Professional Documents

Culture Documents

Geap - Global Systemic Financial Crisis 2015 - Geopolitics, Oil and Currency Markets - Global Research PDF

Uploaded by

deliriousheterotopiasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Geap - Global Systemic Financial Crisis 2015 - Geopolitics, Oil and Currency Markets - Global Research PDF

Uploaded by

deliriousheterotopiasCopyright:

Available Formats

Global Systemic Financial Crisis 2015: Geopolitics, Oil and Currency...

1 de 4

http://www.globalresearch.ca/global-systemic-financial-crisis-2015-ge...

Notre site en Franais : mondialisation.ca

Espaol Italiano Deutsch Portugus srpski

About

Contact

Membership

Online Store

d of Democracy in the Republic of Korea: Imminent Threat To Political Expression and Civil Rights

Font-size:

Print:

Donate

Did Raul Castro Just Reverse The Entire Cuban

Global Systemic Financial Crisis 2015: Geopolitics, Oil and

Latest News / Top Stories

Currency Markets

Weve Known for 1,700 Years that Torture

Produces False Confessions

By Global Europe Anticipation Bulletin (GEAB)

US, NATO Boost Military Operations near

Russias Borders: Peace and Stability

according to Pentagon official

Region: Middle East & North Africa

Theme: Global Economy, Oil and Energy

Global Research, December 19, 2014

Global Europe Anticipation Bulletin

178

Like

123

15

231

Movement against Fracking Wins as New

York Bans Hydraulic Fracturing

Fixed Fortunes: Biggest US Corporate

Political Interests Spend Billions, Get

Trillions

Deforestation: Community Land Grabs by

Major Pulp and Paper Conglomerate in

Indonesia

How Your Taxes Fund Corporations that

Rig the U.S. Political System

Longstanding US Cuba Policy: Regime

Change

All Articles

For almost two years, by combining various points of view

(speculative, geopolitical, technological, economic, strategic and

monetary), we have continued to anticipate a major crisis in the

entire oil sector.

Today, no one doubts the fact that we are actually at that point,

and the GEAB must therefore anticipate the consequences of this

veritable atomic bomb, which has begun to blow up all the old

systems pillars: everything which we have known, international currencies, financial markets, the

US, the Western alliance, world governance, democracy, etc.

Global systemic crisis: the end of the West we have known since 1945

NEWS

MOST POPULAR

GEOGRAPHIC REGIONS

THEMES

I-BOOKS SERIES

IN-DEPTH REPORTS

GLOBAL RESEARCH VIDEOS

THE GLOBAL RESEARCH NEWS HOUR

Here, we would like to look back on a historic GEAB anticipation, that of Franck Biancheri in

February 2006, which announced the beginning of the global systemic crisis under the title the

end of the West we have known since 1945 (1). It will have taken nine years for this Western

world to collapse (or seven years, if we begin the process with the 2008 subprime crisis, as one

should really do) During these nine years, the GEAB has worked to educate on the crisis, with

the avowed aim of raising all the existing solutions to exit it as quickly and as painlessly as

possible. Apparently, outside the work carried out by the BRICS which, also anticipated by the

GEAB, got through a huge task to lay down the foundations of tomorrows world, the Western

world, meanwhile, has made some positive efforts here and there, signs of which we detect in

some places. But at the end of 2014, and after the huge destabilization caused by the crash of

Euro-Russian relations in the Ukrainian crisis, our team is struggling to put forward a positive

scenario for the coming year.

2015 will show the complete collapse of the Western world we have known since 1945. It will be a

gigantic hurricane, which will blow and rock the whole planet, but the breach points are to be

found in the Western Port, which hasnt been a port for a long time but, as will be clearly shown

in 2015, has been in the eye of the storm in fact, as we have repeatedly said since 2006. Whilst

some boats will try to head offshore, the Ukrainian crisis has had the effect of bringing some of

them back to port and firmly re-mooring them there. Unfortunately, its the port itself which is

rocking the boats and its those with the strongest moorings which will break up first. Of course,

we are thinking of Europe first and foremost, but more so Israel, the financial markets and world

governance.

Of course peace is at stake, a peace which is no more than a vain word, moreover. Ask China,

India, Brazil, Iran, etc., if the West still conveys any image of peace. As for democratic values,

what we show serves more as a foil than a model to the extent that the universal principle of

democracy is relegated to the value of culturally relativized concepts and finishes by serving

antidemocratic agendas of all ilks, in Europe and elsewhere. Yet its not the democratic principle

that is the problem (quite the opposite is needed to reinvent ways to apply it, in partnership with

the new emerging powers), but really the Wests inability to have known how to adapt its

implementation to societys new characteristics (the emergence of supranational political entities,

the Internet which is transforming the social structure..)

The oil crisis is systemic because it is linked to the end of the all-oil era

Lets return for a moment to the principal characteristics of this systemic oil crisis which we have

analyzed. To quickly summarize and to highlight the systemic nature of this crisis, to better

position our anticipations which follow, its the oil markets world governance system OPEC, which

has been undermined. The US, which was its master until around 2005 (2), has seen the arrival

of the emerging nations whose levels of consumption has inevitably made them joint masters.

19.12.2014 23:11

Global Systemic Financial Crisis 2015: Geopolitics, Oil and Currency...

2 de 4

http://www.globalresearch.ca/global-systemic-financial-crisis-2015-ge...

Global Research Newsletter:

enter your email

GO

Become a Member of Global Research

Receive Free Books!

Human Rights and Justice in Canada

The Case of Omar Khadr

Artworks for Peace: Support Global

Research

Oil consumption: in red, by the US, Western Europe and Japan; in blue, by the rest of the world.

Source : Yardeni / Oil market intelligence.Of course, it would have been necessary to

acknowledge this change by a reform of the old system of governance to put everybody in the

same boat. Instead, frightened by the idea of a rise in oil prices to which the US economy ( totally

dependent on oil, unlike Europe, and lacking any significant and coordinated investment in

renewable energy) was unable to resist, the US decided to break any rationale of global

coordination by creating a competing market, the shale market, intended to reduce prices.

Unfortunately, we know what competition in terms of access to energy resources leads to at

least Europe is supposed to know (3).

Donate to Global Research

Advanced Search

Index by Countries

Index by Author

Global Research Publishers

US shale oil production Source : HPDI, LLCAnother strong trend is combining with this major

trend break, currently little mentioned in the media, that of the end of oil as the world economys

primary energy source. And it is this second factor that now makes the situation totally

uncontrollable. Prices are falling apart because the oil era is coming to an end and nobody can do

anything about it. We anticipated this many months ago (4) : China is creating an all electric car

fleet (5), and, in so doing, will turn the global car fleet into an all-electric one: once the technology

has been mastered and mass production becomes inevitable, all the world will go electric. We

anticipated that this transformation would be in place in less than 10 years and that, in five years,

the turning point as regards consumption would be reached. But a year at least has passed since

this anticipation. Speculators of all stripes are starting to see a horizon four years out (6).

In reality, peak oil is what LEAP calls a successful anticipation: putting it into perspective,

has allowed the problem to be avoided. Fear of a shortage and a price explosion, good and bad

avoidance strategies (renewable and shale), all combined with a huge economic downturn and,

as a grand finale, and an ecological agenda whose resumption we will see from this year (7), and

the world is ready to close the oil era except that, to this, the players existentially related to

this commodity will make themselves heard loud and long before disappearing.

Here again, so that our readers dont misunderstand: for a long time oil will continue to be used to

fuel the worlds engines and factories (it even has many years ahead of it again since the risk of

shortage has been postponed for several decades), but the era of sovereign oil is ending and, of

course, that constitutes a systemic change.

In the Telescope section we further examine the consequences of this systemic oil crisis,

particularly on the financial markets. These financial markets, which have well resisted six long

years of crisis, suffocating the real economy in their vice and proving the extent to which they

were the crux of the problem, will not be able to survive the shock that they are about to get, from

the oil industry on the one hand (a central player), and the dollar on the other (financial worlds

main tool). But, as if it werent enough, other bombs are ready to explode

Notes

(1) Source : LEAP/Europe2020, 15 February 2006

(2) In fact, the beginning of the rise in oil prices dates from 2003, and began to explode in 2006. But 2005 is a

recurring date as soon as we analyze price increases in terms of the emerging nations consumption instead of

19.12.2014 23:11

Global Systemic Financial Crisis 2015: Geopolitics, Oil and Currency...

3 de 4

http://www.globalresearch.ca/global-systemic-financial-crisis-2015-ge...

the vagaries of Middle Eastern geopolitics, and generally as soon as one sees the emerging nations rise in

Join us on Facebook

power.

(3) The two world wars at the beginning of the 20th century were intrinsically linked to competition for access to

Global Research (Centre for

Research on Globalization)

Like 78,615

energy resources (source: Cambridge Journals, 09/1968), which is why, at the end of the Second World War, the

European Communities gave birth to the pooling of resources, the ECSC (source :Wikipedia ), a project which

should have remained one of the lightning conductors of European construction, whilst today the Ukrainian crisis

reveals the gaping hole in Europe as regards a common energy policy. And to say that some find that we suffer

from too much Europe!! Actually, European construction came to a halt in 1989 busy regulating the size of

cucumbers and freeing the rest: the European cucumber

(4) In our recommendations last January (GEAB N81) under the heading China goes electric . Source

:LEAP/E2020, 15/01/2014

(5) Source : Bloomberg, 09/02/2014

(6) For those who doubt the reality of this development there is the recent and incredible decision by Germany

(incredible because its completely counter intuitive to the current decline in oil prices) to bet everything on

renewable energy and package everything which is nuclear-gas-oil-coal to get rid of it Source :Deutsche Welle,

01/12/2014

(7) Last month we noted the very tangible results achieved in promises to reduce CO2 emissions, including from

the US, under Chinese leadership. And although the Lima Summit hasnt seemed to produce much in the way of

Partner Websites

results meanwhile, its particularly because the poor countries are pretending to continue to believe that Western

dollars are going to finance their energy transition. But in substance, the environmental agenda is very dynamic

Project Censored

Stop NATO

currently, essentially because it coincides with the strategic objectives for the first time of the worlds first (or

second) power, China.

Strategic Culture Foundation

The Corbett Report

Washington's Blog

Comment on Global Research Articles on our Facebook page

Become a Member of Global Research

Global Research Related Articles

Plummeting Oil Prices

As this is written, West Texas Intermediate (WTI) crude down to below $56 a barrel. Brent at $61. From

a high of $115 in January. Heading for $40 or lower, some analysts believe. Shaking market stability.

Reflecting global economic ...

Next Wave of Banking Crisis to come from Eastern Europe

European banks face an entirely new wave of losses in coming months not yet calculated in any

government bank rescue aid to date. Unlike the losses of US banks which derive initially from their

exposures to low-quality sub-prime real ...

Turmoil Rips Through Global Financial Markets

Global financial markets experienced a day of violent gyrations on Wednesday amid growing signs that

the financial house of cards created by the provision of ultra-cheap money by the worlds major central

banks may be collapsing. European stocks experienced ...

The Global Systemic Crisis: Quantitative Easing and The Fed's Tapering will Trigger a

"Boomerang Effect"

The avalanche of liquidity from the Feds quantitative easing in 2013, allowed the world befores tenets

to wake up: indebtedness, bubbles, globalization, financialization But all it took was a slight slowing

down in the astronomical amounts injected by the ...

178

Like

123

15

231

Articles by:

Global Europe

Anticipation Bulletin

(GEAB)

Disclaimer: The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be

responsible for any inaccurate or incorrect statement in this article. The Center of Research on Globalization grants permission to

cross-post original Global Research articles on community internet sites as long as the text & title are not modified. The source and the

author's copyright must be displayed. For publication of Global Research articles in print or other forms including commercial internet

sites, contact: publications@globalresearch.ca

19.12.2014 23:11

Global Systemic Financial Crisis 2015: Geopolitics, Oil and Currency...

4 de 4

http://www.globalresearch.ca/global-systemic-financial-crisis-2015-ge...

www.globalresearch.ca contains copyrighted material the use of which has not always been specifically authorized by the copyright

owner. We are making such material available to our readers under the provisions of "fair use" in an effort to advance a better

understanding of political, economic and social issues. The material on this site is distributed without profit to those who have

expressed a prior interest in receiving it for research and educational purposes. If you wish to use copyrighted material for purposes

other than "fair use" you must request permission from the copyright owner.

For media inquiries: publications@globalresearch.ca

Copyright Global Europe Anticipation Bulletin (GEAB), Global Europe Anticipation Bulletin, 2014

English Franais

Espaol Italiano

Themes

Geographic Regions

US NATO War Agenda

Militarization and WMD

USA

Deutsch Portugus

Global Economy

Oil and Energy

Canada

srpski

Crimes against Humanity

Police State & Civil Rights

Middle East & North Africa

Militarization and WMD

Politics and Religion

Latin America & Caribbean

Global Research News

Law and Justice

Poverty & Social Inequality

Europe

I-BOOKS SERIES

Police State & Civil Rights

Science and Medicine

sub-Saharan Africa

Countries Index

Culture, Society & History

United Nations

Russia and FSU

9/11 & War on Terrorism

US NATO War Agenda

Asia

Media Disinformation

Womens Rights

Oceania

Authors Index

Most Popular

Links

Contact

Membership

Privacy Policy

Copyright 2005-2014 GlobalResearch.ca

Online Store

19.12.2014 23:11

You might also like

- Game Over Europe – a ‘Colour Revolution’ is ComingDocument3 pagesGame Over Europe – a ‘Colour Revolution’ is ComingdeliriousheterotopiasNo ratings yet

- "Humanitarian Lies" - Evidence Proves US Afghan Hospital Attack Was Deliberate - Global ResearchDocument2 pages"Humanitarian Lies" - Evidence Proves US Afghan Hospital Attack Was Deliberate - Global ResearchdeliriousheterotopiasNo ratings yet

- "Boots On The Ground" Inside Syria - The Pentagon Comes To The Rescue of The "Islamic State" (ISIS) - Global ResearchDocument2 pages"Boots On The Ground" Inside Syria - The Pentagon Comes To The Rescue of The "Islamic State" (ISIS) - Global ResearchdeliriousheterotopiasNo ratings yet

- Thailand Blasts - Has US Pivot To Asia Become A Brawl - The Millennium ReportDocument10 pagesThailand Blasts - Has US Pivot To Asia Become A Brawl - The Millennium ReportdeliriousheterotopiasNo ratings yet

- Russian Troops Put On Combat Alert Over Obama Regime False Flag FearsDocument6 pagesRussian Troops Put On Combat Alert Over Obama Regime False Flag FearsdeliriousheterotopiasNo ratings yet

- Refugee Crisis or Green Transversal Project For EuropeDocument7 pagesRefugee Crisis or Green Transversal Project For EuropedeliriousheterotopiasNo ratings yet

- Society and Violence - KurnitzDocument5 pagesSociety and Violence - KurnitzdeliriousheterotopiasNo ratings yet

- Holter - Global Finance and The "Other" Four Gs - GE, Greece, Germany and Gazprom - Global ResearchDocument2 pagesHolter - Global Finance and The "Other" Four Gs - GE, Greece, Germany and Gazprom - Global ResearchdeliriousheterotopiasNo ratings yet

- The Worth of Gold Growing by The Day - New Eastern OutlookDocument2 pagesThe Worth of Gold Growing by The Day - New Eastern OutlookdeliriousheterotopiasNo ratings yet

- Ellen-Brown - Financial Meltdown - The Greatest Transfer of Wealth in History - Global ResearchDocument4 pagesEllen-Brown - Financial Meltdown - The Greatest Transfer of Wealth in History - Global ResearchdeliriousheterotopiasNo ratings yet

- On Exchange - KurnitzDocument5 pagesOn Exchange - KurnitzdeliriousheterotopiasNo ratings yet

- Saudi King Blamed Mossad For 9 - 11Document2 pagesSaudi King Blamed Mossad For 9 - 11deliriousheterotopiasNo ratings yet

- CounterPunch - Tells The Facts, Names The Names Greek Debt Crisis PrintDocument5 pagesCounterPunch - Tells The Facts, Names The Names Greek Debt Crisis PrintdeliriousheterotopiasNo ratings yet

- Michel-Chossudovsky Indian Ocean TsunamiDocument19 pagesMichel-Chossudovsky Indian Ocean TsunamideliriousheterotopiasNo ratings yet

- Binoy-Kampmark - The Virus of Terror and Prejudice - Using Ebola To Close Borders and Foment Racial Discrimination - Global ResearchDocument3 pagesBinoy-Kampmark - The Virus of Terror and Prejudice - Using Ebola To Close Borders and Foment Racial Discrimination - Global ResearchdeliriousheterotopiasNo ratings yet

- The Role of 9/11 in Justifying Torture and War: The Criminalization of The US State Apparatus. Senate Report On CIA Torture Is A WhitewashDocument14 pagesThe Role of 9/11 in Justifying Torture and War: The Criminalization of The US State Apparatus. Senate Report On CIA Torture Is A WhitewashdeliriousheterotopiasNo ratings yet

- On Exchange - KurnitzDocument5 pagesOn Exchange - KurnitzdeliriousheterotopiasNo ratings yet

- Mitch-Feierstein Economic-Collapse PDFDocument5 pagesMitch-Feierstein Economic-Collapse PDFdeliriousheterotopiasNo ratings yet

- 15 Other Garden Projects, Maintenon, Saint-Cyr, Gaillon and MarlyDocument13 pages15 Other Garden Projects, Maintenon, Saint-Cyr, Gaillon and MarlydeliriousheterotopiasNo ratings yet

- Heather-Callaghan - British Company Oxitec's Proposal To Release Genetically Modified Mosquitoes in The US - Global Research PDFDocument3 pagesHeather-Callaghan - British Company Oxitec's Proposal To Release Genetically Modified Mosquitoes in The US - Global Research PDFdeliriousheterotopiasNo ratings yet

- Larry-Chin - False Flagging The World Towards WarDocument5 pagesLarry-Chin - False Flagging The World Towards WardeliriousheterotopiasNo ratings yet

- Society and Violence - KurnitzDocument5 pagesSociety and Violence - KurnitzdeliriousheterotopiasNo ratings yet

- Note To China and Russia - Did You Import Depopulation Corn - Jon Rappoport's BlogDocument4 pagesNote To China and Russia - Did You Import Depopulation Corn - Jon Rappoport's BlogdeliriousheterotopiasNo ratings yet

- Anonimo - This Is How Doctors Are Puppets For Vaccine Manufacturers - Global Research PDFDocument4 pagesAnonimo - This Is How Doctors Are Puppets For Vaccine Manufacturers - Global Research PDFdeliriousheterotopiasNo ratings yet

- The French GardenDocument161 pagesThe French Gardendeliriousheterotopias100% (3)

- Horowitz Aids and EbolaDocument11 pagesHorowitz Aids and EboladeliriousheterotopiasNo ratings yet

- J-D-Heyes - Ebola Blood Samples Stolen in Guinea This Is How Terrorists Can Easily Acquire The Bioweapon - NaturalNewsDocument5 pagesJ-D-Heyes - Ebola Blood Samples Stolen in Guinea This Is How Terrorists Can Easily Acquire The Bioweapon - NaturalNewsdeliriousheterotopiasNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Automobile EngineeringDocument73 pagesAutomobile EngineeringSolomon Durairaj71% (7)

- Baja 2020 RulebookDocument141 pagesBaja 2020 RulebookpranjalNo ratings yet

- Unit 1Document9 pagesUnit 1Harishma100% (1)

- The White Lotus by OSHODocument450 pagesThe White Lotus by OSHODillip Kumar MahapatraNo ratings yet

- Introduction To Experimental PsychologyDocument27 pagesIntroduction To Experimental PsychologyJhonel NautanNo ratings yet

- Food Preservation System: Istiqomah Rahmawati, S.Si., M.SiDocument14 pagesFood Preservation System: Istiqomah Rahmawati, S.Si., M.SiArya PringgodaniNo ratings yet

- Ansys RecordDocument58 pagesAnsys RecordMr.kaththi perfectNo ratings yet

- Complicated Community Acquired Pneumonia Clinical PathwayDocument14 pagesComplicated Community Acquired Pneumonia Clinical PathwayFaisalMuhamadNo ratings yet

- Warhammer 50k - The Shape of The Nightmare To ComeDocument115 pagesWarhammer 50k - The Shape of The Nightmare To ComeCallum MacAlister100% (1)

- Introduction To Measurements and Error Analysis: ObjectivesDocument17 pagesIntroduction To Measurements and Error Analysis: ObjectivesDeep PrajapatiNo ratings yet

- Suplemento de Aero Controlex GroupDocument266 pagesSuplemento de Aero Controlex GroupGerardo CordovaNo ratings yet

- Group 2 presents chapter on measurement units, tolerances and fitsDocument26 pagesGroup 2 presents chapter on measurement units, tolerances and fitsNguyenThiKhanhLy100% (1)

- Penggolongan Obat 1Document27 pagesPenggolongan Obat 1Dias Angga PerdanaNo ratings yet

- Apex NC Fence OrdinanceDocument28 pagesApex NC Fence OrdinanceKeith BloemendaalNo ratings yet

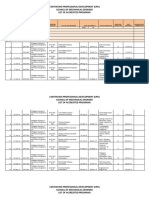

- CPDprogram MECHENG-91018Document43 pagesCPDprogram MECHENG-91018PRC Board100% (1)

- Developing The Whole PersonDocument17 pagesDeveloping The Whole PersonDaphne LavardoNo ratings yet

- As MolesDocument5 pagesAs MolesHaider AliNo ratings yet

- XGC1900 - LEHX0058-00 - 60 HZ DTODocument9 pagesXGC1900 - LEHX0058-00 - 60 HZ DTOjorgearoncancioNo ratings yet

- ConstellationDocument18 pagesConstellationJames Michael Lambaco PabillarNo ratings yet

- A Paper On Silent Sound Technology - : Compiled byDocument4 pagesA Paper On Silent Sound Technology - : Compiled bygvsr4187No ratings yet

- I Believe Chords CDocument3 pagesI Believe Chords Caminahtayco2009No ratings yet

- Fuel Transfer Pump - Disassemble: Shutdown SISDocument3 pagesFuel Transfer Pump - Disassemble: Shutdown SISjasleenNo ratings yet

- Warman Mcu 350 Masbate Philippines Case Study DuplicateDocument2 pagesWarman Mcu 350 Masbate Philippines Case Study DuplicateBJ AbelaNo ratings yet

- Brinda Raghuveer Resume Jan2010Document2 pagesBrinda Raghuveer Resume Jan2010Shawn SolisNo ratings yet

- Polypropylene Impact Co Polymer Injection Molding: Provisional Technical DatasheetDocument2 pagesPolypropylene Impact Co Polymer Injection Molding: Provisional Technical DatasheetMohit MohataNo ratings yet

- Memory InterfacingDocument29 pagesMemory Interfacingabhi198808No ratings yet

- Phreeqc 3 2013 ManualDocument519 pagesPhreeqc 3 2013 ManualpauloalpeNo ratings yet

- SE Answer SheetDocument8 pagesSE Answer SheetEsparrago RandolfNo ratings yet

- Green HydrogenDocument15 pagesGreen HydrogenAbdul RahmanNo ratings yet