Professional Documents

Culture Documents

2 Birth and Growth of Firms

Uploaded by

Saifulahmed49Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2 Birth and Growth of Firms

Uploaded by

Saifulahmed49Copyright:

Available Formats

GN.AEC,Gr.

12Economics Page1

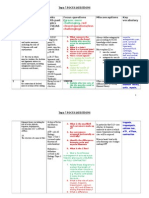

Unit32.BirthandGrowthoffirms

Afirmisaunitofmanagement.Itisanorganizationwhichtradesunderaparticular

name,andwhichcontrolsthewayinwhichland,labourandcapitalareused.Ittakes

decisions onsuch matters as the methodsof production,design of its products and

thewaytheproductsmarketed.

A firm must be distinguished from a unit of production such as a factory, a farm, a

mineoraquarry.Onefirmmayownandcontrolseveralunitsofproduction.Allthe

firmsproducingsimilarproductforaparticularmarkettogethercalledanindustry.

Firmsvaryinsize.Thereareanumberofwaysinwhichwecanattempttomeasure

the size of a firm. These include value of output produced, number of workers

employed,marketshareofthefirm,thevalueofitsassetsanditsstockmarketvalue

(marketcapitalization).

Whyfirmsgrow

1. To obtain the benefits of economies of scale: Firms grow in order to obtain the

benefitsofeconomiesofscaleandtoreduceaveragecostofproduction.Largefirms

canobtainthebenefitsof technical,marketing,financial andmanagerialeconomies

ofscale.Thismeansthatasoutput(orsizeofthefirm)increasestheaveragecostof

production will fall. A fall in average cost will increase the firms profit margins,

enablethemtodriveoutcompetitorsandcompeteinoverseasmarkets.

To obtain larger share of the market: Firms may wish to grow to obtain a larger

shareofthemarketandhencemoremarketpower.Largefirmshavealargemarket

share, that is, they supply a large percentage of the total market. This means that

theyhavethepowertoraisepricesandearnmoreprofits.

Toachievegreatersecurity:Firmswishtogrowinordertoachievegreatersecurity.

Large firms have more resources, they are likely to produce a wider range of

products, and they sell their products in both home and overseas markets. This

means that they suffer less if there is a fall in demand for one of its products. The

expansionofabusinessmightbemotivatedbyadesiretodiversifyproductionand

salessothatfallingsalesinonemarketmightbecompensatedbyhealthierdemand

andoutputinanothermarket.

Managerial motives: Behavioural theories of the firm predict that the growth of a

business is often spurred on by the decisions and strategies of managers employed

byafirmwhoseobjectivesmightbedifferentfromthoseoftheshareholders.Thisis

becausethatthemanagersannualsalariesandotherperksarecloselylinkedtothe

sizeofthefirm.

Howfirmsgrow

Therearetwowaysbywhichgrowthcanbeachieved

1.Internalgrowth:Firmsgrowinternallybyusingmorefactorinputsandproducing

moreoutput.Theymayproducemoreoftheexistingproductsorincreasetherange

oftheirproducts.

2.Externalgrowth:Thisisachievedthroughmergerortakeoverandiscommonly

knownasintegration.Therearethreemaintypesofintegrationhorizontal,vertical

andconglomerateintegration.

Horizontalintegration:Thisreferstothejoiningtogetheroftwoormorefirms

producingsimilarproducts.Forexample,theamalgamationoftwoormoremining

companies

Reasonsforhorizontalintegration

Economiesofscale:Thescaleofproductionoftheintegratedfirmwillbemuch

largerthanthatofanyofthefirmsbeforeintegration.Theaimistoreduceaverage

cost.

Moremarketpower:Amergeroffirmsmakingsimilarproductswillclearlyreduce

thenumberofcompetitors.Italsoincreasesthemarketshareandthemarketpower

ofthenewintegratedfirm.

Rationalisation:Thisreferstotheprocessofeliminatinglessefficientplantor

factoriesandconcentratingproductioninthemoreefficientunitsofproduction.This

willreducethefirmsaveragecost.

Disadvantagesofhorizontalintegration

Ifthesizeofthefirmgrowsbeyondtheoptimum,itmayexperiencediseconomiesof

scale,thatis,risingaveragecost.

GN.AEC,Gr.12Economics Page2

Horizontalintegrationwillincreasethemonopolypowerofthefirm.Itmightuseits

monopolypowertoraiseprice.Highlevelofmarketconcentrationwillalsomean

thatthereisreducedchoiceforconsumersandincreasedbarrierstotheentryof

newfirms.

Rationalisationmightleadtoadirectlossofjobs.

Verticalintegration:Thisreferstothejoiningtogetheroffirmsatdifferentstagesin

theprocessofproduction.Itmaytaketheformofbackwardorforward.

Verticalintegrationbackwardtakesplacewhenafirmtakesoverormergeswithits

suppliers.Forexample,afirmmakingchocolatetradesoveracocoaplantationora

firmproducingtyrestakesoverarubberplantation.Themainreasonsforbackward

verticalintegrationarelikelytohaveagreaterdegreeofcontroloverthequalityof

itssuppliesofmaterialsandtheregularityoftheirdelivery.

Verticalintegrationforwardoccurswhenafirmtakesoverormergeswithits

marketoutlets.Forexample,anoilcompanytakesoveranumberofpetrolstations.

Importantmotivesforthistypeofmergerarethedesiretosecureanadequate

numberofmarketoutletsandtoraisestandardoftheseoutlets.Firmsmayalsobe

forcedtotakeoversomeofitsmarketoutletswhenamajorcompetitorhasalready

madeamoveinthisdirectionotherwisetheymaybesqueezedoutofmarketsby

thecompetitors.

Conglomerateintegration:Thisreferstomergersbetweenfirmwhichproduce

goodsorservicesthatarenotdirectlyrelatedtooneanother.Forexampleafirm

producingfertilizersmaymergewithamanufacturerofpaint.

Reasonsforconglomerateintegration

Toreducetheriskoftradingthroughdiversificationofoutput.Aconglomeratewill

owncompaniesProducingverydifferentproductsandthesuccessofonecompany

willtendtooffsetthelackofsuccessofanothercompany.

Conglomeratemergermayalsoarisewhenafirmbelievesthatthereislittlescope

foranyfurthergrowthinthemarketforitsexistingproducts

Firmsmayalsoengageinconglomerateintegrationwhenitispossibletouse

commonmaterials,commonmarketsorcommontechnology.

Multinationalcompanies(MultinationalorTransnational

corporations)

A multinational company is a firm which produces its products in more than one

country. These companies are usually large limited companies based in

industrialized countries. E.g. Ford, CocaCola, Sony etc. The following are the

reasonsforMNCssettingupfactoriesabroad.

Toreducetransportcost:Producingandsellinginamajormarketabroadwillreduce

thefirmstransportcost.

To avoid import restrictions: Invest decisions by multinational companies are often

influenced by trade barriers. For example, if a country places a high tariff on

imported cars, a multinational company making cars may decide to set up an

assembly plant inside that country in order to avoid the high cost of importing its

cars.

Otherreasons:MNCssettingupfactoriesabroadmaybeabletogetthebenefitsof

cheap raw materials and cheap labour. Sometimes MNCs set up factories in

countrieswherehealth,safety,andotheremploymentlegislationsaremorelaxthan

those in the home country. The MNCs can also take advantage of government

assistancesuchasinvestmentgrantsandreducedtaxesonprofits.

TheeffectsofalargeMNCssettingupanewproductionplantto

thehostcountry

MNCs can bring a number of benefits to a nation. They bring finance, technical

personnel and new technology. They create employment and income in the host

country.Theyincreaseeconomicgrowth(realGDP)andimprovespeoplesstandard

of living. They increase governments tax revenue and reduce its expenditure on

unemployment benefits. They also increase competition in the home country and

this might benefit consumers in the form of more choice, high quality and lower

prices.

However, the presence of multinational companies can have some adverse effects

ontheeconomy.Theymayforcecompetingfirms outofbusiness.Ifthishappens,

consumers will not be able to obtain the benefits of competition and the effect of

employment will be uncertain. They may deplete the natural resources at a faster

rate and this will affect the countrys future economic growth. They may exploit

GN.AEC,Gr.12Economics Page3

local workforce and environment. This is because the large size of multinational

companies gives them considerable bargaining power in wage negotiations and in

discussions with governments. They may also discourage potential local

entrepreneurs.

Inadditiontothis,thepresenceofMNCsaffectsthecountrysbalanceofpayments.

InvestmentbyMNCsrepresentsinvestmentinflows.Therefore,itwouldimprovethe

capital and financial account of the balance of payments leading to a balance of

payments surplus in the short run. In the long run, it might increase the countrys

export and lead to a current account inflow and it might reduce the countrys

importsandleadtoafallincurrentaccountoutflow.Thesearelikelytoimprovethe

currentaccountofthecountrysbalanceofpayments.However,itmightimportraw

materialsandleadtoanincreaseincurrentaccountoutflowanditmighttakehuge

profits out of the nation and lead to an increase in current account outflow. These

are likelytoleadtodeterioration inthecurrentaccountofthecountrysbalanceof

payments.

Small Firms

A firm can be classified as small if it employs relatively less workers and

capital and produces a small value of output. Another way of measuring

the size of the firm is its market share (the % of the total market which is

supplied by the firm). A small firm has a small share of the market. The

following are the reasons why some firms remain small.

The size of the market: If the size of the market for a good or service is

small, then the firm will be forced to remain small. For products such as

clothing, footwear and jewellery, the market for any one design or fashion

is likely to be small. This is because consumers prefer to have a wider

variety of these products. Sometimes the size of the market is restricted

by geographical factors. For example, most small islands in the Maldives

cannot provide a large enough market to support a large supermarket.

Repair work is another example of an industry where the product cannot

be standardized; each work tends to be different. Hence, in trades such as

the repair of motor cars, shoes and watches, we find a large number of

small firms.

Specialist producers and distributors: Small firms may act as specialist

producers of parts and components for large manufacturers. For example,

in the car industry small specialist producers supply parts such as wheels,

carburetors and break lining to the car manufacturers. Small firms also

distribute the products of large firms.

The nature of the business: The nature of the business is another

factor that causes firms to remain small. For example, firms which are

engaged in service industries tend to be small. Medical, dental, accounting

and catering firms work more efficiently remaining small.

Lack of capital: Some firms remain small because they may not be able

to raise capital to expand. There may not be enough investors or the

interest rates offered to them may be too high. Therefore, they cant

expand.

Problems of growth: Some firms may choose to remain small even if

they have the prospective of growth, because they want to avoid the

problems of being large. Eg. Government regulation and trade union

problems.

Proprietors reluctance: In some cases firms remain small because the

entrepreneur does not want to take the additional worries and

responsibilities of running a large business.

Demerger:Demergerisacorporate strategy to sell off subsidiaries or divisions

of a company. Demerger occurs when a firm splits itself into two or more

separate parts to create two or more firms.

You might also like

- Differencescpirpi2 tcm77-229382Document3 pagesDifferencescpirpi2 tcm77-229382Saifulahmed49No ratings yet

- Economics Notes Unit 3 Managing The EconomyDocument74 pagesEconomics Notes Unit 3 Managing The EconomySaifulahmed49No ratings yet

- Standard of Living and Economic Development FactorsDocument7 pagesStandard of Living and Economic Development FactorsSaifulahmed49No ratings yet

- Skeletal Muscle Contraction Keyhole SurgeryDocument17 pagesSkeletal Muscle Contraction Keyhole SurgerySaifulahmed49No ratings yet

- As Chemistry Unit 1 NotesDocument71 pagesAs Chemistry Unit 1 NotesUmer Mohammed100% (2)

- Balance of PaymentDocument4 pagesBalance of PaymentSaifulahmed49No ratings yet

- Exchange Rate PolicyDocument9 pagesExchange Rate PolicySaifulahmed49No ratings yet

- Topic 5 (Focus Questions)Document12 pagesTopic 5 (Focus Questions)Saifulahmed49No ratings yet

- C Language Tutorial by Gordon Drodrill (1999)Document124 pagesC Language Tutorial by Gordon Drodrill (1999)felixandy101100% (1)

- Topic 8 Focus QuestionsstudentsDocument7 pagesTopic 8 Focus QuestionsstudentsSaifulahmed49No ratings yet

- Writing Practice Test 1 IELTS Academic Model AnswersDocument2 pagesWriting Practice Test 1 IELTS Academic Model Answersmahfuz507100% (1)

- Unit 3 Revision Business StudiesDocument19 pagesUnit 3 Revision Business StudiesSaifulahmed49No ratings yet

- Mod 1 Revision Guide Organic2Document6 pagesMod 1 Revision Guide Organic2Saifulahmed49No ratings yet

- 2 Calculating Energy Change For An Experimental ReactionDocument5 pages2 Calculating Energy Change For An Experimental ReactionSaifulahmed49No ratings yet

- 3rdquarterreport 2013Document8 pages3rdquarterreport 2013Saifulahmed49No ratings yet

- 9693 Marine Science A2 Teacher SupportDocument40 pages9693 Marine Science A2 Teacher SupportSaifulahmed49100% (1)

- 01 - 04 - Basic Orientation in The Human CNSDocument3 pages01 - 04 - Basic Orientation in The Human CNSSaifulahmed49No ratings yet

- Mod 5 Revision Guide 3 RedoxDocument7 pagesMod 5 Revision Guide 3 RedoxSaifulahmed49No ratings yet

- Secondary Higher Mathematics GeometryDocument125 pagesSecondary Higher Mathematics GeometrySaifulahmed49No ratings yet

- 3 Hess - S LawDocument9 pages3 Hess - S LawSaifulahmed49No ratings yet

- 1-Enthalpy Intro DefinitionsDocument6 pages1-Enthalpy Intro DefinitionsSaifulahmed49No ratings yet

- Mod 5 Revision Guide 4 Transition MetalsDocument14 pagesMod 5 Revision Guide 4 Transition MetalsSaifulahmed49100% (1)

- Optical Isomerism - Edexcel Chemistry Unit 2Document9 pagesOptical Isomerism - Edexcel Chemistry Unit 2Da GuyNo ratings yet

- Edexcel M2 QP Jan 2011Document28 pagesEdexcel M2 QP Jan 2011Issam SaifNo ratings yet

- 3 Hess - S LawDocument9 pages3 Hess - S LawSaifulahmed49No ratings yet

- D1 2011 June Qu.Document32 pagesD1 2011 June Qu.Batool AbbasNo ratings yet

- As Unit 2 June 2012 Exam PaperDocument36 pagesAs Unit 2 June 2012 Exam Paperapollo3605693No ratings yet

- List of Core Practicals For Edexcel Biology As Exam 2010Document35 pagesList of Core Practicals For Edexcel Biology As Exam 2010moalna80% (25)

- C Language Tutorial by Gordon Drodrill (1999)Document124 pagesC Language Tutorial by Gordon Drodrill (1999)felixandy101100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Lecture 36Document14 pagesLecture 36praneix100% (1)

- Pharmerging MarketsDocument24 pagesPharmerging MarketsAlexandre100% (1)

- Ise1 406-C FakDocument9 pagesIse1 406-C FakjaisnsjsjaNo ratings yet

- Inter HRMDocument38 pagesInter HRMNrityam NundlallNo ratings yet

- Contemporary World Lesson 1 GlobalizationDocument3 pagesContemporary World Lesson 1 GlobalizationMelchor SambranoNo ratings yet

- Q1.Explain The Concept of Franchising With An Example. List Out The Advantages and Disadvantages of FranchisingDocument11 pagesQ1.Explain The Concept of Franchising With An Example. List Out The Advantages and Disadvantages of FranchisingNabil SayyedNo ratings yet

- Trac Nghiem Tai Chinh Quoc TeDocument16 pagesTrac Nghiem Tai Chinh Quoc TePhước Đinh TriệuNo ratings yet

- Assignment (F.y.j.c)Document46 pagesAssignment (F.y.j.c)Nilesh AbhyankarNo ratings yet

- Chapter 4 - Environmental Scanning & Industry AnalysisDocument25 pagesChapter 4 - Environmental Scanning & Industry AnalysisDaniel Hunks100% (3)

- Benjamin OwusuDocument103 pagesBenjamin OwusuKishor JhaNo ratings yet

- SM2 PGP22-24 M2 Samar21Jul23Document75 pagesSM2 PGP22-24 M2 Samar21Jul23Himanshu SinghNo ratings yet

- Cambridge IGCSE (9-1) : Economics For Examination From 2020Document16 pagesCambridge IGCSE (9-1) : Economics For Examination From 2020EHANo ratings yet

- Foreign Direct Investment & Globalization TrendsDocument19 pagesForeign Direct Investment & Globalization TrendsDe Leon LeizylNo ratings yet

- Multinational Companies PPTTTDocument26 pagesMultinational Companies PPTTTAnmolNo ratings yet

- Solution Manual For International Business 2nd Edition Michael Geringer Jeanne Mcnett Donald BallDocument28 pagesSolution Manual For International Business 2nd Edition Michael Geringer Jeanne Mcnett Donald Ballplainingfriesishd1hNo ratings yet

- Emerging Markets Midterm 2Document11 pagesEmerging Markets Midterm 2manuelaNo ratings yet

- Unit PlannerDocument14 pagesUnit PlannerMarusaha MP SiahaanNo ratings yet

- Case1 1Document3 pagesCase1 1rgovindan123No ratings yet

- Recruitment Is Defined As Searching For and Obtaining Job Candidates inDocument4 pagesRecruitment Is Defined As Searching For and Obtaining Job Candidates inSiponAliNo ratings yet

- Criticisms and counterarguments of MNC activities in developing nationsDocument2 pagesCriticisms and counterarguments of MNC activities in developing nationsVikram KumarNo ratings yet

- Layout of ManagementDocument72 pagesLayout of ManagementPolite CharmNo ratings yet

- Summary Financial Management Chapter 1Document2 pagesSummary Financial Management Chapter 1DeviNo ratings yet

- BBA IV Semester International Business SyllabusDocument84 pagesBBA IV Semester International Business Syllabuskumar86% (7)

- MIB NotesDocument47 pagesMIB NotesAjay SinghNo ratings yet

- MNCDocument10 pagesMNCvinoth_17588No ratings yet

- Jatiya Kabi Kazi Nazrul Islam University, Trishal, MymensinghDocument18 pagesJatiya Kabi Kazi Nazrul Islam University, Trishal, MymensinghMd. Mahin MiaNo ratings yet

- Wrong Targeting Renders Strategy IneffectiveDocument5 pagesWrong Targeting Renders Strategy IneffectiveEmelia D' SilvaNo ratings yet

- Assignment No. 1 Human Resource Management: Name: Moosa Rizwan Roll No: 70071471 Section: C Instructor: Sir Aasim GillDocument6 pagesAssignment No. 1 Human Resource Management: Name: Moosa Rizwan Roll No: 70071471 Section: C Instructor: Sir Aasim GillMoosa RizwanNo ratings yet

- UAS Bahasa Inggris Hukum (Fix)Document2 pagesUAS Bahasa Inggris Hukum (Fix)Dex DauhNo ratings yet

- Verbeke Chapter 1 Conceptual Foundations of International Business StrategyDocument8 pagesVerbeke Chapter 1 Conceptual Foundations of International Business StrategyCarolina Pérez HuamaníNo ratings yet