Professional Documents

Culture Documents

Financial Analysis Report OGDCL

Uploaded by

Raza SohailOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Analysis Report OGDCL

Uploaded by

Raza SohailCopyright:

Available Formats

1

Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012

e

Oil & Gas Development Company Limited

Financial Analysis Report

Period coverage: 1

st

July 2011 to 30

th

June 2012

Prepared and Presented by:

Dr. Babur Zahiruddin Raza,

Corporate Office

Consultant in Human Resources & Master Trainer in H.R Applications

Research Consultant Mr. J. S Khan

IT Consultant Mr. Raheel Rustam

Ph: 051-5584905, 5792836

Cell: 0332 4923235

Email: baburzahiruddin@yahoo.com,

2

Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012

TABLE OF CONTENTS

SR no Description Page no

1

Financial analysis approach ------------------------------------------

3

2 Key discussion points for AGM---------------------------------------

9

3

Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012

1. FINANCIAL ANALYSIS APPROACH

We have tried to perform holistic and integrated financial analysis of OGDCL with the help

environmental analysis, industry analysis, company operational review and annual report.

1.1 Flow chart of analysis approach

2.2 Requisite essential documents for financial analysis

Environmental analysis

Industry analysis

Operational review of OGDCL

Financial analysis

4

Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012

The under mentioned documents are essential to perform comprehensive analysis of financial position,

performance and cash position of OGDCL

1. Financial plan-Year 2011 to 2015

2. Audited financial statements-Year 2012

3. Internal audit reports

4. Management letter /. Letter of internal control from external auditors

5. Minutes of board meetings

3. Energy sector analysis

Energy is considered to be the lifeline of economic development. For a developing economy with a high

population growth rate, it is important to keep a balance between energy supply and emerging needs. If

corrective measures are not effectively anticipated significant constraints start emerging for

development activities. The rise in global energy demand has raised questions regarding energy security

and increased the focus on diversification, generation and efficient allocation. The answer lies in the

attainment of optimal energy mix through fuel substitution by promoting energy efficiency and

renewable energy and interregional co-operation. However, oil and natural gas will continue to be the

worlds top two energy sources through 2040.

Pakistans economy has been growing at an average growth rate of almost 3 percent for the last four

years and demand of energy both at production and consumer end is increasing rapidly.

Pakistans total energy consumption stood at 38.8 million tonnes of oil equivalent in 2010-11. The

relative importance of the various sources of energy consumption of Liquid Petroleum Gas (LPG),

electricity and coal has been broadly similar since 2005-06. The share of gas consumption stood at the

highest equal to 43.2 percent of the total energy mix of the country, followed by oil (29.0 percent).

3.1 Crude Oil

The total supply of crude oil for the fiscal year 2010-11 was 75.3 million barrels. The 68.1 percent was

imported and 31.9 percent was locally extracted.

3.2 Natural Gas

The consumption of increasing natural gas is rapidly. As on December 31st 2011, the balance

recoverable natural gas reserves have been estimated at 24.001 Trillion Cubic Feet. The average

production of natural gas during July- March 2011-12 was 4236.06 million cubic feet per day (Mmcfd) as

against 4050.64 (Mmcfd) during the corresponding period of last year, showing an increase of 4.57

percent. Natural gas is used in general industry to prepare consumer items, to produce cement and to

generate electricity. In the form of CNG, it is used in transport sector and most importantly to

manufacture fertilizer to boost the agricultural sector. Currently 27 private and public sector companies

are engaged in oil and gas exploration & production activities.

5

Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012

3.3 Liquefied Petroleum Gas-LPG

LPG currently contributes only 0.5 percent to the total primary energy supply in the country. However,

87 percent of its demand is met through local production. The rest is imported. This lower share is

mainly due to local supply constraints and the higher price of LPG in relation to competing fuels like fuel

wood, dung etc. Currently, in Pakistan, out of 27 million households, approximately 6 million are

connected to the natural gas network while the rest are relying on LPG and conventional fuels such as

coal, firewood, kerosene, biomass etc. LPG has thus become a popular domestic fuel for those who live

in areas where the natural gas infrastructure does not exist. The annual total supply of LPG remained

467,476 tonnes; 1, 281 tonnes were produced daily during 2012, out of this 46 percent is produced in

the private sector while 54 percent is produced in the public sector. The three main sources of LPG are;

refineries 32 percent, gas producing fields 55 percents and imports 13 percent.

3.4 Petroleum products

Petroleum products are produced from the processing of crude oil at petroleum refineries and the

extraction of liquid hydrocarbons at natural gas processing plants. These products are further classified

into Energy and Non-Energy products. Energy products include Motor Spirit, Kerosene, High Octane

Blending Component (HOBC), High Speed Diesel Oil (HSD), Light Diesel Oil (LDO), Furnace Oil (FO),

Aviation Fuels, Naphtha and Liquefied Petroleum Gas (LPG), while Non- Energy products include Lube

Oil, Solvent Oil, Mineral Turpentine (MTT), Jute Batch Oil (JBO), Asphalt, Process Oil, Benzyne Toulene

Xylene (BTX), Wax and Sulphur etc. During 2011 the total production of petroleum products (energy and

non-energy) remained 9.40 million tones compared to 9.53 million tonnes during 2009-10; thus posting

a negative growth of 1.36 percent. Out of 9.40 million tonnes 8.91 million tonnes are energy products

while 0.49 million tonnes are non energy products. In these products diesel has the highest share of 34.9

percent followed by Furnace Oil (FO) having 25.9 percent. Motor Spirit and High Octane Blending

Component (HOBC) together have 13.3 percent while Aviation Fuels, Naphtha and Liquefied Petroleum

Gas (LPG) hold 8.8 percent, 8.6 percent and 1.9 percent respectively. Non-Energy products together

have 5.3 percent share in the total production of petroleum products.

The total import of petroleum products were 12.37 million tonnes while total export of petroleum

products were 1.57 million tonnes in 2010-11.

4. INDUSTRY ANALYSIS

We have applied the porters five competitive forces model to analyze the Electricity industry and its

details are stated as under

4.1 Listed companies in the Oil & Gas sector

1 Attock Petroleum Limited

2 Attock Refinery Limited

3 Burshane LPG ( Pakistan)Limited

4 Byco Petroleum Pakistan Limited

5 Mari Gas Company Limited

6 National Refinery Limited

7 Pakistan Oilfields Limited

8 Pakistan Petroleum Limited

6

Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012

9 Pakistan Refinery Limited

10 Pakistan State Oil Company Limited

11 Shell Pakistan Limited

4.2 Threat of new entrants

Flexible requirements for entry in Oil & Gas industry

4.3 Threat of substitutes

At present, the substitute of electricity is not available for consumers

4.4 Bargaining power of suppliers

The bargaining power of fuel suppliers is relatively strong

Bargaining power of customers

The bargaining power of end users is weak

5.CORPORATE AND OPERATIONAL REVIEW OF OGDCL

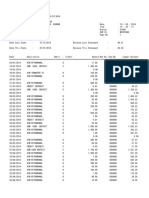

5.1. Ownership structure

SR

No

Categories Number of

shareholders

Number of shares % age

1 Individuals 21,706 32,026,532 0.74

2 Investment companies 7 646,253 0.02

3 Insurance companies 12 17,019,982 0.40

4 Joint Stock Companies 129 1,445,750 0.03

5 Banks, DFIs, NBFIs 14 10,649,548 0.25

6 Modarabas and Mutual Funds 71 51,055,638 1.19

7 Foreign investors 117 524,981,937 12.21

8 Co-operative societies 1 3 0.00

9 Charitable Trusts 21 970,583 0.02

10 Others 120 5,334,054 0.12

11 OGDCL Employee Empowerment Trust 1 432,189,039 10.05

12 Government of Pakistan 1 3,224,609,081 74.97

Total 22,200 4,300,928,400 100.00

5.2 Strategic direction; Vision, Mission and objectives

Vision: To be a leading multinational exploration and production company

Mission statement: To become the leading provider of oil and gas to the country by increasing

exploration and production both domestically and internationally, utilizing all options including strategic

alliances.

To continuously realign ourselves to meet the expectations of our stakeholders through both

management practices, the use of latest technology and innovation for sustainable growth while being

socially responsible.

5.3 Overall strategic objectives

1. To build strategic reserves for future growth / expansion

7

Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012

2. To improve reliability and efficiency of supply to the customer

3. To excel in exploration, development and commercialization

4. To improve internal business decision making and strategic planning through state of art MIS

.

5.4 Legal status and operational

Oil and Gas Development Company Limited (OGDCL), "the Company", was incorporated on 23 October

1997 under the Companies Ordinance, 1984. The registered office of the Company is located at OGDCL

House, Plot No. 3, F-6/G-6, Blue Area, Islamabad, Pakistan. The Company is engaged in the exploration

and development of oil and gas resources, including production and sale of oil and gas and related

activities. The Company is listed on all the three stock exchanges of Pakistan and its Global Depository

Shares (1GDS = 10 ordinary shares of the Company) are listed on the London Stock Exchange.

5.5 Number of employees

Regular employees: 10,185,000

Contractual employees:218,000

5.6 Quantity sold

Year 2011-12

Wells drilled 17

Oil & Gas discoveries 2

Crude oil sold in thousand BBL 13,713

Gas solid in MMcf 381,863

LPG sold in M.Tons 75,005

Sulphur sold in M.Tons 21,400

White Petroleum Products sold in thousand BBL 19

5.7 Key strategic assets of OGDCL

A. Plant & Machinery

B. Rigs

C. Pipelines

D. Development and production assets

E. Exploration and evaluation assets

5.8 Exploration and development activities

As at 30 June 2012, the Company held the largest exploration acreage in the Country having thirty four

(34) exploration licenses which include twenty two (22) blocks with 100% interest and twelve (12) blocks

as operated JV covering an area of 61,079 Sq. Kms.

5.9 Production

Products FY 2012 FY 2011

Crude oil barrels per day 37,615 37,370

8

Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012

Gas MMcf per day 1,091 1,013

LPG 205 195

5.10 Identification of key business, financial and non-financial risks as statutory report of directors

under section 236 of Companies Ordinance 1984

5.10.1 Exploration and Drilling Risks

Exploration risks include selection of incorrect exploration acreage, inaccuracies in acquisition,

processing, interpretation of seismic data and selection of exploratory well site. The Company is

exposed to variety of hazards during the drilling process including well blowout, fishing, fire and other

safety hazards. There is always a risk of failure in drilling exploratory wells. Risk of un-successful drilling

has an adverse effect on Company's earnings and growth.

5.10.2 Commodity Price Risk

The Company is exposed to fluctuations in international prices of crude oil and other petroleum

products, prices of which are determined by reference to the international market prices. International

oil prices are volatile and are influenced by global as well as regional supply and demand conditions. This

volatility has significant impact on the Company's net sales and net profit.

5.10.3 Credit Risk

Credit risk is the potential exposure of the Company to losses in case counter parties fail to perform or

pay amounts due.

5.10.4 Security Conditions

Security concerns in shape of armed conflict, terrorism, insurgency and political instability constitute

security risk and adversely influence the Company operations causing risk of loss or production

limitations, threat to the lives of the workers performing duties in these affected operational areas etc.

Exposure to such risks act as an impediment in the smooth running of the Company operations

particularly in the provinces of Khyber Pakhtunkhwa and Balochistan.

5.10.5 Strategic Risk

Strategic risk is the current and prospective impact on Company's earnings or capital arising from

adverse business decisions, improper implementation of decisions, or lack of responsiveness to industry

changes.

5.10.6 Environmental Risks

The Company is not insured against all potential losses and may be seriously harmed by natural disasters

or operational catastrophes. The occurrence of events such as earthquakes, hurricanes, floods,

blowouts, fires, explosions, equipment failure and other such events that cause operations to cease or

be curtailed, may negatively affect OGDCL's business and the communities in which it operates.

5.10.7 Commercial Risk

9

Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012

Calculations of oil and gas reserves depend on estimates concerning reservoir characteristics and

recoverability, which geological, geophysical and engineering data demonstrate with a specified degree

of certainty to be recoverable in future years from known reservoirs and which are considered

commercially producible. The commercial risk associated with the reserves is that the actual quantity of

recoverable reserves may be different from the estimated proven and probable reserves.

10

Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012

Key discussion points for AGM

Human Resources

More than 10000 employees makes OGDCL the second biggest corporate commodity as regards number

of employees being second to PTCL.

It is plagued with great HR problems.

a. Delay in payments to retiring employees for their buy back of shares of OGDCL under BISP.

b. The principal of right man for the right job being ignored as internal audit department was

headed for 4 months by non qualified person.

c. Lack of recognition of merit and discouraging employees who are upright and honest.

d. Lack of succession and progression planning.

e. Lack of continuous on job training and application of HR principals.

f. Too much of excess baggage as most of the employee are retiring in 2013 / 2014

Page 56 of Annual Report

Point no 1: Five years strategic plan of OGDCL

In the statutory directors reports, managing director / CEO of company state that board of directors

have prepared strategic plan of 5 years for OGDCL.

We make request to directors to share the key details of strategic plan for the information of members /

shareholders.

Page 41, 42 and 56 of Annual Report

Point no 2: Security conditions, new discoveries and exploration activities

In the statutory directors report, managing director share following key information

Security conditions- Page 56 of annual report

Security concerns in shape of armed conflict, terrorism, insurgency and political instability constitute

security risk and adversely influence the Company operations causing risk of loss or production

limitations, threat to the lives of the workers performing duties in these affected operational areas etc.

Exposure to such risks act as an impediment in the smooth running of the Company operations

particularly in the provinces of Khyber Pakhtunkhwa and Balochistan. This is potentially detrimental as

Company's exploration, drilling and development activities are hampered due to unfavorable security

situation resulting in affecting the Company's sustainable growth.

Discoveries-Page 42 of annual report

11

Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012

The Company's exploratory efforts to locate new hydrocarbon reserves yielded two (02) new significant

oil and gas discoveries at Nashpa-2 exploratory well in District Karak, Khyber Pakhtunkhwa province and

at Zin X-1 exploratory well in District Dera Bugti, Balochistan province.

Exploration activities-Page 41 of annual report

The Company, however, could not commence operations in eleven (11) exploration blocks namely

Latamber, Wali, Jandran, Saruna, Shahana, Samandar, Shaan, Kohlu, Lakhi Rud, Kalchas and Jandran

West due to security reasons. In this context, OGDCL is in close liaison with the respective provincial

Governments and MP&NR for early resumption of exploration activities in the said blocks.

We would make request to directors to share the latest security conditions in the operational areas of

Company for the information of members / shareholders of OGDCL.

Page 49 of Annual Report

Point no 3: The reason of change in the composition of board members-OGDCL

The statutory report of directors reveals the fact that following changes had been occurred in the

composition of board of directors-OGDCL.

Mr. Masood Siddiqui was appointed as MD & CEO on 18 June 2012 in place of Mr. Basharat A. Mirza.

Ch. Muhammad Shafi Arshad was appointed as Chairman Board on 25 July 2012 in place of Mr.

Muhammad Ejaz Chaudhry.

Consequent upon transfer of Mr. Ahmad Bakhsh Lehri as Chief Secretary Balochistan, Mr. Babar Yaqoob

Fateh Muhammad was appointed on the Board as Director. Further, M/s Mohomed Bashir, Iskander

Mohammed Khan, Mohamed Anver Ali Rajpar, Sheraz Hashmi and Raza Ullah Khan were appointed on

the Board as Directors in place of M/s Syed Amir Ali Shah, Dr. Kaiser Bengali, Tariq Faruque, Wasim

Zuberi and Mr. Raashid Bashir Mazari.

We would make request to company management to share the reasons of changes in board of directors

Note # 30.2 on Page 111 of annual report

Point no 4: Non-compliance with financial reporting framework

The note to the financial statements 30.2 reveals the fact; Various appeals in respect of assessment

years 1992-93 to 2002-03, tax years 2003 to 2011 are pending at different appellate forums in the light

of the order of the Commissioner of Inland Revenue (Appeals) and decision of the Adjudicator,

appointed by both the Company as well as the Federal Board of Revenue (FBR) mainly on the issues of

decommissioning cost, depletion allowance and tax rate.

12

Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012

The above mentioned note 30.2 reflects dispute of company management with tax authorities on the

issues of decommissioning or depletion allowance. The tax authorities stance on decommissioning and

depletion allowance is explicitly delineated in Part I of Fifth Schedule under section 100 of Income Tax

Ordinance 2001.

As per the requirements of IAS 37 and fourth schedule under section 234 of Companies 1984, the

provision for disputed tax issues should be recognized in the financial statement or it should be

disclosed under the heading of contingencies and commitments.

Note # 30.1 on Page 111 of annual report

Point no 5: Non statutory corporate tax rate on accounting profits

The note # 30.1 contains tax rate of 48.68% on accounting profits of OGDCL where as statutory tax on

accounting profits of companies is 35% under Division II, Part I of First Schedule of Income Tax

Ordinance 2001.

The directors of OGDCL are requested to clarify the query of tax rates on accounting profits for the

information of members / shareholders.

Page 66 of Annual Report

Point no 6: Unusual share of tax obligations in the total liabilities of OGDCL

The details of total liabilities of OGDCL as at 30-06-2012 are summarized below.

A. Total non-current liabilities: PKR 45,362,739,000

B. Total current liabilities: PKR 24,593,682,000

C. Total liabilities: PKR 69,956,421,000

The details of tax liabilities as at 30-06-2012 are stated as under

A. Deferred taxation: PKR 23,545,773,000

B. Provision for taxation: PKR 2,421,831,000

C. Total tax obligations: PKR 25,967,604,000

The % age share of tax obligations in the total liabilities of OGDCL: 25,967,604,000 / 69,956,421,000=

37%

13

Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012

The Directors of OGDCL are requested to clarify the above mentioned query of members

Note # 15.2 on Page 101 of Annual Report

Point no 7: Non-compliance with section 234 of Companies Ordinance 1984 and

paragraph 60 of IAS 1 pertains to current and non-current distinction

The 15.2.1 contains disclosure regarding classification judgment of directors to classify short term

investment named as term deposit receipts under the heading of Non-current assets which constitute

non compliance with paragraph 60 of IAS 1 and section 234 of Companies Ordinance 1984.

Note # 18.1 on Page 104 of Annual Report

Point no 8: Liquidity and credit risk pertains to circular debt

The note # 18.1 reveals the fact that trade debts include amount of PKR 92,878,000,000 which is

receivable from oil refineries and gas companies. The directors of company have been negotiating with

Government to recover the trade 92.8 billion rupees under the circular debt arrangement.

We would like to make request to directors to share details of their efforts regarding the recovery of

92.8 billion rupees during the period from 01-07-2012 to 04-10-2012.

Note # 19.1 on Page 104 of Annual Report

Point no 9: Provision for doubtful debts for loan and advances of 3.2 billion

rupees

The 19.1 provide following details regarding the loan and advances amounting to 3.2 billion rupees.

This includes an amount of Rs 3,206 million paid under protest to Inland Revenue Authority on account

of sales tax demand raised in respect of capacity invoices from Uch Gas Field for the period from July

2004 to March 2011. The Company has explained its position on various forums and the issue went to

Supreme Court of Pakistan which also turned down the appeal. However, the Company has filed a

review petition before the Supreme Court of Pakistan and based on advice of legal counsel, the

Company strongly believes that the matter will be decided in its favor.

Under the requirements of applicable financial reporting framework of OGDCL the provision for doubt

debts amounting to 3.2 billion rupees should be recognized in the financial statement in order to ensure

true and fair view of financial performance and position under section 234 of Companies Ordinance

1984.

14

Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012

The impact of non-recording of provision for doubtful debts is summarized as below.

A. Overstatement of profits

B. Understatement of expenses

C. Understatement of liabilities

Emphasis of matter paragraph on Page 65 of Annual Report

Point no 10: Emphasis of matter paragraph in the audit report under ISA 706

The audit report contains following emphasis of matter paragraphs

We draw attention to Note 18.1 to the financial statements wherein it is stated that trade debts

include an overdue amount of Rs 92,878 million receivable from oil refineries and gas companies. We

also draw your attention to Note 16.3 to the financial statements wherein it is stated that long term

receivable amounting to Rs 606.937 million has not been paid by Karachi Electric Supply Company

Limited in accordance with settlement plan. Though the recovery of these debts have been slow due to

circular debt issue, the Company considers the amount as fully recoverable for the reason given in the

aforementioned notes. Our report is not qualified in respect of this matter

We would like to make request to directors of company to explain the underlying rationale and reason

for emphasis of matter paragraphs in the audit report.

Note # 27 on Page 109 of Annual Report

Point no 11: The substantial increase in the prospecting expenditures

The note # 27 on page 109 of annual report reveals the fact that prospecting expenditures were

increased from PKR 2,689,007,000 to PKR 4,038,429,000 in Year 2012.

We would like to make request to Company directors to explain the underlying reason of increase in the

prospecting cost from year 2011 to year 2012.

15

Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012

Note # 28 on Page 109 of Annual Report

Point no 12: The substantial increase in the advertising cost

The note # 28 on page 109 of annual report reveals the fact that advertising cost was increase from PKR

41,765,000 to PKR 152,023,000 in Year 2012.

We would like to make request to Company directors to explain the underlying reason of increase in the

advertising cost from year 2011 to year 2012.

Note # 24 on Page 106 of Annual Report

Point no 13: Sales and profitability of OGDCL

Non-financial sales data Page 30 of annual report

Year 2011-12 Year 2010-11

Quantity sold

Crude oil sold in thousand BBL 13,713 13,224

Gas solid in MMcf 381,863 362,924

LPG sold in M.Tons 75,005 71,061

Sulphur sold in M.Tons 21,400 34,400

White Petroleum Products sold in thousand BBL 19 30

Financial sales data-Page 106 of annual report

Year 2011-12 Year 2010-11

Rupees Rupees

Gross sales

Crude oil 109,413,764,000 84,825,937,000

Gas 104,924,338,000 93,823,246,000

Gasoline 172,820,000 75,940,000

Kerosene Oil 48,697,000 47,045,000

High speed diesel oil 1,823,000

Naphtha 151,162,000

Liquefied petroleum gas 6,464,469,000 5,424,125,000

Sulphur 600,142,000 880,162,000

Other operating income 96,506,000 47,478,000

221,720,736,000 185,276,918,000

16

Financial analysis of Oil & Gas Development Company Limited-Year ended 30-06-2012

Commodity Price Risk

The Company is exposed to fluctuations in international prices of crude oil and other petroleum

products, prices of which are determined by reference to the international market prices. International

oil prices are volatile and are influenced by global as well as regional supply and demand conditions. This

volatility has significant impact on the Company's net sales and net profit.

The analytical review of sales data, figures and commodity price risk reveals the fact that sales and

profitability of OGDCL were increased primarily from price fluctuations rather sold units.

In the light of above mentioned facts ,we would like to ask a question from Company directors regarding

strategic business planning to mitigate the commodity price risk and desired measures to ensure

organizational and financial sustainability in OGDCL.

CONCLUSION AND SUMMARY

OGDCL is like a jewel in the crown for Pakistan as it caters for more than 40% of the hydro carbon inputs

of the petroleum industry but it is plagued with great HR and security problems.

The new management with a fresh MD may play some pivotal role in stream lining the problems

enumerated above but they have a long way to go and a colossal task ahead of them.

On the financial side the monster of circular debt looms over their head which will be difficult to tackle

in the coming quarter.

The two finds at NASHPA and ZINN may give value addition to the company but putting ZINN online will

be a big hurdle because of the security problems.

The problems of taxation, sales tax and loss of appeal in the Supreme Court may have a negative bearing

on the future profitability of the company.

Finally a hold status is recommended for the shareholders of

OGDCL for the future.

DR. BABUR ZAHIRUDDIN

You might also like

- Foundations of Energy Risk Management: An Overview of the Energy Sector and Its Physical and Financial MarketsFrom EverandFoundations of Energy Risk Management: An Overview of the Energy Sector and Its Physical and Financial MarketsNo ratings yet

- Carbon Efficiency, Carbon Reduction Potential, and Economic Development in the People's Republic of China: A Total Factor Production ModelFrom EverandCarbon Efficiency, Carbon Reduction Potential, and Economic Development in the People's Republic of China: A Total Factor Production ModelNo ratings yet

- Chapter One: Introduction: Financial Performance Analysis of Gas Sector in BangladeshDocument39 pagesChapter One: Introduction: Financial Performance Analysis of Gas Sector in Bangladeshorihime inoieNo ratings yet

- Final Report On OIL and Gas INDUSTRYDocument18 pagesFinal Report On OIL and Gas INDUSTRYShefali SalujaNo ratings yet

- ONGC CSR Final NikhilDocument66 pagesONGC CSR Final Nikhilenrique_sumit100% (1)

- AnnualReport2011 12Document140 pagesAnnualReport2011 12Sagar DamaniNo ratings yet

- MBA ProjectDocument80 pagesMBA ProjectMadhan LaalNo ratings yet

- Equity Note - Padma Oil Company LTDDocument2 pagesEquity Note - Padma Oil Company LTDMd Saiful Islam KhanNo ratings yet

- BPCL Supply Chain MGT ProjectDocument27 pagesBPCL Supply Chain MGT Projectdeepti12sharma100% (3)

- WCM Project (Working Capital Management)Document61 pagesWCM Project (Working Capital Management)d82vinoNo ratings yet

- Shri Chimanbhai Patel Institutes, Ahmadabad: Arti Trivedi Jay Desai Nisarg A JoshiDocument31 pagesShri Chimanbhai Patel Institutes, Ahmadabad: Arti Trivedi Jay Desai Nisarg A Joshinisarg_No ratings yet

- Indian Oil and Gas Outlook 2015Document3 pagesIndian Oil and Gas Outlook 2015iData InsightsNo ratings yet

- HPCLDocument164 pagesHPCLPawan ChadhaNo ratings yet

- Financial Statement Analysis of Oil & Gas Companies: Project OnDocument50 pagesFinancial Statement Analysis of Oil & Gas Companies: Project OnkevingoyalNo ratings yet

- Oil India Ongc ComparisionDocument35 pagesOil India Ongc ComparisionAlakshendra Pratap TheophilusNo ratings yet

- Export of Refined Petroleum Product From IndiaDocument36 pagesExport of Refined Petroleum Product From IndiaMadhukant DaniNo ratings yet

- Indian Petrolium Industry EsseyDocument15 pagesIndian Petrolium Industry EsseyShashank BansalNo ratings yet

- Business Diversification Strategies of Energy Companies in India A Study of OilDocument27 pagesBusiness Diversification Strategies of Energy Companies in India A Study of Oiladiti pathakNo ratings yet

- India Country InsightsDocument24 pagesIndia Country InsightsAjith BabuNo ratings yet

- A Project Report ON Globalization Strategy Analysis of Ongc: (Oil & Natural Gas Corporation)Document13 pagesA Project Report ON Globalization Strategy Analysis of Ongc: (Oil & Natural Gas Corporation)Vasundhra VermaNo ratings yet

- Apr Jun12 PetrofedDocument92 pagesApr Jun12 PetrofedUsman FaarooquiNo ratings yet

- Energy Scenario - Oil Gas - Rev1Document27 pagesEnergy Scenario - Oil Gas - Rev1Ajay RawatNo ratings yet

- CGD Report 12Document63 pagesCGD Report 12Saurabh Dubey50% (2)

- Project Report On HRDocument93 pagesProject Report On HRSwapnil PanpatilNo ratings yet

- Annual Reports ONGC Annual Report 10-11Document256 pagesAnnual Reports ONGC Annual Report 10-11Amit VirmaniNo ratings yet

- GAIL India CompanyAnalysis923492384Document11 pagesGAIL India CompanyAnalysis923492384yaiyajieNo ratings yet

- Review of Management Discussions & Analysis For Indian Natural Gas Trading & Distribution CompaniesDocument3 pagesReview of Management Discussions & Analysis For Indian Natural Gas Trading & Distribution CompaniesAshish ChoudharyNo ratings yet

- PSO Management ReportDocument66 pagesPSO Management ReportShoaib Mughal100% (1)

- Advantages For Centre From PSU Oil MergersDocument10 pagesAdvantages For Centre From PSU Oil Mergerstechnoconsulting4smbsNo ratings yet

- Project Report: Submitted To: Submitted byDocument31 pagesProject Report: Submitted To: Submitted byKunwar PrinceNo ratings yet

- Forecasting of Gas Demand and System LossDocument35 pagesForecasting of Gas Demand and System LossShamsur Rahman RussellNo ratings yet

- Final ProjectDocument47 pagesFinal ProjectKshitij MishraNo ratings yet

- Summer Internship Final Report: Submitted To: Submitted byDocument35 pagesSummer Internship Final Report: Submitted To: Submitted byAyushi NautiyalNo ratings yet

- Revenue From International Operations of (A ET 500 Company) Submitted To Prof.R.K.ChawalaDocument7 pagesRevenue From International Operations of (A ET 500 Company) Submitted To Prof.R.K.Chawalakrishan_28No ratings yet

- 1.1 Executive SummaryDocument93 pages1.1 Executive SummaryArashKhuranaNo ratings yet

- Indian Oil CoorporationDocument38 pagesIndian Oil CoorporationGheethu Maria JoyNo ratings yet

- Overview of Oil and Gas SectorDocument8 pagesOverview of Oil and Gas SectorMudit KothariNo ratings yet

- Oil and Gas Sector: 1) OverviewDocument9 pagesOil and Gas Sector: 1) OverviewShital Parakh100% (1)

- Oil and Gas IndustryDocument6 pagesOil and Gas IndustrySoubam LuxmibaiNo ratings yet

- India's Fiscal Challenge: KonnectDocument8 pagesIndia's Fiscal Challenge: KonnectAdhiraj MukherjiNo ratings yet

- Biofuels Annual Jakarta Indonesia 7-15-2013Document10 pagesBiofuels Annual Jakarta Indonesia 7-15-2013kahwooi88No ratings yet

- Current Oil ND GasDocument5 pagesCurrent Oil ND Gassaurav1131489No ratings yet

- Company Name: IOCL (Indian Oil Corporation of India) Industry: Oil Gas and Consumable FuelsDocument12 pagesCompany Name: IOCL (Indian Oil Corporation of India) Industry: Oil Gas and Consumable FuelsAnkit PandaNo ratings yet

- SM Report Group01Document13 pagesSM Report Group01Aninda DuttaNo ratings yet

- 1DGH Annual Report 2011-12Document152 pages1DGH Annual Report 2011-12Ram KrishNo ratings yet

- Impact of Crude Oil On Indian EconomyDocument14 pagesImpact of Crude Oil On Indian Economyneha saifiNo ratings yet

- NTPC - Heading For 128 GW of Installed Capacity by 2032Document10 pagesNTPC - Heading For 128 GW of Installed Capacity by 2032PravendraSinghNo ratings yet

- Policy Brief On "Development and Governance of The Energy Sector"Document53 pagesPolicy Brief On "Development and Governance of The Energy Sector"tajreen01No ratings yet

- Micro Economics ReportDocument10 pagesMicro Economics ReportAbhiroop MukherjeeNo ratings yet

- 2012 PGN Annual ReportDocument538 pages2012 PGN Annual Reporterwin hpNo ratings yet

- Energy Security and AffordabilityDocument12 pagesEnergy Security and AffordabilityhonestscarryNo ratings yet

- Neha Rawat (IOCL)Document63 pagesNeha Rawat (IOCL)KonarkRawatNo ratings yet

- Oil and Gas SKN Haryana City Gas DistributionDocument15 pagesOil and Gas SKN Haryana City Gas DistributionBalaji MNo ratings yet

- Ashu Report FinalllDocument129 pagesAshu Report Finalllcj97No ratings yet

- IREDA InvestorManualDocument704 pagesIREDA InvestorManualAshish SharmaNo ratings yet

- Eng Nkea Oil Gas EnergyDocument16 pagesEng Nkea Oil Gas EnergytanboemNo ratings yet

- Coal India LTD.: Published DateDocument4 pagesCoal India LTD.: Published DatePragyanDasNo ratings yet

- Energy Efficiency in South Asia: Opportunities for Energy Sector TransformationFrom EverandEnergy Efficiency in South Asia: Opportunities for Energy Sector TransformationNo ratings yet

- Fueling Up: The Economic Implications of America's Oil and Gas BoomFrom EverandFueling Up: The Economic Implications of America's Oil and Gas BoomNo ratings yet

- Accelerating hydrogen deployment in the G7: Recommendations for the Hydrogen Action PactFrom EverandAccelerating hydrogen deployment in the G7: Recommendations for the Hydrogen Action PactNo ratings yet

- Application Form For Employment in ANF: Name Cnic No - Father's Name Date of BirthDocument1 pageApplication Form For Employment in ANF: Name Cnic No - Father's Name Date of BirthRaza SohailNo ratings yet

- Financial Analysis of PsoDocument3 pagesFinancial Analysis of PsoRaza SohailNo ratings yet

- Impact of Leadership Styles On Employee Performance Parks DuncanDocument31 pagesImpact of Leadership Styles On Employee Performance Parks DuncancintoyNo ratings yet

- Shell General Business Principles 2014Document12 pagesShell General Business Principles 2014SKataNo ratings yet

- 1.mukherjee - 2019 - SMM - Customers Passion For BrandsDocument14 pages1.mukherjee - 2019 - SMM - Customers Passion For BrandsnadimNo ratings yet

- The "Solid Mount": Installation InstructionsDocument1 pageThe "Solid Mount": Installation InstructionsCraig MathenyNo ratings yet

- Sacmi Vol 2 Inglese - II EdizioneDocument416 pagesSacmi Vol 2 Inglese - II Edizionecuibaprau100% (21)

- BACE Marketing Presentation FINALDocument14 pagesBACE Marketing Presentation FINALcarlosfelix810% (1)

- Mpi Model QuestionsDocument4 pagesMpi Model QuestionshemanthnagNo ratings yet

- Bug Head - Fromjapanese To EnglishDocument20 pagesBug Head - Fromjapanese To EnglishAnonymous lkkKgdNo ratings yet

- Numerical Transformer Differential RelayDocument2 pagesNumerical Transformer Differential RelayTariq Mohammed OmarNo ratings yet

- Lexington School District Two Return To School GuideDocument20 pagesLexington School District Two Return To School GuideWLTXNo ratings yet

- QCM Part 145 en Rev17 310818 PDFDocument164 pagesQCM Part 145 en Rev17 310818 PDFsotiris100% (1)

- Vicente, Vieyah Angela A.-HG-G11-Q4-Mod-9Document10 pagesVicente, Vieyah Angela A.-HG-G11-Q4-Mod-9Vieyah Angela VicenteNo ratings yet

- In Partial Fulfillment of The Requirements For The Award of The Degree ofDocument66 pagesIn Partial Fulfillment of The Requirements For The Award of The Degree ofcicil josyNo ratings yet

- Beam Deflection by Double Integration MethodDocument21 pagesBeam Deflection by Double Integration MethodDanielle Ruthie GalitNo ratings yet

- Service Manual Lumenis Pulse 30HDocument99 pagesService Manual Lumenis Pulse 30HNodir AkhundjanovNo ratings yet

- RCC Design of Toe-Slab: Input DataDocument2 pagesRCC Design of Toe-Slab: Input DataAnkitaNo ratings yet

- Fr-E700 Instruction Manual (Basic)Document155 pagesFr-E700 Instruction Manual (Basic)DeTiEnamoradoNo ratings yet

- Payment of GratuityDocument5 pagesPayment of Gratuitypawan2225No ratings yet

- Supreme Court of The United StatesDocument296 pagesSupreme Court of The United StatesABC News PoliticsNo ratings yet

- Chapter 2 A Guide To Using UnixDocument53 pagesChapter 2 A Guide To Using UnixAntwon KellyNo ratings yet

- Quantum Hopfield NetworksDocument83 pagesQuantum Hopfield NetworksSiddharth SharmaNo ratings yet

- Jetweigh BrochureDocument7 pagesJetweigh BrochureYudi ErwantaNo ratings yet

- Dr. Najeebuddin Ahmed: 969 Canterbury Road, Lakemba, Sydney, NSW, Australia, 2195Document2 pagesDr. Najeebuddin Ahmed: 969 Canterbury Road, Lakemba, Sydney, NSW, Australia, 2195Najeebuddin AhmedNo ratings yet

- Overcurrent CoordinationDocument93 pagesOvercurrent CoordinationKumar100% (1)

- Brief Curriculum Vitae: Specialisation: (P Ea 1. 2. 3. Statistical AnalysisDocument67 pagesBrief Curriculum Vitae: Specialisation: (P Ea 1. 2. 3. Statistical Analysisanon_136103548No ratings yet

- Fletcher Theophilus Ato CVDocument7 pagesFletcher Theophilus Ato CVTHEOPHILUS ATO FLETCHERNo ratings yet

- 1980WB58Document167 pages1980WB58AKSNo ratings yet

- Bank Statement SampleDocument6 pagesBank Statement SampleRovern Keith Oro CuencaNo ratings yet

- Napoleon RXT425SIBPK Owner's ManualDocument48 pagesNapoleon RXT425SIBPK Owner's ManualFaraaz DamjiNo ratings yet

- Concrete For Water StructureDocument22 pagesConcrete For Water StructureIntan MadiaaNo ratings yet

- Active Directory FactsDocument171 pagesActive Directory FactsVincent HiltonNo ratings yet

- Paul Milgran - A Taxonomy of Mixed Reality Visual DisplaysDocument11 pagesPaul Milgran - A Taxonomy of Mixed Reality Visual DisplaysPresencaVirtual100% (1)