Professional Documents

Culture Documents

Provident Fund and ESI Contribution Rates

Uploaded by

paravindOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Provident Fund and ESI Contribution Rates

Uploaded by

paravindCopyright:

Available Formats

Provident Fund, 1952:

Provident fund is calculated @ 12% on the basic salary, which indeed is deducted from

Employee's salary and the same plus 12% on the basic is contributed by the employer. So the

aggregate 12% + 12% is remitted to the Provident fund Department and along with includes

Administrative charges like EDLIS+Admin works contribution is 1.61%(1.11%+0.5%)

I.e.; 12%+12%+1.61%=25.61%

Where as in Employer contribution 12% is divided into 8.33%(PS) + 3.67% (EPF)

PS: Pension Scheme

EPF: Employee PF

EDLIS: Employee direct link insurance scheme

Always PF 12% is calculated on Basic Salary.

So, Sum of covered for employee total PF is 12%(Emp) + 3.67% (Employer)=15.67%

Rest of the 8.33% covered on Pension scheme.

Example:

Employee Side- 12% of Basic(Gross is:8000/month)

So if Basic of an employee is 3200/Basic+DA then

ESI contribution would be 3200*12% = 384 Rupees

Employer side- 12% of Basic(Gross is:8000/month)

ESI contribution would be 3200* 12% = 384 Rupees.

Admin charges 1.61% of Basic(Gross is:8000/month)

Contribution would be 3200*1.61% = 52 Rupees.

Total: 384+384+52 = 820 Rupees.

Employee State Insurance Act, 1948:

ESI : Employee State Insurance is calculated at 1.75% on the gross salary of the employees

whose salary is below Rs. 10000/-permonth (w.e.f 2008) and Employer contributes 4.75%

on the gross salary of the employee and the aggregate 1.75% + 4.75% is remitted to the

ESI Department.

4.75% of gross salary (Employers contribution) +1.75% of gross salary (Employees Contribution)

Note: The person who r getting more above 10,000 Gross salary, is not applicable for ESI Act

Example:

Employee Side- 1.75% of gross/month

So if gross of an employee is 8000/month then

ESI contribution would be 8000*1.75% = 140 Rupees

Employer side- 4.75% of gross/month

ESI contribution would be 8000* 4.75% = 380 Rupees.

Salary Structure:(Vary from Company to Company and Cities to Cities)

BASIC + DA = 25-30% of CTC / 30-35% of CTC / 40-50% of CTC

(Dearness Allowance is a component, which fluctuates to handle inflation)

HRA = Maximum 50% basic (Metro cities) 40% basic (non metro cities)

Conveyance Allowances = 800 (fixed) (Vary from company / Place to Company / Place)

Other Allowances like

CTC means cost to the company.i.e .what are all the expenses incurred by the Company for any of its

employee for a particular period(monthly/yearly)

gross pay + employers pf+employers ESI + bonus = CTC

i.e THE SALARY PAYABLE AND OTHER STATUTORY BENIFTS PAYABLE BY COMPANY.

CTC is cost to company and the components are

Basic

+HRA

+CONVEYANCE

+MOBILE REIMBURSHMENT

+MEDICAL reimburshment

+All allowances

+LTA

+employer cotri of PF

+Employer Cotri towards ESI

+Total variable incentives

+Perks & benefits

+ insurance Premium (in case of Group insurance)

PROVIDENT FUND(PF)

EMPLOYER'S CONTRIBUTION

PF

PENSION

EDLI

Admin charges for Pf

Admin charges for

EDLI

13.61% on Basic

TOTAL

EMPLOYEE'S CONTRIBUTION

12% on Basic

8.33%

3.67%

0.50%

1.10%

0.01%

13.61

%

12.00

%

PF

25.61

%

GRAND TOTAL

ESI

EMPLOYER'S CONTRIBUTION

4.75%

ON GROSS

EMPLOYEE'S CONTRIBUTION

GRAND TOTAL

1.75%

6.50

%

You might also like

- Salary, Net Salary, Gross Salary, Cost To Company Are They Same or Different. For Most People It IsDocument6 pagesSalary, Net Salary, Gross Salary, Cost To Company Are They Same or Different. For Most People It IsAnonymous CwxsRiwNo ratings yet

- Whichever Is Lower Is Exempt From Tax. For ExampleDocument13 pagesWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedNo ratings yet

- Salary Break UpDocument17 pagesSalary Break UpRam Surya Prakash DommetiNo ratings yet

- ESI & PF Brief InformationDocument8 pagesESI & PF Brief InformationPrashant Dhangar0% (1)

- Statutory Compliances For HRDocument12 pagesStatutory Compliances For HRGaurav Narula83% (65)

- Anirudh Kumar JainDocument4 pagesAnirudh Kumar JainAnirudh JainNo ratings yet

- Relevant Dates: 15-Apr QuarterlyDocument6 pagesRelevant Dates: 15-Apr Quarterlysanyu1208No ratings yet

- Salary Calculation Yearly & Monthly Break Up of Gross SalaryDocument2 pagesSalary Calculation Yearly & Monthly Break Up of Gross Salarymoh300No ratings yet

- Labour Law Compliance Due DatesDocument4 pagesLabour Law Compliance Due DatesAchuthan RamanNo ratings yet

- PF & ESI Compliance GuideDocument15 pagesPF & ESI Compliance GuideAbdul KhadhirNo ratings yet

- Statutory Check List 927Document62 pagesStatutory Check List 927Saravana KumarNo ratings yet

- Godrej Construction Compliance ChecklistDocument19 pagesGodrej Construction Compliance ChecklistPashinPatell100% (1)

- EPF CalenderDocument1 pageEPF CalenderAmitav TalukdarNo ratings yet

- Statutory ComplianceDocument16 pagesStatutory ComplianceGovindNo ratings yet

- Esic ChallanDocument7 pagesEsic Challanrgsr2008No ratings yet

- Compliance ChecklistDocument66 pagesCompliance ChecklistHemant AmbekarNo ratings yet

- Dearness Allowance: by Alpi Sharma Kavya Krishnan KDocument15 pagesDearness Allowance: by Alpi Sharma Kavya Krishnan KKavya KrishnanNo ratings yet

- Leave StructureDocument8 pagesLeave StructureJignesh V. KhimsuriyaNo ratings yet

- HR Practices of Two HotelsDocument11 pagesHR Practices of Two HotelsSonica RajputNo ratings yet

- CTC - Salary CalculatorDocument4 pagesCTC - Salary Calculatorboopathi.nNo ratings yet

- Compliance PDFDocument20 pagesCompliance PDFSUBHANKAR PALNo ratings yet

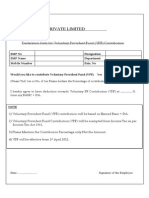

- VPF Declaration FormDocument1 pageVPF Declaration FormjerrinNo ratings yet

- Statutory Compliance Checklist.Document3 pagesStatutory Compliance Checklist.jockeyjockey0% (1)

- Guidelines On Labour LawsDocument29 pagesGuidelines On Labour LawsSARANYAKRISHNAKUMARNo ratings yet

- Registers and reports required under Factories ActDocument2 pagesRegisters and reports required under Factories ActSanjay SinghNo ratings yet

- The List of Components Which You Can Use For Salary BreakupDocument8 pagesThe List of Components Which You Can Use For Salary BreakupAnonymous VhqxrXNo ratings yet

- DGM Annexure B Know Your Pay ComponentsDocument3 pagesDGM Annexure B Know Your Pay ComponentsaakritishellNo ratings yet

- RegistrationDocument15 pagesRegistrationpratikdhond100% (3)

- Employee Provident Fund ComplianceDocument3 pagesEmployee Provident Fund ComplianceAswanth GokaNo ratings yet

- Gratuity ActDocument34 pagesGratuity Actapi-369848680% (5)

- Employee Attendance PolicyDocument5 pagesEmployee Attendance PolicyZalak ShahNo ratings yet

- Statutory CompliancesDocument4 pagesStatutory CompliancesPratibha ChopraNo ratings yet

- ECR PreparationDocument6 pagesECR Preparationkunalaggarwal123100% (10)

- EPF Provident Fund CalculatorDocument6 pagesEPF Provident Fund CalculatorUtkal SolankiNo ratings yet

- FAQ (Flexi) PDFDocument4 pagesFAQ (Flexi) PDFDivyansh Chand BansalNo ratings yet

- Higher Pension As Per SC Decision With Calculation - Synopsis1Document13 pagesHigher Pension As Per SC Decision With Calculation - Synopsis1hariveerNo ratings yet

- Payment of Bonus Act 1965Document39 pagesPayment of Bonus Act 1965Manojkumar MohanasundramNo ratings yet

- DA Wiki Explains Indian Salary SupplementDocument2 pagesDA Wiki Explains Indian Salary SupplementMathew JcNo ratings yet

- Exit PolicyDocument16 pagesExit PolicyRangunwalaNo ratings yet

- Salary Structure CalculatorDocument6 pagesSalary Structure CalculatorNisha_Yadav_6277No ratings yet

- Industrial Employment - Standing Orders Act, 1946Document11 pagesIndustrial Employment - Standing Orders Act, 1946rashmi_shantikumar100% (1)

- Form K Under Maternity Benefit ActDocument1 pageForm K Under Maternity Benefit Acthdpanchal8660% (5)

- Local Conveyance PolicyDocument4 pagesLocal Conveyance PolicyNazneen KhanNo ratings yet

- Check List For Statutory Compliance - Deposits, Returns & InformationDocument25 pagesCheck List For Statutory Compliance - Deposits, Returns & InformationHarshivLSharma83% (6)

- Joining Forms Guide for BCCL New EmployeesDocument13 pagesJoining Forms Guide for BCCL New EmployeesgopamaheshwariNo ratings yet

- What Is A Flexible Benefit Plan in A Salary Breakup? - QuoraDocument8 pagesWhat Is A Flexible Benefit Plan in A Salary Breakup? - QuoraSiNo ratings yet

- Statutory Compliance of All ActsDocument16 pagesStatutory Compliance of All ActsezhilarasanmpNo ratings yet

- Acts RegisterDocument3 pagesActs Registersheru006No ratings yet

- Introduction To Indian Labour LawsDocument23 pagesIntroduction To Indian Labour LawsSantosh Bagwe100% (2)

- FAQs On Sodexo Meal PassDocument7 pagesFAQs On Sodexo Meal PassPooja TripathiNo ratings yet

- HR Laws Check ListDocument18 pagesHR Laws Check Listdpak111No ratings yet

- Cost To The CompanyDocument15 pagesCost To The CompanyrockNo ratings yet

- PGFB1943 - Sanjana Jasmine SinghDocument4 pagesPGFB1943 - Sanjana Jasmine SinghSanjana SinghNo ratings yet

- Basics of EPF, EPS and EDLISDocument53 pagesBasics of EPF, EPS and EDLISAnjaneyulu ReddyNo ratings yet

- PF, ESI, VAT and Sales Tax Calculation ExplainedDocument1 pagePF, ESI, VAT and Sales Tax Calculation ExplainedR.Gowri Sankar RajaNo ratings yet

- Case Study 1 (Payroll Management)Document8 pagesCase Study 1 (Payroll Management)ABINYA A 2237921No ratings yet

- Complete Basic of PF&ESIDocument5 pagesComplete Basic of PF&ESIDevendradangeNo ratings yet

- Income From SalariesDocument19 pagesIncome From SalariesVineeta WadhwaniNo ratings yet

- C&BDocument24 pagesC&Bsrishashank92No ratings yet

- PF / ESIC Rate of Deduction For Both Employee & Employer ContributionDocument1 pagePF / ESIC Rate of Deduction For Both Employee & Employer ContributionNagrani PuttaNo ratings yet

- Ordinary Annuity and SuchDocument20 pagesOrdinary Annuity and SuchアゼロスレイゼルNo ratings yet

- Commissions and OverridesDocument25 pagesCommissions and OverridesCarlaRiotetaNo ratings yet

- My - Bill - 11 Apr, 2023 - 10 May, 2023 - 300886936899-1Document2 pagesMy - Bill - 11 Apr, 2023 - 10 May, 2023 - 300886936899-1Abhijnyan ChandraNo ratings yet

- The Future and Present Value of Money Over TimeDocument10 pagesThe Future and Present Value of Money Over TimeNABILAH KHANSA 1911000089No ratings yet

- Statement: Select AccountDocument22 pagesStatement: Select Accountmike brienNo ratings yet

- WellsFargo..0167 Business 2Document5 pagesWellsFargo..0167 Business 276xzv4kk5vNo ratings yet

- Halifax StatementDocument4 pagesHalifax StatementVALENTIN SHABLIKANo ratings yet

- Pension expense and liability calculationsDocument1 pagePension expense and liability calculationsCassyNo ratings yet

- Debt Acknowledgement LetterDocument1 pageDebt Acknowledgement LetterMyers BautistaNo ratings yet

- Compound Interest Formula & ExamplesDocument5 pagesCompound Interest Formula & ExamplesKim JayNo ratings yet

- List of Escalation Matrix With TAT V 1 9Document5 pagesList of Escalation Matrix With TAT V 1 9sonu11febNo ratings yet

- Since 1977Document3 pagesSince 1977Wynona Balandra0% (1)

- PFIN3 3rd Edition Gitman Solutions Manual 1Document36 pagesPFIN3 3rd Edition Gitman Solutions Manual 1rebeccabuckwecfyrisgj100% (23)

- Brown Resume-WPS OfficeDocument1 pageBrown Resume-WPS OfficeTech 4 TechnologyNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnchinna rajaNo ratings yet

- Stationery Supplies LTD: Payroll For The Month Emp No. Name Basic Pay Allowances Overtime Gross Deductions PAYEDocument7 pagesStationery Supplies LTD: Payroll For The Month Emp No. Name Basic Pay Allowances Overtime Gross Deductions PAYEGeorge KariukiNo ratings yet

- Deed of Sale and Assumption of Mortgage for Toyota VanDocument2 pagesDeed of Sale and Assumption of Mortgage for Toyota VanMark Enzo VillanuevaNo ratings yet

- 6-Cash Book Multiple Choice Questions With Answers PDFDocument14 pages6-Cash Book Multiple Choice Questions With Answers PDFHammadkhan Dj89No ratings yet

- EMI Calculator ExplainedDocument22 pagesEMI Calculator Explainedsushaht modiNo ratings yet

- Banker-Customer Relationship: M A H Sazzad ShikderDocument14 pagesBanker-Customer Relationship: M A H Sazzad ShikderManish KumarNo ratings yet

- Silicon Valley Bank AssignmentDocument2 pagesSilicon Valley Bank AssignmentMaazNo ratings yet

- Acct Statement - XX1794 - 20122023Document49 pagesAcct Statement - XX1794 - 20122023rakshit7985231877No ratings yet

- Internship Report On BAJK 2022Document37 pagesInternship Report On BAJK 2022Husnain AwanNo ratings yet

- 15 Bank Management and Funds Transfer PricingDocument23 pages15 Bank Management and Funds Transfer PricingCalebNo ratings yet

- 500 Free New Fullz ?Document555 pages500 Free New Fullz ?Mo Ar89% (27)

- Plaza Premium Lounge T NCDocument6 pagesPlaza Premium Lounge T NCNick ChengNo ratings yet

- Deed of Mortgage by Conditional SaleDocument1 pageDeed of Mortgage by Conditional SaleNiharika AgarwalNo ratings yet

- Ir340 2020 PDFDocument168 pagesIr340 2020 PDFmaria_nikol_3No ratings yet

- Jethro S. Cortado BSA 1B Goverment Grants and BorrowingDocument5 pagesJethro S. Cortado BSA 1B Goverment Grants and BorrowingJi Eun VinceNo ratings yet

- Finance in AccountingDocument5 pagesFinance in AccountingNiño Rey LopezNo ratings yet