Professional Documents

Culture Documents

Qualification Parameters For Failed Trust Company Acquisitions

Uploaded by

Mark Reinhardt0 ratings0% found this document useful (0 votes)

6 views10 pagessource: accesscorrections.com

Original Title

trqualparfailacq

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentsource: accesscorrections.com

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views10 pagesQualification Parameters For Failed Trust Company Acquisitions

Uploaded by

Mark Reinhardtsource: accesscorrections.com

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 10

451.699-6-01/1 [Rev.

9/07] Texas Department of Banking

QUALIFICATION PARAMETERS FOR FAILED

TRUST COMPANY ACQUISITIONS

INFORMATION AND INSTRUCTIONS

The Texas Department of Banking (the "Department") welcomes any interest in acquiring a failed or failing institution

or trust company via a trust company charter, either existing or de novo. Following is a synopsis of qualifications

which must be satisfied in order to qualify to acquire a failing institution by or through a Texas trust company.

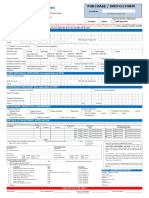

PROCEDURE / APPLICATION. If the resulting institution will be a Texas trust company, the approval of the

Department must be obtained prior to the submission of your bid. All applicants must supply the Department

sufficient information to review the proposed transaction in a timely manner. The Department's "APPLICATION TO

PURCHASE ASSETS AND ASSUME LIABILITIES" form (the "P&A form) solicits most of the information

required to review a proposal. Additional information may be required.

EXISTING TRUST COMPANY OR BANK - BRANCH

If you represent an existing trust company or state bank and determine to establish one or more branches as a result of

the proposed transaction, the P&A form will be considered your application to establish such branch(es).

TRUST COMPANY CHARTER - DE NOVO

If you are a member of a group that wishes to obtain a trust company charter as a result of the subject transaction it is

essential that you contact the representatives of the Department (See "CONTACTS") immediately after the

information meeting and submit the requisite biographical and financial information on all members of the proposed

control group AS SOON AS POSSIBLE. The Department must conduct background investigations on each proposed

principal. An application to charter a trust company must be submitted in addition to the P&A form.

DUE DILIGENCE

Those who intend to conduct a due diligence review of the institution must contact the Department regarding their

intent and verify that clearance has been granted.

FORMS-INTERAGENCY. The Department will accept the completed Interagency Bank Merger Act (if a bank)

form and the Interagency Biographical and Financial Report (bank or trust company) in lieu of the State forms

provided that the forms are accompanied by the executed and notarized signature pages on the State forms.

OUT-OF-STATE TRUST COMPANY/BANK

An out-of-state trust company or bank which seeks to establish a trust office or a branch(es) in Texas through the

acquisition of a failed trust company must provide the notice required by Article 342a-9.101 et seq. of the Texas Trust

Company Act or by Section 203.001(a) of the Texas Finance Code, respectively.

451.699-6-01/2 [Rev. 9/07] Texas Department of Banking

BID PROPOSALS

Summary of Requirements:

All applicants must submit the following information to the Corporate Activities Division of the Department. The

Departments P&A form solicits the information noted. A "*" indicates the information requested is related to the

acquisition of a failed thrift.

A. Capital Plan

1. Pro forma Balance Sheet and Income Statements demonstrating at least $1,000,000 in equity

capital.

2. Premium paid is not considered a component of the RESULTING TRUST COMPANYS

TANGIBLE CAPITAL.

B. Financing. Indicate the type and terms of any financing. Written documentation or phone verification

of any proposed financing is required.

C. Due Diligence. Summary of the Review Performed.

D. Bids.

1. Must be broken down by the applicable asset/liability categories.

E. Management Plan and Staff Considerations.

F. Investment in Fixed Assets. A state trust companys investment in fixed assets is limited to 60% of the

trust company's restricted capital accounts (Section 184.002 of the Texas Finance Code). Requests to

exceed such limitation must be submitted in writing.

G. Fidelity Insurance. Evidence of Coverage of the Resulting Trust Company.

H. Tax Considerations. Summary of any special or unusual Tax Considerations.

I. Nonbank Assets / Unauthorized Investments. Plan for the disposition of any assets / investments not

authorized for a trust company or any nonconforming assets.

Provide the Department with copies of the information provided to other regulators (FDIC and FRB) regarding your

bid.

FORMS. De novo trust company charter and P&A application forms will be supplied upon request. See "Corporate

Activities Contacts" below. Should you be the successful bidder the fee for a de novo charter is $5,000. The fee for a

P&A is $4,000.

HOLDING COMPANY. If your institution is or will be held by a holding company, you must demonstrate that

the acquisition will not result in a violation of any state or federal law.

OVERRIDE OR PREEMPTION OF STATE LAW. If an override or preemption of a state banking

law will be required, notify the Department.

CONTACTS. A representative of the Department will be available to discuss your proposal or you may discuss your

proposal directly with the Corporate Activities Division of the Department. The regulatory contact, as indicated in

the "List of Regulators" provided in the information packet, should be contacted as soon as a decision is reached

451.699-6-01/3 [Rev. 9/07] Texas Department of Banking

regarding the intent to bid on the institution or if you have any questions in preparing your bid proposal.

Corporate Activities Contacts:

Loren E. Svor

Analyst

e-mail: loren.svor@banking.state.tx.us

TELEPHONE #: 512/475-1300 FAX #: 512/475-1313 or 512/475-1707

NOTE: Bid proposals must be received by the Austin Headquarters Office of the Department located at 2601 North

Lamar Boulevard, Austin, Texas 78705.

451.699-6-01/4 [Rev. 9/07] Texas Department of Banking

APPLICATION TO PURCHASE AND ASSUME LIABILITIES

Application is hereby made for approval of this proposal to purchase certain assets and assume certain liabilities of a failed

financial institution as required by the Texas Finance Code.

___________________________________________________________________________________________________

Legal Title of Charter/Acquiring Trust Company Charter No.

___________________________________________________________________________________________________

Legal Address City State Zip Code County

___________________________________________________________________________________________________

Legal Title of Target Institution Charter No.

___________________________________________________________________________________________________

Legal Address City State Zip Code County

___________________________________________________________________________________________________

Legal Title of Holding Company for Charter /Acquiring Trust Company Charter No.

___________________________________________________________________________________________________

Legal Address City State Zip Code County

Requests for additional information or other communications concerning this application and the underlying proposal should be

directed to:

___________________________________________________________________________________________________

Name Title

___________________________________________________________________________________________________

Mailing Address Telephone Number

451.699-6-01/5 [Rev. 9/07] Texas Department of Banking

It is hereby certified that all statements in this application and in any other documents or paper submitted in connection with this

application and the underlying bid proposal contain no misrepresentations or omissions of material facts.

_____________________________________________________ By _______________________________________

Charter Trust Company Signature of Authorized Officer

_______________________________________

Typed Name

_______________________________________

SEAL OF THE BANK Title

THE FOLLOWING SCHEDULES AND EXHIBITS MUST BE FILED IN CONJUNCTION WITH THIS APPLICATION.

SCHEDULE I: Transaction - Description / Management / Agreement

SCHEDULE II: Pro Forma Combined Balance Sheet

SCHEDULE III: Capital Ratio Computation

SCHEDULE IV: Trust Offices/Branches

SCHEDULE V: Non-conforming Assets

[fixed assets, overlines, non-conforming assets, etc.]

Note: Complete each section. If the information requested is not applicable, so indicate. Round all dollar amounts to the

nearest thousand, unless otherwise noted.

451.699-6-01/6 [Rev. 9/07] Texas Department of Banking

SCHEDULE I: TRANSACTION - DESCRIPTION / MANAGEMENT / AGREEMENT

Attach a brief description of the terms of the proposed transaction and how such conforms to your trust

companys/bank's long term strategic plan. Also provide information regarding senior management and staffing

requirements for any trust offices/branches or other facilities to be established in connection with the proposed

transaction. Winning bidders are required to file a copy of the completed Purchase and Assumption Agreement with

the Department.

451.699-6-01/7 [Rev. 9/07] Texas Department of Banking

SCHEDULE II: PRO FORMA COMBINED BALANCE SHEET

Attached schedule reflects the pro forma combined balance sheet of the RESULTING TRUST COMPANY/BANK including

adjustments. Provide information in separate columns for each institution participating in the transaction. All

adjustments must be footnoted and explained in detail. Also provide a brief pro forma income statement for the

RESULTING TRUST COMPANY/BANK as of year-end, after the proposed transaction. Provide a pro forma statement for

fiduciary assets.

451.699-6-01/8 [Rev. 9/07] Texas Department of Banking

SCHEDULE III: CAPITAL RATIO COMPUTATION

COMPUTATION OF TANGIBLE CAPITAL RATIO

Equity Capital __________________________

Plus: Minority interest in consolidated subsidiaries __________________________

Less: Disallowed intangible assets __________________________

Less: Loss not charged off __________________________

Less: Premium for this transaction * __________________________

TANGIBLE EQUITY CAPITAL __________________________

TANGIBLE PRIMARY CAPITAL __________________________

If Bank, provide your capital ratios (pre and post transaction), pursuant to Part 325 of the FDI Act.

* Includes, but is not limited to intangibles purchased or premiums paid.

451.699-6-01/9 [Rev. 9/07] Texas Department of Banking

SCHEDULE IV: TRUST OFFICES/BRANCHES

List all trust offices of the target institution and denote which ones you plan to retain (this normally will

include the Home Office and opened trust offices of the target). Also list separately approved but unopened

trust company additional trust offices. Authorizations for trust offices/branches of the acquiring trust

company/bank will not be issued until they are to be opened. Also list separately the current trust

offices/branches, if any, of the acquiring trust company/bank.

Trust Office/Branch Existing Dept. Branch

Street Address Date Trust Office/Branch Certificate

City, County, State Opened of Target Needed

451.699-6-01/10 [Rev. 9/07] Texas Department of Banking

SCHEDULE V: NON-CONFORMING ASSETS / INVESTMENTS

Attach a schedule/description of any assets or investments which do not conform to the requirements of the

Texas Finance Code, or Regulations (i.e. excess investment in fixed assets, liquidity, assets/investments not

authorized for trust company). Applicants must provide a plan, acceptable to the Banking Commissioner,

describing how and when the trust company will bring any non-conforming asset/investment into compliance.

Name or Type of Amount Collateral Discount

Asset/Investment $__________ $__________ $__________

You might also like

- Trapp To MergeDocument6 pagesTrapp To MergeMark ReinhardtNo ratings yet

- SBA DISASTER ASSISTANCE PROGRAM BORROWER'S PROGRESS CERTIFICATIONDocument3 pagesSBA DISASTER ASSISTANCE PROGRAM BORROWER'S PROGRESS CERTIFICATIONaphexishNo ratings yet

- Corp t02Document2 pagesCorp t02Mark ReinhardtNo ratings yet

- Corp m02Document44 pagesCorp m02Mark ReinhardtNo ratings yet

- Uniform Interstate AppDocument4 pagesUniform Interstate AppMark ReinhardtNo ratings yet

- Notice To Applicants Conversion ApplicationDocument2 pagesNotice To Applicants Conversion ApplicationMark ReinhardtNo ratings yet

- Notice To Applicants Establishing or Relocating A BranchDocument2 pagesNotice To Applicants Establishing or Relocating A BranchMark ReinhardtNo ratings yet

- Corp b18Document4 pagesCorp b18Mark ReinhardtNo ratings yet

- Notice To Applicants Application For A Merger, Reorganization, or Share ExchangeDocument2 pagesNotice To Applicants Application For A Merger, Reorganization, or Share ExchangeMark ReinhardtNo ratings yet

- Corp b16Document3 pagesCorp b16Mark ReinhardtNo ratings yet

- Specialized Loan Servicing Charges $250 For A Refi, and $125 For A Loan ModDocument4 pagesSpecialized Loan Servicing Charges $250 For A Refi, and $125 For A Loan ModTim BryantNo ratings yet

- Anrlf Loan Package 9-14Document19 pagesAnrlf Loan Package 9-14api-295308761No ratings yet

- Notice To Applicants Acquisition of ControlDocument2 pagesNotice To Applicants Acquisition of ControlMark ReinhardtNo ratings yet

- Corp b17Document4 pagesCorp b17Mark ReinhardtNo ratings yet

- VT Contractor Qualification QuestionnaireDocument14 pagesVT Contractor Qualification QuestionnaireDeibi Gp GpNo ratings yet

- Subrecipient Risk Assessment QuestionnaireDocument6 pagesSubrecipient Risk Assessment QuestionnaireGbadeyanka O WuraolaNo ratings yet

- Subrecipient Commitment Form CertificationDocument4 pagesSubrecipient Commitment Form CertificationSanjeev SreetharanNo ratings yet

- SBIR Application VCOC CertificationDocument3 pagesSBIR Application VCOC CertificationGOKUL PRASADNo ratings yet

- Renew Appt RDocument6 pagesRenew Appt RMark ReinhardtNo ratings yet

- 22890761Document198 pages22890761William HarrisNo ratings yet

- RFP SSBCI Capital Access Program 1.13.2022 FINALDocument18 pagesRFP SSBCI Capital Access Program 1.13.2022 FINALcreditprofessional.solutionsNo ratings yet

- Application Guidelines For TARP Community Development Capital InitiativeDocument4 pagesApplication Guidelines For TARP Community Development Capital InitiativeREAL SolutionsNo ratings yet

- Corp b31Document3 pagesCorp b31Mark ReinhardtNo ratings yet

- TCF Financial CriteriaDocument7 pagesTCF Financial CriteriaDinesh YogiNo ratings yet

- Chase Short Sale PackageDocument12 pagesChase Short Sale PackageZenMaster1969No ratings yet

- FFATA Data Collection Form.EDocument2 pagesFFATA Data Collection Form.EandresNo ratings yet

- Banking License ApplicationDocument22 pagesBanking License ApplicationFrancNo ratings yet

- Application For Change in PolicyDocument6 pagesApplication For Change in PolicyklerinetNo ratings yet

- FY19 Funding Opportunity Submission InstructionsDocument7 pagesFY19 Funding Opportunity Submission InstructionsChris PearsonNo ratings yet

- Startup Checklist 20151Document3 pagesStartup Checklist 20151anawarmohammed637No ratings yet

- Credit InvestigationDocument23 pagesCredit Investigationdeshmukhprajakta369No ratings yet

- T 01 QuestDocument5 pagesT 01 Questhafsa.ahammoutNo ratings yet

- Standard Operating Procedure for Accounts Payable VendorsDocument4 pagesStandard Operating Procedure for Accounts Payable VendorsmaheshNo ratings yet

- Belzak Matter - JPMorgan Chase Proof of Claim, January 1, 2011 PDFDocument24 pagesBelzak Matter - JPMorgan Chase Proof of Claim, January 1, 2011 PDFFraudInvestigationBureau50% (2)

- New Valley Bank & Trust Public Co. FileDocument91 pagesNew Valley Bank & Trust Public Co. FileJim KinneyNo ratings yet

- Complete-Before-SigningDocument2 pagesComplete-Before-SigningMinh HuynhNo ratings yet

- Capability Statement 28Document7 pagesCapability Statement 28Ulek BuluNo ratings yet

- 2012 01 Sme FinanceDocument12 pages2012 01 Sme FinanceBonny Ya SakeusNo ratings yet

- Application Guidelines For TARP Capital Purchase ProgramDocument6 pagesApplication Guidelines For TARP Capital Purchase ProgramFOXBusiness.comNo ratings yet

- Application For Release From Prohibition or Removal OrderDocument13 pagesApplication For Release From Prohibition or Removal OrderMark ReinhardtNo ratings yet

- Form 5 - Application To Withdraw or Transfer Money From An Ontario Locked-In AccountDocument6 pagesForm 5 - Application To Withdraw or Transfer Money From An Ontario Locked-In AccountDimitrios LatsisNo ratings yet

- PPP Forgiveness 3508SDocument6 pagesPPP Forgiveness 3508SJustin Davies100% (1)

- How To Register A Corporation With SEC PhilippinesDocument2 pagesHow To Register A Corporation With SEC PhilippinesRoger JavierNo ratings yet

- Description: Tags: 2008LenSerOPADocument5 pagesDescription: Tags: 2008LenSerOPAanon-804606No ratings yet

- Fomtnp RRF 2013Document2 pagesFomtnp RRF 2013L. A. PatersonNo ratings yet

- Section: Permission To Organize A Federal Savings InstitutionDocument20 pagesSection: Permission To Organize A Federal Savings Institutionadsasd3333No ratings yet

- Manual XiiDocument868 pagesManual XiiyogeshdagaurNo ratings yet

- 1199 A 1 PDFDocument4 pages1199 A 1 PDFGerry Ruff100% (1)

- Confidential report as per iba format summaryDocument3 pagesConfidential report as per iba format summarySriram ReddyNo ratings yet

- Details of MSME subsidy programme for performance and credit ratingsDocument769 pagesDetails of MSME subsidy programme for performance and credit ratingsManav Hota0% (1)

- Uprading of CategoryDocument15 pagesUprading of CategoryApl Dugui-es ToleroNo ratings yet

- format for seeking PSP authorisationDocument20 pagesformat for seeking PSP authorisationHitesh MishraNo ratings yet

- Manual XIIDocument677 pagesManual XIIGnanesh Shetty Bharathipura0% (2)

- Refusal ApplicationDocument3 pagesRefusal ApplicationROB BELLNo ratings yet

- SBA Offer Compromise RequirementsDocument2 pagesSBA Offer Compromise RequirementsSagar PatelNo ratings yet

- Authorization To Release Account InformationDocument2 pagesAuthorization To Release Account InformationamiNo ratings yet

- SBIC Draw Request Submission GuideDocument7 pagesSBIC Draw Request Submission GuideFDS_03No ratings yet

- Charter Relocation ApplicationDocument6 pagesCharter Relocation ApplicationNeliseka XhakazaNo ratings yet

- Patrol LP Scenario04 July2021Document24 pagesPatrol LP Scenario04 July2021Mark ReinhardtNo ratings yet

- Patrol LP Scenario03 July2021Document25 pagesPatrol LP Scenario03 July2021Mark ReinhardtNo ratings yet

- MMCP CY2023 Idaho Blue Cross Medicaid ContractDocument185 pagesMMCP CY2023 Idaho Blue Cross Medicaid ContractMark ReinhardtNo ratings yet

- Crime Scene Manual Rev3Document153 pagesCrime Scene Manual Rev3Mark ReinhardtNo ratings yet

- A Bill: 117 Congress 1 SDocument22 pagesA Bill: 117 Congress 1 SMark ReinhardtNo ratings yet

- WW Idaho Power Co. - Natural Gas Plant Cooling Water Draft PermitDocument27 pagesWW Idaho Power Co. - Natural Gas Plant Cooling Water Draft PermitMark ReinhardtNo ratings yet

- Sustainability of Idaho's Direct Care Workforce (Idaho Office of Performance Evaluations)Document80 pagesSustainability of Idaho's Direct Care Workforce (Idaho Office of Performance Evaluations)Mark ReinhardtNo ratings yet

- Transitioning Coal Plants To Nuclear PowerDocument43 pagesTransitioning Coal Plants To Nuclear PowerMark ReinhardtNo ratings yet

- 20221230final Order No 35651Document5 pages20221230final Order No 35651Mark ReinhardtNo ratings yet

- H0001Document2 pagesH0001Mark ReinhardtNo ratings yet

- 20200206press Release IPC E 18 15Document1 page20200206press Release IPC E 18 15Mark ReinhardtNo ratings yet

- The First Rules of Los Angeles Police DepartmentDocument1 pageThe First Rules of Los Angeles Police DepartmentMark ReinhardtNo ratings yet

- NIYSVADocument15 pagesNIYSVAMark ReinhardtNo ratings yet

- Bills 113s987rsDocument44 pagesBills 113s987rsMark ReinhardtNo ratings yet

- Affidavit Writing Made EasyDocument6 pagesAffidavit Writing Made EasyMark ReinhardtNo ratings yet

- NIYSSDDocument4 pagesNIYSSDMark ReinhardtNo ratings yet

- A Bill: 116 Congress 2 SDocument15 pagesA Bill: 116 Congress 2 SMark ReinhardtNo ratings yet

- Idaho H0098 2021 SessionDocument4 pagesIdaho H0098 2021 SessionMark ReinhardtNo ratings yet

- NIYSWADocument17 pagesNIYSWAMark ReinhardtNo ratings yet

- City of Boise Housing Bonus Ordinance and Zoning Code Rewrite MemoDocument11 pagesCity of Boise Housing Bonus Ordinance and Zoning Code Rewrite MemoMark ReinhardtNo ratings yet

- NIYSUTDocument4 pagesNIYSUTMark ReinhardtNo ratings yet

- HJR003Document1 pageHJR003Mark ReinhardtNo ratings yet

- NIYSTXDocument19 pagesNIYSTXMark ReinhardtNo ratings yet

- NIYSWIDocument8 pagesNIYSWIMark ReinhardtNo ratings yet

- NIYSTNDocument5 pagesNIYSTNMark ReinhardtNo ratings yet

- NIYSRIDocument9 pagesNIYSRIMark ReinhardtNo ratings yet

- NIYSVTDocument4 pagesNIYSVTMark ReinhardtNo ratings yet

- NIYSPRDocument7 pagesNIYSPRMark ReinhardtNo ratings yet

- NIYSSCDocument11 pagesNIYSSCMark ReinhardtNo ratings yet

- NIYSPADocument8 pagesNIYSPAMark ReinhardtNo ratings yet

- SIRA1H11Document8 pagesSIRA1H11Inde Pendent LkNo ratings yet

- Government Economic PolicyDocument20 pagesGovernment Economic Policyqueen_of_awesomenessNo ratings yet

- Questions, Anwers Chapter 22Document3 pagesQuestions, Anwers Chapter 22basit111No ratings yet

- Negotiable Instruments Bar Questions with Suggested AnswersDocument30 pagesNegotiable Instruments Bar Questions with Suggested AnswersEugene Albert Olarte Javillonar100% (1)

- Questionnaire ActDocument6 pagesQuestionnaire ActLorainne AjocNo ratings yet

- From PLI's Course Handbook: Conducting Due DiligenceDocument16 pagesFrom PLI's Course Handbook: Conducting Due DiligencedaucNo ratings yet

- Walt Disney CompanyDocument20 pagesWalt Disney CompanyGabriella VenturinaNo ratings yet

- Bancassurance: An Indian PerspectiveDocument17 pagesBancassurance: An Indian Perspectivealmeidabrijet100% (1)

- Deez Logs Seeks 55% Profit Margin as Top African Timber ExporterDocument42 pagesDeez Logs Seeks 55% Profit Margin as Top African Timber ExporterMundiya Muyunda KwalombotaNo ratings yet

- 9d0t9 3000INC Rs.3000Document108 pages9d0t9 3000INC Rs.3000Murli MenonNo ratings yet

- VP Director Bus Dev or SalesDocument5 pagesVP Director Bus Dev or Salesapi-78176257No ratings yet

- Kiran Sharma Financial Modeling and Valuation ExpertDocument3 pagesKiran Sharma Financial Modeling and Valuation ExpertKiran SharmaNo ratings yet

- United Kingdom Bank Transaction RecordsDocument9 pagesUnited Kingdom Bank Transaction Recordsbjj100% (1)

- Valuation - Final NotesDocument62 pagesValuation - Final NotesPooja GuptaNo ratings yet

- Project Feasibility Study AnalysisDocument3 pagesProject Feasibility Study AnalysisJanus Aries SimbilloNo ratings yet

- IAP1 OperationsDocument7 pagesIAP1 OperationsromeoNo ratings yet

- The effect of foreign ownership on financial performance of banking companiesDocument10 pagesThe effect of foreign ownership on financial performance of banking companieskrisnasavitriNo ratings yet

- RHB Switch FormDocument2 pagesRHB Switch FormWei CongNo ratings yet

- 1 Overview of Financial DecisionsDocument73 pages1 Overview of Financial DecisionsChhavi Mehta100% (1)

- Ultratech Annual ReportDocument49 pagesUltratech Annual ReportMax ScanNo ratings yet

- Part A Answer ALL Questions.: Confidential AC/JUN 2010/FAR360 2Document4 pagesPart A Answer ALL Questions.: Confidential AC/JUN 2010/FAR360 2Syazliana KasimNo ratings yet

- SMEs - Key Differences Between Full PFRS and PFRS for SMEsDocument17 pagesSMEs - Key Differences Between Full PFRS and PFRS for SMEsDesai SarvidaNo ratings yet

- Introduction GenpactDocument7 pagesIntroduction GenpactchoudharynehaNo ratings yet

- NotesDocument72 pagesNotesSandeep Singh MaharNo ratings yet

- HSBC India Manufacturing PMI™: HSBC Purchasing Managers' Index™ Press ReleaseDocument3 pagesHSBC India Manufacturing PMI™: HSBC Purchasing Managers' Index™ Press ReleaseRonitsinghthakur SinghNo ratings yet

- Engagement Letter SampleDocument2 pagesEngagement Letter SampleSherwinNo ratings yet

- Five Proven Racing SystemsDocument8 pagesFive Proven Racing SystemsNick Poole50% (4)

- Internal Control Manual (Brokerage House)Document22 pagesInternal Control Manual (Brokerage House)hamzaaccaNo ratings yet

- Factors First A Risk-Based Approach To Harnessing Alternative Sources of Income WhitepaperDocument20 pagesFactors First A Risk-Based Approach To Harnessing Alternative Sources of Income WhitepaperLalit PonnalaNo ratings yet

- Ch01.Ppt OverviewDocument55 pagesCh01.Ppt OverviewMohammadYaqoob100% (1)