Professional Documents

Culture Documents

WP - Mangalya Nidhi Cess

Uploaded by

P. Thomas GeevergheseOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WP - Mangalya Nidhi Cess

Uploaded by

P. Thomas GeevergheseCopyright:

Available Formats

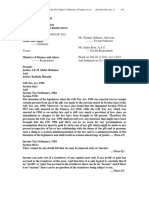

BEFORE THE HONOURABLE HIGH COURT OF KERALA,

AT ERNAKULAM

W.P (C) No. ________________ of 2013

PETITIONER

1. Thulasidharan Pilla, aged 52 years,

S/o Raghavan Pillai, Kadakkal House,

Thamarakkulam, Mavelikkara - 690530

2. Nazarudeen K.M., aged 51years,

S/o V. Muhammed Musthaffa, Proprietor of Thampuran Land Ground,

7/449, Thamarakulam, Mavelikkara 690530.

v.

RESPONDENTS

State of Kerala,

Represented by its Additional Chief Secretary (Finance),

Finance Department, First Floor, Main Block, Government Secretariat,

Thiruvananthapuram, Pin 695001

WRIT PETITION FILED UNDER ARTICLE 226 OF THE

CONSTITUTION OF INDIA

A. Address for service of all notice and process to the Petitioner is that of its Counsel

Shri. P. THOMAS GEEVERGHESE, Advocate, Room No. 201, Mannanthara

Buildings, Paramara Temple Road, Ernakulam North 682 018.

B. Address for service of all notices and processes to the Respondents is as shown above.

STATEMENT OF FACTS

1. The first petitioner is a father, preparing for the wedding of his daughter that is

auspiciously scheduled to be conducted on 23

rd

March 2014, in the auditorium owned

by the Second Petitioner. A true copy of the astrological schedule drawn up for the

said wedding by Josthsyer Ramesh K Nambuthiri on 10.8.2013, is produced herewith

and may be marked as Exhibit P1.

2. The first petitioner is actually a farmer by avocation and is classified by the

respondent as a person falling in below poverty line family. A true copy of his ration

card issued by the respondent is produced herewith and may be marked as Exhibit

P2. He is arranging the finances for his daughters wedding through his large circle of

friends and relatives, who all are being invited for the wedding. It is usually a custom

for the people living in the southern part of Kerala, to financially and materially

contribute, when a wedding is being conducted in their family or neighbourhood. In

expectation of such contributions, the first petitioner is inviting about a thousand

people, for his daughters wedding.

3. The second petitioner is the proprietor of an auditorium named Thampuran Land

Ground at Thamarakkulam, Alappuzha, having a total seating capacity of 1100 seats.

He is an assessee of Luxury Tax levied by the respondent, bearing registration

number 32042541767. A true copy of his registration certificate is produced herewith

and may be marked as Exhibit P3.

4. In the Kerala Finance Act, 2013 (hereafter referred to as the Act) the respondent has

introduced a new levy titled as Mangalya Nidhi Cess in Section 11 of the Act. It is

submitted that the said cess is a compulsory taxation on every wedding and its connected

celebrations, and is liable to paid by the person who is conducting the wedding. Section 11 of

the Act (hereafter referred to as the impugned provision/tax) is extracted below for

ready reference:

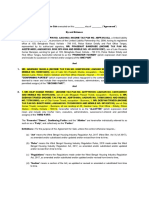

11. Levy and collection of cess on wedding celebrations.(1) There shall be levied

and collected a cess to be called Mangalya Nidhi Cess on every wedding and its

connected celebrations conducted in hotels having the classification of three star and

above or in auditoriums with a seating capacity of above five hundred including that of

dining halls, at the rated specifed in the Table below, namely:

TABLE

(i) Hotels of three star and above Rs. 10,000

(ii) Air conditioned auditorium situated Rs. 10,000 in Municipality area

(iii) Air conditioned auditorium situated Rs. 7,500 in Panchayat area

(iv) Other auditoriums situated in the area Rs. 5,000 of Municipality

(v) Other auditoriums situated in Rs. 3,000 Panchayat area

(2) The cess shall be collected from the person from whom the charges or rent for such

celebration are received by the proprieter of such hotel or auditorium, as the case may be,

and shall be remitted to Government Treasury in the Head of Account of Mangalya Nidhi

on or before the 15th day of every month.

(3) The proprietor of such hotel or auditorium shall file a statement in such form as may be

prescribed and submit the same along with the proof of remittance of Mangalya Nidhi Cess

to the assessing authority under the Kerala Tax on Lururies Act, 1976 (32 of 1976) having

jurisdiction over the area, on or before the 15th day of every month. He shall also keep a

register containing the details of remittance of Mangalya Nidhi Cess is such manner as

may be prescribed.

(4) The statement referred to in sub-section (3) may be filed and the amount of cess may

also be paid electronically be the proprietor through the website of the Commerical Taxes

Department, Government of Kerala.

(5) The proprietor of the establishment entrusted with the collection of the cess shall apply

for obtaining a unique identification number to the assessing authority under to Kerala Tax

on Luxuries Act, 1976 (32 of 1976) having jurisdication over the area where such

establishment is situated, in such manner as may be prescribed and the assessing

authority shall allot the same to the establishment.

(6) Where any proprietor of a hotel or an auditorium as stated in subsection (1) permits any

person to conduct a wedding celebration without the payment of cess under this section,

such proprietor shall be liable to pay such amount of cess as if he had conducted the

wedding celebration and such amount shall be recovered from him as if it is arrear due

from him under the Kerala Tax on Luxuries Act, 1976 (32 of 1976).

(7) The Government may, after due appropriation made by the Legislature by law is this

behalf, utilise such sums of money for the purposes specified in the Mangalya Nidhi

Scheme framed by the Government.

Explanation.For the purpose of this section,

(a) The word proprietor shall include the person who the time being is in-charge of

management of such hotels or auditoriums, as the case may be;

(b) The word auditorium hall include shall and kalyanamandapam also;

(c) The word prescribed means prescribed by rules made by the Government in this

behalf.

(8) The provisions regarding the assessment and recovery of tax in the Kerala Tax on

Luxuries Act, 1976 shall mutatis mutandis apply to the assessment and recovery of cess

under this section.

5. The Mangalya Nidhi Cess is neither an amendment to any existing tax-legislation nor

is an increment to an existing tax, but it is a new tax, standing independently under

the Finance Act, 2013 itself. Section 11 was not declared under Kerala Provisional

Collection of Revenues Act, 1985, and therefore it came into force only on 23

rd

July

2013, when the Finance Bill was signed by the Governor and got promulgated.

6. It is submitted that the impugned Mangalya Nidhi Cess although uses the euphemism

Cess, it is a compulsory extraction of money without providing any benefit or

service in return. The mere fact that it is called in the name of cess for administrative

needs by the draftsman do not in any manner either undermine the compulsory

nature of the levy or render it any less a mandatory levy. The true character of the

impugned Managalya Nidhi Cess is that of a TAX on those who conduct a

marriage/wedding in an auditorium/hotel.

7. If one analyses the four essential components of the impugned levy, then the

Taxable Event is the Wedding and its connected celebrations conducted at

hotel/auditorium ;

Tax Obligation is upon the Person who pays the rent of the hotel/auditorium ie the

person who is conducting the Wedding;

Tax Collection is by the Proprietor of auditorium/hotel; and the

Rate of Tax is fixed according to the location and category of hotel/auditorium in

which wedding is conducted and its minimum is 3000/-.

Pith and substance of the impugned cess is imposition of tax on every wedding and

connected celebrations happening in the State of Kerala.

8. The budget discussion explaining the reasons and objects for the introduction of the

Mangalya Nidhi Cess, as available in the website maintained by the respondent, is

produced herewith and may be marked as Exhibit P4. Apart from the preliminary

introduction as evidenced in Ext. P4, there was not a single serious discussion or legal

debate on the competence or impact of the impugned cess, when the Finance Bill was

tabled in the State Legislature.

9. It is respectfully submitted that the petitioners are deeply aggrieved by the

introduction of impugned tax, since it adversely affects their divergent and collective

interests. The impugned cess casts an additional financial burden on the 1

st

petitioner,

to conduct his daughters wedding. Similarly, the 2

nd

petitioner is unnecessarily

dragged into additional tax collection and compliances, which would make his

business less competitive in the market.

10. It is most humbly submitted that the impugned Mangalya Nidhi Cess is beyond the

legislative competence of the respondent. It is unreasonable, arbitrary and violative of

fundamental rights guaranteed to the petitioners by the Indian Constitution. Hence,

deeply aggrieved with enactment of Section 11 of the Kerala Finance Act, 2013, the

petitioner is left with no other alternative remedy, but to file this writ petition under

Article 226 of the Constitution on the following among other grounds:

GROUNDS

A. Section 11 of the Kerala Finance Act, 2013 which introduces Mangalya Nidhi Cess, is

outside the legislative competence of the respondent. In Shinde Brothers v. Dy.

Commissioner, AIR 1967 SC 1512, it was held that Cess is a tax levied for a specific

administrative purpose and it should comply with Arts. 245, 246 and 265 of the

Constitution. Wedding/Marriage is a matter falling in Item No. 5 of List III

(Concurrent List) of Seventh Schedule to the Indian Constitution. IT IS A NON-

TAXABLE ENTRY. The Indian Constitution does not permit a State to impose tax on

marriages, unlike instances of sale of goods or agricultural income. Hence, the

Mangalya Nidhi Cess enacted by the respondent is beyond the legislative competence

of the respondent.

B. In Seven Schedule of the Indian Constitution, Entries 1 to 81 in List I mention the

several matters on which Parliament could legislate and entries 82 to 92A of List I

enumerate the taxes which Partliament could impose tax. Similarly in List II, entries

in 1 to 44 form a group comprising the subjects on which States can legislate; entries

45 to 63 deal with State taxes. There are no taxable entries in List III- Concurrent

List. To understand the difference between taxable and non-taxable entries, one can examine

Entry 18 of List II which is Land, while entry 45 is Land Revenue. From above, it

is clear that taxation is not included in the main subject in which it might, on an

extended construction, be regarded as included, but actually it is treated as distinct

matter for purposes of legislative competence. A tax cannot, therefore, be levied

outside the specific tax entries enumerated in the three lists (Indian Conditional Law,

Prof.M.P Jain, 6

th

ed, p.663). A tax can be levied only under a tax entry and not

under a non-tax entry as an ancillary or incidental matter (Abdul Quader & Co

v. STO, AIR 1964 SC 922). Hence, Section 11 of the Kerala Finance Act, 2013 is

violative of Articles 245, 248(2) and 265 of the Constitution.

C. Besides, the impugned tax is violative of fundamental rights guaranteed to the

petitioners under Articles 14, 19 & 21of the Constitution. Right to get married is a

fundamental right of every citizen protected under Article 21 of the Constitution.

Tax imposed upon marriage is an unreasonable, arbitrary and irrational restriction

placed upon ones Right to Life and Liberty. The impugned tax is authoritarian and

repressive in nature, which is inconsistent with the democratic, progressive and

welfare framework of the country. The impugned tax fails the Test of

Reasonableness laid down by Maneka Gandhis Case(AIR 1978 SC 597 at p.622)

through Bank Nationalisation Case(AIR 1970 SC 564). Hence, Section 11 of the Kerala

Finance Act, 2013 is violative of Articles 21, 14 & 19 of the Constitution.

D. The impugned cess is also a Tax on Assembly in relation to marriage functions. The

first petitioner have fundamental Right to assemble peaceably and without arms under

Article 19(1)(b) of the Constitution, which can be restrained under Article 19(3) only

for reasons of Sovereignty and Integrity of India or Public Order. Revenue collection

is not a permissible restriction under Article 19(3) of the constitution. Hence, Section

11 of the Kerala Finance Act, 2013 is violative of Articles 19(1)(b) read with 19(3) of

the Constitution.

E. Marriage/Wedding is a sacred religious ceremony for the majority of Indians. For

Hindus and Muslims, Auditoriums/Kalyanamandapums, are essential for conducting

any marriage. According to Article 25 of the Constitution All persons are equally

entitled to freely profess, practise and propagate religion. Article 27 deals with Freedom

as to payment of taxes for promotion of any particular religion. A conjoint reading of

Articles 25 and 27 of the Constitution makes it abundantly clear that religious

ceremonies are beyond the direct taxing realm of the Government. Hence, the

Mangalya Nidhi Cess enacted by the respondent is violative of Article 25 read with

Article 27 of the Indian Constitution.

F. The impugned cess cannot be categorised as a luxury tax, since firstly there is already

a luxury tax levied under the Kerala Luxury Tax Act, 1976; secondly the literal

interpretation of the impugned provision explains it as a tax on marriage; thirdly and

most importantly wedding conducted by inviting 250persons and above is a not a luxury

but a matter of social commitment. One who does not have a minimum of

500persons to invite for his wedding, is a social deviant, and not a normal person. In

Godfrey Phillips India Ltd. v. State of UP, 2005(2) SCC 515, it was held that luxury

means activities of indulgence, enjoyment or pleasure, and only those activities can be

subject matter of tax under the said entry. Marriage is not a matter of indulgence or

enjoyment, but it is a social institution and a requirement of the society. Besides, size

of the hall booked or the locality in which it is located, are not the attributes of luxury

to impose a quotient of luxury tax. The 1

st

Petitioner is inviting so many number of

people for his daughters wedding, only in expectation to receive financial support

from the invitees and to discharge his social commitment.

G. The State cannot under the grab of Luxury Tax under Entry 62 List II, abduct a non-

taxable subject like marriage, by merely describing it as luxury. In Godfrey Philips

India Ltd. v. State of UP, 2005(2) SCC 515, it was held that first principle in relation to

the legislative entries is that they should be liberally interpreted, that is, each general word should be

held to extend to ancillary or subsidiary matters which can fairly and reasonably be said to be

comprehended in it. Second Principle is that competing entries must be read harmoniously, that is, to

read the entries together and to interpret the language of one by that of the other. In such

interpretation, wedding and wedding celebrations falls under Entry 5 of List III, and

not Entry 62 List II.

H. Even otherwise, the impugned tax provision is so badly conceived and drafted that it

imposes tax even on Mass-Wedding-of-Poor, which are also organised in

auditoriums alone. Hence, the very object for which the impugned tax is introduced,

stands defeated currently due to the bad drafting and poor conception of the

impugned provision. Besides, the inclusion of dining seats while computing the

seating capacity of the hall, virtually reduces the number of permissible invitees to

less than 250, if one decides to avoid tax.

I. The classification of weddings conducted in auditoriums/hotels having seating

capacity of 500 and above, is an arbitrary and unreasonable classification lacking any

reasonable nexus to the object sought to be achieved. Wedding and wedding

celebrations are not only conducted in Auditoriums, Hotels and Kalyanamandapams

alone, but they are also organised in Panthals/Canopy, which currently stands

excluded from any taxation. The exclusion of weddings conducted in

Panthals/Canopy, is arbitrary, unreasonable and differential treatment of

persons similarly situated. Therefore impugned cess is violative of Article 14 of the

constitution.

J. There is no reasonable excuse for differently taxing auditoriums/hotels, based on

their location, ie whether it is in Grama Panchayat, Municipality or Corporation, since

such classification does not further the object for which the tax is imposed.

K. The union government has enacted Dowry Prohibition Act, 1961, which occupies

and governs all monitory transactions during a marriage. It specifically prohibits

compulsory extraction of money during marriage, whether directly or indirectly, from

either party to the marriage. Therefore, Section 11 of the Kerala Finance Act, 2013

which demands tax on marriage, is akin to dowry, and is repugnant to the Dowry

Prohibition Act, 1961 and therefore is void by operation of Art. 254(1) of the

Constitution.

For these and other grounds to be urged at the time of hearing it is most humbly

prayed that this Honble Court may be pleased to

1. Declare that Section 11 of the Finance Act, 2013 which introduces

Mangalya Nidhi Cess, is ultra vires the Indian Constitution and quash the

same as illegal and invalid.

2. Issue any other writ, order, declaration or direction as this Honble Court

may deem fit and proper in the facts and circumstances of the case.

Dated this the 22

nd

day of September, 2013.

Thulasidharan Pilla Nazarudeen K.M

[Petitioners]

P.Thomas Geeverghese

Counsel for Petitioners

Interim Relief

For the reasons stated in the Writ Petition and the accompanying affidavit this Honble

Court may be pleased to stay the enforcement of Section 11 of the Finance Act, 2013, till the

final disposal of the Writ Petition.

Dated this the 22

nd

day of September, 2013

P.Thomas Geeverghese

Counsel for Petitioners

BEFORE THE HONOURABLE HIGH COURT OF KERALA,

AT ERNAKULAM

W.P(C) No. _________________ of 2013

Thulasidharan Pilla & another : Petitioner

v.

State of Kerala : Respondent

Affidavit

I, Nazarudeen K.M., aged 51years, S/o V. Muhammed Musthaffa, Proprietor of Thampuran

Land Ground, 7/449, Thamarakulam, Mavelikkara 690530., do hereby solemnly affirm and

state as follows:

1. I am the 2

nd

petitioner in the above writ petition. I know the facts of the case. I am

affirming this affidavit on behalf of the 1

st

petitioner also, who is aggrieved similarly

and is espousing this writ together.

2. The statement of facts and grounds urged in the writ petition are true and correct.

The Exhibits P1 to P4 produced are true copies of the originals.

3. I have not filed any other writ petition before this Honble Court seeking the very

same reliefs prayed for in this original petition.

All facts stated above are true and correct to the best of my knowledge, information and

belief.

Dated this the 22

nd

day of September, 2013

DEPONENT

Solemnly affirmed and signed before me by the Deponent on this the dated this the 22

nd

day

of September, 2013 in my office at Ernakulam.

P.THOMAS GEEVERGHESE

COUNSEL FOR PETITIONER

BEFORE THE HONOURABLE HIGH COURT OF KERALA,

AT ERNAKULAM

W.P(C) No. _________________ of 2013

Thulasidharan Pilla & another : Petitioner

v.

State of Kerala : Respondent

Synopsis

1. Petitioners are aggrieved by enactment of Section 11 of the Kerala Finance Act, 2013,

which introduces a new tax in the name of Mangalya Nidhi Cess.

2. Section 11 levies cess/tax on every wedding and its connected celebrations conducted in

halls/hotels/kalyanamandapams having minimum seating capacity of 500 and above.

The tax is levied from the person who is conducting the marriage, and the minimum

tax is 3,000.

3. Wedding/Marriage is a matter falling in Item No. 5 of List III (Concurrent List) of

Seventh Schedule to the Indian Constitution. It is a non-taxable entry.

4. A tax can be levied only under a tax entry and not under a non-tax entry as an

ancillary or incidental matter (Abdul Quader & Co v. STO, AIR 1964 SC 922).

5. Hence, this writ petition is filed to declare that Section 11 of Kerala Finance Act,

2013 is ultra vires the constriction and quash the same as illegal.

Dated this the 22

nd

day of September, 2013

P.THOMAS GEEVERGHESE

COUNSEL FOR PETITIONER

BEFORE THE HONOURABLE HIGH COURT OF KERALA,

AT ERNAKULAM

W.P(C) No. _________________ of 2013

Thulasidharan Pilla & another : Petitioner

v.

State of Kerala : Respondent

INDEX

SL. NO. ITEM PAGE NO.

1 Synopsis I

2 Writ Petition

3 Affidavit

4

Exhibit P1: True copy of the astrological schedule drawn up for

the 1

st

petitioners daughters wedding by Josthsyer Ramesh K

Nambuthiri on 10.8.2013.

5

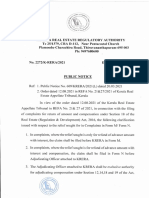

Exhibit P2: True copy of Ration card No. 1421042555 of the 1

st

petitioner

6

Exhibit P3: True copy of luxury tax registration certificate No.

320425/2013/CERTINO/60 of the 2

nd

petitioner dated 14

th

June 2013.

7

Exhibit P4: Print out of relevant pages of Budget Speech of the

Finance Minister, downloaded from

http://www.finance.kerala.gov.in

Dated this the 22

nd

day of September, 2013

P.THOMAS GEEVERGHESE

COUNSEL FOR PETITIONER

Presented on : ______________

Sub: Tax Mangalya Nidhi Cess introduced in Section 11 of the Kerala Finance Act, 2013

Legislative competence and legality of, challenged.

BEFORE THE HONOURABLE HIGH COURT OF KERALA

AT ERNAKULAM

W.P(C) No. _________________ of 2013

Thulasidharan Pilla & another : Petitioner

v.

State of Kerala : Respondent

WRIT PETITION FILED UNDER ARTICLE 226 OF THE

CONSTITUTION OF INDIA

P. THOMAS GEEVERGHESE (T- 293)

Room No.201, Mannanthara Building

Paramara Temple Road, Ernakulam

Appendix

Petitioners Exhibits:

Exhibit P1: True copy of the astrological schedule drawn up for the 1

st

petitioners daughters wedding by Josthsyer Ramesh K Nambuthiri on

10.8.2013.

Exhibit P2: True copy of Ration card No. 1421042555 of the 1

st

petitioner

Exhibit P3: True copy of luxury tax registration certificate No.

320425/2013/CERTINO/60 of the 2

nd

petitioner dated 14

th

June 2013.

Exhibit P4: Print out of relevant pages of Budget Speech of the Finance Minister,

downloaded from http://www.finance.kerala.gov.in

BEFORE THE HONOURABLE

HIGH COURT OF KERALA, AT ERNAKULAM

W.P (C) No. 23476 of 2013

THULASIDHARAN PILLA & ANOTHER : PETITIONERS

V.

STATE OF KERALA : RESPONDENT

REPLY AFFIDAVIT FILED BY THE PETITIONERS

I, Nazarudeen KM, aged 52years, S/o V. Muhammed Mustaffa, Proprietor of Thampuran

Land Ground, 7/449, Thamarakulam, Mavelikkara, do hereby solemnly affirm and state the

following:

1. I am the 2

nd

petitioner in the above case. I know the fact of the case. I am

affirming this affidavit on behalf of the 1

st

petitioner also, who is my friend, espousing this

writ petition along with me.

2. I have read the counter affidavit filed on behalf of the respondent, and this

reply affidavit is necessitated to address certain contentions made therein.

3. According to the respondent, the impugned Mangalya Nidhi Cess is a Fee

and not a Tax, and it is legislated under Entry 66 of List II of the 7

th

Schedule to the

Indian Constitution.

4. In this context, it relevant to state that the validity of a statutory provision

is to be tested by the courts considering the principles enshrined in the Constitution, and

not by the explanation rendered by an official of the executive in his counter affidavit. The

executive does not hold the brief for the legislature. Hence, the interpretation given by

respondent that Mangalya Nidhi Cess is a fees and not a tax, is actually of no relevance.

5. Presuming of the sake of argument that Mangalya Nidhi Cess is a fee as contended

by the respondent, then it becomes all the more illegal and unconstitutional. In Hingir

Rampur Coal Co. Ltd. v. State of Orissa, AIR 1961 SC 459, the constitutional bench of the

Supreme Court explained when cess becomes a fees, and its characterises, as under:

(Para 9) A fee is levied essentially for services rendered and as such there is an

element of quid pro quo between the person who pays the fee and the public

authority which imposes it. If specific services are rendered to a specific area or

to a specific class of persons or trade or business in any local area, and as a

condition precedent for the said services or in return for them cess is levied against

the said area or the said class of persons or trade or business the cess is

distinguishable from tax and is described as a fees. Tax recovered by public

authority invariably goes into the consolidated fund which ultimately is utilised for all

public purposes, whereas a cess levied by way of a fee is not intended to be, and

does not become, a part of the consolidated fund.

This judgment is usually read along with the dicta in State of WB v. Kesoram Industries Ltd.,

(2004) 10 SCC 201 to explain the concept of quid pro quo attributed to fees. The revenant

paragraph is extracted hereunder:

(Para 146) Depending on the context and purpose of levy, cess may not be

a tax; it may be a fee or fee as well. It is not necessary that the services rendered

from out of the fee collected should be directly in proportion with the amount of fee

collected. It is equally not necessary that the services rendered by the fee collected

should remain confined to the person from whom the fee has been collected.

Availability of indirect benefit and general nexus between the persons bearing

the burden of levy of fee and the services rendered out of the fee collected is

enough to uphold the validity of fee charged.

6. Therefore, the most important factor for a cess to be categorised as a fee, is

that there should be a beneficiary for the cess levied. In this case, there is no beneficiary

defined by the legislature. There is no provision or rule whereby anybody can be

benefited out of the impugned levy titled as Mangalya Nidhi Cess. All that Section 11(7) say

is that :

Section 11(7): The Government may, after due appropriation made by the

Legislature by law is this behalf, utilise such sums of money for the purposes

specified in the Mangalya Nidhi Scheme framed by the Government.

The impugned regime of Mangalya Nidhi Cess, as it stands today, provides only for

collection of fees and it has no provision, rule or mechanism for distributing the

benefits/services, for which it is allegedly enacted.

7. The non-compulsive axillary verb may used in Section 11(7) of the impugned

provision clarifies the fact that, levy is a tax indeed, and not a fees as sought to be

misrepresented by the respondent.

8. Besides, there is a complete mystery regarding the quantum of benefit

that is probable from the impugned cess. It prevents this court, as well as the petitioner,

from properly analysing the proportionality of impugned cess levied as fees.

9. In this juncture, it is relevant to state that the Finance Minister has made a

vague declaration in Ext. P4 that the money collected through the impugned levy would

be used to fund the marriages of brides hailing from poor families. Ext. P4 does not

have any statutory force. Hence, it cannot be the sole basis for collection of a cess, on a

subject which is prima facie outside the scope of legislative competence of the state.

10. Even if Ext. P4 declaration is given any statutory force in understanding the

real purpose behind the impugned levy and beneficial service intended thereby, even then

the impugned levy cannot be categorised as fee due to lack of apparent nexus between

the fee-payer and the proclaimed beneficiary.

11. In the impugned cess, the beneficiaries proclaimed as per Ext. P4 are girls from

economically weak families. The fee-payer is the person who is conducting a wedding with more

than 500 invitees, which is usually the father of the bride. There is no nexus between the two

characters involved in the cess. They are complete strangers. The cess event does not

connect the two characters involved in the cess. The cess-payer is not even remotely

benefited by the impugned cess or its avowed benefit.

12. Similarly, the authority vested with the duty to collect the impugned cess, is

the Commercial Tax Department. They usually remit the money collected to the

Consolidated Fund of the State. In the impugned cess regime, there is no legislative embargo

on the collection agency not to remit the cess into the consolidated fund or to keep the fund

separately for the benefit of the alleged beneficiary. In such circumstances, it cannot be said

that impugned cess is a fees.

13. A more disturbing factor about the impugned cess is the pure illegality of

the transaction, or what it stands for. Mangalya Nidhi Cess collects money from the

organiser of a wedding with more than 500 invitees, which is usually the father of the bride

and in lieu desires to finance the wedding of girls hailing from economically weak families.

This transaction, if rightly perceived, is the nature of the State demanding dowry

from the father of bride, and promoting dowry among weaker sections of the society.

14. Any fees levied on marriage, weather by State or family of the bridegroom,

would fall within the ambit of Dowry, which is prohibited under Dowry Prohibition Act,

1961. Section 2 of the 1961 Act reads:

Section 2 Definition of `dowry :- In this act, `dowry means any property or valuable

security given or agreed to be given either directly or indirectly-

(a) by one party to a marriage to the other party to the marriage; or

(b) by the parents of either party to a marriage or by any other person, to either

party to the marriage or to any other person;

at or before or any time after the marriage in connection with the marriage of said

parties but does not include dower or mahr in the case of persons to whom the

Muslim Personal Law (Shariat) applies.

Explanation II.-The expression `valuable security has the same meaning as in Sec.

30 of the Indian Penal Code (45 of 1860).

The impugned cess demanded as fees, would squarely fall within the definition of Dowry.

The cess/fee is basically money, which is a property. It is demanded by the State, in

connection with the marriage, from parents of either party to a marriage.

15. In Kerala, there used to be a despicable practice of conducting a sons

wedding to finance the marriage of the daughter. The impugned cess is one of similar nature.

Therefore, Section 11 of the Kerala Finance Act,2013 is repugnant to the Dowry Prohibition

Act and therefore void by operation of Art. 254(1) of the Constitution.

16. Hence, the contentions of the respondent in its counter affidavit are without

any substance or basis. The writ petition ought to be allowed and Section 11 of the Kerala

Finance Act,2013 has to be quashed as unconstitutional.

All the facts stated above are true to the best of my knowledge, information and belief.

Dated this the 13

th

day of July, 2014

Deponent

Solemnly affirm and signed before me by the deponent who is personally known to me on

this the 13

th

day of July, 2014 in my office at Ernakulam.

P. THOMAS GEEVERGHESE

Counsel for the Petitioner

BEFORE THE HONOURABLE

HIGH COURT OF KERALA, AT ERNAKULAM

I.A No. _________________ of 2014

in

W.P (C) No. 23476 of 2013

THULASIDHARAN PILLA & ANOTHER : PETITIONERS

V.

STATE OF KERALA : RESPONDENT

VERIFIED PETITION TO ACCEPT REPLY AFFIDAVIT,

filed under Rule 150 of the Kerala High Court Rules

I, P.Thomas Geeverghese, aged 29years, advocate, S/o P.T. Geeverghese, Vayaliparambil

House, Perumbavoor, do hereby solemnly affirm and state the following:

1. I am the counsel appearing for the petitioners. I know the facts of the case.

2. The respondent had filed a memo on 19.3.2014 to adopt counter affidavit filed in a

related case, onto this case.

3. The petitioner ought to have filed reply affidavit within 24days thereon. However,

there occurred a delay in filing the reply affidavit, owing to the unavailability of the

petitioners.

4. The petitioners have filed a reply affidavit today, which may be accepted onto the file

of the writ petition.

5. The delay occurred as aforesaid, is not due to any wilful laches or omission on the

part of the Petitioner. If the delay in filing the reply affidavit is not condoned,

petitioner will be put to irreparable loss and hardship

Hence, prayed that this Honble Court may be pleased to condone the delay in filing the

reply affidavit and accept the same onto the record.

Dated this the 14

th

day of July 2014.

P. Thomas Geeverghese

Counsel for the Petitioner

All the facts stated above are true.

P. Thomas Geeverghese

Counsel for the Petitioner

BEFORE THE HONOURABLE

HIGH COURT OF KERALA, AT ERNAKULAM

W.P (C) No. 23476 of 2013

THULASIDHARAN PILLA & ANOTHER : PETITIONERS

V.

STATE OF KERALA : RESPONDENT

INDEX

SL. NO. ITEM PAGE NO.

1 Reply Affidavit

2 Verified petition to accept reply affidavit

Dated this the 14

th

day of July 2014.

P. Thomas Geeverghese

Counsel for the Petitioner

BEFORE THE HONOURABLE

HIGH COURT OF KERALA, AT ERNAKULAM

W.P (C) No. 23476 of 2013

THULASIDHARAN PILLA & ANOTHER : PETITIONERS

V.

STATE OF KERALA : RESPONDENT

REPLY AFFIDAVIT FILED BY THE PETITIONERS

P. THOMAS GEEVERGHESE (T-293)

Room No.201, Mannanthara Building

Paramara Temple Road, Ernakulam

You might also like

- Interim Order in The Matter of Suncity Infracon Corporation India LimitedDocument12 pagesInterim Order in The Matter of Suncity Infracon Corporation India LimitedShyam SunderNo ratings yet

- Interim Order Cum Show Cause Notice in The Matter of Real Sunshine Corp LimitedDocument11 pagesInterim Order Cum Show Cause Notice in The Matter of Real Sunshine Corp LimitedShyam SunderNo ratings yet

- Interim Order in The Matter of Astha Techno Realty India LimitedDocument11 pagesInterim Order in The Matter of Astha Techno Realty India LimitedShyam SunderNo ratings yet

- Interim Order in The Matter of Newland Agro Industries LimitedDocument11 pagesInterim Order in The Matter of Newland Agro Industries LimitedShyam SunderNo ratings yet

- PC Joshi & Others v. Union of India & OthersDocument75 pagesPC Joshi & Others v. Union of India & OthersBar & BenchNo ratings yet

- 54F NewDocument7 pages54F Newswap57770No ratings yet

- Andhra Pradesh (Telangana Area) Money Lenders Act, 1349Document43 pagesAndhra Pradesh (Telangana Area) Money Lenders Act, 1349bharatheeeyuduNo ratings yet

- Cholamandalam Vs SARANJEET SINGH SODhi (Noida)Document11 pagesCholamandalam Vs SARANJEET SINGH SODhi (Noida)jitendra singhNo ratings yet

- Taxation of Charitable TrustDocument39 pagesTaxation of Charitable TrustsubhashcvNo ratings yet

- Sky Light Hospitality LLP V Assistant Commissioner of Income Tax, New DelhiDocument9 pagesSky Light Hospitality LLP V Assistant Commissioner of Income Tax, New DelhiRaghav NaiduNo ratings yet

- Interim Order in The Matter of Greenbang Agro LimitedDocument14 pagesInterim Order in The Matter of Greenbang Agro LimitedShyam SunderNo ratings yet

- Interim Order in The Matter of Infocare Infra LimitedDocument14 pagesInterim Order in The Matter of Infocare Infra LimitedShyam SunderNo ratings yet

- 7_SCOB_HCD_13Document8 pages7_SCOB_HCD_1379 Shaima MahamudNo ratings yet

- Ranjana Singh Vs Commissioner of State Tax Allahabad High CourtDocument12 pagesRanjana Singh Vs Commissioner of State Tax Allahabad High Courtkumarhealthcare2000No ratings yet

- Interim Order in The Matter of Everlight Realcon Infrastructure LimitedDocument13 pagesInterim Order in The Matter of Everlight Realcon Infrastructure LimitedShyam SunderNo ratings yet

- K. N. Food Industries Pvt. Ltd. Vs The Commissioner of CGST Central Excise CESTAT AllahabadDocument4 pagesK. N. Food Industries Pvt. Ltd. Vs The Commissioner of CGST Central Excise CESTAT AllahabadKaranNo ratings yet

- Bank Pension Trust CaseDocument5 pagesBank Pension Trust CaseRaj ChouhanNo ratings yet

- AsdDocument13 pagesAsdhearthacker_302No ratings yet

- 1992 SCMR 891 (Double Taxation)Document18 pages1992 SCMR 891 (Double Taxation)Anum ZaheerNo ratings yet

- Model IU AgreementDocument13 pagesModel IU AgreementShashi Ranjan KumarNo ratings yet

- Interim Order in The Matter of Micro Leasing and Funding LimitedDocument12 pagesInterim Order in The Matter of Micro Leasing and Funding LimitedShyam SunderNo ratings yet

- Muthoot Finance NCD Application Form Mar 2012Document8 pagesMuthoot Finance NCD Application Form Mar 2012Prajna CapitalNo ratings yet

- Legal NoticeDocument6 pagesLegal NoticejkdbsdNo ratings yet

- Interim Order in The Matter of Nava Diganta Capital Services LimitedDocument14 pagesInterim Order in The Matter of Nava Diganta Capital Services LimitedShyam SunderNo ratings yet

- Dated This The 2 Day of November 2016 Present The Hon'Ble MR - Justice Jayant Patel AND The Hon'Ble MR - Justice Aravind KumarDocument32 pagesDated This The 2 Day of November 2016 Present The Hon'Ble MR - Justice Jayant Patel AND The Hon'Ble MR - Justice Aravind KumarKinjal KeyaNo ratings yet

- Legal notice regarding delayed possessionDocument6 pagesLegal notice regarding delayed possessionUmair Ahmed Andrabi100% (1)

- Sarfaesi ActDocument40 pagesSarfaesi ActLive Law100% (2)

- Interim Order in The Matter of Eris Energy LimitedDocument15 pagesInterim Order in The Matter of Eris Energy LimitedShyam SunderNo ratings yet

- Interim Order in The Matter of Bishal Distillers LimitedDocument12 pagesInterim Order in The Matter of Bishal Distillers LimitedShyam SunderNo ratings yet

- Introduction To Trust AccountsDocument8 pagesIntroduction To Trust AccountsTakudzwa Larry G Chiwanza100% (1)

- Dr. Shakuntala Misra National Rehabilitation University, LucknowDocument6 pagesDr. Shakuntala Misra National Rehabilitation University, LucknowPRAWARTIKA SINGHNo ratings yet

- Muthoot Finance NCD Application Form Dec 2011 - Jan 2012Document8 pagesMuthoot Finance NCD Application Form Dec 2011 - Jan 2012Prajna CapitalNo ratings yet

- ITAT Holds That Charitable Trust Running Max Hospital Was Charitable To Only To Corporate Max Group of Companies and Uncharitable' Towards The Society or PublicDocument46 pagesITAT Holds That Charitable Trust Running Max Hospital Was Charitable To Only To Corporate Max Group of Companies and Uncharitable' Towards The Society or PublicLive LawNo ratings yet

- Interim Order - Vikdas Industries LimitedDocument15 pagesInterim Order - Vikdas Industries LimitedShyam SunderNo ratings yet

- Interim Order Cum Show Cause Notice in The Matter of Bhabiswajyoti Infrastructure India LimitedDocument16 pagesInterim Order Cum Show Cause Notice in The Matter of Bhabiswajyoti Infrastructure India LimitedShyam SunderNo ratings yet

- Mpkby FormsDocument8 pagesMpkby FormsmrinankadharlillyNo ratings yet

- Andhra Pradesh Money Lenders Act, 2000Document29 pagesAndhra Pradesh Money Lenders Act, 2000talktoravi8911No ratings yet

- Interim Order - Cell Industries LimitedDocument16 pagesInterim Order - Cell Industries LimitedShyam SunderNo ratings yet

- Interim Order in The Matter of Goldmine Industries LimitedDocument14 pagesInterim Order in The Matter of Goldmine Industries LimitedShyam SunderNo ratings yet

- Malabar Goldmines (P) LTD Vs CTODocument6 pagesMalabar Goldmines (P) LTD Vs CTOvrinda_aghi4115No ratings yet

- EDITED-FORM CA of Priti GeraDocument15 pagesEDITED-FORM CA of Priti GeraAmbience LegalNo ratings yet

- REC TAx Free Bond Application FormDocument8 pagesREC TAx Free Bond Application FormPrajna CapitalNo ratings yet

- 15 K 1 - ATS With NominationDocument77 pages15 K 1 - ATS With NominationLegal OfficerNo ratings yet

- POEA CasesDocument33 pagesPOEA CasesEvan Michael ClerigoNo ratings yet

- High Court upholds stamp duty on security deposit in lease renewalDocument18 pagesHigh Court upholds stamp duty on security deposit in lease renewalJAGDISH GIANCHANDANINo ratings yet

- Labour Law Thailand English VersionDocument24 pagesLabour Law Thailand English VersionDavid LeoNo ratings yet

- (Agogue) - E Auction (Phy Possession) - SALE NOTICE PUBLICATION DRAFTDocument3 pages(Agogue) - E Auction (Phy Possession) - SALE NOTICE PUBLICATION DRAFTSaurabh KapurNo ratings yet

- CasesDocument139 pagesCasesSpidermanNo ratings yet

- ESSO STANDARD EASTERN, INC., (Formerly: Standard-Vacuum Refining Corp. (Phil.), Respondent G.R. No. 186400 October 20, 2010Document8 pagesESSO STANDARD EASTERN, INC., (Formerly: Standard-Vacuum Refining Corp. (Phil.), Respondent G.R. No. 186400 October 20, 2010vj hernandezNo ratings yet

- Order in The Matter of M/s Weird Infrastructure Corporation Ltd.Document14 pagesOrder in The Matter of M/s Weird Infrastructure Corporation Ltd.Shyam SunderNo ratings yet

- PITC vs. COA G.R. No. 183517 June 22, 2010Document9 pagesPITC vs. COA G.R. No. 183517 June 22, 2010Cherry CarlosNo ratings yet

- Interim Order in The Matter of Sankalp Projects LimitedDocument14 pagesInterim Order in The Matter of Sankalp Projects LimitedShyam SunderNo ratings yet

- Interim Order Against Ravi Kiran Realty India Limited.Document12 pagesInterim Order Against Ravi Kiran Realty India Limited.Shyam SunderNo ratings yet

- Office of The Commissioner, Central Excise & Service Tax, 38, M.G. Marg, Civil Lines, Allahabad-211001Document5 pagesOffice of The Commissioner, Central Excise & Service Tax, 38, M.G. Marg, Civil Lines, Allahabad-211001jitendraktNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- Simple Guide for Drafting of Civil Suits in IndiaFrom EverandSimple Guide for Drafting of Civil Suits in IndiaRating: 4.5 out of 5 stars4.5/5 (4)

- Bar Review Companion: Labor Laws and Social Legislation: Anvil Law Books Series, #3From EverandBar Review Companion: Labor Laws and Social Legislation: Anvil Law Books Series, #3No ratings yet

- Publiic Notice - 20210902 - 0001Document2 pagesPubliic Notice - 20210902 - 0001P. Thomas GeevergheseNo ratings yet

- Cemetery OrdinanceDocument3 pagesCemetery OrdinanceP. Thomas GeevergheseNo ratings yet

- Notification of Sidco Ettumanoor Industrial EstateDocument6 pagesNotification of Sidco Ettumanoor Industrial EstateP. Thomas GeevergheseNo ratings yet

- Judgment AuditoriumDocument4 pagesJudgment AuditoriumP. Thomas GeevergheseNo ratings yet

- Change of Date of Birth NotificationDocument3 pagesChange of Date of Birth NotificationP. Thomas GeevergheseNo ratings yet

- 1934 MOS ConstitutionDocument32 pages1934 MOS ConstitutionP. Thomas GeevergheseNo ratings yet

- New Doc 2018-08-14Document18 pagesNew Doc 2018-08-14P. Thomas Geeverghese100% (1)

- New Doc 2017-07-10 - 2Document2 pagesNew Doc 2017-07-10 - 2P. Thomas Geeverghese50% (2)

- Kerala School RecoginitionDocument27 pagesKerala School RecoginitionP. Thomas Geeverghese100% (2)

- Retirement Speech of Justice B Kamal PashaDocument11 pagesRetirement Speech of Justice B Kamal PashaP. Thomas GeevergheseNo ratings yet

- Air 1929 PC 110Document3 pagesAir 1929 PC 110P. Thomas GeevergheseNo ratings yet

- Kerala Maternity Benefit RulesDocument17 pagesKerala Maternity Benefit RulesP. Thomas GeevergheseNo ratings yet

- Travancore Wrecks Regulation, Regulation 1 of 1108Document6 pagesTravancore Wrecks Regulation, Regulation 1 of 1108P. Thomas GeevergheseNo ratings yet

- Mangalya Nidhi Cess JudgmentDocument31 pagesMangalya Nidhi Cess JudgmentP. Thomas GeevergheseNo ratings yet

- AIR 1923 Cal 200Document3 pagesAIR 1923 Cal 200P. Thomas GeevergheseNo ratings yet

- Minimum Wages Beedi WorkersDocument3 pagesMinimum Wages Beedi WorkersP. Thomas GeevergheseNo ratings yet

- Property TaxDocument4 pagesProperty TaxP. Thomas GeevergheseNo ratings yet

- Government Order Constituting Church CourtDocument1 pageGovernment Order Constituting Church CourtP. Thomas GeevergheseNo ratings yet

- VakalathDocument3 pagesVakalathP. Thomas Geeverghese0% (1)

- Jurisiction of Green TribunalDocument8 pagesJurisiction of Green TribunalP. Thomas GeevergheseNo ratings yet

- Case Against Aviva Life Insurance India Ltd.Document7 pagesCase Against Aviva Life Insurance India Ltd.P. Thomas GeevergheseNo ratings yet

- Minimum WagesDocument11 pagesMinimum WagesP. Thomas Geeverghese100% (1)

- Minimum Wages Beedi WorkersDocument3 pagesMinimum Wages Beedi WorkersP. Thomas GeevergheseNo ratings yet

- 141.protesting BIR Assessments - dds.04.29.2010Document2 pages141.protesting BIR Assessments - dds.04.29.2010Arnold ApduaNo ratings yet

- December 2022 salary slipDocument1 pageDecember 2022 salary slipGanesh SumaNo ratings yet

- City of Fort Lauderdale Police and Fire Retierment Plan 2009 Summary Plan Description.Document24 pagesCity of Fort Lauderdale Police and Fire Retierment Plan 2009 Summary Plan Description.Ken RudominerNo ratings yet

- May June 2020 FullDocument75 pagesMay June 2020 FullArif TusherNo ratings yet

- The Economics of The Informal SectorDocument16 pagesThe Economics of The Informal SectorAlexander Mori EslavaNo ratings yet

- DeGolyer & MacNaughton Reserve Report For Polvo FieldDocument47 pagesDeGolyer & MacNaughton Reserve Report For Polvo FieldStan HollandNo ratings yet

- 04 Teaching Material 2Document5 pages04 Teaching Material 2ShanNo ratings yet

- Externality Analysis in EconomicsDocument17 pagesExternality Analysis in EconomicsVaibhav GmailNo ratings yet

- PRF192 Workshop 01 SolutionsDocument7 pagesPRF192 Workshop 01 SolutionsLê Hồng PhướcNo ratings yet

- 2021 S C M R 437Document3 pages2021 S C M R 437Yahia MustafaNo ratings yet

- Q3-Humss-Whlp-Week 7Document4 pagesQ3-Humss-Whlp-Week 7Cade EscobarNo ratings yet

- Investigation 2024 GR 12Document6 pagesInvestigation 2024 GR 12koekoeorefileNo ratings yet

- Unshakeable Tony Robbins PDFDocument5 pagesUnshakeable Tony Robbins PDFRizaldy D ValienteNo ratings yet

- COC at LEVEL-4Document53 pagesCOC at LEVEL-4RoNo ratings yet

- The FIRPTA Investment Guide: For Foreign Investments in Certain US Oil and Gas AssetsDocument16 pagesThe FIRPTA Investment Guide: For Foreign Investments in Certain US Oil and Gas AssetsEugene FrancoNo ratings yet

- Collection of HC and SC DecisionsDocument63 pagesCollection of HC and SC DecisionsDayavantiNo ratings yet

- Mpa 111 Asg 1 CH 1 (Gp7 Mpa - NPT)Document9 pagesMpa 111 Asg 1 CH 1 (Gp7 Mpa - NPT)MPA-NPT-5 AungZawWinNo ratings yet

- Implementing Value Capture in Latin AmericaDocument72 pagesImplementing Value Capture in Latin AmericaLincoln Institute of Land PolicyNo ratings yet

- Kenya's Legal Framework for Local Ag ProductionDocument13 pagesKenya's Legal Framework for Local Ag ProductionRodney AmenyaNo ratings yet

- DocumentDocument2 pagesDocumentBIRANCHI NARAYAN KHUNTIANo ratings yet

- ST ND RD THDocument20 pagesST ND RD THMath MarianoNo ratings yet

- Econ TaxDocument28 pagesEcon TaxAllyana Marie AlcantaraNo ratings yet

- Cash Flow and Financial Planning Class ExerciseDocument2 pagesCash Flow and Financial Planning Class ExerciseCANo ratings yet

- Artifact 1 Superannuation Settlement FormDocument7 pagesArtifact 1 Superannuation Settlement FormLini SinhaNo ratings yet

- MWSSDocument27 pagesMWSSMary Rocelyn PabalayNo ratings yet

- Latihan 1Document25 pagesLatihan 1Sanda Patrisia KomalasariNo ratings yet

- Punjab Police Performance DataDocument16 pagesPunjab Police Performance DataKhurram PervaizNo ratings yet

- Lidasan v. COMELEC: Rider Clause: Every Bill Passed by The Congress Shall Embrace OnlyDocument4 pagesLidasan v. COMELEC: Rider Clause: Every Bill Passed by The Congress Shall Embrace Onlyangelo doceoNo ratings yet

- Political Economy Under MarcosDocument8 pagesPolitical Economy Under Marcosxpthatsme100% (1)

- SPS-Avelino-v.-Celedonio 2Document7 pagesSPS-Avelino-v.-Celedonio 2Jorge M. GarciaNo ratings yet