Professional Documents

Culture Documents

Premier Bank's Financial Performance Analysis

Uploaded by

toxictouchOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Premier Bank's Financial Performance Analysis

Uploaded by

toxictouchCopyright:

Available Formats

Mission:

To be the premier financial institution in the country providing high quality products and

services backed by latest technology and a team of highly motivated personnel to deliver

Excellence in Banking.

Vision:

At Dhaka Bank, we drew our inspiration from the distant stars. Our team is committed to

assure a standard that makes every banking transaction a pleasurable eperience. Our

people, products and processes are aligned to meet the demand of our discerning

customer. Our goal is to achieve like the luminaries in the sky. Our prime ob!ective is to

deliver a quality that demonstrates a true reflection of our vision " #cellence in Banking.

The Dhaka Bank care for our society. $t shares its pride with its surrounding. $t has

estabilished Dhaka bank %oundation, a philanthropic arm of our bank in &ovember '(,

'))'.

Ratio Analysis of Dhaka Bank

Ratio:

*atios are useful for financial analysis by investor because ratios capture critical

dimensions of the economic performance of the entity. $ncreasingly, ratios are a tool that

managers use to guide measure and reward workers. A ratio analysis isn+t !ust comparing

different numbers from the balance sheet, income statement, and cash flow statement. $t+s

comparing the number against previous years, other companies, the industry, or even the

economy in general. *atios look at the relationships between individual values and relate

them to how a company has performed in the past, and might perform in the future.

Types of Ratio:

The different types of financial ratios include,

-iquidity *atio.

Activity *atio.

Debt *atio.

.rofitability *atio.

/

Liquidity Ratio:

Liquidity ratios measure a firms ability to meet its current financial obliations!

Liquidity Ratios include:

&et working capital

0urrent *atio

1uick *atio

Acti"ity ratio:

$nventory *atio.

Average collection .eriod.

Total Assets Turnover.

Debt Ratio:

Debt *atio.

Debt #quity *atio.

$nterest 0overage *atio.

#rofitability Ratio:

2ross .rofit 3argin.

Operating .rofit 3argin.

&et .rofit 3argin.

*eturn on Total Assets.

*eturn on 4hareholders #quity.

'

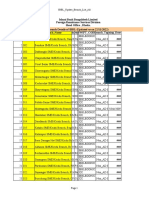

$ %ears &inancial 'ihlihts:

No

:

Name of Item 2001 2002 2003 2004

1

&et 5orking 0apital "

67((,/78,))9:

"6(97,87;,89<: "6<7',89/,=;8: "

6/,';),;9/,'7/:

2

0urrent *atio .8'7= .=8= .8<)= .=((8

3

Debt *atio 89.7(> 87.</> 8(./8> 8(.;'>

4

Debt #quity *atio ';.8< ').<<( /9.')< /;.8(

5

Total Assets Turnover .)/8( .)')9 .)/=9 .)'')

6

Operating .rofit 3argin '.'( '.(( '.(< '.)('

7

&et .rofit 3argin ;=./> 78.7> 98.<> 7;.7>

8

*eturn on Assets 6*OA: /.7'> /.'<> /.<> /.<>

8

*eturn on #quity 6*O#: (<.8'> '9./9> ''.'<> '(.)<>

<

(! )et *orkin +apital:

The &et 5orking 0apital of a business is an indication of the short"run solvency of the

business.

The &et 5orking 0apital computes as follows,

)et *orkin +apital , 0urrent Assets ? 0urrent -iabilities.

-..( -..- -../ -..$

9,;8(,/)8,99) ?

;,<<=,'9=,999

(,)=8,<9/,;7= ?

(,777,</8,;'/

(,;7),(;<,9(; ?

7,/)<,(<7,7'9

9,8'',7)/,87( ?

=,/8<,'9<,')7

012$$3(243..56 01$523457345/6 01/2-345(38746 01(3-7.375(3-2(6

+omment:

The net working capital means reserve cash of a company. This reserve is used to meet

the daily working transaction of the bank. $n Dhaka Bank net working capital is negative

over the four years. This represents a negative trend. 4o, the bank borrows from other

sources to operate the day to day transaction.

-! +urrent Ratio:

The 0urrent *atio determines short"term debt"paying ability. The relationship of current

assets to current liabilities is an attempt to show the safety of current debt holders@ claim

in case of default.

(

The 0urrent *atio computes as follows,

+urrent Ratio ,

s Liabilitie !""ent

#ssets !""ent

-..( -..- -../ -..$

999 , '9= , <<= , ;

99) , /)8 , ;8( , 9

;'/ , </8 , 777 , (

;7= , <9/ , )=8 , (

7'9 , (<7 , /)< , 7

9(; , (;< , ;7) , (

')7 , '9< , /8< , =

87( , 7)/ , 8'' , 9

!4-28 !848 !4/.8 !8$$4

+omment:

This ratio means that for every dollar of current liabilities, Dhaka Bank has .TA. .8'7=, .

=8=, .8)<=, .=((8 of current assets in '))/, '))', '))<, '))(. $t means the bank has not

adequate money to meet its current liabilities. 5ithin these four years in '))< B '))/

Dhaka Bank could meet the current liabilities better than the rest of the years.

/! Debt Ratio:

The debt ratio measures the percentage of the total assets provided by creditors. This ratio

indicates the company@s degree of leverage.

The Debt *atio computes as follows,

Debt Ratio C

#ssets $otal

%ebt $otal

-..( -..- -../ -..$

;(/ , /=; , /'7 , /8

'<) , )7/ , (9( , /=

97< , 79= , /)< , /8

(/; , /'/ , ')= , /=

/7; , 9'< , =/7 , ')

<() , 9(= , 9)7 , /8

;9< , )8( , /;= , '=

()/ , '); , 98) , '9

45!2$9 42!/(9 4$!(49 4$!7-9

+omments:

This ratio means that creditors have provided that percentage of Dhaka Bank@s total

assets in '))/, '))', '))<, and '))(. The higher the ratio, the grater the likely risk for

the lenders.

$! Debt :quity Ratio:

The debt equity ratio is an attempt to show, the relative proportions of all lenders@ claims

to ownership claims, and it is used as a measure of debt eposure. The measure is

epressed as either a percentage or as a proportion.

The &et 5orking 0apital computes as follows,

7

Debt :quity Ratio ,

E&!it' "s ()a"e)ol*e

%ebt $otal

-..( -..- -../ -..$

7// , /<9 , 99/

'<) , )7/ , (9( , /=

'<9 , ((; , =87

(/; , /'/ , ')= , /=

=/; , 8;( , ')8 , /

<() , 9(= , 9)7 , /8

<9' , ==; , (=; , /

()/ , '); , 98) , '9

-7!4/ -.!//$ (5!-./ (7!4$

+omments:

This ratio implies that Dhaka bank@s total debt is ';.8<, ').<<, /9.'), /;.8( times to its

equity capital in '))/, '))', '))<, '))(.Alternatively stayed, Dhaka bank@s credit

financing equals Tk. ';.8<, ').<<, /9.'), /;.8( for every Tk./ of equity financing.

2! Total Assets Turno"er:

Total assets turnover measures how efficiently a company uses its assets to generate

sales. The resulting number shows the dollars of sales produced by each dollar invested in

assets.

The 0urrent *atio computes as follows,

Total Assets Turno"er Ratio ,

#ssets $otal

(ales

-..( -..- -../ -..$

;(/ , /=; , /'7 , /8

'// , 9/8 , <;/

97< , 79= , /)< , /8

/)' , )(< , <8(

/7; , 9'< , =/7 , ')

8;9 , /=< , <==

;9< , )8( , /;= , '=

/;; , ;7) , 9'/

!.(4$ !.-.5 !.(85 !.--.

+omments:

Total Assets turnover implies that how much sales is created by Dhaka Bank by using its

total assets. By analyDing this ratio $ can say that Dhaka Bank is generating ).)/8(, .

)')9, .)/=9, .)'') Tk. of sales by using the / Tk. of assets in '))/, '))', '))<, and

'))(.

5! ;peratin profit Marin:

Operating profit margin 6O.3: measures the percentage of sales revenue remaining after

all epenses.

The 0urrent *atio computes as follows,

9

;peratin #rofit Marin ,

(ales

ofit +,e"ating .r

-..( -..- -../ -..$

'// , 9/8 , <;/

'(/ , <89 , =<'

/)' , )(< , <8(

)=8 , )7' , 89<

8;9 , /=< , <==

'9) , /(' , 8(<

/;; , ;7) , 9'/

/;9 , =(' , '98 , /

--$9 -$$9 -$/9 -.$!-9

+omments:

The operating profit margins of the Dhaka Bank are ''(>, '((>, '(<>, ')(.'> in

'))/, '))', '))<, and '))(. Eere, Operating profit margin '))( is ')(.'> which is

quite bad in comparison to other years.

7! )et #rofit Marin:

&et profit margin, one of the most popular indicators of company health, measures the

percentage of sales revenue remaining after all epenses is paid.

The 0urrent *atio computes as follows,

)et #rofit Marin ,

(ales

ofit Net .r

-..( -..- -../ -..$

'// , 9/8 , <;/

(<9 , <8' , '8)

/)' , )(< , <8(

;'9 , </) , '<(

8;9 , /=< , <==

<=/ , )); , '98

/;; , ;7) , 9'/

=8( , 7;' , <7;

78!(9 24!29 54!/9 27!29

+omments:

This ratio indicates that the percentage of the net profit is generating from the sales of

Dhaka Bank. This ratio also shows that Dhaka Bank eperienced a quite bad eperience

because of the fleible percentage net profit margin.

8! Return on Assets:

An overall measure of profitability is return assets. $t measures a firm@s efficient at

generating profit with its assets.

The 0urrent *atio computes as follows,

Return on Assets,

#ssets $otal

ofit Net .r

;

-..( -..- -../ -..$

;(/ , /=; , /'7 , /8

(<9 , <8' , '8)

97< , 79= , /)< , /8

;'9 , </) , '<(

/7; , 9'< , =/7 , ')

<=/ , )); , '98

;9< , )8( , /;= , '=

=8( , 7;' , <7;

(!2-9 (!-/9 (!/9 (!/9

+omments:

The return on equity refers that how much percentage of the return the bank earns by

using the total assets. These imply that Dhaka Bank earns /7>, /'>, /<>, /<> in '))/,

'))', '))<, and '))( by using total assets. Eere Dhaka Bank@s earnings is quite

decreased in '))' than the other years.

4! Return on :quity:

*eturn on equity shows how many dollars of net income were earned for each dollar

invested by owners.

The *eturn on #quity computes as follows,

Return on :quity,

E&!it' "s ()a"e)ol*e

ofit Net .r

-..( -..- -../ -..$

7// , /<9 , 99/

(<9 , <8' , '8)

'<9 , ((; , =87

;'9 , </) , '<(

=/; , 8;( , ')8 , /

<=/ , )); , '98

<9' , ==; , (=; , /

=8( , 7;' , <7;

$/!4-9 -5!(59 --!-/9 -$!./9

+omments:

The return on equity refers that how much percentage of the return the bank earns by

using the total equity. These imply that Dhaka Bank earns (<.8'>, '9./9>, ''.'<>,

'(.)<> in '))/, '))', '))<, and '))( by using total shareholders equity. Eere Dhaka

Bank@s earnings are decreasing from '))/.

=

You might also like

- A Study On Management of Non Performing Assets in District Central Cooperative Bank PDFDocument5 pagesA Study On Management of Non Performing Assets in District Central Cooperative Bank PDFDevikaNo ratings yet

- Complete Mba Project 1Document47 pagesComplete Mba Project 1sachingaubaNo ratings yet

- GB of Rupali Bank LTDDocument12 pagesGB of Rupali Bank LTDShakilNo ratings yet

- Evaluating CusEvaluating Customer Satisfaction in General Banking, Internship Report, Brac Bank, Customer Satisfaction in General Banking ofDocument79 pagesEvaluating CusEvaluating Customer Satisfaction in General Banking, Internship Report, Brac Bank, Customer Satisfaction in General Banking ofমোঃ রহিচ উদ্দীন100% (1)

- PRJCT Finance Reliance MoneyDocument63 pagesPRJCT Finance Reliance Moneyhimanshu_choudhary_2No ratings yet

- A Study On Operational and Financial Performance of Canara BankDocument10 pagesA Study On Operational and Financial Performance of Canara Bankshrivathsa upadhyaya0% (1)

- Internship Report On Financial Statement Analysis of Islamic Bank Bangladesh Limited Submitted ToDocument10 pagesInternship Report On Financial Statement Analysis of Islamic Bank Bangladesh Limited Submitted ToNafiz Fahim0% (1)

- Case Study On Bajaj AvisekDocument9 pagesCase Study On Bajaj AvisekAvisek SarkarNo ratings yet

- Agrani BankDocument28 pagesAgrani BankSh1r1nNo ratings yet

- Working Capital Management and Its Impact On Profitability Evidence From Food Complex Manufacturing Firms in Addis AbabaDocument19 pagesWorking Capital Management and Its Impact On Profitability Evidence From Food Complex Manufacturing Firms in Addis AbabaJASH MATHEWNo ratings yet

- Internship Report On: "Human Resource Management Practices of Southeast Bank Limited"Document45 pagesInternship Report On: "Human Resource Management Practices of Southeast Bank Limited"Choton AminNo ratings yet

- A Study On Comparative Analysis of HDFC Bank and Icici Bank On The Basis of Capital Market PerformanceDocument11 pagesA Study On Comparative Analysis of HDFC Bank and Icici Bank On The Basis of Capital Market PerformanceSahil BansalNo ratings yet

- Nabil Bank Management Information SystemDocument7 pagesNabil Bank Management Information Systemtransformer_nepal50% (2)

- Tour Report On Chittagong Stock ExchangeDocument5 pagesTour Report On Chittagong Stock ExchangeRajuRahmotulAlamNo ratings yet

- PMC Bank Summer Internship ReportDocument78 pagesPMC Bank Summer Internship ReportManpreet Singh Sasan0% (4)

- Capital Structure - Bharati CementDocument14 pagesCapital Structure - Bharati CementMohmmedKhayyumNo ratings yet

- General Banking Activities and Loan Disbursement and Recovery of RAKUBDocument56 pagesGeneral Banking Activities and Loan Disbursement and Recovery of RAKUBiqbal78651No ratings yet

- Scope of HRMDocument1 pageScope of HRMVandana VermaNo ratings yet

- Report On Performance Analysis of SEBLDocument53 pagesReport On Performance Analysis of SEBLShanu Uddin Rubel80% (10)

- Investment Mechanism of Islami Bank BangladeshDocument67 pagesInvestment Mechanism of Islami Bank BangladeshImranAhamedShakhor50% (2)

- Introduction To Financial ManagementDocument46 pagesIntroduction To Financial ManagementChethan KumarNo ratings yet

- The Trial Balance of The Sterling Company Shown Below Does PDFDocument1 pageThe Trial Balance of The Sterling Company Shown Below Does PDFAnbu jaromiaNo ratings yet

- Assignment of Management of Working Capital: TopicDocument13 pagesAssignment of Management of Working Capital: TopicDavinder Singh BanssNo ratings yet

- Financial Statement Analysis of ICICI Bank and A Comparative Study With Axis BankDocument7 pagesFinancial Statement Analysis of ICICI Bank and A Comparative Study With Axis Banksridharkar06100% (1)

- ICICI 7P'sDocument15 pagesICICI 7P'sdheeraj422No ratings yet

- IciciDocument14 pagesIcicimercyNo ratings yet

- Introduction to Auditing - Meaning, Importance and DifferencesDocument56 pagesIntroduction to Auditing - Meaning, Importance and Differencesanon_696931352No ratings yet

- Performance Evaluation of Rupali Bank LimitedDocument27 pagesPerformance Evaluation of Rupali Bank LimitedHarunur RashidNo ratings yet

- Icici Bank FinalDocument25 pagesIcici Bank Finaldinesh mehlawatNo ratings yet

- Tips On Project FinancingDocument3 pagesTips On Project FinancingRattinakumar SivaradjouNo ratings yet

- Chapter 16 MGT of Equity CapitalDocument29 pagesChapter 16 MGT of Equity CapitalRafiur Rahman100% (1)

- A Project Report On: Customer Preference & Attributes Towards Saving-AccountDocument68 pagesA Project Report On: Customer Preference & Attributes Towards Saving-AccountchinunanaNo ratings yet

- Role of Mis in Airtel WithDocument9 pagesRole of Mis in Airtel WithsangeetaaggarwalNo ratings yet

- Calculate the room rent to be charged per day to earn a profit of 25% on cost excluding interestDocument5 pagesCalculate the room rent to be charged per day to earn a profit of 25% on cost excluding interestchirag shah100% (1)

- Desh Garments FY 2012-13 Annual Report HighlightsDocument46 pagesDesh Garments FY 2012-13 Annual Report HighlightsAr123No ratings yet

- Intern Report - Sanima BankDocument11 pagesIntern Report - Sanima BankRajan ParajuliNo ratings yet

- Ratio Analysis Comparison Between Beximco & Square by Simon (BUBT)Document16 pagesRatio Analysis Comparison Between Beximco & Square by Simon (BUBT)Simon Haque100% (1)

- Internship Report FormatDocument4 pagesInternship Report FormatMian AhsanNo ratings yet

- Bank of Baroda - Presentation OverviewDocument24 pagesBank of Baroda - Presentation OverviewDinesh Babu PugalenthiNo ratings yet

- Footwear Industry and Bay Emporium AnalysisDocument9 pagesFootwear Industry and Bay Emporium AnalysisTaisir Mahmud0% (1)

- EMI CalculatorDocument6 pagesEMI CalculatorPhanindra Sarma100% (1)

- Canara Robeco MF SAI SummaryDocument77 pagesCanara Robeco MF SAI SummaryMohamed YousufNo ratings yet

- Southeast University Southeast Business School: HRM Final ExaminationDocument9 pagesSoutheast University Southeast Business School: HRM Final ExaminationSHEIKH AHSUN ULLAHNo ratings yet

- HDFC Bank CAMELS AnalysisDocument15 pagesHDFC Bank CAMELS Analysisprasanthgeni22No ratings yet

- Forex Numericals PDFDocument8 pagesForex Numericals PDFprashant kaushikNo ratings yet

- Foreign Exchange Operations of Agrani Bank LimitedDocument52 pagesForeign Exchange Operations of Agrani Bank LimitedRaiHan AbeDin50% (4)

- Camel ModelDocument10 pagesCamel ModelHarsha ChowdharyNo ratings yet

- IBBL - BR - List - Updated - 22122022 - Branch - Sub Branch - AD BranchDocument38 pagesIBBL - BR - List - Updated - 22122022 - Branch - Sub Branch - AD BranchRomel Abdullh AlNo ratings yet

- APEX FOOTEAR LIMITED Shakkhor2001980018Document5 pagesAPEX FOOTEAR LIMITED Shakkhor2001980018Yeasin AzizNo ratings yet

- Internship Report on Capital Structure of IBBLDocument47 pagesInternship Report on Capital Structure of IBBLFahimNo ratings yet

- Internship Report On Credit Adminitraation of Mutual Trust BankDocument140 pagesInternship Report On Credit Adminitraation of Mutual Trust BankNazmul Amin AqibNo ratings yet

- Ratio Analysis of NCC & UCB Bank (2010-2014)Document17 pagesRatio Analysis of NCC & UCB Bank (2010-2014)سرابوني رحمانNo ratings yet

- Credit Risk Management in BanksDocument50 pagesCredit Risk Management in BanksDivyaNo ratings yet

- Kathmandu University: Dhulikhel, KavreDocument19 pagesKathmandu University: Dhulikhel, KavreAayush GurungNo ratings yet

- Strategic Management ConceptsDocument40 pagesStrategic Management ConceptsAmos Dmello0% (1)

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- The Four Walls: Live Like the Wind, Free, Without HindrancesFrom EverandThe Four Walls: Live Like the Wind, Free, Without HindrancesRating: 5 out of 5 stars5/5 (1)

- The Robert Donato Approach to Enhancing Customer Service and Cultivating RelationshipsFrom EverandThe Robert Donato Approach to Enhancing Customer Service and Cultivating RelationshipsNo ratings yet

- Regal ProductsDocument2 pagesRegal ProductstoxictouchNo ratings yet

- Prudential Regulations Report 1.0Document4 pagesPrudential Regulations Report 1.0toxictouchNo ratings yet

- Peda Ting Ting (Menu Details)Document6 pagesPeda Ting Ting (Menu Details)toxictouchNo ratings yet

- The New DHL The World Wide ExpressDocument48 pagesThe New DHL The World Wide ExpresstoxictouchNo ratings yet

- GMG Airline's Performance Appraisal and Compensation SystemDocument29 pagesGMG Airline's Performance Appraisal and Compensation SystemtoxictouchNo ratings yet

- Bullying's Psychological Impact on TeensDocument24 pagesBullying's Psychological Impact on TeenstoxictouchNo ratings yet

- Performance of HSBC BankDocument44 pagesPerformance of HSBC BanktoxictouchNo ratings yet

- Global Trade (Economic Analysis of Malaysia)Document11 pagesGlobal Trade (Economic Analysis of Malaysia)toxictouchNo ratings yet

- The Banking Industry in BangladeshDocument7 pagesThe Banking Industry in BangladeshtoxictouchNo ratings yet

- Prime Bank Project ReportDocument96 pagesPrime Bank Project ReporttoxictouchNo ratings yet

- Aristocrat Development and BuildersDocument21 pagesAristocrat Development and BuilderstoxictouchNo ratings yet

- The State of Administrative Accountability in BangladeshDocument8 pagesThe State of Administrative Accountability in Bangladeshtoxictouch100% (1)

- Bank of Cylon ProjectDocument43 pagesBank of Cylon ProjecttoxictouchNo ratings yet

- Mirinda ReportDocument39 pagesMirinda Reporttoxictouch0% (1)

- Shokti DoiDocument34 pagesShokti Doitoxictouch100% (1)

- ACI Limited-Final SlidesDocument22 pagesACI Limited-Final SlidestoxictouchNo ratings yet

- Ntroduction: Facts AND FiguresDocument4 pagesNtroduction: Facts AND FigurestoxictouchNo ratings yet

- GMG Airline's Performance Appraisal and Compensation SystemDocument29 pagesGMG Airline's Performance Appraisal and Compensation SystemtoxictouchNo ratings yet

- Mirinda ReportDocument39 pagesMirinda Reporttoxictouch0% (1)

- Somera ProjMgtExer3Document2 pagesSomera ProjMgtExer3john johnNo ratings yet

- PLDT Vs - Estranero, GR No.192518, Oct 15, 2014 FactsDocument2 pagesPLDT Vs - Estranero, GR No.192518, Oct 15, 2014 FactsHoreb FelixNo ratings yet

- Lecture 17Document37 pagesLecture 17irshan amirNo ratings yet

- NCBA Financial Management (Financial Analysis)Document9 pagesNCBA Financial Management (Financial Analysis)Joanne Alexis BiscochoNo ratings yet

- CFAS Chapter 2 Problem 3Document1 pageCFAS Chapter 2 Problem 3jelou ubagNo ratings yet

- Bhakti Chavan CV For HR ProfileDocument3 pagesBhakti Chavan CV For HR ProfileADAT TestNo ratings yet

- Housing Site AnalysisDocument1 pageHousing Site AnalysisFrances Irish Marasigan100% (1)

- HTTP WWW - Aiqsystems.com HitandRunTradingDocument5 pagesHTTP WWW - Aiqsystems.com HitandRunTradingpderby1No ratings yet

- FAR Study Guide - Students Notes - Updated Jan 2020Document168 pagesFAR Study Guide - Students Notes - Updated Jan 2020sa guNo ratings yet

- Queen's MBA Operations Management CourseDocument9 pagesQueen's MBA Operations Management CourseNguyen Tran Tuan100% (1)

- Solutions Manual: Introducing Corporate Finance 2eDocument9 pagesSolutions Manual: Introducing Corporate Finance 2eMane Scal JayNo ratings yet

- # An - Je - 100k - 2-0 - 3-29-19 - v2Document5 pages# An - Je - 100k - 2-0 - 3-29-19 - v2Collblanc Seatours Srl Jose LahozNo ratings yet

- Review Question in Engineering Management Answer KeyDocument9 pagesReview Question in Engineering Management Answer KeysephNo ratings yet

- Case 3 4Document2 pagesCase 3 4Salvie Angela Clarette UtanaNo ratings yet

- HCL ProposalDocument2 pagesHCL Proposalrishabh21No ratings yet

- Continuing Certification Requirements: (CCR) HandbookDocument19 pagesContinuing Certification Requirements: (CCR) HandbookLip Min KhorNo ratings yet

- Aus Tin 20104493Document166 pagesAus Tin 20104493david_llewellyn_smithNo ratings yet

- Foreign Grants Fund EntriesDocument23 pagesForeign Grants Fund Entriesjaymark canayaNo ratings yet

- 210: Understand How To Communicate With Others Within Building Services EngineeringDocument3 pages210: Understand How To Communicate With Others Within Building Services EngineeringGheorghe Ciubotaru50% (4)

- Orion POS - Guide - Accounting Workflow PDFDocument20 pagesOrion POS - Guide - Accounting Workflow PDFcaplusincNo ratings yet

- Turning Great Strategy Into Great PerformanceDocument22 pagesTurning Great Strategy Into Great PerformanceCathy Jeny Jeny Catherine100% (2)

- SWOT Analysis of The IdeaDocument5 pagesSWOT Analysis of The IdeaSaim QadarNo ratings yet

- Application OF THE Balanced Scorecard IN Strategy Implementation by Unilever Tea Kenya LimitedDocument50 pagesApplication OF THE Balanced Scorecard IN Strategy Implementation by Unilever Tea Kenya LimitedShokry AminNo ratings yet

- ABCs of Relationship Selling Through Service 12th Edition Futrell Solutions Manual 1Document251 pagesABCs of Relationship Selling Through Service 12th Edition Futrell Solutions Manual 1autumn100% (26)

- Sample Partnership AgreementDocument38 pagesSample Partnership AgreementAlex VolkovNo ratings yet

- Payables Selected Installments Report: Payment Process Request PPR Selection CriteriaDocument10 pagesPayables Selected Installments Report: Payment Process Request PPR Selection Criteriaootydev2000No ratings yet

- Pt. Aruna Karya Teknologi Nusantara Expenses Reimbushment FormDocument12 pagesPt. Aruna Karya Teknologi Nusantara Expenses Reimbushment Formfahmi ramadhanNo ratings yet

- Toyota C HR Hybrid 10 2016 Workshop ManualDocument12 pagesToyota C HR Hybrid 10 2016 Workshop Manualbriansmith051291wkb100% (42)

- Five Forces ModelDocument6 pagesFive Forces Modelakankshashahi1986No ratings yet