Professional Documents

Culture Documents

Financial Statements, Cash Flow, and Taxes

Uploaded by

Anna Stoycheva0 ratings0% found this document useful (0 votes)

33 views19 pagesPresentation about Financial Statements, Cash Flow, And Taxes

Original Title

Financial Statements, Cash Flow, And Taxes

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPresentation about Financial Statements, Cash Flow, And Taxes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

33 views19 pagesFinancial Statements, Cash Flow, and Taxes

Uploaded by

Anna StoychevaPresentation about Financial Statements, Cash Flow, And Taxes

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 19

Financial Statements, Cash

Flow, and Taxes

The Annual Report

Balance sheet provides a snapshot of a firms

financial position at one point in time.

Income statement summarizes a firms revenues

and expenses over a given period of time.

Statement of cash flows reports the impact of a

firms activities on cash flows over a given period of

time.

Statement of stockholders equity shows how

much of the firms earnings were retained, rather

than paid out as dividends.

Why do We Need Financial Statements?

Creditors and investors need them to make

informed financial decisions about whether to

lend and invest in the company.

Managers need them to operate their

business efficiently.

Taxing authorities (Government) need them

to assess taxes in a reasonable way.

A Typical Balance Sheet

Stockholders Equity

Paid-in capital - money raised from investors; paid-in

capital represents external financing.

Retained earnings that part of the profit which is

not distributed to investors as dividends, but instead is

reinvested in the business; it provides the most

important source of financing for the corporations

growth internal financing.

Stockholders Equity = Paid-in capital + Retained earnings

BS Equation

Stockholders equity represents a residual claim;

Residual is whatever is left from the assets after all the

liabilities are satisfied. This means that stockholders have

a claim after everybody else has been completely

satisfied;

From the the BS equation, we can calculate

stockholders equity as a residual:

Stockholders equity = Total assets - Total liabilities

Working Capital

Current assets are often called working capital

Net working capital = Current assets Current Liabilities

Distinction between free liabilities (accruals and accounts payable)

and interest-bearing liabilities (notes payable)

NOWC = Current assets (Current liabilities Notes Payable)

Income Statement

EBIT (operating profit) = Sales revenues Operating costs

EBITDA = Sales revenues Operating costs except

depreciation and amortization

Depreciation it simply means a loss of value of an asset

because of normal use (in accounting we use the term

wear and tear); similar to depreciation is amortization with

the only difference that it is associated with intangible

assets; firms often used accelerated depreciation for tax

purposes and straight-line depreciation for stockholder

reporting.

Statement of Stockholders Equity

It simply has 2 main components paid-in capital and

retained earning.

Stockholders Equity: Beg. Balance + in Retained Earnings

= Ending Balance

Net income and dividends jointly give you the change in

retained earnings for the current year.

Retained Earnings: Beg. Balance (accumulated retained

earnings until last year) + Net Income Dividends =

Ending Balance

Paid-in Capital: Beg. Balance + Stock issuance/issue Stock

buyback/repurchase = Ending Balance

Cash Flow Statement

Cash flows from operating activities

Cash flows from investing activities

Cash flows from financing activities

A Typical Cash Flow Statement

I. Operating activities

Net Income 117,5

Depreciation & Amortization 100

Increase in inventories -200

Increase in accounts receivable -60

Increase in accounts payable 30

Increase in accrued wages and taxes 10

Net cash provided by (used in) operating activities -2,5

II. Long-Term Investing Activities

Additions to property, plant and equipment -230

Net cash from (used in) investing activities -230

III. Financing Activities

Increase in notes payable 50

Increase in bonds 170

Payment of dividends to stockholders -57,5

Net cash from (used in) Financing activities 162,5

IV. Summary

Net increase/decrease in cash and cash equivalents (Net sum of I, II and III) -70

Cash & cash equivalents at the beginning of the period 80

Cash & cash equivalents at the end of the period 10

Free Cash Flow

FCF is the amount of cash that could be withdrawn from the firm

without harming its ability to operate and to produce future cash flows.

FCF is equal to whatever is left from the operating profit after you

satisfy the government and then you take care of your short-term

capital needs (operating needs) and long-term capital needs (investment

needs). It is available to satisfy debtholders and stockholders and can be

used to pay down debt, interest, dividends, to repurchase stock (in any

way to satisfy liabilities).

FCF = [(EBIT(1-T)+ Depreciation & Amortization] - [CapEx + NOWC]

EBIT (1-T) = after-tax profit; it is often referred to as NOPAT (net

operating profit after taxes)

Is it possible a rapidly growing business that is very profitable and

produce high CFs to have a negative FCF?

Performance Measures

Market Value Added (MVA) is the difference between the market value

of a firms equity and its book value.

Economic Value Added (EVA) is the excess of NOPAT over capital costs

EVA = NOPAT Annual dollar cost of capital =

= EBIT(1-T) (Total Investor-supplied operating capital * After-tax

percentage cost of capital)

EVA is an estimate of business true economic profit for a given year

and it differs sharply from accounting net income.

Relationship between EVA and MVA

If EVA is positive, then after-tax operating income >

cost of capital needed to produce that income.

Positive EVA on annual basis helps to ensure MVA is

positive.

MVA is applicable to entire firm, while EVA can be

calculated on a divisional basis as well.

Individual Taxes

Individual taxes (on wages and salaries, on investment income and on

profits of proprietorships and partnerships) have a progressive

structure (the higher the taxable income, the higher the marginal tax

rate).

Taxable income gross income less a set of exemptions and

deductions.

Marginal tax rate the tax rate on the last unit of income (begin at

10% and rise to 39,6% for 2013)

Average tax rate taxes paid divided by taxable income.

Interest income received by individuals is added to their income for

tax purposes.

Capital gains and losses short-term ones are added to ordinary

income, long-term are treated differently (they are usually taxed at a

lower rate than regular income).

Dividends are classified either as ordinary dividends or as qualified

dividends. Ordinary dividends are taxed at ordinary tax rates for

whatever tax bracket you are in. Qualified dividends are taxed at the

long-term capital gains tax rates of zero percent, 15% or 20% rates.

Tax Rate Example

Taxable Income

You Pay This Amount

on the Base of the

Bracket

Plus This Percentage on the

Excess over the Base

(Marginal Rate)

$0 to $8 925 0 10,0%

$8 925 to $36 250 892,5 15,0%

$36 250 to $87 850

4 991,25

25,0%

$87 850 to $183 250 17 891,25 28,0%

$183 250 to $398 350 44 603,25 33,0%

$398 350 to $400 000 115 586,25 35,0%

$400 000 and up 116 163,75 39.6%

If you earn $100,000 per year, how much tax you would owe?

What are you marginal and average tax rates?

You would owe 10% of $8,925, 15% of $27,325 (the difference

between the top and the threshold of the second tax bracket),

25% of $51,600, and 28% of $12,150 (the difference between

your income and the threshold of the third tax bracket).That

calculation results in $21,293, or an effective (not marginal) tax

rate of 21.3%.

Corporate Taxes

Corporate income taxes have a progressive tax structure.

Interest earned: usually fully taxable at regular tax rates (an

exception being interest from a muni).

Dividends received: A portion of dividends (up to 100%

depending on the percentage of ownership) is excluded from

taxable income, while the remaining is taxed at the ordinary

tax rate, the purpose being to avoid triple taxation.

Capital gains - U.S. corporations face the same tax rate on

capital gains as on ordinary income.

Interest paid: tax deductible for corporations (paid out of

pre-tax income).

Dividends are paid out of net income which has already been

taxed at the corporate level, this is a form of double

taxation.

Corporate Tax Rates

Taxable Income

You Pay This Amount

on the Base of the

Bracket

Plus This Percentage on

the Excess over the

Base (Marginal Rate)

$0 to $50 000 0 15,0%

$50 000 to $75 000 7 500 25,0%

$75 000 to $100 000

13 750

34,0%

$100 000 to $335 000 22 250 39,0%

$335 000 to $10 000 000 113 900 34,0%

$10 000 000 to $15 000 000 3 400 000 35,0%

$15 000 000 to $ 18 333 333 5 150 000 38,0%

$18 333 333 and up

6 416 667

35,0%

Average Tax

Rate at Top

of Bracket

15%

18,3%

22,3%

34,0%

34,0%

34,3%

35,0%

35,0%

What is the average tax rate at top of each tax bracket?

More Tax Issues

Tax Loss Carry-Back and Carry-Forward since corporate

incomes can fluctuate widely, the Tax Code allows firms to

carry losses back to offset profits in previous years or forward

to offset profits in the future.

2011 2012

Original taxable income $3 000 000 $2 000 000

Carry-back credit -3 000 000 -2 000 000

Adjusted profit $ 0 $ 0

Taxes previously paid (40%) 1 200 000 800 000

Tax refund $ 1 200 000 $ 800 000

Total refund received in 2014: $1 200 000 + $800 000 = $2 000 000

Amount of loss carry-forward available for use in 2014-2034:

2013 loss

$6 000 000

Carry-back losses used $5 000 000

Carry-forward losses still available $1 000 000

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- 2012 F MAT-103 Final SampleDocument33 pages2012 F MAT-103 Final SampleAnna StoychevaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Photography in The Civil WarDocument4 pagesPhotography in The Civil WarAnna StoychevaNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- MIS Ch4 ITMetricsDocument36 pagesMIS Ch4 ITMetricsAnna StoychevaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- MIS Ch5 ITRolesStructures, Ethics, Security+BP6,7Document22 pagesMIS Ch5 ITRolesStructures, Ethics, Security+BP6,7Anna StoychevaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Management Information Systems: Chapter 8: Accessing Organizational Information - Data Warehouse + BP18Document27 pagesManagement Information Systems: Chapter 8: Accessing Organizational Information - Data Warehouse + BP18Anna StoychevaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- R C I R: Etail Lothing Ndustry EportDocument19 pagesR C I R: Etail Lothing Ndustry EportAnna StoychevaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Management Information Systems: Chapter 7: Storing Organizational Information - DatabasesDocument22 pagesManagement Information Systems: Chapter 7: Storing Organizational Information - DatabasesAnna StoychevaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- HRM EmployerBranding FinalDocument20 pagesHRM EmployerBranding FinalAnna StoychevaNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Implement Competitive Advantages with ERP, CRM, SCM & BPRDocument22 pagesImplement Competitive Advantages with ERP, CRM, SCM & BPRAnna StoychevaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- BGF InstrumentsDocument1 pageBGF InstrumentsAnna StoychevaNo ratings yet

- FinalDocument7 pagesFinalAnna StoychevaNo ratings yet

- "A Modest Proposal" Is Jonathan Swift's Way of Showing The Irish People HowDocument1 page"A Modest Proposal" Is Jonathan Swift's Way of Showing The Irish People HowAnna StoychevaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- PraktrikDocument9 pagesPraktrikAnna StoychevaNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Praktrik: BUS 362c: Marketing Research Anna Stoycheva, Tereza Georgieva, Elvis Dura - INCEPTIONDocument25 pagesPraktrik: BUS 362c: Marketing Research Anna Stoycheva, Tereza Georgieva, Elvis Dura - INCEPTIONAnna StoychevaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Report FinalDocument29 pagesReport FinalAnna StoychevaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Time Value of MoneyDocument41 pagesTime Value of MoneyAnna StoychevaNo ratings yet

- Corporate Finance Report On LegoDocument8 pagesCorporate Finance Report On LegoAnna StoychevaNo ratings yet

- Financial SystemDocument11 pagesFinancial SystemAnna StoychevaNo ratings yet

- Introduction To Corporate FinanceDocument16 pagesIntroduction To Corporate FinanceAnna StoychevaNo ratings yet

- Financial Statement AnalysisDocument39 pagesFinancial Statement AnalysisAnna StoychevaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- FinalDocument7 pagesFinalAnna StoychevaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Section A-MCQ (15 Marks) : Good LuckDocument3 pagesSection A-MCQ (15 Marks) : Good Luckhuzaifa anwarNo ratings yet

- Financial Times UK. September 06, 2022Document24 pagesFinancial Times UK. September 06, 2022Mãi Mãi LàbaoxaNo ratings yet

- Group 2 Fiscal Policy Assignment 2Document16 pagesGroup 2 Fiscal Policy Assignment 2NGHIÊM NGUYỄN MINH100% (1)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- By: By: BKG Gabay BKG Gabay RM Remotin, Jr. RM Remotin, Jr. Eam Uy Eam UyDocument20 pagesBy: By: BKG Gabay BKG Gabay RM Remotin, Jr. RM Remotin, Jr. Eam Uy Eam UyTine FNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Kisu ShuteNo ratings yet

- MGT201 BRAC Bank ReportDocument30 pagesMGT201 BRAC Bank Report2221979No ratings yet

- Bos 44566Document24 pagesBos 44566Bhavani KannanNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- State - A Community of Persons More or Less Numerous, Permanently Occupying A Definite Portion ofDocument7 pagesState - A Community of Persons More or Less Numerous, Permanently Occupying A Definite Portion ofRonna MaeNo ratings yet

- 73 153 1 PBDocument18 pages73 153 1 PBTataNo ratings yet

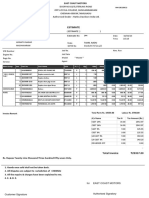

- Tax Invoice for Electrical PartsDocument1 pageTax Invoice for Electrical PartsShilpa GuptaNo ratings yet

- Notes FMDocument42 pagesNotes FMSneha JayalNo ratings yet

- Ordinance No 302 2016 of The 2nd DecemberDocument118 pagesOrdinance No 302 2016 of The 2nd DecemberEscobar Ruiz Iris MaríaNo ratings yet

- QuestionDocument16 pagesQuestionda5ew99No ratings yet

- Job Est PrintDocument1 pageJob Est PrintKashish JainNo ratings yet

- income From Salary-Problems, Theory and Solutions: by Prof - Augustin AmaladasDocument76 pagesincome From Salary-Problems, Theory and Solutions: by Prof - Augustin AmaladasAnkit Dhyani100% (6)

- Architectural AgreementDocument8 pagesArchitectural AgreementDeepak HiremathNo ratings yet

- Strict or Liberal Construction of StatutesDocument32 pagesStrict or Liberal Construction of StatutesGreg BaldoveNo ratings yet

- Price List Price List: Floor Price Per Sq. FTDocument2 pagesPrice List Price List: Floor Price Per Sq. FTishaan singhNo ratings yet

- PIT IllustrationsDocument2 pagesPIT IllustrationsBảo BờmNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- GX Fsi Dcfs 2019 Banking Cap Markets Outlook PDFDocument40 pagesGX Fsi Dcfs 2019 Banking Cap Markets Outlook PDFJyoti KumawatNo ratings yet

- Watch Adventure Time On Cartoon Network: DSTV Channel 301Document9 pagesWatch Adventure Time On Cartoon Network: DSTV Channel 301Mohamed FaidallaNo ratings yet

- Abdul Rehman 2022 ReturnDocument4 pagesAbdul Rehman 2022 Returnbalawal mirzaNo ratings yet

- Gh-Morocco DtaDocument2 pagesGh-Morocco DtabatuchemNo ratings yet

- Market Failure ExplainedDocument3 pagesMarket Failure ExplainedAbdul Basit JamilNo ratings yet

- The Basics of Investing in StocksDocument208 pagesThe Basics of Investing in StocksSatish Adhav100% (1)

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Reset No Tax Due ReportDocument1 pageReset No Tax Due ReportKent WhiteNo ratings yet

- Economics Edexcel Theme2 Workbook Answers 1Document40 pagesEconomics Edexcel Theme2 Workbook Answers 1Thais LAURENTNo ratings yet

- Advanced Finacial ModellingDocument1 pageAdvanced Finacial ModellingLifeis BeautyfulNo ratings yet

- RDO No. 99 - Malaybalay City, BukidnonDocument368 pagesRDO No. 99 - Malaybalay City, BukidnonCzar Ian AgbayaniNo ratings yet