Professional Documents

Culture Documents

Settlement Order With Respect To M/s Archana Software Limited

Uploaded by

Shyam SunderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Settlement Order With Respect To M/s Archana Software Limited

Uploaded by

Shyam SunderCopyright:

Available Formats

BEFORE THE SECURITIES AND EXCHANGE BOARD OF INDIA

SETTLEMENT ORDER

On the Application No. 2847 of 2014

filed by

M/s. Archana Software Limited

(PAN no. AAACS9087L)

Consent Order No: CFD/EAD-6/AO/AK/ 220/2014

1.

Securities and Exchange Board of India (hereinafter referred to as "SEBI") had

initiated adjudication proceedings in respect of M/s. Archana Software Limited

(hereinafter referred to as "the applicant"/ "the company") to inquire into and

adjudge under section 15A(b) of the Securities and Exchange Board of India Act,

1992 (hereinafter referred to as SEBI Act), for the alleged violation/ contravention of

the provisions of Regulation 8(3) of SEBI (Substantial Acquisition of Shares and

Takeover) Regulations 1997 (hereinafter referred to as "Takeover Regulations") and

the undersigned was appointed as Adjudicating Officer (AO) vide order dated August

16, 2013 under section 15-I of the SEBI Act. Consequently, Show Cause Notice dated

April 22, 2014 was issued to the company under rule 4 of the SEBI (Procedure for

Holding Inquiry and Imposing Penalties by Adjudicating Officer) Rules, 1995, seeking

reply of the company as to why an inquiry should not be held in respect of the

violations alleged to have been committed by the company.

2.

Subsequent to the same, the applicant vide its application dated May 27, 2014 had

filed an application with SEBI in terms of SEBI (Settlement of Administrative and Civil

Proceedings) Regulations, 2014 for proposing to settle through a Settlement order,

the aforementioned adjudication proceedings for the delayed compliance of the

provisions of Regulation 8(3) of the Takeover Regulations.

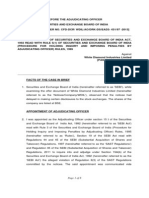

3.

It was observed that the applicant, a listed company did not make necessary

disclosures within the stipulated time as per the aforementioned provisions, details

Brought to you by http://StockViz.biz

Page 1 of 3

of which are as given below:

4.

Sr.

No.

Violation of

Regulation

Due date for

compliance

Actual date for

compliance

1.

2.

3

4.

5.

6.

7.

8.

9.

10

11.

8(3)

8(3)

8(3)

8(3)

8(3)

8(3)

8(3)

8(3)

8(3)

8(3)

8(3)

30-Apr-2001

30-Apr-2002

30-Apr-2003

30-Apr-2004

30-Apr-2005

30-Apr-2006

30-Apr-2007

30-Apr-2008

30-Apr-2009

30-Apr-2010

30-Apr-2011

09-Aug-2007

09-Aug-2007

09-Aug-2007

09-Aug-2007

09-Aug-2007

09-Aug-2007

11-Feb-2010

11-Feb-2010

11-Feb-2010

16-Feb-2011

Not complied

Delay in

disclosures made

(No. of days)

2,292

1,927

1,562

1,196

831

466

1,018

652

287

292

Not complied

The representatives of the applicant had a meeting with the Internal Committee of

SEBI where the terms of settlement was deliberated upon. Thereafter, the applicant

vide its letter dated September 04, 2014 proposed the revised consent terms to

settle the aforesaid adjudication proceedings for the delayed compliance of

Regulation 8(3) of the Takeover Regulations by offering to pay a sum of Rs.

5,22,750/- (Rupees Five Lakhs, Twenty Two Thousand, Seven Hundred and Fifty only)

towards settlement charges.

5.

The High Powered Advisory Committee (hereinafter referred to as "HPAC")

considered the settlement terms proposed by the applicant and recommended the

case for settlement upon payment of Rs. 5,22,750/- (Rupees Five Lakhs, Twenty Two

Thousand, Seven Hundred and Fifty only) towards settlement charges. The Panel of

Whole Time Members of SEBI accepted the said recommendations of the HPAC and

the same was communicated to the applicant vide an e-mail dated November 13,

2014.

6.

Accordingly, the applicant has vide demand draft No. '017141' dated November

17,2014 drawn on 'IDBI Bank' and payable at par at all Branches in India, remitted a

sum Rs. 5,22,750.00/- (Rupees Five Lakhs, Twenty Two Thousand, Seven Hundred

and Fifty only) towards the settlement charges.

Brought to you by http://StockViz.biz

Page 2 of 3

7.

In view of the above, in terms of Regulation 15(1) of SEBI (Settlement of

Administrative and Civil Proceedings) Regulations, 2014 it is hereby ordered that:

i.

this Settlement Order disposes of the said Adjudication Proceedings pending

in respect of the Applicant as mentioned above and;

ii.

passing of this Order is without prejudice to the right of SEBI to take

enforcement actions including commencing/ reopening of the pending

proceedings against the Applicant, if SEBI finds that:

a. any representations made by the Applicant in the consent

proceedings are subsequently discovered to be untrue;

b. the Applicant has breached any of the clauses/ conditions of

undertakings/ waivers filed during the current consent proceedings.

8.

This Settlement Order is passed on this Twenty Sixth day of November, 2014 and shall

come into force with immediate effect.

9.

In terms of Regulation 17 of SEBI (Settlement of Administrative and Civil Proceedings)

Regulations, 2014, copies of this order are being sent to the Applicant and also to

Securities and Exchange Board of India, Mumbai.

Place: Mumbai

Anita Kenkare

Adjudicating Officer

Brought to you by http://StockViz.biz

Page 3 of 3

You might also like

- Settlement Order in The Matter of M/s. Welspun India LimitedDocument3 pagesSettlement Order in The Matter of M/s. Welspun India LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of M/s Integra Engineering India LimitedDocument3 pagesSettlement Order in Respect of M/s Integra Engineering India LimitedShyam SunderNo ratings yet

- Settlement Order in Respect of M/s Sabero Organics Gujarat Limited in The Matter of M/s Sabero Organics Gujarat LimitedDocument5 pagesSettlement Order in Respect of M/s Sabero Organics Gujarat Limited in The Matter of M/s Sabero Organics Gujarat LimitedShyam SunderNo ratings yet

- Adjudication Order in Respect of Neha Jainarain Agarwal in The Matter of Jaipan Industries LimitedDocument7 pagesAdjudication Order in Respect of Neha Jainarain Agarwal in The Matter of Jaipan Industries LimitedShyam SunderNo ratings yet

- Adjudication Order Against Upvan Securities Pvt. Ltd. (Currently Known As Altius Finserve Pvt. LTD.) in The Matter of Capman Financials Ltd.Document7 pagesAdjudication Order Against Upvan Securities Pvt. Ltd. (Currently Known As Altius Finserve Pvt. LTD.) in The Matter of Capman Financials Ltd.Shyam SunderNo ratings yet

- Settlement Order in Respect of Taveta Properties Pvt. Ltd. in The Matter of Mipco Seamless Rings (Gujarat)Document3 pagesSettlement Order in Respect of Taveta Properties Pvt. Ltd. in The Matter of Mipco Seamless Rings (Gujarat)Shyam SunderNo ratings yet

- Adjudication Order in Respect of Shri Kahaan Vasa and Shri Karan Vasa in The Matter of Contech Software Ltd.Document9 pagesAdjudication Order in Respect of Shri Kahaan Vasa and Shri Karan Vasa in The Matter of Contech Software Ltd.Shyam SunderNo ratings yet

- Adjudication Order in Respect of Waverley Investments Ltd.Document8 pagesAdjudication Order in Respect of Waverley Investments Ltd.Shyam SunderNo ratings yet

- Adjudication Order against Shri. Bhanwarlal H Ranka, Shri. Pradeep B Ranka, Ms. Kusum B Ranka, Ms. Sangeetha P Ranka, Ms. Anjana B Ranka, Shri. Arun B Ranka , Ms. Rachana A Ranka and Shri. Kantilal G Bafna in the matter of Residency Projects and Infratech Ltd.Document8 pagesAdjudication Order against Shri. Bhanwarlal H Ranka, Shri. Pradeep B Ranka, Ms. Kusum B Ranka, Ms. Sangeetha P Ranka, Ms. Anjana B Ranka, Shri. Arun B Ranka , Ms. Rachana A Ranka and Shri. Kantilal G Bafna in the matter of Residency Projects and Infratech Ltd.Shyam SunderNo ratings yet

- Adjudication Order Against Hatigor Tea Estates Limited in The Matter of SCORESDocument6 pagesAdjudication Order Against Hatigor Tea Estates Limited in The Matter of SCORESShyam SunderNo ratings yet

- Adjudication Order in Respect of Nature India Communique LimitedDocument10 pagesAdjudication Order in Respect of Nature India Communique LimitedShyam SunderNo ratings yet

- Adjudication Order in Respect of Right Finstock Pvt. Ltd. in The Matter of M/s Gujarat Arth Ltd.Document16 pagesAdjudication Order in Respect of Right Finstock Pvt. Ltd. in The Matter of M/s Gujarat Arth Ltd.Shyam SunderNo ratings yet

- Adjudication Order in Respect of Kajal R. Vasa in The Scrip of Contech Software Ltd.Document8 pagesAdjudication Order in Respect of Kajal R. Vasa in The Scrip of Contech Software Ltd.Shyam SunderNo ratings yet

- Adjudication Order in Respect of in Respect of Mipco Seamless Rings (Gujarat) Ltd.Document7 pagesAdjudication Order in Respect of in Respect of Mipco Seamless Rings (Gujarat) Ltd.Shyam SunderNo ratings yet

- Adjudication Order Against Compact Disc India Limited in Matter of Non-Redressal of Investor Grievance(s)Document5 pagesAdjudication Order Against Compact Disc India Limited in Matter of Non-Redressal of Investor Grievance(s)Shyam SunderNo ratings yet

- Adjudication Order Against One Source Ideas Venture LimitedDocument8 pagesAdjudication Order Against One Source Ideas Venture LimitedShyam SunderNo ratings yet

- Adjudication Order in Respect of M/s Ambe Hotel & Resorts LimitedDocument8 pagesAdjudication Order in Respect of M/s Ambe Hotel & Resorts LimitedShyam SunderNo ratings yet

- Adjudication Order in Respect of Rudra Securities & Capital Limited in The Matter of Turbotech Engineering LTDDocument5 pagesAdjudication Order in Respect of Rudra Securities & Capital Limited in The Matter of Turbotech Engineering LTDShyam SunderNo ratings yet

- Adjudication Order Against Kiev Finance Limited in The Matter of SCORESDocument6 pagesAdjudication Order Against Kiev Finance Limited in The Matter of SCORESShyam SunderNo ratings yet

- Amit Jain v. SEBIDocument9 pagesAmit Jain v. SEBIUjjwal AgrawalNo ratings yet

- Re - Settlement Order in Respect of Emkay Global Financial Services Ltd. in The Matter of Aarey Drugs and Pharmaceuticals Ltd.Document3 pagesRe - Settlement Order in Respect of Emkay Global Financial Services Ltd. in The Matter of Aarey Drugs and Pharmaceuticals Ltd.Shyam SunderNo ratings yet

- Adjudication Order Against Computech International Limited in The Matter of SCORESDocument6 pagesAdjudication Order Against Computech International Limited in The Matter of SCORESShyam SunderNo ratings yet

- Order in The Matter of Kukar Sons (Indo French) Exports Ltd.Document11 pagesOrder in The Matter of Kukar Sons (Indo French) Exports Ltd.Shyam SunderNo ratings yet

- Adjudication Order Against Chain Impex Limited in The Matter of SCORESDocument6 pagesAdjudication Order Against Chain Impex Limited in The Matter of SCORESShyam SunderNo ratings yet

- Adjudication Order Against Kanika Infotech Limited in The Matter of SCORESDocument5 pagesAdjudication Order Against Kanika Infotech Limited in The Matter of SCORESShyam SunderNo ratings yet

- Adjudication Order in Respect of Micro Accessories India Limited in The Matter of Micro Accessories India LimitedDocument7 pagesAdjudication Order in Respect of Micro Accessories India Limited in The Matter of Micro Accessories India LimitedShyam SunderNo ratings yet

- Adjudication Order Against Tyroon Tea Company Limited in The Matter of SCORESDocument4 pagesAdjudication Order Against Tyroon Tea Company Limited in The Matter of SCORESShyam SunderNo ratings yet

- Adjudication Order in Respect of M/s Western Foods LimitedDocument8 pagesAdjudication Order in Respect of M/s Western Foods LimitedShyam SunderNo ratings yet

- Adjudication Order Against Parikarma Tecfhnofab LTD in Matter of Non-Redressal of Investor GrievancesDocument5 pagesAdjudication Order Against Parikarma Tecfhnofab LTD in Matter of Non-Redressal of Investor GrievancesShyam SunderNo ratings yet

- Adjudication Order Against Cepham Milk Specialities Ltd. in Matter of Non-Redressal of Investor Grievances(s)Document5 pagesAdjudication Order Against Cepham Milk Specialities Ltd. in Matter of Non-Redressal of Investor Grievances(s)Shyam SunderNo ratings yet

- Settlement Order in Respect of Vishal K Mahadevia in The Matter of M/s Tak Machinery and Leasing Limited (Now Known As "M/s Mangal Credit & Fincorp Limited")Document4 pagesSettlement Order in Respect of Vishal K Mahadevia in The Matter of M/s Tak Machinery and Leasing Limited (Now Known As "M/s Mangal Credit & Fincorp Limited")Shyam SunderNo ratings yet

- SAT Order On NDTV AppealDocument37 pagesSAT Order On NDTV AppealRaju DasNo ratings yet

- Adjudication Order in Respect of Haresh Infrastructure Private Ltd. in The Scrip of Turbotech Engineering Ltd.Document5 pagesAdjudication Order in Respect of Haresh Infrastructure Private Ltd. in The Scrip of Turbotech Engineering Ltd.Shyam SunderNo ratings yet

- Adjudication Order Against Usha Rectifier Corporation Ltd. in Matter of Non-Redressal of Investor GrievancesDocument6 pagesAdjudication Order Against Usha Rectifier Corporation Ltd. in Matter of Non-Redressal of Investor GrievancesShyam SunderNo ratings yet

- Adjudication Order Against Kothari Global Limited in The Matter of SCORESDocument6 pagesAdjudication Order Against Kothari Global Limited in The Matter of SCORESShyam SunderNo ratings yet

- Consent Order in Respect of Thinksoft Global Services Ltd. (Now SQS India BFSI LTD.) in The Matter of Thinksoft Global Services Ltd.Document2 pagesConsent Order in Respect of Thinksoft Global Services Ltd. (Now SQS India BFSI LTD.) in The Matter of Thinksoft Global Services Ltd.Shyam SunderNo ratings yet

- In The Matter of Akriti Global Traders Ltd.Document8 pagesIn The Matter of Akriti Global Traders Ltd.Shyam SunderNo ratings yet

- Adjudication Order Against Complex Trading Company Limited in The Matter of SCORESDocument6 pagesAdjudication Order Against Complex Trading Company Limited in The Matter of SCORESShyam SunderNo ratings yet

- Adjudication Order Against Dilip Yewale in The Matter of Mahindra & Mahindra LimitedDocument7 pagesAdjudication Order Against Dilip Yewale in The Matter of Mahindra & Mahindra LimitedShyam SunderNo ratings yet

- Adjudication Order in Respect of Shreeji Broking Pvt. Ltd. in The Matter of Turbotech Engineering LTDDocument5 pagesAdjudication Order in Respect of Shreeji Broking Pvt. Ltd. in The Matter of Turbotech Engineering LTDShyam SunderNo ratings yet

- Adjudication Order in Respect of Asia Pacific Financial Services Limited in The Matter of Asia Pacific Financial Services LimitedDocument7 pagesAdjudication Order in Respect of Asia Pacific Financial Services Limited in The Matter of Asia Pacific Financial Services LimitedShyam SunderNo ratings yet

- Adjudication Order Against CRB Capital Markets LimitedDocument5 pagesAdjudication Order Against CRB Capital Markets LimitedShyam SunderNo ratings yet

- Adjudication Order in Respect of Sanjay Thakkar in The Matter of M/s. Gujarat Arth Ltd.Document14 pagesAdjudication Order in Respect of Sanjay Thakkar in The Matter of M/s. Gujarat Arth Ltd.Shyam SunderNo ratings yet

- Adjudication Order Against Sooraj Automobiles Ltd. in The Matter of Non-Redressal of Investor GrievanceDocument6 pagesAdjudication Order Against Sooraj Automobiles Ltd. in The Matter of Non-Redressal of Investor GrievanceShyam SunderNo ratings yet

- Adjudication Order Against Consolidated Securities Ltd. in The Matter of Asian Oilfield Services Ltd.Document13 pagesAdjudication Order Against Consolidated Securities Ltd. in The Matter of Asian Oilfield Services Ltd.Shyam SunderNo ratings yet

- Adjudication Order in Respect of Monotona Exports Limited in The Matter of Monotona Exports LimitedDocument7 pagesAdjudication Order in Respect of Monotona Exports Limited in The Matter of Monotona Exports LimitedShyam SunderNo ratings yet

- Page 1 of 8Document8 pagesPage 1 of 8Jairaam PrasadNo ratings yet

- Adjudication Order Against Shriram Bearings LTD in Matter of Non-Redressal of Investor Grievances(s)Document6 pagesAdjudication Order Against Shriram Bearings LTD in Matter of Non-Redressal of Investor Grievances(s)Shyam SunderNo ratings yet

- Adjudication Order Against Organic Chemoils Limited in Matter of Non-Redressal of Investor Grievances(s)Document5 pagesAdjudication Order Against Organic Chemoils Limited in Matter of Non-Redressal of Investor Grievances(s)Shyam SunderNo ratings yet

- Adjudication Order in Respect of M/s Sitapur Plywood Manufacturers LTDDocument6 pagesAdjudication Order in Respect of M/s Sitapur Plywood Manufacturers LTDShyam SunderNo ratings yet

- Adjudication Order Against Rajamani in The Matter of Gee Gee Granites Ltd.Document6 pagesAdjudication Order Against Rajamani in The Matter of Gee Gee Granites Ltd.Shyam SunderNo ratings yet

- Adjudication Order in The Matter of Inspection of Onepaper Research Analysts PVT LTDDocument22 pagesAdjudication Order in The Matter of Inspection of Onepaper Research Analysts PVT LTDcawojin576No ratings yet

- ContemptDocument17 pagesContemptVikasNo ratings yet

- Adjudication Order in Respect of Shri Mahendra P Rathod in The Matter of SEL Manufacturing Co Ltd.Document7 pagesAdjudication Order in Respect of Shri Mahendra P Rathod in The Matter of SEL Manufacturing Co Ltd.Shyam SunderNo ratings yet

- Adjudication Order in Respect of M/s. Suryaamba Spinning Mills Limited in The Matter of M/s. Suryaamba Spinning Mills LimitedDocument10 pagesAdjudication Order in Respect of M/s. Suryaamba Spinning Mills Limited in The Matter of M/s. Suryaamba Spinning Mills LimitedShyam SunderNo ratings yet

- Adjudication Order in Respect of Gazi Financial Services and Investments Ltd. (In The Matter of Investor Grievance Case)Document5 pagesAdjudication Order in Respect of Gazi Financial Services and Investments Ltd. (In The Matter of Investor Grievance Case)Shyam SunderNo ratings yet

- Adjudication Order in Respect of Platinum Finance Limited in The Matter of Platinum Finance LimitedDocument7 pagesAdjudication Order in Respect of Platinum Finance Limited in The Matter of Platinum Finance LimitedShyam SunderNo ratings yet

- Adjudication Order in Respect of M/s Genus Prime Infra Limited (Erstwhile Known As 'M/s Gulshan Chemfill Limited')Document7 pagesAdjudication Order in Respect of M/s Genus Prime Infra Limited (Erstwhile Known As 'M/s Gulshan Chemfill Limited')Shyam SunderNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Special Tribunal For LebanonDocument3 pagesSpecial Tribunal For LebanonShivansh JaiswalNo ratings yet

- ANG y PASCUA V CADocument3 pagesANG y PASCUA V CAClarice Joy SjNo ratings yet

- Morani v. Landenberger, 196 F.3d 9, 1st Cir. (1999)Document6 pagesMorani v. Landenberger, 196 F.3d 9, 1st Cir. (1999)Scribd Government DocsNo ratings yet

- Philippine Supreme Court Rules on Impossible Crime CaseDocument4 pagesPhilippine Supreme Court Rules on Impossible Crime CaseM Azeneth JJNo ratings yet

- United States Court of Appeals Second Circuit.: No. 252. Docket 23469Document3 pagesUnited States Court of Appeals Second Circuit.: No. 252. Docket 23469Scribd Government DocsNo ratings yet

- BIE2001: Law of Land Development Tutorial Week 1: Introduction To Land Administration System in Malaysia Lecturer: Dr. Hasniyati HamzahDocument16 pagesBIE2001: Law of Land Development Tutorial Week 1: Introduction To Land Administration System in Malaysia Lecturer: Dr. Hasniyati HamzahSin YeeNo ratings yet

- Comparative Public Law: Submitted To: Dr. Shruti Bedi Ms. Kajori BhatnagarDocument17 pagesComparative Public Law: Submitted To: Dr. Shruti Bedi Ms. Kajori BhatnagarJaskaran Singh BediNo ratings yet

- PEOPLE vs. NUEVAS: Warrantless Searches InvalidDocument2 pagesPEOPLE vs. NUEVAS: Warrantless Searches InvalidMyra MyraNo ratings yet

- AUSL The Law Pertaining To The State and Its Relationship With Its CitizensDocument146 pagesAUSL The Law Pertaining To The State and Its Relationship With Its CitizensRedraine ReyesNo ratings yet

- Uy v. Court of AppealsDocument2 pagesUy v. Court of AppealsJoyce Anne Cruz100% (1)

- New OutlineDocument5 pagesNew Outlineapi-315734227No ratings yet

- Hlurb-Br 871 2011 Rules of ProcedureDocument31 pagesHlurb-Br 871 2011 Rules of ProcedureTata Hitokiri0% (1)

- Defamation Complaint Against Media HouseDocument9 pagesDefamation Complaint Against Media HousemantraratnamNo ratings yet

- Torts de Guzman V Toyota IncDocument2 pagesTorts de Guzman V Toyota IncAnn Alejo-Dela TorreNo ratings yet

- Exceptions: Unlawful Activities Defined in Numbers (1), (2) andDocument3 pagesExceptions: Unlawful Activities Defined in Numbers (1), (2) andTherese Grace PostreroNo ratings yet

- La Grange AccidentDocument12 pagesLa Grange AccidentDavid GiulianiNo ratings yet

- Caltex v. Palomar, G.R. No. L-19650, September 29, 1966Document13 pagesCaltex v. Palomar, G.R. No. L-19650, September 29, 1966Cheala ManagayNo ratings yet

- Agent of The Philippine National Bank Branch in The ProvinceDocument6 pagesAgent of The Philippine National Bank Branch in The ProvinceHoney BiNo ratings yet

- Declaratory Relief CasesDocument10 pagesDeclaratory Relief CasesDiosa Mae SarillosaNo ratings yet

- Complete The Crossword Puzzle Below: Down AcrossDocument1 pageComplete The Crossword Puzzle Below: Down AcrossWhilmark Tican MucaNo ratings yet

- Torts CasesDocument95 pagesTorts CasesJimi SolomonNo ratings yet

- Jessa CrimlawDocument5 pagesJessa CrimlawJessa MaeNo ratings yet

- CRIMPRO Cases Rule 112 Section 3Document64 pagesCRIMPRO Cases Rule 112 Section 3Marielle Joyce G. AristonNo ratings yet

- Tatel vs. Municipality of ViracDocument9 pagesTatel vs. Municipality of ViracborgyambuloNo ratings yet

- USA vs. Roger StoneDocument38 pagesUSA vs. Roger StoneAndy BeltNo ratings yet

- Heirs of Gabatan V CA GR 150206 March 13Document2 pagesHeirs of Gabatan V CA GR 150206 March 13JenniferPizarrasCadiz-CarullaNo ratings yet

- 1 31 13KarlLentz (Episode199)Document11 pages1 31 13KarlLentz (Episode199)naturalvibes100% (2)

- Section 100 CPCDocument12 pagesSection 100 CPCAarif Mohammad BilgramiNo ratings yet

- Ronquillo vs. RocoDocument1 pageRonquillo vs. RocorienaanaaNo ratings yet

- Article 12 of The Indian Constitution PDF UPSC NotesDocument3 pagesArticle 12 of The Indian Constitution PDF UPSC NotesMohit sharmaNo ratings yet