Professional Documents

Culture Documents

Road To Wealth

Uploaded by

Anonymous 01pQbZUMMOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Road To Wealth

Uploaded by

Anonymous 01pQbZUMMCopyright:

Available Formats

If You Want to Retire in 10 Years, Do These 5 Things Now | Money.

com

1 of 3

http://time.com/money/3606172/pre-retirement-moves/?xid=timefb

HIT PEAK PERFORMANCE

If You Want to Retire in 10 Years, Do

These 5 Things Now

The decade before retirement is a critical

time. Here's how to make sure you're on

the right path.

After 30-plus years of working and

socking away savings, you can finally see

retirement on the horizon. But its not

time to coast just yet.

The actions you take in the final decade

before you quit working are crucial to

getting the next phase off to a smooth

start. Here are 5 things you must do now.

PM Images/Getty Images

1. See if youre saving enough. If you havent recently, take stock of where you are

and where you need to be. For example, to replace 70% of your earnings by age 65, youll

need to accumulate 12 times your pay at 65. But even if youre playing catch-up, you can

still make it to the finish line with what you need. Your choice: Seriously power-save, or

work a bit longer while saving less. Say you have five times your income; you could sock

away 33% a year for the next 10 years, or delay retirement 24 months while banking

20%. Either way, dont miss out on catch-up contributions! Those 50-plus can put

$6,000 extra in a 401(k), $1,000 more in an IRA in 2015.

2. Stagger your retirement with your spouse. Among two-income couples, nearly

one in five retires in the same year, and another 30% within two years of each other,

reports the Urban Institute. But quitting in tandem isnt necessarily the best move. If one

spouse works just a few years longer, you can draw less from your portfolio in those initial

years.

3. Dont automatically quit on stocks. To achieve returns to sustain a 30-year

retirement, you need to still be investing for growth. Stocks should make up 50% to 60%

of your allocation, with the rest in bonds. The caveat: Those within 10% of their ultimate

savings goal can choose to dial back to 40%.

4. Do the math on your mortgage. Of course you dont want to carry credit card debt

into retirement, but what about the mortgage? The old advice was to burn it before you

left work, but in todays low-rate environment, maybe not. Assuming that your rate is less

than 5% and that youll be able to afford the payments from guaranteed-income sources

in retirementor if youre planning to movetheres no rush. You may do better by

investing money you would have put toward the loan.

On the other hand, if you wont be able to swing the nut later on, or simply want peace of

mind, use the repayment calculator at bankrate.com to figure out how to erase the debt

sooner. Or consider a cash-in refi to a shorter-term loan. Say you have $200,000 and 20

years left on a 30-year mortgage at 5%. Refinancing to a 15-year at 3% and putting in

$50,000 would shave off five years and cut the monthly payment from $1,381 to $1,074.

Keep up the original payment, and the loan will be paid off in 11 years, plus youll save

$10,300 in interest.

5. Make friends with the younguns. Sure, you still want to dazzle your boss, but

youd better be working just as hard to make allies below you. Your younger coworkers

are likely to move up the ranks over the next 10 years and have a say in whether you stay

or go. Hanging onto your job for the next decade will be essential to keeping your plan on

track. So train subordinates, mentor up-and-comers, and look into a reverse

mentorship in which a junior colleague teaches you something new.

Answer this question to get more financial advice tailored to your place on

the Road to Wealth:

Which best describes your financial life?

1. a) A disaster

2/4/2015 4:09 PM

If You Want to Retire in 10 Years, Do These 5 Things Now | Money.com

2 of 3

http://time.com/money/3606172/pre-retirement-moves/?xid=timefb

2. b) I have a little savings

3. c) Ive got a nest egg but big goals too

4. d) Doing great

HIT PEAK PERFORMANCE

So Youre Retired! Now What?

Donna Rosato @RosatoDonna

Susie Poppick @susiepoppick

Carla Fried

Get in these 4 habits to keep your

financial plans on track.

Youve crossed the proverbial finish line to

retirement. And if youve planned

carefully and done your homework, your

financial plan should practically run

itself. Still, youll want to check in

periodically and avoid some common

pitfalls.

iStock

Dont go chasing yield

As you age, the fixed-income portion of your portfolio becomes more important. The goal

isnt maximum income, but maximum preservationby way of diversification. So put the

majority of these holdings into a total bond market index fund. For inflation protection,

add TIPS (Treasury Inflation-Protected Securities), keeping them to less than 30% of

your bond share. Anyone who has substantial money outside tax-deferred accounts and is

in a high tax bracket should consider municipal bonds too. Initially, youll also keep 12

months of expenses, plus your emergency fund, in cash.

Every couple of years, trim a few percentage points from your stock holdings and stick

the money in bonds and cash. By 75at which point you dont need as much growth to

keep up with inflationyou should have two to three years worth of expenses in a moneymarket or short-term bond fund.

Do a yearly spending checkup

Before you quit working, you gave yourself a budget. Expect to blow it.

Some experts suggest tracking your spending once annually to keep yourself honest.

Check out the budget worksheet on Fidelitys Retirement Income Planner. Then plug in

your assets to see if your spending is sustainable. Chronically going over a 4% inflationadjusted draw could cause your money to run out, but even if youve gone off the rails in a

few years, dialing back can make a difference.

Take from all baskets

As you spend down your cash account, youll need to replenish it. Minimizing the taxes

you incur on portfolio withdrawals will maximize the life span of your savings. Generally,

retirees have been advised to tap taxable assets first, because the long-term capital gains

rate on them is lower than the income tax rate owed on traditional 401(k) and IRA

withdrawals, and because this method allows tax-deferred accounts to continue to grow

without a tax bite.

Whether or not the strategy works, however, depends on many variables. Another failing:

Once you do transition to drawing solely on tax-deferred accounts, you may be bumped

into a higher tax bracket.

While theres no one perfect system, one smart approach is to be more egalitarian with

your withdrawals. Start by balancing any tax deductions you have with withdrawals from

tax-deferred accounts, then take the rest of the money you need from taxable accounts.

Never retire your rsum

Keep in mind that a worst-case scenario may necessitate your returning to work.

Submitting a CV that hasnt been dusted off since Y2K wont do you any favors. So update

your rsum now while recent accomplishments are fresh in your mind. Then revisit it

once a year to add something, even if its volunteer work or leadership in a social club.

Answer this question to get more financial

advice tailored to your place on the Road to

2/4/2015 4:09 PM

If You Want to Retire in 10 Years, Do These 5 Things Now | Money.com

3 of 3

http://time.com/money/3606172/pre-retirement-moves/?xid=timefb

Wealth:

Do your investments carry high management fees?

1. I have no idea

2. I try to pick lower-cost funds when possible

3. I mostly invest in no-load mutual funds

4. I only invest in ultra-low-fee index funds and ETFs

Read next: If You Want to Retire in 10 Years, Do These 5 Things Now

Listen to the most important stories of the day.

2014 Time Inc. All rights reserved.

2/4/2015 4:09 PM

You might also like

- 14 Ways To Retire EarlyDocument3 pages14 Ways To Retire EarlyRoan OrolfoNo ratings yet

- Business Journal March 2012 B SectionDocument16 pagesBusiness Journal March 2012 B SectionThe Delphos HeraldNo ratings yet

- 13 Personal Finance Thumb Rules To Help Kick-Start Your Financial Planning - The Economic TimesDocument4 pages13 Personal Finance Thumb Rules To Help Kick-Start Your Financial Planning - The Economic TimesMounika PNo ratings yet

- 5 Financial Habits to Help You Achieve Your GoalsDocument2 pages5 Financial Habits to Help You Achieve Your Goalsx3No ratings yet

- The Cost of WaitingDocument2 pagesThe Cost of Waitingmirando93No ratings yet

- Mini Guide to Common Sense Retirement for the Blue Collar Man: By Thomas a Kinkade a Common Sense ManFrom EverandMini Guide to Common Sense Retirement for the Blue Collar Man: By Thomas a Kinkade a Common Sense ManNo ratings yet

- Road Map For Investing SuccessDocument44 pagesRoad Map For Investing Successnguyentech100% (1)

- Money ManagementDocument2 pagesMoney ManagementJon SnowNo ratings yet

- How Much Should You InvestDocument3 pagesHow Much Should You InvestKurian PunnooseNo ratings yet

- 10 Questions About Money That You'Re Afraid To AsDocument2 pages10 Questions About Money That You'Re Afraid To AsMark LabramonteNo ratings yet

- How To Become Rich 3 StepsDocument6 pagesHow To Become Rich 3 StepsDickson NsiimeNo ratings yet

- Investing For Beginners Book: Investing Basics and Investing 101From EverandInvesting For Beginners Book: Investing Basics and Investing 101No ratings yet

- CSE K Reading-Morton Niederjohn Thomas-Building WealthDocument17 pagesCSE K Reading-Morton Niederjohn Thomas-Building Wealthgraphicman1060No ratings yet

- The 5-Minute 401 (K) Investment Plan - DecDocument5 pagesThe 5-Minute 401 (K) Investment Plan - DecprodeepmNo ratings yet

- Tax Saving OprionsDocument17 pagesTax Saving OprionsvempadareddyNo ratings yet

- Setting and Targeting Investment GoalsDocument3 pagesSetting and Targeting Investment GoalsChris RhodesNo ratings yet

- 5 Critical Financial Planning Tips for 20-SomethingsDocument2 pages5 Critical Financial Planning Tips for 20-Somethingsjojo laygoNo ratings yet

- 10 Tips Improving PensionDocument16 pages10 Tips Improving PensionAlviNo ratings yet

- Chapter 1: IntroductionDocument20 pagesChapter 1: IntroductionAlyn CheongNo ratings yet

- How To Make Your Retirement Kitty LastDocument1 pageHow To Make Your Retirement Kitty LastDurai NaiduNo ratings yet

- Self-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentFrom EverandSelf-Help Guidebook for Retirement Planning For Couples and Seniors: Ultimate Retirement Planning Book for Life after Paid EmploymentNo ratings yet

- ML MyFuture 0107Document19 pagesML MyFuture 0107redminstrelNo ratings yet

- Top 10 Ways To Prepare For RetirementDocument6 pagesTop 10 Ways To Prepare For RetirementAniketNo ratings yet

- Meeting Your Obligations and Finding Some Opportunities.: RMD Precautions and OptionsDocument2 pagesMeeting Your Obligations and Finding Some Opportunities.: RMD Precautions and Optionsapi-118535366No ratings yet

- Building A Budget: Credit Card DebtDocument5 pagesBuilding A Budget: Credit Card DebtRohit BajpaiNo ratings yet

- The 401K First Aid Kit: Stop Your Portfolio Bleeding and Get Back to Financial HealthFrom EverandThe 401K First Aid Kit: Stop Your Portfolio Bleeding and Get Back to Financial HealthNo ratings yet

- Your Money Cheat SheetDocument3 pagesYour Money Cheat SheetNaowNo ratings yet

- Finance Life Cycle Stages GuideDocument9 pagesFinance Life Cycle Stages Guidemamudul hasan100% (1)

- Ways To Wealth - in Your 60'S Start Ensuring That Your Money Lasts Longer!Document6 pagesWays To Wealth - in Your 60'S Start Ensuring That Your Money Lasts Longer!LandaLeighNo ratings yet

- Financially Fit PersonDocument8 pagesFinancially Fit PersonMoises Von Rosauro De Gracia100% (1)

- 8 Financial Tips for Young AdultsDocument5 pages8 Financial Tips for Young AdultsChris FloresNo ratings yet

- Retirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyFrom EverandRetirement Strategies For Millennials: A Simple and Practical Plan for Retiring EarlyNo ratings yet

- Personal Financial ManagementDocument4 pagesPersonal Financial ManagementLes Jara LJNo ratings yet

- How Much of Your Paycheck Should You Save - SoFiDocument10 pagesHow Much of Your Paycheck Should You Save - SoFiJerry liuNo ratings yet

- HL Guide Retirement For Under 40s 1018Document18 pagesHL Guide Retirement For Under 40s 1018BenNo ratings yet

- Calculating Your Financial Ratios: U C C E S SDocument4 pagesCalculating Your Financial Ratios: U C C E S SPhil_OrwigNo ratings yet

- How to Control Your Finances: Save Money, Increase Income, Invest, & Grow your NetworthFrom EverandHow to Control Your Finances: Save Money, Increase Income, Invest, & Grow your NetworthNo ratings yet

- Mid-Year Financial Check-InDocument7 pagesMid-Year Financial Check-InVickfor LucaniNo ratings yet

- Best Debt Elimination Plan: Debt Management Strategies that Get You Out of Debt Quickly and Economically: Becoming Financially Independent, #1From EverandBest Debt Elimination Plan: Debt Management Strategies that Get You Out of Debt Quickly and Economically: Becoming Financially Independent, #1Rating: 5 out of 5 stars5/5 (1)

- Consolidating Retirement AccountsDocument4 pagesConsolidating Retirement AccountscdietzrNo ratings yet

- Make Your Money Grow With Compound InterestDocument2 pagesMake Your Money Grow With Compound InterestMARY DESEREE V. RETIRONo ratings yet

- Thumb Rules For Smart Financial PlanningDocument2 pagesThumb Rules For Smart Financial PlanningMrinal SandbhorNo ratings yet

- Retirement Planning Month at Investment-Mantra - In: Best Pension Plans 1 Crore Life InsuranceDocument6 pagesRetirement Planning Month at Investment-Mantra - In: Best Pension Plans 1 Crore Life InsuranceMansoor AhmedNo ratings yet

- The Golden Rules for Financial SuccessDocument4 pagesThe Golden Rules for Financial SuccessTeacher ReginaNo ratings yet

- The Graduates Guide To Getting Rid of Your Student LoansDocument27 pagesThe Graduates Guide To Getting Rid of Your Student LoansKurtis RoseNo ratings yet

- 2013 Year-End Tax Planning Considerations: Collaborative Financial Solutions, LLCDocument4 pages2013 Year-End Tax Planning Considerations: Collaborative Financial Solutions, LLCJanet BarrNo ratings yet

- 10 Retirement PlanningDocument11 pages10 Retirement PlanningayraNo ratings yet

- 11 Ways To Plan Financial LifeDocument5 pages11 Ways To Plan Financial LifeClifford DmelloNo ratings yet

- The 250 Personal Finance Questions You Should Ask in Your 20s and 30sFrom EverandThe 250 Personal Finance Questions You Should Ask in Your 20s and 30sRating: 3 out of 5 stars3/5 (1)

- 4 Signs You Won't Be Ready For Retirement That Are Obvious by Age 40Document8 pages4 Signs You Won't Be Ready For Retirement That Are Obvious by Age 40IvanNo ratings yet

- Automatic Wealth for Grads (Review and Analysis of Masterson's Book)From EverandAutomatic Wealth for Grads (Review and Analysis of Masterson's Book)No ratings yet

- Centorbi - AE Taxes White Paper - DL - GGDocument8 pagesCentorbi - AE Taxes White Paper - DL - GGchad centorbiNo ratings yet

- Savings: Demystifying Investment ProductsDocument20 pagesSavings: Demystifying Investment ProductsznyingwaNo ratings yet

- A Smart Guide to Building Wealth: Money Moves Your Parents Wish They Had MadeFrom EverandA Smart Guide to Building Wealth: Money Moves Your Parents Wish They Had MadeNo ratings yet

- HL Guide Retirement For Under 40s 1018Document18 pagesHL Guide Retirement For Under 40s 1018mwj7f2hmx7No ratings yet

- 5 Ways to Choose the Right Home Loan and Retire With Rs 5 CroreDocument22 pages5 Ways to Choose the Right Home Loan and Retire With Rs 5 Croreavinash sharmaNo ratings yet

- Retirement Planning Guidebook for Couples and Seniors: All You Need to Know to Plan For and Have a Stress-Free RetirementFrom EverandRetirement Planning Guidebook for Couples and Seniors: All You Need to Know to Plan For and Have a Stress-Free RetirementNo ratings yet

- Waiver of Right to Partition AgreementDocument2 pagesWaiver of Right to Partition AgreementAnonymous 01pQbZUMMNo ratings yet

- Final Notice To Vacate - OpenDocument1 pageFinal Notice To Vacate - OpenAnonymous 01pQbZUMMNo ratings yet

- Final Notice To Vacate - OpenDocument1 pageFinal Notice To Vacate - OpenAnonymous 01pQbZUMMNo ratings yet

- SENATOR of PHILIPPINES PDFDocument11 pagesSENATOR of PHILIPPINES PDFAnonymous 01pQbZUMMNo ratings yet

- Negative Defense Law and Legal Definition - USLegal, IncDocument8 pagesNegative Defense Law and Legal Definition - USLegal, IncAnonymous 01pQbZUMMNo ratings yet

- Final Notice To Vacate - OpenDocument1 pageFinal Notice To Vacate - OpenAnonymous 01pQbZUMMNo ratings yet

- Nondisclosure Agreement - OpenDocument2 pagesNondisclosure Agreement - OpenAnonymous 01pQbZUMMNo ratings yet

- Evarola - Position Paper - DTI PDFDocument6 pagesEvarola - Position Paper - DTI PDFrationalbossNo ratings yet

- Bir 1701a FormDocument2 pagesBir 1701a FormChe CacatianNo ratings yet

- ARTICLE - A Review of The Development of Marriage Law in The People - S Republic of China - 79 U. deDocument1 pageARTICLE - A Review of The Development of Marriage Law in The People - S Republic of China - 79 U. deAnonymous 01pQbZUMMNo ratings yet

- OCP Bacoor Citizen's Charter outlines servicesDocument4 pagesOCP Bacoor Citizen's Charter outlines servicesRusty Nomad100% (1)

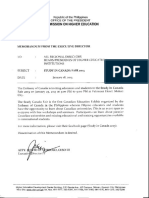

- Study in Canada Fair 2013Document1 pageStudy in Canada Fair 2013Anonymous 01pQbZUMMNo ratings yet

- Celestial v. People (2015) G.R. No. 214865Document11 pagesCelestial v. People (2015) G.R. No. 214865Anonymous 01pQbZUMMNo ratings yet

- INTP - DetailsDocument6 pagesINTP - DetailsAnonymous 01pQbZUMMNo ratings yet

- Baguio WeatherDocument6 pagesBaguio WeatherAnonymous 01pQbZUMMNo ratings yet

- 1031 3356 1 PBDocument15 pages1031 3356 1 PBAnonymous 01pQbZUMMNo ratings yet

- Top LawyersDocument5 pagesTop LawyersAnonymous 01pQbZUMMNo ratings yet

- INTJ - MeDocument3 pagesINTJ - MeAnonymous 01pQbZUMMNo ratings yet

- Ra 10870Document11 pagesRa 10870Anonymous 01pQbZUMMNo ratings yet

- 211212Document8 pages211212Anonymous K286lBXothNo ratings yet

- Decision: Division (Zierk of CourtDocument17 pagesDecision: Division (Zierk of CourtAnonymous 01pQbZUMMNo ratings yet

- SB 14 21 J - ReyesDocument12 pagesSB 14 21 J - ReyesAnonymous 01pQbZUMMNo ratings yet

- Celestial v. People (2015) G.R. No. 214865Document11 pagesCelestial v. People (2015) G.R. No. 214865Anonymous 01pQbZUMMNo ratings yet

- Simple Facts in LifeDocument1 pageSimple Facts in LifeAnonymous 01pQbZUMMNo ratings yet

- People v. Bayker (On Double Jeopardy)Document14 pagesPeople v. Bayker (On Double Jeopardy)Anonymous 01pQbZUMMNo ratings yet

- Anti Corruption RegulationDocument10 pagesAnti Corruption RegulationAnonymous 01pQbZUMMNo ratings yet

- Mary, June 13 2015 - The Voice of JesusDocument2 pagesMary, June 13 2015 - The Voice of JesusAnonymous 01pQbZUMMNo ratings yet

- Anti Corruption RegulationDocument10 pagesAnti Corruption RegulationAnonymous 01pQbZUMMNo ratings yet

- Cta Eb CV 00801 D 2013jan29 AssDocument17 pagesCta Eb CV 00801 D 2013jan29 AssAnonymous 01pQbZUMMNo ratings yet

- Application of R130, S17Document25 pagesApplication of R130, S17Anonymous 01pQbZUMMNo ratings yet

- EA1 Ia2Document6 pagesEA1 Ia2alia fauniNo ratings yet

- COA authority to disallow oil company claims questionedDocument16 pagesCOA authority to disallow oil company claims questionedKiko GriffinNo ratings yet

- FSSP: Financial Sector Support ProjectDocument6 pagesFSSP: Financial Sector Support ProjectRaihanul KabirNo ratings yet

- Appsf 2007Document28 pagesAppsf 2007miangulNo ratings yet

- Initiating Coverage On Olam International - Strong SellDocument133 pagesInitiating Coverage On Olam International - Strong SellFranck JocktaneNo ratings yet

- Home Loan Application FormDocument2 pagesHome Loan Application Formdavid durianNo ratings yet

- Acca Oxford Brookes Dissertation TopicsDocument7 pagesAcca Oxford Brookes Dissertation TopicsWhatIsTheBestPaperWritingServiceCanada100% (1)

- Case Analysis Massey Ferguson 1980Document7 pagesCase Analysis Massey Ferguson 1980Muhammad Faisal Hayat100% (2)

- R1.5 Billion Revolving Credit FacilityDocument52 pagesR1.5 Billion Revolving Credit FacilityKnowledge Guru100% (1)

- Settlement Agreement With Children PDFDocument8 pagesSettlement Agreement With Children PDFKevin TudNo ratings yet

- High-Flying Fund May Bar EntryDocument8 pagesHigh-Flying Fund May Bar EntryamvonaNo ratings yet

- PRACTICAL FINANCIAL ACCOUNTING - Volume 1Document33 pagesPRACTICAL FINANCIAL ACCOUNTING - Volume 1KingChryshAnneNo ratings yet

- 20 Current LiabilitiesDocument15 pages20 Current Liabilitieserica lamsenNo ratings yet

- 504 Loan Refinancing ProgramDocument5 pages504 Loan Refinancing ProgramPropertywizzNo ratings yet

- SPRS Project+Finance+Ratings+Criteria+Reference+Guide FINALDocument356 pagesSPRS Project+Finance+Ratings+Criteria+Reference+Guide FINALEduardo Latorre UribeNo ratings yet

- US Small Business Administration Disaster Loan Information For August StormDocument2 pagesUS Small Business Administration Disaster Loan Information For August StormKaren WallNo ratings yet

- Bankers' Acceptance in Brief: 1. Credit QualityDocument15 pagesBankers' Acceptance in Brief: 1. Credit QualityWahid MuradNo ratings yet

- Theory of AccountsDocument11 pagesTheory of AccountsMarc Eric Redondo50% (2)

- 26 Bridle Path LN, Methuen MA, 01844 - HomesDocument6 pages26 Bridle Path LN, Methuen MA, 01844 - Homesashes_xNo ratings yet

- Business Plan Final FinalDocument22 pagesBusiness Plan Final FinalTony100% (6)

- Unit 5: Current Liabilities and ContingenciesDocument21 pagesUnit 5: Current Liabilities and Contingenciessamuel kebedeNo ratings yet

- LIABILITIESDocument12 pagesLIABILITIESJOHANNANo ratings yet

- ACC 211 Review AssignmentDocument5 pagesACC 211 Review Assignmentglrosaaa cNo ratings yet

- HDB - Interest Rates and ChargesDocument2 pagesHDB - Interest Rates and ChargesManish PandeyNo ratings yet

- Mortgage MathDocument14 pagesMortgage MathAtaNo ratings yet

- Portugal Is FuckedDocument64 pagesPortugal Is FuckedZerohedgeNo ratings yet

- Affordable HousingDocument20 pagesAffordable HousingSourabh S PhanaseNo ratings yet

- Blind Freddy - Common Errors in Presentation of Financial StatementsDocument5 pagesBlind Freddy - Common Errors in Presentation of Financial StatementsMikaNo ratings yet

- RBI ECB GuidelinesDocument19 pagesRBI ECB GuidelinesnareshkapoorsNo ratings yet

- Ch 13 Current Liabilities and ProvisionsDocument85 pagesCh 13 Current Liabilities and ProvisionsViviane Tavares60% (5)