Professional Documents

Culture Documents

Advertisment

Uploaded by

shaikh javedCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advertisment

Uploaded by

shaikh javedCopyright:

Available Formats

GOVERNMENT OF SINDH

FINANCE DEPARTMENT

(ECONOMIC REFORM UNIT)

Vacancy Announcement

interested

basis:

Finance

Department,

candidates (Pakistani

Government

of

Sindh

invites

applications

nationals) for the following positions purely

Position

1. Debt Management Specialist (1 position):

Educational Qualifications & Experience:

MBA (Finance)/ MSc Finance/CFA/CA from a

HEC recognized university.

A minimum of 5 years experience, gained in

government or international organizations, in one or

more of the following areas:

Public debt policy including debt management

strategy formulation and implementation;

Risk management frameworks and financial

analysis;

Market knowledge related to development of

domestic debt market and functioning of

international capital markets;

The ability to use output from the framework for

debt analysis to guide the formulation and

implementation of debt management policy and

strategy;

Clear understanding of inter linkages between

debt management and macroeconomic policy,

including fiscal and exchange rate policies for the

implementation of debt strategies including

liability management operations;

Advance quantitative skill supporting debt

analysis;

Writing analytical and advisory reports and past

record in authoring publications.

Age Limit: Not exceeding than 45 years.

Domicile: Sindh Province

from

the

on contract

Job Description

To be responsible for overall coordination with all

relevant Federal and Provincial Government

departments/agencies that come under the ambit of

Government of Sindhs Debt Management.

To be responsible for examination of all loan

documents and to provide technical inputs there in

with respect to financial implications.

To be responsible to formulate sound policies and

medium-term debt management strategy (MTDS)

with objectives of improving realism and

sustainability of the budget, strengthening debt

management functions (forecasting, financial analysis

and payment management) covering both external and

domestic debt, and linking them to budget formulation

and execution, as designated under the Public

Financial Management (PFM) Reform Strategy of the

Government of Sindh.

To provide detailed strategic recommendations,

technical advice, and on-the-job training to

departments/units concerned to strengthen integrated

public debt management functions, based on a

thorough review of prevailing practices in Sindh and

on account of international best practices.

To provide assistance to Finance Department in

further enhancing institutional and capacity

development of Debt Management Unit.

To provide assistance in strengthening middle office

functions.

To prepare implement a training plan in debt

sensitivity analysis; risk management analysis for

middle office staff and enhanced use of a specialized

debt data base.

To do periodically review legal framework of debt

management and public debt management any other

tasks required.

To assist Finance Department, Government of Sindh

in enhancing policy coordination with the tax

Educational Qualification & Experience:

collecting departments/agencies.

To conduct high quality empirical research and

PhD in Economics or Public Policy with strong

analyses to help tax policy and administration

emphasis on issues relating to tax policy and

decision-making processes.

2. Tax Management Specialist (1 position):

administration from HEC recognized University;

A minimum of 8 years relevant professional

experience with at least 3 years related to

economic research (modeling and forecasting of

tax revenues). Experience relating to tax

administration/policy will be an advantage;

Strong analytical and advanced quantitative skills

to support economic research and analyses;

Strong report writing skills and ability to

effectively communicate;

Computer literate (MS Office applications) and

proficiency in application of mainstream

statistical software for economic research;

Knowledge of the tax policy and regulatory

system in the province;

Must be fluent (written and oral) in Urdu, Sindhi

& English;

Age Limit: Not exceeding than 45 years.

Domicile: Sindh Province

To coordinate with the tax policy analysts and

academic institutions of national and international

repute for tax policy research and analyses in the

identified areas of tax policy and administration.

To conduct periodic simulations and modelling of

different revenue forecasting and collection scenarios

for consideration of revenue collecting agencies

through Finance Department, Government of Sindh.

To foster engagement with and ownership of tax

policy reforms through effective communication

strategy.

To collaborate with tax policy analysts, academic

institutions, civil society, and other relevant

stakeholders for development and communication of

tax policy and administration reforms.

To be based on internal and external research and

analyses, suggests ways to promote efficiency, equity,

effectiveness, and transparency in tax policy and

administration.

To suggest objective and measurable revenue targets

for different revenue collecting agencies.

To coordinate for effective implementation of the

Sindh Tax Revenue Mobilization Plan (STRMP)

through Finance Department, Government of Sindh.

To prepare and publish annual report on the

performance of the Sindh Tax Revenue Mobilization

Plan (STRMP).

To advise Finance Department on improvement of tax

policy and statistics.

Any other tax policy or administration reform task

that Finance Department, Government of Sindh may

require.

To assist and provide support to the Debt

Management Specialist in disposing off his day to

day functions and report to him on all official

matters.

MBA (Finance) / MSc Finance/CFA/CA from a

To be responsible to formulate policy on the main

HEC recognized university.

sources of debt - foreign and domestic.

Proficient in the use of MS Office

To provide financial analysis to inform loan

particularly Excel, Word and PowerPoint.

negotiations and debt repayment decisions.

Minimum 5 years post qualification

To provide timely advice on the desired currency

experience in relevant filed.

mix and tenor or new borrowings to the loan

negotiators.

Age Limit: Not exceeding than 35 years.

To comprehend the functioning of domestic and

Domicile: Sindh Province

international capital markets as they relate to debt

management and of the public policy

responsibility of a provincial debt manager.

To maintain a liaison with key stakeholders

within the Government of Sindh as well as in the

Federal Government.

To manage debt-related transaction and perform

all other functions.

To provide comprehensive statistical support and

prepare key periodical reports.

To demonstrate sound appreciation of the full

3. Financial Analyst (Debt Management):

(2 positions)

Educational Qualification & Experience:

range of financial risk and exposure arising from

the debt portfolio and translate it.

To perform duties assigned by the Debt

Management Specialist to facilitate the working

of Debt Management Unit.

4. Financial Analyst (Tax Management):

(2 positions)

Educational Qualification & Experience:

Masters in Economics or a related field from a

HEC recognized University.

A minimum of 5 years professional experience

with at least 1 year related to economic research

(modeling and forecasting of tax revenues).

Experience relating to tax administration/policy

will be an advantage;

Strong quantitative and analytical skills to

support economic research and analyses;

Strong report writing skills and ability to

effectively communicate;

Computer literate (MS Office applications) and

proficiency in application of mainstream

statistical software for economic research;

Knowledge of the tax policy and regulatory

system in the province;

Must be fluent (written and oral) in Urdu, Sindhi

& English.

Age Limit: Not exceeding than 35 years.

Domicile: Sindh Province

To monitor revenue collection of tax collecting

agencies and report the collection trend with

analytical feedback to the tax entities through Finance

Department, on a weekly basis.

To liaise between provincial tax collecting agencies

and the individual researchers and research

institutions as and when required.

To provide comprehensive statistical support to

facilitate research by the Tax Reform Unit and

research institution(s) hired for the purpose.

To keep updated on international best practice

methodology for tax-related research.

To assist Tax Management Specialist to review final

research reports submitted research institutions for

ensuring quality control of the research.

To

set

up

briefing

sessions

and

presentations/workshops on each tax study performed

on a rotating basis.

To

participate

in

briefing

sessions

and

presentations/workshop, as required by the Finance

Department and record minutes.

To draft Terms of References for all core related

research (revenue forecasting, tax expenditure

analysis, compliance costs, etc.) based on technical

proposals developed by the Tax Management

Specialist and research institution(s).

To review all tax research requests from provincial tax

collecting agencies.

To develop Request for Proposals which outline the

objective(s),

rationale,

key

dates/timeline,

expectations, methodology required (if applicable),

and other mandatory requirements, if any.

To ensure all documentation is in order (CVs, etc.) for

the

selection

of

potential

candidates

(consultants/firms) to undertake research.

To draft Terms of References for all specialized

research as requested by provincial tax collecting

agencies.

To write periodic reports on the aforementioned tasks.

To perform any other related tasks as required by the

Tax Management Specialist.

Salary package: Competitive market-based salary packages would be offered to the successful candidates.

Address: The applications along with detailed C.Vs should reach to the office of the Director, Economic Reform

Unit, Finance Department, Government of Sindh, 7th Floor A. K. Lodhi Complex, Sindh Secretariat No.6,

Shahrah-e-Kamal Atta Turk, Karachi through post or on e-mail address erufd.sindhgovt.@gamil.com. The last

date for submission of applications will be 8th December, 2014.

Director

Economic Reforms Unit

Finance Department,

Government of Sindh

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- PP Mcqs (Solved)Document18 pagesPP Mcqs (Solved)On Line100% (7)

- Introduction Foreign Policy AnalysisDocument21 pagesIntroduction Foreign Policy AnalysisAtif100% (4)

- Apple's Five Forces Analysis Reveals Competitive Rivalry and Buyer Power as Key External FactorsDocument3 pagesApple's Five Forces Analysis Reveals Competitive Rivalry and Buyer Power as Key External Factorsshaikh javedNo ratings yet

- Studying Public Policy SummaryDocument28 pagesStudying Public Policy SummaryfadwaNo ratings yet

- Public Policy: Seventh EditionDocument38 pagesPublic Policy: Seventh EditionRifqi Andika ArsyadNo ratings yet

- Public Policy PDFDocument525 pagesPublic Policy PDFMutemwa Emmanuel Tafira93% (15)

- Air Asia FinalDocument21 pagesAir Asia FinalIshmail People's33% (3)

- Modern Management Theories and PracticesDocument25 pagesModern Management Theories and PracticesSyed Waqar Akbar Tirmizi100% (4)

- Introduction of Public Administration PA 101Document24 pagesIntroduction of Public Administration PA 101Ray AllenNo ratings yet

- Air Asia's Low-Cost Leadership StrategyDocument8 pagesAir Asia's Low-Cost Leadership StrategyLaila Al-Alawi80% (5)

- TermsDocument6 pagesTermsshaikh javedNo ratings yet

- My PresentationDocument8 pagesMy Presentationshaikh javedNo ratings yet

- Chap # 1 - Introduction To Entrepreneurship (Edited)Document41 pagesChap # 1 - Introduction To Entrepreneurship (Edited)shaikh javedNo ratings yet

- Intro To Research PDFDocument19 pagesIntro To Research PDFshaikh javedNo ratings yet

- Chap # 1 - Introduction To Entrepreneurship (Edited)Document41 pagesChap # 1 - Introduction To Entrepreneurship (Edited)shaikh javedNo ratings yet

- My PresentationDocument8 pagesMy Presentationshaikh javedNo ratings yet

- Basic Research: Presented by Manu AliasDocument11 pagesBasic Research: Presented by Manu Aliasshaikh javedNo ratings yet

- Research Methods Chapter #09Document39 pagesResearch Methods Chapter #09shaikh javedNo ratings yet

- Shaheed Benazir Bhutto University, Shaheed BenazirabadDocument1 pageShaheed Benazir Bhutto University, Shaheed Benazirabadshaikh javedNo ratings yet

- Personality Tests AnnouncementsDocument36 pagesPersonality Tests Announcementsshaikh javedNo ratings yet

- Difference Between International, Multinational and Global CompaniesDocument1 pageDifference Between International, Multinational and Global Companiesshaikh javedNo ratings yet

- Basic Research: Presented by Manu AliasDocument11 pagesBasic Research: Presented by Manu Aliasshaikh javedNo ratings yet

- Strategic Management Case SkodaDocument4 pagesStrategic Management Case SkodaymmahmudNo ratings yet

- Shaheed Benazir Bhutto University, Shaheed BenazirabadDocument1 pageShaheed Benazir Bhutto University, Shaheed Benazirabadshaikh javedNo ratings yet

- Customer Relationship Management: Acknowledgements To Euan Wilson (Staffordshire University)Document18 pagesCustomer Relationship Management: Acknowledgements To Euan Wilson (Staffordshire University)Neha BhograNo ratings yet

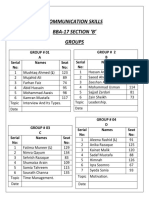

- Communication Skills Bba-17 Section B' GroupsDocument2 pagesCommunication Skills Bba-17 Section B' Groupsshaikh javedNo ratings yet

- None of AboveDocument4 pagesNone of Aboveshaikh javedNo ratings yet

- Abstract of ExtremismDocument3 pagesAbstract of Extremismshaikh javedNo ratings yet

- A Glossary of Terms Used in Brand ManagementDocument3 pagesA Glossary of Terms Used in Brand ManagementWasipfcNo ratings yet

- OGDCL ProductionAug14Document1 pageOGDCL ProductionAug14Muhammad AliNo ratings yet

- CHPT 7 Products and ServicesDocument58 pagesCHPT 7 Products and Servicesshaikh javedNo ratings yet

- Packaging ElementsDocument1 pagePackaging Elementsshaikh javedNo ratings yet

- Javed Ahmed Shaikh: Chapter 1-Slide 1Document19 pagesJaved Ahmed Shaikh: Chapter 1-Slide 1shaikh javedNo ratings yet

- Exam QuestionDocument10 pagesExam Questionshaikh javedNo ratings yet

- Subject: Application For The Post of Management TraineeDocument1 pageSubject: Application For The Post of Management Traineeshaikh javedNo ratings yet

- Brooks Cole Empowerment Series Becoming An Effective Policy Advocate 7th Edition Jansson Solutions Manual 1Document36 pagesBrooks Cole Empowerment Series Becoming An Effective Policy Advocate 7th Edition Jansson Solutions Manual 1thomashayescdrjaymwgx100% (22)

- APS 305 2011 Group ProjectDocument3 pagesAPS 305 2011 Group ProjectSaad KhanNo ratings yet

- AssignmentDocument10 pagesAssignmentmicheal adebayoNo ratings yet

- I term Units 1,2,3,4 для заочн фнDocument29 pagesI term Units 1,2,3,4 для заочн фнIllia SemeniukNo ratings yet

- An Intersectionality-Based Policy Analysis Framework: Edited by Olena HankivskyDocument212 pagesAn Intersectionality-Based Policy Analysis Framework: Edited by Olena HankivskyK58 VU HA ANHNo ratings yet

- Chapter 5Document7 pagesChapter 5Luelle PacquingNo ratings yet

- VP Government Relations Advocacy in Dallas FT Worth TX Resume Steven BristowDocument2 pagesVP Government Relations Advocacy in Dallas FT Worth TX Resume Steven BristowStevenBristowNo ratings yet

- Institutionalism and Public PolicyDocument27 pagesInstitutionalism and Public PolicyMay BastesNo ratings yet

- Public Policy Analysis GuidebookDocument9 pagesPublic Policy Analysis GuidebookRinkuKashyapNo ratings yet

- Myanmar Military Regime Foreign Policy AnalysisDocument3 pagesMyanmar Military Regime Foreign Policy AnalysisYusop B. Masdal100% (2)

- Assignment 2: Characteristic of The Procedural Theories: TPS 551: Planning TheoryDocument9 pagesAssignment 2: Characteristic of The Procedural Theories: TPS 551: Planning TheoryAfif NajmiNo ratings yet

- Unit 12Document14 pagesUnit 12Sai Anil S100% (1)

- Fischer 1998Document18 pagesFischer 1998Alexander Amezquita OchoaNo ratings yet

- The Policy Analysis ProcessDocument5 pagesThe Policy Analysis Processgashaw yematawNo ratings yet

- Milano The New School For Management and Urban Policy / Viewbook 2010Document13 pagesMilano The New School For Management and Urban Policy / Viewbook 2010The New SchoolNo ratings yet

- Alternative Policy Analysis ModelsDocument5 pagesAlternative Policy Analysis ModelsMads KalisNo ratings yet

- Presenters: Horace M. Estrella Jay Mart A. Lazana Princess Camille R. HipolitoDocument23 pagesPresenters: Horace M. Estrella Jay Mart A. Lazana Princess Camille R. HipolitoHorace EstrellaNo ratings yet

- Exam Summary PUB Comp Graduate July 2020Document24 pagesExam Summary PUB Comp Graduate July 2020ajrevillaNo ratings yet

- Best IAS Coaching in DelhiDocument20 pagesBest IAS Coaching in Delhishibaji biswasNo ratings yet

- Bergek Et Al (2008) Functions - RPDocument23 pagesBergek Et Al (2008) Functions - RPprocopiodelllanoNo ratings yet

- Citizen-Centered Public Policy Making in Turkey: Volkan Göçoğlu Naci Karkin EditorsDocument475 pagesCitizen-Centered Public Policy Making in Turkey: Volkan Göçoğlu Naci Karkin EditorsFapet UnhasNo ratings yet

- Development Communication and The Policy SciencesDocument9 pagesDevelopment Communication and The Policy SciencesPeter Pitas DalocdocNo ratings yet

- Social Work Policies Programs and ServicesDocument3 pagesSocial Work Policies Programs and ServicesJohn FranNo ratings yet

- Public Policy ProjectDocument28 pagesPublic Policy Projectvijaya choudhary100% (1)