Professional Documents

Culture Documents

Home Depot Financial Analysis MBA Case Study

Uploaded by

mktg1990Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Home Depot Financial Analysis MBA Case Study

Uploaded by

mktg1990Copyright:

Available Formats

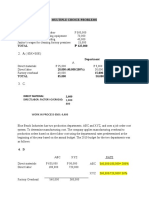

MBA 6620

Fall 2014

Professor Brown

Please refer to the financial statements from the 2010 Annual Report of The Home Depot to answer the

following questions.

1. On what dates did the companys fiscal year end in 2011 and 2010?

January 30

th

2011

January 31

st

2010

2. Why does the annual report refer to fiscal 2010 when the calendar year is 2011? Explain the

relationship between calendar and fiscal year ends.

Home Depots fiscal year (2010) ends at the end of January 2011, so the one month after the calendar

year ends.

3. Use the companys balance sheet to determine the amounts in the accounting equation: A = L + E

40,125=21,236+18,889

4. How much did The Home Depots sales revenue increase or decrease in the year ended January 30,

2011?

2011 66,997 2010 66,176

5. What is the largest expense on the income statement, and how much did it change from the previous

year? -.33% change

2011 15,849 2010 15,902

6. How much did The Home Depot owe for salaries and related expenses at January 30, 2011? Was this

an increase or decrease from the previous year?

1,290, it increased

7. Refer to the Revenues note in the Summary of Significant Accounting Policies that follows The Home

Depots statements of cash flows. How does the company account for customer payments received in

advance of providing services?

When the Company receives payment from customers before the customer has taken possession ofthe

merchandise or the service has been performed, the amount received is recorded as Deferred Revenue

in the accompanying Consolidated Balance Sheets until the sale or service is complete. The Company

also records Deferred Revenue for the sale of gift cards and recognizes this revenue upon the

redemption of gift cards in NetSales. Gift card breakage income is recognized based upon historical

redemption patterns and represents thebalance of gift cards for which the Company believes the

likelihood of redemption by the customer is remote.During fiscal 2010, 2009 and 2008, the Company

recognized $46 million, $40 million and $37 million,respectively, of gift card breakage income. This

income is included in the accompanying Consolidated Statements of Earnings as a reduction in SG&A.

8. What adjusting journal entry must The Home Depot make when it provides services paid by gift card?

Debit Unearned Revenue

Credit Revenue

9. Assume The Home Depot experienced no shrinkage or inventory write downs in the most recent year.

Using the balance sheet and income statement, estimate the amount of inventory purchases in the

2010-2011 year. 10,625 for 2011 10,188 for 2010 Beginning 10,188, 10625 + buy

45,130---Amount of purchased inventory 2010 2011 year

10. How much inventory does the company hold on January 30, 2011? Does this represent an increase

or decrease in comparison to the prior year? An increase, 10625 from 2010.

11. What method(s) does the company use to determine the cost of its inventory? Describe where you

found this information. They used FIFO we found this , under merchandise inventories

12. Where does the company report the amount of its Allowance for Doubtful Accounts? (Hint: The

company refers to its Allowance for Doubtful Accounts as a Valuation Reserve related to

Accounts Receivable.

13. What is the amount of Accumulated Depreciation and Amortization at January 30, 2011? 13,325

What percentage is this of the total cost of property and equipment? 53.17%

14. What amount of Depreciation and Amortization Expense was reported for the year ended January

30, 2011? What percentage of net sales is it? 1616 2.38%

15. As of January 30, 2011, how many shares of common stock were authorized? How many shares were

issued? How many shares were held in treasury?

; authorized: 10 billion shares; issued: 1.722 billion shares a t January 30, 2011 and 1.716 billion shares

at January 31, 2010; outstanding: 1.623 billionshares at January 30, 2011 treasure 99 mil shares in

treasurey stock

16. According to the Retained Earnings column in the Statement of Stockholders Equity, what was the

total dollar amount of cash dividends declared during the year ended January 30, 2011? Is this the same

as the cash amount paid for dividends? How do you know?

1569 declared in 2011, It is the same, because the amount of cash dividends is deducted from net

earnings, soit is the same amount . Because we .945 per share, which equals 1.569 millions, which

means we divided which gave us 1.623 shares outstanding.

17. According to the income statement, how has The Home Depots net earnings and basic earnings per

share changed over the past three years? Increased steadily,

18. Does The Home Depot use the direct method or the indirect method for reporting cash flows from

operations? Direct method, a direct cash flows statement starts with operating activities which home

depot does.

19. What amount of cash tax payments did The Home Depot make during the year ended January 30,

2011? $2,067 billion.

20. In the 2010-2011 fiscal year, The Home Depot generated $4,585 million from operating activities.

Indicate where this cash was spent by listing the two largest cash outflows (from any type of firm

activity). The biggest cash outflows in the operating activities realms was merchandise inventrory and

accounts payable and accrued expenses.

You might also like

- AFN Forecasting - Practice QuestionsDocument1 pageAFN Forecasting - Practice QuestionsMuhammad Ali Samar100% (3)

- Accounting Errors Impact on Income and Retained EarningsDocument5 pagesAccounting Errors Impact on Income and Retained EarningsGlizette SamaniegoNo ratings yet

- Mid-semester exam questions for business reporting and analysisDocument11 pagesMid-semester exam questions for business reporting and analysisb393208No ratings yet

- FABM 2 Lesson3Document7 pagesFABM 2 Lesson3---0% (2)

- Q&P Financial Statements PDFDocument9 pagesQ&P Financial Statements PDFHiểu LêNo ratings yet

- Acct 504 Week 8 Final Exam All 4 Sets - DevryDocument17 pagesAcct 504 Week 8 Final Exam All 4 Sets - Devrycoursehomework0% (1)

- Day 2 Chap 12 Rev. FI5 Ex PRDocument9 pagesDay 2 Chap 12 Rev. FI5 Ex PRCollin EdwardNo ratings yet

- Teaching Note On Financial StatementsDocument36 pagesTeaching Note On Financial StatementsMilton StevensNo ratings yet

- HW2 CF1 Spring 2013Document3 pagesHW2 CF1 Spring 2013impurewolfNo ratings yet

- Statement of Cash Flows-International Accounting Standard (IAS) 7Document18 pagesStatement of Cash Flows-International Accounting Standard (IAS) 7Adenrele Salako100% (1)

- Financial Ratios Quiz - Accounting CoachDocument3 pagesFinancial Ratios Quiz - Accounting CoachSudip Bhattacharya100% (1)

- Income StatementDocument20 pagesIncome StatementkasoziNo ratings yet

- Ratio Analysis and InterpretationDocument8 pagesRatio Analysis and Interpretationruksharkhan7100% (1)

- Adjusting Entries and Their EffectsDocument2 pagesAdjusting Entries and Their EffectsShang BugayongNo ratings yet

- Какаунтинг питаннячкоDocument8 pagesКакаунтинг питаннячкоДенис ЗаславскийNo ratings yet

- Cash BasisDocument4 pagesCash BasisMark DiezNo ratings yet

- Home Depot Financial Statement Analysis ReportDocument6 pagesHome Depot Financial Statement Analysis Reportapi-301173024No ratings yet

- Name - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sDocument11 pagesName - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sAtty CpaNo ratings yet

- Cash FlowsDocument27 pagesCash FlowsRandhir Mankotia100% (1)

- Analyze Financial Statements to Evaluate Business PerformanceDocument18 pagesAnalyze Financial Statements to Evaluate Business PerformancezunaedNo ratings yet

- BioLife Solutions AnalysisDocument15 pagesBioLife Solutions AnalysisJorge GrubeNo ratings yet

- Document 2Document3 pagesDocument 2Un Konown Do'erNo ratings yet

- 098.ASX IAW Aug 12 2010 15.13 Full Year Result and Dividend AnnouncementDocument8 pages098.ASX IAW Aug 12 2010 15.13 Full Year Result and Dividend AnnouncementASX:ILH (ILH Group)No ratings yet

- Chapter 3 Financial Model ExcelDocument11 pagesChapter 3 Financial Model Excelzzduble1No ratings yet

- Retained Earnings: Dividends ExplainedDocument76 pagesRetained Earnings: Dividends ExplainedKristine DoydoraNo ratings yet

- FMCG Profit AnalysisDocument8 pagesFMCG Profit AnalysisTarun BhatiaNo ratings yet

- WK 3 Textbook AssignmentDocument4 pagesWK 3 Textbook AssignmentTressa audellNo ratings yet

- ch11 SolutionsDocument36 pagesch11 Solutionsaboodyuae2000No ratings yet

- FS ExerciseDocument30 pagesFS Exercisesaiful2522No ratings yet

- Case Study Accounting Policy, Changes in Accounting Estimate, and ErrorsDocument2 pagesCase Study Accounting Policy, Changes in Accounting Estimate, and ErrorsHAO HUYNH MINH GIANo ratings yet

- Cairn India Financial InfoDocument4 pagesCairn India Financial Infohirenchavla93No ratings yet

- BU127 Quiz Q&aDocument14 pagesBU127 Quiz Q&aFarah Luay AlberNo ratings yet

- 105 DepaDocument12 pages105 DepaLA M AENo ratings yet

- ExercisesDocument5 pagesExercisesSandip GhoshNo ratings yet

- Bus5110 Week1 ReeceDocument5 pagesBus5110 Week1 Reeceapi-37239463192% (12)

- DCF Analysis Forecasting Free Cash FlowsDocument4 pagesDCF Analysis Forecasting Free Cash Flowshamrah1363No ratings yet

- TB CLDocument2 pagesTB CLObe AbsinNo ratings yet

- Practice 4 - Statement of Cash FlowsDocument8 pagesPractice 4 - Statement of Cash FlowsLLNo ratings yet

- Review Questions Liabilities and Current LiabilitiesDocument21 pagesReview Questions Liabilities and Current LiabilitiesAbigail Valencia MañalacNo ratings yet

- Cash Flow Statement For The Year Ended December 31, 2010: Operating ActivitiesDocument5 pagesCash Flow Statement For The Year Ended December 31, 2010: Operating ActivitiesHamza ShafiqueNo ratings yet

- Chapter2 Statement of Comprehensive IncomeDocument46 pagesChapter2 Statement of Comprehensive IncomeRonald De La Rama100% (1)

- Financial Reporting and Analysis II Exam QuestionsDocument27 pagesFinancial Reporting and Analysis II Exam QuestionsSagarPirtheeNo ratings yet

- CmaDocument22 pagesCmaAhmed Mostafa ElmowafyNo ratings yet

- Use of retained earnings account in SAP financialsDocument3 pagesUse of retained earnings account in SAP financialsAnanthakumar ANo ratings yet

- Practice Questions On Financial Planning and Corporate ValuationDocument6 pagesPractice Questions On Financial Planning and Corporate ValuationsimraNo ratings yet

- Projected Financial StatementDocument8 pagesProjected Financial StatementRicaNo ratings yet

- Analyze Financial StatementsDocument7 pagesAnalyze Financial StatementsJianne Ricci GalitNo ratings yet

- Analisis Laporan Keuangan - PT Unilever Indonesia Tbk.Document7 pagesAnalisis Laporan Keuangan - PT Unilever Indonesia Tbk.Fara Laynds Lamborghini100% (4)

- Accounting Textbook Solutions - 17Document19 pagesAccounting Textbook Solutions - 17acc-expertNo ratings yet

- Accounting Textbook Solutions - 12Document19 pagesAccounting Textbook Solutions - 12acc-expertNo ratings yet

- 5.AUDITING ProblemDocument111 pages5.AUDITING ProblemAngelu Amper68% (22)

- Financial Analysis Ratio Analysis of The Shifa International HospitalDocument4 pagesFinancial Analysis Ratio Analysis of The Shifa International HospitalNaheed AdeelNo ratings yet

- Managerial Accounting Ass Written Ass 1Document1 pageManagerial Accounting Ass Written Ass 1Roba HassanNo ratings yet

- HW#2Document6 pagesHW#2Kristy WuNo ratings yet

- Corporation Tax 1Document4 pagesCorporation Tax 1Sanjida KhanNo ratings yet

- Financial Statement Analysis Business RatiosDocument63 pagesFinancial Statement Analysis Business RatiosAdmire MamvuraNo ratings yet

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNo ratings yet

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthFrom EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNo ratings yet

- Quantatative Analysis of QCORDocument21 pagesQuantatative Analysis of QCORmktg1990No ratings yet

- Metabical-Case StudyDocument4 pagesMetabical-Case Studymktg1990No ratings yet

- Presentation Skills: Gabriel RivasDocument18 pagesPresentation Skills: Gabriel Rivasmktg1990No ratings yet

- In A Bind: Peak SealingDocument7 pagesIn A Bind: Peak Sealingmktg1990No ratings yet

- Customer service impact on customer satisfactionDocument8 pagesCustomer service impact on customer satisfactionQuame Enam Kunu0% (1)

- Company Profile KAP Hendrawinata Hanny Erwin & SumargoDocument12 pagesCompany Profile KAP Hendrawinata Hanny Erwin & SumargoHusni YasinNo ratings yet

- The State of Product Management Annual Report 2023Document34 pagesThe State of Product Management Annual Report 2023develisa.glendaNo ratings yet

- Larson 2001Document3 pagesLarson 2001Carleen Camacho-CalimponNo ratings yet

- Emerging Markets Bond Index Plus (EMBI+) JPMorganDocument19 pagesEmerging Markets Bond Index Plus (EMBI+) JPMorganRodrigo CostaNo ratings yet

- D-Marin Job Description Marketing ManagerDocument2 pagesD-Marin Job Description Marketing ManagersarathNo ratings yet

- Second Preboards in Auditing - Answer KeyDocument15 pagesSecond Preboards in Auditing - Answer KeyROMAR A. PIGANo ratings yet

- Tugas Kasus Construction Company - Fahmi Izzuddin - 1506750296Document3 pagesTugas Kasus Construction Company - Fahmi Izzuddin - 1506750296Fahmi IzzuddinNo ratings yet

- ABM FABM1 AIRs LM Q4-M13Document12 pagesABM FABM1 AIRs LM Q4-M13Jomarie Lagos0% (1)

- Eco 204 Week 2 AssignmentDocument8 pagesEco 204 Week 2 AssignmentNickki JohnsonNo ratings yet

- 07 DCF Steel Dynamics AfterDocument2 pages07 DCF Steel Dynamics AfterJack JacintoNo ratings yet

- Intermediate Examination Syllabus 2016 Paper 8: Cost Accounting (Cac)Document19 pagesIntermediate Examination Syllabus 2016 Paper 8: Cost Accounting (Cac)Mohit SangwanNo ratings yet

- Auditing Theories - Summary NotesDocument36 pagesAuditing Theories - Summary NotesBheybi Zian50% (2)

- Multiple Choice-Problems 1. A: Direct MaterialDocument11 pagesMultiple Choice-Problems 1. A: Direct MaterialIT GAMINGNo ratings yet

- Ambuja Cements Company ProfileDocument12 pagesAmbuja Cements Company ProfileJM MANOJKUMARNo ratings yet

- Managing Brands Over Geographic Boundaries and Market SegmentsDocument17 pagesManaging Brands Over Geographic Boundaries and Market SegmentsAnuj ChandaNo ratings yet

- As Entrepreneurship Q4 Week 1 2Document13 pagesAs Entrepreneurship Q4 Week 1 2Mawie duligNo ratings yet

- Study Question Bank Becker F7 DipIFRDocument134 pagesStudy Question Bank Becker F7 DipIFRNguyen Nhan100% (1)

- Ias 15Document23 pagesIas 15Harsh KhandelwalNo ratings yet

- Confident Guidance CG 09-2013Document4 pagesConfident Guidance CG 09-2013api-249217077No ratings yet

- DMCC Company Regulations - Jan 2022 - V2Document79 pagesDMCC Company Regulations - Jan 2022 - V2Laila NadifNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument12 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionthisisfordesignNo ratings yet

- S4 MOCK 1 2016 CommerceDocument5 pagesS4 MOCK 1 2016 CommerceDaniel MarkNo ratings yet

- Assignment #1: Porter's Five Forces Analysis For Starbucks' Launch in PakistanDocument3 pagesAssignment #1: Porter's Five Forces Analysis For Starbucks' Launch in Pakistanmaryam sherazNo ratings yet

- ESOP PresentationDocument19 pagesESOP Presentationneha_bahadurNo ratings yet

- Victoria Company financial statements and journal entriesDocument4 pagesVictoria Company financial statements and journal entries林義哲No ratings yet

- Sales Management Strategies of LG Consumer Durables in IndiaDocument7 pagesSales Management Strategies of LG Consumer Durables in IndiarjnbhattNo ratings yet

- CRM FinalDocument16 pagesCRM FinalAmy KnightNo ratings yet

- Megadyne Product LeafletsDocument8 pagesMegadyne Product LeafletsEvgeniy SemenenkoNo ratings yet

- How Can Design Thinking Re-Invent A BrandDocument11 pagesHow Can Design Thinking Re-Invent A BrandShivansh TyagiNo ratings yet