Professional Documents

Culture Documents

Business Funding Axis Capital Group: Micro, Retail To Remain Mandiri's Focus

Uploaded by

Axis Capital Group Business FundingOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Funding Axis Capital Group: Micro, Retail To Remain Mandiri's Focus

Uploaded by

Axis Capital Group Business FundingCopyright:

Available Formats

Micro, retail to remain Mandiris focus

State-owned lender Bank Mandiri will continue focusing on micro and retail business in the

coming years as the two provide the highest margin for the bank compared to other

segments, according to its executives.

Mandiri vice president director Riswinandi said the focus on micro and retail was part of

its rebalancing plan.

We want micro and retail to make up 35 percent of total operations from 25 percent in

previous years, while we are aiming for wholesale to make up 65 percent from 75 percent,

he said in a press conference during the 2014 Investor Summit and Capital Market Expo on

Wednesday.

Business Funding Axis

Capital Group

He added that the bigger focus on micro and retail would provide the publicly listed lender

with a better income margin as the overall banking industry was facing a margin squeeze

due to the tight monetary policy.

Data from Mandiris first-half financial report shows that the amount of loans channeled to

the micro sector reached Rp 30.96 trillion (US$2.6 billion) by the end of June, while those

disbursed to the retail or consumer sector stood at Rp 60.3 trillion.

Mandiri claims to control the second-largest share in the domestic micro lending market

after state-owned lender Bank Rakyat Indonesia (BRI).

Compared to banking statistics published in June by the Financial Services Authority (OJK)

and Bank Indonesia (BI), Mandiris micro figure was equal to 4.7 percent of outstanding

micro loans.

The segment is also targeted by other banks looking to gain higher profitability, so we

need to have a solid foothold in the sector, Riswinandi said.

Mandiri micro and retail banking director Hery Gunardi said that it targeted a 28 to 30

percent increase in micro lending this year. It means that the lender will see the loans surge

to between Rp 34.56 trillion and Rp 35.1 trillion, up from the Rp 27 trillion booked in 2013.

We are planning to open 300 new micro lending outlets and have opened up more than

half of the target, Hery said.

In retail, Mandiri senior executive vice president on consumer finance Tardi said that

mortgage and auto loans would remain its major growth drivers, even though the mortgage

market had been recently affected by BIs down payment regulation.

As previously reported, the regulation requires customers to provide a higher down

payment on their second and third home purchases. The homes must have also already

been built upon purchase.

Our mortgage is quite stagnant at the moment because of the new rule, but our automotive

financing has bounced back after a slight decline during the Idul Fitri holidays, Tardi said.

Mandiri hopes to achieve a 33 percent increase year-on-year (y-o-y) in automotive

financing and a 10 to 15 percent y-o-y mortgage rise in 2014.

Meanwhile, the lender now the largest lender in terms of assets in Indonesia is

looking to boost retail or low-cost deposits by expanding transaction services, such as

electronic banking.

We cannot rely solely on time deposits because that tends to create price wars among

banks, Riswinandi said, adding that it would maintain the portion of low-cost funds at

more than 60 percent of total funding.

In the first half, the low-cost deposits figure was already equal to 62 percent of total

funding.

Mandiris shares ended at Rp 10,275 on Wednesday at the Indonesia Stock Exchange, up

1.2 percent from a day before.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

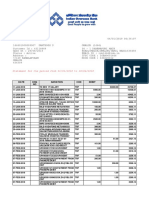

- Temenos T24 PW Client ReportingDocument2 pagesTemenos T24 PW Client ReportingSyed Muhammad Ali SadiqNo ratings yet

- Statement 166601000009907Document5 pagesStatement 166601000009907Nithiyandran RajNo ratings yet

- Chapter 6 2Document7 pagesChapter 6 2ArkokhanNo ratings yet

- Majid ResumeDocument1 pageMajid ResumeasifllahNo ratings yet

- Country Finance Indonesia 2012Document71 pagesCountry Finance Indonesia 2012maliNo ratings yet

- Manulife Financial Corporation 2015 Annual ReportDocument194 pagesManulife Financial Corporation 2015 Annual ReportGeorge SilvaNo ratings yet

- HRM in banking sector BANK OF BARODADocument35 pagesHRM in banking sector BANK OF BARODAVanita MahadikNo ratings yet

- BNPL Literature Review Examines Pay Later ImpactDocument1 pageBNPL Literature Review Examines Pay Later ImpactRISHAV RAJ GUPTANo ratings yet

- 100 transaction cycle in VisionPLUS banking systemDocument7 pages100 transaction cycle in VisionPLUS banking systemGoushik Balakrishnan100% (1)

- Brand Awareness Study of Equitas Small Finance Bank in BengaluruDocument112 pagesBrand Awareness Study of Equitas Small Finance Bank in BengaluruAkshay K RNo ratings yet

- Audit of Non Banking Financial Companies: HapterDocument6 pagesAudit of Non Banking Financial Companies: HapterAditya Jayseelan KNo ratings yet

- Comprehensive Loan Management Software For Micro Finance InstitutionsDocument40 pagesComprehensive Loan Management Software For Micro Finance InstitutionsDivya SinghNo ratings yet

- BCG Corporate Treasury Insights 2015Document19 pagesBCG Corporate Treasury Insights 2015thesrajesh7120100% (1)

- Government Receipt Portal SystemDocument1 pageGovernment Receipt Portal Systempetergr8t1No ratings yet

- Contract in Islamic Finance and Banking.: BWSS 2093Document49 pagesContract in Islamic Finance and Banking.: BWSS 2093otaku himeNo ratings yet

- Detailstatement - 28 2 2024@22 21 29Document5 pagesDetailstatement - 28 2 2024@22 21 29himmatsingh40500No ratings yet

- Selegna Management v. UCPB (2006) DigestDocument2 pagesSelegna Management v. UCPB (2006) Digestspringchicken88No ratings yet

- Unlock Your Business Potential with 4 Keys to Profit GrowthDocument28 pagesUnlock Your Business Potential with 4 Keys to Profit GrowthPratiiek Mor100% (6)

- Post Date Value Date Narration Cheque Details Debit Credit BalanceDocument2 pagesPost Date Value Date Narration Cheque Details Debit Credit BalanceCh AranNo ratings yet

- Repaso1, PRIMER AÑODocument8 pagesRepaso1, PRIMER AÑOtowersalar1117No ratings yet

- PPSC Challan FormDocument2 pagesPPSC Challan FormMuhammad JamilNo ratings yet

- UCO Bank performance analysis using CAMELS frameworkDocument69 pagesUCO Bank performance analysis using CAMELS frameworkMilind Singh100% (1)

- Bali Nusra Region Sales Report Q4Document35 pagesBali Nusra Region Sales Report Q4dollers jrNo ratings yet

- Monthly Statement: Name Address Account Number Statement PeriodDocument18 pagesMonthly Statement: Name Address Account Number Statement PeriodAlexander Weir-WitmerNo ratings yet

- CIB Form001Document11 pagesCIB Form001PRANJAL AGRAWALNo ratings yet

- MTN Gns W 120 eDocument7 pagesMTN Gns W 120 eTrung KhuatNo ratings yet

- An Appraisal of Bank Lending and Credit Administration in Nigeria Case Study of Inland Bank of Nigeria PLCDocument67 pagesAn Appraisal of Bank Lending and Credit Administration in Nigeria Case Study of Inland Bank of Nigeria PLCOlayiwola Taoheed KoladeNo ratings yet

- Summer Revision 29 QuestionsDocument13 pagesSummer Revision 29 Questionsetelka4farkasNo ratings yet

- Contact Us for SAP Financial Supply Chain Management Online TrainingDocument12 pagesContact Us for SAP Financial Supply Chain Management Online TrainingFlávio PiresNo ratings yet

- 8 IsicpDocument195 pages8 Isicpwyc199806No ratings yet