConvertiblesDocument33 pagesHybrid Financing: Understanding Preferred Stock, Leasing, Warrants and ConvertiblesKim Aaron T. RuizNo ratings yet

- Financial Management: 1. An IntroductionDocument14 pagesFinancial Management: 1. An IntroductionsshreyasNo ratings yet

- Raising Equity Funds: - Public Issue - Rights Issue - Bonus Issue - Private PlacementDocument33 pagesRaising Equity Funds: - Public Issue - Rights Issue - Bonus Issue - Private PlacementPallav KumarNo ratings yet

- WS9-1 31 2013Document37 pagesWS9-1 31 2013University Securities Investment TeamNo ratings yet

- Financing Decision: Dr. Md. Rezaul KabirDocument129 pagesFinancing Decision: Dr. Md. Rezaul KabirUrbana Raquib Rodosee100% (1)

- Shareholder S' EquityDocument55 pagesShareholder S' EquityRojParconNo ratings yet

- UntitledDocument25 pagesUntitledEhab M. Abdel HadyNo ratings yet

- Stock Market Investment Course - 2Document69 pagesStock Market Investment Course - 2N RajasubaNo ratings yet

- FIN 370T WK 5 - Apply Homework HTTPS://WWW - Hwtutorial.com/category/fin-370Document57 pagesFIN 370T WK 5 - Apply Homework HTTPS://WWW - Hwtutorial.com/category/fin-370Donny JobNo ratings yet

- CF - 01Document43 pagesCF - 01Нндн Н'No ratings yet

- Presentation Structuring ConceptsDocument24 pagesPresentation Structuring ConceptsAnupam GuptaNo ratings yet

- Investing 101: How To Make Your Money Work For YouDocument49 pagesInvesting 101: How To Make Your Money Work For YouyuqdbakmagicNo ratings yet

- Dividends and Share Repurchases: Basics: Presenter's Name Presenter's Title DD Month YyyyDocument20 pagesDividends and Share Repurchases: Basics: Presenter's Name Presenter's Title DD Month YyyyKavin Ur FrndNo ratings yet

- Working Capital, Credit and Accounts Receivable ManagementDocument28 pagesWorking Capital, Credit and Accounts Receivable ManagementVinodh Kumar LNo ratings yet

- Financial Planning and Forecasting: Key Concepts and ToolsDocument27 pagesFinancial Planning and Forecasting: Key Concepts and ToolsKinza gulNo ratings yet

- SERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKNo ratings yet

- Mercer-Capital FinTech 18Q1 PDFDocument13 pagesMercer-Capital FinTech 18Q1 PDFGabriel Fioravanti CantuNo ratings yet

- Fin N MGT Acc - Intro - PPTDocument30 pagesFin N MGT Acc - Intro - PPTJochiengNo ratings yet

- Distribution Channel of Mutual Funds in IndiaDocument73 pagesDistribution Channel of Mutual Funds in IndiaGeorge T Cherian100% (2)

- Supplemental Separate ReportDocument20 pagesSupplemental Separate ReportmmlazNo ratings yet

- Instructional Module: Republic of The Philippines NUEVA Vizcaya State University Bayombong, Nueva VizcayaDocument4 pagesInstructional Module: Republic of The Philippines NUEVA Vizcaya State University Bayombong, Nueva VizcayaJarold MatiasNo ratings yet

- PT Hutama Karya 2020 Consolidated Financial StatementsDocument152 pagesPT Hutama Karya 2020 Consolidated Financial StatementsAlfa AnugerahNo ratings yet

- Global Systemically Important Banks Indicators 2022Document3 pagesGlobal Systemically Important Banks Indicators 2022Alina PapazarcadaNo ratings yet

- Analyzing Financial Ratios to Evaluate a CompanyDocument38 pagesAnalyzing Financial Ratios to Evaluate a Companymuzaire solomon100% (1)

- CPU - Financial Acctg & Reporting II - CHAPTER 3Document17 pagesCPU - Financial Acctg & Reporting II - CHAPTER 3Princess Jonabelle BaylonNo ratings yet

- Chap 010Document54 pagesChap 010MubasherAkramNo ratings yet

- Slide AKT 202 Akuntansi Keuangan Menengah Presentasi 12Document44 pagesSlide AKT 202 Akuntansi Keuangan Menengah Presentasi 12Alan KurniawanNo ratings yet

- Financial Reporting Framework-SMES and SMALL ENTITIES - SssssssssssssssssssDocument14 pagesFinancial Reporting Framework-SMES and SMALL ENTITIES - SsssssssssssssssssschiNo ratings yet

- Bank Reconciliation Statement NotesDocument9 pagesBank Reconciliation Statement Notesdayna davisNo ratings yet

- Cost of CapitalDocument26 pagesCost of CapitalFaroque AhmedNo ratings yet

- Part1 Topic 4 Reconstitution of PartnershipDocument21 pagesPart1 Topic 4 Reconstitution of PartnershipShivani ChoudhariNo ratings yet

- Believe Are Doing The " Right Thing" in Terms of Consumer Protection, Human Rights and TheDocument48 pagesBelieve Are Doing The " Right Thing" in Terms of Consumer Protection, Human Rights and TheSofia SantosNo ratings yet

- MS-4 (2007)Document6 pagesMS-4 (2007)singhbaneetNo ratings yet

- VAT on ConsumptionDocument2 pagesVAT on Consumptionclothing shoptalkNo ratings yet

- Cash Flow 05 With Answers Just Give SolutionsDocument21 pagesCash Flow 05 With Answers Just Give SolutionsEdi wow WowNo ratings yet

- PT Mustika Ratu TBK.: Summary of Financial StatementDocument2 pagesPT Mustika Ratu TBK.: Summary of Financial StatementdennyaikiNo ratings yet

- CH 19Document29 pagesCH 19Emey CalbayNo ratings yet

- V Natarajan Vs Nilesh Industrial Products Privatey020086COM308388Document5 pagesV Natarajan Vs Nilesh Industrial Products Privatey020086COM308388Lucky BoyNo ratings yet

- LW Pro Forma Template 6.4.20Document1 pageLW Pro Forma Template 6.4.20Charielle Esthelin BacuganNo ratings yet

- Adani Power: On Thin IceDocument13 pagesAdani Power: On Thin IceamruthaNo ratings yet

- Financial Statement Analysis PPT 3427Document25 pagesFinancial Statement Analysis PPT 3427imroz_alamNo ratings yet

- 03 Financial InstrumentsDocument2 pages03 Financial InstrumentsCarmela PeducheNo ratings yet

- Partnership - Key Notes and Sample ProblemsDocument6 pagesPartnership - Key Notes and Sample ProblemsCrestinaNo ratings yet

- Senior 12 Business Finance - Q1 - M1 For PrintingDocument30 pagesSenior 12 Business Finance - Q1 - M1 For PrintingAngelica Paras100% (8)

- Volkswagens Bad Decisions & Harmful Emissions - How Poor ProcessDocument45 pagesVolkswagens Bad Decisions & Harmful Emissions - How Poor ProcessheyNo ratings yet

- Review Test QuestionsDocument24 pagesReview Test QuestionsKent Mathew BacusNo ratings yet