Professional Documents

Culture Documents

Corporate Guide - Malaysia, April 2014

Uploaded by

tth28288969Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate Guide - Malaysia, April 2014

Uploaded by

tth28288969Copyright:

Available Formats

M a l a y s i a

C o r p o r a t e

April 2014

G u i d e

Market Outlook & Strategy

FBMKLCI

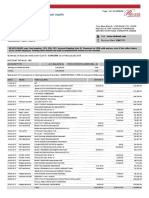

REVIEW: The FBMKLCI tumbled in the first half of Mar 14 amid a lack of domestic catalysts, and as

sentiment turned cautious on the external front due to: a) the escalating political crisis in Ukraine, b)

concerns over Chinas economic growth following an unexpected slump in its exports, and c) as industrial

output and retail sales had missed estimates. However, the market recovered in the second half of the

month, as concerns over the Ukraine situation eased, and on positive US economic data. We note that

foreign investors turned less averse to Malaysian equities, chalking up net buy trades in late-March. Buying

support lifted the market to a high of 1,850.73 in late-March, before closing the month a shade lower at

1,848.42 (+0.7% mom).

STRATEGY: We maintain our end-14 FBMKLCI target at 1,900 (with upside once Tenaga Nasional comes

under our coverage), pegging the market at around 15.3x prospective PE, +0.4SD vs its long-term average

PE. Our outlook is premised on ample domestic liquidity, particularly for small/mid caps. Appealing

investment themes include: a) MRT2 beneficiaries, and b) potential extended dry spell that could benefit

Tenaga Nasional and plantation companies. We expect small/mid caps to continue outperforming, with our

favourite plays being Malaysia Aica, Mah Sing Group, Perisai Petroleum, Sunway Bhd, Uzma, and NOT

RATED O&G play Yinson Holdings. Large-cap stocks are expected to deliver modest returns in 2014, and

our top picks are DiGi.Com, Gamuda, Genting Bhd, Maybank and SapuraKencana Petroleum. We also like

NOT RATED companies Tenaga Nasional and Dialog Group. We downgraded AirAsia and Malaysia

Airports to SELL, and consequently the Malaysian aviation sector to UNDERWEIGHT, on the fallout of the

MH370 tragedy, particularly on expectation of lower visitor arrivals from China. We also downgraded

Telekom Malaysia to a SELL following its acquisition of a 57% stake in WiMAX operator P1.

TOP GAINERS & LOSERS*

(RM)

Feb

Mar

% Chg

Hong Leong Capital

Cahya Mata Sarawak

Datasonic Group

Coastal Contract

IJM Land

Sarawak Oil Palm

Jaya Tiasa

Parkson Holdings

MISC

BIMB Holdings

9.36

7.68

3.60

4.20

2.64

5.98

2.51

2.76

6.35

4.00

12.16

9.80

4.47

5.05

2.96

6.60

2.76

3.00

6.90

4.33

29.9

27.6

24.2

20.2

12.1

10.4

10.0

8.7

8.7

8.3

(RM)

MAS

Top Glove

KPJ Healthcare

Media Prima

UMW Holdings

Affin

IGB REIT

Malaysia Airport

MSM Malaysia

Alliance Financial

* Top 100 companies by market capitalization.

Refer to last page for important disclosures.

Feb

Mar

% Chg

0.25

5.77

3.37

2.59

11.80

4.11

1.20

8.38

4.92

4.58

0.21

4.95

2.99

2.36

10.98

3.87

1.14

8.00

4.71

4.41

(16.0)

(14.2)

(11.3)

(8.9)

(6.9)

(5.8)

(5.0)

(4.5)

(4.3)

(3.7)

From 1 Apr 13 to 31 Mar 14

1,900

1,850

1,800

1,750

1,700

1,650

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

SECTOR RATINGS & STOCK RECOMMENDATIONS

Sector

Mar/Feb (% Chg)

Airport

Automobile

Aviation

Banking

Construction

Consumer

Exchange

Gaming

Glove Manufacturing

Media

Oil & Gas - Fabrication

Oil & Gas - Drilling & Production

Oil & Gas - Shipping

Plantation

Property

REITs

Telecommunications

KLCI

(4.5)

(6.9)

0.0

(0.2)

5.4

(0.7)

0.3

(2.0)

(6.1)

1.3

5.3

1.2

8.7

2.4

2.6

0.8

2.1

0.7

Weighting*

Underweight

Underweight

Underweight

Market Weight

Overweight

Underweight

Market Weight

Overweight

Market Weight

Market Weight

Underweight

Overweight

Market Weight

Overweight

Market Weight

Market Weight

Market Weight

Top Buys

Maybank, Public Bank

Gamuda, IJM Corp

Bursa Malaysia

Genting Bhd, Magnum

Top Glove

Astro

Perisai Petroleum, SapuraKencana Petroleum

MRCB, Sunway Bhd

CapitalMalls Malaysia Trust, Sunway REIT

DiGi

* Refers to business prospects & earnings growth of the sector for the next 12 months.

M a l a y s i a

C o r p o r a t e

April 2014

G u i d e

Sector Performance

----------------- PE ----------------2013

2014F

2015F

(x)

(x)

(x)

---------- EPS Growth ---------2013

2015F

2015F

(%)

(%)

(%)

AIRPORT

34.0

41.4

24.6

(19.8)

(17.8)

68.3

AUTOMOBILE

14.9

13.8

13.1

(6.2)

7.5

AVIATION

24.8

14.0

10.0

(53.7)

BANKING

13.8

12.7

11.7

CONSTRUCTION

18.3

15.5

CONSUMER

22.4

EXCHANGE

Net

Margin

(%)

------- Yield ------2013

2014F

(%)

(%)

Price/

NTA ps

(x)

Net Cash

(Debt) to

Equity

(%)

Market

Cap.

(%)

Total

Market

Cap.

(RMm)

ROA

(%)

ROE

(%)

9.5

4.0

8.6

1.6

1.8

n.a.

(76.4)

1.2

10,917

5.6

4.8

5.2

12.2

3.3

4.0

2.0

(8.5)

1.4

12,828

77.2

39.5

7.0

2.2

7.4

1.6

1.6

1.4

(178.1)

0.8

7,092

6.2

8.6

8.0

n.a.

1.2

15.7

3.6

4.0

2.4

n.a.

32.5

303,777

13.8

(6.3)

18.1

12.1

11.3

4.4

9.7

2.4

2.7

1.6

(48.7)

2.4

21,970

21.3

20.6

6.2

5.2

3.8

12.8

31.3

64.8

4.0

4.0

11.0

(40.3)

5.0

56,519

23.0

21.5

20.0

15.3

7.2

7.2

36.4

8.8

20.5

6.9

4.4

5.2

45.2

0.4

4,021

GAMING

17.4

17.0

16.8

(12.9)

2.4

1.1

12.7

4.4

9.8

2.4

2.3

2.1

14.9

7.5

70,487

GLOVE MANUFACTURING

17.6

16.2

14.7

14.4

9.0

9.8

12.4

17.0

22.8

2.2

2.6

3.7

3.4

1.2

10,913

MEDIA

36.0

27.4

20.7

(0.5)

31.7

32.2

9.4

6.6

79.7

2.8

2.8

n.a.

(454.9)

1.8

16,635

OIL & GAS - FABRICATION

32.6

21.3

19.3

(44.8)

53.4

10.2

8.2

5.0

9.3

1.3

1.6

2.4

13.1

0.6

6,016

OIL & GAS - DRILLING & PRODUCTION

26.5

19.3

15.9

52.2

37.7

21.6

15.1

5.3

12.2

0.3

0.3

4.9

(110.7)

4.3

40,099

OIL & GAS - SHIPPING

19.4

18.1

16.2

86.3

7.4

11.4

23.2

10.3

9.1

0.7

1.7

1.3

(23.9)

3.3

30,800

PLANTATION

21.2

19.2

17.3

(15.3)

10.2

11.2

10.0

7.7

13.4

3.2

3.1

2.9

(28.1)

13.2

123,597

PROPERTY

18.4

13.6

12.0

7.3

34.9

13.8

19.9

6.4

16.7

2.2

2.3

1.8

(51.9)

3.2

30,329

REITs

19.3

17.8

16.7

32.7

8.2

6.4

74.5

6.3

9.4

4.8

4.9

1.1

(24.2)

2.9

27,468

TELECOMMUNICATIONS

23.5

22.6

20.4

2.0

3.8

11.2

15.0

7.8

19.9

4.3

4.4

10.2

(53.1)

18.4

172,225

OVERALL (RMb)

18.1

16.5

15.0

2.0

9.9

9.8

22.4

2.4

14.3

3.3

3.4

2.9

(21.6)

100.0

936b

Refer to last page for important disclosures.

M a l a y s i a

C o r p o r a t e

April 2014

G u i d e

Corporate Statistics

Share Price Last

31/3/14 Year

(RM)

End

2015F

(RMm)

2013

(sen)

EPS

2014F

(sen)

2015F

(sen)

2013

(x)

PE

2014F

(x)

2015F

(x)

DPS

2013 2014F

(sen)

(sen)

Yield

Hist.

2013 2014F CFPS

(%)

(%) (RM)

Net

Margin

(%)

ROA

(%)

ROE

(%)

No. of

Shares

(m)

Market Book Price/

Cap. NTA ps NTA ps

(RMm) (RM)

(x)

Net Cash/(Debt) to

Mkt Cap Equity

(%)

(%)

Avg Daily

52-Wk Price

Turnover

High

Low

52-Wk

(RM)

(RM)

('000)

Company

Ticker

Rec

AIRPORT

Malaysia Airports

Sector

MAHB MK

SELL

8.00

12/13

320.9 A

320.9

263.7

263.7

443.9 23.5

443.9

19.3

32.5

34.0

34.0

41.4

41.4

24.6

24.6

13.0

14.0

1.6

1.6

1.8

1.8

0.49

9.5

9.5

4.0

4.0

8.6

8.6

1,364.6

10,916.8

10,916.8

n.a.

n.a.

n.a.

(31.6)

(31.6)

(76.4)

(76.4)

9.78

5.68

1,675

AUTOMOBILE

UMW Holdings

Sector

UMWH MK

SELL

10.98

12/13

862.4 A

862.4

926.8

926.8

978.9

978.9

73.8

79.3

83.8

14.9

14.9

13.8

13.8

13.1

13.1

36.0

44.0

3.3

3.3

4.0

4.0

0.85

4.8

4.8

5.2

5.2

12.2

12.2

1,168.3

12,827.9

12,827.9

5.41

2.0

2.0

(3.7)

(3.7)

(8.5)

(8.5)

15.87

10.44

1,717

AVIATION

AirAsia

Sector

AIRA MK

SELL

2.55

12/13

285.8 A

285.8

506.3

506.3

706.5 10.3

706.5

18.2

25.4

24.8

24.8

14.0

14.0

10.0

10.0

4.0

4.0

1.6

1.6

1.6

1.6

0.36

7.0

7.0

2.2

2.2

7.4

7.4

2,781.3

7,092.4

7,092.4

1.80

1.4

1.4

(123.9)

(123.9)

(178.1)

(178.1)

3.54

2.18

8,608

BANKING

Alliance Financial

AMMB Holdings

CIMB Group

Hong Leong Bank

Hong Leong Financial

Maybank

Public Bank (F)

RHB Capital

Sector

AFG MK

AMM MK

CIMB MK

HLBK MK

HLFG MK

MAY MK

PBKF MK

RHBC MK

HOLD

HOLD

HOLD

SELL

SELL

BUY

BUY

HOLD

4.41

7.18

7.15

14.14

15.68

9.68

19.20

8.42

03/13

03/13

12/13

06/13

06/13

12/13

12/13

12/13

549.5

1,729.5

4,015.2 A

1,856.3 A

1,487.7 A

6,552.4 A

4,064.7 A

1,831.2 A

22,086.5

561.6

1,814.5

4,541.5

1,920.5

1,680.2

6,905.6

4,601.9

1,962.2

23,988.0

CONSTRUCTION

Gamuda

IJM Corporation

WCT Holdings

Sector

GAM MK

BUY

IJM MK

BUY

WCTHG MK HOLD

4.71

6.14

2.17

07/13

03/13

12/13

CONSUMER

BAT

Carlsberg

Guinness Anchor

JT International

Nestle

QL Resouces

Sector

ROTH MK

CAB MK

GUIN MK

RJR MK

NESZ MK

QLG MK

59.12

13.02

14.08

6.50

66.68

3.24

12/13

12/13

06/13

12/13

12/13

3/13

HOLD

HOLD

HOLD

BUY

HOLD

HOLD

2013

(RMm)

Net Profit

2014F

(RMm)

614.8

1,942.5

4,928.3

2,024.2

1,789.0

7,347.8

5,123.7

2,129.0

25,899.3

35.5

57.4

48.8

103.2

141.3

73.9

116.1

71.9

36.3

60.2

55.2

106.8

159.6

77.9

131.4

77.0

39.7

64.4

59.9

112.5

169.9

82.9

146.3

83.6

12.4

12.5

14.7

13.7

11.1

13.1

16.5

11.7

13.8

12.2

11.9

13.0

13.2

9.8

12.4

14.6

10.9

12.7

11.1

11.1

11.9

12.6

9.2

11.7

13.1

10.1

11.7

17.7

23.0

24.0

34.0

36.0

55.0

52.0

16.3

18.0

24.0

23.0

37.5

40.0

58.0

59.0

31.5

4.0

3.2

3.4

2.4

2.3

5.7

2.7

1.9

3.6

4.1

3.3

3.2

2.7

2.6

6.0

3.1

3.7

4.0

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

1.3

1.4

1.4

1.2

0.8

1.2

1.4

1.0

1.2

13.8

14.1

16.7

15.0

15.7

14.9

21.1

11.5

15.7

1,548.1

3,014.2

8,229.3

1,798.8

1,052.8

8,867.8

3,502.1

2,546.9

6,827.1

21,641.8

58,839.8

25,435.1

16,507.4

85,840.2

67,240.8

21,445.0

303,777.3

2.37

3.06

2.62

6.43

9.24

4.51

5.26

4.52

1.9

2.3

2.7

2.2

1.7

2.1

3.7

1.9

2.4

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

5.77

8.12

8.70

15.06

16.36

10.80

19.98

10.92

4.17

6.43

6.67

13.32

13.50

9.25

16.08

7.14

1,500

4,983

12,678

604

246

10,722

1,303

1,580

541.4 A 670.2

496.2

554.4

187.6 A 228.9

1,225.2

1,453.5

746.9

633.3

251.9

1,632.1

23.5

34.3

15.4

29.1

38.3

18.3

32.4

43.6

20.0

20.0

17.9

14.1

18.3

16.2

16.0

11.9

15.5

14.5

14.1

10.9

13.8

12.0

10.0

10.0

15.0

10.0

10.0

2.5

1.6

4.6

2.4

3.2

1.6

4.6

2.7

0.25

0.41

0.19

13.9

9.0

11.8

11.3

5.9

2.9

7.5

4.4

12.1

7.7

9.8

9.7

2,302.7

1,427.3

1,087.7

10,845.6

8,763.9

2,360.2

21,969.7

2.16

4.40

2.02

2.2

1.4

1.1

1.6

(10.0)

(43.9)

(37.4)

(26.5)

(24.4)

(70.3)

(44.0)

(48.7)

5.05

6.15

2.74

3.95

5.30

1.99

6,865

3,010

2,442

823.7 A 874.7

183.9 A 192.8

217.6 A 203.2

121.6 A 129.9

561.7 A 593.3

164.2

186.0

2,072.7

2,179.9

879.5

206.3

216.0

132.4

626.8

202.3

2,263.3

288.5

59.8

72.0

46.5

239.5

13.2

306.3

62.7

67.3

49.7

253.0

14.9

308.0

67.1

71.5

50.6

267.3

16.2

20.5

21.8

19.5

14..0

27.8

24.6

22.4

19.3

20.8

20.9

13.1

26.4

21.7

21.3

19.2

19.4

19.7

12.8

24.9

20.0

20.6

281.0

61.0

68.5

16.3

235.0

3.8

291.0

60.0

64.0

18.5

239.0

4.1

4.8

4.7

4.9

2.5

3.5

1.2

4.0

4.9

4.6

4.5

2.8

3.6

1.3

4.20

3.17

0.66

0.82

0.53

2.86

0.16

18.2

11.8

13.0

9.5

11.7

6.1

12.8

57.0

31.5

28.6

25.4

39.6

7.2

31.3

165.8

64.2

58.4

34.1

71.7

15.5

64.8

285.5

307.6

302.1

261.5

234.5

1,248.0

16,880.5

4,005.2

4,253.5

1,700.0

15,636.5

4,043.6

46,519.3

0.34

0.86

0.98

1.37

3.22

0.73

n.m.

15.1

14.3

4.8

20.7

4.4

11.0

(2.7)

0.1

(4.6)

6.7

(0.1)

(17.8)

(2.7)

(90.7)

1.3

(52.6)

32.4

(2.3)

(84.6)

(40.3)

68.00

17.06

22.40

7.71

69.50

3.32

56.58

11.10

14.00

6.18

60.20

2.07

183

176

97

47

35

770

Refer to last page for important disclosures.

M a l a y s i a

C o r p o r a t e

April 2014

G u i d e

Corporate Statistics

Rec

Share Price Last

31/3/14 Year

(RM)

End

Net Profit

2014F

(RMm)

2015F

(RMm)

187.2

187.2

386.5

388.6

1,658.3 A 1,883.9

1,677.9 A 1,551.5

329.3 A 326.5

4,052.0

4,150.5

2013

(x)

PE

2014F

(x)

2013

(sen)

2015F

(sen)

200.6

200.6

32.8

35.1

391.8

1,914.9

1,546.6

341.2

4,194.5

29.3

44.6

29.6

23.1

DPS

2013 2014F

(sen)

(sen)

Yield

Hist.

2013 2014F CFPS

(%)

(%) (RM)

2015F

(x)

37.7

23.0

23.0

21.5

21.5

20.0

20.0

52.0

33.4

6.9

6.9

4.4

4.4

29.5

50.7

27.4

22.9

29.7

51.5

27.3

23.9

13.5

22.4

14.2

13.0

17.4

13.5

19.7

15.4

13.1

17.0

13.3

19.4

15.4

12.5

16.8

28.0

12.0

9.5

20.0

24.0

13.6

8.7

20.0

7.1

1.2

2.3

6.7

2.4

No. of

Shares

(m)

Market Book Price/

Cap. NTA ps NTA ps

(RMm) (RM)

(x)

Net Cash/(Debt) to

Mkt Cap Equity

(%)

(%)

Avg Daily

52-Wk Price

Turnover

High

Low

52-Wk

(RM)

(RM)

('000)

Net

Margin

(%)

ROA

(%)

ROE

(%)

0.39

36.4

36.4

8.8

8.8

20.5

20.5

532.6

4,021.2

4,021.2

1.44

5.2

5.2

9.5

9.5

45.2

45.2

8.29

6.62

957

6.0

1.4

2.1

6.7

2.3

0.31

0.97

0.38

0.19

10.6

10.6

19.2

9.1

12.7

26.0

2.6

8.7

5.6

4.4

64.3

7.7

11.2

9.2

9.8

1,317.5

3,716.9

5,671.4

1,427.3

5,230.5

37,168.9

23,820.0

4,267.7

70,487.1

n.a.

5.38

1.95

n.a.

n.a.

1.9

2.2

n.a.

2.1

(5.8)

13.4

8.6

(13.8)

8.7

(50.7)

21.3

14.3

(20.0)

14.9

4.47

10.58

4.55

3.63

3.20

8.74

3.46

2.97

1,102

2,850

4,007

1,010

Company

Ticker

EXCHANGE

Bursa Malaysia

Sector

BURSA MK

HOLD

7.55

12/13

GAMING

Berjaya Sports Toto

Genting Bhd

Genting Malaysia

Magnum

Sector

BST MK

GENT MK

GENM MK

MAG MK

HOLD

BUY

HOLD

BUY

3.97

10.00

4.20

2.99

04/12

12/13

12/13

12/13

GLOVE MANUFACTURING

Hartalega

HART MK

Kossan Rubber

KRI MK

Top Glove

TOPG MK

Sector

SELL

HOLD

HOLD

6.85

4.26

4.95

03/13

12/13

08/12

266.9

137.1 A

215.2 A

619.2

294.5

176.6

204.1

675.2

315.6

35.7

197.9

21.4

227.7 34.7

741.2

39.4

27.6

32.9

42.2

30.9

36.7

19.2

19.9

14.3

17.6

17.4

15.4

15.1

16.2

16.2

13.8

13.5

14.7

12.3

7.0

16.0

13.6

9.7

19.0

1.8

1.6

3.2

2.2

2.0

2.3

3.8

2.6

0.37

0.30

0.44

22.8

10.7

8.7

12.4

27.7

13.4

13.4

17.0

33.9

21.4

17.0

22.8

747.0

639.5

620.6

5,117.2

2,724.1

3,072.0

10,913.3

1.21

1.10

2.14

5.6

3.9

2.3

3.7

3.6

(1.9)

(1.5)

0.8

26.7

(7.9)

(4.0)

3.4

7.69

4.60

6.70

4.82

1.75

4.84

614

1,496

1,233

MEDIA

Astro

Sector

ASTRO MK

BUY

3.20

1/14

461.7 A

461.7

607.9

607.9

803.9

803.9

8.9

11.7

15.5

36.0

36.0

27.4

27.4

20.7

20.7

9.0

8.8

2.8

2.8

2.8

2.8

0.20

9.4

9.4

6.6

6.6

79.7

79.7

5,198.3

16,634.6

16,634.6

n.a.

n.a.

n.a.

(15.4)

(15.4)

(454.9)

(454.9)

3.23

2.75

3,768

OIL & GAS - FABRICATION

MMHE

MMHE MK

Sector

HOLD

3.76

12/13

184.6

184.6

283.1

283.1

312.1

312.1

11.5

17.7

19.5

32.6

32.6

21.3

21.3

19.3

19.3

5.0

6.1

1.3

1.3

1.6

1.6

0.19

8.2

8.2

5.0

5.0

9.3

9.3

1,600.0

6,016.0

6,016.0

1.58

2.4

2.4

5.5

5.5

13.1

13.1

4.53

3.14

1,550

OIL & GAS - DRILLING & PRODUCTION

Bumi Armada

BAB MK

HOLD

Perisai Petroleum

PPT MK

BUY

SapuraKencana Petroleum SAKP MK

BUY

Sector

3.91

1.54

4.50

12/13

12/13

1/14

431.2 A 610.9

712.6

14.7

62.0 A

88.3 149.4 5.7

1,017.4 A 1,380.4

1,666.4

17.0

1,510.6

2,079.6

2,528.4

20.8

8.1

23.0

24.3

13.8

27.8

26.6

26.9

26.5

26.5

18.8

18.9

19.5

19.3

16.1

11.2

16.2

15.9

3.5

0.0

0.0

4.5

0.0

0.0

0.9

0.0

0.0

0.3

1.2

0.0

0.0

0.3

0.29

0.10

0.29

20.8

64.3

13.0

15.1

5.5

5.6

5.2

5.3

10.6

10.4

13.1

12.2

2,932.0

1,084.3

5,992.2

11,464.3

1,669.8

26,964.7

40,098.8

1.49

0.83

0.48

2.6

1.9

9.3

4.9

(27.4)

(17.4)

(40.7)

(35.9)

(77.5)

(42.0)

(132.7)

(110.7)

4.18

1.73

4.96

3.68

1.03

2.95

2,241

4,611

12,639

OIL & GAS - SHIPPING

MISC

MISC MK

Sector

6.90

12/13

1,585.4 A 1,702.6

1,585.4

1,702.6

38.1

42.5

19.4

19.4

18.1

18.1

16.2

16.2

5.0

11.5

0.7

0.7

1.7

1.7

0.77

23.2

23.2

10.3

10.3

9.1

9.1

4,463.8

30,800.2

30,800.2

5.33

1.3

1.3

(17.8)

(17.8)

(23.9)

(23.9)

7.10

4.19

2,770

HOLD

2013

(RMm)

EPS

2014F

(sen)

174.7 A

174.7

1,896.1

1,896.1

Refer to last page for important disclosures.

35.5

M a l a y s i a

C o r p o r a t e

April 2014

G u i d e

Corporate Statistics

2015F

(RMm)

424.7

167.5

1,593.3

1,403.2

2,851.8

6,440.5

475.6

181.7

1,748.5

1,487.5

3,267.7

7,161.0

2013

(sen)

EPS

2014F

(sen)

2013

(x)

PE

2014F

(x)

2015F

(sen)

30.0

11.7

20.1

83.7

55.2

56.0

19.7

25.1

131.8

47.0

DPS

2013 2014F

(sen)

(sen)

Yield

Hist.

2013 2014F CFPS

(%)

(%) (RM)

2015F

(x)

62.7

21.3

27.5

139.7

53.9

36.0

28.6

23.9

28.9

16.9

21.2

19.3

17.0

19.1

18.4

19.8

19.2

17.2

15.7

17.4

17.3

17.3

17.3

35.8

5.9

15.5

50.0

34.0

16.8

10.0

13.2

65.7

34.0

3.3

1.8

3.2

2.1

3.7

3.2

1.6

3.0

2.8

2.7

3.7

3.1

No. of

Shares

(m)

Market Book Price/

Cap. NTA ps NTA ps

(RMm) (RM)

(x)

Net Cash/(Debt) to

Mkt Cap Equity

(%)

(%)

Avg Daily

52-Wk Price

Turnover

High

Low

52-Wk

(RM)

(RM)

('000)

Net

Margin

(%)

ROA

(%)

ROE

(%)

0.39

0.19

0.35

1.18

0.82

16.5

24.6

16.2

10.6

7.9

10.0

4.8

6.0

8.4

8.4

7.7

7.7

6.7

7.2

15.0

13.2

13.9

13.4

759.0

804.4

6,349.2

1,065.0

6,064.1

8,197.1

2,694.7

30,476.0

25,772.2

56,456.8

123,596.8

4.30

1.60

0.64

7.12

4.39

2.5

2.1

7.5

3.4

2.1

2.9

0.8

(11.0)

(23.5)

(3.3)

(11.4)

(11.9)

1.8

(17.8)

(54.4)

(11.8)

(24.2)

(28.1)

11.53

3.65

4.92

25.28

9.97

8.14

2.80

3.73

20.30

8.69

354

283

6,531

642

6,239

Ticker

PLANTATION

Genting Plantations

IJM Plantations

IOI Corporation*

Kuala Lumpur Kepong

Sime Darby

Sector

GENP MK

IJMP MK

IOI MK

KLK MK

SIME MK

SELL

SELL

HOLD

HOLD

HOLD

10.80

3.35

4.80

24.20

9.31

12/13

03/13

06/13

09/13

06/13

227.8 A

96.6

1,276.5

891.7

3,348.2

5,840.8

PROPERTY

Mah Sing

MRCB

SP Setia

Sunway Bhd

Tropicana Corporation

UEM Sunrise

Sector

MSGB MK

MRC MK

SPSB MK

SWB MK

TRCB MK

UEMS MK

BUY

BUY

HOLD

BUY

BUY

SELL

2.18

1.64

2.92

3.03

1.57

2.20

12/13

12/13

10/13

12/13

12/13

12/13

280.6 A 332.2

412.4

(119.2)A 104.7

161.1

417.9 A 540.5

720.7

482.7 A 513.7

541.0

144.7 A 158.4

189.7

443.1 A 576.3 508.3

1,649.8

2,225.8

2,533.2

19.8

(7.2)

17.0

31.7

29.9

9.8

23.4

6.3

22.0

30.3

11.6

12.7

29.1

9.8

29.3

31.9

12.5

11.2

11.0

n.m

17.2

9.6

5.3

22.5

18.4

9.3

25.9

13.3

10.0

13.5

17.3

13.6

7.5

16.8

10.0

9.5

12.6

19.6

12.0

8.0

0.0

14.0

10.0

5.0

3.0

9.2

2.0

14.0

10.0

5.0

3.0

3.7

0.0

4.8

3.3

3.2

1.4

2.2

8.2

1.2

4.8

3.3

3.2

1.4

2.3

0.21

(0.03)

0.18

0.92

0.25

0.14

14.0

n.m

13.7

28.1

24.6

23.9

19.9

6.9

n.m

3.8

12.8

7.2

6.2

6.4

17.6

n.m

15.0

35.1

15.5

10.2

16.7

1,418.0

1,651.3

2,458.7

1,723.5

1,366.2

4,537.4

3,091.3

2,708.2

7,179.4

5,222.3

2,145.0

9,982.4

30,328.5

1.37

0.84

2.29

3.26

1.82

1.19

1.6

2.0

1.3

0.9

0.9

1.8

1.8

(54.1)

(111.6)

(20.6)

(24.4)

(66.2)

(5.8)

(31.1)

(104.6)

(195.6)

(53.0)

(29.9)

(60.8)

(10.2)

(51.9)

2.82

1.84

3.99

3.61

2.20

3.66

1.83

1.23

2.70

2.46

1.19

2.02

2,793

3,716

2,155

1,166

2,561

9,326

REITs

Axis REIT

CapitalMalls Malaysia Trust

IGB REIT

KLCC Property

Pavilion REIT

Sunway REIT

Sector

AXRB MK

CMMT MK

IGBREIT MK

KLCCSS MK

PREIT MK

SREIT MK

HOLD

BUY

HOLD

HOLD

BUY

BUY

3.38

1.47

1.14

6.35

1.31

1.36

12/13

12/13

12/13

12/13

12/13

6/13

84.0 A

89.4

148.5 A 165.0

206.9 A 218.0

554.5 A 623.7

213.9 A 214.0

218.8 A 233.9

1,426.6

1,544.0

93.5

174.1

224.2

667.4

220.2

263.8

1,643.2

18.2

8.4

6.0

43.4

7.1

7.5

19.4

9.3

6.4

48.7

7.1

8.0

20.3

9.8

6.5

52.1

7.3

9.0

18.6

17.6

18.9

14.6

18.4

18.2

19.3

17.4

15.8

17.9

13.0

18.4

17.0

17.8

16.7

15.0

17.4

12.2

17.9

15.1

16.7

18.5

8.8

6.7

29.0

6.9

8.3

19.5

7.7

6.8

31.0

7.6

8.1

5.5

6.0

5.9

4.6

5.3

6.1

4.8

5.8

5.2

6.0

4.9

5.8

6.0

4.9

0.24

0.13

0.09

0.46

0.11

0.13

77.5

75.3

72.4

64.6

87.1

94.0

74.5

6.9

7.2

6.3

5.2

7.6

7.9

6.3

11.0

10.6

8.8

8.2

9.6

12.0

9.4

461.2

1,776.1

3,428.8

1,805.3

3,011.8

2,926.3

1,559.0

2,610.8

3,908.8

11,463.9

3,945.5

3,979.8

27,467.7

2.23

1.20

1.05

6.48

1.17

1.18

1.5

1.2

1.1

1.0

1.1

1.2

1.1

(31.6)

(29.0)

(25.7)

(10.9)

(12.6)

(42.1)

(20.7)

(48.9)

(35.1)

(28.4)

(12.4)

(14.7)

(51.4)

(24.2)

4.18

1.96

1.42

7.75

1.64

1.70

2.80

1.32

1.12

5.47

1.20

1.22

487

1,180

1,737

1,168

1,273

1,682

HOLD

BUY

HOLD

SELL

6.67

5.39

6.96

5.89

12/13

12/13

12/13

12/13

2,659.1 A

1,787.2 A

2,093.5 A

785.9 A

7,325.7

3,171.0

1,988.0

2,362.3

934.8

8,456.1

31.1

23.0

27.9

22.0

33.0

23.4

28.0

24.2

37.1

25.6

31.5

26.1

21.4

23.4

25.0

26.8

23.5

20.2

23.1

24.8

24.3

22.6

18.0

21.1

22.1

22.5

20.4

22.0

21.0

40.0

26.0

23.3

23.4

40.0

22.0

3.3

3.9

5.7

4.4

4.3

3.5

4.3

5.7

3.7

4.4

0.65

0.31

0.39

1.01

12.2

25.3

19.4

9.5

15.0

5.2

43.9

10.0

4.7

7.8

11.3

369.9

27.0

14.4

19.9

8,547.6

7,775.0

7,504.9

3,577.4

57,012.5

41,907.3

52,234.0

21,070.9

172,224.7

1.18

n.a.

n.a.

1.91

5.7

n.a.

n.a.

3.1

10.2

(12.3)

(0.8)

(12.9)

(18.7)

(10.4)

(35.3)

(73.3)

(102.9)

(56.2)

(53.1)

7.27

5.43

7.32

6.20

6.37

4.45

6.48

5.05

10,265

9,613

5,710

6,480

18.1

16.5

15.0

3.3

3.4

22.4

2.4

14.3

2.9

(8.9)

(21.6)

OVERALL

2013

(RMm)

Net Profit

2014F

(RMm)

Company

TELECOMMUNICATIONS

Axiata

Axiata MK

DiGi.Com

DIGI MK

Maxis

Maxis MK

Telekom Malaysia

T MK

Sector

Rec

Share Price Last

31/3/14 Year

(RM)

End

51.7b

2,819.1

1,815.8

2,104.8

867.0

7,606.7

56.8b

62.4b

935.7b

Note: If year end is before June, earnings are shown in the previous period.

* IOI Corporation: Earnings adjusted for demerger exercise.

Refer to last page for important disclosures.

M a l a y s i a

C o r p o r a t e

April 2014

G u i d e

Economics

2011

2012

2013F

2014F

1Q13

2Q13

3Q13

4Q13

Nov 13

Dec 13

Jan 14

Feb 14

GDP by Sector (Real) (yoy % chg)

GDP

Agriculture

Mining & Quarrying

Manufacturing

Construction

Services

Utilities

Transport & Communications

Commerce

Finance & Business Services

Government Services

Other Services

5.6

1.0

1.4

4.8

18.1

6.4

4.3

7.1

4.9

7.6

9.5

3.9

4.7

2.1

0.5

3.4

10.9

5.9

4.1

7.4

6.3

3.9

8.2

5.1

5.2

4.5

0.4

4.9

7.8

6.0

4.9

7.2

5.9

5.7

7.2

5.3

5.0

3.5

0.9

4.8

8.7

5.7

5.0

6.9

5.3

6.6

6.2

4.5

4.1

6.0

(1.9)

0.3

14.2

6.1

3.9

6.4

6.0

6.2

7.0

5.2

4.4

0.4

4.1

3.5

9.9

5.0

4.1

7.1

5.0

2.5

7.7

5.3

5.0

2.1

1.7

4.2

10.2

5.9

4.0

8.0

6.0

3.5

9.5

5.0

5.1

0.2

(1.5)

5.1

9.8

6.4

4.4

8.0

8.0

3.3

8.5

5.1

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a.

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

External Trade

Exports of Goods (yoy % chg)

Imports of Goods (yoy % chg)

Trade Balance (RMb)

Current Account Balance (RMb)

0.7

5.8

96.0

57.3

2.4

7.0

70.6

37.3

6.3

6.8

73.0

45.0

5.9

6.0

77.0

55.0

(2.6)

6.4

16.4

8.7

(5.4)

2.5

8.2

2.6

7.6

7.5

18.6

9.8

10.2

11.6

27.5

16.2

6.7

6.4

9.7

n.a.

14.4

14.8

9.5

n.a.

12.2

7.2

6.4

n.a.

n.a

n.a

n.a

n.a

Monetary Data (end of period)

Loans (yoy % chg)

M1 Growth (yoy % chg)

M2 Growth (yoy % chg)

Overnight Policy Rate (%)

3-month Interbank Rate (%)

Base Lending Rate (%)

Exchange Rates (RM/US$)

Foreign Reserves (RMb)

11.1

11.9

9.7

3.00

3.21

6.60

3.06

427.2

11.2

13.0

8.4

3.00

3.32

6.60

3.28

441.7

10.0

10.0

8.0

3.25

3.50

6.80

3.40

470.0

9.0

9.0

8.0

3.50

3.70

6.80

3.35

490.0

11.5

12.7

9.7

3.00

3.21

6.60

3.09

431.3

10.0

12.5

9.0

3.00

3.20

6.60

3.16

432.8

10.6

12.9

8.0

3.00

3.21

6.60

3.26

444.6

11.2

13.0

8.4

3.00

3.32

6.60

3.28

441.9

10.5

13.9

7.1

3.00

3.22

6.60

3.22

443.8

11.2

13.0

8.4

3.00

3.32

6.60

3.28

441.7

11.3

12.6

7.2

3.00

3.29

6.60

3.35

436.0

10.8

11.2

6.6

3.00

3.31

6.60

3.28

427.6

4.4

1.7

3.3

2.1

4.6

3.0

4.5

4.0

(0.7)

1.5

5.3

1.8

5.7

2.2

2.9

3.0

3.7

2.9

4.8

3.2

3.6

3.4

n.a.

3.5

Other Macro Variables (yoy % chg)

Industrial Production Index

Inflation

Source: CEIC, UOB Economic-Treasury Research

Refer to last page for important disclosures.

M a l a y s i a

C o r p o r a t e

April 2014

G u i d e

Ranking By Market Parameters

Highest PE (x)

Forward

Highest P/NTA (x)

Historical

Highest Dividend Yield (%) Historical

Highest 90 days Volatility (%)

Highest Market Cap (RMm)

Malaysia Airports

41.4

Nestle

20.7

Mah Sing

8.2

Tropicana Corp

34.6

Maybank

85,840

Astro

27.4

Carlsberg

15.1

Magnum

6.7

MRCB

33.5

Public Bank (F)

67,241

Nestle

26.4

Guinness Anchor

14.3

Berjaya Sports Toto

6.0

Kossan Rubber

32.5

CIMB Group

58,840

MRCB

25.9

SapuraKencana Petroleum

9.3

Maybank

6.0

JT International

32.2

Axiata

57,012

Maxis

24.8

IOI Corp

7.5

IGB REIT

6.0

WCT Holdings

29.9

Sime Darby

56,457

Telekom Malaysia

24.3

Axiata

5.7

Sunway REIT

6.0

KLCC Property

29.9

Maxis

52,234

DiGi

23.1

Hartalega

5.6

Pavilion REIT

5.8

CapitalMalls Malaysia Trust

27.7

DiGi

41,907

QL Resouces

21.7

Bursa Malaysia

5.2

Axis REIT

5.8

Perisai Petroleum

27.4

Genting Bhd

37,169

Bursa Malaysia

21.5

JT International

4.8

Maxis

5.7

Malaysia Airports

27.2

MISC

30,800

MMHE

21.3

QL Resouces

4.4

CapitalMalls Malaysia Trust

5.2

IJM Plantations

26.6

IOI Corp

30,476

Lowest PE (x)

Forward

Lowest P/NTA (x)

Historical

Lowest Dividend Yield (%) Historical

Lowest 90 days Volatility (%)

Lowest Market Cap (RMm)

Mah Sing

9.3

Tropicana Corp

0.9

SapuraKencana Petroleum

0.0

Axiata

7.9

Axis REIT

1,559

Hong Leong Financial

9.8

Sunway Bhd

0.9

Perisai Petroleum

0.0

Nestle

8.3

Perisai Petroleum

1,670

Sunway Bhd

10.0

KLCC Property

1.0

AirAsia

0.0

Hong Leong Bank

9.8

JT International

1,700

RHB Capital

10.9

WCT Holdings

1.1

Sunway Bhd

0.0

Public Bank (F)

9.9

Tropicana Corp

2,145

WCT Holdings

11.9

IGB REIT

1.1

MMHE

0.0

Maxis

10.7

WCT Holdings

2,360

AMMB Holdings

11.9

Pavilion REIT

1.1

Genting Bhd

1.4

Maybank

10.8

CapitalMalls Malaysia Trust

2,611

Alliance Financial

12.2

Sunway REIT

1.2

UEM Sunrise

1.4

Sime Darby

10.8

IJM Plantations

2,695

Maybank

12.4

CapitalMalls Malaysia Trust

1.2

Genting Plantations

1.6

Magnum

11.7

MRCB

2,708

CIMB Group

13.0

SP Setia

1.3

AirAsia

1.6

AMMB Holdings

12.4

Kossan Rubber

2,724

KLCC Property

13.0

MISC

1.3

MMHE

1.6

Bursa Malaysia

14.8

Top Glove

3,072

Refer to last page for important disclosures.

M a l a y s i a

C o r p o r a t e

April 2014

G u i d e

Performance At A Glance

Company

AVIATION

Malaysia Airports

Sector

AUTOMOBILE

UMW Holdings

Sector

AVIATION

AirAsia

Sector

BANKING

Alliance Financial

AMMB Holdings

CIMB Group

Hong Leong Financial

Hong Leong Bank

Maybank

Public Bank (F)

RHB Capital

Sector

CONSTRUCTION

Gamuda

IJM Corp

WCT Holdings

Sector

Share Price (RM)

28/2/14

31/3/14

-------------- % Change -------------mom

yoy

ytd

Company

CONSUMER

BAT

Carlsberg

Guinness Anchor

JT International

Nestle

QL Resources

Sector

8.38

8.00

(4.5)

(4.5)

36.5

36.5

(11.1)

(11.1)

11.80

10.98

(6.9)

(6.9)

(17.7)

(17.7)

(9.0)

(9.0)

2.55

2.55

0.0

0.0

(9.9)

(9.9)

15.9

15.9

EXCHANGE

Bursa Malaysia

Sector

(3.7)

(0.8)

(0.1)

(0.8)

(0.3)

(1.0)

0.7

2.7

(0.2)

0.2

9.6

(6.3)

5.0

(2.2)

3.5

17.9

(0.4)

4.0

(7.4)

(0.8)

(6.2)

1.3

(1.8)

(2.6)

(1.7)

6.6

(2.2)

GAMING

Berjaya Sports Toto

Genting Bhd

Genting Malaysia

Magnum

Sector

4.2

6.4

7.4

5.4

16.6

12.7

(8.8)

11.5

(1.9)

4.4

5.9

1.4

4.58

7.24

7.16

15.80

14.18

9.78

19.06

8.20

4.52

5.77

2.02

4.41

7.18

7.15

15.68

14.14

9.68

19.20

8.42

4.71

6.14

2.17

Refer to last page for important disclosures.

Share Price (RM)

28/2/14

31/3/14

-------------- % Change -------------mom

yoy

ytd

60.00

13.16

14.60

6.42

66.80

3.15

59.12

13.02

14.08

6.50

66.68

3.24

(1.5)

(1.1)

(3.6)

1.2

(0.2)

2.9

(0.7)

(4.9)

(5.7)

(23.3)

4.2

9.9

53.7

1.0

(7.8)

6.9

(12.0)

0.3

(1.9)

14.0

(3.3)

7.53

7.55

0.3

0.3

8.6

8.6

(8.3)

(8.3)

3.82

10.10

4.35

3.09

3.97

10.00

4.20

2.99

3.9

(1.0)

(3.4)

(3.2)

(2.0)

(3.6)

(0.2)

16.0

(17.4)

7.5

(2.0)

(2.5)

(4.1)

(5.4)

(1.3)

GLOVE MANUFACTURING

Hartalega

Kossan Rubber

Top Glove

Sector

7.00

4.39

5.77

6.85

4.26

4.95

(2.1)

(3.0)

(14.2)

(6.1)

38.7

140.0

(8.3)

33.4

(5.3)

(1.4)

(12.1)

(6.4)

MEDIA

Astro

Sector

3.16

3.20

1.3

1.3

13.5

13.5

6.7

6.7

M a l a y s i a

C o r p o r a t e

April 2014

G u i d e

Performance At A Glance

Company

Share Price (RM)

28/2/14

31/3/14

-------------- % Change -------------mom

yoy

ytd

OIL & GAS - FABRICATION

MMHE

Sector

3.57

3.76

5.3

5.3

(0.3)

(0.3)

7.4

7.4

OIL & GAS - DRILLING & PRODUCTION

Bumi Armada

Perisai Petroleum

SapuraKencana Petroleum

Sector

3.90

1.52

4.43

3.91

1.54

4.50

0.3

1.3

1.6

1.2

4.0

42.6

50.0

33.0

(3.0)

(3.1)

(8.2)

(6.5)

OIL & GAS - SHIPPING

MISC

Sector

PLANTATION

Genting Plantations

IJM Plantations

IOI Corp

Kuala Lumpur Kepong

Sime Darby

Sector

6.35

6.90

8.7

8.7

28.5

28.5

21.1

21.1

10.50

3.28

4.61

23.98

9.11

10.80

3.35

4.80

24.20

9.31

2.9

2.1

4.1

0.9

2.2

2.4

24.9

11.7

26.0

15.7

0.4

10.7

(2.2)

(5.6)

1.9

(2.8)

(2.2)

(1.4)

Company

-------------- % Change -------------mom

yoy

ytd

PROPERTY

MRCB

Mah Sing

SP Setia

Sunway

Tropicana Corp

UEM Sunrise

Sector

1.58

2.07

2.91

2.91

1.36

2.20

1.64

2.18

2.92

3.03

1.57

2.20

3.8

5.3

0.3

4.1

15.4

0.0

2.6

14.7

13.7

(11.5)

17.4

1.9

(19.4)

(5.8)

27.1

(3.5)

(3.0)

11.4

28.7

(6.8)

1.6

REITs

Axis REIT

CapitalMalls Malaysia Trust

IGB REIT

KLCC Property

Pavilion REIT

Sunway REIT

Sector

3.10

1.47

1.20

6.15

1.35

1.34

3.38

1.47

1.14

6.35

1.31

1.36

9.0

0.0

(5.0)

3.3

(3.0)

1.5

0.8

(0.6)

(22.2)

(19.1)

(3.5)

(17.6)

(10.5)

(12.9)

15.4

5.0

(4.2)

8.5

2.3

9.7

5.8

TELECOMMUNICATIONS

Axiata

DiGi

Maxis

Telekom Malaysia

Sector

6.55

5.15

6.97

5.67

6.67

5.39

6.96

5.89

1.8

4.7

(0.1)

3.9

2.1

1.1

16.4

6.6

9.3

7.2

(3.3)

8.7

(4.3)

6.1

0.2

0.9

6.3

(0.9)

OVERALL

Refer to last page for important disclosures.

Share Price (RM)

28/2/14

31/3/14

M a l a y s i a

C o r p o r a t e

April 2014

G u i d e

Performance At A Glance

Airport

(31 Dec 13=100)

100

(31 Dec 13=100)

105

Automobile

(31 Dec 13=100)

120

Aviation

FBMKLCI

98

115

100

96

FBMKLCI

Av iation

110

94

95

92

105

90

Airport

90

Automobile

88

86

85

Jan

(31 Dec 13=100)

100

Feb

Mar

Banking

99

FBMKLCI

95

Jan

(31 Dec 13=100)

102

FBMKLCI

100

Feb

Mar

Construction

Jan

(31 Dec 13=100)

100

100

Feb

Consumer

99

FBMKLCI

FBMKLCI

98

98

98

97

96

97

Banking

96

95

Construction

94

96

92

Jan

Feb

Mar

Refer to last page for important disclosures.

Mar

Consumer

95

Jan

Feb

Mar

Jan

Feb

Mar

10

M a l a y s i a

C o r p o r a t e

April 2014

G u i d e

Performance At A Glance

(31 Dec 13=100)

100

Exchange

Gaming

(31 Dec 13=100)

101

FBMKLCI

98

100

(31 Dec 13=100)

102

100

Gaming

99

98

96

98

96

94

97

94

96

92

Ex change

92

95

90

Feb

Media

(31 Dec 13=100)

107

(31 Dec 13=100)

110

Feb

Mar

Oil & Gas Fabrication

108

105

Oil & Gas - Fabrication

106

103

Media

100

FBMKLCI

95

Oil & Gas Drilling & Production

FBMKLCI

98

92

FBMKLCI

96

94

Jan

Feb

Mar

Refer to last page for important disclosures.

Mar

(31 Dec 13=100)

100

98

97

Feb

94

102

99

Jan

96

104

101

Glov e Manufacturing

88

Jan

Mar

FBMKLCI

90

FBMKLCI

94

Jan

Glove Manufacturing

Oil & Gas - Drilling & Production

90

88

Jan

Feb

Mar

Jan

Feb

Mar

11

M a l a y s i a

C o r p o r a t e

April 2014

G u i d e

Performance At A Glance

(31 Dec 13=100)

125

Oil & Gas Shipping

120

Oil & Gas - Shipping

115

(31 Dec 13=100)

100

Plantation

(31 Dec 13=100)

102

FBMKLCI

98

Property

Property

100

110

96

98

105

94

96

FBMKLCI

100

FBMKLCI

95

90

92

94

Plantation

90

Jan

Feb

Mar

REITs

(31 Dec 13=100)

108

92

Jan

(31 Dec 13=100)

101

106

Feb

Feb

Mar

Telecommunications

99

REITs

102

98

100

97

98

96

FBMKLCI

96

Jan

Telecommunications

100

104

Mar

94

FBMKLCI

95

94

Jan

Feb

Mar

Refer to last page for important disclosures.

Jan

Feb

Mar

12

M a l a y s i a

C o r p o r a t e

April 2014

G u i d e

Warrants

31/3/14

Warrant

Price

(RM)

Exercise

Price

(RM)

Share

Price

(RM)

Conversion

Price

(RM)

AGRICULTURE

Genting Plantations 2019

IJM Plantations 2014

Kulim 2016

Muar Ban Lee Group 2022

3.15

0.735

0.75

0.335

7.75

2.62

3.13

0.80

10.80

3.35

3.36

1.02

10.90

3.36

3.88

1.14

0.9

0.1

15.5

11.3

BUILDING MATERIAL

BTM Resources 2019

DPS Resource 2018

Harvest Court 2019

Harvest Court 2023

Java Inc 2014

Kia Lim 2016

Lion Corp 2019

Malaysia Steel 2015

Priceworth 2016

SWS Capita 2015

0.075

0.04

0.125

0.13

0.04

0.13

0.03

0.345

0.055

0.15

1.00

0.54

0.25

0.25

1.00

1.00

1.00

0.67

0.50

0.80

0.225

0.095

0.265

0.265

0.265

0.545

0.075

1.01

0.20

0.645

1.08

0.58

0.38

0.38

1.04

1.13

1.03

1.02

0.56

0.95

CONSTRUCTION

Crest Builder 2015

Gadang 2015

Gamuda 2015

IJM Corp 2014

Jetson 2019

Kimlun 2024

MBSB 2016

PJI Holdings 2016

Resintech 2016

Salcon 2014

TRC Synergy 2016

TRC Synergy 2017

Unimech 2018

WCT Holdings 2016

WCT Holdings 2017

Zecon 2017

0.665

0.375

1.97

1.94

0.23

0.505

1.18

0.045

0.08

0.055

0.155

0.18

0.37

0.415

0.41

0.12

1.00

1.00

2.66

4.00

0.75

1.68

1.00

0.13

0.50

0.75

0.61

1.00

1.50

2.04

2.25

1.06

1.50

1.13

4.71

6.14

0.71

1.60

2.18

0.115

0.275

0.745

0.55

0.55

1.58

2.17

2.17

0.755

1.67

1.38

4.63

5.94

0.98

2.19

2.18

0.18

0.58

0.81

0.77

1.18

1.87

2.46

2.66

1.18

Refer to last page for important disclosures.

Warrant

Premium

Gearing

(%)

(x)

High

(RM)

Wrt 52-Wk

Low

(RM)

Issue

Size

(m)

Years

To Run

Expiry

3.4

4.6

4.5

3.0

4.90

0.92

0.90

0.51

2.85

0.59

0.635

0.28

139.2

80.1

156.2

46.0

5.2

0.6

1.9

8.7

17/06/19

07/11/14

26/02/16

28/11/22

377.8

510.5

41.5

43.4

292.5

107.3

1273.3

0.5

177.5

47.3

3.0

2.4

2.1

2.0

6.6

4.2

2.5

2.9

3.6

4.3

0.20

0.07

0.355

0.205

0.22

0.13

0.08

0.58

0.11

0.19

0.035

0.04

0.105

0.11

0.04

0.13

0.02

0.22

0.045

0.03

18.6

66.0

80.7

33.2

24.6

4.1

36.7

105.4

86.9

21.1

5.7

3.7

5.6

9.4

0.7

1.8

5.0

1.6

2.1

1.7

20/12/19

03/01/18

19/11/19

25/08/23

28/11/14

05/02/16

14/04/19

26/10/15

24/04/16

11/12/15

11.0

21.7

(1.7)

(3.3)

38.0

36.6

(0.0)

52.2

110.9

8.1

39.1

114.5

18.4

13.1

22.6

56.3

2.3

3.0

2.4

3.2

3.1

3.2

1.8

2.6

3.4

13.5

3.5

3.1

4.3

5.2

5.3

6.3

0.89

0.445

2.34

2.01

0.35

0.60

2.29

0.08

0.105

0.29

0.23

0.27

0.50

0.705

0.65

0.255

0.185

0.16

1.21

1.25

0.21

0.305

1.15

0.045

0.045

0.03

0.115

0.155

0.28

0.375

0.32

0.075

41.3

19.7

252.3

132.1

34.2

60.1

506.4

304.5

68.6

106.0

93.5

36.9

60.4

157.3

164.8

44.2

1.5

1.5

1.1

0.6

4.8

10.7

2.2

2.0

2.5

0.1

2.3

2.8

4.5

1.9

3.7

2.9

21/10/15

29/09/15

25/05/15

24/10/14

06/02/19

03/12/24

31/05/16

27/03/16

26/09/16

17/05/14

14/07/16

20/01/17

18/09/18

10/03/16

11/12/17

05/03/17

13

M a l a y s i a

C o r p o r a t e

April 2014

G u i d e

Warrants

31/3/14

Warrant

Price

(RM)

Exercise

Price

(RM)

Share

Price

(RM)

Conversion

Price

(RM)

CONSUMER

Asia Media 2018

Berjaya Food 2017

Biosis Group 2020

Careplus Group 2016

China Stationery 2017

DBE Gurney Resource 2016

EG Industries 2015

Farm's Best 2018

Fiamma 2018

Hovid 2018

Guan Chong 2016

Kuantan Flour 2016

Niche Capital 2017

Malayan Flour 2017

Spritzer 2016

Takaso 2016

Xidelang Holding 2015

Xidelang Holding 2017

0.04

0.69

0.035

0.09

0.05

0.03

0.07

0.215

0.66

0.17

0.335

0.15

0.135

0.35

0.66

0.105

0.05

0.075

0.22

0.70

0.50

0.49

1.15

0.10

1.00

1.00

1.00

0.18

1.34

0.51

0.16

2.06

1.18

0.35

0.35

0.35

0.095

1.43

0.175

0.335

0.20

0.07

0.43

0.69

1.67

0.34

1.36

0.535

0.06

1.54

1.76

0.23

0.285

0.285

0.26

1.39

0.54

0.58

1.20

0.13

1.07

1.22

1.66

0.35

1.68

0.66

0.30

2.41

1.84

0.46

0.40

0.43

173.7

(2.8)

205.7

73.1

500.0

85.7

148.8

76.1

(0.6)

2.9

23.2

23.4

391.7

56.5

4.5

97.8

40.4

49.1

FINANCE

BIMB 2023

MBSB 2016

0.68

1.18

4.72

1.00

4.33

2.18

5.40

2.18

GAMING

Genting Bhd 2018

2.90

7.96

10.0

INDUSTRIAL

ABRIC 2016

Astral Supreme 2016

Astral Supreme 2018

Bright Packaging 2019

Boon Koon Group 2023

China Automobile Parts 2016

Chuan Huat 2016

0.09

0.075

0.08

0.235

0.065

0.075

0.135

0.30

0.20

0.20

0.82

0.20

0.35

0.50

0.285

0.17

0.17

0.675

0.14

0.345

0.46

Refer to last page for important disclosures.

Warrant

Premium

Gearing

(%)

(x)

High

(RM)

Wrt 52-Wk

Low

(RM)

Issue

Size

(m)

Years

To Run

Expiry

2.4

2.1

5.0

3.7

4.0

2.3

6.1

3.2

2.5

2.0

4.1

3.6

0.4

4.4

2.7

2.2

5.7

3.8

0.075

1.18

0.125

0.14

0.115

0.045

0.125

0.475

0.75

0.195

0.70

0.18

0.225

0.425

0.77

0.145

0.285

0.16

0.025

0.60

0.03

0.06

0.045

0.025

0.05

0.165

0.40

0.085

0.31

0.06

0.095

0.215

0.19

0.08

0.035

0.065

412.0

115.1

40.0

105.0

596.3

200.0

16.7

27.8

52.4

381.0

89.7

37.2

53.1

107.6

32.7

56.4

242.0

181.5

3.7

3.3

6.4

2.3

3.5

2.0

1.2

4.3

4.6

4.2

1.9

2.5

3.3

3.1

2.7

2.4

1.1

2.8

01/01/18

08/08/17

24/08/20

09/08/16

18/09/17

22/03/16

16/06/15

14/07/18

26/11/18

05/06/18

16/02/16

19/10/16

09/08/17

09/05/17

13/12/16

04/09/16

25/04/15

22/01/17

24.7

(0.0)

6.4

1.8

0.905

2.29

0.305

1.15

426.7

509.0

9.7

2.2

04/12/23

31/05/16

10.86

8.6

3.4

3.88

2.60

764.2

4.7

18/12/18

0.39

0.28

0.28

1.06

0.27

0.43

0.64

36.8

61.8

64.7

56.3

89.3

23.2

38.0

3.2

2.3

2.1

2.9

2.2

4.6

3.4

0.12

0.165

0.175

0.265

0.10

0.12

0.295

0.07

0.055

0.055

0.14

0.055

0.06

0.10

49.5

39.9

70.4

57.7

138.4

300.0

41.8

2.0

2.3

4.2

4.8

9.3

2.7

1.8

07/04/16

08/08/16

20/06/18

12/01/19

07/07/23

29/12/16

06/01/16

14

M a l a y s i a

C o r p o r a t e

April 2014

G u i d e

Warrants

31/3/14

Warrant

Price

(RM)

Exercise

Price

(RM)

Share

Price

(RM)

Conversion

Price

(RM)

Destini 2016

Fututech 2017

GBH 2020

Gefung 2017

Hap Seng Conso 2016

Hartalega 2015

Heveaboard 2020

Hiap Teck 2017

Ho Wah Genting 2015

Inari 2018

Integrated Rubber 2015

Jadi Image 2015

Johore Tin 2017

KBB Resources 2019

Luster Industries 2022

Luster Industries 2023

MBM Resources 2017

Mclean Technology 2016

Muar Ban Lee 2022

PA Resources 2015

Pensonic 2024

Perwaja 2022

Press Metal 2019

Ralco 2019

Rapid Synergy 2017

Sanichi Technology 2018

Seacera Group 2017

Sersol 2023

SMPC Corporation 2022

Scope Industries 2020

Toyo Ink 2018

0.17

0.20

0.805

0.055

1.31

2.57

0.705

0.325

0.07

2.29

0.16

0.04

0.30

0.06

0.05

0.06

0.535

0.035

0.335

0.045

0.15

0.05

0.75

0.12

3.50

0.045

0.225

0.265

0.175

0.26

0.10

0.40

1.00

1.00

0.15

1.65

4.02

1.00

0.69

0.20

0.38

0.25

0.17

2.28

0.20

0.10

0.10

3.20

0.52

0.80

0.50

0.60

1.00

2.20

1.00

1.00

0.10

1.00

0.18

1.00

0.15

1.50

0.525

0.82

1.76

0.14

3.01

6.85

1.45

0.74

0.19

2.69

0.365

0.14

1.67

0.155

0.10

0.10

3.25

0.135

1.02

0.135

0.43

0.155

2.26

0.60

4.48

0.075

0.97

0.37

0.93

0.375

0.68

0.57

1.20

1.81

0.21

2.96

6.59

1.71

1.02

0.27

2.67

0.41

0.21

2.58

0.26

0.15

0.16

3.74

0.56

1.14

0.55

0.75

1.05

2.95

1.12

4.50

0.15

1.23

0.45

1.18

0.41

1.60

8.6

46.3

2.6

46.4

(1.7)

(3.8)

17.6

37.2

42.1

(0.7)

12.3

50.0

54.5

67.7

50.0

60.0

14.9

311.1

11.3

303.7

74.4

577.4

30.5

86.7

0.4

93.3

26.3

20.3

26.3

9.3

135.3

OIL & GAS

CLIQ Energy 2016

Coastal Contract 2016

0.295

1.99

0.50

3.18

0.63

5.05

0.80

5.17

26.2

2.4

Refer to last page for important disclosures.

Warrant

Premium

Gearing

(%)

(x)

High

(RM)

Wrt 52-Wk

Low

(RM)

Issue

Size

(m)

Years

To Run

Expiry

3.1

4.1

2.2

2.5

2.3

2.7

2.1

2.3

2.7

1.2

2.3

3.5

5.6

2.6

2.0

1.7

6.1

3.9

3.0

3.0

2.9

3.1

3.0

5.0

1.3

1.7

4.3

1.4

5.3

1.4

6.8

0.22

0.255

0.82

0.10

1.36

3.70

0.80

0.365

0.22

2.55

0.325

0.055

0.565

0.08

0.15

0.18

1.00

0.055

0.51

0.065

0.18

0.21

0.965

0.13

3.53

0.065

0.345

0.91

0.405

0.30

0.185

0.09

0.11

0.16

0.05

0.355

1.06

0.155

0.10

0.065

0.325

0.055

0.025

0.30

0.05

0.04

0.04

0.53

0.03

0.28

0.035

0.135

0.025

0.51

0.07

1.90

0.035

0.08

0.045

0.05

0.095

0.095

242.0

23.5

61.9

21.8

364.4

73.1

42.7

88.5

137.9

202.9

236.8

348.2

23.3

120.0

441.6

216.0

73.2

58.7

46.0

90.2

64.8

280.0

145.7

20.3

21.1

60.5

20.5

96.4

20.3

118.6

42.8

2.5

3.7

6.0

2.8

2.3

1.2

5.9

2.8

1.0

4.2

1.7

1.5

3.6

4.8

8.2

9.1

3.2

2.1

8.7

1.3

9.8

7.9

5.4

5.7

3.0

3.9

3.1

9.0

8.1

6.3

4.1

02/10/16

20/12/17

07/04/20

19/01/17

09/08/16

29/05/15

28/02/20

09/01/17

08/04/15

04/06/18

18/12/15

12/10/15

21/11/17

22/01/19

03/06/22

26/05/23

14/06/17

09/05/16

28/11/22

18/07/15

20/01/24

28/02/22

22/08/19

13/12/19

09/04/17

13/03/18

16/05/17

18/04/23

09/05/22

18/07/20

22/04/18

2.1

2.5

0.56

2.15

0.155

0.17

630.9

60.4

2.0

2.3

09/04/16

18/07/16

15

M a l a y s i a

C o r p o r a t e

April 2014

G u i d e

Warrants

31/3/14

Warrant

Price

(RM)

Exercise

Price

(RM)

Share

Price

(RM)

Conversion

Price

(RM)

Dialog 2017

Hibiscus 2014

Kejuruteraan Samudra 2018

KNM Group 2017

Perdana Petroleum 2015

Ramunia 2014

Sona Petroleum 2018

Sumatec 2021

Sumatec 2018

Tanjung Offshore 2016

1.46

1.33

0.15

0.24

1.20

0.43

0.285

0.18

0.205

0.295

2.40

0.50

0.30

1.00

0.71

0.51

0.35

0.32

0.175

0.50

3.59

1.88

0.395

0.775

1.91

0.895

0.51

0.285

0.285

0.55

3.86

1.83

0.45

1.24

1.91

0.94

0.64

0.50

0.38

0.80

7.5

(2.7)

13.9

60.0

(0.0)

5.0

24.5

75.4

33.3

44.5

PROPERTY

Encorp 2016

Gabungan Aqrs 2018

Hunza Property 2015

Ivory Properties 2017

KSL Holdings 2016

Karambunai Corp 2023

LBI Capital 2018

LBS Bina 2018

Mah Sing 2018

Meda Inc 2021

Meda Inc 2022

MKH 2017

MRCB 2018

OSK Property 2017

PJ Development 2020

See Hup 2017

Sunway Bhd 2016

Symphony Life 2020

Tambun Indah 2017

Tropicana Corp 2019

YKGI Holdings 2020

0.55

0.28

0.82

0.23

0.84

0.03

0.43

0.755

0.54

0.125

0.27

2.86

0.23

0.735

0.72

0.12

0.765

0.285

1.29

0.805

0.09

1.00

1.30

1.10

0.75

1.60

0.131

1.00

1.00

1.98

0.50

0.60

2.26

2.30

1.00

1.00

1.00

2.50

1.10

0.60

1.00

0.50

1.30

1.36

1.93

0.60

2.11

0.09

1.47

1.73

2.18

0.75

0.75

4.85

1.64

1.66

1.48

0.71

3.03

0.965

1.95

1.57

0.36

1.55

1.58

1.92

0.98

2.44

0.16

1.43

1.76

2.52

0.63

0.87

5.12

2.53

1.74

1.72

1.12

3.27

1.39

1.89

1.81

0.59

19.2

16.2

(0.5)

63.3

15.6

78.9

(2.7)

1.4

15.6

(16.7)

16.0

5.6

54.3

4.5

16.2

57.7

7.8

43.5

(3.1)

15.0

63.9

Refer to last page for important disclosures.

Warrant

Premium

Gearing

(%)

(x)

High

(RM)

Wrt 52-Wk

Low

(RM)

Issue

Size

(m)

Years

To Run

Expiry

2.5

1.4

2.6

3.2

1.6

2.1

1.8

1.6

1.4

1.9

1.57

2.16

0.23

0.295

1.27

0.55

0.35

0.635

0.28

0.465

0.405

0.80

0.06

0.09

0.37

0.225

0.195

0.045

0.15

0.105

198.4

334.4

71.5

488.9

76.2

277.9

1,410.7

118.8

567.7

37.9

2.9

0.3

3.7

3.6

1.6

0.7

4.3

6.9

4.6

2.0

12/02/17

24/07/14

01/01/18

15/11/17

26/10/15

20/12/14

29/07/18

03/03/21

13/11/18

07/04/16

2.4

4.9

2.4

2.6

2.5

3.0

3.4

2.3

4.0

6.0

2.8

1.7

7.1

2.3

2.1

5.9

4.0

3.4

1.5

2.0

4.0

0.62

0.48

1.44

0.41

1.45

0.04

0.56

1.19

0.96

0.215

0.37

2.90

0.315

0.845

0.83

0.18

1.30

0.365

1.38

1.09

0.14

0.065

0.18

0.59

0.18

0.62

0.025

0.20

0.31

0.39

0.105

0.18

0.43

0.20

0.175

0.135

0.075

0.50

0.22

0.385

0.45

0.085

32.9

160.0

43.6

186.0

96.6

1,015.0

31.2

154.1

168.1

53.6

114.0

29.1

537.9

106.2

213.8

20.4

289.7

107.4

44.2

129.8

95.0

2.0

4.3

0.9

3.1

2.4

9.5

4.0

4.2

4.0

7.4

8.1

3.7

4.5

3.4

6.7

3.7

2.4

6.6

3.2

5.6

6.2

17/03/16

20/07/18

02/03/15

26/04/17

19/08/16

20/10/23

17/04/18

11/06/18

18/03/18

13/08/21

23/04/22

30/12/17

16/09/18

28/08/17

04/12/20

22/12/17

17/08/16

11/11/20

30/05/17

19/11/19

28/05/20

16

M a l a y s i a

C o r p o r a t e

April 2014

G u i d e

Warrants

31/3/14

Warrant

Price

(RM)

Exercise

Price

(RM)

Share

Price

(RM)

Conversion

Price

(RM)

SERVICES

APFT 2018

Berjaya Corp 2022

Berjaya Media 2016

Borneo Oil 2018

Eduspec 2018

Engtex 2017

Engtex 2017

Freight Management 2017

Flonic Hi-Tec 2017

Frontken Corp 2015

FSBM Holdings 2022

GD Express 2015

Gunung Capital 2020

Hubline 2019

KPJ Healthcare 2015

KPJ Healthcare 2019

Marco 2014

Media Prima 2014

Pantech 2020

Puncak 2020

Puncak 2018

Tiong Nam Logistics 2018

0.07

0.155

0.10

0.365

0.12

0.865

0.07

0.835

0.05

0.03

0.08

1.53

0.50

0.015

1.80

0.62

0.07

0.535

0.44

1.97

0.98

0.67

0.40

1.00

1.00

1.00

0.18

1.25

0.50

0.97

0.05

0.18

0.30

0.195

0.50

0.20

1.13

4.01

0.10

1.80

0.60

1.00

1.00

1.00

0.215

0.53

0.50

0.67

0.26

1.89

0.285

1.83

0.085

0.105

0.285

1.78

0.85

0.045

2.99

2.99

0.17

2.36

0.88

2.85

1.51

1.28

0.47

1.16

1.10

1.37

0.30

2.12

0.57

1.81

0.10

0.21

0.38

1.73

1.00

0.22

2.93

4.63

0.17

2.34

1.04