Professional Documents

Culture Documents

Measurement of Profit & Reporting Comprehensive Income: Week 11 Lecture

Uploaded by

legolasckkOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Measurement of Profit & Reporting Comprehensive Income: Week 11 Lecture

Uploaded by

legolasckkCopyright:

Available Formats

13/10/2014

1

Measurement of Profit & Reporting

Comprehensive Income

Week 11 Lecture

ACCT2011

Financial Accounting A

Dr Eagle Zhang

Week 11

Text Readings:

- Chapter 16: section 16.1 16.3.1 (to p.510)

- Chapter 19: section 19.5

Handbook Readings:

- AASB 101

2

Week 11

Learning objectives

1. Understand different approaches to profit

measurement and the approach adopted in Australia

(Ch 16 LO 1 - 2)

2. Understand the requirements for the preparation of a

statement of comprehensive income in AASB 101 (Ch

16 LO 3)

3. Understand the requirements of AASB 108 in terms of

accounting for changes in accounting policies,

estimates and errors (Ch 19 LO 7, 8 & 9)

4. Understand some of the social implications of the

financial reporting for comprehensive income

3

Objective 1

Understand different approaches to profit

measurement and the approach

adopted in Australia

4

Measurement of profit

Traditionally, profit has been the process of:

- Matching revenues for a period with expenses incurred in

generating those revenues

The traditional profit measurement has changed due

to:

- Changes in the categorisation and labelling of financial

statement elements.

- Reduced emphasis on matching.

5

Measurement of profit (Contd)

- Operating-profit approach:

- Profit is measured as income from operations minus

expenses from operations.

- All-inclusive approach:

- Profit is measured as the result of ordinary operations plus

income and expenses relating to prior periods, the effects

of some accounting policy changes and the result of

extraordinary transactions and events.

- Comprehensive income approach:

- Profit includes all income and expenses as defined in the

Framework.

6

13/10/2014

2

Measurement of profit (contd)

Approach adopted in AASB 101:

- The Statement of Comprehensive Income:

identifies total comprehensive income as all changes in

equity other than contributions from or distributions to equity

holders (shareholders).

Profit or Loss is the total of income less expenses,

excluding the components of other comprehensive income.

(AASB101:7)

Other comprehensive income comprises items of income

and expense (including reclassification adjustments) that

are not recognised in profit or loss as required or permitted

by other Australian Accounting Standards. (AASB101:7)

7

Measurement of profit (contd)

Measurement of comprehensive income:

Statement of comprehensive income

Income

Less: Expenses

= Profit or loss for the period

+/- Items of other comprehensive income

=Total comprehensive income for the period

8

Objective 2

Understand the requirements for the

preparation of a statement of comprehensive

income in AASB 101

9

AASB 101

The approach in AASB101 is similar to the comprehensive

income approach.

AASB 101.7:

Total comprehensive income is the change in equity

during a period resulting from transactions and other

events, other than those changes resulting from

transactions with owners in their capacity as owners.

Total comprehensive income comprises all components

of profit or loss and of other comprehensive income.

Owners are holders of instruments classified as equity.

10

AASB 101

Other comprehensive income comprises items of income and

expense (including reclassification adjustments) that are not

recognised in profit or loss as required or permitted by other

Australian Accounting Standards.

The components (101.7) of other comprehensive income include:

(a) changes in revaluation surplus (see AASB 116 Property, Plant and

Equipment and AASB 138 Intangible Assets);

(b) actuarial gains and losses on defined benefit plans recognised in

accordance with paragraph 93A of AASB 119 Employee Benefits;

(c) gains and losses arising from translating the financial statements of a

foreign operation (see AASB 121 The Effects of Changes in Foreign

Exchange Rates);

(d) gains and losses on remeasuring available-for-sale financial assets (see

AASB 139 Financial Instruments: Recognition and Measurement); and

(e) the effective portion of gains and losses on hedging instruments in a cash

flow hedge (see AASB 139).

11

AASB 101

IASB/FASB convergence project

Framework, released in September 2010

ED IAS 1 The Presentation of Items of Other

Comprehensive Income, released in May 2010.

Statement of Comprehensive Income (current

requirement)

- Option of one inclusive statement, or

- Two related statements ie, Income Statement and

Statement of Other Comprehensive Income

12

13/10/2014

3

AASB 101

Profit or Loss for the Period:

An entity shall recognise all items of income and expense in a

period in profit or loss unless an Australian Accounting

Standard requires or permits otherwise. (AASB101:88)

Some Australian Accounting Standards specify circumstances

when an entity recognises particular items outside profit or

loss in the current period. AASB 108 specifies two such

circumstances: the correction of errors and the effect of

changes in accounting policies. (AASB101:89)

13

AASB101

Other Comprehensive Income for the Period:

An entity shall disclose the amount of income tax relating to

each item of other comprehensive income, including

reclassification adjustments, either in the statement of profit or

loss and other comprehensive income or in the notes.

(AASB101:90)

An entity shall disclose reclassification adjustments relating to

components of other comprehensive income. (AASB101:92)

14

Reclassification adjustments disclosure

AASB 101.90-96

AASB 101 defines a reclassification adjustment as amounts

reclassified to profit or loss in the current period that were

recognised in other comprehensive income in the current or

previous periods

Individual accounting standards specify whether and when

amounts previously recognised in other comprehensive

income are reclassified to profit or loss (e.g. the disposal of

available-for-sale financial instruments)

A reclassification adjustment is included with the related

component of other comprehensive income in the period that

the adjustment is reclassified to profit or loss.

15

Reclassification adjustments disclosure

Why disclose reclassification adjustments?

The purpose is to provide users with information to assess the

effect of suchreclassifications on profit or loss.

For example, gains realised on the disposal of available-for-sale

financial assets are included in profit or loss of the current

period. These amounts may have been recognised in other

comprehensive income as unrealised gains in the current or

previous periods. Those unrealised gains must be deducted

from other comprehensive income in the period in which the

realised gains are reclassified to profit or loss to avoid including

themin total comprehensive income twice.

16

Example (Reclassification)

17

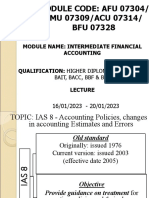

Objective 3

Apply the requirements of AASB 108 Accounting Policies,

Changes in Accounting Estimates and Errors to the selection,

application and modification of accounting policies in the

preparation of financial statements

13/10/2014

4

Revising accounting estimates

Revisions made to the numbers or disclosures do not

constitute a change in accounting policy.

A revision of an accounting estimate must be accounted for

prospectively (para. 36): this means it must be corrected in

the current and/or future periods, not revised in a prior period.

A material change in an accounting estimate must be

disclosed, with details of the nature and amount of the change

(para.39).

19

Correcting errors

A material error made in a prior period, you must correct it

retrospectively by (AASB108.42):

Restating the comparative amounts for the prior period(s) presented in

which the error occurred; or

If the error occurred before the earliest prior period presented, restating

the opening balances of assets, liabilities and equity for the earliest prior

period presented.

Disclosure requirements para.49.

Example

20

Objective 4

Understand some of the social

implications of the financial reporting for

comprehensive income

21

The concept of income

What are we trying to measure and how can we measure

it?

Income is increases in economic benefits during the

accounting period in the form of inflows or enhancements of

assets or decreases of liabilities that result in increases in

equity, other than those relating to contributions from equity

participants (Framework para. 70)

Why does this matter?

22

The concept of income

Start of the 2014 End of the 2014

3-year-old Toyota 4-year-old Toyota

5 shirts The same 5 shirts

A keyboard The same keyboard

4 pairs of jeans 6 pairs of jeans

$1,000 cash $1,800 cash

23

The competing ideas of income realisation

The central issue*:

Pre-double entry bookkeeping period (Resources rather than

profits, no clear distinction b/w income and capital)

Pacioli times (15

th

16

th

century) (income calculation replaced

accountability as the major bookkeeping problem)

Matching costs with revenues (19

th

century)

Early 20

th

century (business income still was a core issue).

Stewardship perspective vs. Predictability argument

* Chatfield (1977) A History of the Accounting Thought

24

13/10/2014

5

Historical debates

Financial nature of organisation that could be quantified into

monetary numbers were highlighted.

Accounting has been defined as a measurement where

numbers are assigned to quantities of something deemed

important.

Users need current price information.

Owners of capitals with unquestioned significance attached.

Competing ideas:

the importance of measuring the capitalised value of the enterprise and

changes therein.

profits exist only when the increase in wealth is realised rather than

assets appreciated in value.

25

An economic concept of income: Increases in asset values

when they accrue but not when they are realised through sale

Patons (1922) Accounting Theory with special reference to the

corporate enterprise: Ensure we accounted for inflation and maintain

capital at an appropriate level to continue operating.

Alexander (1950): the importance of measuring the capitalised value of the

enterprise and changes therein.

Moonitz (1961): measuring the changes in enterprise wealth, using the

present value of future cash flows.

Chambers (1966): asset measurement on the basis of current cash

equivalents (realisable values)

Edwards and Bell (1961): capital maintenance (Current Value Accounting)

The concept of income

26

More competing ideas:

Dicksee (1921): long-term assets are recorded at

historical costs and income is recognised only when they

are sold

Hatfield (1927): profits exist only when the increase in

wealth is realised rather than assets appreciated in

value.

Canning (1920)/Gilman (1939)

The concept of income

27

What do you think

Income as a measure of performance: arising only from

purposeful activities, particularly the recurring usage of

physical non-current (or fixed) capital;

Or as an enhancement of investors wealth.

Asset and Liability View vs Revenue and Expense

View of income.

28

Financialised global economic system

A systematic transition of profit making from traditional

production to the financial sector

Proliferation of complex financial instruments and derivatives,

and a powerful incentive to pursue high-risk, high-leverage

strategies

Change managerial behaviour in non-financial companies

with greater emphases on short-term financial market-based

performance.

Corporate performance =financial performance (as reflected

in the balance sheets)

29

Financialised global economic system

Financial innovations =market efficiency improvements

Finance sector attracts significant resources away from other

productive sectors.

Financial speculation offers unprecedented risks/returns, but

contributes little to the real economy.

13/10/2014

6

Implications for accounting

Refocus accounting towards the needs of speculators in

capital markets.

reliability vs faithful representation

Instead of providing information that allows an

assessment of risk, the focus (OCI/FVA) obscures and/or

normalises the systemic risks associated with

financialisedearnings.

31

Implications for accounting

Mispricing and misrepresenting the systemic risks of

financialisation

Speculation and instability introduced into the valuation

process.

- Zhang Y and Andrew J 2014 'Financialisation and the

Conceptual Framework', Critical Perspectives on Accounting

(Special Issue on Critical Perspectives on Financialization),

vol.25, iss.1, pp. 17-26

You might also like

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Belgian Ale by Pierre Rajotte (1992)Document182 pagesBelgian Ale by Pierre Rajotte (1992)Ricardo Gonzalez50% (2)

- Solutions Manual: Company Accounting 10eDocument57 pagesSolutions Manual: Company Accounting 10eLSAT PREPAU171% (7)

- Case 6 - 3 Dan 6 - 4 SchroederDocument2 pagesCase 6 - 3 Dan 6 - 4 SchroederKhoirul AnamNo ratings yet

- MFRS 108 Changes in Accounting PoliciesDocument21 pagesMFRS 108 Changes in Accounting Policiesnatasha thaiNo ratings yet

- Advanced Financial Accounting Under IFRS - Lecture Notes - FinalDocument89 pagesAdvanced Financial Accounting Under IFRS - Lecture Notes - Finalnicodimoana100% (1)

- Developing New Products: Isaa Ruth F. Lesma Marketing Management G14-0139Document16 pagesDeveloping New Products: Isaa Ruth F. Lesma Marketing Management G14-0139Isaa Ruth FernandezNo ratings yet

- Overview of Stock Transfer Configuration in SAP-WMDocument11 pagesOverview of Stock Transfer Configuration in SAP-WMMiguel TalaricoNo ratings yet

- Ias 8 Accounting Policies, Change in Accounting Estimates and ErrorsDocument13 pagesIas 8 Accounting Policies, Change in Accounting Estimates and ErrorsSyed Munib AbdullahNo ratings yet

- Catalog EnglezaDocument16 pagesCatalog EnglezaCosty Trans100% (1)

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- Test 1 PreparationDocument11 pagesTest 1 PreparationSze ChristienyNo ratings yet

- Accounting Policies, Changes in Estimates and ErrorsDocument91 pagesAccounting Policies, Changes in Estimates and Errorsnishania pillayNo ratings yet

- Accounting Policy and EstimateDocument5 pagesAccounting Policy and EstimateADEYANJU AKEEMNo ratings yet

- Class 1 and 2 Chapter 3. Reporting Financial PerformanceDocument59 pagesClass 1 and 2 Chapter 3. Reporting Financial PerformanceTowhidul IslamNo ratings yet

- Topic 6 MFRS 108 Changes in Acc Policies, Estimates, ErrorsDocument30 pagesTopic 6 MFRS 108 Changes in Acc Policies, Estimates, Errorsdini sofiaNo ratings yet

- Theory of Accounts (Income Statement)Document49 pagesTheory of Accounts (Income Statement)PaulineBiroselNo ratings yet

- The Statement of Comprehensive Income IfrDocument20 pagesThe Statement of Comprehensive Income IfrBon juric Jr.No ratings yet

- Module 010 Week004-Finacct3 Statement of Comprehensive IncomeDocument6 pagesModule 010 Week004-Finacct3 Statement of Comprehensive Incomeman ibeNo ratings yet

- Accounting Changes CH 22Document62 pagesAccounting Changes CH 22chloekim03No ratings yet

- Equity, Income and Expenses Definition of Equity-Owner's Equity Is A Residual Interest in The Assets of An Entity After Deducting Its LiabilitiesDocument21 pagesEquity, Income and Expenses Definition of Equity-Owner's Equity Is A Residual Interest in The Assets of An Entity After Deducting Its LiabilitiesFarah PatelNo ratings yet

- Chapter 3 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document24 pagesChapter 3 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- IAS 08 PPSlidesDocument44 pagesIAS 08 PPSlideschaieihnNo ratings yet

- AS 5 Net Profit or Loss For The Period, Prior Period Items and Changes in Accounting PoliciesDocument8 pagesAS 5 Net Profit or Loss For The Period, Prior Period Items and Changes in Accounting PoliciesChandan KumarNo ratings yet

- Presentation of Financial Statements:: International Accounting Standards IAS 1Document19 pagesPresentation of Financial Statements:: International Accounting Standards IAS 1Barif khanNo ratings yet

- G4+1 1999Document37 pagesG4+1 1999David KohNo ratings yet

- FARAP-4519Document4 pagesFARAP-4519Accounting StuffNo ratings yet

- Topic 3 4 5 6 7 Cash Flow Analysis CFO CFI CFFDocument22 pagesTopic 3 4 5 6 7 Cash Flow Analysis CFO CFI CFFYadu Priya DeviNo ratings yet

- ACCG907 Module 2 S1 2019 - StudentDocument61 pagesACCG907 Module 2 S1 2019 - StudentVương Đức TrungNo ratings yet

- ACC 101 - Module 4Document12 pagesACC 101 - Module 4Kyla Renz de LeonNo ratings yet

- Chapter 9 IAS-8 Accounting Policies, Change in Estimates and ErrorsDocument30 pagesChapter 9 IAS-8 Accounting Policies, Change in Estimates and Errorszarnab azeemNo ratings yet

- Income Statement GuideDocument4 pagesIncome Statement GuideTia WhoserNo ratings yet

- HI5020 Corporate Accounting: Session 4c Statement of Comprehensive Income & Statement of Changes in EquityDocument16 pagesHI5020 Corporate Accounting: Session 4c Statement of Comprehensive Income & Statement of Changes in EquityFeku RamNo ratings yet

- Week 7 - Accounting PoliciesDocument25 pagesWeek 7 - Accounting PoliciesJeremy BreggerNo ratings yet

- REAC PHA Accounting ChangesDocument3 pagesREAC PHA Accounting ChangesAnna Mae CortezNo ratings yet

- Indian and International Accounting StandardsDocument13 pagesIndian and International Accounting StandardsBhanu PrakashNo ratings yet

- HI5020 Corporate Accounting: Session 4a Statement of Comprehensive Income & Statement of Changes in EquityDocument37 pagesHI5020 Corporate Accounting: Session 4a Statement of Comprehensive Income & Statement of Changes in EquityFeku RamNo ratings yet

- Disclosure of Accounting Policies under AS-1Document9 pagesDisclosure of Accounting Policies under AS-1Dipak UgaleNo ratings yet

- SM ch04Document54 pagesSM ch04Rendy Kurniawan100% (1)

- Resume ch04 AkmDocument9 pagesResume ch04 AkmRising PKN STANNo ratings yet

- Income Statement CH 4Document6 pagesIncome Statement CH 4Omar Hosny100% (1)

- Accounting StandardsDocument2 pagesAccounting Standardsshona39No ratings yet

- Group-IV Paper-16: Advanced Financial Accounting & Reporting Dec 2011Document71 pagesGroup-IV Paper-16: Advanced Financial Accounting & Reporting Dec 2011pkaul1No ratings yet

- Accounting Standard (AS) 5 on Net Profit or LossDocument9 pagesAccounting Standard (AS) 5 on Net Profit or LossPankaj GourNo ratings yet

- Statement of Comprehensive Income - HandoutDocument6 pagesStatement of Comprehensive Income - HandoutdesyanggandaNo ratings yet

- 1.3 Accounting PoliciesDocument23 pages1.3 Accounting Policiestirodkar.sneha13No ratings yet

- Solutions Manual - Chapter 3Document7 pagesSolutions Manual - Chapter 3Renu TharshiniNo ratings yet

- Draft Accounting Standard 1 on Financial Statement PresentationDocument26 pagesDraft Accounting Standard 1 on Financial Statement PresentationratiNo ratings yet

- IAS 8 PPT FinalDocument19 pagesIAS 8 PPT Finaljaneth pallangyoNo ratings yet

- AS-01 Financial Statement StandardsDocument9 pagesAS-01 Financial Statement StandardsAtaulNo ratings yet

- AS 1-6 ACCOUNTING STANDARDS OVERVIEWDocument13 pagesAS 1-6 ACCOUNTING STANDARDS OVERVIEWJohanna Pauline SequeiraNo ratings yet

- Disclosure of Accounting Policies StandardDocument9 pagesDisclosure of Accounting Policies StandardAkshi BhagiaNo ratings yet

- As Quick PDFDocument23 pagesAs Quick PDFChandreshNo ratings yet

- Chapter 5 - Accounting Policies, Changes in Accounting Estimates and Errors (Compatibility Mode)Document6 pagesChapter 5 - Accounting Policies, Changes in Accounting Estimates and Errors (Compatibility Mode)Chi Nguyễn Thị KimNo ratings yet

- Other Comprehensive IncomeDocument11 pagesOther Comprehensive IncomeJoyce Ann Agdippa BarcelonaNo ratings yet

- Current Applicable International Accounting Standard (IAS) Under IASBDocument11 pagesCurrent Applicable International Accounting Standard (IAS) Under IASBEZEKIEL100% (1)

- Chapter 4 17th Edition Part 5 TO BE POSTEDDocument22 pagesChapter 4 17th Edition Part 5 TO BE POSTEDAccounting geekNo ratings yet

- Aik CH 6Document15 pagesAik CH 6rizky unsNo ratings yet

- 27272asb As 5Document9 pages27272asb As 5teamhackerNo ratings yet

- Ba606 Financial Accounting: Professor Garry Carnegie Lectures 9 & 10Document46 pagesBa606 Financial Accounting: Professor Garry Carnegie Lectures 9 & 10Sunita PatilNo ratings yet

- Cfas Exam3 TheoriesDocument4 pagesCfas Exam3 TheoriespolxrixNo ratings yet

- Accounting Changes and Error AnalysisDocument39 pagesAccounting Changes and Error AnalysisIrwan Januar100% (1)

- Accounting Standard (As) 5Document19 pagesAccounting Standard (As) 5Ashish NemaNo ratings yet

- Learning Activity Sheet # 1 Lesson / Topic: Financial Statements Learning Targets: Reference(s)Document8 pagesLearning Activity Sheet # 1 Lesson / Topic: Financial Statements Learning Targets: Reference(s)Franz Ana Marie CuaNo ratings yet

- Ac Standard - AS05Document6 pagesAc Standard - AS05api-3705877No ratings yet

- Eng - P4 - Visakha Liu TestDocument8 pagesEng - P4 - Visakha Liu TestlegolasckkNo ratings yet

- P5 Summer Chin 01 v1 - 1Document1 pageP5 Summer Chin 01 v1 - 1legolasckkNo ratings yet

- Chin - P3 - Alvin Wong Ex AnsDocument12 pagesChin - P3 - Alvin Wong Ex AnslegolasckkNo ratings yet

- Chin - P6 - Kandice Wong Ex AnsDocument8 pagesChin - P6 - Kandice Wong Ex AnslegolasckkNo ratings yet

- Chin - P6 - Kandice Wong ExDocument8 pagesChin - P6 - Kandice Wong ExlegolasckkNo ratings yet

- Eng - P5 - Markus Ex AnsDocument6 pagesEng - P5 - Markus Ex AnslegolasckkNo ratings yet

- Longman English Edge VocabDocument1 pageLongman English Edge VocablegolasckkNo ratings yet

- Maths S1 08 Areas and Volumes v2Document24 pagesMaths S1 08 Areas and Volumes v2legolasckkNo ratings yet

- Week 2 Lecture Slides PDFDocument38 pagesWeek 2 Lecture Slides PDFlegolasckkNo ratings yet

- ACCT3012 Lecture W11 - Read PDFDocument6 pagesACCT3012 Lecture W11 - Read PDFlegolasckkNo ratings yet

- ACCT3012 Lecture W10 PDFDocument5 pagesACCT3012 Lecture W10 PDFlegolasckkNo ratings yet

- Work2210 S2 2014 L1 PDFDocument55 pagesWork2210 S2 2014 L1 PDFlegolasckkNo ratings yet

- Chapter 3 - Project SelectionDocument15 pagesChapter 3 - Project SelectionFatin Nabihah100% (2)

- Fashion Cycle - Steps of Fashion CyclesDocument3 pagesFashion Cycle - Steps of Fashion CyclesSubrata Mahapatra100% (1)

- Digest Fernandez Vs Dela RosaDocument2 pagesDigest Fernandez Vs Dela RosaXing Keet LuNo ratings yet

- Personal Assignment Fraud Audit ReviewDocument8 pagesPersonal Assignment Fraud Audit ReviewNimas KartikaNo ratings yet

- Renaming of The Dept. of Geology, Univ. of Kerala.Document6 pagesRenaming of The Dept. of Geology, Univ. of Kerala.DrThrivikramji KythNo ratings yet

- Power PSU's in INDIADocument53 pagesPower PSU's in INDIAUjjval JainNo ratings yet

- Setup QUAL2E Win 2000 PDFDocument3 pagesSetup QUAL2E Win 2000 PDFSitole S SiswantoNo ratings yet

- GST Functional BOE Flow Phase2Document48 pagesGST Functional BOE Flow Phase2Krishanu Banerjee89% (9)

- From Homeless To Multimillionaire: BusinessweekDocument2 pagesFrom Homeless To Multimillionaire: BusinessweekSimply Debt SolutionsNo ratings yet

- ME Quiz1 2010Document6 pagesME Quiz1 2010Harini BullaNo ratings yet

- Small Business & Entrepreneurship - Chapter 14Document28 pagesSmall Business & Entrepreneurship - Chapter 14Muhammad Zulhilmi Wak JongNo ratings yet

- NABJ Finance Committee PresentationDocument26 pagesNABJ Finance Committee PresentationGabriel AranaNo ratings yet

- gb10nb37lz 179Document10 pagesgb10nb37lz 179Jan RiskenNo ratings yet

- Chapter 11 Appendix Transfer Pricing in The Integrated Firm: ExercisesDocument7 pagesChapter 11 Appendix Transfer Pricing in The Integrated Firm: ExerciseschrsolvegNo ratings yet

- Fin 465 Case 45Document10 pagesFin 465 Case 45MuyeedulIslamNo ratings yet

- NewfundoptionextpitchesDocument6 pagesNewfundoptionextpitchesSunil GuptaNo ratings yet

- Carlin e Soskice (2005)Document38 pagesCarlin e Soskice (2005)Henrique PavanNo ratings yet

- An Overview of SMEDocument3 pagesAn Overview of SMENina HooperNo ratings yet

- Pocket ClothierDocument30 pagesPocket ClothierBhisma SuryamanggalaNo ratings yet

- Keto Diet PlanDocument5 pagesKeto Diet PlanSouharda MukherjeeNo ratings yet

- William Mougayar: Designing Tokenomics and Tokens 2.0Document16 pagesWilliam Mougayar: Designing Tokenomics and Tokens 2.0rammohan thirupasurNo ratings yet

- 7.1 Ec PDFDocument2 pages7.1 Ec PDFEd Z0% (1)

- Light Activated RelayDocument8 pagesLight Activated RelayAceSpadesNo ratings yet

- Airline Industry Metrics - MA - Summer 2017Document21 pagesAirline Industry Metrics - MA - Summer 2017Yamna HasanNo ratings yet

- Receivables Management's Effect on ProfitabilityDocument12 pagesReceivables Management's Effect on ProfitabilityRhona BasongNo ratings yet