Professional Documents

Culture Documents

Capital Budgeting Practice Set

Uploaded by

Arushi AggarwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Budgeting Practice Set

Uploaded by

Arushi AggarwalCopyright:

Available Formats

Capital Budgeting Practice Set

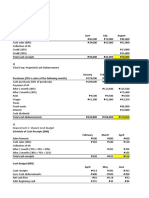

Q.1

A company is considering an investment proposal to install new milling control at a cost of

Rs.50,000. The facility has a life expectancy of 5 years and no salvage value. The tax rate is 35%.

Assume the firm uses straight line deprecation and the same is allowed for tax purpose. The

estimated cash flows before depreciation and tax (CFBT) from the investment proposal are as

follows:

Years

Cash flows before depreciation and tax (CFBT)

1

10,000

2

10,692

3

12,769

4

13,462

5

20,385

Compute the following:

1. Payback period

2. Average rate of Return

3. Internal rate of return

4. Net Present Value

5. Profitability index at 10% rate of return

Q.2

Consider the following two projects and answer the following questions.

Cash flows

NPV at

Projects C0

C1

C2

C3

10%

C

-10,000

+2,000

+4,000 +12,000 +4,134

D

-10,000

+10,000 +3,000 +3,000

+3,821

1) Why is there a conflict of rankings of these two projects?

IRR

26.5%

37.6%

2) Why should you recommend Project C in spite of a lower rate of return?

Q.3

CASE STUDY

Palco limited is a leading manufacturer of automotive components. It supplies to the original

equipments as well as the replacement market. Its projects typically have a shorter life as it

introduces new models periodically.

You have recently joined Palco Limited as a financial analyst reporting to Mr.John, the CEO of the

company. He has provided you the following information about three projects A, B, C, that are

being considered by the Executive Committee of Palco ltd:

Project A is an extension of an existing line. Its cash flow will decrease over time.

Project B involves a new product. Building its market will take some time and

hence its cash flow will increase over time.

Project C is concerned with sponsoring a pavilion at the Trade Fair. It will entail a

cost initially which will be followed by a huge benefit for one year. However, in

the year following that a substantial cost will be incurred to raze the pavilior

The expected cash flows of the three projects are as follows:

Year

Project A

Project B

Project C

(15,000)

(15,000)

(15,000)

11,000

3,500

42,000

7,000

8,000

(4,000)

4,800

13,000

----

Mr. John believes that all the three projects have risk characteristics similar to the average risk

of the firm and hence the firms cost of capital, viz. 12%, will apply to them.

You are asked to evaluate the projects.

a) What is payback period and discounted payback period? Find the payback period

and the discounted payback periods of project A and project B.

b) What is the NPV (net present value)? What are the properties of the NPV?

Calculate the NPVs of projects A, B and C.

c) What is Profitability Index of above three projects? Also interpret its value.

(PVF at 12% discount rate for 1-5 years are 0.893, 0.797, 0.712, 0.613, 0.636, 0.567)

You might also like

- Capital Budgeting Illustrative NumericalsDocument6 pagesCapital Budgeting Illustrative NumericalsPriyanka Dargad100% (1)

- Sample Problems - Principles of Corporate Finance Dec 2015Document26 pagesSample Problems - Principles of Corporate Finance Dec 2015ahmetdursun03100% (4)

- R35 Capital Budgeting Q BankDocument15 pagesR35 Capital Budgeting Q BankAhmedNo ratings yet

- Question 3 2010 McGregorDocument6 pagesQuestion 3 2010 McGregorJosann WelchNo ratings yet

- Problems & Solns - Capital Budgeting - SFM - Pooja GuptaDocument6 pagesProblems & Solns - Capital Budgeting - SFM - Pooja Guptaritesh_gandhi_70% (1)

- Activity - Capital Investment AnalysisDocument5 pagesActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTENo ratings yet

- Lecture_7_notesDocument6 pagesLecture_7_notesAna-Maria GhNo ratings yet

- AssignemntDocument2 pagesAssignemntMohit VermaNo ratings yet

- SWM, Financial Systems, Capital Budgeting, NPV, IRR, PaybackDocument2 pagesSWM, Financial Systems, Capital Budgeting, NPV, IRR, PaybackAnonymous duzV27Mx3No ratings yet

- Business Finance II: Exercise 1Document7 pagesBusiness Finance II: Exercise 1faisalNo ratings yet

- Mini CaseDocument13 pagesMini CaseVaibhav Goyal0% (1)

- Pset Capital Budgeting SolDocument6 pagesPset Capital Budgeting SolMarjorie Mae Manaois CruzatNo ratings yet

- Chapter 06Document5 pagesChapter 06Md. Saidul IslamNo ratings yet

- Assessment 1 October 2021 POCFDocument2 pagesAssessment 1 October 2021 POCFAakanksha ChughNo ratings yet

- CF - PWS - 5Document3 pagesCF - PWS - 5cyclo tronNo ratings yet

- Capital BudgetingDocument7 pagesCapital BudgetingKazi Abdullah Susam0% (1)

- 01 - Adv Issues in Cap BudgetingDocument17 pages01 - Adv Issues in Cap BudgetingMudit KumarNo ratings yet

- Module 3 - Capital Budgeting - 3A - Questions 2022-23Document10 pagesModule 3 - Capital Budgeting - 3A - Questions 2022-23Manya GargNo ratings yet

- Tutorial 3 SheetDocument2 pagesTutorial 3 Sheetnourkhaled1218No ratings yet

- Homework Capital BudgetingDocument4 pagesHomework Capital BudgetingChristy AngkouwNo ratings yet

- Capital Budgeting Practice Questions QueDocument9 pagesCapital Budgeting Practice Questions QuemawandeNo ratings yet

- MBALN-622 - Midterm Examination BriefDocument6 pagesMBALN-622 - Midterm Examination BriefwebsternhidzaNo ratings yet

- Tutorial 5 Investment Appraisal Tutorial QuestionsDocument3 pagesTutorial 5 Investment Appraisal Tutorial QuestionsNicholas LowNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingMahedi HasanNo ratings yet

- Capital Budgeting Techniques for Investment EvaluationDocument5 pagesCapital Budgeting Techniques for Investment EvaluationUday Gowda0% (1)

- Project Appraisal-1 PDFDocument23 pagesProject Appraisal-1 PDFFareha RiazNo ratings yet

- Project Appraisal 1Document23 pagesProject Appraisal 1Fareha RiazNo ratings yet

- Bangladesh University exam questions on corporate financeDocument3 pagesBangladesh University exam questions on corporate financeRahman NiloyNo ratings yet

- Capital Budgeting QuestionsDocument5 pagesCapital Budgeting QuestionsMonika KauraNo ratings yet

- Capital Budgeting QuestionsDocument5 pagesCapital Budgeting QuestionsMonika KauraNo ratings yet

- Capital Budgeting Techniques and CalculationsDocument6 pagesCapital Budgeting Techniques and CalculationsDeep DebnathNo ratings yet

- Question of Capital BudgetingDocument7 pagesQuestion of Capital Budgeting29_ramesh170100% (2)

- Capital Budgeting Assignment QuestionsDocument3 pagesCapital Budgeting Assignment QuestionsNgaiza3No ratings yet

- Corporate Finance I: Home Assignment 2 Due by January 30Document2 pagesCorporate Finance I: Home Assignment 2 Due by January 30RahulNo ratings yet

- Choose Investment Projects Using NPV and Payback PeriodDocument5 pagesChoose Investment Projects Using NPV and Payback Periodbusinessdoctor23No ratings yet

- Principles of Corporate Finance Concise 2Nd Edition Brealey Test Bank Full Chapter PDFDocument48 pagesPrinciples of Corporate Finance Concise 2Nd Edition Brealey Test Bank Full Chapter PDFmirabeltuyenwzp6f100% (8)

- Principles of Corporate Finance Concise 2nd Edition Brealey Test BankDocument47 pagesPrinciples of Corporate Finance Concise 2nd Edition Brealey Test Bankhoadieps44ki100% (32)

- PAF - Karachi Institute of Economics and Technology Course: Financial Management Faculty: Ali Sajid Class ID: 110217 Total Marks: Examination: Assignment #1 DateDocument3 pagesPAF - Karachi Institute of Economics and Technology Course: Financial Management Faculty: Ali Sajid Class ID: 110217 Total Marks: Examination: Assignment #1 DateZaka HassanNo ratings yet

- Capital Budgeting Q-BankDocument12 pagesCapital Budgeting Q-BankMarwa Abd-ElmeguidNo ratings yet

- Capital Budgeting ProblemsDocument3 pagesCapital Budgeting ProblemsrahulNo ratings yet

- Capital Budgeting TechniquesDocument21 pagesCapital Budgeting Techniquesmusa_scorpionNo ratings yet

- Ch(10) - Book Answers (3) (1)Document17 pagesCh(10) - Book Answers (3) (1)abdulraufdghaybeejNo ratings yet

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- Calculate NPV of water supply project using discounted cash flow analysisDocument8 pagesCalculate NPV of water supply project using discounted cash flow analysisVijaya AgrawalNo ratings yet

- Financial Management (MBOF 912 D) 1Document5 pagesFinancial Management (MBOF 912 D) 1Siva KumarNo ratings yet

- The Appraisal of Capital Projects: C. G. LewinDocument28 pagesThe Appraisal of Capital Projects: C. G. LewinBhuvana ArasuNo ratings yet

- Section 2Document1 pageSection 2Hello WorldNo ratings yet

- Q Finman2 Capbudgtng 1920Document5 pagesQ Finman2 Capbudgtng 1920Deniece RonquilloNo ratings yet

- MAS Midterm Quiz 2Document4 pagesMAS Midterm Quiz 2Joseph John SarmientoNo ratings yet

- Project Financial Appraisal and SelectionDocument5 pagesProject Financial Appraisal and SelectionAbhishek KarekarNo ratings yet

- q3 3Document7 pagesq3 3JimmyChaoNo ratings yet

- Tutorial 2 - Principles of Capital BudgetingDocument3 pagesTutorial 2 - Principles of Capital Budgetingbrahim.safa2018No ratings yet

- College WorkDocument10 pagesCollege Workmansuriadil2001No ratings yet

- 6 - Chapter Six - Project AppraisalDocument31 pages6 - Chapter Six - Project AppraisalmeseretNo ratings yet

- BA 140 Reviewer Chap 1011Document9 pagesBA 140 Reviewer Chap 1011Alexis NievesNo ratings yet

- Notes On Capital BudgetingDocument3 pagesNotes On Capital BudgetingCheshta Suri100% (1)

- FM Unit 8 Lecture Notes - Capital BudgetingDocument4 pagesFM Unit 8 Lecture Notes - Capital BudgetingDebbie DebzNo ratings yet

- Capital Budgeting TechniquesDocument21 pagesCapital Budgeting TechniquesMishelNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Front AdanientDocument13 pagesFront AdanientArushi AggarwalNo ratings yet

- Cost of Capital-Practice SetDocument1 pageCost of Capital-Practice SetArushi AggarwalNo ratings yet

- Cost of Capital-Practice SetDocument1 pageCost of Capital-Practice SetArushi AggarwalNo ratings yet

- MAN 383.16 - Leading People and Organizations - Dierking - 04645Document14 pagesMAN 383.16 - Leading People and Organizations - Dierking - 04645Arushi AggarwalNo ratings yet

- Managing Cross-Cultural and Virtual TeamsDocument31 pagesManaging Cross-Cultural and Virtual Teamslali62No ratings yet

- Managing Cross-Cultural and Virtual TeamsDocument31 pagesManaging Cross-Cultural and Virtual Teamslali62No ratings yet

- Boundary Issues in Global Virtual TeamsDocument198 pagesBoundary Issues in Global Virtual TeamsArushi AggarwalNo ratings yet

- Challenges and Success FactorsDocument23 pagesChallenges and Success FactorsArushi AggarwalNo ratings yet

- Summary of The Movie TerminalDocument5 pagesSummary of The Movie TerminalArushi AggarwalNo ratings yet

- Pre ReadsDocument7 pagesPre ReadsArushi AggarwalNo ratings yet

- CFA Level 2 Monthly Test - 25-01-19 Capital Budgeting Music Inc Case ScenarioDocument44 pagesCFA Level 2 Monthly Test - 25-01-19 Capital Budgeting Music Inc Case ScenarioAnonymus75% (4)

- 208 Wise V MeerDocument1 page208 Wise V Meeragnes13No ratings yet

- Senior 12 Business Finance - Q1 - M1 For PrintingDocument30 pagesSenior 12 Business Finance - Q1 - M1 For PrintingAngelica Paras100% (8)

- Business Tax ReviewerDocument15 pagesBusiness Tax ReviewermeowNo ratings yet

- Application of Fixed Asset DepreciationDocument4 pagesApplication of Fixed Asset DepreciationGiffari Ibnu ToriqNo ratings yet

- Date of AGM : Dd-Mon-YyyyDocument26 pagesDate of AGM : Dd-Mon-YyyyrNo ratings yet

- Good Info CapsimDocument11 pagesGood Info Capsimmstephens1No ratings yet

- Requirement 1: Shazam Cash BudgetDocument4 pagesRequirement 1: Shazam Cash BudgetVixen Aaron EnriquezNo ratings yet

- Tutorial 4 Answer Mfrs123 Borrowing CostsDocument5 pagesTutorial 4 Answer Mfrs123 Borrowing CostsannabelleNo ratings yet

- Holding CompanyDocument5 pagesHolding CompanySADIANo ratings yet

- JG Summit Holdings Inc. Comeprative Balance Sheet December 31 2018 and 2017Document20 pagesJG Summit Holdings Inc. Comeprative Balance Sheet December 31 2018 and 2017eath__No ratings yet

- Exercice RBDocument61 pagesExercice RBGagAnasNo ratings yet

- Income Tax - Resident AlienDocument17 pagesIncome Tax - Resident AlienStela PantaleonNo ratings yet

- Partnership Liquidation ExercisesDocument11 pagesPartnership Liquidation ExercisesEUSTAQUIO JR., Felix C.No ratings yet

- Chapter 10Document50 pagesChapter 10duy blaNo ratings yet

- ch11 Beams10e TBDocument28 pagesch11 Beams10e TBK. CustodioNo ratings yet

- (Test Bank) Chapter 3Document41 pages(Test Bank) Chapter 3Kiara Mas100% (2)

- Partnership - Key Notes and Sample ProblemsDocument6 pagesPartnership - Key Notes and Sample ProblemsCrestinaNo ratings yet

- MCQ Financial AccountingDocument4 pagesMCQ Financial AccountingKhushal JunejaNo ratings yet

- Equivalent Units and Cost Per Equivalent UnitDocument14 pagesEquivalent Units and Cost Per Equivalent UnitIqra AbbasNo ratings yet

- O Grady Apparel CompanyDocument4 pagesO Grady Apparel CompanySoniaKasellaNo ratings yet

- Feedback Report - 24042023 - Randstad Corporate DevelopmentDocument12 pagesFeedback Report - 24042023 - Randstad Corporate DevelopmentTejas BNo ratings yet

- Chapter 18 Capital Budgeting and Valuation With Leverage: Corporate Finance, 2E, Global Edition (Berk/Demarzo)Document46 pagesChapter 18 Capital Budgeting and Valuation With Leverage: Corporate Finance, 2E, Global Edition (Berk/Demarzo)WesNo ratings yet

- CDC - Central Depository Company of PakistanDocument1 pageCDC - Central Depository Company of Pakistanaraza_962307No ratings yet

- This Study Resource Was: Problem Set 2: Call and Put Option ContractDocument3 pagesThis Study Resource Was: Problem Set 2: Call and Put Option Contractdummy tommyNo ratings yet

- Twitter Acquisition by Elon Musk: Motives, Problems and Way AheadDocument18 pagesTwitter Acquisition by Elon Musk: Motives, Problems and Way AheadKosHanNo ratings yet

- Class+8+ Chapter+8 +Practice+Questions+ ANSWERSDocument4 pagesClass+8+ Chapter+8 +Practice+Questions+ ANSWERSMar JoNo ratings yet

- Interim Financial ReportingDocument3 pagesInterim Financial ReportingPaula De RuedaNo ratings yet

- Oxford Business Plan Pg8Document1 pageOxford Business Plan Pg8sladurantayeNo ratings yet

- Manila Bulletin Publishing Corporation Sec Form 17a 2018Document128 pagesManila Bulletin Publishing Corporation Sec Form 17a 2018Kathryn SantosNo ratings yet