Professional Documents

Culture Documents

Questions North Star

Uploaded by

inebergmansCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Questions North Star

Uploaded by

inebergmansCopyright:

Available Formats

Questions North Star:

1) Set up Financial report for 2007 (zie andere bladzijden)

2) Do you expect financial problems during 2007? If so, propose a

solution.

Gedurende 4 maanden zijn er negatieve cash flows (zie cash budget).

Liquiditeit is hier een belangrijke maatstaf ( bankruptcy).

Liquiditeitsratio (balans):

current assets

KT liabilities

800+10+96

100+125

906

225

= 4 > 1! Dus

geen probleem, want balans is foto van situatie in december, doorheen het jaar

evalueren Cash Budget.

Mogelijke oplossingen:

A. Extension payment delay suppliers

B. Shortening payment time customers, but the customers wont be happy

and (maybe) go elsewhere. So a better solution would be to give them a

reduction, of course the less the better, but the reduction has to be

interesting.

Hoe bepalen of korting interessant is? vergelijken met rente op bank!

What do I get for putting my money on the bank Rente

When I loan money interest

Payment condition 1%/0/30

1% if, cash betalen, anders 30 dagen betalingsuitstel MAAR korting

moet aantrekkelijk genoeg zijn; bank leent alleen aan 10%; 1%*12 = 12%

dus beter dan 10%, dus aantrekkelijk!

C. Creating new receipts

= Lease & Sell-back, vb. leasing car (you can use it, pay rent)

Here you could sell your assets to leasing companies, but you lease it

back.

Nadeel: je kan je activa maar 1 keer verkopen!

D. Cutting costs

Vb. Ford Belgi

E. More depreciation in the beginning = degressief afschrijven! (altijd)

In this way you pay less taxes, but you may think that the effect balances

out (later you pay more taxes) BUT TIME VALUE OF MONEY!! There is one

exception (when not?): wanneer net income negatief wordt, want equity

capital daalt dit betekent dat de solvabiliteit daalt (leningen meer

krijgen).

F. Bank: short term loan vb. 10% yearly.

3) What adjustments should be introduced to the solutions of

questions 1 and 2 if the company should extent, by one month,

the term of payment of the customers (starting with the sales

from January 2007)?

- No changes in income statement

- Changes in balance sheet: cash and accounts receivable

- Changes in cash budget: nog negatievere waarde!

4) What adjustments should be introduced to the solutions of

questions 1 and 2 if the suppliers of raw materials should allow

(starting with the purchases from January 2007) one extra month

of the credit term ?

Uitgaven grondstoffen schuiven allemaal met 1 maand op.

This will have a positive effect.

Balance sheet: accounts payable wordt 250 (tweemaal 125) en cash wordt

221 (of 451?).

5) What adjustments should be introduced to the solutions of

questions 1. and 2. if the company decides to increase the

inventory of raw materials by an amount of 100 ?

- if the increase will be effected in January 2007 ?

Income statement does NOT change.

Balans: inventories increase, cash decreases = so only assets change; buy

more from suppliers, so cash position also changes.

The ending cash position will be worse in January and Ferbruary.

The ending cash position will be worse in December (= new problem).

So this is worse, now there are 2 problems!

- if the increase will be effected in December 2007?

Wijzigt vanaf januari 2008. De inventaris op de balans stijgt met 100. Cash

daalt met 100.

6) What adjustments should be introduced to the solutions of

questions 1 and 2 if the Tax Administration should agree with

another method of depreciation ?

In this case the North Star Company should be allowed to

increase the depreciation

costs in 2007 with an amount of 100.

Income statement verandert: afschrijvingen stijgen met 100, dus KVG stijgt

met 100, met als gevolg dat de winst voor belasting daalt met 100 (= nu

32) waardoor de belasting tot slot daalt met 50.

Balance sheet: op de passiva-kant verandert net income, op de activakant stijgt cash (tot 146, hoezo?) en plant & equipment daalt (5045+220220(ipv van -120)).

Taxes: 8 in July and 8 in October + net profit = 16 This is less

interesting than before.

Ending cash position in December is higher (why?).

7) What adjustments should be introduced if, in December 2007, a

machine with an accounting value of 100 should be sold for an

amount of 150 (cash payment)?

Income statement: revalues increases (HWMW) Sales stijgen met 50

(BW= 100 >< VP=150), taxes=91 (ipv 66).

Cash budget: in December you get cash cash position is now better

(150 extra in December, July & October veranderen omwille van taxes).

Balance sheet: cash verandert; net income verandert; plants & equipment

veranderen.

You might also like

- International Corporate Governance: Incentivising Managers and Disciplining Badly Performing ManagersDocument69 pagesInternational Corporate Governance: Incentivising Managers and Disciplining Badly Performing ManagersinebergmansNo ratings yet

- Coase THEOREMADocument46 pagesCoase THEOREMAinebergmansNo ratings yet

- Applied Econometrics, Group Assignment: The Gravity Model of International Trade - Due Date For This Assignment Is May 30th, 2012Document13 pagesApplied Econometrics, Group Assignment: The Gravity Model of International Trade - Due Date For This Assignment Is May 30th, 2012inebergmansNo ratings yet

- Regression Hypothesis Tests Confidence IntervalsDocument46 pagesRegression Hypothesis Tests Confidence IntervalsinebergmansNo ratings yet

- Tekstverdeling EngelsDocument4 pagesTekstverdeling EngelsinebergmansNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Shine of The ScaleDocument18 pagesShine of The ScaleNo ThanksNo ratings yet

- c7 PDFDocument34 pagesc7 PDFAnjaana PrashantNo ratings yet

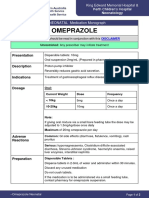

- OmeprazoleDocument2 pagesOmeprazolephawphawphawNo ratings yet

- Faculty ReviewDocument39 pagesFaculty ReviewHarsh Kanani100% (1)

- The FishbowlDocument3 pagesThe FishbowlGrace RtnNo ratings yet

- Filipino Cuisine Inventory Highlights Dishes From LuzonDocument30 pagesFilipino Cuisine Inventory Highlights Dishes From LuzonXaimin MequiNo ratings yet

- Food Laws and Food Standards: 1. General Course InformationDocument6 pagesFood Laws and Food Standards: 1. General Course InformationMinh DuyNo ratings yet

- G.R. No. 111426Document10 pagesG.R. No. 111426Trix BermosaNo ratings yet

- MAF151 COMMON TEST 2023NOV - QDocument4 pagesMAF151 COMMON TEST 2023NOV - QArissa NashaliaNo ratings yet

- PMS VS PasDocument47 pagesPMS VS PasBasumitra ChakrabortyNo ratings yet

- Laura Saeli ResumeDocument1 pageLaura Saeli Resumeapi-285990983No ratings yet

- Rehabilitation Will Increase The Capacity of Your Insert Musculoskeletal Tissue Here Defining Tissue Capacity A Core Concept For CliniciansDocument3 pagesRehabilitation Will Increase The Capacity of Your Insert Musculoskeletal Tissue Here Defining Tissue Capacity A Core Concept For CliniciansChristhoper HermosillaNo ratings yet

- Enclosure 6150 Derscription PDFDocument85 pagesEnclosure 6150 Derscription PDFCeleste Maradiaga50% (2)

- Chapter 5Document34 pagesChapter 5Angel Dela PeñaNo ratings yet

- CrimproDocument28 pagesCrimproAlex RabanesNo ratings yet

- Healthy Knees: Manual On Knee Pain and Different Therapeutic ApproachesDocument37 pagesHealthy Knees: Manual On Knee Pain and Different Therapeutic Approachesdaniel70_7No ratings yet

- Manalang V BuendiaDocument2 pagesManalang V Buendiamissperfectlyfine100% (3)

- UMMI HAFILDA BTE ALI & ANOR V KARANGKRAF SDNDocument10 pagesUMMI HAFILDA BTE ALI & ANOR V KARANGKRAF SDNjijahsarahNo ratings yet

- M TYPES - Booking Note-2013Document3 pagesM TYPES - Booking Note-2013Mehmet ErturkNo ratings yet

- COA Auditor Discovers Cash Shortage by Municipal TreasurerDocument2 pagesCOA Auditor Discovers Cash Shortage by Municipal TreasurerDonvidachiye Liwag Cena100% (1)

- Palletizing - Robots MPL 160 II PDFDocument10 pagesPalletizing - Robots MPL 160 II PDFbastian henriquez100% (1)

- English Life N1 M8Document7 pagesEnglish Life N1 M8Ed SoNo ratings yet

- All India Sarkari JobsDocument9 pagesAll India Sarkari JobsSHAIK WASEEM AKRAM.No ratings yet

- Rakshit Bhandari - Byju'sTheLearningAppDocument15 pagesRakshit Bhandari - Byju'sTheLearningAppRakshit BhandariNo ratings yet

- Thesis On Recruitment and RetentionDocument4 pagesThesis On Recruitment and RetentionMiranda Anderson100% (2)

- Tda 7313Document15 pagesTda 7313jordachadiNo ratings yet

- Sri Aurobindo - Glossary To The Records of YogaDocument214 pagesSri Aurobindo - Glossary To The Records of Yogarajibchakraborty2005No ratings yet

- Worksheet Works Comparative and Superlative Adjectives 2Document3 pagesWorksheet Works Comparative and Superlative Adjectives 2Bongkotratt CharuchindaNo ratings yet

- Phuket Report v2.0Document188 pagesPhuket Report v2.0aditya ramlanNo ratings yet

- SOSA 2020 UpdatedDocument42 pagesSOSA 2020 UpdatedMadi GeeNo ratings yet