Professional Documents

Culture Documents

Advanced Operation Management: Name: Amar Verma Roll: 13P119 American Lighting Products

Uploaded by

Archit AroraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advanced Operation Management: Name: Amar Verma Roll: 13P119 American Lighting Products

Uploaded by

Archit AroraCopyright:

Available Formats

Advanced

Operation

Management

Name: Amar Verma

Roll: 13P119

AMERICAN LIGHTING

PRODUCTS

Problem Overview

American Lighting

Products is a manufacturer and distributor of fluorescent lamps and manages it through three

channel Commercial and Industrial (C&I), Consumer and Original Equipment. Top

management wants to reduce the inventory level while maintaining same level of customer

service. Sue Smith and Bryan White have been asked to eliminate 20 percent of the finished

goods inventory. The plan is to reduce the number of stocking locations so as to reduce the total

inventory level. However this will also result in increased transportation cost and time.

Answers to Questions

(1) Evaluate the companys current inventory management procedures.

The company uses some reorder point control for system inventory where the average system

inventory for the product is NSO+1/2. It is also some time modified according to the seasonal

variations and trade promotion activity. However it is not mentioned explicitly how the reorder

point is established. It is not based on the economic order quantity as there is a fixed lot size

produced which is different from the Economic order quantity value.

We have plotted the throughput (i.e. demand) v/s Inventory level with the help of Table 1. We

find using regression technique that the line which is closest to the point has equation of

y=.139x67.89. Now the slope in this case is .139 which is much different from .5 evident in

the equation for economic order quantity.

The inventory curve is I = 2997TP

0.816

with r = 0.816, where I and TP are in lamps. The

projected inventory reduction can be calculated by using this formula.

From the plot of the inventory data, we can see that there is substantial variation about the

fitted inventory curve. There is not a consistent turnover ratio between the warehouses. This

probably results from the centralized control policy. On the other hand, improved control may

be achieved by using a pull procedure at each MDC.

(2) Should establishing the LOC be pursued?

Let us evaluate the idea of consolidating all consumer product line items into one larger order

centre (LOC). From table 2 we get that total consumer demand is 312,211 line items which is

33.4 percent of the total line items.

We assume that same percentage applies to the total demand. Hence, Consumer demand is

33.4%169,023,000 = 56,453,682 lamps.

From the inventory-throughput curve, we estimate the amount of inventory needed at the single

LOC is I = 2.997(56,453,682)

0.816

= 6,339,684 lamps. Since Consumer products account for

33.4% of total inventory, then there are 33.4%23,093,500 = 7,713,229 lamps in Consumer

inventory. The reduction that can be projected is 7,713,229 6,339,684 = 1,373,545 lamps

which is

Reduction = 100 =17.8% in Consumer inventory levels.

Total reduction in inventory = 1,373,545/23,093,499. = 6%

Thus the goal of 20 percent reduction is not achieved. So this alternative can be pursued but options

also need to be evaluated to reach 20% reduction.

(3) Does reducing the number of stocking locations have the potential for reducing system

inventories by 20 percent?Is there enough information available to make a good inventory

reduction decision?

The second alternative proposed in the case is to reduce the number of MDCs from eight to a

smaller number. In order to evaluate this proposal, it needs to be determined which MDCs will

be consolidated and the associated total demand flowing through the consolidated facilities.

The inventory-throughput relationship can then be used to estimate the resulting inventory

levels. For example, if the Seattle and Los Angeles MDCs are combined, the consolidated

demand would be 4,922,000 + 21,470,000 = 26,392,000 lamps. The combined inventory is

projected to be I = 2.997(26,392,000)

0.816

= 3,408,852 lamps, compared with the inventory for

the two locations of 4,626,333, as shown in Table 1. This yields a 26.3 percent reduction from

current levels.

Table 1 shows other possible MDC consolidations and the resulting inventory reductions that

can be projected.

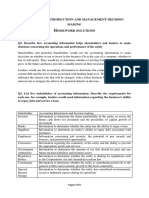

TABLE 1 Inventory Reduction for Selected MDC Combinations, in Lamps

MDC combination

Combined demand Combined

inventory

Inventory

reduction

Seattle/Los Angeles 26,392,000 3,408,852 1,217,481

Kansas City/Dallas 29,194,000 3,701,403 50,181

Chicago/Ravenna 49,174,000 5,664,257 -557,590

Atlanta/Dallas 39,314,000 4,718,862 1,224,721

Kansas City/Chicago 39,271,000 4,714,650 -933,900

Ravenna/Hagerstown 64,046,000 7,027,231 1,715,607

K City/Dallas/Chicago 52,515,000 5,976,377 -36,377

Ravenna/Htown/Chicago 87,367,000 7,508,054 3,423,196

Atlanta/Dallas/K City 55,264,000 5,242,351 2,293,566

From the MDC combinations in Table 1, proximity to each other is a primary consideration in

order to not increase transportation costs or jeopardize delivery service any more than

necessary. Several options can be identified that yield a 20 percent inventory reduction. These

are:

Option

MDC combinations

Inventory

reduction, lamps

Total

inventory

reduction

1 LA/Seattle 1,217,481

Ravenna/Htown/Chicago 3,423,196

Total reduction 4,640,677 20.1%

2 LA/Seattle 1,217,481

Kansas City/Hagerstown 1,224,721

Ravenna/Hagerstown 1,715,602

Total reduction 4,157,804 18.0%

3 LA/Seattle 1,217,481

Ravenna/Hagerstown 1,715,602

Atlanta/Dallas/K City 2,293,566

Total reduction 5,226,649 22.6%

Options 1 and 3 achieve the 20 percent reduction goal, although other MDC combinations not

evaluated may also do so. The maximum reduction would be achieved with one MDC. The

total inventory would be I = 2.997(169,023,000)

0.816

= 15,512,812 lamps, for a system reduction

of 32.8 percent. However, we must recognize that as the number of warehouses is decreased,

outbound transportation costs will increase. Inbound transportation costs to the combined MDC

will remain about the same, since replenishment shipments are already in truckload quantities.

Some difference in cost will result from differences in the length of the hauls to the warehouses.

On the other hand, outbound costs may substantially increase, since the combined MDC

locations are likely to be more removed from customers then they are at present. Outbound

transportation rates will be higher, as they are likely to be for shipments of less-than-truckload

quantities. If the sum of the inbound and outbound transportation cost increases is greater than

the inventory carrying cost reduction, then the decision to reduce inventories must be

questioned.

Calculating all transportation cost changes is not possible, since the case study does not provide

sufficient data on outbound transportation rates. However, they should be determined before

and after consolidation to assess the tradeoff between inventory reduction and transportation

costs increases. On the other hand, inbound transportation costs can be found, as shown below

for option 1, where the consolidation points are Los Angeles and Hagerstown.

Location

TL rate,

$/TL

Annual

demand,

lamps

Transport

cost, $

Combined

annual

demand, lamps

Transport

cost, $

Seattle 1800 4,922,000 253,131

a

Los Angeles 1800 21,470,000 1,104,171 26,392,000 1,357,302

Ravenna 250 25,853,000 184,664

Hagerstown 475 38,193,000 518,334 87,367,000 1,185,695

Chicago 350 23,321,000 233,210

Total 113,759,000 2,293,510 113,759,000 2,542,997

a

(4,922,000/35,000)1800 = 253,131

There will be a net increase in inbound transportation costs of $2,542,997 2,293,510 =

$249,487 for option 1.

In addition, the annual fixed costs for the MDCs will be less, since the total space needed in the

consolidated facilities should be less than that for the existing facilities. Again, the case study

does not estimate the fixed costs for existing or potential locations.

We do know that taking them into account would favor consolidation.

In summary, the costs associated with option 1, that just meets the 20 percent inventory

reduction goal, would be:

Cost type Cost savings, $

Inventory carrying cost reduction

0.200.8824,640,677 = 818,615

Warehouse cost

0.104,640,677 = 464,068

Warehouse fixed cost Unknown, but may be included in warehouse cost

Outbound transportation cost

Unknown data not given

Inbound transportation cost (249,487)

Although Sue and Bryan could report a substantial savings in inventory related costs, they

should be encouraged to include fixed costs and transportation costs so as to report the true

benefits of the inventory reduction plan.

(4) How might customer service be affected by the proposed inventory reduction?

The general effect of inventory consolidation is to reduce the number of stocking points and

make them more remote from customers. That is, the delivery distance will be increased if

inventory consolidation is implemented. Therefore, delivery customer service may be

jeopardized and must be considered before deciding to consolidate inventories.

From Table 3 of the case, it can be seen that customer lead times remain constant for a variety

of locations with the exception of Kansas City. Since consolidation points will be selected

among the existing locations, outbound lead times will remain unaffected. Customer service

due to location should be constant, at least for a moderate degree of consolidation.

Customer service due to stock availability will be affected if safety stock levels are reduced

after consolidation. Although the inventory-throughput relationship projects adequate safety

stock to maintain the current first-time delivery levels, it does not account for any increase in

lead times that may occur between the current system of MDCs and the consolidated ones. By

comparing the weighted inbound lead times for the existing distribution system and option 1, as

shown in Table 2, the average inbound lead-time is slightly reduced through consolidation.

Lead-time variability is usually related to average lead-time. This should have a favorable

affect on inventory levels since uncertainty is reduced. First-time deliveries should not be

adversely affected by consolidation, according to option 1.

TABLE 2 A Comparison of Inbound Lead Times for the Existing Distribution

System and a Consolidated Distribution System (Option 1) (a) Current Distribution

System

Master Distribution Center

Shipments

Inbound lead

time, days

Weighted

lead time,

days

Atlanta 26,070,000 2 0.308

Chicago 23,321,000 1 0.138

Dallas 13,244,000 3 0.235

Hagerstown 38,193,000 1 0.226

Kansas City 15,950,000 2 0.094

Los Angeles 21,470,000 5 0.635

Ravenna 25,853,000 1 0.153

Seattle 4,922,000 6 0.175

Total 169,023,000 1.964

(b) Consolidation Option 1

Master Distribution Center

1

Shipments

Inbound lead

time, days

Weighted

lead time,

days

Atlanta 26,070,000 2 0.308

Dallas 13,244,000 3 0.235

1

Consolidation is assumed to take place at the MDC with the largest number of current shipments.

Htown/Ravenna/Chicago 87,367,000 1 0.517

Kansas City 15,950,000 2 0.094

Los Angeles/Seattle 26,392,000 5 0.781

Total 169,023,000 1.935

You might also like

- Sourcebook 2015 - CTRM Software Suppliers and ProductsDocument97 pagesSourcebook 2015 - CTRM Software Suppliers and ProductsCTRM CenterNo ratings yet

- Home WorkDocument2 pagesHome WorkSudhanshu ShekharNo ratings yet

- Inventory ModelsDocument9 pagesInventory ModelshavillaNo ratings yet

- Use MoreDocument5 pagesUse Moreg14032No ratings yet

- Job Order Costing: Patrick Louie E. Reyes, CTT, Micb, Rca, CpaDocument45 pagesJob Order Costing: Patrick Louie E. Reyes, CTT, Micb, Rca, CpaClaudette Clemente100% (1)

- of Management ScienceDocument31 pagesof Management ScienceNusa FarhaNo ratings yet

- In Re: Stern V., 4th Cir. (1997)Document4 pagesIn Re: Stern V., 4th Cir. (1997)Scribd Government DocsNo ratings yet

- (FABM 2) Interactive Module Week 2Document12 pages(FABM 2) Interactive Module Week 2Krisha FernandezNo ratings yet

- FM Consolidation Test - Answers S21-J22Document14 pagesFM Consolidation Test - Answers S21-J22g.d11gopalNo ratings yet

- MBA Supplementary Resources Finance GlossaryDocument21 pagesMBA Supplementary Resources Finance GlossaryZoe ChimNo ratings yet

- ADN-I-033 Key Cost Management Principles Every Executive Must KnowDocument4 pagesADN-I-033 Key Cost Management Principles Every Executive Must Knowjamesdj88914No ratings yet

- Oracle SCM TrainingDocument9 pagesOracle SCM TrainingVishnu SajaiNo ratings yet

- BBA 403 Production ManagementDocument29 pagesBBA 403 Production ManagementPalak JainNo ratings yet

- Ship Planned Maintenance System Database ConceptDocument11 pagesShip Planned Maintenance System Database ConceptamasrurNo ratings yet

- Ballou Logistics Solved Problems Chapter 14Document25 pagesBallou Logistics Solved Problems Chapter 14RenTahL100% (1)

- CO Parking Garage Design Guidelines PDFDocument15 pagesCO Parking Garage Design Guidelines PDFSrki MenNo ratings yet

- Logic Table DocsDocument650 pagesLogic Table Docse026026No ratings yet

- 1122Document7 pages1122Pasqual Barretti Júnior100% (2)

- Accounting FEEPDocument25 pagesAccounting FEEPFOONG MIN JIE MBS221008100% (1)

- Activity 1 - FS Analysis AnswerDocument6 pagesActivity 1 - FS Analysis AnswerMelvert Alvarez MacaranasNo ratings yet

- Ajax Manufacturing Cost AnalysisDocument7 pagesAjax Manufacturing Cost Analysisreva_radhakrish1834No ratings yet

- Sharif Zhanel MID Explain Clustering and Data Independency by Giving An Example in DatabaseDocument4 pagesSharif Zhanel MID Explain Clustering and Data Independency by Giving An Example in DatabaseZhanel ShariffNo ratings yet

- Using ABC Modeling to Manage IT Service CostsDocument12 pagesUsing ABC Modeling to Manage IT Service CostsshrikantsubsNo ratings yet

- Braun Ma4 SM 09Document55 pagesBraun Ma4 SM 09nobleverma100% (1)

- SMch02 SCDocument5 pagesSMch02 SCSureshNo ratings yet

- SCD Hw6 Vũ Hoàng Lam Ielsiu19036Document4 pagesSCD Hw6 Vũ Hoàng Lam Ielsiu19036Lam Vũ HoàngNo ratings yet

- Customer Profitability Case - Management AccountingDocument6 pagesCustomer Profitability Case - Management AccountingTina FluxNo ratings yet

- Silo Manufacturing CorporationDocument22 pagesSilo Manufacturing CorporationCee Phanthira100% (1)

- A System Design Assessment for Westminster Company's Distribution NetworkDocument5 pagesA System Design Assessment for Westminster Company's Distribution NetworktobyfutureNo ratings yet

- Final Exam S1 2007Document9 pagesFinal Exam S1 2007Mansor ShahNo ratings yet

- Order Winners N Order QualifiersDocument4 pagesOrder Winners N Order QualifiersMeet SampatNo ratings yet

- Final LogdesDocument30 pagesFinal LogdesRihana Nhat KhueNo ratings yet

- Spreadsheet Model for Evergreen College Endowment ProjectionsDocument58 pagesSpreadsheet Model for Evergreen College Endowment ProjectionsHaider KamranNo ratings yet

- Direct Product ProfitDocument5 pagesDirect Product Profitahmed_23zulfiqarNo ratings yet

- Chapter 20Document93 pagesChapter 20Irina AlexandraNo ratings yet

- AP Macroeconomics: Free-Response Questions Set 1Document3 pagesAP Macroeconomics: Free-Response Questions Set 1JJ YNo ratings yet

- Supply Chain Contract: Alok RajDocument20 pagesSupply Chain Contract: Alok RajYash Aggarwal BD20073No ratings yet

- Module 1 - Introduction and Management Decision Making - Homework SolutionsDocument4 pagesModule 1 - Introduction and Management Decision Making - Homework SolutionsAbelNo ratings yet

- BAN 602 - Project1Document4 pagesBAN 602 - Project1Michael LipphardtNo ratings yet

- C04-Hema New Retail Comes To GroceryDocument20 pagesC04-Hema New Retail Comes To GroceryisacmacedoNo ratings yet

- Adms 2500 FinalDocument20 pagesAdms 2500 Finalmuyy1No ratings yet

- How operations research methods have aided executive decision makingDocument19 pagesHow operations research methods have aided executive decision makingTaj Gujadhur Beeharry50% (2)

- Exam 3 FINC 631 Summer 2013Document12 pagesExam 3 FINC 631 Summer 2013Sammy Ben MenahemNo ratings yet

- Quiz 10 AnsDocument3 pagesQuiz 10 AnsParth VaswaniNo ratings yet

- Usemore Soap Company 5-Year Supply Chain PlanDocument8 pagesUsemore Soap Company 5-Year Supply Chain Plang14032No ratings yet

- 2014-5-MIller Atkinson Strategy For Future Downsizing (BMEP 29 Bar)Document8 pages2014-5-MIller Atkinson Strategy For Future Downsizing (BMEP 29 Bar)Benedek ZoltánNo ratings yet

- Linear Programming: Dr. T. T. KachwalaDocument17 pagesLinear Programming: Dr. T. T. Kachwalagvspavan100% (1)

- Jim Manzano Is The General Partner of An Investment GroupDocument1 pageJim Manzano Is The General Partner of An Investment GroupAmit PandeyNo ratings yet

- Engineering Economics: XI-Sensitivity and Breakeven AnalysisDocument38 pagesEngineering Economics: XI-Sensitivity and Breakeven AnalysisFÏnô D'ÊxsperåtÏonNo ratings yet

- MECH3600 9660 Quiz 1 CNC 2016 SolutionDocument6 pagesMECH3600 9660 Quiz 1 CNC 2016 SolutionRickNo ratings yet

- XYZ Car Engine Forecasting AccuracyDocument4 pagesXYZ Car Engine Forecasting AccuracyDavid García Barrios100% (1)

- Additional Cases Ch08Document4 pagesAdditional Cases Ch08amanraajNo ratings yet

- Taguchi'S Quality Loss FunctionDocument17 pagesTaguchi'S Quality Loss FunctionAvi Barua100% (1)

- Chapter 8Document30 pagesChapter 8carlo knowsNo ratings yet

- Chapter 05Document75 pagesChapter 05mushtaque61No ratings yet

- Chapter 4Document45 pagesChapter 4Yanjing Liu67% (3)

- CH 06Document20 pagesCH 06jy zNo ratings yet

- 4.invenroy Models 2015Document84 pages4.invenroy Models 2015Ícaro Luiz CostaNo ratings yet

- Table 7.1 Quarterly Demand For Tahoe Salt: Year, QTR Period DemandDocument13 pagesTable 7.1 Quarterly Demand For Tahoe Salt: Year, QTR Period DemandФилипп СибирякNo ratings yet

- Benefits of Risk PoolingDocument15 pagesBenefits of Risk PoolingMiguel Andres Ortiz CoillaNo ratings yet

- Homework Finance 1Document7 pagesHomework Finance 1Chien le Ngoc33% (3)

- Problem 5Document1 pageProblem 5Thu NgânNo ratings yet

- Market ArchitectureDocument23 pagesMarket Architectureshubham100% (1)

- KLF Electronics QuestionDocument5 pagesKLF Electronics QuestionSumit GuptaNo ratings yet

- MidtermADM3302M SolutionDocument5 pagesMidtermADM3302M SolutionAlbur Raheem-Jabar100% (1)

- An Inventory-Location Model with Working and Safety Stock CostsDocument32 pagesAn Inventory-Location Model with Working and Safety Stock CostsEduardo GonzálezNo ratings yet

- Submitted By: Section C Group 7: Archit Arora 13p198 Avneet Sikka 13P201 Nikhil Saini 13P218 Palak Khaneja 13P219 Raj Kumar 13P226Document7 pagesSubmitted By: Section C Group 7: Archit Arora 13p198 Avneet Sikka 13P201 Nikhil Saini 13P218 Palak Khaneja 13P219 Raj Kumar 13P226Archit AroraNo ratings yet

- SeminarDocument20 pagesSeminarArchit Arora100% (1)

- DCN ProjectDocument21 pagesDCN ProjectArchit AroraNo ratings yet

- NTPC ProjectDocument59 pagesNTPC ProjectArchit AroraNo ratings yet

- Business Igcse PPT - 18 Production of Goods and ServicesDocument92 pagesBusiness Igcse PPT - 18 Production of Goods and ServicesShaheeraNo ratings yet

- Developing a Sales and Inventory System for a Motor ShopDocument12 pagesDeveloping a Sales and Inventory System for a Motor ShopAdrianpaul DesalesNo ratings yet

- Managerial Accounting Chapter 1 Exercises SolutionsDocument12 pagesManagerial Accounting Chapter 1 Exercises SolutionsDarrianAustinNo ratings yet

- Ratio Calculations Evidence Profitability Liquidity Leverage EfficiencyDocument3 pagesRatio Calculations Evidence Profitability Liquidity Leverage EfficiencyNur SyafiqahNo ratings yet

- Integrity ReportDocument19 pagesIntegrity Reportprassu1No ratings yet

- TrainingDocument22 pagesTrainingVIKRAM JOSHINo ratings yet

- Exercises of Financial AccountingDocument25 pagesExercises of Financial AccountingSai AlviorNo ratings yet

- Operating and Cash Conversion CyclesDocument4 pagesOperating and Cash Conversion CyclesChristoper SalvinoNo ratings yet

- Curriculum Vitae: Career ObjectiveDocument2 pagesCurriculum Vitae: Career Objectivekarthi_kuttyNo ratings yet

- Chapter3 Auditing 2Document10 pagesChapter3 Auditing 2lilis100% (4)

- Warehouse Binner - LSC - Q2105 - v2.0Document32 pagesWarehouse Binner - LSC - Q2105 - v2.0ARUNKUMAR PMCNo ratings yet

- IFM - Intro to Financial Accounting Tutorial QuestionsDocument5 pagesIFM - Intro to Financial Accounting Tutorial QuestionsPatric CletusNo ratings yet

- Indian PDFDocument25 pagesIndian PDFANIYIE ONYEKANo ratings yet

- Allocation of Support Activity Costs and Joint Costs: Answers To Review QuestionsDocument40 pagesAllocation of Support Activity Costs and Joint Costs: Answers To Review QuestionsMJ YaconNo ratings yet

- Sarita's ResumeDocument2 pagesSarita's Resumefreeny_saritaNo ratings yet

- 45225Document7 pages45225Yes ChannelNo ratings yet

- Chapter 2 - Inventory Management-StDocument60 pagesChapter 2 - Inventory Management-StNnđ KiraNo ratings yet

- Material Requirement Planning PresentationDocument26 pagesMaterial Requirement Planning PresentationGaurav Narula78% (9)

- Sapphire Corporation Limited Annual Report 2014Document128 pagesSapphire Corporation Limited Annual Report 2014WeR1 Consultants Pte LtdNo ratings yet

- Logistics Management Appunti 1 20Document71 pagesLogistics Management Appunti 1 20Parbatty ArjuneNo ratings yet

- Short-Term Financial Management Decisions: Working Capital ManagementDocument13 pagesShort-Term Financial Management Decisions: Working Capital ManagementNhel AlvaroNo ratings yet

- AckmidtocDocument9 pagesAckmidtocraakesh_rrNo ratings yet

- Nama Andra Sulthan Thayyib Mantjanegara Tugas Akuntansi BiayaDocument3 pagesNama Andra Sulthan Thayyib Mantjanegara Tugas Akuntansi BiayaAda DapiNo ratings yet