Professional Documents

Culture Documents

Steel Sector Update - 28 03 08

Uploaded by

Gaurang ShahOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Steel Sector Update - 28 03 08

Uploaded by

Gaurang ShahCopyright:

Available Formats

TM

Angel Broking Service Truly Personalized

March 28, 2008

Steel Sector Update

Government toils to control prices

Steel is an essential commodity and is used in various Government options to control prices

applications like Automobiles, Construction, Transportation,

Overlooking these global factors, the government's focus and

etc. Soaring steel prices have increased the cost for these

efforts are currently aimed at bringing inflation under

user industries. To protect consumers' interests and curb

control. Thus, it now plans to initiate measures to control

inflation, which is now well above the RBI's target of 5%

rising steel prices. Some of the tools that the government

(6.68% for the week ended March 15, 2008), the

could use to control the rising steel prices include:

government has been trying to rein in the soaring steel prices.

In February 2008, after the government's intervention, z Appointment of Steel regulator to control prices

domestic players had agreed to partially roll back the price z Slapping of Export Tax to discourage exports

hike by Rs500-1,000/tonne. Further, despite the reduction

in Excise Duty from 16% to 14% in Budget 2008-09, steel z Ban/Curb Exports to increase the availability of steel in

players increased the prices again in March by the domestic market

Rs2,000-3,000/tonne. z Removal of DEPB benefits

However, steel prices rising globally… z Further reduction in Excise Duty on steel

Globally, steel prices have been on an upward trajectory z Reduction in Import duties on steel raw materials like

over the last few months due to a considerable increase in met coke, refractory, etc.

raw material costs like Iron Ore and Coking Coal. In tandem

z Export ban / Export tax on iron ore exports to increase

with this, domestic steel prices have also increased by

its availability in the domestic market

almost 20% in the last three months. Notably, domestic

players have announced price hikes thrice this year, in-line Setting up a Regulator / Export Tax will send the

with the global trends, taking the domestic HR prices to wrong signals

around Rs40,000/tonne.

We believe that setting up a Steel regulator and imposition

It must be noted that surging input costs had squeezed the of an Export Tax are amongst the extreme measures and

third quarter profit margins of several domestic steel the government should refrain from implementing the same.

players that have no backward linkages to Iron Ore and Coal Many global investors, including the likes of Mittal Steel and

mines. Iron Ore is a key ingredient in making steel, spot Posco, are acquiring land and machinery and are signing

prices of which have catapulted 150% in the last six months MoUs with the State Governments for setting up steel plants

from US$60/tonne to US$150/tonne now. Coking Coal prices in the country. Any wrong signal by the government at this

have similarly soared 100% in the last six months. Ferro stage could dampen the zeal of such investors and hamper

Manganese has increased by 40% from Rs43,000 to the growth of the Steel Industry.

Rs62,000/tonne in the same period. Recently, National

In fact, the point to note here is that there is a strong

Mineral Development Corp. Limited raised prices of ore fines

demand for steel in the country on the back of buoyant

and lumps by 47% and 22-33% respectively. Steel Scrap,

economic growth. At the same time, it is also true that steel

used by induction and electric arc furnaces as input, has

prices have firmed up considerably of late. But, the way

also witnessed a 36% increase in prices, while prices of

ahead to resolve the steel pricing issue is to match supply

Coke, obtained from Coking Coal for use in

with demand. The government should encourage higher

furnaces, have increased from US$290/tonne in

supplies at the producer's end to soften steel prices.

mid-2007 to US$500/tonne now.

Notably, a number of investment proposals in steel continue

to remain mired by Policy inaction. What's required, without

further delays, is ironing out of the Policy glitches that are

Continued...

For Private Circulation Only 12

Angel Broking Ltd : BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838

March 28, 2008

Steel Sector Update

holding back these steel capacities in the pipeline. But to this scheme were that much lower considering that

attempt to douse prices by clamping down on Steel exports globally, steel prices have been ruling at very high levels.

via a steep levy or appointing a Steel regulator is more likely Thus, the impact of the DEPB withdrawal in terms of the

to backfire, as it may discourage incremental steel reduction in benefit to steel players will be lower than

capacities in the country. anticipated.

Mutual understanding at reducing exports - Further, this adverse impact may be mitigated to some

The first step extent by allowing steel players other benefits like duty

drawbacks.

Considering the government's concerns over rising steel

prices, Steel producers have agreed to restrain exports of Exports Tax - a 'What if' analysis!

spot steel even as exports under long-term contracts would

While imposition of an Export Tax is a far-fetched

continue. In return, the Steel industry has urged the

possibility in our view, nonetheless, we have assumed a

government to lower the Excise Duty on steel to 8% from

hypothetical situation of a 10% Export Tax scenario and

14% and reduce Import duties on inputs such as metcoke,

the impact of this on the profitability of steel companies.

refractory, ferro alloys and zinc. The industry has also urged

the government to contain export of Iron Ore through Clearly, if the government does impose an export tax of

physical and fiscal means. 10% on finished steel, profitability of steel players will be

negatively impacted, especially that of JSW Steel, which

Steel prices have been on an uptrend in the recent past

has a higher export revenues share in total revenues. In

mainly due to the unhindered rise in input costs. India

case of JSW Steel, 30% of its revenues can be attributed to

exports 4-5 mn tonnes of steel annually. The Indian Steel

exports, while export revenues of SAIL and Tata Steel

producers have increased prices by Rs5,000-7,000/tonne in

account for 3.5% and 10% of their total revenues,

the last three months. We believe that curtailing exports

respectively.

would have little impact on steel exporting

companies like JSW Steel, SAIL and other ISA (Indian Below is a Sensitivity Analysis of steel companies'

Steel Alliance) member companies. Steel demand in earnings at different export tax scenarios.

India is pretty strong and India, for the first time in 10 JSW Steel's Earnings are highly sensitive to export tax as

years, has become a net importer of steel. Hence, in it contributes almost 30% to its total revenues. It can be

the event of some exports being diverted into the seen in the table below that in the worst case scenario, if

domestic market, it would not create an over-supply the company opts to continue its exports without passing

scenario in the domestic market. Also, only the on the additional burden onto customers, a 10% imposition

products which have a market in India are to be sold of export tax would hit JSW Steel's EBIDTA by Rs500cr and

in the domestic market. For instance, players like JSW Net profit by Rs335cr (15% reduction from base case) in

Steel primarily export galvanised products, the FY2009 and Rs696cr and Rs466cr respectively in FY2010.

domestic supply of which is not of concern.

Removal of DEPB benefits to have little impact

The government has also temporarily suspended the export

subsidy under the Duty Entitlement Pass Book (DEPB)

Scheme on some steel products. It must be noted that the

DEPB benefits are capped at a certain price point

depending upon the product, and thus the actual benefits of

Continued...

For Private Circulation Only 23

Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 0220 / FMC Regn No: NCDEX / TCM / CORP / 0302

TM

Angel Broking Service Truly Personalized

March 28, 2008

Steel Sector Update

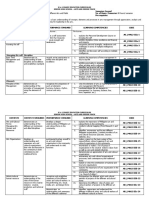

Exhibit 1: JSW Steel - Sensitivity Analysis Exhibit 3: Tata Steel - Sensitivity Analysis

Export Tax Export Tax

FY2009E Base case 5% 7.5% 10% FY2009E Base case 5% 7.5% 10%

EBIDTA (Rs cr) 4,965 4,715 4,590 4,465 EBIDTA (Rs cr) 21,093 20,948 20,875 20,803

Net Profit (Rs cr) 2,210 2,042 1,958 1,875 Net Profit (Rs cr) 8,653 8,555 8,507 8,485

EPS (Rs) 110.0 102.0 98.0 93.0 EPS (Rs) 102.0 100.9 100.4 99.8

Export Tax Export Tax

FY2010E Base case 5% 7.5% 10% FY2010E Base case 5% 7.5% 10%

EBIDTA (Rs cr) 6,073 5,725 5,551 5,377 EBIDTA (Rs cr) 21,263 21,118 21,046 20,975

Net Profit (Rs cr) 2,770 2,537 2,420 2,304 Net Profit (Rs cr) 8,779 8,682 8,634 8,585

EPS (Rs) 138.0 126.0 121.0 115.0 EPS (Rs) 104.0 102.5 101.9 101.3

Target Price (Rs) 1,170 1,074 1,026 978 Source: Angel Research, Note: Numbers are consolidated

Source: Angel Research, Note: Numbers are consolidated

Having considered the various scenarios and their varying

On the contrary, we believe that the export tax impact would impact on 3 large domestic steel players, we would like to

be low on SAIL as exports contribute only 3.5% of its total re-iterate that the possibility of above materialising is very

revenues.We maintain our Neutral view on SAIL. low and it assumes that steel players will continue to

Exhibit 2: SAIL - Sensitivity Analysis export at the same pace despite the export tax without

Export Tax passing on the additional burden to the customers.

FY2009E Base case 5% 7.5% 10% Also, as we understand, in the event of an export tax on

EBIDTA (Rs cr) 10,396 10,311 10,269 10,228 steel, the government would also have to ban export of Iron

Net Profit (Rs cr) 7,004 6,948 6,920 6,893 Ore or hike the export tax on Iron Ore, as iron ore exports

EPS (Rs) 17.0 16.8 16.7 16.6 from India are more than 60% compared to just 10% of steel

Export Tax export. This would effectively mitigate the impact of export

FY2010E Base case 5% 7.5% 10% tax on the steel players.

EBIDTA (Rs cr) 10,030 9,946 9,904 9,861 Thus, considering the latest developments in the sector and

Net Profit (Rs cr) 6,708 6,653 6,625 6,597 the probability of more stringent measures materialising being

EPS (Rs) 16.2 16.1 16.0 15.9 low, we maintain our Buy on JSW Steel with the

Source: Angel Research

Target Price of Rs1,170.

Further, the impact would be minimal for Tata Steel as the

company's exports constitute less than 2% of its total

consolidated Revenues. We believe that Tata Steel, to some

extent, is insulated from any moves by the government to

control the domestic prices due to its acquisition of Corus,

which contributes more than 75% to its consolidated

Revenues. We maintain our Neutral view on Tata Steel.

Analyst - Pawan Burde

For Private Circulation Only 4

Angel Broking Ltd : BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838

You might also like

- Angela DeVarso Irrevocable TrustDocument28 pagesAngela DeVarso Irrevocable Trustapple227100% (18)

- Estate Planning For CanadiansDocument3 pagesEstate Planning For CanadiansNoel Sunil100% (1)

- Do You Make These Mistakes in English - The Story of Sherwin Cody's Famous Language School (PDFDrive)Document224 pagesDo You Make These Mistakes in English - The Story of Sherwin Cody's Famous Language School (PDFDrive)Gaurang Shah100% (1)

- FS ModelDocument13 pagesFS Modelalfx216No ratings yet

- Inside The Yoga Sutras - A Comprehensive Sourcebook For The Study and Practice of Patanjali's Yoga Sutras PDFDocument417 pagesInside The Yoga Sutras - A Comprehensive Sourcebook For The Study and Practice of Patanjali's Yoga Sutras PDFFruquan McDaniel100% (2)

- Best Ice Cream Business Plan WTH Financials PDFDocument11 pagesBest Ice Cream Business Plan WTH Financials PDFNishat Nabila80% (15)

- K to 12 Arts and Design Track Subject on Leadership and ManagementDocument10 pagesK to 12 Arts and Design Track Subject on Leadership and ManagementKarl Winn Liang100% (1)

- SWOT Analysis For JSW SteelDocument8 pagesSWOT Analysis For JSW SteelPankaj Khannade75% (4)

- Mckinsey - The India Consumer StoryDocument61 pagesMckinsey - The India Consumer StoryVineet100% (7)

- Barangay Micro Business Enterprise (Bmbe) Act: 13284-TOPIC 3Document16 pagesBarangay Micro Business Enterprise (Bmbe) Act: 13284-TOPIC 3kim cheNo ratings yet

- Steel Sector - Aug 2022Document36 pagesSteel Sector - Aug 2022Nitish KhatanaNo ratings yet

- Iron & Steel IndustryDocument10 pagesIron & Steel IndustryRishav KhaitanNo ratings yet

- CIR Power to Interpret Tax LawsDocument2 pagesCIR Power to Interpret Tax LawsTimothy Joel CabreraNo ratings yet

- BOI Abused Discretion in Approving Transfer of Petrochemical PlantDocument3 pagesBOI Abused Discretion in Approving Transfer of Petrochemical PlantJay IgpuaraNo ratings yet

- 4qfy23 Results PresentationDocument38 pages4qfy23 Results PresentationMANSI MOHTANo ratings yet

- Steel Price Surges on Chinese Demand and Supply DeficitsDocument50 pagesSteel Price Surges on Chinese Demand and Supply DeficitsAmitabh VatsyaNo ratings yet

- Inerals & Etals Eview: Steel Prices May Decline FurtherDocument20 pagesInerals & Etals Eview: Steel Prices May Decline Furtherkalyan majumdarNo ratings yet

- Iron Steel and Scrap 2017Document29 pagesIron Steel and Scrap 2017Nikhil SinghNo ratings yet

- India Steel: China Tax Change Augurs WellDocument11 pagesIndia Steel: China Tax Change Augurs Wellmbts.14014cm020No ratings yet

- Steel Industry Needs Remedial Measures Not Protection: Budget 2016Document4 pagesSteel Industry Needs Remedial Measures Not Protection: Budget 2016Vikram KhannaNo ratings yet

- NATIONAL STEEL POLICYDocument4 pagesNATIONAL STEEL POLICYNemish KuvadiaNo ratings yet

- TMT BarsDocument3 pagesTMT Barssandeep_hudeNo ratings yet

- Fuel Supply Risks Loom Over New Coal-Based Thermal Power ProjectsDocument6 pagesFuel Supply Risks Loom Over New Coal-Based Thermal Power ProjectsMeenakshi SinhaNo ratings yet

- Valuation of Tata Steel After Corus AcquisitionDocument19 pagesValuation of Tata Steel After Corus Acquisitionrr79No ratings yet

- Steel IndusrtyDocument9 pagesSteel Indusrtyharish333prasadNo ratings yet

- Steel Sector Motilal OswalDocument30 pagesSteel Sector Motilal OswalBinod Kumar PadhiNo ratings yet

- Anomaly in WPI for steel bars and rodsDocument46 pagesAnomaly in WPI for steel bars and rodsSarkar RakeshNo ratings yet

- MMRW 15.11.2021Document20 pagesMMRW 15.11.2021shrinath bhatNo ratings yet

- Metals Sector Update - Govt Measures Impact ValuationsDocument8 pagesMetals Sector Update - Govt Measures Impact Valuationsbeza manojNo ratings yet

- Script of The Day: Tata Iron and Steel Company LTDDocument8 pagesScript of The Day: Tata Iron and Steel Company LTDAnonymous Mw6J6ShNo ratings yet

- High Coking Coal Prices Provide Glimpse Into Steelmaking's FutureDocument5 pagesHigh Coking Coal Prices Provide Glimpse Into Steelmaking's FutureHadi PurnomoNo ratings yet

- India's National Steel Policy 2005 Goals: Modern Steel Industry of 100 Million Tonnes by 2019Document15 pagesIndia's National Steel Policy 2005 Goals: Modern Steel Industry of 100 Million Tonnes by 2019Yadav KrishnaNo ratings yet

- Coal Deficit Widens On Rising DemandDocument4 pagesCoal Deficit Widens On Rising DemandSumanth KumarNo ratings yet

- MMRW06 12 2021Document20 pagesMMRW06 12 2021shrinath bhatNo ratings yet

- Indian Coal SectorDocument9 pagesIndian Coal Sectorhimadri.banerji60No ratings yet

- Pestel Analysis of Tata Steel in United Kingdom (Uk) : Shamim RehmanDocument10 pagesPestel Analysis of Tata Steel in United Kingdom (Uk) : Shamim RehmanSam RehmanNo ratings yet

- Rayen Steels Organization StudyDocument38 pagesRayen Steels Organization StudyAvishek MukhopadhyayNo ratings yet

- Research ReportDocument4 pagesResearch ReportLinda LauwiraNo ratings yet

- Tata SteelDocument27 pagesTata SteelJAYKISHAN JOSHI50% (4)

- A Price Forecasting Model of Iron Ore andDocument30 pagesA Price Forecasting Model of Iron Ore andGaurav VermaNo ratings yet

- Turbulence in The Steel Market: July 29, 2010Document5 pagesTurbulence in The Steel Market: July 29, 2010dvlvardhanNo ratings yet

- MMRW11 09 2023Document20 pagesMMRW11 09 2023Suresh Kumar100% (1)

- Sponge Iron Industry Current Scenario SDocument2 pagesSponge Iron Industry Current Scenario Sapi-26041653100% (1)

- Iron IndiaDocument7 pagesIron Indiaganesh kNo ratings yet

- Rba SteelDocument3 pagesRba Steeltommy-hl6920No ratings yet

- FinMod Final AssignmentDocument17 pagesFinMod Final Assignmentvirat kohliNo ratings yet

- Steel Industry SaiDocument65 pagesSteel Industry SaiM sai chandra Shiva kumarNo ratings yet

- Sub: Strategic Management: Steel IndustryDocument13 pagesSub: Strategic Management: Steel IndustryRohit GhaiNo ratings yet

- India's Growing Steel Industry and Future OutlookDocument6 pagesIndia's Growing Steel Industry and Future OutlookMonish RcNo ratings yet

- 07092014130558IMYB-2012-Iron & Steel and ScrapDocument27 pages07092014130558IMYB-2012-Iron & Steel and ScrapPriyamNo ratings yet

- 11-Article Text-17-2-10-20200124Document21 pages11-Article Text-17-2-10-20200124johnNo ratings yet

- Five Forces AnalysisDocument4 pagesFive Forces Analysisneekuj malikNo ratings yet

- Industry AnalysisDocument39 pagesIndustry AnalysisShiva ParmarNo ratings yet

- Indian Steel Industry SWOT Analysis and PESTLE AnalysisDocument3 pagesIndian Steel Industry SWOT Analysis and PESTLE AnalysisSmaran Pathak67% (3)

- Economics (Sree)Document45 pagesEconomics (Sree)steevejan541No ratings yet

- Steel IBEF September 2021Document35 pagesSteel IBEF September 2021Shiva CharanNo ratings yet

- Tata Corus DealDocument4 pagesTata Corus DealSukanta1992No ratings yet

- Spiking Coal Price Creates Mixed SentimentDocument4 pagesSpiking Coal Price Creates Mixed SentimentHaiyen DinhNo ratings yet

- How coal powers global electricity productionDocument5 pagesHow coal powers global electricity productionakmullickNo ratings yet

- Industry and Company AnalysisDocument76 pagesIndustry and Company AnalysisAnsu MishraNo ratings yet

- Management Discussion and Analysis: Business ReviewDocument10 pagesManagement Discussion and Analysis: Business Reviewshamanthshami623No ratings yet

- Steel IndustryDocument7 pagesSteel IndustryprtapbistNo ratings yet

- Metals Result Review, 22nd February, 2013Document8 pagesMetals Result Review, 22nd February, 2013Angel BrokingNo ratings yet

- Iron and Steel Industry in IndiaDocument10 pagesIron and Steel Industry in IndiaJordan SarasanNo ratings yet

- The Health and Growth Potential of The Steel Manufacturing Industries in SADocument94 pagesThe Health and Growth Potential of The Steel Manufacturing Industries in SAShumani PharamelaNo ratings yet

- Cover StoryDocument7 pagesCover StoryAravind SankaranNo ratings yet

- Foundations of Natural Gas Price Formation: Misunderstandings Jeopardizing the Future of the IndustryFrom EverandFoundations of Natural Gas Price Formation: Misunderstandings Jeopardizing the Future of the IndustryNo ratings yet

- Market Research, Global Market for Germanium and Germanium ProductsFrom EverandMarket Research, Global Market for Germanium and Germanium ProductsNo ratings yet

- An Evening With Sherwin CodyDocument66 pagesAn Evening With Sherwin CodyGaurang ShahNo ratings yet

- Coconut Cures by Bruce FifeDocument257 pagesCoconut Cures by Bruce FifeGaurang Shah100% (3)

- 2015 324818 Yoga-TatvDocument393 pages2015 324818 Yoga-TatvGaurang ShahNo ratings yet

- 2015 399752 Patanjal-YogaDocument190 pages2015 399752 Patanjal-YogaGaurang ShahNo ratings yet

- Arm6ws PDFDocument24 pagesArm6ws PDFGaurang ShahNo ratings yet

- 2015 399776 Umesh-YogaDocument431 pages2015 399776 Umesh-YogaGaurang ShahNo ratings yet

- Indian Real Estate SectorDocument3 pagesIndian Real Estate SectorGaurang Shah100% (4)

- 2015 306569 Yog-ShastranuDocument422 pages2015 306569 Yog-ShastranuGaurang ShahNo ratings yet

- India Vision2020Document108 pagesIndia Vision2020Bhavin Joshi100% (8)

- Indian Entertainment Industry Focus 2010Document163 pagesIndian Entertainment Industry Focus 2010Gaurang Shah100% (5)

- India's Services SectorDocument146 pagesIndia's Services SectorInsideout100% (37)

- India Retail OpportunityDocument37 pagesIndia Retail OpportunityGaurang Shah100% (6)

- Adani Enterprises Initiating CoverageDocument55 pagesAdani Enterprises Initiating CoverageGaurang Shah100% (2)

- India at Risk 2007Document21 pagesIndia at Risk 2007World Economic Forum100% (4)

- The Effects of Education On CrimeDocument12 pagesThe Effects of Education On CrimeMicaela FORSCHBERG CASTORINONo ratings yet

- Ani SecDocument149 pagesAni SecMarivic ChuangNo ratings yet

- ITB NotesDocument84 pagesITB NotesSadiaNo ratings yet

- Heirs of Tancoco v. CADocument28 pagesHeirs of Tancoco v. CAChris YapNo ratings yet

- Dimma HoneyDocument9 pagesDimma HoneyAnonymous h2hxB1No ratings yet

- Contemporary Module 2Document10 pagesContemporary Module 2Darioz Basanez LuceroNo ratings yet

- Excel-Based Model To Value Firms Experiencing Financial DistressDocument4 pagesExcel-Based Model To Value Firms Experiencing Financial DistressgenergiaNo ratings yet

- Copeland 1968Document17 pagesCopeland 1968Aningtyas RatriNo ratings yet

- Relationship Between Tax Policy and Growth of SMEs in NigeriaDocument11 pagesRelationship Between Tax Policy and Growth of SMEs in NigeriaHermenegildo Valente MatsinheNo ratings yet

- DT - Volume 1 - June 22& Dec 22 - CS Executive - CA Saumil ManglaniDocument281 pagesDT - Volume 1 - June 22& Dec 22 - CS Executive - CA Saumil ManglaniIshani MukherjeeNo ratings yet

- ME-BENSON Apart Kontrak - Final-PerhitunganDocument302 pagesME-BENSON Apart Kontrak - Final-PerhitunganTyo WayNo ratings yet

- What Characterise The Nordic Welfare State Model: Journal of Social Sciences February 2007Document10 pagesWhat Characterise The Nordic Welfare State Model: Journal of Social Sciences February 2007AfraInayahDhyaniputriNo ratings yet

- TAX INVOICE DETAILSDocument1 pageTAX INVOICE DETAILSJNPNo ratings yet

- Why Your Government Is Either A Thief or You Are A "Public Officer" For Income Tax Purposes 18 of 220Document1 pageWhy Your Government Is Either A Thief or You Are A "Public Officer" For Income Tax Purposes 18 of 220foro35No ratings yet

- Weekly Tax Table: Pay As You Go (PAYG) Withholding NAT 1005Document9 pagesWeekly Tax Table: Pay As You Go (PAYG) Withholding NAT 1005LalinNo ratings yet

- Self Employment and Small Scale Industry in NepalDocument16 pagesSelf Employment and Small Scale Industry in NepalsamyogforuNo ratings yet

- Epiphany by The Madras High Court in TRAN-1 Debate: CompendiumDocument6 pagesEpiphany by The Madras High Court in TRAN-1 Debate: CompendiumM.KARTHIKEYANNo ratings yet

- Amfi Exam Nism V ADocument218 pagesAmfi Exam Nism V AUmang Jain67% (6)

- QuestionDocument16 pagesQuestionda5ew99No ratings yet

- Pakistan Tobacco Company (PTC) : Taxation ProjectDocument18 pagesPakistan Tobacco Company (PTC) : Taxation ProjectAfnanNo ratings yet

- REVENUE REGULATIONS PARTNERSHIP TAXATIONDocument2 pagesREVENUE REGULATIONS PARTNERSHIP TAXATIONEmmanuel C. DumayasNo ratings yet

- Comparing Quantities Solved ProblemsDocument17 pagesComparing Quantities Solved ProblemsDock N DenNo ratings yet