Professional Documents

Culture Documents

Business School: The Impact of Gray Marketing and Parallel Importing On Brand Equity and Brand Value

Uploaded by

Sal Ie EmOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business School: The Impact of Gray Marketing and Parallel Importing On Brand Equity and Brand Value

Uploaded by

Sal Ie EmCopyright:

Available Formats

Business School

t

h

e

B

u

s

i

n

e

s

s

S

c

h

o

o

l

Research Memorandum

38 2003

The Impact of Gray Marketing and

Parallel Importing on Brand Equity and

Brand Value

PHILIP KITCHEN

Centre for Marketing and Communications

LYNNE EAGLE, LAWRENCE ROSE and BRENDANMOYLE

Massey University, New Zealand

Research Memorandum

38 2003

The Impact of Gray Marketing and Parallel

Importing on Brand Equity and Brand Value

PHILIP KITCHEN

Centre for Marketing and Communication

The University of Hull Business School, Hull, HU6 7RX

Email: p.j.kitchen@hull.ac.uk

LYNNE EAGLE, LAWRENCE ROSE AND BRENDAN MOYLE

Department of Commerce, Massey University at Albany,

Auckland, New Zealand

Email: l.eagle@massey.ac.nz

ISBN 1 902034 317

Research Memorandum 38 The University of Hull Business School 2

Abstract:

Brand equity has received considerable attention since the mid 1990s. This has been

driven partially by changes to international accounting standards relating to the reporting

of the financial value of intangible assets. More prominently, focus has turned to the

impact of marketing activity, and of marketing communication activity in particular, on

brand performance. Much of the academic debate has centered on conflicting definitions

of brand equity and on seeking ways to measure or quantify the value of equity.

Attention is now turning to the nature of equity and of factors that may threaten it. This

paper examines the potential impact of parallel importing on brand equity first by means

of literature reviews, and then by reporting the findings from a small scale exploratory

study involving depth interviews with brand managers whose brands have been affected

by this activity, and with senior executives in two discount retail chains in New Zealand,

who are using this type of marketing activity.

Key words

Parallel importing, grey marketing, marketing in New Zealand, retail marketing.

Research Memorandum 38 The University of Hull Business School 3

1. Introduction

Parallel importing may have a substantial impact on brand equity and values. The impact

of marketing communications activity on brand equity/values is receiving significant

attention, both as a result of changes to international accounting standards relating to the

reporting of the financial value of intangible assets, and as a result of increased focus on

the impact of marketing particularly marketing communication activity on brand

performance (e.g. Eagle and Kitchen, 2000). The marketing activity of parallel importers

falls outside the control of authorized distributors and may in fact not project images

consistent with those planned by the manufacturer and authorized distributor network. It

would important to determine whether the impact of parallel importing activity on brand

equity is positive or negative and what the magnitude of its impact might be.

2. Brand Equity Revisited

Brand valuation is not a new concept, but has focused in the past on financial

measurement for brand acquisition, franchising or royalty calculations. Feldwick (1996)

notes that, prior to the 1990s, the concept of brand image was seen as a vague theory,

primarily used when describing advertising objectives rather than converting prospects or

making sales. Perceptions changed when brands themselves started to change hands for

considerable sums. The difference between the balance sheet valuations and the price

paid for companies or brands was attributed to the value of brands. Brand equity thus

became the focus of many debates. Schultz and Gronstedt (1997) provide a more cynical

rationale for the focus on non-financial brand equity/values however this may be defined.

They assert (1997:9) that since we have so much difficulty relating marketing and

communications expenditure to returns, we must be doing something else .

Yoo and Donthu (2001), in reviewing recent brand equity research, note that there is

evidence that a products brand equity positively affects future profits, long-term cash

flow and a consumers willingness to pay premium prices. Dawar and Pillutla

(2000:215) acknowledge the potential value of brand equity but caution that it is fragile,

and not well understood because it is founded in consumers beliefs and can be prone to

large and sudden shifts outside of management control. Buchanan et al. (1999) highlight

a major aspect of brand vulnerability, noting that the retailer rather than the manufacturer

often controls a brands final presentation to customers.

The unexpected impact of this became evident in New Zealand after a move to legalize

parallel importing in mid 1998. The purpose of the law change was to "allow the New

Zealand consumer to benefit from lower prices for goods as a result of competition that

parallel importers were expected to provide to otherwise exclusive importers" (Ewart,

1998:2). Predictions of a 'flood' of cheap, designer products onto the market and threats

of trade sanctions by major international organizations (particularly those based in the

USA) were made (e.g. Rotherham, 1999). Neither appears to have occurred yet,

although some sectors such as sportswear and cosmetics/toiletries appear to have been

specifically targeted by parallel importers. Given the relative recency of the New

Zealand legislative changes, there is an opportunity to examine the impact of parallel

importing on brands in this market since its approval. Lessons learned can then be

Research Memorandum 38 The University of Hull Business School 4

applied to other markets, particularly those experiencing similar levels of market

freedom.

3. Gray Marketing/Parallel Importing Defined

Gray marketing/parallel importing has been a widespread international practice, and one

of concern to manufacturers and retailers since the mid 1980s (e.g. Baldo, 1985; Barlass,

1988; Mitchell, 1998). Estimates of the size of international 'gray' markets range from

$US7 billion to $US10 billion (Mathur, 1995). We are unable to locate any more recent

estimates of the market size. There is evidence of tensions between attempts to remove

any restrictions on the practice and attempts by organizations such as the European Union

to protect its members from its impact (e.g. Mitchell, 1998).

Parallel importing is not counterfeiting. However, the use of the term synonymously with

'gray marketing' suggests that there is something suspect about the practice. Duhan and

Sheffet (1998:75) suggest that 'gray' may imply an "almost black market. Gray

marketing involves the selling of trademarked goods through channels of distribution that

are not authorized by the trademark holders (Duhan & Sheffet, 1998:76). When gray

marketing occurs across markets, such as in an international setting, the term used most

commonly is parallel importing. It provides the opportunity for companies, usually

major retailing chains, to bypass official franchise holders or agents for particular, usually

high-priced, branded goods and to source them direct from overseas suppliers. It is only

illegal when gray market goods violate either product regulations or a licensing contract

for the trademark's use in a specific country, or where the trademark owner is based in the

country into which parallel imports are intended to be shipped. A non-licensed

distributor cannot use the brand trademark in the 'official' stylized trademark form other

than by a photograph of the label on the product or a photograph of the product itself if it

bears the logo (for example, the Nike 'swoosh').

The practice of parallel importing represents an uneasy balance between the protection of

intellectual property rights such as trademark and patent rights and the liberalization of

trade in goods and services promoted by organizations such at the World Trade

Organization (e.g. Bronkers, 1998). For gray markets to operate there must be a source

of supply, easy access from one market to another, and price differentials that are large

enough to make the venture financially viable. Much of the debate in the academic

literature centres on whether parallel importing is a legitimate response to discriminatory

pricing strategies or a free rider problem (see, e.g. Malueg & Schwartz, 1994). The

interviewees in this paper show that both sides of the debate are of relevance.

4. Perceived Benefits of Gray Marketing/Parallel Importing

In the international context, parallel export channels may assist in penetrating foreign

markets or in increasing overall market share (e.g. Mitchell, 1998). Domestically,

Tapsell (1998) reports the leading New Zealand parallel importer, the discount retail

chain 'The Warehouse' as being unequivocal about the future of the practice in boosting

growth prospects for the organization. This is consistent with Buchanan et al. (1999),

who conclude that retailers often prefer to display high equity brands in close proximity

to lesser or unknown brands in order to leverage the value of the high-equity brand across

Research Memorandum 38 The University of Hull Business School 5

other brands. Conversely, manufacturers who have built equity in their brands want them

to be displayed with brands of similar position and stature. Proximity to lesser or

unknown brands, they believe, may cause the consumer to question the brand (Buchanan

et al. (1999:345). Consumer may then also question the normal pricing structure for a

brand in its official retail outlets versus the often substantially lower price in parallel

importers outlets.

Protecting parallel importers is perceived as providing a check on the near monopoly held

by many large manufacturers, and as acting in the interests of consumers, resulting in

lower prices, better products and, in developing countries at least, a higher quality of life

(e.g. Chang, 1993). Indeed, much of the evidence to support the legalization of parallel

importing came from examination of cases where a small number of companies were

claimed to be extracting excessive profits from consumers (e.g. Davison, 1992).

Malueg and Schwartz (1994) support the view that parallel importing has arisen primarily

as a response to international price discrimination. They contend that consumers view

parallel imports as perfect substitutions for authorized goods. Tan et al. (1997) take a

slightly different view and suggest that parallel importing may represent an unusual

approach to market segmentation, with low-priced goods from parallel importers

generally not offering the same warranties as those (higher priced) goods available

through official channels. Risk-averse consumers will thus be prepared to pay higher

prices for the security of warranties and after sales service. Risk-preferring consumers

will purchase parallel imports in the knowledge that they do not have the same level of

security.

The New Zealand experience is somewhat different, with The Warehouse actively

promoting their own warranties for electronic products, arranged through independent

servicing contractors and/or a money back guarantee on all merchandise sold.

5. Perceived disadvantages of Gray Marketing/Parallel Importing

Consumers may purchase parallel imported trademarked goods without being aware of

the difference between these goods and those purchased through 'official' distribution

channels. If problems arise, and customers find that they do not get the expected post-

sale service and warranty protection, it may be the goodwill established by the 'official'

distributor/trademark owner which will suffer (see Krieger, 1985; Duhan and Sheffet,

1988).

Brands are rarely created by marketing communication activity alone, however

advertising and other related marketing communications activity help communicate and

position brands. Tan et al. (1997) and Michael (1998) claim that parallel importers gain a

free ride on the market demand and brand image of the product created by the authorized

distributor, without sharing in the marketing communications efforts and expenses which

have built the demand and associated image. Thus parallel importers are not concerned

with developing and expanding the market, but rather with acquiring a share of the

market developed by (and at the expense of) authorized channels.

Research Memorandum 38 The University of Hull Business School 6

It could, of course, be claimed that the authorized distributor also benefits from the

advertising and promotional activities undertaken by the parallel importer. However,

given that parallel importers, in New Zealand at least, promote their products primarily

on the basis of substantially lower prices, it is unlikely that such activity could in reality

be construed as aiding brand image.

Brand value lies in the ability of a brand to translate brand reputation and loyalties into

enduring profit streams. The realization of this has brought brand equity management

into focus, both as a result of changes to international accounting standards relating to

intangible assets, and a result of renewed focus on the impact of marketing

communication on brand performance (e.g. Eagle, 1999). This has led to increased focus

on the strategic integration of all elements of marketing communication in order to

provide clarity and consistency of communication messages.

However, the marketing communications activity of a parallel importer does not fall

within the coordination and control ambit of integrated brand communication. It is

possible that brand image communication may focus on quality while the marketing

communications of a parallel importer may focus on discount prices thus potentially

creating confusion and conflicting 'value' messages for the consumer and thus adversely

affecting the brand image. As a result, the future earnings potential of brand names

impacted by parallel imports may be seriously jeopardized (e.g. Maskulka and Gulas,

1987).

The practice of parallel importing, if seen as openly condoned by the manufacturer, may

strain manufacturer/'official' distributor relationships. Loss of goodwill may be

accompanied by a loss of marketing channel support as some official channel members

lessen promotional efforts put behind a product which is also parallel imported, cease to

promote it or perhaps drop it entirely.

Opponents of parallel importing suggest, in calling for the imposition of restrictions on

distribution, that selective distribution enables the guarantee of high levels of product and

service quality. Mitchell (1998) argues that such a stance is a specious argument if

customers want the 'better' service and advice provided by a specialist outlet, they will go

there artificially restricting distribution merely denies choice. He argues that marketers

who want to protect a brand's name and exclusivity should restrict production rather than

distribution!

Parallel importing, while broadening distribution, appears to have also assisted the

counterfeiting industry that pass fake goods off as parallel imports. It is illegal to parallel

import counterfeit or pirated goods, although liberalization of the parallel importing law

has made it more difficult to identify 'fakes'. The problem appears to be a massive one.

In New Zealand alone, Rotherham (1999) notes that NZ$15 million of fake goods

branded under the Microsoft name have been seized by Customs in the most recent

twelve months up from NZ$9 million for the previous year.

Research Memorandum 38 The University of Hull Business School 7

6. The Internet - The Ultimate Parallel Importing Channel

The Internet allows the opportunity for a wide range of products and services to be

purchased on-line, thus competing with traditional distribution channels. The growth of

virtual bookstores such as Amazon.com has been well documented. Of much more

concern though is the growth in on-line pharmacies, in other words - Internet sites that

write drug prescriptions without face-to-face medical evaluation for drugs such as Viagra,

Propecia, and a range of homeopathic remedies (e.g. West, 1998). This raises the

possibility of consumers gaining access to medications that would not necessarily be

available domestically. Wood and Rupright (1997) observe that the FDA is monitoring

such activity with a view to instituting some form of regulation. The ability of the

Internet to transcend national borders, coupled with difficulties in synchronizing

international laws makes international regulation a distant prospect.

Internet pharmacies are of particular concern in New Zealand but not the only Internet

operational concern. The Ministry of Health introduced new regulations in November

2000 to prohibit sales overseas of prescription medicines to individuals who do not have

a prescription from a New Zealand authorised prescriber. This extends the protection

already provided to New Zealand consumers to cover also overseas-based consumers.

This regulation links to the requirement of the Medical Council of New Zealand that the

doctor and patient must have met (face-to-face) on at least one occasion, and for the

patient to be under the care of that doctor. This action has been supported by the

Pharmaceutical Society of New Zealand who has banned at least one cyber-chemist from

practising as a pharmacist (through a physical location or a cyber-pharmacy) and

imposed substantial fines for breaching the Societys Code of Ethics, i.e. there is seen to

be a higher standard of behaviour expected of a pharmacist than merely what action is

legal (Booth, 2001).

Problems have arisen with other products and the use of the Internet to bypass

conventional distribution chains. Samiee (1998:16) reviews problems encountered by

recording companies who have attempted to compete with their established distribution

channels by distributing recordings over the Internet. He suggests that channel

intermediaries "must constantly economically justify their presence in the channel,

otherwise other channel members will eventually bypass the structure or develop their

own, more efficient channels and processes".

7. Moves to counter the Impact of Parallel Imports

Sookman (1990), somewhat idealistically, suggests that parallel importing can be

countered by implementing programmes to educate end users regarding the benefits of

purchasing from authorised resellers particularly with regard to after-sales service and

warranties. This is likely to be effective only where parallel importers offer no after-sales

support, and, as previously noted, the New Zealand experience indicates that the major

parallel importer of consumer goods is offering both support and a money back guarantee

in lieu of warranties.

Michael (1998) reports that more pragmatic solutions, such as reducing export prices to

authorized distributors have commonly been used to counter parallel imports. The main

Research Memorandum 38 The University of Hull Business School 8

problem encountered with this strategy appears to be that price discounts intended as a

temporary tactical measure have been perceived as a permanent strategy. Certainly, large

price increases in a previously purchased brand does much to facilitate cognitive

dissonance.

Tan et al. (1997) review a number of reactive and proactive strategies. These centre

primarily on pricing adjustments and on the restructuring of manufacturer/distributor

agreements in order to prohibit gray marketing/parallel importing. Thus, pricing

strategies include engaging in price wars and scaling down promotional activity to regain

cost advantages. The success of such strategies would of course be dependent on the

ability to withstand the loss of profits through a price war period and/or whether

competitors were able to capitalize on reduced promotional activity in order to grow

competing brands at the expense of embattled marketers.

Moves to cut supplies to parallel exporters have met with varied success largely

dependent on the terms of manufacturing and licensing contracts between the trademark

holder and offshore manufacturers and distributors. In spite of strategies to restrict/cut

off supplies and to counter parallel import activity through pricing and promotional

tactics, the phenomenon of parallel importing appears to be persistent and ongoing.

8. The Unanswered Questions

Despite this brief review of literature, there is little empirical research on parallel

importing or on its effects. The majority of the literature appears to be opinion-based

rather than providing objective critical analysis of the impact of the practice on brands,

markets, or market segments. Palia and Keown (1991) claim that, although parallel

importing does not appear harmful in the short term, both consumers and manufacturers

are adversely affected in the long term. However, they offer no empirical evidence for

this claim. Thus, in this paper, we seek to explore the phenomenon of parallel importing

from two likely different perspectives. Firstly, from the perspective of two discount retail

chains who are actively involved in this activity in New Zealand. Secondly, from the

perspective of brand/marketing managers who are striving to promote brands in an

official sense i.e. through authorized distribution channels.

9. Research Objectives and Method

This study reports on exploratory research undertaken to explore two related objectives:

a) to explore perceptions of parallel importing among senior

marketing executives with responsibility for the 'official'

marketing and distribution of brands which have also been

parallel imported into New Zealand, and among senior

executives within two retail chains actively involved in parallel

import activity; and

b) to determine what actions, if any, have been taken to counter the

impact of parallel imported goods on the 'official' distributors,

and what success is claimed for these actions.

Research Memorandum 38 The University of Hull Business School 9

9.1 Method

Parallel importing activity can be divided into three main categories: consumer goods,

alcoholic beverages, and industrial products. The experiences of brand managers and

organizations involved in the first category are examined in this working paper. The

second category alcohol is carried within specific and smaller scale specialist stores.

The third category concern with industrial products, is irrelevant when dealing with

retail organizations. However, we do intend to revisit these other categories at a later

date.

15 in-depth depth interviews, ten face-to-face and five by telephone, were conducted with

marketing managers/directors identified as being responsible for the official marketing

of consumer brands that had also been parallel imported into New Zealand. The rationale

for either interview form was governed by management availability. In-depth interviews

were also conducted with senior executives of the (current) two major retail chains

actively involved in parallel import activity of consumer goods, and with executives from

a further three major retail chains impacted by this activity.

Irrespective of interview type, an interview schedule was used, with open-ended

questions used to determine perceptions on the issues identified in the above objectives.

The use of open-ended questions allowed respondents to structure the topic themselves

rather than follow a narrower perspective that would be forced by closed-ended

questions. Responses were fully tape-recorded, transcribed, and then categorized and

compared to identify common themes. Wherever possible, common themes and patterns

are related back to the literature, allowing a measure of generalisability from the findings,

although in a more restricted form than more traditional, randomly sampled surveys

(Sarantakos, 1998). Use of the interview form limits the findings of the paper to those

interviewed, and cannot be extended to wider populations, though of course they may

have ramifications of interest to brand/marketing managers, and to organizations involved

in, or impacted by, parallel importing activity.

10. Research Findings

The research findings are presented as follows. Firstly, we present findings from the two

major retail chains involved in extensive parallel importing activity (see Section 11.1)

then we report the findings from 15 marketing/brand managers in the official marketing

domain whom we interviewed. To some degree, we combine these findings with those

from the three retailers involved in the official marketing process.

10.1 Consumer Goods: The Retailers/Parallel Importers

Both Deka and The Warehouse are discount department stores. The Warehouse has 67

stores throughout New Zealand and recorded 1998 sales of NZ$750 million; 1999 sales

of NZ$933 million and 2000 sales of NZ$1,075. They accounted for 99% of the growth

in department store sales and achieved a market share (department store sales) of 36% in

1998 (source: The Warehouse Group Ltd Annual Reports, 1998 2000). Deka has 60

stores. Neither sales data nor market share data are available for Deka, though industry

estimates place their turnover as being approximately half of that of The Warehouse. The

Research Memorandum 38 The University of Hull Business School 10

two chains together can therefore be assumed to account for approximately half of the

sales in the department store sector.

There are differences between the philosophies of the two chains, in terms of their

strategies for parallel imports. Deka adopt what they term a considered approach,

having extensively researched overseas market trends prior to commencing parallel

importation. The practice for them constitutes just a small part of the business, being

used primarily to complement their existing product range. The Warehouse has taken a

far more aggressive approach, epitomized by the following extract from their 1998

Annual Report, p.11, as pointed out by the executive we interviewed.

"Parallel importing opens up a number of exciting new opportunities for growth. We can now

import directly from overseas if we cannot agree on satisfactory terms with local distributors. For

our customers, it means that the 'brand tax' inherent in some branded products will be reduced

thus allowing us to continue to ensure that our customers come first".

Given the discount store status of Deka and The Warehouse, New Zealand distributors

have made a number of consumer brands unavailable to these chains in the past. Both

interviewees noted that, since they began to parallel import many of these brands, several

distributors have reconsidered the situation and have offered more products to them.

The Deka interviewee acknowledged a certain amount of free rider effect. He contended

that authorized distributors are seen as having historically created 'a rod for their own

backs' because of their restrictive distribution policies regarding who could stock certain

products/brands, and because of excessive price markups "parallel importing has

[thus] made them review the quantum".

The Warehouse interviewee suggested that the reality is that companies create brand

demand and by means of effective marketing and communications they assist retailers in

fulfilling the brand promise and grow market share. But, from his perspective, even if

parallel imports take place via The Warehouse, in all cases, the brand owner receives the

requisite royalties therefore our interviewee claimed that parallel import retailers are

not riding on the back of others efforts. The interviewee acknowledged that this may

seem cold comfort for official brand controllers whose promotional budgets are based on

sales only through official distribution channels. Thus from the Warehouse perspective,

any gains in market share via parallel importers will see a corresponding reduction in

funds available for brand reinvestment by official brand controllers via their promotional

activity (as an aside, interviews with brand controllers confirmed these somewhat

pessimistic comments, though unsupported by provision of detailed quantitative

evidence).

The Warehouse interviewee pointed out that in his view, discriminatory pricing was not

seen as a deliberate international policy by brand controllers. Indeed, exchange rate

fluctuations were seen as presenting greater problems in maintaining profit levels. For

New Zealand, there was demonstrably a lack of strong domestic price competitiveness,

evidently operating in larger markets. This, in itself, provided a form of umbrella under

which parallel importing particularly for discount retailers becomes a well-nigh

Research Memorandum 38 The University of Hull Business School 11

irresistible activity particularly when distributors debarred discount retailers from

accessing certain brands.

Interviewees at both companies claim to treat parallel imported products as lead lines, but

not as loss leaders. While they endeavour to make profits on parallel import sales, such

profits were claimed to be not as high as for products sourced through conventional

channels. Pragmatically, both chains acknowledge a preference for dealing with New

Zealand distributors who then must deal with issues such as inventory control. The

criteria used in both The Warehouse and Deka for assessing potential imports are

consistency of quality, continuity of supply, brand names, realistic pricing, and stock that

is likely to move quickly. Not considered are one-off lots, unknown brands, and

quantities that would be unrealistic for the size of the New Zealand market. In achieving

successful importation, relationship building with official distributor sources is perceived

to be important. Several important caveats apply trademark ownership and clean paper

trails are seen as essential including making sure that the people selling the product are

legally entitled to do so. These factors imply that parallel importing at least from these

two company perspectives is not the preferred method of dealing with distributors.

According to the respondents, in most cases, dealing with established brand controllers is

preferred.

Parallel importing has, however, opened the door to source other products compatible

with the chains' product ranges in selected sectors. For example, Deka has imported a

number of household linen lines from the American 'Martha Stewart' label, which have

not previously been available in this country. Generally, these are not international

brands, but rather retailer house brands. The same distributors who organise parallel

imports often handle these products. Such products must meet the same criteria as apply

to parallel imports. Both chains believe that consumers have gained significantly in

specific areas. Deka suggest that consumers are "entitled to the best product at the best

price", however they caution "that it is always caveat emptor". The Warehouse notes that

much of their parallel imported stock are outgoing models (about to be replaced by new

models). They criticise suppliers for complacency and a tendency to "wait until

something happens to make them change their methods". To illustrate this, they suggest

that official distributors can always get first releases and could pre-empt The Warehouse

strategies by using more aggressive marketing strategies such as "trade in your old

model.".

Thus, for both retailers, parallel importing activity is caused by certain environmental

forces, usually associated with negative but specific distributor marketing activities; the

opportunity for sourcing brands overseas; the purchase of brands at low prices; and

passing these prices onto consumers albeit with lower profit margins, and in some cases

using parallel imports as loss leaders. It is interesting to note that even for Deka and The

Warehouse, the evident preference for dealing with distributors directly. There is also a

nagging suspicion that building market share from a discount retail chain perspective,

invariably means acting to a limited degree of course, outside the normal channels to

some extent.

Research Memorandum 38 The University of Hull Business School 12

10.2 Interviews with Brand Owners/Official Retailers

Based on the transcribed interviews, it was difficult to pick out common themes as

experiences were variable across the 15 interviewees. Several interviews (9) noted

significant losses in sales (up to 30%) as a direct result of parallel importing. Others,

generally concerned with changing technology or fashion, reported minimal impact.

However, all interviewees believed that parallel importing of their brands into discount

retail stores was negatively impacting, or had the potential to impact on brand equity.

Major concerns related to the lowering of prestige images by the brands' placement in

what the brand controllers perceived to be incompatible retail environments. Some

concern was expressed regarding inferior quality brands (i.e. of standards below that

which were set for officially distributed product) being brought in by the parallel

importers. The overall consensus was that these two factors would detract from their

brands' quality perceptions. Of major note, however, is that of the official brand

controllers at least in New Zealand, had conducted any research (either quantitatively or

qualitatively) to measure the impact of parallel importing activity, relying instead on

informal feedback from retailers and, in some instances, from consumers.

Concerns were noted that, in the case of electrical and electronic goods, parallel imported

products (it is alleged) did not appear to be accompanied by the normal certificates of

compliance with New Zealand electrical and radiation regulations that are required by the

Ministry of Commerce. Such certification is a normal cost of production for products

sourced for the New Zealand market through official channels. When this was queried

with the New Zealand Commerce Commission, the organization charged with overseeing

the investigation of breaches of much of the consumer protection legislation, the response

was that such activity would become an issue for them only if the parallel imported stock

was represented as having been checked for compliance when it had not, or that it met

New Zealand safety standards when it did not. Thus, the New Zealand Commerce

Commission would investigate behaviour that was held to be misleading and deceptive

conduct or which constituted false representation under the Fair Trading Ac, (1986), Part

I, Sections 10 & 13. It would appear that there might be a potential consumer safety issue

that requires further investigation to verify the extent of any potential for serious harm

and to determine what regulatory or legislative action might be appropriate.

Based on the interviews, official brand controllers varied widely in terms of their

attempts to counter parallel imports (see Table 1 below), from attempting to re-establish

original price points to aggressively countering with an integrated marketing strategy

aimed at making specific brands unattractive for parallel importers. Several brand

owners expressed concern that parallel imports had originated from within their own

international organization, stemming largely from inventory control/excess stock

problems. Others expressed disappointment that their international controllers had not

been proactive in assisting their endeavours to prevent further 'attacks'. Others reported

rapid and effective synchronized international action to locate the source of parallel

imported product and to prevent future imports.

Research Memorandum 38 The University of Hull Business School 13

Table 1: Brand Owners/Controllers' Intended Marketing Reaction to Counter the

Impact of Parallel Importing on Their Brands

Intended Action/Re-action

Respondents

No %

Develop ability to stop future parallel import

activity from occurring

1

6

Insure tighter international controls in place to

minimize future parallel import 'attacks'

2

13

No action anticipated problem stems from

company's own inventory control internationally

3

21

Aggressive marketing reaction planned to counter

parallel imports each time they are introduced

2

13

Increased promotion of 'value added' official

product packages to counter 'basic' parallel imported

offering

3

21

No major action intended/reestablish original price

points

2 13

Unsure 2 13

Total 15 100%

From Table 1 it can be assumed that official marketing reaction to parallel importing

activity is likely to be just as variable as the activities pursued by parallel importers.

Thus, there would be appear to be no consistent or coherent strategies pursued by official

brand owners/managers or distributors when faced with parallel importing.

Reactions from the retailers of official brands was just as varied. Obviously, none

welcomed the competition which parallel imports have introduced. Most of the brand

owners in the previous section indicated that their retailers were concerned, and might

reduce promotional support if the practice continued, but were not likely to take drastic

action unless their profits were seriously impacted in the long term. However, two of

the retail chain executives interviewed who had been affected by the activity of parallel

importers indicated that they will reduce promotional support of affected brands; and that,

if the products continue to be subject to parallel importing, they will drop the brands

entirely. In New Zealand, this would leave these brands available only through parallel

imported sources, with potentially serious adverse effects on brand equity and

profitability.

All three interviewees indicated that generally, the more proactive brand owners were in

their strategies for countering parallel importing, and the closer they were involved in

both defence and counter-attacking manoeuvres, the less likely they were to consider

reducing brand support. One interesting aside here was that all three official distributors

flagged the possibility that, should the practice continue, they would not rule out

becoming involved directly in parallel importing themselves in order to be able to

compete.

For these official retailers, discriminatory pricing was not seen as a deliberate tactic by

brand owners. All three cited New Zealand's weak exchange rate relative to major

international currencies, freight costs from the point of manufacture, and /or government

Research Memorandum 38 The University of Hull Business School 14

imposed duty and goods and services taxes (the latter two making up to 50% of the retail

price of some products) as the main reasons for the price differentials between New

Zealand and markets such as the USA and Australia. Notably, these findings bore

significant resemblance to those from official brand controllers (14) who also cited the

same factors (see Table 2 below):

Table 2: Brand Owners Perceptions of Whether International Price

Discrimination Drives Parallel Importing

Factors driving parallel importing Respondents

No. %

Respondents who disagree that international price discrimination is a major factor

- NZ pricing is similar to Australia/other markets

but may be impacted by exchange rates

6

40

- Price differences due to duties/GST 2 13

- Price differences are due to New Zealand small

volumes

5

33

- Price differentials are due to transport costs 1 7

Respondents who agree that that international price discrimination is a major

factor in driving parallel importing

- NZ pricing is not competitive needs more

competition

1 7

Total 15 100

Thus, of 15 brand controllers, 14 indicate that international price discrimination is not a

major factor in opening the door for parallel importing. Only one brand owner indicated

that price competition in New Zealand is not competitive.

All brand owners and the official retailers supported the notion that parallel importers

gain a free ride on market demand and brand image generated by the official brand

controllers. They noted that only high profile brands, and generally key models/lines

within brands, are targeted. They also cautioned that brands could be destroyed in the

long-term because declining sales through official channels would result in declining

promotional support. If this was coupled with reduced support at the retail level, there

would be a point at which a brand might become uneconomic for the official agent and/or

the retailers to stock. Several respondents referred to brands whose distribution had been

taken over by one of the discount store chains in recent years and which had since ceased

to exist.

Marketing communication by the parallel importers was also seen as a major concern,

being entirely price based, although one respondent noted that, while they believed that

The Warehouse added no value to their brand, neither did most official retailers.

However, almost all respondents as a major concern noted the negative impact of

conflicting 'value' and brand image messages.

11. Discussion

Based on the preceding findings, several issues are raised relating to parallel importing.

A major issue concerns consumers. Are consumers being deliberately kept uninformed,

Research Memorandum 38 The University of Hull Business School 15

or being misled, regarding brands they may perceive as 'normal' i.e. brands that are well

recognized and which are simply available at a special price? Does potential exist for

potentially unsafe brands to be sold or for brands that may vary in terms of quality

expectations? Can average consumers identify potential risks? It would seem that, as

already discussed for electrical and electronic products, there might be a potential

consumer safety issue that requires further investigation to verify the extent of any

potential for serious harm and to determine what regulatory or legislative action might be

appropriate.

Given these consumer issues, governmental intervention may be required not to protect

official distributors, but to inform and educate consumers. For example, Fisher (1999)

recommended a number of consumer protection legislative amendments, largely directed

at ensuring that all parties have full information about parallel imported products. These

amendments included:

- clear labelling of all parallel imported goods. He notes that this recommendation

was made in the NZIER (1998:19) report prior to the law change that permitted

parallel importing, i.e. where "quality differences could arise, appropriate

labelling of the product as originating in the authorized or unauthorized channel

should overcome [any] difficulties" (brackets added).

- disclosure to customers of parallel importers and their distributors that they are

not authorized dealers and that the product is not sourced through authorized

channels and that therefore parallel importers and imports may not offer the

same guarantee.

Although these recommendations were not taken seriously at that time, they could, in

tandem with a review of potential safety issues noted above, appear to warrant further

investigation.

Table 3 (on the following page) summarises the factors which appear, from this

exploratory study, to affect the success or otherwise of parallel import activity as seen

from the perspective of the parallel importers:

Research Memorandum 38 The University of Hull Business School 16

Table 3: Factors Affecting the Success of Parallel Import Activity

Marketing

Factor

Most Successful When: Least Successful When:

Product - parallel imported brand is positioned /

perceived as directly substitutable for

official brand

- quality inferred as being equivalent

or consumer is unable (or not given

information to allow them) to

differentiate between the parallel

imported and the official brand

- parallel imported brand is seen as being old

stock/out of fashion/out of date

- quality of parallel product is perceivably

inferior to the official brand

Price - parallel imported brand is at a

substantially lower price (half to a third

off the price of the official brand)

- parallel brand price differential is minimal

- 'value added' by official distributors prevents

direct product/price comparison

Promotion - promotional activity centres on image

rather than on complexity of technology

- promotional activity centres on

technology/continual improvement/rapidly

changing technology or the requirement of

expert knowledge by retail staff

Distribution - no defensive action is undertaken with

by the brand owner/controller in

conjunction with official retailers

- aggressive defensive action to counter parallel

imported product is undertaken by the brand

owner/controller in conjunction with official

retailers

12. Conclusion: The Potential Brand Equity/Valuation Impact

From this exploratory study, it is unclear whether consumers will be ultimately better or

worse off, both in the short and longer term, when allowing for the consumer safety and

information issues identified earlier. What is also unclear is the impact on the perception

of, and ultimately the value, of brands that are impacted by parallel marketing activity.

As we noted in the literature review section of this paper, brand values and valuations are

now receiving considerable attention. For example, Interbrand is a major supplier of

brand valuation services. The methodology used by Interbrand to calculate brand value

includes financial analysis of brand earning, analysis of the market and key drivers, and

analysis of risk factors impacting on brand strength. Risk factors include trend analysis

of market stability and brand loyalty. Other factors considered include the strength of

market share, international acceptance and appeal, consistent investment in and focussed

support of the brand, and the basis of legal protection such as trademarks (see, e.g.

Andrew, 1997).

As we have seen, parallel importing has the potential to substantially impact many of

these factors and thus to negatively impact brand valuations. Where brand value is

included on the balance sheet, or as a note included with balance sheet data, a decline in

brand valuation could signal a drop in shareholder value and thus investor attractiveness.

This exploratory study has revealed some facets of parallel importing which has the

potential to negatively impact on brand equity and brand value. These facets are,

Research Memorandum 38 The University of Hull Business School 17

however, reported in different ways by retailers involved in parallel importing, and brand

owners, controllers, and official distributors. The real benefits or risks associated with

parallel importing now need to be explored in far more widely ranging studies, probably

exploring these issues from an international if not a multinational perspective. Certainly,

there also appear to be benefits and risks from a consumer perspective also. The triad of

legislators, businesses (for and against parallel importing), and the consumers they seek

ostensibly to serve, are all key constituencies wherein further research is required.

References

Andrew, D. (1997). "Brand Strength Analysis" in Perrier, R. (ed) Brand Valuation (3

rd

ed.) Premier Books, London.

Baldo, A. (1985). "Score one for the gray market". Forbes, 135 (4), February 25, 1985,

p. 4.

Barlass, S. (1988). "Gray marketing war escalates". Marketing News, 26 September

1988, pp. 8 9.

Blackston, M. (2000). Observations: Building Brand Equity by Managing the Brands

Relationships. J ournal of Advertising Research, Nov/Dec., pp. 101 105.

Booth, H. (2001). Correspondence regarding disciplinary action against a New Zealand

cyber-pharmacy from Deputy Registrar, Pharmaceutical Society of NZ.

Bronckers, M.C.E.J . (1988). "The exhaustion of patent rights under WTO laws".

Journal of World Trade, October 1998, pp. 137 159.

Buchanan, L., Simmons, C.J . & Bickart, B.A. (1999). Brand Equity Dilution: Retailer

Display and Context Brand Effects. Journal of Marketing Research, Vol. XXXVI, pp.

345 355.

Cavusgil, S.T. & Sikora, E. (1988). "How multi-nationals can counter gray market

imports". Columbia Journal of World Business, Vol 23, Winter, pp. 75 85.

Chang, Tung Zong (1993). "Parallel importing in Taiwan. A view from a newly

emerged country and a comparative analysis". International Marketing Review, 10 (6).

pp. 30 41.

Consumer Guarantees Act (1993), New Zealand.

Davison, M.J . (1992). "The market for sound recordings: open or closed". Australian

Business Law Review, February 1992, pp. 30 40.

Research Memorandum 38 The University of Hull Business School 18

Dawar, N. & Pillutla, M.M. (2000). Impact of Product-Harm Crises on Brand Equity:

The Moderating Role of Consumer Expectations. Journal of Marketing Research, Vol.

XXXVII, pp. 215 226.

Duhan, D.F. & Sheffert, M.J . (1988). "Gray markets and the legal status of parallel

importing". Journal of Marketing, Vol. 52 (J uly 1988). pp. 75 83.

Eagle, L. C. & Kitchen, P.J . (2000). "Building Brands or Bolstering Egos? A

Comparative Review of the Impact and Measurement of Advertising on Brand Equity".

Journal of Marketing Communications, Vol. 6 (2), pp. 91 106.

Ewart, D. (1998). "Parallel Importing Threat or Opportunity?" Presentation to

Employers and Manufacturers' Association Seminar on Parallel Importing, Auckland, 20

November 1998 by partner in Courtney Ewart (legal practice).

Fair Trading Act (1986), New Zealand.

Feldwick, P. (1996). What is Brand Equity anyway and how do you measure it?

Journal of the Market Research Society, 18 (2), April 1996, pp. 85 104.

Fisher, S. (1999). The Impact of Parallel Importing on Consumer Law. Bachelor of

Laws (Hons) Dissertation, The University of Auckland.

Krieger, R.H. & Tansuhaj, P.S. (1988). "Gray marketing. Not all black and white".

Marketing News 19 (18). 30 August 1988, p. 7.

Malueg, D.A. & Schwartz, M. (1994). "Parallel imports, demand dispersion and

international price discrimination". Journal of International Economics, Vol. 37, pp.

167 195.

Maskulka, J .M. & Gulas, C.S. (1987). "The long-term dangers of gray-market sales".

Business, Vol.37, J an-Mar, pp. 25 31.

Mathur, L.M. (1995). "The impact of international gray marketing on consumers and

firms". Journal of Euro-marketing, Vol. 4, No.2, pp. 39 59.

Michael, J . (1998). "A supplemental distribution channel? The case of US parallel

export channels". Multinational Business Review, Spring 1998, pp. 24 35.

Ministry of Health (2000). New Regulations Controlling Internet Drug Sales. Press

Release 2 November 2000, Ministry of Health, Wellington.

Mitchell, A. (1998). "Customer rights a gray area in distribution ban". Marketing Week,

J uly 23, 1998, pp. 30 31.

Research Memorandum 38 The University of Hull Business School 19

NZ Institute of Economic Research (1998). Parallel Importing. A theoretical and

empirical investigation. Report to Ministry of Commerce, Working Paper 98/4. NZ

Institute of Economic Research, Wellington.

Palia, A.P. & Keown, C.F. (1991). "Combating parallel importing views of US exporters

to the Asia-Pacific region". International Marketing Review, Vol. 8 (1), pp. 47 56.

Picard, J . (1996). "The legality of international gray marketing. A comparison of the

position in the United States, Canada and the European Union". Canadian Business Law

Journal, 26, pp. 422 436.

Rotherham, F. (1999). "Prophets of parallel importing doom proved wrong". The

Independent, 10 March 1999, pp. 24 25.

Samiee, S. (1998). "The Internet and international marketing: Is there a fit?" Journal of

Interactive Marketing, Vol.12 No. 4, autumn 1998, pp. 5 21.

Santakos, S. (1998) Social Research, Macmillan Press, Basingstoke, 2

nd

edition.

Schultz, D.E. & Gronstedt, A. (1997). Making Marcom an Investment. Marketing

Management, 6(3), Fall 1997, pp 40 49.

Sookman, B. (1990). "Can gray marketing be stopped?" Computing Canada. 16 (4).

p.48.

Tan, S.J ., Lim, G.H. & Lee, K.S. (1997). "Strategic responses to parallel importing".

Journal of Global Marketing, 10 (4). pp. 45 66.

Tapsell, S. (1998). "The Deloitte/Management Executive of the Year". Management,

December 1998, pp. 32 33.

The Warehouse Group Limited Annual Report (1998).

Weigard, R.E. (1991), "Parallel import channels options for preserving territorial

integrity". Columbia Journal of World Business, Spring 1991, pp. 53 60.

West, D. (1998). "On-line prescriptions have adverse reactions". Pharmaceutical

Executive, 18 (11) November, p.28.

Wood, J . & Rupright, P. (1997). "Erosion of the learned intermediary rule".

Pharmaceutical Executive, 17 (10) October, pp. 104 110.

Yoo, B. & Donthu, N. (2000). Developing and Validating A Multidimensional

Consumer-Based Brand Equity Scale. Journal of Business Research, Vol. 52, pp. 1

14.

Research Memorandum 38 The University of Hull Business School 20

Research Memoranda published in the HUBS Memorandum Series

Please note that some of these are available at:

http://www.hull.ac.uk/hubs/research/memoranda

Marianne Afanassieva (no. 37 2003)

Managerial Responses to Transition in the Russian Defence Industry

J os-Rodrigo Crdoba-Pachn and Gerald Midgley (no. 36 2003)

Addressing Organisational and Societal Concerns: An Application of Critical Systems

Thinking to Information Systems Planning in Colombia

*J oanne Evans and Richard Green (no. 35 2003) (Part of the Hull Economics Research

Paper Series: 284)

Why did British Electricity Prices Fall After 1998?

Christine Hemingway (no. 34 2002)

An Exploratory Analysis of Corporate Social Responsibility: Definitions, Motives and

Values

Peter Murray (no. 33 2002)

Constructing Futures in New Attractors

Steven Armstrong, Christopher Allinson and J ohn Hayes (no. 32 2002)

An Investigation of Cognitive Style as a Determinant of Successful Mentor-Protg

Relationships in Formal Mentoring Systems

Norman O'Neill (no. 31 2001)

Education and the Local Labour Market

Ahmed Zakaria Zaki Osemy and Bimal Prodhan (no. 30 2001)

The Role of Accounting Information Systems in Rationalising Investment Decisions in

Manufacturing Companies in Egypt

Andrs Meja (no. 29 2001)

The Problem of Knowledge Imposition: Paulo Freire and Critical Systems Thinking

Patrick Maclagan (no. 28 2001)

Reflections on the Integration of Ethics Teaching into the BA Management Degree

Programme at The University of Hull

Norma Romm (no. 27 2001)

Considering Our Responsibilities as Systemic Thinkers: A Trusting Constructivist

Argument

L. Hajek, J . Hynek, V. J anecek, F. Lefley, F. Wharton (no. 26 2001)

Manufacturing Investment in the Czech Republic: An International Comparison

Gerald Midgley, J ifa Gu, David Campbell (no. 25 2001)

Dealing with Human Relations in Chinese Systems Practice

Zhichang Zhu (no. 24 2000)

Dealing With a Differentiated Whole: The Philosophy of the WSR Approach

Wendy J . Gregory, Gerald Midgley (no. 23 1999)

Planning for Disaster: Developing a Multi-Agency Counselling Service

Luis Pinzn, Gerald Midgley (no. 22 1999)

Developing a Systemic Model for the Evaluation of Conflicts

Gerald Midgley, Alejandro E. Ochoa Arias (no. 21 1999)

Unfolding a Theory of Systemic Intervention

Mandy Brown, Roger Packham (no. 20 1999)

Organisational Learning, Critical Systems Thinking and Systemic Learning

Gerald Midgley (no. 19 1999)

Rethinking the Unity of Science

Paul Keys (no. 18 1998)

Creativity, Design and Style in MS/OR

Gerald Midgley, Alejandro E. Ochoa Arias (no. 17 1998)

Visions of Community for Community OR

Gerald Midgley, Isaac Munlo, Mandy Brown (no. 16 1998)

The Theory and Practice of Boundary Critique: Developing Housing Services for

Older People

J ohn Clayton, Wendy Gregory (no. 15 1997)

Total Systems Intervention of Total Systems Failure: Reflections of an Application of

TSI in a Prison

Luis Pinzn, Nstor Valero Silva (no. 14 1996)

A Proposal for a Critique of Contemporary Mediation Techniques The

Satisfaction Story

Robert L Flood (no. 13 1996)

Total Systems Intervention: Local Systemic Intervention

Robert L Flood (no. 12 1996)

Holism and the Social Action 'Problem Solving'

Peter Dudley, Simona Pustylnik (no. 11 1996)

Modern Systems Science: Variations on the Theme?

Werner Ulrich (no. 10 1996)

Critical Systems Thinking For Citizens: A Research Proposal

Gerald Midgley (no. 9 1995)

Mixing Methods: Developing Systems Intervention

J ane Thompson (no. 8 1995)

User Involvement in Mental Health Services: The Limits of Consumerism, the Risks of

Marginalisation and the Need for a Critical Approach

Peter Dudley, Simona Pustylnik (no. 7 1995)

Reading the Tektology: Provisional Findings, Postulates and Research Directions

Wendy Gregory, Norma Romm (no. 6 1994)

Developing Multi-Agency Dialogue: The Role(s) of Facilitation

Norma Romm (no. 5 1994)

Continuing Tensions Between Soft Systems Methodology and Critical Systems

Heuristics

Peter Dudley (no. 4 1994)

Neon God: Systems Thinking and Signification

Mike J ackson (no. 3 1993)

Beyond The Fads: Systems Thinking for Managers

Previous Centre for Economic Policy Research Papers

J oanne Evans and Richard Green (no. 284/35 J anuary 2003)

Why did British Electricity Prices Fall after 1998?

Naveed Naqvi, Tapan Biswas and Christer Ljungwall (no. 283 J uly 2002)

Evolution of Wages and Technological Progress in Chinas Industrial Sector

Tapan Biswas, J olian P McHardy (no. 282 May 2002)

Productivity Changes with Monopoly Trade Unions in a Duopoly Market

Christopher Tsoukis (no. 281 J anuary 2001)

Productivity Externalities Tobins Q and Endogenous Growth

Christopher J Hammond, Geraint J ohnes and Terry Robinson (no. 280 December 2000)

Technical Efficiency Under Alternative Regulatory Regimes: Evidence from the Inter-

War British Gas Industry

Christopher J Hammond (no. 279 December 2000)

Efficiency in the Provision of Public Services: A Data Envelopment Analysis of UK

Public Library Systems

Keshab Bhattarai (no. 278 December 2000)

Efficiency and Factor Reallocation Effects and Marginal Excess Burden of Taxes in

the UK Economy

Keshab Bhattarai, Tomasz Wisniewski (no. 277 Decembe 2000)

Determinants of Wages and Labour Supply in the UK

Taradas Bandyopadhay, Tapan Biswas (no. 276 December 2000)

The Relation Between Commodity Prices and Factor Rewards

Emmanuel V Pikoulakis (no. 275 November 2000)

A Market Clearing Model of the International Business Cycle that Explains the

1980s

J olian P McHardy (no.274 November 2000)

Miscalculations of Monopoly and Oligopoly Welfare Losses with Linear Demand

J olian P McHardy (no. 273 October 2000)

The Importance of Demand Complementarities in the Calculation of Dead-Weight Welfare

Losses

J olian P McHardy (no. 272 October 2000)

Complementary Monopoly and Welfare Loss

Christopher Tsoukis, Ahmed Alyousha (no. 271 J uly 2000)

A Re-Examination of Saving Investment Relationships: Cointegration, Causality and

International Capital Mobility

Christopher Tsoukis, Nigel Miller (no. 270 J uly 2000)

A Dynamic Analysis of Endogenous Growth with Public Services

Keshab Bhattarai (no. 269 October 1999)

A Forward-Looking Dynamic Multisectoral General-Equilibrium Tax Model of the UK

Economy

Peter Dawson, Stephen Dobson and Bill Gerrad (no. 268 October 1999)

Managerial Efficiency in English Soccer: A comparison of Stochastic Frontier

Methods

Iona E Tarrant (no 267 August 1999)

An Analysis of J S Mills Notion of Utility as a Hierarchical Utility Framework and the

Implications for the Paretian Liberal Paradox

Simon Vicary (no. 266 J une 1999)

Public Good Provision with an Individual Cost of Donations

Nigel Miller, Chris Tsoukis (no. 265 April 1999)

On the Optimality of Public Capital for Long-Run Economic Growth: Evidence from

Panel data

Michael J Ryan (no. 264 March 1999)

Data Envelopment Analysis, Cost Efficiency and Performance Targetting

Michael J Ryan (no. 263 March 1999)

Missing Factors, Managerial Effort and the Allocation of Common Costs

www.hull.ac.uk/hubs

the Business School

ISBN 1 902034 317

You might also like

- Ali Express Drop Shipping Guide BonusDocument39 pagesAli Express Drop Shipping Guide BonusWeb Development Labs50% (2)

- How To Open A Pharmacy in PakistanDocument7 pagesHow To Open A Pharmacy in PakistanGulzar Ahmad Rawn73% (15)

- Saga Book XXXDGDGDGDGDDocument152 pagesSaga Book XXXDGDGDGDGDSal Ie EmNo ratings yet

- Multiple Assessment Portfolio PDFDocument36 pagesMultiple Assessment Portfolio PDFThuyDuong80% (5)

- Marketing StrategiesDocument21 pagesMarketing StrategiesMara MateoNo ratings yet

- The Physics of God and The Quantum Gravity Theory of EverythingDocument186 pagesThe Physics of God and The Quantum Gravity Theory of Everythingjrredford100% (1)

- 13 International Market Segmentation Issues and PerspectivesDocument29 pages13 International Market Segmentation Issues and PerspectivesCarolina AlvarezNo ratings yet

- Turbo Tech 101 (Basic) : How A Turbo System WorksDocument6 pagesTurbo Tech 101 (Basic) : How A Turbo System Workscogit0No ratings yet

- Global ProcurementDocument14 pagesGlobal Procurementtyrone_yearwoodNo ratings yet

- The Competitive Power of the Product Lifecycle: Revolutionise the way you sell your productsFrom EverandThe Competitive Power of the Product Lifecycle: Revolutionise the way you sell your productsNo ratings yet

- Customer Satisfaction, Relationship Marketing and Service QualityDocument18 pagesCustomer Satisfaction, Relationship Marketing and Service QualitySreerag GangadharanNo ratings yet

- MBA Research Topics 4th Sem 2020Document14 pagesMBA Research Topics 4th Sem 2020raj33% (3)

- Threats and Opportunities of Private LabelsDocument5 pagesThreats and Opportunities of Private Labelscamipavel2003No ratings yet

- Module 3. Modern Theories of International TradeDocument9 pagesModule 3. Modern Theories of International TradePrince CalicaNo ratings yet

- International Pricing StrategyDocument16 pagesInternational Pricing StrategyJobeer DahmanNo ratings yet

- 0521772524Document352 pages0521772524Samuel RyanNo ratings yet

- Online Buying vs. Traditional BuyingDocument16 pagesOnline Buying vs. Traditional BuyingAlexandra Maxin Serrano100% (2)

- Branding Challenges and OpportunitiesDocument2 pagesBranding Challenges and Opportunitiesstandalonemba75% (8)

- Final PresentationDocument97 pagesFinal PresentationNaaman BangalanNo ratings yet

- Parking Generation 4th EditionDocument30 pagesParking Generation 4th EditionRadu Terioiu0% (1)

- FINAL ContemporaryDocument36 pagesFINAL Contemporaryelie lucidoNo ratings yet

- A Market and Network Based Model For Retailers' Foreign Entry StrategiesDocument16 pagesA Market and Network Based Model For Retailers' Foreign Entry StrategiesrosesaimeNo ratings yet

- Brand Equity, Brand Preference, and Purchase IntentDocument17 pagesBrand Equity, Brand Preference, and Purchase IntentfutulashNo ratings yet

- International Economics 6th Edition James Gerber Solutions Manual 1Document7 pagesInternational Economics 6th Edition James Gerber Solutions Manual 1judith100% (39)

- The Myth of GlobalizationDocument23 pagesThe Myth of GlobalizationMeita SelinaNo ratings yet

- Customer Evaluations and Global Market FactorsDocument27 pagesCustomer Evaluations and Global Market FactorsPratama DiefaNo ratings yet

- International Pricing - A Market Perspective (Marsh)Document6 pagesInternational Pricing - A Market Perspective (Marsh)Μιχάλης ΘεοχαρόπουλοςNo ratings yet

- Determinants of SME Brand Adaptation in Global MarketingDocument34 pagesDeterminants of SME Brand Adaptation in Global MarketingAbdul GhaniNo ratings yet

- Explain The Modern Theory of International TradeDocument13 pagesExplain The Modern Theory of International TradeLeenaa Nair100% (1)

- IKEA and McDonalds strategies of standardisation, localisation and international expansionDocument13 pagesIKEA and McDonalds strategies of standardisation, localisation and international expansionIsiaku E Jimmy-Braimah100% (1)

- Trade Theory Literature ReviewDocument4 pagesTrade Theory Literature Reviewafdtygyhk100% (1)

- Chapter 2 Literature Review: Brand Building Process For Industrial ProductsDocument14 pagesChapter 2 Literature Review: Brand Building Process For Industrial ProductsHari KrishnanNo ratings yet

- The Pragmatic Value of Metaphor in English Print and TV AdvertismentDocument22 pagesThe Pragmatic Value of Metaphor in English Print and TV AdvertismentAnna ManukyanNo ratings yet

- Marketing Mix and Branding Competitive Hypermarket StrategiesDocument19 pagesMarketing Mix and Branding Competitive Hypermarket StrategiesArun MishraNo ratings yet

- Chap 1 IntlmktDocument46 pagesChap 1 IntlmktAlexis RoxasNo ratings yet

- International Review of Financial Analysis: Steffen Meinshausen, Dirk SchiereckDocument9 pagesInternational Review of Financial Analysis: Steffen Meinshausen, Dirk SchiereckSaravanakkumar KRNo ratings yet

- International Trade TheoriesDocument6 pagesInternational Trade TheoriesFav TangonanNo ratings yet

- Globalization of MarketDocument14 pagesGlobalization of MarketDrogNo ratings yet

- A Study of The Degree of Branding Standard Is at Ion Practised by Irish Food and Drink Export CompaniesDocument11 pagesA Study of The Degree of Branding Standard Is at Ion Practised by Irish Food and Drink Export CompaniesGaurav KapoorNo ratings yet

- The Task EnvironmentDocument8 pagesThe Task EnvironmentStoryKingNo ratings yet

- Failed Internationalization AttemptsDocument8 pagesFailed Internationalization AttemptsStephanie YipNo ratings yet

- Unique Brand Extension ChallengesDocument12 pagesUnique Brand Extension ChallengesDr. Firoze KhanNo ratings yet

- Consumer PerceptionsDocument10 pagesConsumer PerceptionsSyahridzuel Ulquiorra SchifferNo ratings yet

- International Pricing StrategyDocument16 pagesInternational Pricing StrategyArkadeep Paul ChoudhuryNo ratings yet

- Modeling Consumer AttitudesDocument17 pagesModeling Consumer AttitudessahinchandaNo ratings yet

- The Role of Diversification Strategies in Global Companies: - Research ResultsDocument8 pagesThe Role of Diversification Strategies in Global Companies: - Research ResultscuribenNo ratings yet

- Going Public: How Stock Market Listing Changes Firm Innovation BehaviorDocument55 pagesGoing Public: How Stock Market Listing Changes Firm Innovation BehaviormagiNo ratings yet

- Answer All Question: NO PagesDocument30 pagesAnswer All Question: NO Pageszakuan79No ratings yet

- Private Labels Production by Brand ManufacturersDocument5 pagesPrivate Labels Production by Brand Manufacturerscamipavel2003No ratings yet

- Traditional Motives and International EmergeDocument7 pagesTraditional Motives and International Emergesujoy12345No ratings yet

- International MarketingDocument25 pagesInternational Marketingvishwanathkims11No ratings yet

- Palgrave Macmillan JournalsDocument14 pagesPalgrave Macmillan JournalsLucia DiaconescuNo ratings yet

- Disserr LitraDocument17 pagesDisserr LitraDisha GangwaniNo ratings yet

- Market Structure and Entry: Where'S The Beef?: Department of EconomicsDocument54 pagesMarket Structure and Entry: Where'S The Beef?: Department of EconomicsAR RafiNo ratings yet

- 1 PBDocument7 pages1 PBHoài Nguyễn Thị ThuNo ratings yet

- Relationship Marketing in The Internet AgeDocument28 pagesRelationship Marketing in The Internet AgePranshu SharmaNo ratings yet

- Anderson Markides Si at Base of Economic Pyramid FinalDocument18 pagesAnderson Markides Si at Base of Economic Pyramid FinalEnrique De La HozNo ratings yet

- Standardised vs Localised Strategies in International MarketsDocument21 pagesStandardised vs Localised Strategies in International MarketsjackNo ratings yet

- Conduct and PerformanceDocument5 pagesConduct and Performanceinnocent angelNo ratings yet

- E-commerce Marketing Framework IntegrationDocument10 pagesE-commerce Marketing Framework IntegrationAbdalkhaligIbrahimNo ratings yet

- Export StrategiesDocument20 pagesExport StrategiesPasha AhmadNo ratings yet

- International Journal of Management (Ijm) : ©iaemeDocument15 pagesInternational Journal of Management (Ijm) : ©iaemeIAEME PublicationNo ratings yet

- Chapter 1 International Marketing and Exporting PDFDocument41 pagesChapter 1 International Marketing and Exporting PDFmz100% (1)

- An Empirical Study of The Effect of Brand Proliferation On Private Label - National Brand Pricing BehaviorDocument17 pagesAn Empirical Study of The Effect of Brand Proliferation On Private Label - National Brand Pricing BehaviorAnnisa RakhmawatiNo ratings yet

- Lessons Learned From Unsuccessful Internationalization Attempts: Example of Multinational Retailers in ChileDocument22 pagesLessons Learned From Unsuccessful Internationalization Attempts: Example of Multinational Retailers in Chiletictac56No ratings yet

- International Buyers’ Sourcing Strategies Impact Suppliers’ Markups in Bangladesh Garment IndustryDocument67 pagesInternational Buyers’ Sourcing Strategies Impact Suppliers’ Markups in Bangladesh Garment IndustryArittro ChakmaNo ratings yet

- Bmbs Marks:35 Test Chapter 2Document5 pagesBmbs Marks:35 Test Chapter 2Arslan Arif100% (1)

- Standardization vs. Adaptation of The Marketing Mix Strategy in Sme ExportsDocument29 pagesStandardization vs. Adaptation of The Marketing Mix Strategy in Sme ExportsShubhra Jyoti HazraNo ratings yet

- Market Entry Strategies.. Pioneers Versus Late ArrivalsDocument12 pagesMarket Entry Strategies.. Pioneers Versus Late ArrivalsMarlene LeuluaiNo ratings yet

- Fast Second (Review and Analysis of Markrides and Geroski's Book)From EverandFast Second (Review and Analysis of Markrides and Geroski's Book)No ratings yet

- 2014 Michael Kors Announces Eyewear License With Luxottica April 15 2014Document3 pages2014 Michael Kors Announces Eyewear License With Luxottica April 15 2014Sal Ie EmNo ratings yet

- 145 AP498 DGGDGDGDDocument10 pages145 AP498 DGGDGDGDSal Ie EmNo ratings yet

- 145 AP498 DGGDGDGDDocument10 pages145 AP498 DGGDGDGDSal Ie EmNo ratings yet

- Curiosity Killed The BatgdgdgdgdDocument5 pagesCuriosity Killed The BatgdgdgdgdSal Ie EmNo ratings yet

- The Murder of Norbert Zongo - A Historydgdgdgdg of Investigative Journalism in Burkina FasoDocument47 pagesThe Murder of Norbert Zongo - A Historydgdgdgdg of Investigative Journalism in Burkina FasoSal Ie EmNo ratings yet

- AHGroup Humane KillingdgdgdgdDocument30 pagesAHGroup Humane KillingdgdgdgdSal Ie EmNo ratings yet

- Final EISdgdgdgdgDocument505 pagesFinal EISdgdgdgdgSal Ie EmNo ratings yet

- Medicinal Leeches (Hirudo Medicinalis) Attacking and Killing Adult AmphibiansDocument4 pagesMedicinal Leeches (Hirudo Medicinalis) Attacking and Killing Adult AmphibiansSal Ie EmNo ratings yet

- 15 RfsfsfsDocument8 pages15 RfsfsfsSal Ie EmNo ratings yet

- PantexbxxgvsdgsdgDocument173 pagesPantexbxxgvsdgsdgSal Ie EmNo ratings yet

- TurbochagingDocument16 pagesTurbochagingbatinoac9973No ratings yet

- 1409 2664Document9 pages1409 2664Sal Ie EmNo ratings yet

- TADE Pope FinalReport - Analysis of A Turbocharger System For A Diesel EngineDocument66 pagesTADE Pope FinalReport - Analysis of A Turbocharger System For A Diesel EngineStorm RiderNo ratings yet

- CF Bartlett Etal 2012Document1 pageCF Bartlett Etal 2012Sal Ie EmNo ratings yet

- ch033 PDFFSGFSFGSDGDocument15 pagesch033 PDFFSGFSFGSDGSal Ie EmNo ratings yet

- Kokoro No TomobmbmbDocument1 pageKokoro No TomobmbmbSal Ie EmNo ratings yet

- Errata To 20022003 RtaDocument1 pageErrata To 20022003 RtaSal Ie EmNo ratings yet

- Episode4 ExcerptfsfsfsDocument12 pagesEpisode4 ExcerptfsfsfsSal Ie EmNo ratings yet

- SolvalDocument16 pagesSolvalervin custovicNo ratings yet

- NASA Black Hole ShortDocument5 pagesNASA Black Hole ShortAndrej Vuk BlesićNo ratings yet

- Abnormal InfantDocument8 pagesAbnormal InfantSal Ie EmNo ratings yet

- Marine Corps Manual W CH 1-3Document125 pagesMarine Corps Manual W CH 1-3Sal Ie EmNo ratings yet

- Sap Flow ResponseDocument11 pagesSap Flow ResponseSal Ie EmNo ratings yet

- 1906 Anonymous Encyclopedia of SuperstitionsDocument510 pages1906 Anonymous Encyclopedia of SuperstitionsSal Ie EmNo ratings yet

- Asha - Hope: - Hahn. She Rocks Her Crying Baby Girl Back and Pyaar. Despite The Mumbai Heat, She ShiversDocument4 pagesAsha - Hope: - Hahn. She Rocks Her Crying Baby Girl Back and Pyaar. Despite The Mumbai Heat, She ShiversSal Ie EmNo ratings yet

- BH LecturenotesDocument49 pagesBH LecturenotesAvinanda ChaudhuriNo ratings yet

- Eter Oodwin EltzelDocument6 pagesEter Oodwin EltzelSal Ie EmNo ratings yet

- Merch - 6 Six MonthsDocument83 pagesMerch - 6 Six MonthsVishwajeet BhartiNo ratings yet

- Entrepreneurship Notes 1-3Document11 pagesEntrepreneurship Notes 1-3BALIWANG, MARCOS JR. G.No ratings yet

- Commission Report On Illegal TobaccoDocument30 pagesCommission Report On Illegal TobaccoShira SchoenbergNo ratings yet

- Chapter 4 Lecture Note Analyzing A Company's Resources and Competitive PositionDocument19 pagesChapter 4 Lecture Note Analyzing A Company's Resources and Competitive PositionsanzitNo ratings yet

- Planning Inspector ReportDocument94 pagesPlanning Inspector ReportslaughteraNo ratings yet

- SWOT Analysis Beard Balm CompanyDocument7 pagesSWOT Analysis Beard Balm CompanyKelly FunaroNo ratings yet

- Rap An enDocument42 pagesRap An eningbarragan87No ratings yet

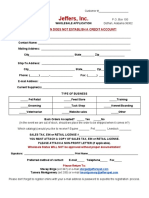

- Jeffers, Inc.: Application Does Not Establish A Credit Account!Document1 pageJeffers, Inc.: Application Does Not Establish A Credit Account!Son NguyenNo ratings yet

- SAM2014 Fish Supply Chain and Fish TransportDocument22 pagesSAM2014 Fish Supply Chain and Fish TransportJeampierr JIMENEZ MARQUEZNo ratings yet

- CTG Security SolutionsDocument56 pagesCTG Security Solutionsadeol5012No ratings yet

- B Witney Multi-Storey Car ParkDocument2 pagesB Witney Multi-Storey Car Parkkomal jilaniNo ratings yet

- Site Analysis of New Market KhulnaDocument30 pagesSite Analysis of New Market KhulnaUm MuNo ratings yet

- Al-Fatah Retail Strategy and SWOT AnalysisDocument4 pagesAl-Fatah Retail Strategy and SWOT Analysisbint e zainabNo ratings yet