Professional Documents

Culture Documents

Pennsylvania Income Tax Return: Official Use Only

Uploaded by

Violeta BusuiocOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pennsylvania Income Tax Return: Official Use Only

Uploaded by

Violeta BusuiocCopyright:

Available Formats

1400110050

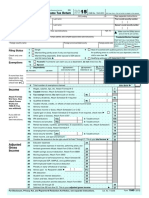

PA-40 2014

OFFICIAL USE ONLY

(07-14)(FI)

Pennsylvania Income Tax Return

PA Department of Revenue, Harrisburg, PA 17129

START

OFFICIAL USE ONLY

PLEASE PRINT IN BLACK INK. ENTER ONE LETTER OR NUMBER IN EACH BOX. FILL IN OVALS COMPLETELY.

Your Social Security Number

Spouses Social Security Number (even if filing separately)

Extension. See the instructions.

Amended Return. See the instructions.

Residency Status. Fill in only one oval.

CAREFULLY PRINT YOUR SOCIAL SECURITY NUMBER(S) ABOVE

Last Name

R Pennsylvania Resident

Suffix

N Nonresident

Your First Name

P Part-Year Resident from

___ ___/2014 to ___ ___/2014

MI

Spouses First Name

MI

Filing Status.

OVERSEAS

MAIL See Foreign

Address Instructions

in PA-40 booklet.

S Single

J Married, Filing Jointly

M Married, Filing Separately

F Final Return. Indicate reason:

Spouses Last Name - Only if different from Last Name above

Suffix

D Deceased

First Line of Address

Taxpayer

Date of death ___ ___/2014

Spouse

Date of death ___ ___/2014

Second Line of Address

City or Post Office

State

Daytime Telephone Number

Farmers. Fill in this oval if at least

two-thirds of your gross income is

from farming.

ZIP Code

Name of school district where you lived

on 12/31/2014:

School Code

Your occupation

Spouses occupation

1a. Gross Compensation. Do not include exempt income, such as combat zone pay and

qualifying retirement benefits. See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a.

1b. Unreimbursed Employee Business Expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b.

1c. Net Compensation. Subtract Line 1b from Line 1a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1c.

2. Interest Income. Complete PA Schedule A if required. . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

3. Dividend and Capital Gains Distributions Income. Complete PA Schedule B if required. . .

3.

4. NetIncome or Loss from the Operation of a Business, Profession or Farm. . . .

LOSS

4.

5. NetGain or Loss from the Sale, Exchange or Disposition of Property. . . . . . . . .

LOSS

5.

LOSS

6.

6. Net Income or Loss from Rents, Royalties, Patents or Copyrights. . . . . . . . . . . .

7. Estate or Trust Income. Complete and submit PA Schedule J. . . . . . . . . . . . . . . . . . . . .

7.

8. Gambling and Lottery Winnings. Complete and submit PA Schedule T. . . . . . . . . . . . . .

8.

9. Total PA TaxableIncome. Add only the positive income amounts from Lines 1c, 2, 3,

4, 5, 6, 7 and 8. DO NOT ADD any losses reported on Lines 4, 5 or 6. . . . . . . . . . . . . . .

9.

10. Other Deductions. Enter the appropriate code for the type of deduction.

See the instructions for additional information. . . . . . . . . . . . . . . . . . . . . . . . .

10.

11. Adjusted PA Taxable Income. Subtract Line 10 from Line 9. . . . . . . . . . . . . . . . . . . . . . 11.

Reset Entire Form

NEXT PAGE

Side 1

EC

1400110050

OFFICIAL USE ONLY

PRINT FORM

FC

1400210058

PA-40 2014 (07-14)(FI)

START

Social Security Number (shown first)

ESTIMATED TAX PAID

Name(s)

12. PA Tax Liability. Multiply Line 11 by 3.07 percent (0.0307). . . . . . . . . . . . . . . . . . . . . .

12.

13. Total PATax Withheld. See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13.

14. Credit from your 2013 PAIncome Tax return. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.

15. 2014 Estimated Installment Payments. Fill in oval if including Form REV-459B.

15.

16. 2014 Extension Payment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16.

17. Nonresident Tax Withheld from your PA Schedule(s) NRK-1. (Nonresidents only) . . . .

17.

18. Total Estimated Payments and Credits. Add Lines 14, 15, 16 and 17. . . . . . . . . . . . .

18.

Tax Forgiveness Credit, submit PA Schedule SP

19a. Filing Status:

Unmarried or

Married

Separated

20. Total Eligibility Income from Part C, Line 11, PA Schedule SP. .

Deceased

19b.

21. Tax Forgiveness Credit from Part D, Line 16, PA Schedule SP. . . . . . . . . . . . . . . . . .

21.

22. Resident Credit. Submit your PA Schedule(s) G-L and/or RK-1. . . . . . . . . . . . . . . . . .

22.

23. Total Other Credits. Submit your PA Schedule OC. . . . . . . . . . . . . . . . . . . . . . . . . . . .

23.

24. TOTAL PAYMENTS and CREDITS. Add Lines 13, 18, 21, 22 and 23. . . . . . . . . . . . . . .

24.

25. USETAX. Due on internet, mail order or out-of-state purchases. See the instructions.

25.

26. TAXDUE. If the total of Line 12 and Line 25 is more than Line 24,

enter the difference here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26.

27. Penalties and Interest. See the instructions for additional

information. Fill in oval if including Form REV-1630/REV-1630A . . . . . .

27.

28. TOTAL PAYMENT DUE. See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28.

29. OVERPAYMENT. If Line 24 is more than the total of Line 12, Line 25 and Line 27

enter the difference here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

The total of Lines 30 through 36 must equal Line 29.

30. Refund Amount of Line 29 you want as a check mailed to you.. . . . . . . . REFUND

31. Credit Amount of Line 29 you want as a credit to your 2015 estimated account. . . . .

DONATIONS

OFFICIAL USE ONLY

32. Refund donation line. Enter the organization code and donation amount.

See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33. Refund donation line. Enter the organization code and donation amount.

See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

34. Refund donation line. Enter the organization code and donation amount.

See the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

35. Refund donation line.

See the instructions.

36. Refund donation line.

See the instructions.

Enter the organization code and donation amount.

...............................................

Enter the organization code and donation amount.

...............................................

Dependents, Part B, Line 2,

PA Schedule SP. . . . . . . . . . . .

29.

30.

31.

32.

33.

34.

35.

36.

SIGNATURE(S). Under penalties of perjury, I (we) declare that I (we) have examined this return, including all accompanying schedules and statements, and to the best of my

(our) belief, they are true, correct, and complete.

Your Signature

Date

E-File Opt Out

See the instructions.

Please sign after printing.

Spouses Signature, if filing jointly

Please sign after printing.

Reset Entire Form

Preparers Name and Telephone Number

Preparers PTIN

Firm FEIN

PLEASE DO NOT CALL ABOUT YOUR REFUND UNTIL EIGHT WEEKS AFTER YOU FILE.

Side 2

1400210058

BACK TO PAGE ONE

PRINT FORM

1400210058

PLEASE DO NOT CALL ABOUT YOUR REFUND UNTIL EIGHT WEEKS AFTER YOU FILE.

You might also like

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- 2011 Pa-40Document2 pages2011 Pa-40Hesam AhmadiNo ratings yet

- 2014 Federal 1040 (Esther)Document2 pages2014 Federal 1040 (Esther)Abdirahman Abdullahi Omar43% (7)

- Senior Circuit Breaker 2014Document2 pagesSenior Circuit Breaker 2014Scott LieberNo ratings yet

- Chapter 4 For FilingDocument9 pagesChapter 4 For Filinglagurr100% (1)

- Schedule CB For Tax Year 2012Document2 pagesSchedule CB For Tax Year 2012Scott LieberNo ratings yet

- Santos Return PDFDocument14 pagesSantos Return PDFMark Long75% (4)

- Tax Return ScribdDocument5 pagesTax Return ScribdYvonne TanNo ratings yet

- Tax Return ProjectDocument62 pagesTax Return ProjectGiovaniPerez100% (1)

- MM DD YY MM DD YY: State of New Jersey Income Tax-Resident ReturnDocument3 pagesMM DD YY MM DD YY: State of New Jersey Income Tax-Resident ReturnNirali ShahNo ratings yet

- PA Property Tax or Rent Rebate Form PA-1000Document2 pagesPA Property Tax or Rent Rebate Form PA-1000joekehmNo ratings yet

- MAIN IDEAS IN CHAPTER 1, TOPIC 1, © Kermit Keeling: Solution - PAGE 1Document25 pagesMAIN IDEAS IN CHAPTER 1, TOPIC 1, © Kermit Keeling: Solution - PAGE 1юрий локтионовNo ratings yet

- Jeff Bell 2012 Tax ReturnDocument71 pagesJeff Bell 2012 Tax ReturnRaylene_No ratings yet

- Chapter 4Document6 pagesChapter 4Ashanti T Swan0% (1)

- FTF1301242185129Document3 pagesFTF1301242185129Donna SchatzNo ratings yet

- Pet Kingdom IncDocument20 pagesPet Kingdom Incjessica67% (3)

- File Your 2014 Tax ReturnDocument4 pagesFile Your 2014 Tax ReturnShakilaMissz-KyutieJenkins100% (1)

- Example Tax ReturnDocument6 pagesExample Tax Returnapi-252304176No ratings yet

- North Dakota Tax Form ND-S1Document2 pagesNorth Dakota Tax Form ND-S1Rob PortNo ratings yet

- Ivan Incisor CH 3 2014 Tax Return - For - FilingDocument6 pagesIvan Incisor CH 3 2014 Tax Return - For - FilingShakilaMissz-KyutieJenkinsNo ratings yet

- President Barack Obama Income Tax Return - Form 1040 - April 2011Document59 pagesPresident Barack Obama Income Tax Return - Form 1040 - April 2011Zim VicomNo ratings yet

- Worksheet 1. Figuring Your Taxable Benefits: Keep For Your RecordsDocument1 pageWorksheet 1. Figuring Your Taxable Benefits: Keep For Your RecordsKelly Phillips ErbNo ratings yet

- Schauer 2013 Tax ReturnDocument3 pagesSchauer 2013 Tax ReturnDetroit Free Press0% (1)

- 2015 Two BrothersDocument43 pages2015 Two BrothersAnonymous Wu0bxv6p7No ratings yet

- M 1 PRDocument2 pagesM 1 PRAndy KrogstadNo ratings yet

- 2013 Pennsylvania ReturnDocument2 pages2013 Pennsylvania ReturnVictoriaChristianDukesNo ratings yet

- LCGS 2011 941Document2 pagesLCGS 2011 941Timothy Rampage RushNo ratings yet

- Short Form Return of Organization Exempt From Income TaxDocument9 pagesShort Form Return of Organization Exempt From Income TaxHalosNo ratings yet

- 1040x2 PDFDocument2 pages1040x2 PDFolddiggerNo ratings yet

- 2012 Biden Complete Return PDFDocument31 pages2012 Biden Complete Return PDFTyler DeiesoNo ratings yet

- Will Frost 2013 Tax Return - T13 - For - RecordsDocument146 pagesWill Frost 2013 Tax Return - T13 - For - RecordsjessicaNo ratings yet

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocument6 pagesCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnStephanie YatesNo ratings yet

- By The Numbers, Inc.Document51 pagesBy The Numbers, Inc.mailfrmajithNo ratings yet

- Bruce Byrd 2013 Tax Return - T13 - For - Records PDFDocument69 pagesBruce Byrd 2013 Tax Return - T13 - For - Records PDFjessica50% (2)

- MO-1040A Fillable Calculating - 2015 PDFDocument3 pagesMO-1040A Fillable Calculating - 2015 PDFAnonymous 3RVba19mNo ratings yet

- 2015 Tax Return Documents (US Auto Motors LLC) Revised PDFDocument20 pages2015 Tax Return Documents (US Auto Motors LLC) Revised PDFzlNo ratings yet

- Tax Form 2013 (Trinidad)Document5 pagesTax Form 2013 (Trinidad)Natasha ThomasNo ratings yet

- 2011 Pa-40 Fastfile BookDocument20 pages2011 Pa-40 Fastfile BookGaurav ShuklaNo ratings yet

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocument6 pagesCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax Returnapi-252942620No ratings yet

- Amended Tax Return Form 1040X ExplainedDocument2 pagesAmended Tax Return Form 1040X ExplainedKel TranNo ratings yet

- TaxReturn PDFDocument7 pagesTaxReturn PDFChristine WillisNo ratings yet

- Maine Individual Income Tax: FORM 1040ME 2 0 1 3Document3 pagesMaine Individual Income Tax: FORM 1040ME 2 0 1 3Daniel DillNo ratings yet

- 2022 Draft Schedule ADocument2 pages2022 Draft Schedule ARiley CareNo ratings yet

- Form 1040 Tax ReturnDocument2 pagesForm 1040 Tax ReturnHamzah B ShakeelNo ratings yet

- Vice-President Biden's 2010 Tax ReturnDocument28 pagesVice-President Biden's 2010 Tax ReturnBarack ObamaNo ratings yet

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument6 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetAshutosh Singh ParmarNo ratings yet

- Lance Dean 2013 Tax Return - T13 - For - RecordsDocument57 pagesLance Dean 2013 Tax Return - T13 - For - Recordsjessica50% (4)

- Form 1040Document3 pagesForm 1040Peng JinNo ratings yet

- FORM MO-1040A: Missouri Individual Income Tax Return Single/Married (Income From One Spouse) - Short FormDocument2 pagesFORM MO-1040A: Missouri Individual Income Tax Return Single/Married (Income From One Spouse) - Short Formpixel986No ratings yet

- 2013 Financial StatementsDocument31 pages2013 Financial Statementsapi-307029847100% (1)

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax Returnapi-310622354No ratings yet

- F 706Document31 pagesF 706Bogdan PraščevićNo ratings yet

- Complete Return President Obama 2012 PDFDocument38 pagesComplete Return President Obama 2012 PDFTyler DeiesoNo ratings yet

- Itx203 02 e - Return of Income Entity Colored OrangeDocument9 pagesItx203 02 e - Return of Income Entity Colored OrangeGregory MabinaNo ratings yet

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnNo ratings yet

- European Business Statistics Methodological Manual For PRODCOMDocument24 pagesEuropean Business Statistics Methodological Manual For PRODCOMVioleta BusuiocNo ratings yet

- Financial Statement Analysis: The Raw Data for InvestingDocument18 pagesFinancial Statement Analysis: The Raw Data for Investingshamapant7955100% (2)

- Monetary Policy: April 2022Document34 pagesMonetary Policy: April 2022Violeta BusuiocNo ratings yet

- Theory of NothingDocument262 pagesTheory of Nothingssr_1No ratings yet

- 2014 Financial Statements enDocument116 pages2014 Financial Statements enpros_868No ratings yet

- B GG HandbookDocument53 pagesB GG HandbookVioleta BusuiocNo ratings yet

- Understanding Your Business Financial StatementsDocument12 pagesUnderstanding Your Business Financial Statementsrajko313No ratings yet

- Universal Declaration of Human RightsDocument8 pagesUniversal Declaration of Human RightselectedwessNo ratings yet

- 2014 Financial Statements enDocument116 pages2014 Financial Statements enpros_868No ratings yet

- Verify financial support for UCLA I-20Document1 pageVerify financial support for UCLA I-20Violeta BusuiocNo ratings yet

- Financial Statement Analysis: The Raw Data for InvestingDocument18 pagesFinancial Statement Analysis: The Raw Data for Investingshamapant7955100% (2)

- Delegated Act Solvency 2 enDocument312 pagesDelegated Act Solvency 2 enVioleta BusuiocNo ratings yet

- Ag 2013 enDocument59 pagesAg 2013 enVioleta BusuiocNo ratings yet

- How Insurance WorksDocument24 pagesHow Insurance WorksVioleta BusuiocNo ratings yet

- Z 1Document179 pagesZ 1Violeta BusuiocNo ratings yet

- Financial AccountingDocument746 pagesFinancial Accountingwakemeup143100% (4)

- 2013 Full ReportDocument45 pages2013 Full ReportVioleta BusuiocNo ratings yet

- IMF - Global Financial Stability ReportDocument166 pagesIMF - Global Financial Stability ReportParomita2013No ratings yet

- Purpose of The Financial Information Kit Is To Provide Practical and Easy To Read FinancialDocument20 pagesPurpose of The Financial Information Kit Is To Provide Practical and Easy To Read Financialteti2kNo ratings yet

- Doing Business-Pwc-Paying-Taxes-2014 PDFDocument182 pagesDoing Business-Pwc-Paying-Taxes-2014 PDFRolando NanezNo ratings yet

- Ati Acgr For 2012Document49 pagesAti Acgr For 2012Violeta BusuiocNo ratings yet

- Do Tax Havens FlourishDocument37 pagesDo Tax Havens FlourishVioleta BusuiocNo ratings yet

- Aspecte Ale Economiei Subterane in RomaniaDocument6 pagesAspecte Ale Economiei Subterane in RomaniaVioleta BusuiocNo ratings yet

- 2-IHC-Awareness of Halal Industry PDFDocument50 pages2-IHC-Awareness of Halal Industry PDFMaulana Burney100% (1)

- Screenshot 2023-05-06 at 1.13.40 PMDocument2 pagesScreenshot 2023-05-06 at 1.13.40 PMLorna LintagNo ratings yet

- HR Professional with Education and CertificationsDocument1 pageHR Professional with Education and CertificationsdestaputrantoNo ratings yet

- FILE SE VC Tech T-10 2023-24 Version 1 1684570086666Document64 pagesFILE SE VC Tech T-10 2023-24 Version 1 1684570086666Deelip ZopeNo ratings yet

- Exam 1 Learning ObjectivesDocument4 pagesExam 1 Learning ObjectivesYingfanNo ratings yet

- General Banking Law CompilationDocument6 pagesGeneral Banking Law CompilationCristineNo ratings yet

- FELS Energy, Inc. vs. Province of Batangas (G.R. No. 168557)Document23 pagesFELS Energy, Inc. vs. Province of Batangas (G.R. No. 168557)aitoomuchtvNo ratings yet

- FATCA Individual PDFDocument2 pagesFATCA Individual PDFPrathik NamakalNo ratings yet

- Jaspreet Singh - CVDocument3 pagesJaspreet Singh - CVJas SiNo ratings yet

- ARP Performance Report Draft 8-23-21Document73 pagesARP Performance Report Draft 8-23-21Wmar WebNo ratings yet

- The Iqta SystemDocument5 pagesThe Iqta SystemJahnvi BhadouriaNo ratings yet

- Niall Ferguson Is Full of Shit With No Friggin Facts To Back Up His BsDocument9 pagesNiall Ferguson Is Full of Shit With No Friggin Facts To Back Up His Bsmsf3153840% (5)

- Delhi HT 01-12-2022Document32 pagesDelhi HT 01-12-2022Hemabh ShivpuriNo ratings yet

- BRD InvoicesDocument29 pagesBRD InvoicesJTOCCN ORAINo ratings yet

- Ebooks v15-2Document76 pagesEbooks v15-2Marcos Rodriguez MercadoNo ratings yet

- Sustainability 10 00602 v2Document24 pagesSustainability 10 00602 v2Layla MainNo ratings yet

- Pearsons Federal Taxation 2017 Corporations Partnerships 30Th Full ChapterDocument41 pagesPearsons Federal Taxation 2017 Corporations Partnerships 30Th Full Chaptermargret.brennan669100% (28)

- United States Court of Appeals, Sixth CircuitDocument9 pagesUnited States Court of Appeals, Sixth CircuitScribd Government DocsNo ratings yet

- 1040 Tax Return SummaryDocument29 pages1040 Tax Return SummaryBonilla Cesar100% (2)

- Income Tax History - Check Your Income Tax - GOV - UK - Check Your Income Tax - GOV - UKDocument5 pagesIncome Tax History - Check Your Income Tax - GOV - UK - Check Your Income Tax - GOV - UKChris CritchNo ratings yet

- Pricing For International Markets 1. Discuss The Causes of and Solutions For Parallel (Grey Markets) Imports and Their Effects On PriceDocument23 pagesPricing For International Markets 1. Discuss The Causes of and Solutions For Parallel (Grey Markets) Imports and Their Effects On PricePeter Mboma100% (1)

- Endterm Paper Finmgt - FinalDocument46 pagesEndterm Paper Finmgt - FinalJenniveve ocenaNo ratings yet

- AcknowledgementDocument3 pagesAcknowledgementJasmin Sheryl FortinNo ratings yet

- Executive Order 1035 Streamlines Gov't Land AcquisitionDocument5 pagesExecutive Order 1035 Streamlines Gov't Land Acquisitionahsiri22No ratings yet

- 10000000879Document299 pages10000000879Chapter 11 DocketsNo ratings yet

- Draft: A Vision For Missouri's Transportation Future - Appendix, November 2013Document266 pagesDraft: A Vision For Missouri's Transportation Future - Appendix, November 2013nextSTL.comNo ratings yet

- Industrial Relations and Labour Legislations BBA - 345Document45 pagesIndustrial Relations and Labour Legislations BBA - 345Meghana RaoNo ratings yet

- Chapter 1 The Investment Environment: Fundamentals of InvestingDocument14 pagesChapter 1 The Investment Environment: Fundamentals of InvestingElen LimNo ratings yet

- Special Journals Cherry Lopez Wear Ever Store BSA13Document12 pagesSpecial Journals Cherry Lopez Wear Ever Store BSA13Erika RepedroNo ratings yet

- MGFP One PagerDocument2 pagesMGFP One PagerHumanearthNo ratings yet