Professional Documents

Culture Documents

LEYNES Phil Refining Co V CA

Uploaded by

Eugenio Sixwillfix LeynesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LEYNES Phil Refining Co V CA

Uploaded by

Eugenio Sixwillfix LeynesCopyright:

Available Formats

PHILIPPINE REFINING COMPANY (now known as UNILEVER PHILIPPINES [PRC], INC.

),

petitioner, vs. COURT OF APPEALS, COURT OF TAX APPEALS, and THE COMMISSIONER OF

INTERNAL REVENUE, respondents.

May 8, 1996

REGALADO, J.

Digest by Eugenio Leynes

Syllabus:

2. TAXATION; NATIONAL INTERNAL REVENUE CODE; INCOME TAX; BAD DEBTS; REQUISITES FOR

DEDUCTION. For debts to be considered as worthless, and thereby qualify as bad debts making

them deductible, the taxpayer should show that (1) there is a valid and subsisting debt; (2) the debt

must be actually ascertained to be worthless and uncollectible during the taxable year; (3) the debt

must be charged off during the taxable year; and (4) the debt must arise from the business or trade of

the taxpayer. Additionally, before a debt can be considered worthless, the taxpayer must also show

that it is indeed uncollectible even in the future. Furthermore, there are steps outlined to be

undertaken by the taxpayer to prove that he exerted diligent efforts to collect the debts, viz: (1)

sending of statement of accounts; (2) sending of collection letters; (3) giving the account to a lawyer

for collection; and (4) filing a collection case in court.

Facts:

Petitioner Philippine Refining Company (PRC) was assessed by respondent Commissioner of

Internal Revenue (Commissioner) to pay a deficiency tax for the year 1985 in the amount of

P1,892,584.00

The assessment was timely protested by petitioner on April 26, 1989, on the ground that it was

based on the erroneous disallowances of bad debts and interest expense although the

same are both allowable and legal deductions.

Issue:

1) WON the accounts can be considered bad debts

Held:

1) No. Not enough evidence.

Dispositive:

Ratio:

We find that said accounts have not satisfied the requirements of the worthlessness of a debt.

Mere testimony of the Financial Accountant of the Petitioner explaining the

worthlessness of said debts is seen by this Court as nothing more than a selfserving exercise which lacks probative value.

There was no iota of documentary evidence (e. g., collection letters sent, report from

investigating fieldmen, letter of referral to their legal department, police report/affidavit that

the owners were bankrupt due to fire that engulfed their stores or that the owner has been

murdered, etc.), to give support to the testimony of an employee of the Petitioner.

Mere allegations cannot prove the worthlessness of such debts in 1985. Hence, the claim for

deduction of these thirteen (13) debts should be rejected.

For debts to be considered as worthless, and thereby qualify as bad debts making them

deductible, the taxpayer should show that:

o (1) there is a valid and subsisting debt;

o (2) the debt must be actually ascertained to be worthless and uncollectible during the

taxable year;

o (3) the debt must be charged off during the taxable year; and

o (4) the debt must arise from the business or trade of the taxpayer.

o Additionally, before a debt can be considered worthless, the taxpayer must also show

that it is indeed uncollectible even in the future.

Furthermore, there are steps outlined to be undertaken by the taxpayer to prove that he

exerted diligent efforts to collect the debts, viz:

o (1) sending of statement of accounts;

o (2) sending of collection letters;

o (3) giving the account to a lawyer for collection; and

o (4) filing a collection case in court.

It appears that the only evidentiary support given by PRC for its aforesaid claimed deductions

was the explanation or justification posited by its financial adviser or accountant. Guia D.

Masagana.

You might also like

- Property SketcherDocument5 pagesProperty SketcherEugenio Sixwillfix LeynesNo ratings yet

- NBA FantasyDocument25 pagesNBA FantasyEugenio Sixwillfix LeynesNo ratings yet

- Securities and Regulations CodeDocument2 pagesSecurities and Regulations CodeEugenio Sixwillfix LeynesNo ratings yet

- LEYNES Roxas V ArroyoDocument3 pagesLEYNES Roxas V ArroyoEugenio Sixwillfix LeynesNo ratings yet

- Legitimate Targets Under International Humanitarian LawDocument3 pagesLegitimate Targets Under International Humanitarian LawEugenio Sixwillfix LeynesNo ratings yet

- 17 Leynes Great Asian Sales Center Corp. v. CADocument4 pages17 Leynes Great Asian Sales Center Corp. v. CAEugenio Sixwillfix LeynesNo ratings yet

- 17 LEYNES Asia Lighterage v. CADocument2 pages17 LEYNES Asia Lighterage v. CAEugenio Sixwillfix LeynesNo ratings yet

- Leynes Trans-Asia v. CADocument2 pagesLeynes Trans-Asia v. CAEugenio Sixwillfix LeynesNo ratings yet

- LEYNES Vda de Catalan V Catalan-LeeDocument2 pagesLEYNES Vda de Catalan V Catalan-LeeEugenio Sixwillfix Leynes0% (1)

- Judge Not Guilty of Pointing Gun at Woman in LaborDocument2 pagesJudge Not Guilty of Pointing Gun at Woman in LaborEugenio Sixwillfix LeynesNo ratings yet

- LEYNES Taxicab Ops v. Board of TransportationDocument2 pagesLEYNES Taxicab Ops v. Board of TransportationEugenio Sixwillfix LeynesNo ratings yet

- 15 LEYNES People V SaceDocument2 pages15 LEYNES People V SaceEugenio Sixwillfix LeynesNo ratings yet

- Bank of Philippine Islands vs Fidelity & Surety Co reformation of guarantyDocument3 pagesBank of Philippine Islands vs Fidelity & Surety Co reformation of guarantyEugenio Sixwillfix Leynes100% (1)

- 11 Leynes Villanueva v. SantosDocument1 page11 Leynes Villanueva v. SantosEugenio Sixwillfix LeynesNo ratings yet

- LEYNES in The Matter of The Corporate Rehabilitation of Bayan Telecommunications IncDocument2 pagesLEYNES in The Matter of The Corporate Rehabilitation of Bayan Telecommunications IncEugenio Sixwillfix LeynesNo ratings yet

- LEYNES Estate of KH Hemady V Luzon SuretyDocument2 pagesLEYNES Estate of KH Hemady V Luzon SuretyEugenio Sixwillfix LeynesNo ratings yet

- 14 LEYNES Eastern Shipping v. CADocument2 pages14 LEYNES Eastern Shipping v. CAEugenio Sixwillfix LeynesNo ratings yet

- Forgery Acceptance Precludes RecoveryDocument1 pageForgery Acceptance Precludes RecoveryEugenio Sixwillfix LeynesNo ratings yet

- LEYNES Paquete HabanaDocument3 pagesLEYNES Paquete HabanaEugenio Sixwillfix LeynesNo ratings yet

- 11 LEYNES Clark v. SellnerDocument1 page11 LEYNES Clark v. SellnerEugenio Sixwillfix LeynesNo ratings yet

- LEYNES CIR vs. BurroughsDocument2 pagesLEYNES CIR vs. BurroughsEugenio Sixwillfix LeynesNo ratings yet

- Judge Not Guilty of Pointing Gun at Woman in LaborDocument2 pagesJudge Not Guilty of Pointing Gun at Woman in LaborEugenio Sixwillfix LeynesNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Unemployment Benefits: TypesDocument2 pagesUnemployment Benefits: TypesTop Artist ReviewsNo ratings yet

- Income Tax AccountingDocument18 pagesIncome Tax AccountingSeptian Dwi AnggoroNo ratings yet

- Goods and Services Tax - GSTR-2BDocument7 pagesGoods and Services Tax - GSTR-2BMD AZHARNo ratings yet

- 2022 FinalsDocument49 pages2022 FinalsJane GaliciaNo ratings yet

- Taxation Direct and Indirect NMIMS AssignmentDocument6 pagesTaxation Direct and Indirect NMIMS AssignmentN. Karthik UdupaNo ratings yet

- 14 Employee Benefits That Are Tax-ExemptDocument4 pages14 Employee Benefits That Are Tax-ExemptLuke RobinsonNo ratings yet

- FBTDocument5 pagesFBTKenneth Bryan Tegerero TegioNo ratings yet

- Toaz - Info May Pay Slippdf PRDocument1 pageToaz - Info May Pay Slippdf PRkunalandsolanki2002No ratings yet

- 704 (B) Allocations KPMGDocument72 pages704 (B) Allocations KPMGturbinetimeNo ratings yet

- Tax Related Thesis TopicsDocument8 pagesTax Related Thesis Topicsafkodpexy100% (1)

- TAKENAKA CORPORATION v. CIRDocument3 pagesTAKENAKA CORPORATION v. CIRAngelique Padilla UgayNo ratings yet

- Tax Deducted at SourceDocument23 pagesTax Deducted at SourcePrathamesh ParkerNo ratings yet

- Property Twins Cashflow Spreadsheet - v0.5Document7 pagesProperty Twins Cashflow Spreadsheet - v0.5Vivek HandaNo ratings yet

- General Principles of Income Taxation - KKDocument11 pagesGeneral Principles of Income Taxation - KKKenncyNo ratings yet

- Guide to Atal Pension Yojana benefits for unorganized workersDocument3 pagesGuide to Atal Pension Yojana benefits for unorganized workersds468No ratings yet

- Temporary Differences (Result in Deferred Taxes)Document45 pagesTemporary Differences (Result in Deferred Taxes)chuynh18No ratings yet

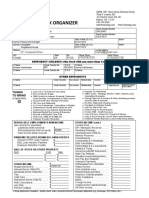

- 2020 Income Tax Organizer: 211 Crescent DriveDocument2 pages2020 Income Tax Organizer: 211 Crescent DriveLeslie HutchinsonNo ratings yet

- Ganesh JangidDocument2 pagesGanesh JangidGanesh JangidNo ratings yet

- PDF NO:201915489 Page 1Document3 pagesPDF NO:201915489 Page 1Mahendar ErramNo ratings yet

- Tax Implications of AOP and JDADocument8 pagesTax Implications of AOP and JDAParameswar ERNo ratings yet

- Recover Bad Debts Tax RulesDocument7 pagesRecover Bad Debts Tax RulesRonHilarioNo ratings yet

- Correction in Income TaxDocument13 pagesCorrection in Income TaxchiragsmguptaNo ratings yet

- F6-Dec 2007 PYQDocument16 pagesF6-Dec 2007 PYQTan Wan ChingNo ratings yet

- Accounting for Tax Amnesty Assets and LiabilitiesDocument13 pagesAccounting for Tax Amnesty Assets and LiabilitiesHeriyanto MonmonNo ratings yet

- 12 Chapter 4Document102 pages12 Chapter 4Anonymous reIq4DHr2No ratings yet

- Text Book Multiple Choice Quiz AnswersDocument128 pagesText Book Multiple Choice Quiz Answersbinod gaire0% (1)

- Allegations Cancellation Notice For Aditya TelengDocument3 pagesAllegations Cancellation Notice For Aditya TelengAaditya TelangNo ratings yet

- Score 75 Marks in DT IDT For Recording 1Document16 pagesScore 75 Marks in DT IDT For Recording 1saiNo ratings yet

- FAQ For PIC and Cash GrantDocument4 pagesFAQ For PIC and Cash GrantSathis KumarNo ratings yet

- Income From House Property Practical 1Document1 pageIncome From House Property Practical 1Jitendra SharmaNo ratings yet