Professional Documents

Culture Documents

Bob Atam

Uploaded by

Amit SaxenaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bob Atam

Uploaded by

Amit SaxenaCopyright:

Available Formats

ATM / Credit Card facility of BOB

ATM

We offer debit card (in association with VISA), a product that

represents the most secure, convenient and reliable form of

payment through ATM.

Our Debit Card is accepted at over 4000 Visa Electron ATMs

and 780000 ATMs worldwide. The card is also accepted at 45000 Point of Sales

(POS) in India and around 10 million POS worldwide. The card enables you to

enjoy the convenience of cash-less purchasing power without the fear of

overdrawing your account.

Credit Card Facility

Our Credit Cards (BOBCARD) provide financial flexibility, worldwide acceptance

and round the clock convenience at the minimum service charges in the entire card

industry.

The Credit Cards, various products of our BOBCARDS Ltd. (our subsidiary),

marketed by Bank are namely BOBCARDS PARAS, SILVER, PREMIUM,

EXCLUSIVE, GOLD, GLOBAL, EXCLUSIVE FOR WOMEN and GOLD

FLEXI. These products have been launched keeping in view the different needs of

all sections of people. The credit limits under these cards range from Rs.20,000/- to

Rs.3.00 lakhs. Bank is also providing Credit Card cum ATM card to the customers

on request.

Service charges payable for rendering credit card services including Revolving

Credit Facility, emergency Cash Withdrawal (wherever applicable) are very

nominal.

Insurance

Insurance cover in case of death due to air accident or other accidents is available

to the cardholder as well as his / her spouse, (even if he / she is not a cardholder)

incase of Bobcard Premium, Bobcard Exclusive, Bobcard Gold. Bobcard Gold

Flexi and Bobcard Global. The amount of the available insurance for each card is

printed in the respective application form.

Our Commitment and Responsibilities

Common Practices followed by our Branches

Safeguards

Common areas of Customer Banker relationship

Time - Norms for various banking transactions

Extended Banking Hours

Customer Communication

Banking Ombudsman Scheme, 2006

Redressal of Complaints

Other customer centric initiatives

Baroda Home Loan

Value propositions

Bank offers following benefits with home loan availed by you:

Free Personal Accident Insurance is available for stipulated tenure.

Free Credit Card (BOBCARD complementary for first year) to all Home

Loan borrowers (first borrower) with loan limit of Rs. 2/- Lacs and above.

Concession of 0.25% in rate of interest for Car Loans.

Concession of 0.50% in rate of interest for Loan for consumer durables.

Top up Loan (Baroda Additional Assured Advance AAA) can be availed

5 times during loan period.

(Minimum Rs.1/- Lac, Maximum Rs.200/- Lacs or 75% of residual value

of house property after deducting 150% of outstanding loan amount of

existing Home Loan, whichever is lower).

As per current IT provisions Interest on loan upto Rs.1.50 lacs per

annum is exempt from income tax (Under section 23/24 (1) of the Income

Tax Act). An additional deduction of interest upto Rs.1 lac is available to

persons taking a loan for their first home upto Rs.25 lacs during March 2013

to Feb 2014.

Terms & Conditions

In case of Salaried:

Monthly Income Modified Criteria

Up to Rs. 20,000/- 36 times of monthly

income

More than Rs.20,000/- & up to Rs. 1

lac

48 times of monthly

income

More than Rs. 1 lac 54 times of monthly

income

In case of others viz. professionals / self-employed / businesspersons etc., 5-

times of average annual income (last three years).

Margin:

Loan Amount Margin

Loans upto Rs.20/- Lacs 10%

Loans above Rs.20/- Lacs upto Rs.75/- Lacs 20%

Loans above Rs.75/- Lacs 25%

As security against the loan amount, the bank will take an equitable

mortgage of the housing property and/or other suitable securities.

No Fees will be charged on part prepayment / full prepayment of the loan

amount.

The loan can be repaid in a maximum period of 30 years taken under

floating rate option subject to the period up to age of retirement in case of

salaried persons and 70 years in case of others.

Baroda Education Loan

Education is the most important investment one makes in life. Higher studies and

specialization in certain fields call for additional financial support from time to

time.

Whether you are planning school education (nursery to standard XII) of your child,

pursuing a graduate or post-graduate degree, the Bank of Baroda Education

Loans, can help finance your ambitions and goals.

Following are the loan options available:

Baroda Vidya

Baroda Gyan

Baroda Scholar

Baroda Education Loan for Vocational Education & Training

Central Scheme of Interest Subsidy for Education Loans

The National Skill Certification and Monetary Reward scheme

covered under Baroda Education Loan for Vocational Education &

Training

Baroda Education Loan for Vocational Education &

Training

1. Scheme shall be applicable at all our Branches across the country

2. The prospective borrower should be an Indian National and have secured admission in a

course approved /supported by a Ministry/ Deptt/ Organization of the Govt or a

Company /Society/ Organization supported by National Skill development Corporation

or State Skill Missions /State Skill Corporation leading to a certificate /diploma /degree

etc. by Govt. Organization or an Organization recognized /authorized by Govt to do so.

3. Courses eligible: Vocational /Skill development courses of duration from 2 months to 3

years run or supported by a Ministry /Deptt/Organization of the Govt or a company

/society/ organization supported by National Skill Development Corporation or State

Skill Missions /State Skill Corporations, preferably leading to a certificate /diploma

/degree etc. issued by a Government Organization or an organization recognized

/authorized by the Govt. to do so. State Level Bankers committee (SLBC) / State level

Co-ordination Committee (SLCC) may add other skill development courses

/programmes, having good employability.

a. Approved courses/training programs as per The National Skill Certification and

Monetary Reward Scheme

4. The Student should not be minor and in case he is a minor, documents shall be executed

by the parents and bank will obtain a letter of ratification from him/her upon attaining

majority. There is no bar on maximum age of the borrower

5. Need based finance to meet expenses will be considered subject to following:

1 For courses of duration upto 3 Months Rs.20000/

2 For courses of duration >3 months and upto 6 months Rs.50000/

3 For Courses of duration >6 months to 1 year Rs.75000/

4 For courses of duration above 1 year Rs.150000/

6. Following expenses shall be considered for granting the loan under this scheme:

1. Tuition fee/Course fee

2. Examination /Library/Laboratory fee

3. Caution Deposit

4. Cost of Books/Equipments and Instruments

5. Any other reasonable expenditure found necessary for completion of the course.

7. There will not be stipulation of any margin under the product i.e. Margin will be Nil-

8. Rate of Interest shall be Base rate plus 2% i.e. 12.50% at present and simple interest

shall be charged till the start of repayment. Servicing of interest during Study Period and

Moratorium Period shall be at the option of the borrower. In case, interest is serviced

during the study period and Moratorium period , Concession of 1% in interest rate for

entire tenure of loan shall be provided.

For girl students, an incentive in the form of 1% Interest Concession shall be provided as

being provided under our Education Loan Product.

9. Processing Charge/documentation Charges: NIL

10. Security: No Collateral or third party guarantee will be obtained, however, the parent

will execute loan document alongwith the student borrower as joint borrower.

11. Moratorium Period and Repayment: Repayment of loan will commence after a

period of 6 months from the completion of course of maximum 1 year duration. Whereas

for courses of duration of more than 1 year, Repayment will commence after a period of

12 months from the completion of course. Maximum Repayment period will be as under:

Loans upto Rs 50,000 : Upto 2 Years

Loans between Rs 50,000 to Rs 1 lac : 2 to 5 Years

Loans above Rs 1 lac : 3 to 7 Years

12.

13. Insurance : Group credit Life Insurance Cover will be available at the option and cost of

the borrower. Cost of Insurance Premium may be financed by Bank by adding the same

in the project cost and shall be recovered alongwith EMIs of the loan.

14. The Borrower can repay the loan any time after commencement of repayment

WITHOUT having to pay any prepayment charges.

Profit And Loss A/c

Profit & Loss Account for the year ended 31st March, 2013(000's Omitted)

SCHEDULE Year ended

31

st

March 2013

Year ended

31

st

March 2012

Rs. Rs.

I. INCOME

Interest Earned 13 35196,65,44 29673,72,42

Other Income 14 3630,62,49 3422,32,82

T O T A L

38827,27,93

33096,05,24

II. EXPENDITURE

Interest Expended 15 23881,38,91 19356,71,23

Operating Expenses 16 5946,73,63 5158,71,73

Provisions and Contingencies 4518,43,39 3573,66,66

T O T A L 34346,55,93 28089,09,62

III. PROFIT

Net Profit for the period 4480,72,00 5006,95,62

Available for Appropriation 4480,72,00 5006,95,62

Appropriations

a) Statutory Reserve 1120,18,00 1251,73,91

b) Capital Reserve 81,44,81 22,39,86

c) Revenue and Other

Reserves

I) General Reserve 1369,46,69 2453,86,08

II) Special Reserve u/s 36 (1)

(viii) of the Income Tax Act, 1960

Income Tax Act, 1961

850,00,00 533,84,66

III) Statutory Reserve (Foreign) 1,55,80

d) Proposed Dividend (including

Dividend Tax)

1059,62,50 812,29,04

e) Investment Reserve Account -- (68,73,73)

T O T A L 4480,72,00 5006,95,62

Basic & Diluted Earnings per

Share (Rs)

(Nominal value per share Rs. 10)

18 (B-5) 108.84 127.84

Significant Accounting Policies 17

Notes on Accounts 18

You might also like

- PankajDocument1 pagePankajAmit SaxenaNo ratings yet

- NpaDocument7 pagesNpaAmit SaxenaNo ratings yet

- Bestseller ADocument1 pageBestseller AAmit SaxenaNo ratings yet

- Quotation: The Manager IPE LucknowDocument1 pageQuotation: The Manager IPE LucknowAmit SaxenaNo ratings yet

- Report GuidelinesDocument2 pagesReport GuidelinesBhoomikaSehgalNo ratings yet

- Physics Project ON Semi Conductors: Session 2014-15Document4 pagesPhysics Project ON Semi Conductors: Session 2014-15Amit SaxenaNo ratings yet

- Western Green Mamba: Water MoccasinDocument2 pagesWestern Green Mamba: Water MoccasinAmit SaxenaNo ratings yet

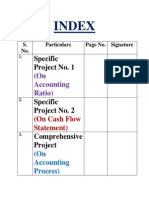

- Index: Specific Project No. 1Document3 pagesIndex: Specific Project No. 1Amit SaxenaNo ratings yet

- Tin No. 09750018120 Megha Engineering DetailsDocument1 pageTin No. 09750018120 Megha Engineering DetailsAmit SaxenaNo ratings yet

- Backwell: 19-A, Shahadana Colony, BareillyDocument1 pageBackwell: 19-A, Shahadana Colony, BareillyAmit SaxenaNo ratings yet

- Bestseller ADocument1 pageBestseller AAmit SaxenaNo ratings yet

- Manju 10.9.14Document2 pagesManju 10.9.14Amit SaxenaNo ratings yet

- PhytoremediationDocument43 pagesPhytoremediationAmit SaxenaNo ratings yet

- Rishi Kumar Agrawal: DATEDocument2 pagesRishi Kumar Agrawal: DATEAmit SaxenaNo ratings yet

- Samsung Consumer Survey BareillyDocument3 pagesSamsung Consumer Survey BareillyAmit SaxenaNo ratings yet

- Questionnaire DellDocument15 pagesQuestionnaire Dellkumarrohit352100% (2)

- GHJGHJDocument2 pagesGHJGHJAmit SaxenaNo ratings yet

- PriyaDocument1 pagePriyaAmit SaxenaNo ratings yet

- SDFSDFSDFDocument1 pageSDFSDFSDFAmit SaxenaNo ratings yet

- DFGDFGDocument15 pagesDFGDFGAmit SaxenaNo ratings yet

- PriyaDocument1 pagePriyaAmit SaxenaNo ratings yet

- Manoj Bhojwani ResumeDocument1 pageManoj Bhojwani ResumeAmit SaxenaNo ratings yet

- SDFSDFSDFDocument1 pageSDFSDFSDFAmit SaxenaNo ratings yet

- SDFSDFSDFDocument1 pageSDFSDFSDFAmit SaxenaNo ratings yet

- DFGDFGDocument9 pagesDFGDFGAmit SaxenaNo ratings yet

- SDFSDFSDFDocument1 pageSDFSDFSDFAmit SaxenaNo ratings yet

- MS Access2007Document14 pagesMS Access2007Amit SaxenaNo ratings yet

- Renewable Nonrenewable ResourcesDocument16 pagesRenewable Nonrenewable ResourcesAmit SaxenaNo ratings yet

- Entrepreneurship Development A4Document44 pagesEntrepreneurship Development A4paroothiNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- C6030 BrochureDocument2 pagesC6030 Brochureibraheem aboyadakNo ratings yet

- Final Thesis Report YacobDocument114 pagesFinal Thesis Report YacobAddis GetahunNo ratings yet

- Maverick Brochure SMLDocument16 pagesMaverick Brochure SMLmalaoui44No ratings yet

- Three-D Failure Criteria Based on Hoek-BrownDocument5 pagesThree-D Failure Criteria Based on Hoek-BrownLuis Alonso SANo ratings yet

- Level 3 Repair PBA Parts LayoutDocument32 pagesLevel 3 Repair PBA Parts LayoutabivecueNo ratings yet

- DLP in Health 4Document15 pagesDLP in Health 4Nina Claire Bustamante100% (1)

- Panel Data Econometrics: Manuel ArellanoDocument5 pagesPanel Data Econometrics: Manuel Arellanoeliasem2014No ratings yet

- Survey Course OverviewDocument3 pagesSurvey Course OverviewAnil MarsaniNo ratings yet

- Briana SmithDocument3 pagesBriana SmithAbdul Rafay Ali KhanNo ratings yet

- Music 7: Music of Lowlands of LuzonDocument14 pagesMusic 7: Music of Lowlands of LuzonGhia Cressida HernandezNo ratings yet

- TWP10Document100 pagesTWP10ed9481No ratings yet

- India: Kerala Sustainable Urban Development Project (KSUDP)Document28 pagesIndia: Kerala Sustainable Urban Development Project (KSUDP)ADBGADNo ratings yet

- Oracle Learning ManagementDocument168 pagesOracle Learning ManagementAbhishek Singh TomarNo ratings yet

- Customer Perceptions of Service: Mcgraw-Hill/IrwinDocument27 pagesCustomer Perceptions of Service: Mcgraw-Hill/IrwinKoshiha LalNo ratings yet

- #### # ## E232 0010 Qba - 0Document9 pages#### # ## E232 0010 Qba - 0MARCONo ratings yet

- HenyaDocument6 pagesHenyaKunnithi Sameunjai100% (1)

- ServiceDocument47 pagesServiceMarko KoširNo ratings yet

- Oxford Digital Marketing Programme ProspectusDocument12 pagesOxford Digital Marketing Programme ProspectusLeonard AbellaNo ratings yet

- Evolution of Bluetooth PDFDocument2 pagesEvolution of Bluetooth PDFJuzerNo ratings yet

- HCW22 PDFDocument4 pagesHCW22 PDFJerryPNo ratings yet

- ESA Knowlage Sharing - Update (Autosaved)Document20 pagesESA Knowlage Sharing - Update (Autosaved)yared BerhanuNo ratings yet

- Math5 Q4 Mod10 DescribingAndComparingPropertiesOfRegularAndIrregularPolygons v1Document19 pagesMath5 Q4 Mod10 DescribingAndComparingPropertiesOfRegularAndIrregularPolygons v1ronaldNo ratings yet

- Exercises 6 Workshops 9001 - WBP1Document1 pageExercises 6 Workshops 9001 - WBP1rameshqcNo ratings yet

- Maj. Terry McBurney IndictedDocument8 pagesMaj. Terry McBurney IndictedUSA TODAY NetworkNo ratings yet

- Zelev 1Document2 pagesZelev 1evansparrowNo ratings yet

- JurnalDocument9 pagesJurnalClarisa Noveria Erika PutriNo ratings yet

- International Certificate in WealthDocument388 pagesInternational Certificate in Wealthabhishek210585100% (2)

- Axe Case Study - Call Me NowDocument6 pagesAxe Case Study - Call Me NowvirgoashishNo ratings yet

- SD8B 3 Part3Document159 pagesSD8B 3 Part3dan1_sbNo ratings yet