Professional Documents

Culture Documents

BPI

Uploaded by

Mikee FactoresCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BPI

Uploaded by

Mikee FactoresCopyright:

Available Formats

B.

Company Background

The Bank of the Philippine Islands (BPI) is a commercial bank with an

expanded banking license. Together with its subsidiaries, BPI offers a wide range of

financial services that include corporate banking, consumer banking and lending,

investment banking, asset management, securities distribution, insurance services,

leasing, and foreign exchange. These services are offered to a wide range of

customers, from multinational corporations, government agencies, large

corporations, small- and medium-sized enterprises (SMEs) and individuals.

Established on August 1, 1851 under Spanish colonial rule, BPI was originally

known as El Banco Espaol Filipino de Isabel II, named after then Queen of Spain,

Isabel II. The Bank was the first to be established in the Philippines, and was

responsible for starting the countrys banking and finance industry. Playing a unique

role in the early economic history of the Philippines, the Bank performed many

functions that in effect made it the countrys central bank, including providing credit

to the Treasury and printing and issuing currency in its own name.

Following the Spanish-American War of 1898, the Bank was reorganized and

essentially privatized under the U.S. federal governments National Bank Acts of

1863 and 1864. The reorganization, however, preserved the Banks authority to

issue the about BPI a legacy of strength Philippine currency. The Bank adopted its

current name on January 1, 1912.

For many years after its founding, BPI was the only domestic commercial

bank in the Philippines. Its business was largely focused on taking deposits,

extending credit to exporters and traders of raw materials and commodities, and

funding public infrastructure. Its business grew as the country rose in prominence as

an agricultural exporter. In the early 1980s, the Monetary Board of the Central Bank

of the Philippines (now the Bangko Sentral ng Pilipinas) allowed BPI to evolve into a

fully diversified universal bank, to offer investment and consumer banking services

in addition to traditional commercial banking activities. This transformation into a

universal bank was accomplished through both organic growth and mergers and

acquisitions.

Today, BPI is not only known as the oldest bank in the Philippinesand

indeed, in Southeast Asia but it is also an acknowledged leader in Philippine

banking, with total assets of Php1.2 trillion, market capitalization of Php302.5

billion, and a 2013 full year net income of Php 18.8 billion. In January 2014, the

Bank successfully raised Php25 billion in stock rights offering, in what is to-date the

largest capital markets transaction in its 162-year history.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 1099-G unemployment benefitsDocument1 page1099-G unemployment benefitsKristine McVeighNo ratings yet

- Problem #16 Distribution of Profits or Losses Based On Partner's AgreementDocument2 pagesProblem #16 Distribution of Profits or Losses Based On Partner's Agreementspp50% (2)

- Philippine income tax rules for individuals and corporationsDocument2 pagesPhilippine income tax rules for individuals and corporationsDanny LabordoNo ratings yet

- The Determination of Exchange RatesDocument33 pagesThe Determination of Exchange RatesBorn HyperNo ratings yet

- China Pakistan Economic CorridorDocument48 pagesChina Pakistan Economic CorridorbenishNo ratings yet

- Business Law and Taxation ReviewerDocument5 pagesBusiness Law and Taxation ReviewerJeLo ReaNdelar100% (2)

- MidtermQ2 - Home Office Branch Accounting Billing Above CostDocument13 pagesMidtermQ2 - Home Office Branch Accounting Billing Above Costsarahbee100% (2)

- Kev GreenDocument29 pagesKev GreenWabz AbwaoNo ratings yet

- Chapter 07 - Intercompany Inventory TransactionsDocument38 pagesChapter 07 - Intercompany Inventory Transactions_casals100% (8)

- Partnership Memory AidDocument10 pagesPartnership Memory AidMikee FactoresNo ratings yet

- Partnership Memory AidDocument10 pagesPartnership Memory AidMikee FactoresNo ratings yet

- Fiscal Policy From 1946 To PresentDocument3 pagesFiscal Policy From 1946 To PresentRimar Abarientos83% (24)

- Obligations and Contracts Provisions ReviewerDocument21 pagesObligations and Contracts Provisions Reviewerazdariel75% (8)

- Financial StatementsDocument12 pagesFinancial StatementsMikee FactoresNo ratings yet

- Electric FieldsDocument17 pagesElectric FieldsMikee FactoresNo ratings yet

- Examination of Original DocumentsDocument3 pagesExamination of Original DocumentsMikee FactoresNo ratings yet

- EM SimpleDocument18 pagesEM SimpleMikee FactoresNo ratings yet

- DR FloresDocument8 pagesDR Floresakoe_2No ratings yet

- DimsumDocument1 pageDimsumMikee FactoresNo ratings yet

- Characteristics of A Good MissionDocument3 pagesCharacteristics of A Good MissionMikee FactoresNo ratings yet

- Latest Philhealth Contribution Table1Document2 pagesLatest Philhealth Contribution Table1Mikee FactoresNo ratings yet

- People and Work SystemsDocument7 pagesPeople and Work SystemsMikee FactoresNo ratings yet

- BSCE Second SemesterDocument9 pagesBSCE Second SemesterMikee FactoresNo ratings yet

- Population Characteristics: Chapter 2: Population and The World EconomyDocument8 pagesPopulation Characteristics: Chapter 2: Population and The World EconomyHarish ChavlaNo ratings yet

- Fs Database StructureDocument4 pagesFs Database StructureMikee FactoresNo ratings yet

- Chapter - II Estate and Donor's Taxes PDFDocument10 pagesChapter - II Estate and Donor's Taxes PDFNyce OrcenaNo ratings yet

- 4T12 Project Feasibility Study Guideline v4-0Document16 pages4T12 Project Feasibility Study Guideline v4-0azharjalilNo ratings yet

- ACC102-Chapter10new 000Document28 pagesACC102-Chapter10new 000Mikee FactoresNo ratings yet

- Fractional Reserve BankingDocument3 pagesFractional Reserve BankingMikee FactoresNo ratings yet

- Fractional Reserve BankingDocument3 pagesFractional Reserve BankingMikee FactoresNo ratings yet

- How To Make YourDocument1 pageHow To Make YourMikee FactoresNo ratings yet

- 1050radiation 1Document56 pages1050radiation 1Mikee FactoresNo ratings yet

- Go GreenDocument3 pagesGo GreenMikee FactoresNo ratings yet

- Asia Pacific MarketView Q1 2018 FINALDocument18 pagesAsia Pacific MarketView Q1 2018 FINALPrima Advisory SolutionsNo ratings yet

- G.O. Rt. No. 611Document2 pagesG.O. Rt. No. 611Surya TejaNo ratings yet

- Industry Analysis Fishing ToolsDocument1 pageIndustry Analysis Fishing ToolsShu LianNo ratings yet

- Indian Income Tax Return Acknowledgement for AY 2019-20Document1 pageIndian Income Tax Return Acknowledgement for AY 2019-20Sourav KumarNo ratings yet

- Impact of Fdi in Insurance Sector in IndiaDocument3 pagesImpact of Fdi in Insurance Sector in IndiaAamir Saleem50% (2)

- InvoiceDocument1 pageInvoiceRamanjaneya ReddyNo ratings yet

- Econ 406 Assignment 1 International FinanceDocument5 pagesEcon 406 Assignment 1 International FinanceCharlotteNo ratings yet

- CCT Credit CooperativeDocument3 pagesCCT Credit CooperativeRex Munda DuhaylungsodNo ratings yet

- FTP - Mid Term Review - v.1.Document16 pagesFTP - Mid Term Review - v.1.DeepakSinghNo ratings yet

- Major potato producing states and production in IndiaDocument9 pagesMajor potato producing states and production in Indiasouravroy.sr5989No ratings yet

- 6QQMN969 Tutorial 2Document2 pages6QQMN969 Tutorial 2yuvrajwilsonNo ratings yet

- Adaptive Solutions Online: Eight-Year Financial Projection For Product XDocument3 pagesAdaptive Solutions Online: Eight-Year Financial Projection For Product XLinh MaiNo ratings yet

- Agriculture - China Vs IndiaDocument4 pagesAgriculture - China Vs IndiaAlok SachanNo ratings yet

- Assignment On World BankDocument12 pagesAssignment On World BankHani ShehzadiNo ratings yet

- Devina Singh - EDPM 2023 Assignment 2Document11 pagesDevina Singh - EDPM 2023 Assignment 2Devina SinghNo ratings yet

- Solved Write in Algebraic Form A Calculation of U K Pounds PerDocument1 pageSolved Write in Algebraic Form A Calculation of U K Pounds PerM Bilal SaleemNo ratings yet

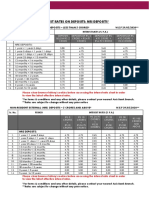

- Rate Chart Nre Nro FCNR RFC Deposit - Wef 29 05 2020Document3 pagesRate Chart Nre Nro FCNR RFC Deposit - Wef 29 05 2020Manveer SinghNo ratings yet

- Service Sector and Its Role in Indian EconomyDocument12 pagesService Sector and Its Role in Indian EconomyTage Nobin100% (1)

- Bahasa Inggris PPHDocument9 pagesBahasa Inggris PPHRiska UsmawardaniNo ratings yet

- GDP Explained: What is GDP and How is it CalculatedDocument13 pagesGDP Explained: What is GDP and How is it CalculatedNine ToNo ratings yet

- CBN Releases Names of Bank DebtorsDocument14 pagesCBN Releases Names of Bank DebtorszubbiedanNo ratings yet

- KES Assigment 1Document7 pagesKES Assigment 1Vash PatniNo ratings yet

- Kerala VAT refund applicationDocument2 pagesKerala VAT refund applicationAnonymous OkCjxs2yt0% (1)

- Benefits of International TradeDocument3 pagesBenefits of International Tradeyasasrii45No ratings yet