Professional Documents

Culture Documents

Lec20cost - Allocaindirect Allocation of Costs, Destin Brass PDF

Uploaded by

jasminetso0 ratings0% found this document useful (0 votes)

36 views11 pagesDialglow corporation manufactures travel clocks and watches. Overhead costs are currently allocated using direct labor hours. Controller has recommended an activity-based costing system.

Original Description:

Original Title

lec20cost_allocaIndirect Allocation of Costs, Destin Brass.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDialglow corporation manufactures travel clocks and watches. Overhead costs are currently allocated using direct labor hours. Controller has recommended an activity-based costing system.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

36 views11 pagesLec20cost - Allocaindirect Allocation of Costs, Destin Brass PDF

Uploaded by

jasminetsoDialglow corporation manufactures travel clocks and watches. Overhead costs are currently allocated using direct labor hours. Controller has recommended an activity-based costing system.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 11

1

1

15.501/516

Cost Allocation

Accounting

Spring 2004

Professor S. Roychowdhury

Sloan School of Management

Massachusetts Institute of Technology

May 3, 2004

2

i

ials

ly

i

i

Traditional Costing System

Direct Costs

Direct Labor

Direct Materials

Overhead Costs

Ind rect Labor

Indirect Mater

Depreciation

Product

Costs

Traced

direct

Traced us ng

allocation base

eg direct labor hrs,

mach ne hrs

3

Examples of Overhead Activities

Purchase order processing

Receiving/Inventorying materials

Inspecting materials

Processing accounts payable

Facility maintenance

Scheduling production

Customer complaints

Quality inspection/testing

2

Activity-Based Costing System

Di

Di ls

i

i i

i

i

dri

Direct Costs

rect Labor

rect Materia

Overhead Costs

Ind rect Labor

Ind rect Mater als

Depreciat on

Product

Costs

Activ ties

that

ve

overhd

4

Typical Activity Cost Drivers

Number of alteration notices per product

Units produced

Number of receipts for materials/parts

Stockroom transfers

Direct labor hours

Set-up hours

Inspection hours

Facility hours

Number of customer complaints

5

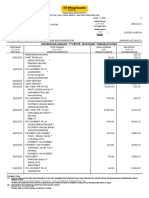

Cost Allocation Example

Dialglow Corporation manufactures travel clocks and watches.

Overhead costs are currently allocated using direct labor hours,

but the controller has recommended an activity-based costing

system using the following data:

Activity Cost Cost Driver Clocks Watches

Production Setup $120,000 No. of setups 10 15

Material Handling

& Requisition 30,000 No. of parts 18 36

Packaging

& Shipping 60,000 #Units Shipped 45,000 75,000

Total Overhead $210,000

Direct labor hours 140,000 35,000 105,000

6

3

Using Traditional Costing System

Allocate Total OH based on labor hours

(35,000 hours for travel clocks; 105,000 hours for watches.)

OH Rate:

$210,000 / 140,000 hours = $1.50/hour

OH cost per Travel Clock:

($1.50/hr * 35,000 hrs) / 45,000 units = $1.167

OH cost per Watch:

($1.50/hr * 105,000 hrs) / 75,000 units = $2.10

Using ABC

7

Allocation of :

Production Setup Costs: $120,000 / (10+15) setups = $4,800/setup

Material Handlg Costs: $30,000 / (18+36) part numbers = $555.56/part

Packing/shipping Costs: $60,000 / (45,000+75,000) units = $0.50/unit shipped

Activity Activity

Product Costs using ABC: Level Clocks Level Watches

Production Setup

Material Handling

Packing/Shipping

Total

Per Unit

8

Using ABC

Allocation of :

Production Setup Costs: $120,000 / (10+15) setups = $4,800/setup

Material Handlg Costs: $30,000 / (18+36) part numbers = $555.56/part

Packing/shipping Costs: $60,000 / (45,000+75,000) units = $0.50/unit shipped

Activity Activity

Product Costs using ABC: Level Clocks Level Watches

Production Setup 10 $48,000 15 $72,000

Material Handling

Packing/Shipping

Total

Per Unit

9

4

Using ABC

Allocation of :

Production Setup Costs: $120,000 / (10+15) setups = $4,800/setup

Material Handlg Costs: $30,000 / (18+36) part numbers = $555.56/part

Packing/shipping Costs: $60,000 / (45,000+75,000) units = $0.50/unit shipped

Activity Activity

Product Costs using ABC: Level Clocks Level Watches

Production Setup 10 $48,000 15 $72,000

Material Handling 18 10,000 36 20,000

Packing/Shipping

Total

Per Unit

10

Using ABC

Allocation of :

Production Setup Costs: $120,000 / (10+15) setups = $4,800/setup

Material Handlg Costs: $30,000 / (18+36) part numbers = $555.56/part

Packing/shipping Costs: $60,000 / (45,000+75,000) units = $0.50/unit shipped

Activity Activity

Product Costs using ABC: Level Clocks Level Watches

Production Setup

Material Handling

Packing/Shipping

Total

Per Unit

10 $48,000

18 10,000

45000 22,500

15 $72,000

36 20,000

75000 37,500

Using ABC

Allocation of :

Production Setup Costs: $120,000 / (10+15) setups = $4,800/setup

Material Handlg Costs: $30,000 / (18+36) part numbers = $555.56/part

Packing/shipping Costs: $60,000 / (45,000+75,000) units = $0.50/unit shipped

Activity Activity

Product Costs using ABC: Level Clocks Level Watches

Production Setup 10 $48,000 15 $72,000

Material Handling 18 10,000 36 20,000

Packing/Shipping 45000 22,500 75000 37,500

Total $80,500 $129,500

Per Unit

12

11

5

Using ABC

Allocation of :

Production Setup Costs: $120,000 / (10+15) setups = $4,800/setup

Material Handlg Costs: $30,000 / (18+36) part numbers = $555.56/part

Packing/shipping Costs: $60,000 / (45,000+75,000) units = $0.50/unit shipped

Activity Activity

Product Costs using ABC: Level Clocks Level Watches

Production Setup 10 $48,000 15 $72,000

Material Handling 18 10,000 36 20,000

Packing/Shipping 45000 22,500 75000 37,500

Total $80,500 $129,500

Per Unit $1.79 $1.73

13

Summary

Managerial accounting focuses on decision making and

control:

Decision making: initiating and implementing decisions.

Control: ratifying and monitoring decisions.

Important: Organizational structure of firm should separate both

functions.

Characteristics of good internal accounting system:

Provide information necessary to identify most profitable products.

Provide information necessary to identify production inefficiencies to

ensure production at minimum cost.

Combine measurement of performance with evaluation of

performance to create incentives for managers that maximize firm

value.

14

Destin Brass Products Co.

What does Destin Brass do?

What is the dilemma that management faces?

What type of costs does Destin Brass incur?

Exhibit 2

How has it organized its cost system?

15

6

Traditional Costing System

i

ials

ly

i

i

Direct Costs

Direct Labor

Direct Materials

Overhead Costs

Ind rect Labor

Indirect Mater

Depreciation

Product

Costs

Traced

direct

Traced us ng

allocation base

eg direct labor hrs,

mach ne hrs

16

Why Allocate?

Simple alternative to allocation: forego allocation

altogether

Charge overhead as period expense

Evaluate products using contribution margin

(CM = price variable cost / unit)

What is the danger?

Forget overheads exist while pricing remember the

incentives of the marketing guys

Forget overheads exist period! this would lead to overhead

costs spiraling out of control

17

The Challenge Of Cost Allocation Alt. 1

Traditional cost system: See Exhibit 3

Practice: Two-stage process

All overhead is assigned to production

Overhead is assigned to product using DIRECT

LABOR $

Pros of the system:

Simple, i.e., inexpensive

Satisfies all the needs to do financial/tax reporting

18

7

The Challenge Of Cost Allocation Alt. 2

The alternative:See Exhibit 4

Different overhead allocation:

Material related overhead (no relation with labor cost)

Single out set-up labor cost (no relation with labor

cost of production run)

Remaining overhead: allocate based on machine-

hours: machine hours better reflect the use of the

resources related to using the (expensive) machines

Pros of the system:

Still simple, i.e., inexpensive: we have all the info

Satisfies all the needs to do financial/tax reporting

19

Comparison Of Two Systems

Profitability of products depends on allocation rules

Valves Pumps Flow C.

Price $57.78 $81.26 $97.07

Cost Alt. 1 $37.56 $63.12 $56.50

Cost Alt. 2 $49.00 $58.95 $47.96

Profit margin Alt. 1 35% 22% 42%

Profit margin Alt. 2 15% 27% 51%

(Alt. 1 = DL$ allocation from Exh. 1

Alt. 2 = Mach. Hrs alloc from Exh. 4)

20

Comparison Of Two Systems

Problem?

E.g., engineering costs

Volume does not cause the costs

Suggested solution: trace costs to transactions

21

8

Activity-Based Costing

Starting point:

Activities cause costs

Activities occur to produce products and services

Basis of the ABC system:

Identify activities

Trace the costs of resources to the activities consumed

Identify activity measures by which the costs of the

process vary most directly

Trace activity costs to cost objects (e.g., products)

22

Activity-Based Costing System

Di

Di ls

i

i i

i

i

dri

Direct Costs

rect Labor

rect Materia

Overhead Costs

Ind rect Labor

Ind rect Mater als

Depreciat on

Product

Costs

Activ ties

that

ve

overhd

23

Apply ABC to Destin Brass

Direct Costs: as before

Depreciation (270K)

Activity related costs

Receiving and Materials Handling (20K and

200K)

Packing and Shipping (60K)

Engineering (100K)

Maintenance (30K)

24

9

Implications

Profit margin by product?

Valves Pumps Flow C.

Alt. 1 35% 22% 42%

Alt. 2 15% 27% 51%

ABC 35% 40% -4%

Do we better understand the price setting by

competitors now?

25

Implications

Issues raised by ABC analysis

Pumps arent so bad!

But flow controllers are negative margins

Is the logical conclusion to exit the flow

controller market ?

Are there are hints in the case that prices of flow

controllers can be raised further?

Are there other issues?

Number of production runs

Number of components

Number of shipments

Implications Does ABC Over-Penalize Flow

Controllers?

What is Receiving an Materials Handling overhead

per unit for Flow Controllers?

Using Revised Standard Cost (allocation base is

total direct materials cost)

$10.56

Using ABC (allocation is based on proportion of

transactions)

$170,543/4,000 = $42.64!

27

26

10

Benefits of ABC

Very useful in multi-product firms where

large overheads exist.

Forces mangers to think about what drives

costs

Leads to managers to question why certain

activities exist in the first place.

More accurate costing if cost drivers are

chosen carefully.

28

Some Facts About ABC Adoption

A survey of 178 US plants came up with the

following results:

49% committed resources for ABC

implementation

25% are considering adoption

5% considered and rejected

21% did not consider

Only around 10% actually use ABC in a

significant number of operations

29

Problems

Different cost drivers result in very different

allocations

Number of potential cost drivers is large

Identification of cost driving activities leads

to political squabbles amongst managers and

departmental heads.

Traditional costing systems with carefully

chosen allocation bases are simpler and often

work as well.

30

11

What Are The Trade-Offs In Cost Allocation?

Should be representative of overheads consumed by different

products / product lines.

Should fit the economic purpose for which cost allocations

are being used.

Should be simple and easy to track and maintain.

The common problem of allocation systems: they are

adequate and simple at the time they are put in place but

slowly become outdated as businesses and business

processes evolve

In other words, they are too simple to handle the complexity of new

developments over time Seligram case.

31

Summary

When products or services are homogeneous,

volume cost drivers are appropriate for allocating

overhead

When a variety of products or services is produced,

ABC is more accurate because it traces costs to

activities, performed to produce products or

services:

Costs result from how we do business!

ABC systems allow strategic evaluation of product

design, manufacturing technology, pricing

decisions, product line decisions

32

You might also like

- Bs en Iso 1 1:2012 4064Document32 pagesBs en Iso 1 1:2012 4064jasminetsoNo ratings yet

- Note For Finance CommitteeDocument8 pagesNote For Finance CommitteejasminetsoNo ratings yet

- International Standard: Risk Management - GuidelinesDocument24 pagesInternational Standard: Risk Management - Guidelinesjasminetso100% (14)

- WorldGBC ANZ Status Report 2021 - FINALDocument25 pagesWorldGBC ANZ Status Report 2021 - FINALjasminetsoNo ratings yet

- Graduate STEM Education For The 21st CenturyDocument203 pagesGraduate STEM Education For The 21st CenturyJuan PobleteNo ratings yet

- 01 GasolineDocument9 pages01 GasolineYarin HernandezNo ratings yet

- Example Research ProposalDocument8 pagesExample Research ProposalMarco BarretoNo ratings yet

- Revised RODP 500x500Document1 pageRevised RODP 500x500jasminetsoNo ratings yet

- NEC3 Delegate Handbook v2 - Sept2018Document39 pagesNEC3 Delegate Handbook v2 - Sept2018jasminetsoNo ratings yet

- The Next Normal in ConstructionDocument90 pagesThe Next Normal in ConstructionRodrigo Giorgi100% (1)

- Inspect The BuildingDocument5 pagesInspect The BuildingjasminetsoNo ratings yet

- Sample Format of Grand Summary of The Activity Schedule / Bill of Quantities in NEC ECC ContractsDocument1 pageSample Format of Grand Summary of The Activity Schedule / Bill of Quantities in NEC ECC ContractsjasminetsoNo ratings yet

- The Ultimate Guide To Benchmarking Construction WorkflowsDocument13 pagesThe Ultimate Guide To Benchmarking Construction WorkflowsjasminetsoNo ratings yet

- BIM International Edition 2020Document36 pagesBIM International Edition 2020Edward C100% (1)

- NEC Certificate PrinciplesDocument1 pageNEC Certificate PrinciplesjasminetsoNo ratings yet

- Appendix To The General Conditions of Tender Correction Rules For Tender Errors (General Conditions of Tender Clause GCT 11)Document15 pagesAppendix To The General Conditions of Tender Correction Rules For Tender Errors (General Conditions of Tender Clause GCT 11)Jasmine TsoNo ratings yet

- PHP Error opening fileDocument2 pagesPHP Error opening fileSofia VelásquezNo ratings yet

- NEC Collaboration CLLB Ti: Practice NotesDocument122 pagesNEC Collaboration CLLB Ti: Practice NotesCT0011No ratings yet

- RICS Hong Kong Mediator RegisterDocument3 pagesRICS Hong Kong Mediator RegisterjasminetsoNo ratings yet

- 01 Nec Ecc PN V1.0 201610 PDFDocument120 pages01 Nec Ecc PN V1.0 201610 PDFghjtyu0% (1)

- 11 Sample Template of WI Preambles To Specifications V1.0 201610Document5 pages11 Sample Template of WI Preambles To Specifications V1.0 201610Bruce WongNo ratings yet

- Experiments with ElectrostaticsDocument1 pageExperiments with ElectrostaticsjasminetsoNo ratings yet

- CWDCS Web Basic 20210129Document1,050 pagesCWDCS Web Basic 20210129jasminetsoNo ratings yet

- 13 Sample Template For BQ Preambles V1!1!201703Document7 pages13 Sample Template For BQ Preambles V1!1!201703Jasmine TsoNo ratings yet

- Contract Clause "Hired and Hire-Purchase Constructional Plant". The Project Offices ShouldDocument17 pagesContract Clause "Hired and Hire-Purchase Constructional Plant". The Project Offices ShouldjasminetsoNo ratings yet

- CWDCS Web Basic 20210129Document1,050 pagesCWDCS Web Basic 20210129jasminetsoNo ratings yet

- Emp 1201Document12 pagesEmp 1201jasminetsoNo ratings yet

- Architecture Design Handbook - Fundamentals - Radio Frequency ShieldingDocument1 pageArchitecture Design Handbook - Fundamentals - Radio Frequency ShieldingjasminetsoNo ratings yet

- ICNIRPemfgdl 1Document38 pagesICNIRPemfgdl 1lukiNo ratings yet

- Bim 2019Document4 pagesBim 2019jasminetso100% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Kelvinator - RefrigeratorDocument1 pageKelvinator - RefrigeratorArvind D ArvindNo ratings yet

- MIS Assignment 3Document3 pagesMIS Assignment 3Duaa FatimaNo ratings yet

- Ibs Bachok SC 1 28/02/23Document4 pagesIbs Bachok SC 1 28/02/23Sabariah MansoorNo ratings yet

- Industry Profile: Vega Auto Accessories Private LTDDocument57 pagesIndustry Profile: Vega Auto Accessories Private LTDSanjay SmartNo ratings yet

- Functions Sales ManagementDocument31 pagesFunctions Sales ManagementSeth ValdezNo ratings yet

- Questions About The Case Study: ELE PLCDocument2 pagesQuestions About The Case Study: ELE PLCMicaela Hidalgo RamírezNo ratings yet

- BRM Project ProposalDocument4 pagesBRM Project ProposalVijeta BaruaNo ratings yet

- The BCG Growth-Share MatrixDocument2 pagesThe BCG Growth-Share Matrixyushveer002No ratings yet

- Thesis MKTGDocument65 pagesThesis MKTGkyrstynNo ratings yet

- Business Analytics M17 EVAN7821 09 SE SUPPA Online - EvansDocument30 pagesBusiness Analytics M17 EVAN7821 09 SE SUPPA Online - EvanssulgraveNo ratings yet

- ERA SpecificationDocument831 pagesERA SpecificationSamuel Gezahegn94% (90)

- Decision Theory - PPT UNIT 4Document38 pagesDecision Theory - PPT UNIT 4som mahatoNo ratings yet

- Aeon Mall Questionnaire 1Document8 pagesAeon Mall Questionnaire 1Lê Tố NhưNo ratings yet

- B2B Product Decisions New Product DevelopmentDocument30 pagesB2B Product Decisions New Product DevelopmentZee ZaaNo ratings yet

- The Stahl Family Pottery in Powder Valley, PA - Page 2Document1 pageThe Stahl Family Pottery in Powder Valley, PA - Page 2Justin W. ThomasNo ratings yet

- Tabumpama Car Rental services business planDocument15 pagesTabumpama Car Rental services business planmarbie tabumpamaNo ratings yet

- Customer Satisfaction On Maruti 4 WheelersDocument147 pagesCustomer Satisfaction On Maruti 4 WheelerssudheerNo ratings yet

- Bake N Flake Company Final 4Document31 pagesBake N Flake Company Final 4sarojNo ratings yet

- Cadbury Schweppes Raspberry Ginger Ale Launch StrategyDocument10 pagesCadbury Schweppes Raspberry Ginger Ale Launch StrategyPam UrsolinoNo ratings yet

- Demantra OverviewDocument45 pagesDemantra OverviewMushtaq AhmedNo ratings yet

- 3084 2940 1 PBDocument13 pages3084 2940 1 PBshaunakroysxccalNo ratings yet

- Project Management ProcedureDocument16 pagesProject Management ProcedureKailas Anande100% (2)

- 13Document17 pages13reemmajzoubNo ratings yet

- Tahp4 - Writing TestDocument5 pagesTahp4 - Writing TestTrúc Diệp KiềuNo ratings yet

- VRIN Analysis - HECDocument2 pagesVRIN Analysis - HECMona RishiNo ratings yet

- RTE FOOD Industry ReportDocument39 pagesRTE FOOD Industry ReportChaitanya ThotaNo ratings yet

- Business Mastery II Brochure - LRDocument4 pagesBusiness Mastery II Brochure - LRsfredrickson733% (3)

- EBW SampleDocument8 pagesEBW SampleArianna GarciaNo ratings yet

- 129 Kanak RaikwarDocument61 pages129 Kanak RaikwarAashish singhNo ratings yet

- Grameen Danone Foods Limited (GDF) : Keywords: Teaching Case, Social Entrepreneurship, Bangladesh, Yogurt, Dairy IndustryDocument32 pagesGrameen Danone Foods Limited (GDF) : Keywords: Teaching Case, Social Entrepreneurship, Bangladesh, Yogurt, Dairy IndustryZahirkhan71No ratings yet