Professional Documents

Culture Documents

Accounting Quiz YP 51 B

Uploaded by

nicasavio2725Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Quiz YP 51 B

Uploaded by

nicasavio2725Copyright:

Available Formats

Date : September 23,

2014

ACCOUNTING QUIZ

MBA YP 51 B

SCHOOL OF BUSINESS AND MANAGEMENT - ITB

Name :

Student ID :

1. (Financial Accounting and Accounting Standards). Some argue that having various

organizations establish accounting principles is wasteful and inefficient. Rather than

mandating accounting rules, each company could voluntarily disclose the type of

information it considered important. In addition, if an investor wants additional

information, the investor could contact the company and pay to receive the additional

information desired.

Instruction : Comment on the appropriateness of this viewpoint.

2. (Conceptual Framework for financial Reporting). Accounting information provides useful

information about business transactions and events. Those who provide and use financial

reports must often select and evaluate accounting alternatives. The IFRS Framework

examines the characteristics of accounting information that make it useful for decision-

making. It also points out that various limitations inherent in the measurement and

reporting process may necessitate trade-offs or sacrifices among the characteristics of

useful information.

Instructions :

a. Describe briefly the following characteristics of useful accounting information

(1) Relevance (4) Comparability

(2) Faithful representation (5) Neutrality

(3) Understandability

b. For each of the following pairs of information characteristics, give an example of a

situation in which one of the characteristics may be sacrificed in return for a gain in the

order

(1) Relevance and faithful representation (3) Comparability and consistency

(2) Relevance and consistency (4) Relevance and understandability

c. What criterion should be used to evaluate trade-offs between information

characteristic ?

3. (The Accounting Information System).

a. Distinguish between cash-basis accounting and accrual-basis accounting. Why is accrual-

basis accounting acceptable for most business enterprises and the cash-basis unacceptable

in preparation of an income statement and a statement of financial position ?

b. When wages expense for the year is computed, why are beginning accrued wages

substracted from, and ending accrued wages added to, wages paid during the year ?

4. (The Accounting Information System). Give an example of a transaction that results in :

a. A decrease in an asset and decrease in a liability

b. A decrease in one asset and an increase in another asset

c. A decrease in one liability and an increase in another liability

5. (The Accounting Information System). Do the following events represent business transactions

? Explain your answer in each case :

a. A computer is purchased on account

b. A customer returns merchandise and is given credit on account

c. A prospective employee is interviewed

d. The owner of the business withdrawls cash from the business for personal use

e. Merchandise is ordered for delivery next mont

Date : September 23,

2014

ACCOUNTING QUIZ

MBA YP 51 B

SCHOOL OF BUSINESS AND MANAGEMENT - ITB

Name :

Student ID :

6. (The Accounting Information System). Prepare the following adjusting entries at August 31 for

NOKIA.

a. Interest on notes payable of 300 is accrued

b. Fees earned but unbilled total 1,400

c. Salaries earned by employees of 700 have not been recorded

d. Bad debt expense for year is 900

Use the following account titles : Service revenue, Accounts receivable, Interest expense,

Interest payable, Salaries expense, Salaries payable, Allowance for doubtful accounts, and Bad

debt expense.

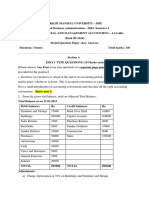

7. (The Accounting Information System). Presented on the next page is the trial balance of the

Crestwood Golf Club, Inc. as of December 31. The books are closed annually on December 31.

CRESTWOOD GOLF CLUB, INC.

Trial Balance

December,31

Cash

Accounts receivable

Allowance for doubtful accounts

Prepaid insurance

Land

Buildings

Accumulated depreciation-buildings

Equipment

Accumulated depreciation-equipment

Share capital ordinary

Retained earnings

Dues revenue

Greens fee revenue

Rental revenue

Utilities expense

Salaries expense

Maintenance expence

Debit

15,000

13,000

9,000

350,000

120,000

150,000

54,000

80,000

24,000

815,000

Credit

1,100

38,400

70,000

400,000

82,000

200,000

5,900

17,600

815,000

Instruction:

a. Enter the balances in ledger accounts. Allow five lines for each account

b. From the trial balance and the information given below, prepare annual adjusting entries

and post to the ledger accounts (omit explanations).

(1) The buildings have an estimated life of 30 years with no residual value (straight-line

method).

(2) The equipment is depreciated at 10 % per year.

(3) Insurance expired during the year 3,500

Date : September 23,

2014

ACCOUNTING QUIZ

MBA YP 51 B

SCHOOL OF BUSINESS AND MANAGEMENT - ITB

Name :

Student ID :

(4) The rental revenue represents the amount received for 11 months for dining facilities.

The December rent has not yet been received.

(5) It is estimated that 12 % of the account receivable will be uncollectible

(6) Salaries earned but not paid by December 31, 3,600

(7) Dues received in advance from members 8,900

c. Prepare an adjusted trial balance.

d. Prepare closing entries and post

e. Prepare post-closing trial balance

8. (Income Statement). Presented below are selected ledger accounts of Laksana Ltd. Co. at

December 31, 2012 (Rupiah).

Cash

Administrative expenses

Selling expenses

Net Sales

Cost of goods sold

Cash dividends declared (2012)

50,000

100,000

80,000

540,000

260,000

20,000

Cash dividends paid (2012)

Discontinued operations (loss before

income tax)

Depreciation expense, not recorded in

2011

Retained earnings, December 31, 2011

15,000

40,000

30,000

90,000

Effective tax rate on all items is 30 %. Prepare 2012 income statement with assume 20,000

ordinary shares were outstanding during 2012.

9. (Statement of Financial Position). Presented below is the adjusted trial balance of PT ABADI at

December 31, 2010 (Rupiah).

Debits Credits

Cash

Office supplies

Prepaid insurance

Equipment

Accumulated depreciation-equipment

Trademarks

Account payable

Wages payable

Unearned service revenue

Bonds payable, due 2017

Share capital-ordinary

Retained earnings

Service revenue

Wages expense

Insurance expense

Rent expense

Interest expense

1,200

1,000

48,000

950

9,000

1,400

1,200

900

9,000

10,000

500

2,000

9,000

10,000

20,000

10,000

Total .. .

Additional information : net loss for the year was Rp. 2,500. No dividends were declared during

2010.

a. Fill in the blank of the table above

b. Prepare a statement of financial position as of December 31, 2010.

Date : September 23,

2014

ACCOUNTING QUIZ

MBA YP 51 B

SCHOOL OF BUSINESS AND MANAGEMENT - ITB

Name :

Student ID :

10. (Statement of Cash Flows)

a. Why is it necessary to convert accrual-based net income to a cash basis when preparing a

statement of cash flow ?

b. During the last year, the company reported a net loss of Rp. 2,000,000, yet its cash increased

Rp. 825,000 during the same period of time. Explain how this situation could accur.

***

You might also like

- Assignment # 2 MBA Financial and Managerial AccountingDocument7 pagesAssignment # 2 MBA Financial and Managerial AccountingSelamawit MekonnenNo ratings yet

- Rift Valley University Geda Campus Post Graduate Program Masters of Business Administration (MBA) Accounting For Managers Individual AssignmentDocument7 pagesRift Valley University Geda Campus Post Graduate Program Masters of Business Administration (MBA) Accounting For Managers Individual Assignmentgenemu fejoNo ratings yet

- # 2 Assignment On Financial and Managerial Accounting For MBA StudentsDocument7 pages# 2 Assignment On Financial and Managerial Accounting For MBA Studentsobsa alemayehuNo ratings yet

- Management Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDocument6 pagesManagement Accounting Versus Financial Accounting.: Takele - Fufa@aau - Edu.et...... orDeselagn TefariNo ratings yet

- Foundation Nov 2019Document138 pagesFoundation Nov 2019Ntinu joshuaNo ratings yet

- Executive MBA Power Accounting AssignmentDocument5 pagesExecutive MBA Power Accounting AssignmentSai Phanindra Kumar MuddamNo ratings yet

- MOJAKOE AK1 UTS 2010 GasalDocument10 pagesMOJAKOE AK1 UTS 2010 GasalVincenttio le CloudNo ratings yet

- FND - Pilot Question & AnswerDocument118 pagesFND - Pilot Question & AnswerSunday OluwoleNo ratings yet

- NCERT Class 11 Accountancy Part 2Document296 pagesNCERT Class 11 Accountancy Part 2AnoojxNo ratings yet

- Acct1511 2013s2c2 Handout 2 PDFDocument19 pagesAcct1511 2013s2c2 Handout 2 PDFcelopurpleNo ratings yet

- Foundation May 2018Document140 pagesFoundation May 2018multenplanintegratedltdNo ratings yet

- Ifrs PQDocument26 pagesIfrs PQpakhok3No ratings yet

- Assignment 1Document3 pagesAssignment 1Abebe Nigatu100% (1)

- Accounting Decisions Workbook Covers Financials, Costing, AnalysisDocument96 pagesAccounting Decisions Workbook Covers Financials, Costing, AnalysisSatyabrataNayak100% (1)

- CA IPCC Nov 2010 Accounts Solved AnswersDocument13 pagesCA IPCC Nov 2010 Accounts Solved AnswersprateekfreezerNo ratings yet

- S A Ipcc Nov 2011 - GR IDocument97 pagesS A Ipcc Nov 2011 - GR ISaibhumi100% (1)

- XI ACC ASM 2023-24 April-JuneDocument3 pagesXI ACC ASM 2023-24 April-JuneAarush GuptaNo ratings yet

- Kumpulan Kuis AKM 3 UASDocument12 pagesKumpulan Kuis AKM 3 UASAlya Sufi IkrimaNo ratings yet

- Accounting For ManagersDocument14 pagesAccounting For ManagersKabo Lucas67% (3)

- Acct 504 Week 8 Final Exam All 4 Sets - DevryDocument17 pagesAcct 504 Week 8 Final Exam All 4 Sets - Devrycoursehomework0% (1)

- Assignment 1Document11 pagesAssignment 1imamibrahim726No ratings yet

- CUHK Midterm Exam 1st Term 2014-2015 for ACCT 2111 Intro Fin AccountingDocument11 pagesCUHK Midterm Exam 1st Term 2014-2015 for ACCT 2111 Intro Fin AccountingDonald YumNo ratings yet

- Due Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2Document7 pagesDue Date: Tuesday September 30 (By 1:50 PM) : Intermediate Financial Accounting I - ADMN 3221H Accounting Assignment #2kaomsheartNo ratings yet

- AC327PracticeQuiz4 Chapter24 20141129WithoutAnswersDocument6 pagesAC327PracticeQuiz4 Chapter24 20141129WithoutAnswersJuanita Ossa Velez100% (1)

- F1 Answers May 2013Document15 pagesF1 Answers May 2013Chaturaka GunatilakaNo ratings yet

- Pathfinder FND Nov2011Document69 pagesPathfinder FND Nov2011Kristopher SimireNo ratings yet

- Vgu Obrw Halftime Mock ExamDocument9 pagesVgu Obrw Halftime Mock ExamSour CandyNo ratings yet

- 2018 Financial Accounting Paper 2 SolutionDocument15 pages2018 Financial Accounting Paper 2 Solutiontetteh godwinNo ratings yet

- ACCT 504 Midterm Exam 2Document7 pagesACCT 504 Midterm Exam 2DeVryHelpNo ratings yet

- Accounting Exam GuideDocument3 pagesAccounting Exam GuideJUNE CARLO CATULONGNo ratings yet

- FASB and GAAP standards for small dental practiceDocument6 pagesFASB and GAAP standards for small dental practiceNatasha DeclanNo ratings yet

- Chapter 1 AccountingDocument9 pagesChapter 1 Accountingmoon loverNo ratings yet

- 2015 May PFDocument126 pages2015 May PFFareeda KabirNo ratings yet

- MBA Financial Management and Accounting AssignmentDocument6 pagesMBA Financial Management and Accounting Assignmentgiorgos1978No ratings yet

- Section A (20 Marks)Document11 pagesSection A (20 Marks)Taha NasirNo ratings yet

- Fac511s - Financial Accounting - 1st Opp - June 2019Document8 pagesFac511s - Financial Accounting - 1st Opp - June 2019FrancoNo ratings yet

- Tutorial 1 FA IVDocument5 pagesTutorial 1 FA IVZHUN HONG TANNo ratings yet

- Financial AccountingDocument1,056 pagesFinancial AccountingCalmguy Chaitu96% (28)

- CFR 1 Quiz 1Document7 pagesCFR 1 Quiz 1Ahmed SamadNo ratings yet

- Financial Accounting A Business Process Approach 3rd Edition Reimers Solutions ManualDocument49 pagesFinancial Accounting A Business Process Approach 3rd Edition Reimers Solutions Manualtecumwastorel.mio0v100% (23)

- Mojakoe UTS AK1 20143Document12 pagesMojakoe UTS AK1 20143Lia AmeliaNo ratings yet

- March 2010 Part 2 InsightDocument92 pagesMarch 2010 Part 2 InsightLegogie Moses AnoghenaNo ratings yet

- Review FM (Q)Document11 pagesReview FM (Q)ektaNo ratings yet

- K00200 - 20211027174042 - Group Assignment Paf3113 A211Document5 pagesK00200 - 20211027174042 - Group Assignment Paf3113 A211huuuuuuuaaaaaaaNo ratings yet

- Accounting principles assignment on chapters 1 and 2Document36 pagesAccounting principles assignment on chapters 1 and 2DrGeorge Saad AbdallaNo ratings yet

- Tutorial Topic 1Document2 pagesTutorial Topic 1Diyana RizalNo ratings yet

- BSB52415 Diploma of Marketing and Communication Assessment 3: Financial AnalysisDocument14 pagesBSB52415 Diploma of Marketing and Communication Assessment 3: Financial AnalysisASTRI CAHYANINGSIHNo ratings yet

- CH 4 - End of Chapter Exercises SolutionsDocument80 pagesCH 4 - End of Chapter Exercises SolutionsPatrick AlphonseNo ratings yet

- HHM Class 12 CommerceDocument26 pagesHHM Class 12 CommerceAnujNo ratings yet

- Paper 5 - Financial Accounting - Text PDFDocument1,056 pagesPaper 5 - Financial Accounting - Text PDFRohan Singh67% (3)

- MB0041 MQP Answer KeysDocument21 pagesMB0041 MQP Answer Keysajeet100% (1)

- Tutorial 4Document6 pagesTutorial 4Amirul Noris0% (1)

- ACCT550 Homework Week 1Document6 pagesACCT550 Homework Week 1Natasha DeclanNo ratings yet

- QUIZ AKM ACCOUNTINGDocument10 pagesQUIZ AKM ACCOUNTINGAlya Sufi IkrimaNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- International Financial Statement AnalysisFrom EverandInternational Financial Statement AnalysisRating: 1 out of 5 stars1/5 (1)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- DpsDocument272 pagesDpsnicasavio2725No ratings yet

- Why Manage: RIS KDocument13 pagesWhy Manage: RIS Knicasavio2725No ratings yet

- YryDocument55 pagesYrynicasavio2725No ratings yet

- FaDocument15 pagesFanicasavio2725No ratings yet

- CPK NabillahDocument11 pagesCPK Nabillahnicasavio2725No ratings yet

- Risk Management Is Not Modern InventionDocument3 pagesRisk Management Is Not Modern Inventionnicasavio2725No ratings yet

- INFOSYS 50 Month Stock PricesDocument6 pagesINFOSYS 50 Month Stock PricesAbhishek JainNo ratings yet

- Presentation 7Document2 pagesPresentation 7nicasavio2725No ratings yet

- YP51B Job Analysis: Remuneration and Compensation ManagerDocument11 pagesYP51B Job Analysis: Remuneration and Compensation Managernicasavio2725No ratings yet

- CfoDocument2 pagesCfonicasavio2725No ratings yet

- RDocument9 pagesRnicasavio2725No ratings yet

- Paper Pak DonaldDocument4 pagesPaper Pak Donaldnicasavio2725No ratings yet

- After Tax Salvage ValueDocument2 pagesAfter Tax Salvage Valuenicasavio2725No ratings yet

- FsfsfaDocument11 pagesFsfsfanicasavio2725No ratings yet

- CPK NabillahDocument11 pagesCPK Nabillahnicasavio2725No ratings yet

- CPK NabillahDocument11 pagesCPK Nabillahnicasavio2725No ratings yet

- Your Name Is StrongDocument2 pagesYour Name Is Strongnicasavio2725No ratings yet

- Your Name Is StrongDocument2 pagesYour Name Is Strongnicasavio2725No ratings yet

- Theoretical LoveDocument1 pageTheoretical Lovenicasavio2725No ratings yet

- MedcoDocument1 pageMedconicasavio2725No ratings yet

- BreatheDocument1 pageBreathenicasavio2725No ratings yet

- I Surrender AllDocument1 pageI Surrender Allnicasavio2725No ratings yet

- Little ThingsDocument2 pagesLittle Thingsnicasavio2725No ratings yet

- CAPM Group Presentation-Syndicate 10Document18 pagesCAPM Group Presentation-Syndicate 10nicasavio2725No ratings yet

- SanctuaryDocument1 pageSanctuarynicasavio2725No ratings yet

- DreamingDocument2 pagesDreamingnicasavio2725No ratings yet

- BreatheDocument1 pageBreathenicasavio2725No ratings yet

- All My Love Is For YouDocument2 pagesAll My Love Is For Younicasavio2725No ratings yet

- SomedayDocument2 pagesSomedaynicasavio2725No ratings yet

- Presentation 1Document10 pagesPresentation 1nicasavio2725No ratings yet

- 7 Introduction To Binomial TreesDocument25 pages7 Introduction To Binomial TreesDragosCavescuNo ratings yet

- Recall Notice Shiddhivinayak AutolineDocument2 pagesRecall Notice Shiddhivinayak AutolineRaj Royal0% (1)

- Projected Financials and Valuation of a Pharmaceutical CompanyDocument14 pagesProjected Financials and Valuation of a Pharmaceutical Companyvardhan100% (1)

- Trafigura Corporate Brochure en 141218011728 Conversion Gate01Document44 pagesTrafigura Corporate Brochure en 141218011728 Conversion Gate01Uma SubbiahNo ratings yet

- Sahara India's Downfall: A Study on Customer Awareness and PerspectivesDocument5 pagesSahara India's Downfall: A Study on Customer Awareness and PerspectivesVishu RajNo ratings yet

- BBFH202Document196 pagesBBFH202Tawanda Tatenda Herbert100% (1)

- Understanding foreign currency valuation and translationDocument5 pagesUnderstanding foreign currency valuation and translationAnanthakumar ANo ratings yet

- Tri Level 2 Promo 17Document5 pagesTri Level 2 Promo 17asdfafNo ratings yet

- Formulation of Project ReportDocument4 pagesFormulation of Project Reportarmailgm100% (1)

- TPA Cirular No. 059-03-2016 Dated 28-03-16Document89 pagesTPA Cirular No. 059-03-2016 Dated 28-03-16NitinNo ratings yet

- EnglishDocument171 pagesEnglishSrimathi RajamaniNo ratings yet

- Influence of Some Economic Parameters On Cut Off Grade and Ore Reserve Determination at Itakpe Iron Ore Deposit North Central NigeriaDocument6 pagesInfluence of Some Economic Parameters On Cut Off Grade and Ore Reserve Determination at Itakpe Iron Ore Deposit North Central NigerialuisparedesNo ratings yet

- Concept of Tax Planning and Specific Management Decisions: CHANIKA GOEL (1886532) RITIKA SACHDEVA (1886586)Document34 pagesConcept of Tax Planning and Specific Management Decisions: CHANIKA GOEL (1886532) RITIKA SACHDEVA (1886586)parvati anilkumarNo ratings yet

- Accounting 3 Cash Flow Statement DiscussionDocument6 pagesAccounting 3 Cash Flow Statement DiscussionNoah HNo ratings yet

- Mutual Fund Commission Structure July-Sept 2021Document20 pagesMutual Fund Commission Structure July-Sept 2021Jeetu GuptaNo ratings yet

- Supreme Annual Report 15 16Document104 pagesSupreme Annual Report 15 16adoniscalNo ratings yet

- Dominions KB Table of ContentsDocument924 pagesDominions KB Table of ContentsRahTurboNo ratings yet

- Beat The Market - Ed ThorpDocument229 pagesBeat The Market - Ed Thorprychang901100% (9)

- Learning Activity Sheet Business Finance Introduction To Financial Management Quarter 1 - Week 1Document16 pagesLearning Activity Sheet Business Finance Introduction To Financial Management Quarter 1 - Week 1Dhee SulvitechNo ratings yet

- Mba Ii Ed Unit IDocument19 pagesMba Ii Ed Unit IShweta ShrivasNo ratings yet

- Investor PDFDocument3 pagesInvestor PDFHAFEZ ALINo ratings yet

- IDBI Federal Incomesurance Plan BenefitsDocument3 pagesIDBI Federal Incomesurance Plan BenefitsVipul KhandelwalNo ratings yet

- Assignment InnovationDocument26 pagesAssignment Innovationjaskaran50% (4)

- Credit Suisse - How Demographics Affect Asset Prices PDFDocument34 pagesCredit Suisse - How Demographics Affect Asset Prices PDFEquity PrivateNo ratings yet

- Start-Ups in Bulgaria 2016 - JyrqyhvDocument14 pagesStart-Ups in Bulgaria 2016 - JyrqyhvFatmirNo ratings yet

- HSC Accounts Model Question Paper For Board ExamDocument6 pagesHSC Accounts Model Question Paper For Board ExamAMIN BUHARI ABDUL KHADERNo ratings yet

- Financial Due Diligence Art NirmanDocument41 pagesFinancial Due Diligence Art NirmanPravesh PangeniNo ratings yet

- Crypto TradingDocument22 pagesCrypto TradingSOZEK Loyozu70% (10)

- Whats Your OTB Purchase Planning Made Easy.17143105Document2 pagesWhats Your OTB Purchase Planning Made Easy.17143105ramjee prasad jaiswalNo ratings yet

- Darryl Shen - OrderImbalanceStrategy PDFDocument70 pagesDarryl Shen - OrderImbalanceStrategy PDFmichaelguan326No ratings yet