Professional Documents

Culture Documents

JPMorgan Corporate Finance Advisory RiskierCurrencyEnvironment

Uploaded by

noonunits0 ratings0% found this document useful (0 votes)

91 views12 pagesJP Morgan Corporate Finance Advisory

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentJP Morgan Corporate Finance Advisory

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

91 views12 pagesJPMorgan Corporate Finance Advisory RiskierCurrencyEnvironment

Uploaded by

noonunitsJP Morgan Corporate Finance Advisory

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 12

OCTOBER 2012

Riding the foreign exchange roller coaster

Corporate nance implications of a riskier

currency environment

Published by Corporate Finance Advisory

For questions or further information,

please contact:

Corporate Finance Advisory

Marc Zenner

marc.p.zenner@jpmorgan.com

(212) 834-4330

Tomer Berkovitz

tomer.x.berkovitz@jpmorgan.com

(212) 834-2465

RIDING THE FOREIGN EXCHANGE ROLLER COASTER

|

1

1. Dealing with the currency environment you have

(rather than the one youd like to have)

Slower growth in developed economies relative to emerging markets, advances in transpor-

tation and telecommunication infrastructure and lower international trade barriers have led

many U.S. companies to expand their ofshore operations in recent years. Whether through

M&A or organic growth, large multinationals derive a growing part of their revenue from

non-domestic markets. For example, for the 25 largest companies in the S&P 100 index,

the portion of non-U.S. revenues increased from almost 45% in 2006 to over 55% in 2011.

However, with the benets of faster growing non-domestic markets come the risks of

foreign currency uctuations.

Figure 1

Non-domestic revenues are becoming increasingly important for large global rms

Median % of revenue outside of North America

1

Senior managers and capital market participants are used to dealing with risky operations

and changing markets and prices. With ever-expanding non-domestic sales, however, the

impact of currency uctuations in predicting earnings and cash ows becomes paramount.

Figure 2

Increasingly volatile FX environment calls for action

This riskier currency environment profoundly impacts all aspects of corporate nance

decision-making, from risk management to dividend policy, capital structure and M&A.

To guide senior executives, we provide a roadmap that highlights key challenges and

helps users avoid the most common pitfalls of this riskier currency environment.

2006 2007 2008 2009 2010

53.9%

2011

44.7%

47.2%

49.3%

50.1%

55.6%

CAGR 20062011: 4.5%

Source: Bloomberg, FactSet

1

Top 25 S&P 100 companies by market cap

Companies need

to reexamine

their FX strategy

FX environment

More volatile

Harder to predict

Limited benets of

diversication

Corporate environment

Greater revenues

ofshore

Increased investor

attention to FX

Increased FX-related

earnings volatility

Source: J.P. Morgan

2

|

Corporate Finance Advisory

2. How do you dene your currency risk exposure?

Following the recent (and some would say, ongoing) nancial crisis and the ock of associ-

ated black swans, senior decision-makers are even more focused on measuring and manag-

ing risk. The traditional view is that investors expect higher returns when exposed to higher

systematic risk (beta).

We believe that there is another categorization of risk that is useful in the context of

currency exposure: Core versus non-core equity risk. Core equity risk is a key risk

borne by a rm due to the nature of its business; investors would likely choose to have

exposure to this particular risk to enhance their returns. Asymmetric risk, however,

creates exposure to a risk that investors are not necessarily seeking out when purchasing

a stock. They can be material but are not key drivers of the rms investment thesis

(see examples of core and asymmetric risks in Figure 3).

Figure 3

Core versus asymmetric risk exposures

We believe that for most rms, currency risk falls in the category of asymmetric risk.

As a result, the growing impact of currency uctuations is likely to be asymmetric. That is,

the perceived shareholder benet of a favorable currency outcome will be overshadowed

by the penalty due to an unfavorable currency outcome. If currency volatility increases, ex-

posure to asymmetric risk will be higher and corporate nance implications would likely

be more severe.

EXECUTIVE TAKEAWAY

Large global rms realize a growing part

of their sales from non-domestic markets,

while currency volatilities have increased

relative to pre-crisis levels, and the benets

of diversication have diminished. As a result,

currency swings will have a greater impact

on rm value going forward, unless decision-

makers adopt a proactive approach to dealing

with this new reality.

Core Asymmetric

Denition

Risk fundamental to main business activity Risk that is not fundamental to main business activity

Investors

perspective

Investors purchase shares to achieve exposure to

the core risk

Investors do not purchase the stock to obtain exposure

to this risk

Investors may penalize the frm more for adverse

outcomes than they reward it for favorable outcomes

Examples

Company Risk exposure Company Risk exposure

Gas exploration

and production

Gas prices Waste management Trucking fuel

Real estate

investment trust

Real estate market Food and beverage Aluminum prices

Oil refner Crack spreads Iron ore Copper prices

Gold mine Gold prices Global corporations Currency risk?

Source: J.P. Morgan

RIDING THE FOREIGN EXCHANGE ROLLER COASTER

|

3

3. A riskier currency environment

3.1. Sustained higher volatility level

During crises, volatilities of nancial assets tend to spike. At the peak of the recent nancial

crisis, equity volatility (as measured by the VIX index) jumped from a pre-crisis average of

about 15% to as high as 80% on October 27, 2008. Following this trend, currency volatilities

also spiked during the crisis, from a pre-crisis average of about 9% to about 13%. Despite

the signicant economic, regulatory, nancial systemic and geopolitical risks, equity volatil-

ity has dropped back to pre-crisis levels of about 15 to 20%. In contrast, currency volatility

has not yet returned to prior levels in all markets (particularly the Euro/USD rate). As one

can see in Figure 4 below, currency volatilities have settled at a level that is about 50%

higher than that prior to the crisis. The uncertainty around the future of the Euro, concerns

about global economic slowdown, the U.S. elections and the scal clif constitute a large

part of this volatility.

What does this mean for corporate decision-makers? For rms operating in non-domestic

markets, this higher volatility implies more severe shocks to non-domestic revenues and

earnings.

Figure 4

Currency volatilities are still elevated in some markets

Expected volatility of foreign exchange rates

1

EXECUTIVE TAKEAWAY

All rms take on risk. Investors select equity

investments based on the balance between

expected returns and risk. Some rms provide

risk exposures that are uniquely attractive to

some investors. For most rms, currency risk

does not, however, fall into this category. As a

result, rms will be more negatively impacted

by adverse currency movements rather than

positively impacted by favorable ones.

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

20.0%

22.0%

24.0%

01/28/2003 06/15/2004 11/01/2005 03/20/2007 08/05/2008 12/22/2009 05/10/2011

Euro/USD volatility JPY/USD volatility GBP/USD volatility

Post-crisis median: 12.9%

Pre-crisis median: 8.8%

Source: Bloomberg

1

One-year option-implied volatility

4

|

Corporate Finance Advisory

3.2. Reduced ability to predict currency volatility

A more volatile foreign exchange environment makes it more challenging to forecast rate

changes. In May 2007, when currency volatility was relatively low, most economists had

roughly similar forecasts regarding future rates of the Euro. This estimated consensus was

wrong. By the end of the third quarter, the Euro already spiked beyond the highest analyst

forecast of just four months earlier and a similar trend was recognized during the following

two quarters. When currency volatility reached its peak (at the end of 2008), the diver-

gence in economists views almost tripled. Still, the actual spot rate was close to the highest

estimate and signicantly away from the median.

What does this mean for corporate decision-makers? Firms often rely on economists

forecasts and the forward curve to budget foreign earnings and cash ows that will be

translated into USD. Whether evaluating a new project or M&A opportunity, the ability to

forecast USD returns on investments is critical. When realized spot rates are drastically

diferent from the rates used for calculating the expected ROIC, unhedged investments

may turn dilutive (from both economic and accounting perspectives), even if the foreign

currency cash ows of the project or the subsidiary perform as expected.

Figure 5

Economists disagreement about future currency rates is growing

Economists forecasts for the Euro spot price

3.3. Greater difculty in diversifying foreign currency risk

Global companies operating in various international markets often rely on the diversica-

tion among diferent currencies to mitigate the net impact of currency uctuations on their

cash ows. In particular, the correlation between emerging market currencies, such as the

Brazilian Real (BRL) and Indian Rupee (INR), and developed market currencies, was close

to zero in the pre-crisis environment. Figure 6 shows, however, that in the new currency

environment, the correlation between foreign exchange rates of emerging and developed

markets has spiked. For example, the Euro/BRL correlation has jumped from zero to 60%.

Source: Bloomberg, FactSet

Note: Standard deviation refers to the average of the four periods standard deviation of economist forecasts

1

Trough implied Euro volatility and analyst estimates as of May 8, 2007

2

Peak implied Euro volatility and analyst estimates as of December 30, 2008

$1.48 $1.48

$1.52

$1.55

$1.41

$1.07

$1.10

$1.05

$1.00

$1.00

$1.10

$1.20

$1.30

$1.40

$1.50

$1.60

$1.70

Q1 2009 Q2 2009 Q3 2009 Q4 2009

$1.40 $1.40

$1.40

$1.42

$1.35

$1.26

$1.22

$1.16

$1.12

$1.00

$1.10

$1.20

$1.30

$1.40

$1.50

$1.60

$1.70

Q2 2007 Q3 2007 Q4 2007 Q1 2008

Standard

deviation

4%

Standard

deviation

11%

Trough

1

expected currency volatility Peak

2

expected currency volatility

Economists forecasts

Euro spot price

Economists forecasts

Euro spot price

RIDING THE FOREIGN EXCHANGE ROLLER COASTER

|

5

The increased correlation is a result of several factors. First, integration of global

economies and capital markets, combined with innovations in the nancial industry, has

led to increased correlation between markets. Similarly, the correlation between emerging

and developed markets equities has increased signicantly in recent years. Last, the use of

U.S. Treasuries as a safe haven and more macro-driven investments are driving correlations

closer to one.

What does this mean for corporate decision-makers? The value of diversication across

diferent currencies is diminishing, leading more global rms to be more aggressive about

hedging alternatives.

Figure 6

Benets of currency diversication are reduced in todays environment

Source: Bloomberg

Euro/AUD correlation

-0.1

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

-0.1

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

Euro/INR correlation

Developed markets Emerging markets

1/29/04 1/29/06 1/29/08 1/29/10 1/29/12 1/29/04 1/29/06 1/29/08 1/29/10 1/29/12

Euro/CAD correlation

-0.1

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

-0.1

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

Euro/BRL correlation

1/29/04 1/29/06 1/29/08 1/29/10 1/29/12 1/29/04 1/29/06 1/29/08 1/29/10 1/29/12

One-year rolling correlation of Euro/Indian Rupee

One-year rolling correlation of Euro/Brazil Real

One-year rolling correlation of Euro/Australian Dollar

One-year rolling correlation of Euro/Canadian Dollar

EXECUTIVE TAKEAWAY

The new currency environment presents

signicant challenges to corporate executives.

Foreign exchange rates are more volatile and

harder to predict. Moreover, diversication

ofers limited value as correlations have

increased.

6

|

Corporate Finance Advisory

4. Analysts and equity investors pay attention

The new foreign exchange environment and its impact on corporate earnings have

not gone unnoticed by equity analysts and investors. For some global consumer retail,

pharmaceutical and technology companies, the foreign exchange impact on second quarter

sales this year was up to 15% of revenues or US$3.0 billion (see Figure 7A). Following this

signicant impact on revenues, equity analysts are now more focused on FX. For example,

in second quarter earnings calls, 34% of multinational companies were questioned by

analysts about FX, versus only 23% in the rst quarter of 2012 (see Figure 7B).

During the third quarter, investors have returned to risk on trades causing the USD to

weaken again, which should have had a positive impact on the revenue of U.S. companies

that operate globally. The volatility in FX rates remains a major issue, however, and adds

to the uncertainty regarding future earnings and cash ows. If currency risk is perceived

as asymmetric by investors (as discussed in Section 2), then adverse moves in FX rates

will lead to increased investor attention and negative market reaction, while favorable

FX trends will not be rewarded because they are not viewed as sustainable drivers of long-

term growth.

Figure 7A

Investors are becoming increasingly focused on currency losses

Notable impact of FX uctuations on Q2 2012 revenues

T

e

l

e

c

o

m

m

u

n

i

c

a

t

i

o

n

M

e

d

i

c

a

l

t

e

c

h

n

o

l

o

g

y

I

n

t

e

r

n

e

t

s

o

f

t

w

a

r

e

I

n

t

e

g

r

a

t

e

d

O

&

G

I

n

d

u

s

t

r

i

a

l

c

o

n

g

l

o

m

e

r

a

t

e

C

h

e

m

i

c

a

l

P

h

a

r

m

a

c

e

u

t

i

c

a

l

P

h

a

r

m

a

c

e

u

t

i

c

a

l

F

o

o

d

&

b

e

v

e

r

a

g

e

P

h

a

r

m

a

c

e

u

t

i

c

a

l

I

n

d

u

s

t

r

i

a

l

c

o

n

g

l

o

m

e

r

a

t

e

A

e

r

o

s

p

a

c

e

&

d

e

f

e

n

s

e

I

T

c

o

n

s

u

l

t

i

n

g

S

u

p

e

r

c

e

n

t

e

r

s

H

o

u

s

e

h

o

l

d

p

r

o

d

u

c

t

s

Type of company

$0

$500

$1,000

$1,500

$2,000

$2,500

$3,000

0%

5%

10%

15%

Absolute FX impact on revenues

FX impact as a % of revenues

U

S

$

m

m

%

o

f

r

e

v

e

n

u

e

s

$84

$102 $119

$200

$301

$430

$441

$492

$523

$690 $692

$900

$1,000

$2,200

$3,000

Source: Press releases, Company lings, earnings calls transcripts

RIDING THE FOREIGN EXCHANGE ROLLER COASTER

|

7

Figure 7B

Investors are becoming increasingly focused on currency losses (contd)

Multinational rms questioned by analysts about FX

1

5. A roadmap to avoid the most common pitfalls

Foreign exchange rates afect various aspects of a rms corporate nance strategy. As

U.S. rms generate a larger portion of their revenue ofshore and the foreign exchange

environment remains more volatile and harder to predict, companies should reexamine

their strategy. Figure 8 ofers a corporate action plan for decision-makers to potentially

mitigate risk exposure to the increasing currency volatility.

Companies should measure the impact of FX uctuations not only on their earnings and

cash ows, but also on their leverage metrics, payout ratios and liquidity position. Hedging

should be considered, especially if the company believes that FX exposure is asymmetric

and non-core to the business. In addition to forward contracts and cross-currency swaps,

companies can use option strategies to keep some exposure but protect against tail

risk. The application of hedge accounting will also be important in certain situations and

companies need to be aware of the rules in order to avoid increasing earnings volatility

while hedging economic risk.

Source: Press releases

1

According to a review by foreign exchange risk management company FiREapps

34%

0%

5%

10%

15%

20%

25%

30%

35%

40%

23%

Q1 2012 Q2 2012

EXECUTIVE TAKEAWAY

Heightened uncertainty in the foreign

exchange market is attracting the attention

of equity analysts and investors, who are

concerned about its impact on corporate

earnings. Corporate executives, who are

already receiving more FX questions from

analysts during earnings calls, are currently

reexamining their FX strategy in light of this

new environment.

8

|

Corporate Finance Advisory

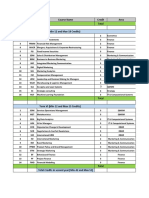

Figure 8

A roadmap to avoid the most common pitfalls

Action plan

1. Valuation

and earnings

Assess the potential impact of FX volatility on your companys earnings guidance

Focus not only on net currency exposure, but also impact on top line growth

2. Operations Consider USD denominated contracts in foreign countries as a natural ofset to FX volatility

Take into account that FX movements will still impact your frms competitiveness versus

local peers

3. Hedging

strategy

Debate de-risking strategies, especially if your company has concentrated currency exposures,

limited liquidity and modest exibility with your credit rating

Recent spike in correlations across currencies underscores the limits of diversifcation

Centralizing risk can provide a better perspective on company-wide currency exposure

4. Capital structure/

ratings

Maintain EBITDA cushion within your rating category (and fnancial covenants) or think about

hedging to protect against the impact of FX on leverage metrics

Match the currency mix of your debt to the EBITDA, either through issuance in local markets

or synthetically

5. M&A and capital

allocation

Weigh the valuation of foreign M&A targets in both the local currency and the USD

Though theoretically the two methodologies should result in similar valuations, recent market

dislocations and practical limitations often lead to diferent valuations

6. Liquidity

management

Convert excess liquidity (such as trapped ofshore cash) to match the currency of your liabilities

7. Shareholder

distributions

Test the sustainability of your companys dividend payments under a downside scenario, taking

the impact of FX into account

EXECUTIVE TAKEAWAY

In todays global economic environment,

the importance of managing the impact of

foreign exchange rates on companies becomes

increasingly important. In contrast, the ability

to predict currency movements and the use

of diversication to protect against adverse

rate changes are declining. Many companies

are currently analyzing the corporate nance

implications of this new environment and

reconsidering their FX strategy. We ofer a

corporate nance action plan that addresses

the key factors afecting global companies.

Source: J.P. Morgan

This material is not a product of the Research Departments

of J.P. Morgan Securities Inc. (JPMSI) and is not a research

report. Unless otherwise specically stated, any views or

opinions expressed herein are solely those of the authors

listed, and may difer from the views and opinions expressed

by JPMSIs Research Departments or other departments or

divisions of JPMSI and its afliates. Research reports and

notes produced by the Firms Research Departments are

available from your Registered Representative or at the

Firms website, http://www.morganmarkets.com.

Information has been obtained from sources believed to

be reliable, but JPMorgan Chase & Co. or its afliates and/

or subsidiaries (collectively J.P. Morgan) do not warrant its

completeness or accuracy. Information herein constitutes

our judgment as of the date of this material and is subject

to change without notice. This material is not intended as an

ofer or solicitation for the purchase or sale of any nancial

instrument. In no event shall J.P. Morgan be liable for any

use by any party of, for any decision made or action taken by

any party in reliance upon or for any inaccuracies or errors

in, or omissions from, the information contained herein,

and such information may not be relied upon by you in

evaluating the merits of participating in any transaction.

J.P. Morgan is the marketing name for the investment

banking activities of JPMorgan Chase Bank, N.A., JPMSI

(member, NYSE), J.P. Morgan Securities Ltd. (authorized

by the FSA and member, LSE) and their investment

banking afliates.

IRS Circular 230 Disclosure: JPMorgan Chase & Co. and

its afliates do not provide tax advice. Accordingly, any

discussion of U.S. tax matters contained herein (including

any attachments) is not intended or written to be used, and

cannot be used, in connection with the promotion, marketing

or recommendation by anyone unafliated with JPMorgan

Chase & Co. of any of the matters addressed herein or for

the purpose of avoiding U.S. tax-related penalties.

Special thanks go to Jessica Lupovici, Matt

Matthews, Allison Greenwald and Noam Gilead

for their invaluable contributions in shaping

this report. We appreciate Mark De Rocco,

Evan Junek, Andrew Kresse, Elizabeth Myers,

Fernando Rivas and John Wang for their

comments and suggestions. We would also

like to thank Jennifer Chan, Sarah Farmer

and rest of the IB Marketing Group for their

help with the editorial process.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Inventory Valuation: First in First Out (FIFO) Last in First Out (LIFO) Average Cost Method (AVCO)Document9 pagesInventory Valuation: First in First Out (FIFO) Last in First Out (LIFO) Average Cost Method (AVCO)Abhilash JhaNo ratings yet

- Raising Seed Capital: Steve Schlafman (@schlaf) RRE VenturesDocument82 pagesRaising Seed Capital: Steve Schlafman (@schlaf) RRE Venturesrezurekt100% (2)

- Favourite 3rd Party Transfer: SuccessfulDocument1 pageFavourite 3rd Party Transfer: SuccessfulMizibalya ImanismailNo ratings yet

- Responsibility Centers Management AccountingDocument3 pagesResponsibility Centers Management AccountingRATHER ASIFNo ratings yet

- Eatest Financial AssetDocument216 pagesEatest Financial AssetsssNo ratings yet

- HrumDocument3 pagesHrumDenny SiswajaNo ratings yet

- Contract LetterDocument5 pagesContract LetterprashantNo ratings yet

- How To Build A Double Calendar SpreadDocument26 pagesHow To Build A Double Calendar SpreadscriberoneNo ratings yet

- Two New Alternatives Have Come Up For Expanding Grandmother S CHDocument1 pageTwo New Alternatives Have Come Up For Expanding Grandmother S CHAmit Pandey0% (1)

- Foreign Capital As A Source of FinanaceDocument8 pagesForeign Capital As A Source of FinanaceD KNo ratings yet

- Elizade Acc 101 Revision Lecture NotesDocument18 pagesElizade Acc 101 Revision Lecture NotesTijani OladipupoNo ratings yet

- SCDL Solved International Finance AssignmentsDocument19 pagesSCDL Solved International Finance AssignmentsShipra GoyalNo ratings yet

- Freddie Mac internal controlsDocument2 pagesFreddie Mac internal controlsElla Marie LopezNo ratings yet

- Sama A&c AnalystDocument2 pagesSama A&c Analystsusreel.somavarapuNo ratings yet

- SampleFullPaperforaBusinessPlanProposalLOKAL LOCADocument279 pagesSampleFullPaperforaBusinessPlanProposalLOKAL LOCANicole SorianoNo ratings yet

- Adjudication Order in Respect of M/s. Tulive Developers LTD., Mr. Atul Gupta and Mr. K V Ramana in The Matter of M/s. Tulive Developers Ltd.Document25 pagesAdjudication Order in Respect of M/s. Tulive Developers LTD., Mr. Atul Gupta and Mr. K V Ramana in The Matter of M/s. Tulive Developers Ltd.Shyam SunderNo ratings yet

- NCBA Financial Management (Financial Analysis)Document9 pagesNCBA Financial Management (Financial Analysis)Joanne Alexis BiscochoNo ratings yet

- Microsoft - NAV - National Pharmaceutical Company (Dynamics NAV Win Over SAP)Document9 pagesMicrosoft - NAV - National Pharmaceutical Company (Dynamics NAV Win Over SAP)Tayyabshabbir100% (1)

- Breakfast is the Most Important Meal: Starting a Pancake House BusinessDocument28 pagesBreakfast is the Most Important Meal: Starting a Pancake House BusinessChristian Lim100% (1)

- Finance, Marketing & HR courses in MBA 2nd yearDocument28 pagesFinance, Marketing & HR courses in MBA 2nd yearGaneshRathodNo ratings yet

- Deed of HypothecmionDocument6 pagesDeed of HypothecmionspacpostNo ratings yet

- Lecture 17Document37 pagesLecture 17irshan amirNo ratings yet

- Assignment - Business Model Canvas Presentation - Fall - 2020Document2 pagesAssignment - Business Model Canvas Presentation - Fall - 2020MattNo ratings yet

- Security AdministrationDocument24 pagesSecurity AdministrationShame BopeNo ratings yet

- Go-to-Market & Scale - 2020-01-09 - Emin, Patrick, TessaDocument58 pagesGo-to-Market & Scale - 2020-01-09 - Emin, Patrick, TessaFounderinstituteNo ratings yet

- CH 02Document37 pagesCH 02Tosuki HarisNo ratings yet

- Solutions Manual: Introducing Corporate Finance 2eDocument9 pagesSolutions Manual: Introducing Corporate Finance 2eMane Scal JayNo ratings yet

- What Informal Remedies Are Available To Firms in Financial Distress inDocument1 pageWhat Informal Remedies Are Available To Firms in Financial Distress inAmit PandeyNo ratings yet

- CFAS Chapter 2 Problem 3Document1 pageCFAS Chapter 2 Problem 3jelou ubagNo ratings yet

- Professional Practice NotesDocument5 pagesProfessional Practice NotesSHELLA MARIE DELOS REYESNo ratings yet