Professional Documents

Culture Documents

Mosley Cracking Cards Complaint

Uploaded by

Steve Warmbir0 ratings0% found this document useful (0 votes)

27K views16 pagesCriminal complaint against Matthew Mosley

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCriminal complaint against Matthew Mosley

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27K views16 pagesMosley Cracking Cards Complaint

Uploaded by

Steve WarmbirCriminal complaint against Matthew Mosley

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 16

AO 91 (Rev.

11/11) Criminal Complaint

AUSA Kate Zell (312) 353-4305

UNITED STATES DISTRICT COURT

NORTHERN DISTRICT OF ILLINOIS

EASTERN DIVISION

UNITED STATES OF AMERICA

v.

MATTHEW MOSLEY

CASE NUMBER:

UNDER SEAL

CRIMINAL COMPLAINT

I, the complainant in this case, state that the following is true to the best of my knowledge

and belief.

From in or about October 2011 and continuing through in or about January 2012, at Chicago, in

the Northern District of Illinois, Eastern Division, and elsewhere, the defendant(s) violated:

Code Section Offense Description

Title 18, United States Code, Section

1344

Defendant knowingly participated in a scheme to

defraud financial institutions and to obtain

money and funds owned by and under the custody

and control of financial institutions by means of

materially false and fraudulent pretenses,

representations, and promises, and by

concealment of material facts, and for the purpose

of executing such scheme, on or about October 18,

2011, caused the withdrawal of approximately

$3,075 from an account belonging to Individual

LR at Citibank, a financial institution whose

deposits were insured by the Federal Deposit

Insurance Corporation.

This criminal complaint is based upon these facts:

X Continued on the attached sheet.

MARTIN J. NITSCHE

Postal Inspector

United States Postal Inspection Service

Sworn to before me and signed in my presence.

Date: October 24, 2014

Judges signature

City and state: Chicago, Illinois J EFFREY T. GILBERT, U.S. Magistrate J udge

Printed name and Title

UNITED STATES DISTRICT COURT

NORTHERN DISTRICT OF ILLINOIS

ss

AFFIDAVIT

I, MARTIN J. NITSCHE, being duly sworn, state as follows:

1. I am a Postal Inspector with the United States Postal Inspection

Service, and have been so employed since January 2008. My current

responsibilities include the investigation of mail theft, access device fraud, bank

fraud, and identity theft. Previously, I was a police officer in Orland Park, Illinois,

for over ten years.

2. This affidavit is submitted in support of a criminal complaint alleging

that, from in about October 2011 and continuing through in or about January 2012,

MATTHEW MOSLEY participated in a scheme to defraud financial institutions,

and to obtain money and property by means of materially false and fraudulent

pretenses, representations, promises and by concealment of material facts, in

violation of Title 18, United States Code, Section 1344 (bank fraud). Because this

affidavit is being submitted for the limited purpose of establishing probable cause in

support of a criminal complaint charging MOSLEY with bank fraud, I have not

included each and every fact known to me concerning this investigation. I have set

forth only the facts that I believe are necessary to establish probable cause to

believe that the defendant committed the offense alleged in the complaint.

3. This affidavit, and my knowledge of the bank fraud scheme described

herein, is based on my personal knowledge; information provided to me by other law

2

enforcement agents; law enforcement interviews of individuals involved in the

scheme, including individuals who provided their debit cards and Personal

Identification Numbers for use in the scheme; information provided to law

enforcement by bank investigators; information provided to law enforcement by

victim businesses whose bank accounts have been compromised as a result of the

scheme; covert operations by law enforcement to confirm the mechanics of the

scheme and the identities of certain participants; and my review of records,

including: (a) financial records and video surveillance provided by banks and credit

unions, (b) currency exchange records, including video surveillance of debit card

transactions, and (c) business records for debit and credit card processing

companies.

FACTS SUPPORTING PROBABLE CAUSE

I. OVERVIEW OF THE CRACKING CARDS BANK FRAUD SCHEMES

4. The United States Postal Inspection Service and the Federal Bureau of

Investigation, in conjunction with other local and federal law enforcement agencies

and fraud investigators at several banks, have been investigating bank fraud

schemes dubbed Cracking Cards by the participants. As detailed below, the

investigation has determined that from approximately 2011 through the present,

Cracking Cards schemers deposit counterfeit checks into bank accounts belonging to

third parties who willingly or unwillingly surrender their debit cards and PINs for

use in the schemes. The schemers then use Automated Teller Machines or point of

sale terminals at currency exchanges and retail stores to withdraw or spend funds

3

that the banks advance to the third-party accounts before learning the counterfeit

nature of the deposited checks. The banks suffer losses when the checks are found

to be counterfeit, and the third-party account holders deny responsibility for the

withdrawals and purchases.

5. Based on the investigation by Postal Inspectors, the FBI, and other law

enforcement agencies, and my training and experience, I understand that the

Cracking Cards bank fraud schemes generally work as follows:

A. Schemers Recruit Bank Account Holders to Provide Their

Debit Cards and PINs

6. Law enforcement has obtained information about the operation of the

Cracking Cards schemes from, among other sources, a Cooperating Witness. The

CW has been charged by complaint in the Northern District of Illinois in relation to

the CWs involvement in a Cracking Cards scheme. The governments preliminary

calculation of actual losses attributable to the CW in conjunction with Cracking

Cards is over $400,000. The CW is cooperating with law enforcement with the hope

that his cooperation will be considered by the government in recommending a lower

sentence. The CW has no prior criminal convictions. In addition, information

provided by CW has been corroborated through witness interviews and review of

financial records. I believe that the CW has provided reliable information about

Cracking Card schemes.

7. According to the CW and numerous individuals who have provided

their debit cards and PINs for use in the scheme, Cracking Cards schemers recruit

4

bank account holders to give up their debit cards and PINs by promising the

account holders a portion of the profits.

8. According to the CW and to individuals who were recruited to give up

their debit cards, the methods of recruitment vary depending on the schemer. Some

recruit card holders in person, such as at a party, at school, or on the street. Others

use social media outlets such as Instagram and Facebook to advertise opportunities

for making fast cash, after which account holders contact the Cracking Cards

schemer by phone and listen to the schemers pitch. Some schemers work together

in pairs or groups in their recruitment efforts.

B. Schemers Purchase or Manufacture Counterfeit Checks

9. According to the CW, once a Cracking Cards schemer has a debit card

and PIN for a third-party account, the schemer manufactures, purchases, or

otherwise obtains one or more counterfeit checks to deposit into the third-party

bank account. As explained by the CW and corroborated by bank records and

interviews of victim businesses, the counterfeit checks used in Cracking Cards

schemes generally contain legitimate bank account and routing numbers that

belong to the accounts of actual business entities.

1

10. According to the CW, the combination of a legitimate bank account

number and routing number, as well as the name and address of the victim

1

On occasion, a schemer will use a fictitious account number on a counterfeit check. Banks

often float or advance the funds on a check deposit before the account number is verified

and the check is cleared.

5

business, is referred to by those involved in Cracking Cards as the bank account

profile for that business.

11. According to the CW, and as confirmed through undercover purchases

of counterfeit checks from Cracking Cards schemers, not everyone who cracks

cards manufactures his or her own counterfeit checks to deposit into third-party

accounts. Rather, certain individuals have a reputation for making paper, that is,

making and printing counterfeit checks. The people who make paper sell

counterfeit checks to others involved in Cracking Cards. The CW explained that he

made paper for his own use and for selling to others who cracked cards, by using a

computer software program. Participants who make paper obtain business

profiles (bank account and routing numbers) through a variety of unauthorized and

illegal means.

C. Schemers Deposit Counterfeit Checks into Third-Party Bank

Accounts

12. According to the CW, once a Cracking Cards schemer has secured a

third-party debit card and PIN, as well as one or more counterfeit checks, the

schemer depositsor recruits someone else to depositthe counterfeit checks into

the third partys bank account, typically via an ATM transaction. As corroborated

by bank records, the Cracking Card schemer then waits for the account holders

bank to credit the purported funds from the counterfeit check, which can happen

within a matter of hours.

13. According to information provided by bank investigators, banks credit

the value of a check to a card holders account before the check clears, that is, before

6

the cardholders bank receives an image of the check (which is sent electronically to

the drawers bank), determines whether it is valid, and requests and receives

payment (or denial of payment) from the check drawers bank. In effect, the

cardholders bank advances the banks own money into the cardholders account

when a check is depositedeven if it is a counterfeit or fraudulent check. During

the time period between the deposit of a fraudulent check and when the

cardholders bank learns that the check is fraudulent, the advanced money in the

cardholders bank account can be withdrawn using the cardholders debit card.

D. Schemers Withdraw or Spend Funds from the Third-Party

Bank Account

14. According to the CW and as corroborated by bank records, after one or

more counterfeit checks are deposited into a third-party bank account, the Cracking

Cards schemer often attempts a relatively small ATM withdrawal (between $100

and $500) a few hours later, to determine whether the bank has credited the

account with the purported funds from the counterfeit check. If the schemer is able

to withdraw the cash at an ATM, (i.e., the bank has advanced funds to the account),

the schemer goes to a point-of-sale terminal to withdraw or spend the remaining

funds that the bank advanced to the third-party account because of the deposit of

the counterfeit checks. Point-of-sale terminals are machines used to process debit

and credit card payments, typically for the purchase of goods. For example, the

machines at a grocery store checkout counter in which a customer swipes a debit

card are point of sale terminals.

7

E. Loss to Financial Institutions

15. When floated funds are withdrawn in person at a bank branch, or at a

bank ATM, as a result of a counterfeit check deposit, the bank suffers the loss when

it hands the cash over to the person or disperses it out of the machine. When

floated funds are withdrawn or spent at a point-of-sale terminal, casino, or retail

store, the bank suffers the loss through a series of electronic funds transfers that

are managed by a debit card processing service, similar to the Automated Clearing

House, but for debit transactions as opposed to credit transactions. The purchase is

premised on the customer entering the correct PIN into the keypad at the

store/currency exchange (the point-of-sale terminal). A communication goes from

the point-of-sale terminal to the terminals processing company, which electronically

communicates with the customers bank via the debit-processing network to verify

that the PIN is accurate and that the account and its funds are accessible. At that

point in the process, it is the customers bank, via the debit-processing network,

that makes the decision whether the purchase can go through. If the bank approves

the purchase, the bank is agreeing to pay back the store/currency exchange the

amount of the purchase. If the purchase is approved, the store/currency exchange

then hands over the product to the customer (e.g., a television, or in the case of the

currency exchange, cash).

16. According to the CW, Cracking Cards schemes are popular methods to

obtain illicit funds and defraud banks in City of Chicago, and are carried out by

numerous schemers, including those affiliated with Chicago gangs.

8

II. FACTS CONCERNING CURRENCY EXCHANGE A

17. Between November 2011 and September 2014, Postal Inspectors and

the FBI, among other law enforcement agencies, have monitored and investigated

Cracking Cards transactions at Currency Exchange A, located in Chicago, Illinois.

Through this investigation, law enforcement agents have obtained information

about suspicious transactions linked to a Cracking Cards scheme, and in particular,

withdrawal transactions from Currency Exchange As point of sale terminals that

followed the deposit of counterfeit checks into the respective card holder bank

accounts.

18. According to Currency Exchange As Chief Operating Officer, starting

in or around January 2012, for debit transactions of $1,000 or more, the Currency

Exchange As processing software required that a customer profile be electronically

attached to the transaction.

2

A customer profile was stored electronically on the

computer system and contained the customers personal identify information which

included his/her name, social security number, date of birth, address, and phone

number. Almost all profiles included a scanned image of a drivers license or state

identification card and some also contained a web camera photo of the customer.

Thus, if a customer wanted to use a point of sale terminal to withdraw funds from a

2

According to Currency Exchange As computer records, there is only one

withdrawal transaction for over $1,000, on January 5, 2012, that was processed

under MOSLEYs electronic profile. As outlined below in paragraph 35, MOSLEYs

other withdrawals at Currency Exchange A happened before Currency Exchange

As computer system required that withdrawals exceeding $1,000 be processed

under the customers electronic profile.

9

debit card for $1,000 or more, the teller

3

had to enter the individuals personal

identifying information into the computer system before the teller could proceed

with the debit card transaction. Once the teller entered identifying information,

such as a name or date of birth, the computer system pulled up the customers

electronic profile, which contained a photograph of the person. Before proceeding

with a debit card withdrawal over $1,000, the teller was required to compare the

profile picture on the screen with the customer standing at the teller window. Only

after confirming the customers identity on the tellers computer could the teller

could proceed to the next screen and move forward with the debit card withdrawal.

4

19. According to Currency Exchange As Chief Operating Officer, if the

customer had no profile in the currency exchanges computer system, the teller had

to set up a customer profile before proceeding, which required scanning the

3

Approximately five tellers from Currency Exchange A have informed law enforcement

that they regularly accepted tips ranging from approximately $10-200 from customers who

made withdrawals from debit cards (as well as from customers who conducted other

business at Currency Exchange A). Currency Exchange As Chief Operating Officer

informed law enforcement that the tellers were permitted to accept voluntary tips from

customers.

4

Based on law enforcements review of over 350 videos of withdrawal transactions at

Currency Exchange A and the corresponding records, there are approximately 11 known

instances in which it appears that one teller (Teller A) processed a debit card withdrawal

under the electronic customer profile for an individual other than the person who was

standing at the teller window making the withdrawal. Law enforcement has no

information that any teller other than Teller A processed any debit card withdrawal under

an incorrect electronic customer profile. Also, at least one witness provided information

that Teller A accepted tips of up to $200, whereas Teller A reported to law enforcement that

the maximum tip she received was approximately $100. However, even if any of the three

withdrawal transactions outlined in paragraphs 24-35, below, involved Teller A, video

surveillance evidence for these three transactions confirms that MOSLEY was the person

making those withdrawals, consistent with the electronic customer profile for MOSLEY.

10

customers State-issued photo-ID and entering the customers personal identifying

information into the computer system.

20. In addition, according to Currency Exchange As Chief Operating

Officer, beginning on November 15, 2011, the tellers were required to maintain a

handwritten log of debit withdrawals over $1,000 by recording the customers name,

the last four digits of the debit card number, and the amount of the withdrawal.

5

21. During the investigation, law enforcement agents have obtained:

(1) video surveillance of these transactions at Currency Exchange A, (2) the

handwritten log of point-of-sale transactions maintained by tellers for transactions

over $1,000, (3) Currency Exchange As profile of its customers, which includes the

customers name and copies of their drivers license; and (4) Currency Exchange As

transaction records for point-of-sale cash withdrawals.

III. FACTS CONCERNING MATTHEW MOSLEY

22. The investigation has determined that there is probable cause to

believe that MATTHEW MOSLEY has participated in the Cracking Cards scheme.

In total, from in or about October 2011 through in or about January 2012, law

enforcement agents have reviewed bank records for five bank accounts belonging to

individuals other than MOSLEY, from which MOSLEY withdrew funds following

one or more deposits of counterfeit checks. In total, the banks affected by

withdrawals of funds from these five accounts suffered losses in excess of $32,000.

5

According to Currency Exchange As handwritten log, there was only one withdrawal

transaction for over $1,000, on January 5, 2012, that was attributed to MOSLEY. As

outlined below in paragraph 35, MOSLEYs other withdrawals at Currency Exchange A

happened before Currency Exchange A implemented the handwritten log.

11

23. According to the CW, MOSLEY makes paper for Cracking Cards.

That is, MOSLEY manufactures counterfeit checks for use in Cracking Cards

schemes. The CW reported that he purchased counterfeit checks from MOSLEY.

Also according to the CW, MOSLEY sells counterfeit checks to other individuals

who then use those counterfeit checks in Cracking Card schemes.

A. Withdrawal Transaction from Individual TMs Bank Account

on or about November 2, 2012

24. According to Citibank account records for an account belonging to

Individual TM, on November 1, 2011, at approximately 11:20 a.m., a check in the

amount of $3,524.68 (check number 217652), drawn on an account purportedly

belonging to Company DI and purportedly drawn on a bank account for the State

Treasurer of Illinois, made payable to Individual TM, was deposited into a savings

account ending in 3488 belonging to Individual TM. Prior to this deposit, the

balance in Individual TMs account ending in 3488 was -$12.26. Also according to

Citibank account records, on November 1, 2011, a check in the amount of $3,584.09

(check number 217653), drawn on an account purportedly belonging to Company DI

and purportedly drawn on an account for the State Treasurer of Illinois, made

payable to Individual TM, was deposited into a checking account ending in 2992

belonging to Individual TM. Prior to this deposit, the balance in Individual TMs

account ending in 2992 was $0.00. Citibank records show that these checks were

rejected on November 4, 2011. Citibank records also show that a debit card ending

in 5121 was the debit card for Individual TMs accounts ending in 3488 and 2992.

12

25. According to information provided by a representative for Company DI,

the checks that were deposited into Individual TMs accounts on November 1, 2011,

(check numbers 217652 and 217653) were counterfeit checks not issued by or

authorized by Company DI.

26. I have reviewed a photograph excerpted from Citibanks video

surveillance of the November 1, 2011, deposits of Company DI checks into

Individual TMs accounts, and compared it to an Illinois drivers license photograph

of MOSLEY. I recognize MOSLEY as the individual who made these deposits.

27. Citibank records also show that, on November 2, 2011, at 6:14 a.m.,

there was an ATM transfer of $3,400 from Individual TMs account ending in 3488,

into Individual TMs account ending in 2992. I have reviewed photographs

excerpted from Citibanks video surveillance of this ATM transfer and compared

them to an Illinois drivers license photograph of MOSLEY. I recognize MOSLEY as

the individual who conducted this ATM transfer.

28. According to Citibank records for Individual TMs account ending in

2992, on November 2, 2011, at 6:51 a.m., there was a withdrawal of $2,770.42 at

Currency Exchange A, using Individual TMs debit card ending in 5121.

29. I have reviewed Currency Exchange As debit card processors records

for November 2, 2011, which show a withdrawal of $2,770.42 at Currency Exchange

A, at 6:51 a.m., using the debit card ending in 5121 that matches the debit card for

Individual TMs accounts.

13

30. I have reviewed a copy of the surveillance video from Currency

Exchange A from November 2, 2011. From my review of the surveillance video and

my comparison to an Illinois drivers license photograph of MOSLEY, I recognize

MOSLEY as the individual who made the withdrawal of $2770.42 from Individual

TMs account ending in 2992. The time stamp on the video surveillance from

Currency Exchange A is approximately 6:51 a.m.

31. Using debit card processor records and bank statements obtained

during the investigation, I have determined that MOSLEY made the withdrawal on

November 2, 2011, from an account belonging to Individual TM, and not an account

belonging to MOSLEY.

32. Citibank records for Individual TMs account further reflect that this

withdrawal occurred after the deposit of the Company DI checks purportedly drawn

on a State Treasurer of Illinois bank account, on November 1, 2011, but before

those check deposits were rejected.

33. According to a representative from Citibank, the bank advances its

own funds into customers bank accounts the next business day after the deposit of

checks so that customers can withdraw funds without waiting for checks to clear.

B. Additional Cracking Cards Transactions for MOSLEY

34. I have also reviewed transactions relating to four additional bank

accounts belonging to individuals other than MOSLEY. For each of these accounts,

I have reviewed bank records that show one or more deposits of counterfeit checks

into the respective individuals bank accounts, followed by withdrawals at ATMs or

15

V. CONCLUSION

36. Based upon the information set forth in this affidavit, I believe there is

probable cause to believe that, from in or about October 2011 and continuing

through in or about January 2012, at Chicago, in the Northern District of Illinois,

Eastern Division, and elsewhere, MOSLEY knowingly participated in a scheme to

defraud a financial institution and to obtain money and funds owned by and under

the custody and control of a financial institution by means of materially false and

fraudulent pretenses, representations, and promises, and by concealment of

material facts, and, for the purpose of executing such scheme, on or about November

2, 2011, caused the withdrawal of approximately $2,770.42 from an account

belonging to Individual TM at Citibank, a financial institution whose deposits were

insured by the FDIC, in violation of Title 18, United States Code, Section 1344

(bank fraud).

FURTHER AFFIANT SAYETH NOT.

MARTIN J. NITSCHE

Postal Inspector

United States Postal Inspection Service

SUBSCRIBED AND SWORN to before me on October 24, 2014.

JEFFREY T. GILBERT

United States Magistrate Judge

You might also like

- Financial Institution Fraud 2013 - Chapter ExcerptDocument15 pagesFinancial Institution Fraud 2013 - Chapter ExcerptLeynard ColladoNo ratings yet

- Ranco Costa Verda ContractDocument21 pagesRanco Costa Verda ContractGregory RussellNo ratings yet

- City of Minneapolis MPD Correspondence With MDHRDocument11 pagesCity of Minneapolis MPD Correspondence With MDHRScott JohnsonNo ratings yet

- ThePurpleLotus - Wattigney InformationDocument6 pagesThePurpleLotus - Wattigney InformationDeepDotWeb.comNo ratings yet

- Trakas LetterDocument3 pagesTrakas LetterMonica Celeste RyanNo ratings yet

- Letter To Police Re Volunteer Informant Mario ArenasDocument2 pagesLetter To Police Re Volunteer Informant Mario ArenasJames Alan BushNo ratings yet

- Government's Sentencing Memorandum For Steve StengerDocument12 pagesGovernment's Sentencing Memorandum For Steve StengerKelsi AndersonNo ratings yet

- JUUL Medical Authorization Packet - Tarek WegDocument4 pagesJUUL Medical Authorization Packet - Tarek WegTed RustNo ratings yet

- Financial CrisisDocument6 pagesFinancial CrisisForeclosure Fraud100% (1)

- Consumer Authorization Background Check FormDocument2 pagesConsumer Authorization Background Check Formapi-351412138No ratings yet

- #GoldenGoFer IndictmentDocument67 pages#GoldenGoFer IndictmentMichael_Lee_RobertsNo ratings yet

- Indictments Unsealed AlleginDocument5 pagesIndictments Unsealed AlleginVictoria MartinNo ratings yet

- Benefit Summary RPTDocument2 pagesBenefit Summary RPTJonathan LipscombNo ratings yet

- Emergency Motion Rechnitz Response-8!29!14Document75 pagesEmergency Motion Rechnitz Response-8!29!14Linda GonzalesNo ratings yet

- ALAN-I GOLDBERG Initial Disclosure 2015 06-17-5581e6768e791Document77 pagesALAN-I GOLDBERG Initial Disclosure 2015 06-17-5581e6768e791ALAN I GOLDBERGNo ratings yet

- Background Investigation FormDocument5 pagesBackground Investigation FormWDAScribdNo ratings yet

- Erby PetitionDocument9 pagesErby PetitionJordan PalmerNo ratings yet

- CC 081213 Dept 14 Lapp LDocument38 pagesCC 081213 Dept 14 Lapp LJudicial Watch, Inc.No ratings yet

- Plaintiff's Opposition On Preservation of Talc SamplesDocument26 pagesPlaintiff's Opposition On Preservation of Talc SamplesKirk HartleyNo ratings yet

- Walton Development, Tanzania Jesuits & Grupo AlcoDocument10 pagesWalton Development, Tanzania Jesuits & Grupo AlcoDavid LangerNo ratings yet

- View Completed FormsDocument13 pagesView Completed FormsKewan WNo ratings yet

- PUBLIC Order For Preparation Release of Transcript Record of Grand JuryDocument4 pagesPUBLIC Order For Preparation Release of Transcript Record of Grand Jurykc wildmoon100% (1)

- Brewer Federal WarrantDocument13 pagesBrewer Federal WarrantMegan Strickland SacryNo ratings yet

- People of The State of Illinois vs. Anthony McKinney - The People's Supplemental Response To The Motion To QuashDocument54 pagesPeople of The State of Illinois vs. Anthony McKinney - The People's Supplemental Response To The Motion To QuashChicago TribuneNo ratings yet

- Medina Arrest WarrantDocument5 pagesMedina Arrest WarrantAlfonso RobinsonNo ratings yet

- Criminal Complaint Filed Against Tarrant County College District With The District Attorney's OfficeDocument18 pagesCriminal Complaint Filed Against Tarrant County College District With The District Attorney's OfficeIsaiah X. SmithNo ratings yet

- Regina R Ross-1ab65dfcfca54a7 PDFDocument21 pagesRegina R Ross-1ab65dfcfca54a7 PDFGlenn ColemanNo ratings yet

- Group List of Extra Scrutiny Targets by IRSDocument10 pagesGroup List of Extra Scrutiny Targets by IRSAnonymous kprzCiZNo ratings yet

- Irs General Criminal Tax Fraud & Tax Evasion Prosecution Summaries Fy 2008-2010 - A Review For South Carolina Criminal Tax Attorneys, Lawyers & Law FirmsDocument201 pagesIrs General Criminal Tax Fraud & Tax Evasion Prosecution Summaries Fy 2008-2010 - A Review For South Carolina Criminal Tax Attorneys, Lawyers & Law FirmsJoseph P. Griffith, Jr.No ratings yet

- Strongest and Weakest Banks and ThriftsDocument108 pagesStrongest and Weakest Banks and ThriftsMayur MahajanNo ratings yet

- 15-0564 - Viramontes Summary Report FINALDocument20 pages15-0564 - Viramontes Summary Report FINALTodd FeurerNo ratings yet

- Michael Richo Criminal ComplaintDocument16 pagesMichael Richo Criminal ComplaintSoftpedia100% (1)

- Corporate Fraud and Employee Theft: Impacts and Costs On BusinessDocument15 pagesCorporate Fraud and Employee Theft: Impacts and Costs On BusinessAkuw AjahNo ratings yet

- Congressmen Home Addresses PDFDocument27 pagesCongressmen Home Addresses PDFProfessor WatchlistNo ratings yet

- SCS 200 Research Check 2Document6 pagesSCS 200 Research Check 2Robin McFaddenNo ratings yet

- Michael and Julie Mardock v. Michael and Virginia McClaughryDocument17 pagesMichael and Julie Mardock v. Michael and Virginia McClaughryThe Department of Official InformationNo ratings yet

- Adding The PPS Credential To Your Master-2Document4 pagesAdding The PPS Credential To Your Master-2CSUFCounselorEdNo ratings yet

- Basic Income and Sovereign Money: The Alternative to Economic Crisis and Austerity PolicyFrom EverandBasic Income and Sovereign Money: The Alternative to Economic Crisis and Austerity PolicyNo ratings yet

- Please DocuSign These Documents UPS On-BoardDocument21 pagesPlease DocuSign These Documents UPS On-BoardJayeven EnglishNo ratings yet

- Completed Unclaimed Prop Dec20 - 202101141120520671Document692 pagesCompleted Unclaimed Prop Dec20 - 202101141120520671Naberius Customs LLCNo ratings yet

- How To Get What The US Government Owes You!Document4 pagesHow To Get What The US Government Owes You!creativemarcoNo ratings yet

- Https WWW - Dol.state - Ga.us WS4-MW5 CicsDocument4 pagesHttps WWW - Dol.state - Ga.us WS4-MW5 CicsDaniel MinnickNo ratings yet

- One SiteDocument2 pagesOne SiteVanessa Burbano AyalaNo ratings yet

- Background Search Clarence Jonathan WoodDocument20 pagesBackground Search Clarence Jonathan Woodkerry campbellNo ratings yet

- Transcript of The Hearing in The Mifepristone Lawsuit On March 14, 2023 in Amarillo, TexasDocument22 pagesTranscript of The Hearing in The Mifepristone Lawsuit On March 14, 2023 in Amarillo, TexasJamie BurchNo ratings yet

- Criminal Complaint Against Former San Bernardino County Assessor Bill PostmusDocument5 pagesCriminal Complaint Against Former San Bernardino County Assessor Bill PostmusThe Press-Enterprise / pressenterprise.comNo ratings yet

- Borland-Clifford House NominationDocument19 pagesBorland-Clifford House NominationReno Gazette JournalNo ratings yet

- A Child 3Document50 pagesA Child 3winona mae marzoccoNo ratings yet

- Better Covid ThingDocument4 pagesBetter Covid ThingAuguste RiedlNo ratings yet

- Letter To Police Re Illegal Gambling Operations in San Jose (Leo Rodriguez)Document2 pagesLetter To Police Re Illegal Gambling Operations in San Jose (Leo Rodriguez)James Alan BushNo ratings yet

- PEOPLE FOR THE ETHICAL OPERATION OF PROSECUTORS AND LAW ENFORCEMENT (P.E.O.P.L.E.), BETHANY WEBB, THERESA SMITH, and TINA JACKSON, vs. ANTHONY J. RACKAUCKASDocument40 pagesPEOPLE FOR THE ETHICAL OPERATION OF PROSECUTORS AND LAW ENFORCEMENT (P.E.O.P.L.E.), BETHANY WEBB, THERESA SMITH, and TINA JACKSON, vs. ANTHONY J. RACKAUCKASFindLawNo ratings yet

- Credit OwnDocument1 pageCredit OwnLuis Miguel PedemonteNo ratings yet

- Valuation Form Kirby 2021-05-04-17-01-19 1Document240 pagesValuation Form Kirby 2021-05-04-17-01-19 1La Rams FanNo ratings yet

- Driver License/identification Card and REAL ID ChecklistDocument3 pagesDriver License/identification Card and REAL ID ChecklistMuneeb QayyumNo ratings yet

- Affidavit of Hipkiss vs. ShinDocument26 pagesAffidavit of Hipkiss vs. ShinP-R HipkissNo ratings yet

- Original Social Security Card Back - Google SearchDocument1 pageOriginal Social Security Card Back - Google SearchhannahNo ratings yet

- TRENT COLBY GEERDES ReportDocument36 pagesTRENT COLBY GEERDES ReportYyNo ratings yet

- Emanuel Emails From March 2012 To August 2012Document140 pagesEmanuel Emails From March 2012 To August 2012Steve WarmbirNo ratings yet

- One of The Heavily Redacted State Documents On YouthCare Released by IllinoisDocument83 pagesOne of The Heavily Redacted State Documents On YouthCare Released by IllinoisSteve WarmbirNo ratings yet

- Emanuel Emails 6Document111 pagesEmanuel Emails 6Steve WarmbirNo ratings yet

- Emanuel Emails From February 2014 To September 2014Document99 pagesEmanuel Emails From February 2014 To September 2014Steve WarmbirNo ratings yet

- Emanuel Emails From September 2012 To December 2012Document68 pagesEmanuel Emails From September 2012 To December 2012Steve WarmbirNo ratings yet

- October 2014 Through December 2014Document98 pagesOctober 2014 Through December 2014dnainfojenNo ratings yet

- Emails Regarding SUPES ContractDocument2 pagesEmails Regarding SUPES ContractSteve WarmbirNo ratings yet

- May 2011 Through July 2011.Document159 pagesMay 2011 Through July 2011.dnainfojenNo ratings yet

- November 2011 Through February 2012Document130 pagesNovember 2011 Through February 2012dnainfojenNo ratings yet

- Copa OrdinanceDocument22 pagesCopa OrdinanceSteve WarmbirNo ratings yet

- CPS Inspector General's ReportDocument6 pagesCPS Inspector General's ReportSteve WarmbirNo ratings yet

- Blagojevich en Banc AppealDocument46 pagesBlagojevich en Banc AppealSteve WarmbirNo ratings yet

- August 2011 Through October 2011Document126 pagesAugust 2011 Through October 2011dnainfojenNo ratings yet

- Aldo Brown Criminal ComplaintDocument5 pagesAldo Brown Criminal ComplaintSteve WarmbirNo ratings yet

- Federal Appellate RulingDocument1 pageFederal Appellate RulingSteve WarmbirNo ratings yet

- CTU Report On Special Ed CutsDocument8 pagesCTU Report On Special Ed CutsSteve WarmbirNo ratings yet

- Sentencing Memo For Steven ZamiarDocument19 pagesSentencing Memo For Steven ZamiarSteve WarmbirNo ratings yet

- Brian Howard PleaDocument18 pagesBrian Howard PleaSteve WarmbirNo ratings yet

- Parcc Prelim State LVL Results 4Document1 pageParcc Prelim State LVL Results 4Steve WarmbirNo ratings yet

- 2016 Budget AddressDocument10 pages2016 Budget AddressCrainsChicagoBusinessNo ratings yet

- NLRB OpinionDocument19 pagesNLRB OpinionAnonymous 6f8RIS6No ratings yet

- CPS Bell Times Change in Policy 081015Document5 pagesCPS Bell Times Change in Policy 081015Chicago Alderman Scott WaguespackNo ratings yet

- Bibbs Complaint FiledDocument30 pagesBibbs Complaint FiledSteve WarmbirNo ratings yet

- Vaughan Plea AgreementDocument16 pagesVaughan Plea AgreementSteve WarmbirNo ratings yet

- Pension RulingDocument35 pagesPension RulingSteve WarmbirNo ratings yet

- Back Page OrderDocument2 pagesBack Page OrderSteve WarmbirNo ratings yet

- Warner 7th Cir July 10 2015 (Sentence Affirmed)Document33 pagesWarner 7th Cir July 10 2015 (Sentence Affirmed)Steve WarmbirNo ratings yet

- Rod Blagojevich RulingDocument23 pagesRod Blagojevich RulingSteve WarmbirNo ratings yet

- CPS School BudgetsDocument32 pagesCPS School BudgetsSteve WarmbirNo ratings yet

- Current Account Statement: United Bank LimitedDocument1 pageCurrent Account Statement: United Bank LimitedkarinaNo ratings yet

- Dec - 21Document17 pagesDec - 21Amit KumarNo ratings yet

- Object Oriented System Analysis and Design (Oosad) INSY3063: Prepared by Meseret Hailu (2022) 1 5/31/2022Document151 pagesObject Oriented System Analysis and Design (Oosad) INSY3063: Prepared by Meseret Hailu (2022) 1 5/31/2022taye teferaNo ratings yet

- Sudhir Kumar 6m Axis FundsDocument2 pagesSudhir Kumar 6m Axis FundsSajan SharmaNo ratings yet

- A STUDY of NPA ProjectDocument74 pagesA STUDY of NPA ProjectAman RajakNo ratings yet

- Project Report On ATM SystemDocument55 pagesProject Report On ATM SystemJaydip Patel100% (3)

- Working of ATMDocument3 pagesWorking of ATMNarendran SrinivasanNo ratings yet

- Axis Bank FinalDocument109 pagesAxis Bank Finalashu1630100% (9)

- MX8700 1Document2 pagesMX8700 1MariyappanSubhash100% (1)

- Chasebankusanationalassociation 489913 Wilmingtondelaware 19Document39 pagesChasebankusanationalassociation 489913 Wilmingtondelaware 19Efrain CabreraNo ratings yet

- Case Study: ATM Machine II: Identifying Class AttributesDocument16 pagesCase Study: ATM Machine II: Identifying Class AttributesCharmi yantinaNo ratings yet

- NBP Bank ChargesDocument28 pagesNBP Bank Chargesayub_balticNo ratings yet

- 05 Ooad-Uml 05Document27 pages05 Ooad-Uml 05Hiren BhingaradiyaNo ratings yet

- Annual Report 2010 2011 PDFDocument31 pagesAnnual Report 2010 2011 PDFbekele abomsaNo ratings yet

- Tax Return Receipt ConfirmationDocument5 pagesTax Return Receipt ConfirmationAntoni Boyd Montejo AlicanteNo ratings yet

- Sagicor Bank Account Terms and Conditions July 27 2020Document9 pagesSagicor Bank Account Terms and Conditions July 27 2020Maxwell R. SmithNo ratings yet

- Mod 1 Mbfs PDF NewDocument22 pagesMod 1 Mbfs PDF NewWalidahmad AlamNo ratings yet

- ATM MachineDocument19 pagesATM MachinevaishalisamNo ratings yet

- FBL (Final)Document88 pagesFBL (Final)Muhammad Rizwan KhanNo ratings yet

- Paket Full 4 StudentDocument5 pagesPaket Full 4 Studentdara mudaNo ratings yet

- Money and Banking TerminologyDocument3 pagesMoney and Banking TerminologythamiztNo ratings yet

- AccDocument7 pagesAccALLIA AHMADNo ratings yet

- Account Statement As of 15-06-2019 14:28:53 GMT +0530 Customer Name Branch Account Number Customer Id Account Currency Opening Balance Closing BalanceDocument11 pagesAccount Statement As of 15-06-2019 14:28:53 GMT +0530 Customer Name Branch Account Number Customer Id Account Currency Opening Balance Closing BalanceNIMMANAGANTI RAMAKRISHNANo ratings yet

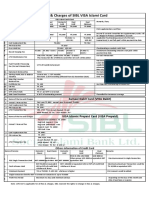

- Fees and Charges of SIBL Islami CardDocument1 pageFees and Charges of SIBL Islami CardMd YusufNo ratings yet

- Checking Account Simulation Powerpoint Presentation 171g1Document77 pagesChecking Account Simulation Powerpoint Presentation 171g1deepag100% (3)

- At The Bank: Speaking A Word To BeginDocument2 pagesAt The Bank: Speaking A Word To BeginJosé Juan SuárezNo ratings yet

- Deposita BrochureDocument2 pagesDeposita BrochuresafinditNo ratings yet

- Soneri Bank Report CompressDocument66 pagesSoneri Bank Report Compressناظم راجپوت بھٹیNo ratings yet

- Case 12 Menton BankDocument2 pagesCase 12 Menton BankJi Jason100% (1)

- Retail 2Document32 pagesRetail 2Pravali SaraswatNo ratings yet