Professional Documents

Culture Documents

Pension Increases Table Punjab

Uploaded by

Humayoun Ahmad FarooqiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pension Increases Table Punjab

Uploaded by

Humayoun Ahmad FarooqiCopyright:

Available Formats

PENSION INCREASES TABEL

INCREASE TYPE

DATE

1-Jul-1963

Revised Incease

1-Apr-1964

Revised Incease 1-Jul-1966

Dearness Increase

1-Mar-1972

Adhoc Increase

1-Jun-1973

Dearness Increase

1-Aug-1973

1-Jul-1980

Additional Adhoc 1-Jul-1981

Dearness Increase 1-Jul-1982

Further Dearness 1-Jul-1983

Indexation

1-Jul-1985

Restoration

Indexation

Indexation

1-Jul-1986

Extra Service Benefit

Restoration

Indexation

1-Jul-1987

Indexation

1-Jul-1988

Minimum Pension

Extra Service Benefit

1-Jul-1989

Adhoc Relief

1-Jul-1990

Extra Service Benefit

30-Sep-1990

Additional Increase

1-Jun-1991

1-Jul-1991

Restoration

Dearness Increase

1-Jul-1995

inclusion of 7

Dearness Increase

1-Mar-1997

increase on Gross pension

Special Dearness 8-Jun-1974

Additional Dearness

7-Apr-1975

Retirement age

1-Dec-1976

Service Benefit

1-Feb-1977

Cut off point

Special Adhoc

PARTICULARS

RATE

12.50% For pensioners retired prior to 01-07-1963

5% For pensioners reitred on 01-07-1963 and onward

For pensioners who retired prior to 01-04-1954

according to table P-181 of compendium (OP and FP defined in it)

For pensioners retired prior to 30-06-1966, Rs. 600 cut of point

12.50% Pensioners retired prior to 1-7-1963 (OP+RI+12.5%)

5% Pensioners retired between 1-3-1963 to 30-06-1966 (OP+RI+5%)

5% Pensioners retired between 1-7-1966 to 29-2-1972 (5%)

20% On gross pension upto Rs. 50, subject to minimum increase of Rs. 5

On gross pension between Rs. 51 and Rs. 100, subject to min Rs.10

15%

and max Rs. 30

15% On gross pension between Rs. 101 and Rs. 500, with marginal adjustments upto Rs.735

15% On gross pension up to Rs. 700 subjec to maximum Rs.100

with marginal adjustments upto Rs. 735

15% For gross pensioners who retired prior to 01-06-1972, subject to maximum of Rs. 100

10% For gross pensioners who retired prior to 01-06-1972, subject to maximum of Rs. 25

60 years, on 21-04-1972 it was 58 years, on 30-03-66 it was 55 years

Rs. 1.5 For per year service, subject to maximum benefit of Rs. 45

increases from 1.3.72 to 1.2.77 admissible to retireees upto 29.2.72 and w.e.f 1.3.72

Pension beyond Rs. 1000 will be reduced by 50%, 70% pension formula

Rs. 40 For pensioners in BS-1 to BS-10 who retires prior 30-6-1985

Rs. 70 For pensioners in BS-11 to BS-16 who retires prior 30-6-1985

Rs. 100 For pensioners in BS-17 and BS -18 who retires prior 30-6-1985

Rs. 150 For pensioners in BS-19 and BS-20 who retires prior 30-6-1985

Rs. 200 For pensioners in BS-21 and BS-22 who retires prior 30-6-1985

10% Max Rs.200/-, after adding all increases in G/Pension, to be paid upto 31-12-1982

10% After adding all increases in G/Pension, to be paid upto 30-06-1983

10% Max Rs.200/-, On G/Pension + all increases, retirees upto 30-06-1983

13.5% On gross pension upto Rs. 1500/-, End of maximum limit

10% On gross pension above Rs. 1500/admissible to employees who retired upto 31.12.1985

Restoration of commutation only (50% in case of death after retirement),

4.50% On gross Pension upto Rs. 1500/- who retierd upto 31.121985

3.50% On gross pension above Rs. 1500/- who retired upto 31.12.1985

4.00% On gross Pension upto Rs. 1500/- who retired between 1.1.86 to 30.6.86

3.00% On gross pension above Rs. 1500/- who retired between 1.1.86 to 30.6.86

2% for each complete year, Max 10%,

Pension to be calculated on Last Pay Drawn

Restoration of garuity also (but one from both i.e. gatuity or commutation)

No restoration for death in service, but restoration of 50% for death after retirement

4% Pensioners retired upto 30-06-1987, On G/Pension + increases

7% For all pensioners on gross Pensioners retired upto 30-06-1988

Minimum G/Pension Rs. 300 to self, and Minimum G/Pension Rs. 150 to family

Extra service benefit 2% for each complete year, for retirees prior to 7/86, no arrears

10% For Pensioners who retires upto 30.06.1990

Extra Service Benefit @2% per incomplete year also, but not for less than 6 months

32% Pensioners who retired upto 30-04-1977

12% Pensioners who retired 01-05-1977 to 30.06.1990

Both Commutation and gartuity may be restroed on completion of living period

15% Pensioners who retired upto 30-04-1977

10% Pensioners who retired between 01-05-1977 to 31-05-1991

5% Pensoiners who retired between 01-06-1991 to 31-05-1993

10% For Pensioners who retired upto 28-02-1997, upto BPS-16 also BPS-17(move over)

PENSION INCREASES TABEL

RATE

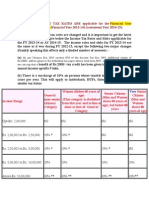

25%

20%

Note

Notional Increment

1-Jun-2000

15%

10%

5%

Dearness Increase

Commutation Rate

1-Dec-2001

Increase

15%

16%

8%

10%

1-Jul-2005

Commutation Rate

Dearness Increase

Dearness Increase

1-Jul-2006

1-Jul-2007

Adhoc Relief

1-Jul-2008

Minimum Pension

Adhoc Relief

1-Jul-2009

Adhoc Increase

Medical allowance

1-Jul-2010

Family pension

Minimum Pension

Adhoc Relief

1-Jul-2011

Medical allowance

Adhoc Relief

1-Jul-2012

Adhoc Relief

1-Jul-2013

Minimum Pension

Adhoc Relief

1-Jul-2014

Minimum Pension

20%

15%

20%

15%

20%

20%

15%

20%

15%

25%

20%

20%

15%

20%

10%

10%

Rs. 300 for self, Rs. 150 for family

For Pensioners retiring in BS-1 to BS-16 and BS-17 move over, not opting scale 2001

For Pensioners retiring in BS-17 and above, for pensioners not opting pay scale 2001

all indexation on gross pension as on 30.6.1983 or 30.06.1985

including previous dearness increases. Indexation of family pension

on net family pension in same way

For Civil servant retiring between firt June and 30 November in a

year, One annual increment in last pay be notionally allowed, also

applicable to civil Servants expiring during said period

For Pensioners prior to 01-06-1991, ON NET PENSION

For Pensioners between 01-06-1991 to 31-05-1994, ON NET PENSION

For Pensioners 01-06-1994 onward, ON NET PENSION

Commutation upto 40% admissible and net pension 60%

Pension increases from now and onward to be calculated at Net

Pension

Extra Service Benefit and increase of 99 discontinued, Commutation table replaced

Restoration discontinued for pensioners retiring after 30.11.2001

On Pension being drawn for all pensioners (Net Pension), admissible upto 30.06.2005

Pensioners who retired prior to 01-06-1994, admissible upto 30.06.2005

Pensioners who retired on 01-06-1994 and onward, admissible upto 30.06.2005

To all the existing pensioners on pension being drawn, admissible upto 30.6.2011

increases of 2003 and 2004 discontinued for retirees on or after 1.7.2005

Commutation may only be opted upto 35%, and net pension 65%

For pensioners who retired prior to 01-05-1977, admissible upto 30.06.2011

For pensioners who retired after to 01-05-1977 onward, admissible upto 30.06.2011

For pensioners who retired prior to 01-07-1997

For pensioners who retired 01-07-1997 and onwards

On Pension being drawn for all pensioners

Rs. 2000 for self, Rs. 1000 for family

For Pensioners who retired on or before 30-11.2001, admissible upto 30.06.2011

For Pensioners who retired after 01-12.2001 onwards, admissible upto 30.06.2011

For Pensioners who retired before 01-12-2001

For Pensioners who retired on or after 01-12-2001

For Pensioners retired in BS-1 to BS-15

For Pensioners retired in BS-16 and above

Increase in family pension rate, 50% to 75%

Rs. 3000 for self, Rs. 2250 for family

For Pensioners who retired on or before 30-06-2002, after excluding Medical

For Pensioners who retired on or after 01-07-2002, after excluding medical

Medical allowance is frozen at the rate of 01-07-2010

On Pension being drawn, excluding medical allowance, for all pensioners

On Pension being drawn, excluding medical allowance, for all pensioners

Rs. 5000 for self, Rs. 3750 for family

On Pension being drawn, excluding medical allowance, for all pensioners

Rs. 6000 for self, Rs. 4500 for family

pension

pension

NetGross

on on

increase

increase

Extra Service Benefit

Restoration

1-Jul-2003

Special Relief

Adhoc Relief

1-Jul-2004

PARTICULARS

inclusion of 7% cost of living allowance

INCREASE TYPE

DATE

1-Mar-1997

Minimum Pension

1-Jul-1963

Special Additional

1-Jul-1999

You might also like

- Pension Increases & Fixation of Pay Scals Income Expediture HeadsDocument26 pagesPension Increases & Fixation of Pay Scals Income Expediture HeadsAamir Lal100% (1)

- Pension Increases 1980-2012 With Commutation TableDocument2 pagesPension Increases 1980-2012 With Commutation TableAamir Lal80% (5)

- PunJab Traveling Allowance RulesDocument121 pagesPunJab Traveling Allowance RulesHumayoun Ahmad FarooqiNo ratings yet

- Finance Department Notifications-2007 (550-706)Document84 pagesFinance Department Notifications-2007 (550-706)Humayoun Ahmad Farooqi50% (2)

- 15.1 - PH - II - RETIREMENT BENEFITS-2019Document77 pages15.1 - PH - II - RETIREMENT BENEFITS-2019Ranjeet SinghNo ratings yet

- Minimum Pension PRC 2010 ... GO100Document246 pagesMinimum Pension PRC 2010 ... GO100SEKHAR100% (5)

- Andhra Pradesh Government Pension Order SummaryDocument252 pagesAndhra Pradesh Government Pension Order SummaryDRAVIDA SANKSHEMA SANGHAM100% (1)

- Family Pension SchemeDocument15 pagesFamily Pension SchemeJitu Choudhary100% (1)

- Surcharge: On Contributi Employee Use Business Proportion - 100% Cost X OperatingDocument4 pagesSurcharge: On Contributi Employee Use Business Proportion - 100% Cost X Operatinglouis_parker_5553No ratings yet

- BENEFITSDocument9 pagesBENEFITSSaurav TomarNo ratings yet

- Budget 2070-71 HighlightsDocument6 pagesBudget 2070-71 Highlightsme_mdjocNo ratings yet

- Income-Tax-Slab 13-14Document2 pagesIncome-Tax-Slab 13-14rani26octNo ratings yet

- Pension To Pre-2006 Punjab Govt Pensioners-5th Punjab Pay Commission. Government of Punjab NotificationDocument61 pagesPension To Pre-2006 Punjab Govt Pensioners-5th Punjab Pay Commission. Government of Punjab Notificationgssekhon9406100% (2)

- Pension Rules 2009trDocument12 pagesPension Rules 2009trjaydeep_chakrabort_2No ratings yet

- FAQ PensionDocument31 pagesFAQ PensionSudhir ParasharNo ratings yet

- Telangana Govt Issues Order on Additional Pension QuantumDocument4 pagesTelangana Govt Issues Order on Additional Pension Quantumnagalaxmi manchalaNo ratings yet

- Pension - Dearness Relief To Pensioners With Effect From 01.01Document35 pagesPension - Dearness Relief To Pensioners With Effect From 01.01SEKHARNo ratings yet

- Tax Data Card Fy12Document2 pagesTax Data Card Fy12Lyn BilbaoNo ratings yet

- 2020 ProjectionsDocument73 pages2020 Projectionsthe kingfishNo ratings yet

- Pension Policy Note - 2013-14 - eDocument40 pagesPension Policy Note - 2013-14 - eAncy RajNo ratings yet

- Punjab Govt. Order On Pension To Those Who Retired On 1.1.2006 or AfterwardsDocument6 pagesPunjab Govt. Order On Pension To Those Who Retired On 1.1.2006 or Afterwardsgssekhon9406No ratings yet

- Gsis Claims & Privileges - HR CSC - 031116Document131 pagesGsis Claims & Privileges - HR CSC - 031116alexes24No ratings yet

- Himachal pension rules revisedDocument13 pagesHimachal pension rules revisedBaldev ChandNo ratings yet

- 15.1 - PH II - PF, Pension, Gratuity, Leave EncashmentDocument72 pages15.1 - PH II - PF, Pension, Gratuity, Leave EncashmentRanjeet SinghNo ratings yet

- LEAVEDocument32 pagesLEAVERaji RoseNo ratings yet

- GO (P) N0.221-2014-Fin Dated 16-06-2014Document8 pagesGO (P) N0.221-2014-Fin Dated 16-06-2014T J AjitNo ratings yet

- FL Tax BasicsDocument10 pagesFL Tax Basicsalvarez.jayden1207No ratings yet

- Financial Professional Factsheet Jan 14Document4 pagesFinancial Professional Factsheet Jan 14peakdotieNo ratings yet

- Circular For Retired Employee Renewal Policy - 2020-21Document7 pagesCircular For Retired Employee Renewal Policy - 2020-21Suresh SuriNo ratings yet

- BSNL KERALA Executives and Non Executives Health Insurance Policy 2021-22Document3 pagesBSNL KERALA Executives and Non Executives Health Insurance Policy 2021-22Vikramjeet MannNo ratings yet

- Arindam Das Salary For The Month of July 2008Document4 pagesArindam Das Salary For The Month of July 2008Bala MuruNo ratings yet

- Kisan Samman Pension To Traders and FAQ On NPSDocument16 pagesKisan Samman Pension To Traders and FAQ On NPSg h raoNo ratings yet

- Greece Pension OverviewDocument8 pagesGreece Pension Overviewmaria_d_kNo ratings yet

- Pen 2Document6 pagesPen 2Rajan GuptaNo ratings yet

- Premium Paid Certificate: Date: 09-JAN-2014Document2 pagesPremium Paid Certificate: Date: 09-JAN-2014kumber_singh5069No ratings yet

- Premium Paid Certificate: Date: 25-MAR-2011Document2 pagesPremium Paid Certificate: Date: 25-MAR-2011sivasivaniNo ratings yet

- 1 Eastern ChalukyasDocument3 pages1 Eastern Chalukyas45satishNo ratings yet

- Employee Pension SchemeDocument6 pagesEmployee Pension SchemeAarthi PadmanabhanNo ratings yet

- Finance Department: O. PanneerselvamDocument40 pagesFinance Department: O. PanneerselvamAncy RajNo ratings yet

- Jeevan UmangDocument68 pagesJeevan UmangDEVELOPMENT OFFICER LIC OF INDIANo ratings yet

- Higher Pension As Per SC Decision With Calculation - Synopsis1Document13 pagesHigher Pension As Per SC Decision With Calculation - Synopsis1hariveerNo ratings yet

- Post-Retirement Benefit SchemeDocument16 pagesPost-Retirement Benefit SchemetomsraoNo ratings yet

- 253-MA Post 2016 ROPA Memorandum For Municipal PensionersDocument9 pages253-MA Post 2016 ROPA Memorandum For Municipal Pensionersarghadiproy012No ratings yet

- Retirement and Retirement Benefits - Pension Scheme For The Public SectorDocument26 pagesRetirement and Retirement Benefits - Pension Scheme For The Public Sectorrachna357No ratings yet

- Fin e 235 2009Document192 pagesFin e 235 2009Balaji Rao N100% (1)

- EPS ESIC RegulationsDocument5 pagesEPS ESIC Regulationsrahul sengarNo ratings yet

- DA Wiki Explains Indian Salary SupplementDocument2 pagesDA Wiki Explains Indian Salary SupplementMathew JcNo ratings yet

- Investment Declaration Form - FY 2023-24Document2 pagesInvestment Declaration Form - FY 2023-24kunal singhNo ratings yet

- Income TaxDocument18 pagesIncome TaxNilesh BagalNo ratings yet

- Pen GO248Document8 pagesPen GO248Upendra KumarNo ratings yet

- Wage IssuesDocument15 pagesWage IssuesistiyaqueNo ratings yet

- KEANDocument1 pageKEANyokekeannNo ratings yet

- FixationDocument3 pagesFixationManjeet RanaNo ratings yet

- Schedule of Salaries for Teachers, members of the Supervising staff and others. January 1-August 31, 1920, inclusiveFrom EverandSchedule of Salaries for Teachers, members of the Supervising staff and others. January 1-August 31, 1920, inclusiveNo ratings yet

- Pay Fixation PunjabDocument79 pagesPay Fixation PunjabHumayoun Ahmad Farooqi100% (2)

- AffidavitDocument2 pagesAffidavitHumayoun Ahmad FarooqiNo ratings yet

- Final Seniority List of DDAO/DTO/DOADocument6 pagesFinal Seniority List of DDAO/DTO/DOAHumayoun Ahmad FarooqiNo ratings yet

- Punjab Delegation of Financial Rules Updated 2012Document394 pagesPunjab Delegation of Financial Rules Updated 2012Humayoun Ahmad FarooqiNo ratings yet

- Islami Mahino Ke Fazail o Ahkaam Molana RoohullahDocument236 pagesIslami Mahino Ke Fazail o Ahkaam Molana RoohullahKamrans_Maktaba_Urdu0% (2)

- DAJJAL Kaun Kaab Kaaha by Mufti Abu Lubaba Shah MansoorDocument250 pagesDAJJAL Kaun Kaab Kaaha by Mufti Abu Lubaba Shah MansoorHumayoun Ahmad Farooqi100% (3)

- Bermuda Tikon Aur Dajjal by Sheikh Umar AsimDocument277 pagesBermuda Tikon Aur Dajjal by Sheikh Umar AsimMusalman Bhai100% (1)

- 50% Allowance ClarificationDocument2 pages50% Allowance ClarificationHumayoun Ahmad FarooqiNo ratings yet

- Regularization of Contract Employees Grade 1-15 Punjab GovtDocument3 pagesRegularization of Contract Employees Grade 1-15 Punjab GovtHumayoun Ahmad Farooqi100% (5)

- Tanbeeh Ul-Ghafileen by Shaykh Abu Laith Samarqandi R.A Urdu TranslationDocument328 pagesTanbeeh Ul-Ghafileen by Shaykh Abu Laith Samarqandi R.A Urdu TranslationTalib Ghaffari86% (7)

- Constitution of Pakistan 1973 in Urdu VerDocument256 pagesConstitution of Pakistan 1973 in Urdu Vermuradlaghari82% (159)

- Intergovernmental TransfersDocument31 pagesIntergovernmental TransfersHumayoun Ahmad FarooqiNo ratings yet

- List of Sahaba R.A - UpdatedDocument92 pagesList of Sahaba R.A - UpdatedShadab Shaikh69% (13)

- Aqeeda Zahoor e Mehdi Ahadith Ki Roshni MayDocument191 pagesAqeeda Zahoor e Mehdi Ahadith Ki Roshni MayISLAMIC LIBRARYNo ratings yet

- Bachon Ke Liay Ibtidai Deeni Taleemaat by Sheikh Mufti Ehsanullah ShaiqDocument59 pagesBachon Ke Liay Ibtidai Deeni Taleemaat by Sheikh Mufti Ehsanullah ShaiqMusalman BhaiNo ratings yet

- Final Manual of DaosDocument265 pagesFinal Manual of DaosHumayoun Ahmad Farooqi100% (1)

- Punjab Medical Attendance RulesDocument55 pagesPunjab Medical Attendance RulesHumayoun Ahmad Farooqi78% (9)

- District Budget RulesDocument98 pagesDistrict Budget RulesHumayoun Ahmad FarooqiNo ratings yet

- Building and Road B&R Code, DFRDocument286 pagesBuilding and Road B&R Code, DFRHumayoun Ahmad Farooqi100% (1)

- The Punjab Urban Immovable Property Tax ActDocument12 pagesThe Punjab Urban Immovable Property Tax ActHumayoun Ahmad FarooqiNo ratings yet

- ETODocument25 pagesETOAltaf SheikhNo ratings yet

- Electronic Crimes Act 2004Document12 pagesElectronic Crimes Act 2004Humayoun Ahmad FarooqiNo ratings yet

- The Punjab Land Revenue ActDocument65 pagesThe Punjab Land Revenue ActHumayoun Ahmad FarooqiNo ratings yet

- The Punjab Motor Vehicles Taxation ActDocument10 pagesThe Punjab Motor Vehicles Taxation ActHumayoun Ahmad FarooqiNo ratings yet

- The Punjab Agricultural Income Tax Act 1997Document11 pagesThe Punjab Agricultural Income Tax Act 1997Humayoun Ahmad FarooqiNo ratings yet

- The Punjab Court FeesDocument1 pageThe Punjab Court FeesHumayoun Ahmad FarooqiNo ratings yet

- The Punjab Government Servants Housing Foundation Act 2004Document6 pagesThe Punjab Government Servants Housing Foundation Act 2004Humayoun Ahmad FarooqiNo ratings yet

- PEEDA ActDocument11 pagesPEEDA ActFurzan AbbasNo ratings yet

- The On-Farm Water ManagementDocument7 pagesThe On-Farm Water ManagementHumayoun Ahmad FarooqiNo ratings yet

- Lecture Slides 0Document40 pagesLecture Slides 0Jamshidbek OdiljonovNo ratings yet

- Pay in SlipDocument2 pagesPay in SlipRahul ManwatkarNo ratings yet

- Miss Nonkumbulo V Shabane Veronica Ward 30 Shoba Location Izingolweni 4260Document1 pageMiss Nonkumbulo V Shabane Veronica Ward 30 Shoba Location Izingolweni 4260nonkumbuloshabaneNo ratings yet

- StatementOfAccount 6316692309 21072023 222045Document17 pagesStatementOfAccount 6316692309 21072023 222045Asekar AlagarsamyNo ratings yet

- Statement 603021 37840886 23 08 2023 22 09 2023 2Document5 pagesStatement 603021 37840886 23 08 2023 22 09 2023 2danNo ratings yet

- 2149 - ABSLI Nishchit Aayush Plan V04 - One PagerDocument1 page2149 - ABSLI Nishchit Aayush Plan V04 - One PagervamsipalagummiNo ratings yet

- Computation of Total Income Income From Salary (Chapter IV A) 1696258Document3 pagesComputation of Total Income Income From Salary (Chapter IV A) 1696258amit22505No ratings yet

- Don Matias Elementary School Disbursement VoucherDocument1 pageDon Matias Elementary School Disbursement VoucherchatNo ratings yet

- API SL - TLF.ACTI - FE.ZS DS2 en Excel v2 569419Document62 pagesAPI SL - TLF.ACTI - FE.ZS DS2 en Excel v2 569419huat huatNo ratings yet

- TT18 - Credit Card Repayment SpreadsheetDocument6 pagesTT18 - Credit Card Repayment SpreadsheetlugoskyNo ratings yet

- Salary Slip: Gross Pay 25,600 Net Pay 14,710Document3 pagesSalary Slip: Gross Pay 25,600 Net Pay 14,710pratixa ranaNo ratings yet

- Power of CompoundingDocument5 pagesPower of CompoundingDasher_No_150% (2)

- Compare total home loan costs from different lendersDocument2 pagesCompare total home loan costs from different lendersUpasana SahniNo ratings yet

- SBI+Life+-+RiNn+Raksha BrochureDocument8 pagesSBI+Life+-+RiNn+Raksha BrochureSanjay SinghNo ratings yet

- Financial Management EssentialsDocument31 pagesFinancial Management EssentialsrenNo ratings yet

- SERPDocument2 pagesSERPBill BlackNo ratings yet

- Wa0007.Document10 pagesWa0007.Maz Izman BudimanNo ratings yet

- Anti-Money Laundering The BasicsDocument12 pagesAnti-Money Laundering The BasicsMangesh BansodeNo ratings yet

- 2023 04 12 - StatementDocument6 pages2023 04 12 - StatementRay JouwenaNo ratings yet

- Credit CardsDocument3 pagesCredit Cardsapi-371057862No ratings yet

- Chapter 4: Life AnnuitiesDocument36 pagesChapter 4: Life AnnuitiesKen NuguidNo ratings yet

- Cash - CRDocument14 pagesCash - CRpingu patwhoNo ratings yet

- Colombia Banco de BogotáDocument2 pagesColombia Banco de BogotáM YNo ratings yet

- Private Banking DocumentDocument7 pagesPrivate Banking DocumentPellaNo ratings yet

- 2018 TSP Catch-Up Contributions and Effective Date ChartDocument1 page2018 TSP Catch-Up Contributions and Effective Date ChartAnonymous O6Pgmls4No ratings yet

- Solutions To Questions - Chapter 6 Mortgages: Additional Concepts, Analysis, and Applications Question 6-1Document16 pagesSolutions To Questions - Chapter 6 Mortgages: Additional Concepts, Analysis, and Applications Question 6-1--bolabolaNo ratings yet

- Ns 20 2023Document156 pagesNs 20 2023Alina Valentina Gomez TroncosoNo ratings yet

- Total 96,860/ 278,406/ 548,697/ 1,081,221Document2 pagesTotal 96,860/ 278,406/ 548,697/ 1,081,221JoelNo ratings yet

- Agency Budget TemplateDocument7 pagesAgency Budget TemplateJohn ZappeNo ratings yet

- Mini Test 1 2 Autumn 2023 1Document4 pagesMini Test 1 2 Autumn 2023 1aquarius21012003No ratings yet