Professional Documents

Culture Documents

Accounting For Installment Sales

Uploaded by

aciamaj1214Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting For Installment Sales

Uploaded by

aciamaj1214Copyright:

Available Formats

Accounting for Installment Sales

-The installment method of accounting is used only when there is no reasonable basis for estimating the degree of

collectability. Under installment accounting, revenue is not recognized at the time a sale is made but rather when cash is

actually collected.*

*Installment Sales = Cash Method

*Percentage of Completion = Accrual Method

Problem Solving Formulas

1. Gross Profit = Sales - COGS

2. Gross Profit % = Gross Profit Sales Price

3. Earned Gross Profit = Cash Collections x Gross Profit %

4. Deferred Gross Profit = Installment Receivable x Gross Profit %

Balance Sheet Presentation

-Deferred Gross Profit is a contra asset that decreases the balance of accounts receivable

-First credit "Deferred Gross Profit" to record the installment sale.

-To record the profit on collection, debit "Deferred Gross Profit" and credit "Realized Gross Profit on Installment Sales."*

*Debiting the deferred gross profit takes it off of the B/S and crediting the realized gross profit on installment sales puts it

onto the I/S.

Cost Recovery Method

-Under the cost recovery method, no profit is recognized on a sale until all costs have been recovered.

1. At the time of sale, the expected profit is recorded as deferred gross profit.

2. Cash collections are first applied to the recovery of product costs.

3. Collections after all costs have been recovered are recognized as profit.

Cost Recovery Method- Comparison to Other Methods

-Similar to the installment sales method in that it may only be used when receivables are collected over an extended

period and there is no reasonable basis for estimating their collectibility.*

*Because no profit is recognized until all costs have been recovered, the cost recovery method is the most conservative

method of revenue recognition.

Installment Sales

Example & Homework Problem

Example:

1.

ABC Corp. sold a piece of real estate on January 2, 2009 for $5,000,000. It had purchased the property in 2002

for $4,500,000 in cash. At that time the land was worth $450,000 and the remainder was attributed to the

building. At the time of the sale, the carrying value of the building was $3,650,000.

The terms of the sale were as follows:

Downpayment

Note Receivable

Interest rate

Length of mortgage

Annual payment

$ 250,000

$4,750,000

10%

20 years

$ 557,933 due at end of each year

The sale has been consummated, the seller's receivable is not subject to future subordination, and the seller has no

continuing involvement with the property. However, because the initial investment is inadequate, the seller must use

the installment method to account for this sale.

REQUIRED: Journal entries needed in 2009, 2010.

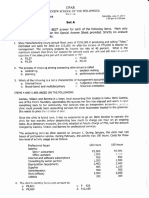

Solution to Installment Accounting Example

1.

Gross profit percentage = 18% [(5,000-3650-450)/5000

or $900,000 deferred gross profit divided by $5,000,000 selling price

1/2/09

12/28/09

Cash

250,000

Notes Receivable

4,750,000

Acc'd Depreciation

400,000

Land

Building

Deferred gross profit on installment sale of land

Cash

557,933

Interest revenue

Notes receivable

12/31/09

12/31/10

475,000

82,933

Deferred gross profit {(82,933+250,000)*18%}

Gain on installment sale of land

Cash

59,928

59,928

557,933

Interest Revenue

Note receivable

12/31/10

YEAR

450,000

4,050,000

900,000

466,707

91,227

Deferred gross profit (18% * 91,227)

Gain on installment sale of land

PAYMENT

DWNPYMT

$

250,000

2009

$557,933

2010

$557,933

2011

$557,933

2012

$557,933

2013

$557,933

2014

$557,933

2015

$557,933

2016

$557,933

2017

$557,933

2018

$557,933

2019

$557,933

2020

$557,933

2021

$557,933

2022

$557,933

2023

$557,933

2024

$557,933

2025

$557,933

2026

$557,933

2027

$557,933

2028

$557,933

$ 11,408,660

10.00%

INTEREST

PRINCIPAL

REVENUE

$475,000

$466,707

$457,584

$447,549

$436,511

$424,369

$411,012

$396,320

$380,159

$362,381

$342,826

$321,315

$297,654

$271,626

$242,995

$211,501

$176,858

$138,750

$96,832

$50,722

$6,408,670

$250,000

$82,933

$91,227

$100,349

$110,384

$121,422

$133,564

$146,921

$161,613

$177,774

$195,552

$215,107

$236,618

$260,279

$286,307

$314,938

$346,432

$381,075

$419,183

$461,101

$507,220

$5,000,000

BALANCE

$ 5,000,000

$4,750,000

$4,667,067

$4,575,840

$4,475,491

$4,365,107

$4,243,685

$4,110,121

$3,963,200

$3,801,587

$3,623,812

$3,428,261

$3,213,154

$2,976,536

$2,716,257

$2,429,949

$2,115,011

$1,768,579

$1,387,504

$968,322

$507,221

$0

16,421

16,421

GROSS

BALANCE

PROFIT

DEFERRED

RECOGNIZED PROFIT

$

900,000

$45,000

$855,000

$14,928

$840,072

$16,421

$823,651

$18,063

$805,588

$19,869

$785,719

$21,856

$763,863

$24,042

$739,822

$26,446

$713,376

$29,090

$684,286

$31,999

$652,286

$35,199

$617,087

$38,719

$578,368

$42,591

$535,776

$46,850

$488,926

$51,535

$437,391

$56,689

$380,702

$62,358

$318,344

$68,594

$249,751

$75,453

$174,298

$82,998

$91,300

$91,300

$0

$900,000

Homework Problem:

2.

RVO Corp. sold a piece of real estate on January 2, 2009 for $10,000,000. It had purchased the property in 2001

for $6,500,000 in cash. At that time the land was worth $500,000. At the time of the sale, the carrying value of

the building was $4,500,000.

The terms of the sale were as follows:

Downpayment

Note Receivable

Interest rate

Length of mortgage

Annual payment

$ 500,000

$ 9,500,000

12%

20 years

$ 1,115,866 due at end of each year

The sale has been consummated, the seller's receivable is not subject to future subordination, and the seller has no

continuing involvement with the property. However, because the initial investment is inadequate, the seller must use

the installment method to account for this sale.

REQUIRED: Journal entries needed in 2009, and 2010

You might also like

- ACC16 - HO 2 Installment Sales 11172014Document7 pagesACC16 - HO 2 Installment Sales 11172014Marvin James Cho0% (2)

- General de Jesus CollegeDocument12 pagesGeneral de Jesus CollegeErwin Labayog MedinaNo ratings yet

- Accounting 4 Note Payable and Debt RestructureDocument2 pagesAccounting 4 Note Payable and Debt RestructurelorenNo ratings yet

- ACTExamsDocument36 pagesACTExamsKaguraNo ratings yet

- Afar ProblemsDocument8 pagesAfar ProblemsSheena BaylosisNo ratings yet

- GOVT ACCOUNTING OVERVIEWDocument15 pagesGOVT ACCOUNTING OVERVIEWTroisNo ratings yet

- 7 - Long-Term Construction ContractsDocument6 pages7 - Long-Term Construction ContractsDarlene Faye Cabral RosalesNo ratings yet

- Problem 17-1, ContinuedDocument6 pagesProblem 17-1, ContinuedJohn Carlo D MedallaNo ratings yet

- Partnership Formation AccountingDocument7 pagesPartnership Formation AccountingSienna PrcsNo ratings yet

- Construction Contracts GuideDocument3 pagesConstruction Contracts GuideJamie RamosNo ratings yet

- MGT Adv Serv 09.2019Document11 pagesMGT Adv Serv 09.2019Weddie Mae VillarizaNo ratings yet

- Reviewer 1st PB P1 1920Document7 pagesReviewer 1st PB P1 1920Therese AcostaNo ratings yet

- Seatwork-Hedging of A Net Investment in Foreign OperationDocument1 pageSeatwork-Hedging of A Net Investment in Foreign OperationAnthony Tunying MantuhacNo ratings yet

- 02Document3 pages02Jodel Castro100% (1)

- Pre-Quali - 2016 - Financial - Acctg. - Level - 1 - Answers - Docx Filename UTF-8''Pre-quali 2016 Financial Acctg. (Level 1) - AnswersDocument10 pagesPre-Quali - 2016 - Financial - Acctg. - Level - 1 - Answers - Docx Filename UTF-8''Pre-quali 2016 Financial Acctg. (Level 1) - AnswersReve Joy Eco IsagaNo ratings yet

- ADVACCDocument3 pagesADVACCCianne AlcantaraNo ratings yet

- MODULE 1 2 Bonds PayableDocument10 pagesMODULE 1 2 Bonds PayableFujoshi BeeNo ratings yet

- 1 Partnership Accounting QuestionnairesDocument11 pages1 Partnership Accounting QuestionnairesShiela MayNo ratings yet

- Requirements:: Intermediate Accounting 3Document7 pagesRequirements:: Intermediate Accounting 3happy240823No ratings yet

- Standard Cost Variances ExplainedDocument17 pagesStandard Cost Variances ExplainedJesselle Marie SalazarNo ratings yet

- Answer - ELEC 001Document2 pagesAnswer - ELEC 001Kris Van HalenNo ratings yet

- Audit Liability 04 Chapter 7Document1 pageAudit Liability 04 Chapter 7Ma Teresa B. CerezoNo ratings yet

- Chapter 16Document16 pagesChapter 16redearth29No ratings yet

- LTCC - ExamDocument5 pagesLTCC - ExamLouise Anciano100% (1)

- Partnership Dissolution and Incorporation NotesDocument3 pagesPartnership Dissolution and Incorporation NotesMila MercadoNo ratings yet

- Receipt and Disposition of InventoriesDocument5 pagesReceipt and Disposition of InventoriesWawex DavisNo ratings yet

- Chapter 10-Investments in Noncurrent Operating Assets-AcquisitionDocument34 pagesChapter 10-Investments in Noncurrent Operating Assets-AcquisitionYukiNo ratings yet

- AdvaccDocument3 pagesAdvaccMontessa GuelasNo ratings yet

- For The Year Ended December 31Document2 pagesFor The Year Ended December 31elsana philipNo ratings yet

- B. Woods Chapter 04 ElectronicDocument19 pagesB. Woods Chapter 04 ElectronicSteven Andrian GunawanNo ratings yet

- CHAPTER 14 Business Combination PFRS 3Document3 pagesCHAPTER 14 Business Combination PFRS 3Richard DuranNo ratings yet

- MA PresentationDocument6 pagesMA PresentationbarbaroNo ratings yet

- Error DiscussionDocument2 pagesError DiscussionGloria Beltran100% (1)

- Module 5 Franchise Accounting WADocument4 pagesModule 5 Franchise Accounting WAMadielyn Santarin MirandaNo ratings yet

- Accounting For Budgetary AccountsDocument7 pagesAccounting For Budgetary AccountsSharn Linzi Buan MontañoNo ratings yet

- "How Well Am I Doing?" Statement of Cash Flows: Managerial Accounting, 9/eDocument51 pages"How Well Am I Doing?" Statement of Cash Flows: Managerial Accounting, 9/eMARY JUSTINE PAQUIBOTNo ratings yet

- Fischer - Pship LiquiDocument7 pagesFischer - Pship LiquiShawn Michael DoluntapNo ratings yet

- MAS 2017 01 Management Accounting Concepts Techniques For Planning and ControlDocument5 pagesMAS 2017 01 Management Accounting Concepts Techniques For Planning and ControlMitch Delgado EmataNo ratings yet

- Home Office, Branch and Agency AccountingDocument15 pagesHome Office, Branch and Agency AccountingErwin Labayog MedinaNo ratings yet

- Instruction: Show Your Solution. No Solution Incorrect AnswerDocument1 pageInstruction: Show Your Solution. No Solution Incorrect AnswerRian ChiseiNo ratings yet

- Accounting Changes and Errors - Lecture by Rey OcampoDocument22 pagesAccounting Changes and Errors - Lecture by Rey OcampoBernadette PanicanNo ratings yet

- AFAR - Partnership OperationDocument21 pagesAFAR - Partnership OperationReginald ValenciaNo ratings yet

- Mixed PDFDocument8 pagesMixed PDFChris Tian FlorendoNo ratings yet

- AFAR3 QuestionnairesDocument5 pagesAFAR3 QuestionnairesTyrelle Dela CruzNo ratings yet

- IA3 Mod 4 REDocument12 pagesIA3 Mod 4 REjulia4razoNo ratings yet

- T02 - Installment Sales & Consignment Sales PDFDocument7 pagesT02 - Installment Sales & Consignment Sales PDFAshley Levy San PedroNo ratings yet

- ACCO 3016 - FINANCIAL ACCOUNTING AND REPORTING EXAMDocument14 pagesACCO 3016 - FINANCIAL ACCOUNTING AND REPORTING EXAMPatrick ArazoNo ratings yet

- Chapter 15Document5 pagesChapter 15Renzo RamosNo ratings yet

- Cash and Cash Equivalents Audit of Papskie CompanyDocument3 pagesCash and Cash Equivalents Audit of Papskie CompanyNicole ReyesNo ratings yet

- Understanding Variable and Fixed Overhead Costs and VariancesDocument13 pagesUnderstanding Variable and Fixed Overhead Costs and VariancesElla Mae TuratoNo ratings yet

- SW04Document8 pagesSW04Nadi Hood0% (1)

- FAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFDocument4 pagesFAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFvhhhNo ratings yet

- Business CombinationDocument3 pagesBusiness CombinationJia CruzNo ratings yet

- Karma Company Sells Televisions at An Average Price of P7Document1 pageKarma Company Sells Televisions at An Average Price of P7Nicole AguinaldoNo ratings yet

- Chapter 5 Installment SalesDocument10 pagesChapter 5 Installment SalesAkkama100% (1)

- Installment, Home-Branch, Liquidation, LT Constn ContractsDocument47 pagesInstallment, Home-Branch, Liquidation, LT Constn ContractsArianne Llorente83% (6)

- Installment accounting revenue recognitionDocument222 pagesInstallment accounting revenue recognitionMichael Brian Torres100% (1)

- Installment accounting revenue recognitionDocument222 pagesInstallment accounting revenue recognitionEmey CalbayNo ratings yet

- Adv ch-3Document20 pagesAdv ch-3Prof. Dr. Anbalagan ChinniahNo ratings yet

- Chapter - 3Document66 pagesChapter - 3Ram KumarNo ratings yet

- 04 Sample PaperDocument45 pages04 Sample Papergaming loverNo ratings yet

- Accounts Form 4 - 2021Document51 pagesAccounts Form 4 - 2021gangstar sippas100% (1)

- Nick Scali Report 2012Document56 pagesNick Scali Report 2012Suzeria Vi RyuriNo ratings yet

- Far160 - Jul 2021 - QDocument9 pagesFar160 - Jul 2021 - QNur ain Natasha ShaharudinNo ratings yet

- Handover Shift Form (Downloadable by Laptop) PDFDocument1 pageHandover Shift Form (Downloadable by Laptop) PDFaldi anggaraNo ratings yet

- Unit - II - Analysis of Financial StatementsDocument54 pagesUnit - II - Analysis of Financial StatementsPRERNA PANDEY100% (1)

- CCE NotesDocument7 pagesCCE NotesHavanah Erika Dela CruzNo ratings yet

- Multiple Choice Problems Chapter 7Document14 pagesMultiple Choice Problems Chapter 7Dieter LudwigNo ratings yet

- Asset Accounting-3Document21 pagesAsset Accounting-3snb1976No ratings yet

- Practice Question On Capital BudgetingDocument4 pagesPractice Question On Capital BudgetingTekNo ratings yet

- IFA-I Assignment PDFDocument3 pagesIFA-I Assignment PDFNatnael AsfawNo ratings yet

- Morningstar Equities Research MethodologyDocument2 pagesMorningstar Equities Research Methodologykanika sengarNo ratings yet

- Financial Accounting Theory Test BankDocument13 pagesFinancial Accounting Theory Test BankPhilip Castro100% (3)

- Option Chain - NSE India1Document1 pageOption Chain - NSE India1bharatNo ratings yet

- BAJAJ AUTO LTD QUANTAMENTAL EQUITY RESEARCH REPORTDocument1 pageBAJAJ AUTO LTD QUANTAMENTAL EQUITY RESEARCH REPORTVivek NambiarNo ratings yet

- Joint Cost Allocation ProblemsDocument3 pagesJoint Cost Allocation ProblemsJune Maylyn MarzoNo ratings yet

- Startmate Clean Shareholders AgreementDocument23 pagesStartmate Clean Shareholders Agreementjung34No ratings yet

- Tina Louise Company financial recordsDocument4 pagesTina Louise Company financial recordsViệt DuyNo ratings yet

- ch09 Invenories AddtlDocument12 pagesch09 Invenories AddtlSalverika TorecampoNo ratings yet

- Cost AccountingDocument120 pagesCost AccountingjulianNo ratings yet

- CH 02 - Financial Stmts Cash Flow and TaxesDocument32 pagesCH 02 - Financial Stmts Cash Flow and TaxesSyed Mohib Hassan100% (1)

- Intangible AssetsDocument2 pagesIntangible AssetsNicole Allyson AguantaNo ratings yet

- Charts of AccountsDocument2 pagesCharts of AccountsNur ika PratiwiNo ratings yet

- Reviewer Midterm Accounting Exercises in Financial and Accouting ReportingDocument20 pagesReviewer Midterm Accounting Exercises in Financial and Accouting ReportingFiel Marie SateraNo ratings yet

- FR 2 QDocument14 pagesFR 2 QG INo ratings yet

- Quiz On DissolutionDocument18 pagesQuiz On Dissolutionjelai anselmoNo ratings yet

- SFM Theory Compiler - Bhavik ChokshiDocument54 pagesSFM Theory Compiler - Bhavik Chokshirajat100% (2)

- Michael Pierro 60787467 ENGG433 Quiz 1Document1 pageMichael Pierro 60787467 ENGG433 Quiz 1Mike PierroNo ratings yet

- Sail Annual Report - 2022.inddDocument11 pagesSail Annual Report - 2022.inddSandeep SharmaNo ratings yet

- Act 171 5.1-1 Midterm Exam 2021 NoneDocument3 pagesAct 171 5.1-1 Midterm Exam 2021 NoneAngeliePanerioGonzagaNo ratings yet