Professional Documents

Culture Documents

ACCT311 Chapter 4 Solutions

Uploaded by

SThomas0708840 ratings0% found this document useful (0 votes)

491 views10 pagesSelected Solutions for Intermediate Accounting

Original Title

Chapter 4

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSelected Solutions for Intermediate Accounting

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

491 views10 pagesACCT311 Chapter 4 Solutions

Uploaded by

SThomas070884Selected Solutions for Intermediate Accounting

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 10

ACCT311 Chapter 4 Selected Solutions Page 1 of 10

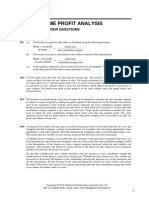

EXERCISE 4-4 (30-35 minutes)

(a) Multiple-Step Form

P. Bride Company

Income Statement

For the Year Ended December 31, 2004

(In thousands, except earnings per share)

Sales $96,500

Cost of goods sold 60,570

Gross proft 35,930

Operating Expenses

Selling expenses

Sales commissions 7,980

Depr. of sales equipment 6,480

Transportation-out 2,690 17,150

Administrative expenses

Ofcers salaries 4,900

Depr. of ofce furn. and equip. 3,960 8,860 26,010

Income from operations 9,920

Other Revenues and Gains

Rental revenue 17,230

27,150

Other Expenses and Losses

Interest expense 1,860

Income before taxes 25,290

Income taxes 9,070

Net income $16,220

ACCT311 Chapter 4 Selected Solutions Page 2 of 10

Earnings per share ($16,220 40,550) $.40

ACCT311 Chapter 4 Selected Solutions Page 3 of 10

EXERCISE 4-4 (Continued)

(b) Single-Step Form

P. Bride Company

Income Statement

For the Year Ended December 31, 2004

(In thousands, except earnings per share)

Revenues

Net sales $ 96,500

Rental revenue 17,230

Total revenues 113,730

Expenses

Cost of goods sold 60,570

Selling expenses 17,150

Administrative expenses 8,860

Interest expense 1,860

Total expenses 88,440

Income before taxes 25,290

Income taxes 9,070

Net income $ 16,220

Earnings per share $.40

(c) Single-step:

1. Simplicity and conciseness.

2. Probably better understood by user.

3. Emphasis on total costs and expenses and net

income.

4. Does not imply priority of one expense over another.

ACCT311 Chapter 4 Selected Solutions Page 4 of 10

Multiple-step:

1. Provides more information through segregation of

operating and nonoperating items.

2. Expenses are matched with related revenue.

ACCT311 Chapter 4 Selected Solutions Page 5 of 10

Exercise 4-8

(a) Ivan Calderon Corp.

Income Statement

For the Year Ended December 31, 2004

Sales Revenue

Net sales $1,300,000

Cost of goods sold 780,000

Gross proft 520,000

Operating Expenses

Selling expenses $65,000

Administrative expenses 48,000 113,000

Income from operations 407,000

Other Revenues and Gains

Dividend revenue 20,000

Interest revenue 7,000 27,000

434,000

Other Expenses and Losses

Write-of of inventory due to obsolescence 80,000

Income before taxes and extraordinary item 354,000

Income taxes 120,360

Income before extraordinary item 233,640

Extraordinary item

Casualty loss 50,000

Less applicable tax reduction 17,000 33,000

Net income $ 200,640

Per share of common stock:

Income before extraordinary item ($233,640 60,000) $3.89

Extraordinary item (net of tax) (.55)

Net income ($200,640 60,000) $3.34

ACCT311 Chapter 4 Selected Solutions Page 6 of 10

EXERCISE 4-8 (Continued)

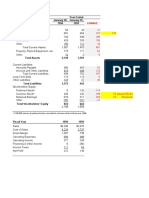

(b) Ivan Calderon Corp.

Retained Earnings Statement

For the Year Ended December 31, 2004

Balance, Jan. 1, as reported $ 980,000

Correction for overstatement of net income in prior period

(depreciation error) (net of $18,700 tax) (36,300)

Balance, Jan. 1, as adjusted 943,700

Add: Net income 200,640

1,144,340

Less: Dividends declared 45,000

Balance, Dec. 31 $1,099,340

ACCT311 Chapter 4 Selected Solutions Page 7 of 10

EXERCISE 4-13 (15-20 minutes)

(a)Depreciation expense for 2004

$450,000 $30,000

=$70,000

6 years

(b)Year DDB Method SL Method Diference

2002 $150,000 $70,000 $

80,000

2003 100,000 70,000

30,000

Total $250,000 $140,000 $

110,000

Income taxes

38,500

Cumulative efect, net of tax $

71,500

ACCT311 Chapter 4 Selected Solutions Page 8 of 10

EXERCISE 4-14 (15-20 minutes)

Roxanne Carter Corporation

Income Statement and Statement of Comprehensive Income

For the Year Ended December 31, 2004

Sales $1,200,000

Cost of goods sold 750,000

Gross proft 450,000

Selling and administrative expenses 320,000

Net income $ 130,000

Net income $ 130,000

Unrealized holding gain 18,000

Comprehensive income $ 148,000

ACCT311 Chapter 4 Selected Solutions Page of 10

PROBLEM 4-3

Tony Rich Inc.

Income Statement (Partial)

For the Year Ended December 31, 2004

Income from continuing operations before taxes $798,500*

Income taxes 220,350**

Income from continuing operations: 578,150

Discontinued operations:

Loss from disposal of recreational division $115,000

Less applicable income tax reduction 34,500 80,500

Income before extraordinary item and cumulative

efect of a change in accounting principle 497,650

Extraordinary item:

Major casualty loss 80,000

Less applicable income tax reduction 36,800 43,200

Cumulative efect on prior years of retroactive

application of new inventory method 40,000

Less applicable income taxes 16,000 24,000

Net income $478,450

Per share of common stock:

Income from continuing operations $7.23

Discontinued operations, net of tax (1.01)

Income before extraordinary items and

cumulative efect of accounting change 6.22

Extraordinary item, net of tax (.54)

Change in accounting principle, net of tax .30

Net income ($478,450 80,000) $5.98

ACCT311 Chapter 4 Selected Solutions Page 10 of 10

PROBLEM 4-3 (Continued)

*Computation of income from cont. operations before taxes:

As previously stated $790,000

Loss on sale of securities (57,000)

Gain on proceeds of life insurance

policy ($110,000 $46,000) 64,000

Error in computation of depreciation

As computed ($54,000 6) $9,000

Corrected ($54,000 $9,000) 6 (7,500) 1,500

As restated $798,500

**Computation of income tax:

Income from continuing operations before taxes $798,500

Nontaxable income (gain on life insurance) (64,000)

Taxable income 734,500

Tax rate X .30

Income tax expense $220,350

You might also like

- FCF 9th Edition Chapter 02Document45 pagesFCF 9th Edition Chapter 02Omer FareedNo ratings yet

- Chapter 4 SolutionsDocument12 pagesChapter 4 SolutionsSoshiNo ratings yet

- Using Excel For Business AnalysisDocument5 pagesUsing Excel For Business Analysis11armiNo ratings yet

- Test 2 HomeworkDocument12 pagesTest 2 HomeworkMiguel CortezNo ratings yet

- ACCT550 Homework Week 2Document5 pagesACCT550 Homework Week 2Natasha Declan100% (2)

- Multiple Step Income StatementDocument1 pageMultiple Step Income StatementstingsscorpioNo ratings yet

- Week 2 Homework (Chap. 4) - PostedDocument4 pagesWeek 2 Homework (Chap. 4) - PostedMs. Nina100% (5)

- Transaction Analysis and Preparation of Statements Practice Problem SolutionDocument6 pagesTransaction Analysis and Preparation of Statements Practice Problem SolutionAshish BhallaNo ratings yet

- Multi-Step Income Statement: Key Terms and Concepts To KnowDocument5 pagesMulti-Step Income Statement: Key Terms and Concepts To KnowĐức NguyễnNo ratings yet

- FCF 12th Edition Chapter 02Document32 pagesFCF 12th Edition Chapter 02David ChungNo ratings yet

- HorngrenIMA14eSM ch05Document65 pagesHorngrenIMA14eSM ch05manunited83100% (1)

- Equity Method Workpaper Entries and Consolidated Financial Statements for Porter Company and SubsidiaryDocument8 pagesEquity Method Workpaper Entries and Consolidated Financial Statements for Porter Company and SubsidiaryIndra PramanaNo ratings yet

- CMA Part2 EssaysDocument128 pagesCMA Part2 EssaysSandeep Sawan100% (1)

- ACC 401 Homework CH 4Document4 pagesACC 401 Homework CH 4leelee03020% (1)

- Excel Sheet For Horizontal AnalysisDocument2 pagesExcel Sheet For Horizontal AnalysisRahim RajaniNo ratings yet

- ACCT550 Week 2 Practice Question SolutionsDocument9 pagesACCT550 Week 2 Practice Question Solutionshy_saingheng_7602609No ratings yet

- Exercises On Cash Flow StatementsDocument3 pagesExercises On Cash Flow StatementsSam ChinthaNo ratings yet

- Quiz 2 Statement of Comprehensive Income Cash Vs Accrual BasisDocument11 pagesQuiz 2 Statement of Comprehensive Income Cash Vs Accrual BasisHaidee Flavier SabidoNo ratings yet

- CH 5 HWDocument8 pagesCH 5 HWCha Chi BossNo ratings yet

- CH 01 Review and Discussion Problems SolutionsDocument11 pagesCH 01 Review and Discussion Problems SolutionsArman BeiramiNo ratings yet

- IAS 12: Practice Questions AnswersDocument8 pagesIAS 12: Practice Questions AnswersTaffy Isheanesu BgoniNo ratings yet

- Chapter 3 Problems 1-30 Input and Output BoxesDocument24 pagesChapter 3 Problems 1-30 Input and Output BoxesSultan_Alali_9279No ratings yet

- BE4-1. The Adjusted Trial Balance of Pacific Scientific Corporation OnDocument10 pagesBE4-1. The Adjusted Trial Balance of Pacific Scientific Corporation OnNguyễn Linh NhiNo ratings yet

- CH 04Document8 pagesCH 04ashibhallauNo ratings yet

- Solman EquityDocument12 pagesSolman EquityBrunxAlabastroNo ratings yet

- Case Study Accounting Oart2Document5 pagesCase Study Accounting Oart2Vero MinaNo ratings yet

- Audited Financial Statements of Salve CompanyDocument28 pagesAudited Financial Statements of Salve CompanybarbieNo ratings yet

- CFA Lecture 4 Examples Suggested SolutionsDocument22 pagesCFA Lecture 4 Examples Suggested SolutionsSharul Islam100% (1)

- FCF 9th Edition Chapter 04Document39 pagesFCF 9th Edition Chapter 04Nitish PokhrelNo ratings yet

- MonteBianco-Solution - With Comments and AlternativesDocument27 pagesMonteBianco-Solution - With Comments and AlternativesGiudittaBiancaLuràNo ratings yet

- Multi-Step Income Statement - CRDocument16 pagesMulti-Step Income Statement - CRVivian BastoNo ratings yet

- Book Solutions Ch2 To Ch11Document45 pagesBook Solutions Ch2 To Ch11FayzanAhmedKhanNo ratings yet

- FINANCIAL PLANNING AND CONTROLDocument1 pageFINANCIAL PLANNING AND CONTROLpotatomatogNo ratings yet

- Intermediate Accounting - Chapter 4 Spreadsheet Answer - KiesoDocument55 pagesIntermediate Accounting - Chapter 4 Spreadsheet Answer - KiesodNo ratings yet

- Financial Reporting & Analysis Solutions Statement of Cash Flows ExercisesDocument72 pagesFinancial Reporting & Analysis Solutions Statement of Cash Flows ExerciseskazimkorogluNo ratings yet

- FCF 9th Edition Chapter 04Document43 pagesFCF 9th Edition Chapter 04tarekffNo ratings yet

- Answers FAR - CASE ANALYSISDocument4 pagesAnswers FAR - CASE ANALYSISJaquelyn ClataNo ratings yet

- ABC Company comparative balance sheet and income statement analysisDocument6 pagesABC Company comparative balance sheet and income statement analysisruruNo ratings yet

- Net Income 1716 1980 2178Document6 pagesNet Income 1716 1980 2178Hiếu Nguyễn Minh HoàngNo ratings yet

- Parmalee Publications FinancialsDocument4 pagesParmalee Publications FinancialsBach CaoNo ratings yet

- Acctg 115 - CH 12 SolutionsDocument45 pagesAcctg 115 - CH 12 SolutionsMark Adel FaridNo ratings yet

- Master Budget Assignment CH 9Document4 pagesMaster Budget Assignment CH 9api-240741436No ratings yet

- Update: Intermediate Accounting 15EDocument10 pagesUpdate: Intermediate Accounting 15ENarissa Mae QuijanoNo ratings yet

- Brokaw Corp financial statements 2010Document1 pageBrokaw Corp financial statements 2010Asma HatamNo ratings yet

- CH 8 Answers 2008Document5 pagesCH 8 Answers 2008ergiesonaNo ratings yet

- Income Statement: Dec 31, 2009 Dec 31, 2008 Dec 31, 2007 Total Revenue 796,800 1,042,800 1,112,900Document2 pagesIncome Statement: Dec 31, 2009 Dec 31, 2008 Dec 31, 2007 Total Revenue 796,800 1,042,800 1,112,900Salman RahiNo ratings yet

- ABC CompanyDocument7 pagesABC CompanyLouise Kyla CabreraNo ratings yet

- Comprehensive Income Statement AnalysisDocument29 pagesComprehensive Income Statement AnalysisAlphan SofyanNo ratings yet

- Marking Scheme: Section ADocument8 pagesMarking Scheme: Section Aaegean123No ratings yet

- Slo 02 Acc230 08 TestDocument5 pagesSlo 02 Acc230 08 TestSammy Ben MenahemNo ratings yet

- Parnevik Corp Income Statement 2010Document4 pagesParnevik Corp Income Statement 2010Florentina AndreNo ratings yet

- Sound Recording Studio Revenues World Summary: Market Values & Financials by CountryFrom EverandSound Recording Studio Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Technical & Trade School Revenues World Summary: Market Values & Financials by CountryFrom EverandTechnical & Trade School Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Soap & Cleaning Compounds World Summary: Market Values & Financials by CountryFrom EverandSoap & Cleaning Compounds World Summary: Market Values & Financials by CountryNo ratings yet

- Accountants' Handbook, Special Industries and Special TopicsFrom EverandAccountants' Handbook, Special Industries and Special TopicsNo ratings yet

- Copy of Broiler FinancialsDocument5 pagesCopy of Broiler Financialskevior2No ratings yet

- (Critical Theory and Contemporary Society) Heiko Feldner, Fabio Vighi, Darrow Schecter-Critical Theory and The Crisis of Contemporary Capitalism-Bloomsbury Academic (2015)Document161 pages(Critical Theory and Contemporary Society) Heiko Feldner, Fabio Vighi, Darrow Schecter-Critical Theory and The Crisis of Contemporary Capitalism-Bloomsbury Academic (2015)duarteclaudioNo ratings yet

- AccountingDocument414 pagesAccountingMuddasir HussainNo ratings yet

- Republic V Bacolod-Murcia Milling Co Inc DigestDocument3 pagesRepublic V Bacolod-Murcia Milling Co Inc Digestcmcsayson100% (2)

- (Notes) FAR Summary (NICE)Document48 pages(Notes) FAR Summary (NICE)Anne Echavez PascoNo ratings yet

- Why Business FailDocument25 pagesWhy Business Failstevo677No ratings yet

- Memorandum Finance Act 2010Document11 pagesMemorandum Finance Act 2010sarmastNo ratings yet

- Langfield-Smith7e IRM Ch18Document45 pagesLangfield-Smith7e IRM Ch18Rujun Wu100% (3)

- CA IPCC Accounts Group I Nov 14 Guideline Answers 08.11.2014Document16 pagesCA IPCC Accounts Group I Nov 14 Guideline Answers 08.11.2014anupNo ratings yet

- Jomo Kenyatta University Strategic ManagementDocument12 pagesJomo Kenyatta University Strategic ManagementRedemptah Mutheu Mutua100% (1)

- Solved Problems in Engineering Economics: CLSU-AE Board Exam Review Materials 1Document49 pagesSolved Problems in Engineering Economics: CLSU-AE Board Exam Review Materials 1Abas Acmad50% (2)

- Dell Case AnswersDocument13 pagesDell Case AnswersMine SayracNo ratings yet

- Industry Report For AUTO MFRS FOREIGNDocument10 pagesIndustry Report For AUTO MFRS FOREIGNPrimož KozlevčarNo ratings yet

- Kavita 2Document2 pagesKavita 2api-3721187No ratings yet

- Oil & Gas Investment BankingDocument9 pagesOil & Gas Investment BankingCanberk DayanNo ratings yet

- Bir Forms: A Final Project in Tax 1 - Income TaxationDocument2 pagesBir Forms: A Final Project in Tax 1 - Income TaxationgracilleNo ratings yet

- Plain Coon To A TycoonDocument58 pagesPlain Coon To A Tycoonsbrown7554No ratings yet

- Dipped Products Annual Report AnalysisDocument106 pagesDipped Products Annual Report AnalysisNimesh GunasekeraNo ratings yet

- Estate Tax Deductions and ExclusionsDocument18 pagesEstate Tax Deductions and ExclusionsLindbergh Sy67% (3)

- Types Of Preference Shares ExplainedDocument2 pagesTypes Of Preference Shares ExplainedpurnendupatraNo ratings yet

- Baumol's Sales or Revenue Maximisation Theory: Assumptions, Explanation and CriticismsDocument9 pagesBaumol's Sales or Revenue Maximisation Theory: Assumptions, Explanation and CriticismsndmudhosiNo ratings yet

- Financial FunctionsDocument7 pagesFinancial FunctionsRavi Kumar KamparaNo ratings yet

- Investment Appraisal TechniquesDocument4 pagesInvestment Appraisal TechniquesSarfraz KhalilNo ratings yet

- CH 5 - AdjustmentsDocument24 pagesCH 5 - Adjustmentsmuhamad elmiNo ratings yet

- PRTC MAS 2017 May Preboards W Ans Key 140 PDFDocument16 pagesPRTC MAS 2017 May Preboards W Ans Key 140 PDFNah HamzaNo ratings yet

- Basic Financial StatementsDocument44 pagesBasic Financial Statementsfikru terfaNo ratings yet

- Final Reviewer GovaccDocument7 pagesFinal Reviewer GovaccShane TorrieNo ratings yet

- Accounting and Financial Statement Analysis Notes PDFDocument58 pagesAccounting and Financial Statement Analysis Notes PDFyadgar ahmedNo ratings yet

- Presentation (Company Update)Document16 pagesPresentation (Company Update)Shyam SunderNo ratings yet

- 3M PhilippinesDocument2 pages3M PhilippinesKarl Vincent Raso100% (1)