Professional Documents

Culture Documents

Financial Analysis of Pakistan Cables: Submitted To: Sir Shahbaz 9/10/2014

Uploaded by

Ali RazaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Analysis of Pakistan Cables: Submitted To: Sir Shahbaz 9/10/2014

Uploaded by

Ali RazaCopyright:

Available Formats

qwertyuiopasdfghjklzxcvbnmqwe

rtyuiopasdfghjklzxcvbnmqwertyu

iopasdfghjklzxcvbnmqwertyuiopa

sdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjkl

zxcvbnmqwertyuiopasdfghjklzxcv

bnmqwertyuiopasdfghjklzxcvbnm

qwertyuiopasdfghjklzxcvbnmqwe

rtyuiopasdfghjklzxcvbnmqwertyu

iopasdfghjklzxcvbnmqwertyuiopa

sdfghjklzxcvbnmqwertyuiopasdfg

hjklzxcvbnmqwertyuiopasdfghjkl

zxcvbnmqwertyuiopasdfghjklzxcv

bnmqwertyuiopasdfghjklzxcvbnm

qwertyuiopasdfghjklzxcvbnmqwe

Financial Analysis of Pakistan Cables

Submitted to : Sir Shahbaz

9/10/2014

Ali Raza M.Com 3rd

Pakistan Cables Limited

Pakistan Cables Limited is the countrys oldest cables manufacturer engaged in

manufacturing of wires and cables and other engineering products.

The Company was established in 1953 in collaboration with BICC, United Kingdom.

The Company manufactures General Wiring Cables in the range of 250/750 volts.

These cables manufactured in conformity with national and international

standards that provides safety and saving in electricity consumption because of the

use of pure copper and cable grade PVC (Plastic Compound Vanile).

The Company provides overhead conductors to the utility companies WAPDA and

KESC which are manufactured from EC grade Aluminum Rod and Copper Rod.

PCL also manufactures telephone, intercom, coaxial cables and various types of

special cables which include air field lighting, control cables, etc.

Alum-Ex is the brand name under which Pakistan Cables manufactures aluminum

sections for the construction and architectural industry.

PCL has also set up a plant to manufacture High Conductivity Oxygen Free 8mm

Copper Rod

Vision

To be the company of first choice for customers and partners for wires, cables and

other engineering products

Mission Statement

To strengthen company leadership in the manufacturing and marketing of wire

and cables. To have a strong presence in the engineering products market while,

retaining the options to participate in other profitable business.

To operate ethically while maximizing profits and satisfying customers needs and

stakeholders interest. To assist in the socio-economic development of Pakistan by

being good corporate citizens

Companys Products

General Wiring

For lighting & general use, Pakistan Cables manufactures General Wiring Cables in the range of

250/750 Volts conforming to BSS: 6004:95:

General wiring single core cables from 1 mm2 to 10 mm2

Larger single core cables from 16mm2 to 70mm2

Multi-core cables from 1 mm2 to 10 mm2

Flexible multi-core cables from 1 mm2 to 4 mm2

These cables are manufactured in conformity with the national & international standards that

provide safety and savings in electricity consumption because of the use of 99.99% pure copper,

cable grade PVC, and thorough quality testing of every meter

Low & Medium Voltage Cables

Pakistan Cables manufactures Low Voltage (LV) power cables up to 3.3 kV with PVC and XLPE

insulation and Medium Voltage (MV) cables up to15 kV with XLPE insulation.

All these cables are subjected to rigorous in-house quality checks. LV Cables have been Type

Tested by internationally recognized certifying body, KEMA Netherlands and MV Cables by

HV&SC Lab PEPCO, Rawat, Islamabad Pakistan.

With growing power demand in Pakistan, the use of overhead conductors for power

transmission purposes has increased. Pakistan Cables provides high quality overhead conductors

to Pakistans utility companies. These conductors are manufactured from EC grade Aluminium

Rod and Copper Rod made from LME Grade A Cu cathodes with 99.99% purity.

Auto Cables

In April 2008, Pakistan Cables began producing cables for the automobile industry in

Pakistan. These cables are used in the assembly of wire harnesses for OEMs (eg.

Toyota) and are manufactured under JIS (Japanese Industrial Standards) and JASO

specifications. Specifications include AV, AVS, AVSS and AVSSH. Pakistan Cables

Auto Cable plant has state of the art machines, including Niehoff wire drawing and

bunching machines and a Tecnocable extruder.

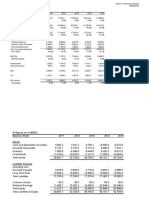

Companys Performance Charts

Companys Key Financial Figures

2012-

2013

2011-

2012

2010-

2011

2009-

2010

2008-

2009

2007-

2008

2006-

2007

Rs.

Millions

Rs.

Millions

Rs.

Millions

Rs.

Millions

Rs.

Millions

Rs.

Millions

Rs.

Millions

Financial Results

Sales 6,164.6 5,344.6 4,096.4 3,798.8 3,352.3 3,794.9 4,168.9

Gross Profit 707.0 687.6 519.6 412.3 532.4 369.9 614.2

Operating Profit 349.0 348.4 250.7 197.7 350.9 7.0 390.5

Profit before tax 266.0 240.9 146.7 52.3 101.8 53.6 293.3

Profit after tax 177.0 139.9 85.7 45.5 63.9 65.4 194.3

EBITDA 478.2 430.6 361.0 323.1 432.4 257.0 464.7

Dividend 113.9 92.5 56.9 32.2 48.3 - 54.8

Bonus Issue - - - - - 19.5 48.8

Capital expenditure 33.0 35.9 34.2 30.2 169.9 338.4 280.0

Fixed assets at cost/revaluation 2,302.4 2,285.0 2,254.0 2,218.0 2,192.0 1,776.4 1,429.6

Current assets less current liabilities 958.6 816.7 569.7 41.4 78.7 2.7 142.6

Cash Flow From:

Operating activities

114.5 496.8 (4.0) (562.4) 630.2 31.8 (345.4)

Investing activities (24.4) 26.7 (27.3) (25.2) (164.9) (246.8) (270.4)

Financing activities (84.7) (625.9) 357.8 556.8 (58.5) (448.5) 353.7

Cash and cash equivalents (108.5) (113.9) (11.6) (338.0) (307.2) (714.0) (50.4)

Shareholders' funds

Issued capital 284.6 284.6 284.6 214.6 214.6 195.1 146.3

Reserve & retained earning 1,265.0 1,176.2 1,088.9 504.2 503.6 455.9 456.4

Total Shareholders' fund 1,549.6 1,460.8 1,373.5 718.8 718.2 651.0 602.7

Surplus on revaluation of fixed assets 688.7 691.6 695.8 680.8 684.2 687.6 549.0

Long term Loans & Liabilities 148.5 182.7 199.3 394.5 510.0 378.2 259.0

Net Assets employed 2,386.8 2,335.1 2,268.7 1,794.2 1,912.4 1,716.8 1,410.7

Liquidity

Current Ratio 1.8:1 1.6:1 1.4:1 1:1 1.1:1 1:1 1.1:1

Acid Test Ratio 0.9:1 0.7:1 0.5:1 0.5:1 0.4:1 0.4:1 0.4:1

Financial Gearing

Financial Leverage 38:62 42:58 46:54 62:38 53:47 60:40 61:39

Debt to equity ratio 06:94 08:92 09:91 22:78 27:73 22:78 18:82

Interest coverage (Times) 4.1 4.6 2.5 1.3 1.4 1.4 3.6

Capital efficiency

Debtor turnover (Times) 7.0 7.5 8.6 6.0 10.4 9.6 8.3

Inventory turnover (Times) 5.4 3.7 2.7 3.4 4.3 3.4 3.1

Total assets turnover (Times) 1.7 1.5 1.1 1.0 1.1 1.1 1.4

Creditor turnover (Times) 99.2 16.8 96.7 15.1 14.1 36.2 15.3

Operating Cycle No. of days 116.0 125 174 144 94 135 138

Fixed asset turn over (Times) 4.4 3.6 2.6 2.3 2.0 2.3 3.4

Capital employed turnover (Times) 2.6 2.3 1.8 2.1 1.8 2.2 2.9

Profitability

Gross profit % 11.5 12.9 12.7 10.9 15.9 9.7 14.7

Net profit % 2.9 2.6 2.1 1.2 1.9 1.7 4.7

EBITDA margin % 7.8 8.1 8.8 8.5 12.9 6.8 11.1

Return on capital employed (excl. revaulation

surplus) %

20.7 18.8 15.4 18.5 27.0 17.9 47.0

Return on capital employed (incl. revaulation

surplus) %

14.8 13.2 10.7 11.5 17.4 10.7 28.7

Return on Equity % 11.4 9.6 6.3 6.3 8.9 10.0 32.2

Return on total assets % 4.9 3.8 2.3 1.2 2.1 1.9 6.5

Investment

Price earning ratio 10.4 7.8 13.7 25.5 11.4 36.4 20.2

Earning per rupee of sales Rs. 0.03 0.03 0.02 0.01 0.02 0.02 0.05

Earning per share Rs. 6.22 4.92 3.34 2.12 2.98 3.35 13.28

Cash dividend per share Rs. 4.00 3.25 2.0 1.50 2.25 - 3.75

Bonus issue per share Rs. - - - - - 1.00 3.33

Dividend (cash+bonus) yield %* 6.17 8.52 4.39 2.78 6.61 10.00 34.70

Dividend payout % 64.3 66.1 66.3 70.7 75.6 29.8 53.3

Dividend Cover (Times) 1.6 1.5 1.5 1.4 1.3 3.4 1.9

Market value per share Rs. 64.8 38.2 45.6 54.0 34.0 122.0 267.9

Market value per share high during the year Rs. 82.0 47.3 68.9 63.0 120.8 276.0 273.2

Market value per share low during the year Rs. 38.7 31.0 45.6 34.2 27.8 122.0 162.0

Break-up value per share including surplus on

revaluation Rs.

78.6 75.6 72.7 65.2 65.3 68.6 78.7

Break-up value per share excluding surplus on

revaluation Rs.

54.4 51.3 48.3 33.5 33.5 33.4 41.2

Value addition and its distribution

Employees as remuneration 372.1 333.7 295.4 251.8 239.8 229.2 204.6

Government as taxes 1,169.8 1,008.3 846.0 708.7 582.7 698.7 838.1

Shareholders as dividends 113.9 92.5 56.9 32.2 48.3 19.5 103.6

Provider of Finance 86.0 67.7 95.9 154.5 230.0 130.3 112.1

Society 4.1 3.2 2.0 0.2 1.5 1.0 5.3

Retained within the business 67.5 51.5 32.5 16.5 19.0 58.0 93.0

Financial Analysis 2012-2013

Balance Sheet (Horizontal Analysis)

Particulars

2013 2012

Horizontal

Analysis

Equity & Liabilities

Share capital and reserves

Share capital 284623 284623 0.00%

share premium reserve 527800 527800 0.00%

general reserve 555500 504000 0.00%

unappropriated profit 181703 144420 10.22%

surplus on revaluation of land and building 688728 691554 25.82%

Total Equity 2238354 1460843 53.22%

Non current liabilities 2238354 3613240

long term loans 0 3125 -100.00%

defferd liabilities for staff gratuity 26871 23334 15.16%

other long term employee benefits 15779 14555 8.41%

deffered tax liablity-net 105805 141734 -25.35%

total non current liabilities 148455 182478 -18.64%

Current liabilities

current portion of long term loans 3125 23750 -86.84%

trade and other payables 619809 768664 -19.37%

short term borrowing 575790 544685 5.71%

mark up accured on bank borrowings 6533 6913 -5.50%

total current liabilities 1205257 1344012 -10.32%

Total equity & liabilities 3592066 3679157 -2.37%

Assests

Non current assets

Property,Plant & Equipemnt 1401668 1495289 -6.26%

Investments in associates 19766 18405 7.39%

long term loans 3613 2201 64.15%

Long term security deposits 3184 2567 24.04%

Total non current assests 1428231 1518462 -5.94%

Current assests

Stores and spares 34058 26953 26.36%

Stock in trade 1011004 1246909 -18.92%

Trade debts 878367 715687 22.73%

Short term loand and advances 17821 6848 160.24%

Short term depostis and prepayments 6854 6839 0.22%

Other receiveables 25424 4712 439.56%

Advance tax net of provisions 178936 147655 21.19%

Cash and bank balances 11371 5092 123.31%

Total current assets 2163835 2160695 0.15%

Total Assets 3592066 3679157 -2.37%

Balance Sheet (Vertical Analysis)

Particulars 2013 2012

Vertical

Analysis

Equity & Liabilities

Share capital and reserves

Share capital 284623 284623 7.92%

share premium reserve 527800 527800 14.69%

general reserve 555500 504000 14.69%

unappropriated profit 181703 144420 15.46%

surplus on revaluation of land and building 688728 691554 5.06%

Total Equity 2238354 1460843 62.31%

Non current liabilities 2238354 3613240

long term loans 0 3125

defferd liabilities for staff gratuity 26871 23334 0.75%

other long term employee benefits 15779 14555 0.44%

deffered tax liablity-net 105805 141734 2.95%

total non current liabilities 148455 182478 4.13%

Current liabilities

current portion of long term loans 3125 23750 0.09%

trade and other payables 619809 768664 17.25%

short term borrowing 575790 544685 16.03%

mark up accured on bank borrowings 6533 6913 0.18%

total current liabilities 1205257 1344012 33.55%

Total equity & liabilities 3592066 3679157

Assests

Non current assets

Property,Plant & Equipemnt 1401668 1495289 39.02%

Investments in associates 19766 18405 0.55%

long term loans 3613 2201 0.10%

Long term security deposits 3184 2567 0.09%

Total non current assests 1428231 1518462 39.76%

Current assests

Stores and spares 34058 26953 0.95%

Stock in trade 1011004 1246909 28.15%

Trade debts 878367 715687 24.45%

Short term loand and advances 17821 6848 0.50%

Short term depostis and prepayments 6854 6839 0.19%

Other receiveables 25424 4712 0.71%

Advance tax net of provisions 178936 147655 4.98%

Cash and bank balances 11371 5092 0.32%

Total current assets 2163835 2160695 60.24%

Total Assets 3592066 3679157 100.00%

Profit & Loss Account (Horizontal Analysis)

Particulars 2013 2012

Vertical

analysis

Net sales 6164555 5344571 100.00%

Cost of sales 5457538 4656976 88.53%

Gross profit 707017 687595 11.47%

Selling cost 223860 189255 3.63%

Admin expenses 123726 106639 2.01%

347586 295894 5.64%

359431 391701 5.83%

Other operating expenses 25687 58993 0.42%

Other income 15255 15734 0.25%

10432 43259 0.17%

Operating Profit 348999 348442 5.66%

Finance expenses 86042 67704 1.40%

Share of profit from associates 3088 8218 0.05%

Impairment loss on investments

profit before income tax 266045 240956 4.32%

Taxation 89063 101000 1.44%

profit for the year 176982 139956 2.87%

Profit & Loss Account (Vertical Analysis)

Particulars 2013 2012

Horizontal

analysis

Net sales 6164555 5344571 15.34%

Cost of sales 5457538 4656976 17.19%

Gross profit 707017 687595 2.82%

Selling cost 223860 189255 18.28%

Admin expenses 123726 106639 16.02%

347586 295894 17.47%

359431 391701 -8.24%

Other operating expenses 25687 58993 -56.46%

Other income 15255 15734 -3.04%

10432 43259 -75.88%

Operating Profit 348999 348442 0.16%

Finance expenses 86042 67704 27.09%

Share of profit from associates 3088 8218 -62.42%

Impairement loss on investments

profit before income tax 266045 240956 10.41%

Taxation 89063 101000 -11.82%

profit for the year 176982 139956 26.46%

Ratio Analysis 2012-2013

Liquidity Ratios

1. Current Ratio

Years Current Assets Current Liabilities Current Ratio

2012 2,160,695 1,344,012 0.90

2013 2,163,835 1,205,257 1.80

2. Quick Ratio

Years Quick Assets Current Liabilities Quick Ratio

2012 2160695-26953 1,344,012 1.59

2013 2163835-34058 1,205,257 1.77

3. Inventory Turnover

Years Cost of Sales Average I nventory I nventory Turnover

2012 4,656,976 (24972+26953)/2 44.84

2013 5,457,538 (26953+34058)/2 44.73

4. Average Account Receivables Turnover

Years Credit Sales Average A/R A/R Turnover

2012 5,344,571 (17813+4712)/2 118.64

2013 6,164,555 (25424+4712)/2 102.28

Profitability Ratios

1. Assets Turnover

Years Sales Average Total Assets Assets Turnover

2012 5,344,571 (3679157+3807776)/2 0.36

2013 6,164,555 (3592066+3679157)/2 0.42

2. Profit Margin

Years Sales Cost of Goods Sold Profit Margin

2012 38 5 7.76

2013 65 6 10.42

3. Return on Assets

Years Net I ncome Average Total Assets Return on Assets

2012 139,956

3679157

3.8%

2013 176,982 3,592,066 4.9%

4. Return on Common Stockholders Equity

Years Net I ncome Average Stock

Holders Equity

Return on Stock

holders Equity

2012 139,956

1460843

9.58%

2013 176,982 1,549,626 11.42%

5. Earnings per Share

Years Net I ncome Average Shares

Outstanding

Earnings per Share

2012 139,956 2846000 4.92%

2013 176,982 2846000 6.22%

6. Payout Ratios

Years Dividends per

Share

Earnings per Share Payout Ratio

2012 3.25 4.92 66.1%

2013 4 6.22 64.3%

7. Price Earnings Ratio

Years Market Price of

Share

Earnings per Share Price Earnings

Ratio

2012 38 5 7.76

2013 65 6 10.42

Solvency Ratios

1. Debt to Assets Ratio

Years Total Debts Total Assets Debt to Assets Ratio

2012 1,827,000

3679157

0.40

2013 1,485,000 3,592,066 0.41

2. Times Interest Earned

Years Operating I ncome I nterest Expense Times I nterest Earned

2012 348,442 67,704 5.15

2013 348,999 86,042 4.06

Liquidity Ratios

The analysis of Pakistan Cabless financial statement shows that it has a high tendency to pay its

debts and to convert assets into liquid form within short intervals of time.

The current ratio of PTC remained between 0.90 1.80 in 2 years and it shows its ability

to pay short term liabilities.

The quick ratio of PTC ranged between 0.159 0.77 in 2 years. It shows the companys

ability to convert its current assets into liquid form (cash form) in order to meet current

liabilities.

On yearly basis from the year 2012 2013, we observed that the number of times the

total inventory or stock of the company was sold on the average of 2.25 times/year. It

shows the sales of the company are on a very large scale and also gives rise to the

company opportunity to generate huge profits in the long run.

Average Account Receivables Turnover shows that how many times a company is able to

recover the amount of credit sales to people. PTC has shown a high Accounts Receivables

turnover rate which shows its high liquidity transformation rate.

Profitability Ratios

Pakistan Tobacco Companies Profitability ratios clearly reflect its great ability to generate huge

profits and of generating dividends for its shareholders.

Average Assets turnover of the company ranges between 0.36-0.42 times in 2 yeasr. It

shows the generation of huge sales from the worth of assets of the company and in the

case of Pakistan Cables, it shows the firm's efficiency at using its assets in generating

sales or revenue - the higher the number the better.

The profit margin of PTC lies between 7.76% - 10.42% in 2 years. It measures the

percentage of each dollars of sales that results in net income. A higher profit margin

indicates a more profitable company that has better control over its costs compared to

its competitors.

The return on assets of PTC ranges among 3.8 to 4.9 according to preceding 2 years

record. An overall measure of profitability is return on assets. ROA gives an idea as to

how efficient management is at using its assets to generate earnings. This number tells

you what the company can do with what it has, i.e. how many rupees of earnings they

derive from each rupee of assets they control.

Return on common stockholders equity of PTC varies between 9.58 11.42 between the

years 2012 & 2013. Another widely used profitability ratio is return on common

stockholders equity. It measures profitability from common stockholders point of

view. Return on equity measures a corporation's profitability by revealing how

much profit a company generates with the money shareholders have invested.

Averaging ROE over the past 5-10 years can give you a better idea of the historical

growth.

Earnings per share are a measure of net income earned on each share of common stock.

PTCs earning per share of last 2 years lies among 4.92-6.22. The EPS formula does not

include preferred dividends for categories outside of continued operations and net

income. Earnings per share serve as an indicator of a company's profitability.

Payout ratio of this company ranges from 66.1-66.4. It measures the percentage of

earnings distributed in the form of cash dividends. The amount of earnings paid out in

dividends to shareholders. Investors can use the payout ratio to determine what

companies are doing with their earnings. Dividend payout ratio is the fraction of net

income a firm pays to its stockholders in dividend.

Price earnings ratio is an oft-quoted measure of the ratio of the market price of each

share of common stock to the earnings per share. It is also called its "P/E", or simply

"multiple". The P/E ratio is a vital ratio for investors. Basically, it gives us an indication of

the confidence that investors have in the future prosperity of the business. A P/E ratio of

1 shows very little confidence in that business whereas a P/E ratio of 20 expresses a

great deal of optimism about the future of a business. It is the valuation ratio of a

company's current share price compared to its per-share earnings.

SOLVENCY RATIOS

Solvency ratios measure the ability of a company to survive over a long period of time. It

provides a measurement of how likely a company will be to continue meeting its debt

obligations. Different countries use different methodologies to calculate the solvency ratio, and

have different requirements.

Debt to total assets ratio measures the percentage of total assets that creditors provide.

A metric used to measure a company's financial risk by determining how much of the

company's assets have been financed by debt. If the ratio is less than one, most of the

company's assets are financed through equity. If the ratio is greater than one, most of

the company's assets are financed through debt. Calculated by adding short-term and

long-term debt and then dividing by the company's total assets.

The average value of Times interest earned of Pakistan Cables is approximately 4.60 for

previous 2 years. IT PROVIDES COMPANYS ABILITY TO MEET interest payments as they

come due. Times interest earned (TIE) or interest coverage ratio is a measure of a

company's ability to honour its debt payments. The times interest earned lets the

creditor understand whether or not a company has sufficient income to cover its interest

payments requirements. It is calculated by taking a company's earnings before interest

and taxes (EBIT) and dividing it by the total interest payable on bonds and other

contractual debt.

You might also like

- Financial Statement Analysis of MTMDocument27 pagesFinancial Statement Analysis of MTMFaizan AshrafNo ratings yet

- Assignments Semester IDocument13 pagesAssignments Semester Idriger43No ratings yet

- AIRTHREAD ACQUISITION Revenue and Expense ProjectionsDocument24 pagesAIRTHREAD ACQUISITION Revenue and Expense ProjectionsHimanshu AgrawalNo ratings yet

- Accounts AssignmentDocument7 pagesAccounts AssignmentHari PrasaadhNo ratings yet

- Adidas Chartgenerator ArDocument2 pagesAdidas Chartgenerator ArTrần Thuỳ NgânNo ratings yet

- TMW Co. Ltd Financial ProjectionsDocument15 pagesTMW Co. Ltd Financial ProjectionsgabegwNo ratings yet

- Airthread Acquisition Operating AssumptionsDocument27 pagesAirthread Acquisition Operating AssumptionsnidhidNo ratings yet

- S9 - XLS069-XLS-ENG MarriottDocument12 pagesS9 - XLS069-XLS-ENG MarriottCarlosNo ratings yet

- Air Thread ConnectionsDocument31 pagesAir Thread ConnectionsJasdeep SinghNo ratings yet

- Airthread SolutionDocument30 pagesAirthread SolutionSrikanth VasantadaNo ratings yet

- Bảng Cân Đối Kế Toán PLXDocument11 pagesBảng Cân Đối Kế Toán PLXbkjp5bnfgdNo ratings yet

- Sui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010Document17 pagesSui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010mumairmalikNo ratings yet

- In RM Million Unless Otherwise Stated: 2018 MfrsDocument4 pagesIn RM Million Unless Otherwise Stated: 2018 MfrsTikah ZaiNo ratings yet

- MECWIN Investment ProposalDocument4 pagesMECWIN Investment ProposalVamsi PavuluriNo ratings yet

- FIN506 Weekly Assignment SolutionsDocument3 pagesFIN506 Weekly Assignment SolutionsAhmed HassaanNo ratings yet

- PGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1Document26 pagesPGPF - 01 - 017 - CV - Assignment - 5 - Keshav v1nidhidNo ratings yet

- Dewan Cement1Document41 pagesDewan Cement1jamalq123No ratings yet

- 17020841116Document13 pages17020841116Khushboo RajNo ratings yet

- Managerial-Finance-Project Orascom Report FinalDocument63 pagesManagerial-Finance-Project Orascom Report FinalAmira OkashaNo ratings yet

- Exhibit 1: Income Taxes 227.6 319.3 465.0 49.9Document11 pagesExhibit 1: Income Taxes 227.6 319.3 465.0 49.9rendy mangunsongNo ratings yet

- BudgetBrief2012 PDFDocument90 pagesBudgetBrief2012 PDFIdara Tehqiqat Imam Ahmad RazaNo ratings yet

- Airthread Excel SolutionDocument18 pagesAirthread Excel SolutionRiya ShahNo ratings yet

- Non-time series assumption analysisDocument44 pagesNon-time series assumption analysisAnrag Tiwari100% (1)

- AirThread CalcDocument15 pagesAirThread CalcSwati VermaNo ratings yet

- CH 32Document2 pagesCH 32Mukul KadyanNo ratings yet

- Group 1 - Hannson CasestudyDocument16 pagesGroup 1 - Hannson Casestudyamanraj21No ratings yet

- Altagas Green Exhibits With All InfoDocument4 pagesAltagas Green Exhibits With All InfoArjun NairNo ratings yet

- Inputs From Income Statement: 2013 2014 2015 2016 2017 2018 2019Document8 pagesInputs From Income Statement: 2013 2014 2015 2016 2017 2018 2019carminatNo ratings yet

- Burton ExcelDocument128 pagesBurton ExcelJaydeep SheteNo ratings yet

- CapitaLand Limited AR 12 FA 9MBDocument129 pagesCapitaLand Limited AR 12 FA 9MBnvanhuu98No ratings yet

- Airthread WorksheetDocument21 pagesAirthread Worksheetabhikothari3085% (13)

- AMTEXDocument87 pagesAMTEXBilal Ahmed KhanNo ratings yet

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- Financial Feasibility of Business PlanDocument14 pagesFinancial Feasibility of Business PlanRizaldi DjamilNo ratings yet

- 1Q23 Supporting SpreadsheetDocument22 pages1Q23 Supporting SpreadsheetJamilly PaivaNo ratings yet

- Vitex Corp Income Statement and Balance Sheet AnalysisDocument12 pagesVitex Corp Income Statement and Balance Sheet AnalysissopiantiNo ratings yet

- Airthread Connections NidaDocument15 pagesAirthread Connections NidaNidaParveen100% (1)

- HanssonDocument11 pagesHanssonJust Some EditsNo ratings yet

- Project Company Subject Group Group Members: GC University FaisalabadDocument23 pagesProject Company Subject Group Group Members: GC University FaisalabadMuhammad Tayyab RazaNo ratings yet

- M Saeed 20-26 ProjectDocument30 pagesM Saeed 20-26 ProjectMohammed Saeed 20-26No ratings yet

- IMT CeresDocument5 pagesIMT CeresSukanya SahaNo ratings yet

- EXIM Bank Financial Highlights 2011-2018Document2 pagesEXIM Bank Financial Highlights 2011-2018jgukykNo ratings yet

- Previous Years: Tata Motor S - in Rs. Cr.Document28 pagesPrevious Years: Tata Motor S - in Rs. Cr.priya4112No ratings yet

- Statement of Profit or Loss and Other Comprehensive Income For The Year Ended 31 December 2018Document11 pagesStatement of Profit or Loss and Other Comprehensive Income For The Year Ended 31 December 2018Tinatini BakashviliNo ratings yet

- Campbell Soup FInancialsDocument39 pagesCampbell Soup FInancialsmirunmanishNo ratings yet

- Tesla DCF Valuation by Ihor MedvidDocument105 pagesTesla DCF Valuation by Ihor Medvidpriyanshu14No ratings yet

- DCF Valuation Pre Merger Southern Union CompanyDocument20 pagesDCF Valuation Pre Merger Southern Union CompanyIvan AlimirzoevNo ratings yet

- Financial Statement ANalysis of National Foods Limited Pakistan From 2005-2009Document97 pagesFinancial Statement ANalysis of National Foods Limited Pakistan From 2005-2009shahid Ali88% (8)

- Top Glove 140618Document5 pagesTop Glove 140618Joseph CampbellNo ratings yet

- Analisis Lap KeuDocument10 pagesAnalisis Lap KeuAna BaenaNo ratings yet

- Burton Sensors SheetDocument128 pagesBurton Sensors Sheetchirag shah17% (6)

- Evaluacion Salud FinancieraDocument17 pagesEvaluacion Salud FinancieraWilliam VicuñaNo ratings yet

- Session 1 2021 SharedDocument44 pagesSession 1 2021 SharedPuneet MeenaNo ratings yet

- AirThread Valuation SheetDocument11 pagesAirThread Valuation SheetAngsuman BhanjdeoNo ratings yet

- Assumptions: Comparable Companies:Market ValueDocument18 pagesAssumptions: Comparable Companies:Market ValueTanya YadavNo ratings yet

- Straight Through Processing for Financial Services: The Complete GuideFrom EverandStraight Through Processing for Financial Services: The Complete GuideNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- The Valuation of Digital Intangibles: Technology, Marketing and InternetFrom EverandThe Valuation of Digital Intangibles: Technology, Marketing and InternetNo ratings yet

- Lean Maintenance: Reduce Costs, Improve Quality, and Increase Market ShareFrom EverandLean Maintenance: Reduce Costs, Improve Quality, and Increase Market ShareRating: 5 out of 5 stars5/5 (2)

- CHP 1Document26 pagesCHP 1Ali RazaNo ratings yet

- 2059 s05 QP 1Document4 pages2059 s05 QP 1Ali RazaNo ratings yet

- Topical p2Document256 pagesTopical p2Ali RazaNo ratings yet

- Class VI GeographyDocument9 pagesClass VI GeographyAli RazaNo ratings yet

- GCE O Level Pakistan Studies Paper 1 History and CultureDocument105 pagesGCE O Level Pakistan Studies Paper 1 History and CultureShirin Jalaluddin56% (16)

- GCE O Level Pakistan Studies Paper 1 History and CultureDocument105 pagesGCE O Level Pakistan Studies Paper 1 History and CultureShirin Jalaluddin56% (16)

- Islamiat CleanlinessDocument1 pageIslamiat CleanlinessAli RazaNo ratings yet

- Geography MCQs on Agriculture, Vegetation and TribesDocument5 pagesGeography MCQs on Agriculture, Vegetation and TribesAli RazaNo ratings yet

- KSE100 - Market Capitalization Calculation MethodDocument24 pagesKSE100 - Market Capitalization Calculation MethodsuhailkiyaniNo ratings yet

- Farah Mushtaq - Full ThesisDocument149 pagesFarah Mushtaq - Full ThesisSohail_ed80% (25)

- Review Notes in ABG Interpretation - NCLEXDocument1 pageReview Notes in ABG Interpretation - NCLEXFilipino Nurses CentralNo ratings yet

- LightingDocument157 pagesLightingtalibanindonesiaNo ratings yet

- PI PaperDocument22 pagesPI PaperCarlota Nicolas VillaromanNo ratings yet

- Microalgae PDFDocument20 pagesMicroalgae PDFaris_nurhidayatNo ratings yet

- Student Assessment Tasks: Tasmanian State Service Senior Executive Performance Management Plan Template 1Document77 pagesStudent Assessment Tasks: Tasmanian State Service Senior Executive Performance Management Plan Template 1Imran WaheedNo ratings yet

- Call HandlingDocument265 pagesCall HandlingABHILASHNo ratings yet

- Case 6 Solved by Iqra's GroupDocument11 pagesCase 6 Solved by Iqra's GroupIqra -Abdul ShakoorNo ratings yet

- Jurisidiction of MeTC, MTC, MCTC, MuTCDocument3 pagesJurisidiction of MeTC, MTC, MCTC, MuTCKENEDY FLORESNo ratings yet

- Strategy Map - Visualize Goals & ObjectivesDocument22 pagesStrategy Map - Visualize Goals & ObjectivesNitin JainNo ratings yet

- Types of Errors and Coding TechniquesDocument11 pagesTypes of Errors and Coding TechniquesTiffany KagsNo ratings yet

- 1 Gaona BrianDocument218 pages1 Gaona BrianElias Nicol100% (1)

- World War 2 Facts Tell Us About A Bloody Conflict That Involved All The Nations of The WorldDocument2 pagesWorld War 2 Facts Tell Us About A Bloody Conflict That Involved All The Nations of The WorldSaikumarVavilaNo ratings yet

- Rubric WordsmithDocument6 pagesRubric Wordsmithapi-200845891No ratings yet

- Maghrib Time Nairobi - Google SearchDocument1 pageMaghrib Time Nairobi - Google SearchHanan AliNo ratings yet

- Adeptia BPM Suite DatasheetDocument2 pagesAdeptia BPM Suite DatasheetadeptiaNo ratings yet

- A Short History of CreteDocument188 pagesA Short History of CreteMilan Savić100% (1)

- GR 11 SLK Pe 1 Week 2 1ST Sem PDFDocument10 pagesGR 11 SLK Pe 1 Week 2 1ST Sem PDFwinslet villanuevaNo ratings yet

- ALL INDIA NURSING TEST REVIEWDocument102 pagesALL INDIA NURSING TEST REVIEWDr-Sanjay SinghaniaNo ratings yet

- Georgethirdearlo 00 WilluoftDocument396 pagesGeorgethirdearlo 00 WilluoftEric ThierryNo ratings yet

- Module 2 (Reviewer)Document5 pagesModule 2 (Reviewer)Mj PamintuanNo ratings yet

- Arrest of Leila de Lima (Tweets)Document74 pagesArrest of Leila de Lima (Tweets)Edwin MartinezNo ratings yet

- Mimw With CoverDocument13 pagesMimw With Coverank123qwerNo ratings yet

- Motion For Reconsideration (Bolado & Aranilla)Document4 pagesMotion For Reconsideration (Bolado & Aranilla)edrynejethNo ratings yet

- Personal Narrative EssayDocument3 pagesPersonal Narrative Essayapi-510316103No ratings yet

- LAB REPORT-Osbourne Reynolds ApparatusDocument20 pagesLAB REPORT-Osbourne Reynolds Apparatusmizizasbonkure9055% (11)

- Research Paper - Interest of Science SubjectDocument5 pagesResearch Paper - Interest of Science SubjectcyrilNo ratings yet

- Mario, You Might Need ThisDocument436 pagesMario, You Might Need ThisJk McCreaNo ratings yet

- q4 Mapeh 7 WHLP Leap S.test w1 w8 MagsinoDocument39 pagesq4 Mapeh 7 WHLP Leap S.test w1 w8 MagsinoFatima11 MagsinoNo ratings yet

- Quieting of TitleDocument11 pagesQuieting of TitleJONA PHOEBE MANGALINDANNo ratings yet

- Einstein AnalysisDocument2 pagesEinstein AnalysisJason LiebsonNo ratings yet