Professional Documents

Culture Documents

How Landed Cost Management Impacts Accounting in Procure-to-Pay

Uploaded by

Abdul Rafay Khan0 ratings0% found this document useful (0 votes)

68 views7 pagesLanded Cost

Original Title

Landed Cost

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLanded Cost

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

68 views7 pagesHow Landed Cost Management Impacts Accounting in Procure-to-Pay

Uploaded by

Abdul Rafay KhanLanded Cost

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 7

anded Cost Management

Impacts the Accounting Flow in

a P2P.

Jun 24 2014

112Views

0Likes

0Comments

Share on LinkedIn

Share on Facebook

Share on Google Pluse

Share on Twitter

1. Receive the PO with estimated landed cost calculated

- Receiving Inspection a/c DR @ Estimated Landed Cost

- AP Accrual a/c CR @ PO Price inclusive of Non-Recoverable

tax

- Landed Cost Absorption a/c CR @ (Estimated Landed cost PO Price inclusive of Non-Recoverable tax) (This a/c is defined

in Receiving options)

These accounting entries can be viewed from Receiving

Transaction summary > Transactions > Tools > View

Accounting

These entries get created in rcv_receiving_sub_ledger

2. Deliver the PO to Inventory destination

For Standard Costing organization

- Material Valuation a/c DR @ Std Cost

- Receiving Inspection a/c CR @ Estimated Landed Cost

- Purchase Price Variance a/c DR @ difference between Std

Cost and Estimated Landed Cost

For Average Costing organization

- Material Valuation a/c DR @ Estimated Landed Cost

- Receiving Inspection a/c CR @ Estimated Landed Cost

These entries can be viewed from Inventory > Material

Transactions > Distributions

These entries get created in mtl_transaction_accounts

3. Invoice validated and actual landed cost calculated

Once the Actual Landed Cost is calculated, LCM will populate

this information in cst_lc_adj_interface with rcv_transaction_id

corresponding to the receipt to which the invoice is matched.

Then the adjustment entries would get created as given

below on running the Landed Cost Adjustment Processor

Landed cost Adjustment - Receiving

- Receiving Inspection a/c DR @ difference between Actual LC

and Estimated LC

- Landed Cost Absorption a/c CR @ difference between Actual

LC and Estimated LC

Landed cost Adjustment - Delivery (Standard Costing)

- Receiving Inspection a/c CR @ difference between Actual LC

and Estimated LC

- Purchase Price Variance a/c DR @ difference between Actual

LC and Estimated LC

Landed cost Adjustment - Delivery (Average Costing)

- Receiving Inspection a/c CR @ difference between Actual LC

and Estimated LC

- Landed Cost Absorption a/c DR @ difference between Actual

LC and Estimated LC

These accounting entries can be viewed from Receiving

Transaction summary > Transactions > Tools > View

Accounting

These entries get created in rcv_receiving_sub_ledger

Average Cost Update (Average Costing)

- Material Valuation a/c DR @ difference between Actual LC

and Estimated LC

- Landed Cost Absorption a/c CR @ difference between Actual

LC and Estimated LC

LC Variance account is hit ONLY when the available onhand

quantity is less that the received (to be adjusted) quantity

but NOT zero. When the onhand balance is zero or negative,

the average cost variance account is hit

If this Average cost update happens for updating the item

cost with the difference between Actual and Estimated landed

cost for an item which has 0 or negative on-hand quantity,

then the accounting entries would be as follows:

- Material Valuation a/c DR @ 0

- Landed Cost Absorption a/c CR @ difference between Actual

LC and Estimated LC

- Average Cost Variance a/c DR

These entries can be viewed from Inventory > Material

Transactions > Distributions

These entries get created in mtl_transaction_accounts

The link between the Receiving transaction and Average

Cost update is done through txn_source_line_id.

Rcv_transaction_id of deliver transaction is stamped as

txn_source_line_id in mtl_material_transactions for the

LCM adjustment transaction which has the transaction

type as Average Cost Update.

4. Create accounting for item invoice

- AP Accrual a/c DR @ PO Price

- Tax a/c DR @ tax rate

- Liability a/c CR @ Invoice Price including tax

- LCM:Invoice Price Variance a/c DR @ difference between PO

Price and Invoice Price (This IPV a/c is defined in Receiving

options)

- LCM:Exchange Rate Variance a/c DR @ difference between

receipt exchange rate and Invoice exchange rate (This ERV

a/c is defined in Receiving options)

5. Create accounting for charge invoice

- Default Charge a/c DR @ invoice price (This charge a/c is

defined in Receiving options)

- Liability a/c CR @ invoice price

6. Perform Return transaction or negative correction after

invoice is accounted and actual landed cost is calculated

Return to Vendor /Negative Correction

- Receiving Inspection a/c CR @ Actual Landed Cost

- AP Accrual a/c DR @ PO Price + Non-Recoverable Tax

- Landed Cost Absorption a/c DR (Actual Landed Cost - {PO

Price+Non-Recoverable Tax})

These accounting entries can be viewed from Receiving

Transaction summary > Transactions > Tools > View

Accounting

These entries get created in rcv_receiving_sub_ledger

Return to Receiving/Negative Correction (Standard Costing)

- Material Valuation a/c CR @ Std Cost

- Receiving Inspection a/c DR @ Actual Landed Cost

- Purchase Price Variance a/c CR @ difference between Std

cost and Actual Landed Cost

Return to Receiving/Negative Correction (Average Costing)

- Material Valuation a/c CR @ Actual Landed Cost

- Receiving Inspection a/c DR @ Actual Landed Cost

These entries can be viewed from Inventory > Material

Transactions > Distributions

These entries get created in mtl_transaction_accounts

7. Raise a Debit Note

- AP Accrual a/c CR @ PO Price

- Tax CR @ tax rate

- Liability a/c DR @ Invoice Price including tax

- Invoice Price Variance a/c CR @ difference between PO price

and Invoice Price

Note:

1. Estimated and Actual Landed Cost are always inclusive of

PO price and Non-Recoverable tax.

2. Landed Cost Absorption account need not be having zero

balance at the end of this procure to pay cycle in LCM

enabled organization. It will be zero only if the Actual landed

cost has been calculated and the Charge a/c, IPV a/c and

Landed Cost

Absorption account are the same

3. Accounting entries for Expense POs and Shopfloor

destination POs has no impact as Landed Cost Management

is not applicable for Purchase Orders with Expense and

Shopfloor destination.

4. Landed Cost Management has no impact on the

Encumbrance Accounting as the PO gets reserved at PO price

and it gets reversed at PO price only even though the actual

charge account get hit at landed cost.

5. Retroactive Pricing is not supported in LCM enabled

organization and hence retroactive price update program will

not create the retroactive price adjustment entries in

Receiving subledger for the receiving transactions created.

You might also like

- LCM Accounts Payable Setup and Landed Cost ReconciliationDocument5 pagesLCM Accounts Payable Setup and Landed Cost Reconciliationjazharscribd100% (1)

- ATT - 337077586686 - 20141222 (1) Rachel Ostorga Sakhi & Jose Moises Ostorga Pozo (AT&T Cellphone Utility Bills)Document12 pagesATT - 337077586686 - 20141222 (1) Rachel Ostorga Sakhi & Jose Moises Ostorga Pozo (AT&T Cellphone Utility Bills)Rachel Sakhi100% (1)

- Oracle LCM titleDocument4 pagesOracle LCM titlephoganNo ratings yet

- LCM EntriesDocument8 pagesLCM EntriesMuhammad Faysal100% (1)

- Accounting Entries LCM ORACLE R12Document4 pagesAccounting Entries LCM ORACLE R12ali iqbalNo ratings yet

- Consigned Inventory FlowDocument13 pagesConsigned Inventory FlowIndra StpNo ratings yet

- How SAP Pricing Works Step-by-StepDocument8 pagesHow SAP Pricing Works Step-by-StepPranshu Rastogi100% (2)

- Period Closing ActivitiesDocument16 pagesPeriod Closing ActivitiesAshu GroverNo ratings yet

- Funds Accrual Engine (FAE) (Doc ID 1606530.2)Document17 pagesFunds Accrual Engine (FAE) (Doc ID 1606530.2)Sandeep Kavuri100% (1)

- R12 GL StudyDocument60 pagesR12 GL StudySingh Anish K.No ratings yet

- Oracle SCM Accounting Quick Reference - Discrete ManufacturingDocument5 pagesOracle SCM Accounting Quick Reference - Discrete ManufacturingtiwarihereNo ratings yet

- Accruals and Accounting FaqDocument3 pagesAccruals and Accounting Faqandrew_bw100% (1)

- AutoAccounting FAQ provides troubleshooting tipsDocument10 pagesAutoAccounting FAQ provides troubleshooting tipsFahd AizazNo ratings yet

- Import Gold Dubai ProcedureDocument3 pagesImport Gold Dubai ProcedureYulia PuspitasariNo ratings yet

- R12: Introduction To Asset TrackingDocument9 pagesR12: Introduction To Asset TrackingAymen HamdounNo ratings yet

- Sap SD Interview QuestionsDocument0 pagesSap SD Interview QuestionsSA130974No ratings yet

- Oracle Fusion Complete Self-Assessment GuideFrom EverandOracle Fusion Complete Self-Assessment GuideRating: 4 out of 5 stars4/5 (1)

- AR Period Close Checklist: Day Step Process Navigation Path (Top-Ten Shortcut) Process DescriptionDocument4 pagesAR Period Close Checklist: Day Step Process Navigation Path (Top-Ten Shortcut) Process Descriptionveerankisai13No ratings yet

- Average Vs Standard Costing1Document3 pagesAverage Vs Standard Costing1Abdul Rafay Khan100% (1)

- Charge Account DetailsDocument1 pageCharge Account DetailsDeepika NathanyNo ratings yet

- Guide to Return to Vendor (RTV) ProcessDocument10 pagesGuide to Return to Vendor (RTV) ProcessSiddharth BiswalNo ratings yet

- R12 - Receivables Setups (Ar) in Oracle AppsDocument38 pagesR12 - Receivables Setups (Ar) in Oracle Appsmk_k80100% (1)

- LCM Setup PDFDocument25 pagesLCM Setup PDFAmcymonNo ratings yet

- INV, Costing Period CloseDocument9 pagesINV, Costing Period CloseMd MuzaffarNo ratings yet

- Is The Transfer of Invoice Price Variance Not Updating Item CostDocument10 pagesIs The Transfer of Invoice Price Variance Not Updating Item Costmks210No ratings yet

- SAP Signavio InsightsDocument208 pagesSAP Signavio InsightsOrion RigelNo ratings yet

- Practice of Setup Steps for Procurement Contracts in R12Document45 pagesPractice of Setup Steps for Procurement Contracts in R12khalidsn75% (4)

- Accounting For AR AP TransactionsDocument9 pagesAccounting For AR AP TransactionsFeroz MohammedNo ratings yet

- The Purchasing Accounts Derived On The Requisitions and Purchase OrdersDocument11 pagesThe Purchasing Accounts Derived On The Requisitions and Purchase OrdersrahuldisyNo ratings yet

- FAQ On ProjectsDocument5 pagesFAQ On ProjectsDhaval GandhiNo ratings yet

- Chapter 7 - Marketing PlanDocument52 pagesChapter 7 - Marketing PlanReina0% (1)

- Oracle R12 Fixed Asset Solution For Dual GAAP LedgersDocument30 pagesOracle R12 Fixed Asset Solution For Dual GAAP LedgersKripaShankarNo ratings yet

- What Are The Accounting Entries in A LCMDocument3 pagesWhat Are The Accounting Entries in A LCMratna8282No ratings yet

- How Does The Landed Cost Management Impacts The Accounting Flow in A Procure To Pay CycleDocument5 pagesHow Does The Landed Cost Management Impacts The Accounting Flow in A Procure To Pay CycleTito247100% (1)

- LCM Accounting in P2PDocument4 pagesLCM Accounting in P2Pramthilak2007gmailcomNo ratings yet

- Landed Cost ProcessDocument17 pagesLanded Cost Processvedavyas4funNo ratings yet

- How To Return Consigned Item After ConsumptionDocument2 pagesHow To Return Consigned Item After ConsumptionDuygu CoşkunNo ratings yet

- LCMDocument3 pagesLCMPritesh MoganeNo ratings yet

- Auto Invoice FAQDocument11 pagesAuto Invoice FAQblshinde88No ratings yet

- A Brief Guide To Periodic Average Costing (PAC)Document21 pagesA Brief Guide To Periodic Average Costing (PAC)Indra StpNo ratings yet

- Profile Options in INV PO OM MSDocument48 pagesProfile Options in INV PO OM MSMaqsood JoyoNo ratings yet

- Oracle OM R12 New FeaturesDocument3 pagesOracle OM R12 New FeaturesMike BuchananNo ratings yet

- Oracle Landed Cost Management - 2 PDFDocument3 pagesOracle Landed Cost Management - 2 PDFMohamed MahmoudNo ratings yet

- El Shaye B Expense Sub Inventory and ItDocument27 pagesEl Shaye B Expense Sub Inventory and ItMadhusudhan Reddy VangaNo ratings yet

- Accounting Reporting Sequences Whitepaper Explains SetupDocument36 pagesAccounting Reporting Sequences Whitepaper Explains SetupGeorge Joseph100% (1)

- Setup and Defaulting of Accounts in A Purchasing Encumbrance EnvironmentDocument7 pagesSetup and Defaulting of Accounts in A Purchasing Encumbrance EnvironmentMuhammad Wasim QureshiNo ratings yet

- India Localization Inter Org TransferDocument33 pagesIndia Localization Inter Org TransferSanthosh KumarNo ratings yet

- Approved Supplier Lists in OracleDocument2 pagesApproved Supplier Lists in OracleBharathiPdNo ratings yet

- Difference Between Amortized and Expensed Adjustments in Oracle Assets - Oracle E-Business Suite Support BlogDocument4 pagesDifference Between Amortized and Expensed Adjustments in Oracle Assets - Oracle E-Business Suite Support Blogshankar pNo ratings yet

- Landed Cost Management Blackbox ScenarioDocument18 pagesLanded Cost Management Blackbox ScenarioelpashotyNo ratings yet

- Purchasing Approval HierarchiesDocument10 pagesPurchasing Approval HierarchiesAli xNo ratings yet

- Best Practices For Oracle ReceivablesDocument31 pagesBest Practices For Oracle ReceivablesHussein SadekNo ratings yet

- Setups For IR-ISODocument25 pagesSetups For IR-ISOSrinivasa PrabhuNo ratings yet

- How To Setup Freight For AutoInvoice and The Transactions Workbench (Doc ID 1096942.1)Document9 pagesHow To Setup Freight For AutoInvoice and The Transactions Workbench (Doc ID 1096942.1)NathanNo ratings yet

- SLA Part 2 Entities - Event Class - Event Types PDFDocument6 pagesSLA Part 2 Entities - Event Class - Event Types PDFsoireeNo ratings yet

- Shipping Ship Method Freight Charges Oracle AppsDocument12 pagesShipping Ship Method Freight Charges Oracle AppsRamesh GarikapatiNo ratings yet

- White Paper On Burden CostsDocument11 pagesWhite Paper On Burden CostschandraNo ratings yet

- Autoinvoice ErrorDocument2 pagesAutoinvoice ErrorConrad RodricksNo ratings yet

- Receiving Options Oracle AppsDocument2 pagesReceiving Options Oracle AppsDheeraj ThapaNo ratings yet

- SCP DemandPlanningScalability R13Document20 pagesSCP DemandPlanningScalability R13javierNo ratings yet

- WIP VarianceDocument34 pagesWIP Varianceanchauhan30610% (1)

- Cost ManagementDocument78 pagesCost ManagementSudheer SanagalaNo ratings yet

- Central Authentication Service CAS Complete Self-Assessment GuideFrom EverandCentral Authentication Service CAS Complete Self-Assessment GuideNo ratings yet

- Practice R12 Assets1Document112 pagesPractice R12 Assets1Abdul Rafay KhanNo ratings yet

- Advance Supply Chain Planning For Oracle Process Manufacturing - TRAINDocument63 pagesAdvance Supply Chain Planning For Oracle Process Manufacturing - TRAINAbdul Rafay KhanNo ratings yet

- Class 2-Process ExecutionDocument1 pageClass 2-Process ExecutionAbdul Rafay KhanNo ratings yet

- Fall 2011Document36 pagesFall 2011Abdul Rafay KhanNo ratings yet

- Org SetupsDocument3 pagesOrg SetupsAbdul Rafay KhanNo ratings yet

- ERP Implementation Steps and Process MappingDocument2 pagesERP Implementation Steps and Process MappingAbdul Rafay KhanNo ratings yet

- SetupsDocument1 pageSetupsAbdul Rafay KhanNo ratings yet

- SetupsDocument1 pageSetupsAbdul Rafay KhanNo ratings yet

- OpmDocument2 pagesOpmAbdul Rafay KhanNo ratings yet

- RM Limestone 100 Clay 75 Coal 300Document8 pagesRM Limestone 100 Clay 75 Coal 300Abdul Rafay KhanNo ratings yet

- Vat and SD Act 2012: Rahman Rahman HuqDocument28 pagesVat and SD Act 2012: Rahman Rahman HuqbappyNo ratings yet

- Rixson Price Book 2012Document144 pagesRixson Price Book 2012Security Lock DistributorsNo ratings yet

- Shakti TradersDocument3 pagesShakti TradersAlok Kumar BiswalNo ratings yet

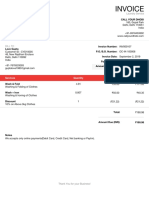

- Invoice 15Document2 pagesInvoice 15Aana sayedNo ratings yet

- Vaccum Cleaner Bill 2019Document2 pagesVaccum Cleaner Bill 2019KrishnaKumar MNo ratings yet

- SudanDocument2 pagesSudanKelz YouknowmynameNo ratings yet

- Test 6Document32 pagesTest 6Santosh JagtapNo ratings yet

- Office Procedures Guide for Bills, Invoices & PaymentsDocument23 pagesOffice Procedures Guide for Bills, Invoices & PaymentsGODWINNo ratings yet

- Chapter 2Document21 pagesChapter 2Severus HadesNo ratings yet

- EPOS User ManualDocument17 pagesEPOS User ManualSree288No ratings yet

- Vat Guide Accounts PayableDocument24 pagesVat Guide Accounts Payablekrishnan_rajesh5740No ratings yet

- SalesDocument8 pagesSalesKeith GuzmanNo ratings yet

- Analysis of Business TransactionsDocument2 pagesAnalysis of Business Transactionskianna aquino100% (1)

- Invoice TemplateDocument1 pageInvoice TemplatesanjeevisfathernowNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sumit PatelNo ratings yet

- SUMMER PRO - Dairyy.productssDocument63 pagesSUMMER PRO - Dairyy.productssManpreetsandher Sandher50% (2)

- Inter Company BillingDocument5 pagesInter Company BillingMaheshJMNo ratings yet

- Ejemplos de FacturaDocument4 pagesEjemplos de Facturajordan amadorNo ratings yet

- Proforma InvoiceDocument1 pageProforma InvoiceNaveen KumarNo ratings yet

- Introduction - ISEB AccountingDocument18 pagesIntroduction - ISEB AccountingScribdTranslationsNo ratings yet

- Oc Ik 100008Document1 pageOc Ik 100008Jagjeet SinghNo ratings yet

- Inventory Accounting EntriesDocument10 pagesInventory Accounting EntriesswayamNo ratings yet

- Accenture V Commissioner, GR 190102, July 11, 2012Document20 pagesAccenture V Commissioner, GR 190102, July 11, 2012Eumell Alexis PaleNo ratings yet

- Inv 168452Document1 pageInv 168452salesNo ratings yet