Professional Documents

Culture Documents

Tab 5

Uploaded by

Ian Terence SheltonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tab 5

Uploaded by

Ian Terence SheltonCopyright:

Available Formats

noceccea wnen compterea

LA DIRECTION DES FINANCES

f "\\I

'' "\ \ 11

THE SENATE

'/

A~~ o~

(Nrl

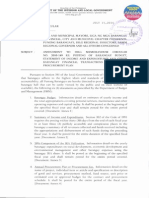

DECLARATION OF PRIMARY ANO SECONDARY RESIDENCfES

Senators ' Living Expenses in the National Capital Region

J...{JS i '() /)...

LE

s EN Ar

:f

tJf:lf.

/.e

~ INANCIAL DIRECTORATE

Period covered from Aoril 151 2012 to March 31st . 201 ---:>:::('""--.;;;..;;;..;.:..;,:~~~~._J

/.

v -

PRIMARY RESIDENCE

l , the Honourable

Michael Duffy, member of the

; J~

Senate for the province or territory of Prince

-- .; ...~

Edward

Island, declare that:

My primary residence is within 100 kilometres from Parliament Hill.

~ My

primary residence is more than 100 kilometres from Parliament R ill.

For the purpose of the Twenty-Second Report of the Standing Senate Committee on Internal Economy, Budgets

and Administration, adopted in the Senate on June 18, 1998, the address of my prim ary residence in the province

or territory that I represent is the following:

Address:

10 Friendly Lane

City:

Unit #:

Cavendish

Province:

n/a

Postal Code: COA INO

PE

SECONDARY RESIDENCE IN THE NCR (to be filled only by senators whose primary residence is more than

100 kilometres from Parliament Hill)

A.

B.

A Senator who fil!.!!! a secondary residence in the NCR will be reimbursed a Oat rate, as determined by the

Standing Committee on J11tem al Economy, Budgets am/ Administrati011, for each day such residence is

available for the Senator' s occupancy, and providing that during such time it is not rented to another person

or claimed as a n expense by another Senator. T he followin g conditions apply:

Only one claim per day for accommodation costs may be made for that dwelling; and

The Senator must submit a copy of the municipal tax sta tement as proof of ownership on a yearly basis

0 Proof anached

1 do oot own or rent a secondary residence in the NCR.

Own ~ I own a secondary residence in the NCR and meet the above conditions.

c.

A Senator who leases or rents accommodations in the NCR will be reimbursed as long as funds for its

monthly costs remain available for this purpose. The following conditions a pply:

The Senator must submit a copy of the lease agreement and proof of payment; D Lease attached

The lessor is not a " family member" as defined in the Senate Administrative Rules;

Entering into tbe lease will oot further the private i terests of the Senator or those of his or her

" family member"; and

No Senator or his or her " family member" shall have an interest in a partnership or private corporation that is a

party to such lease under which the partnership or corporation receives a benefit.

Rent

Address:

I rent a secondary residence in the NCR and meet the above conditions.

47 Morenz Terrace

City:

Unit #:

Ottawa

Province:

ON

Postal Code:

o/a

K2K3A2

Landlord: (if applicable)

SENATOR'S DECLARATION

I declare that the infonnation provided above is accurate as of the date of this declaration and that aU receipts or

reimbursement requests are compliant with the Senate Administration Rules and Senate policies and guidelines.

I will advise tJ1e Financ ial Services Div is ion im me~ of any c hanges in the status o f my residences and w ill

amend th\isJ

v

e/\M~ /

-

Senator's Signature

Date

FINANCJAL SERVICES DIVISION USE O NLY

Entered by:

~ . A.A.CIA ~L

Print Name

d~~

Date:

rC14

3I :i.a1. L

Submit duly completed form to Finance and Procurement Directorate, 40 Elgin Street, 11 lh floor, Ottawa, Ontario, K I A OA4

SENATE

SE NAT

CANADA

With the Compliments of

Hon. Mike Duffy

Senator - Cavendish

frCll1C..P

I

a~ nu!.J?{{C'J1.....!a/, l! U rC I ,a. (

s Ir:;: t .e1 }1. (U115 CU0? 111! (Pt';z$' qc. ( I~)

1

-IL1 I/.

J l tn...t '-r/'V.1-p{-Cre Su J:J<-tff.r_

k> I I( ~ ~)J;,?1 + h1 ~ (a W.S-f- ~1-1/u fCti ffuL-- '-LfYJu .

Tha11 f(

yaL<,

Tel: (613) 947-4163- Fax: (613) 947-4157/)

The Senate, Ottawa, ON K1A OA4

mikeduffy@sen.parl.gc.ca

..ofa, 1.,(~

(6ttawa

TAX BILL I

RELEVE D'IMPOSITION

City of Ottawa Revenue Branch

Direction des recettes Ville d'Ottawa

Tel.\TEil: 613580-2444 Fax\Telecopieur: 613-580-2457

TIY: 613-580-2401 ATS: 613-580-2401

FINAL 2012 TAXES I

IMP0TS TOTAUX 2012

BILLING DATE I DATE DE FACTURATION

JUN/JUIN 19, 2012

ROLL NUMBER I NUMERO DU R6LE

061 4.300.81 1.42805.0000

1111m ~m ~ 11111111111 m11 11111 1111111111 ~rn u11 111111111111m1111111111 nmnm 11111 1111 1111

LA L.. 1. :_c 10

...

DUFFY MICHAEL

DUFFY HEATHER

47 MORENZ TERR

KANATA ON K 2K 3H2

cs

FTP

..JUI~ .

..JUN

3021

z9 2012

E ENAI

IA I 1:11"' L 1r-, An:

f;lfJ t1t

- - -

---

ASSESSMENT I EVALUATION

Tax Class I

Categorie d'impdts

RTEP

RT-T

RT-POL

RT-HOO

RT-FSU

RT-CAL

Value I

Valeur

395.000

395.000

395,000

395.000

395.000

395.000

PROPERTY INFORMATION / INFORMATIONS fONCl~RES

DUFFY MICHAEL

DUFFY HEATHER

47 MORENZ TERR

PLAN 4M651 PT BLK 127 RP

4R18263 PART 1 1/94TH INT

4R15507 PARTS 1AND35 TO 40

IRREG 2854.18SF 29.00FR 98.4

MUNICIPAL I MUNICIPALE

EDUCATION I SCOLAIRE

Municipal Levies

Tax Rate%

Prelevements Municipal

Taux d"imposition %

ClnWIDE I VILLE ENTIERE

.554056

TRANSIT/TRANSP. URB.

.177495

OTIAWA POLICE D'OTIAWA

.165282

KANATA NORTH PROJIPROJET NORD

.003421

FIRE/INCENDIE SERV

.0961 14

CONS AUTHORITY/AU T DE CONSERV

.007028

Municipal Levy

SUB TOTALS I

TOTAUX PARTIELS:

lmpots municlpaux

SPECIAL CHARGES I CREDITS

FRAIS SPECIAUX I CREDITS

Amount

Montan!

:?, 188.52

701.11

652.86

13.51

379.65

27.76

Tax Rate %

Taux d'imposition %

.221000

Amount

Montant

872.95

Education Levy

lmpots scolaires

SUMMARY

SOMMAIRE

Tax Levy Sub-total ( Municipal+ Education)

Total partial des lmpOls (municlpaux + scolalres)

Special Charges I Credits

Frais speciaux I Credits

S3,963.41

SWC SOLID WASTE CURBSIDE SERVICE

SERVICE D~CHETS BORDURE DE RUE

UNITS/UNITES 1 @ $93.00

93.00

$872.95

$4,836.36

$93.00

2012 Tax Cap Adjuslment

Redressement d'imp6l de 2012 salon le plafonnement

Final 2012 Taxes

lmpots totaux de 2012

Less Interim Billing

Moins facturahon inlerimaire

Past Due/Credit (as of JUN 19. 2012)

Arrerages I Credit (au JUN 19. 2012)

$93.00

TOTAL:

Account Balance I Soldo du Compte:

Receipt portion to retain for your records.

-$485.38

$2,019.36

C~TE SEULEMENT

Pre leveme nt~preautorises

0614 .300.811.42805.0000

Paid in full nee all payments have cleared.

Ragle en eniler un ois tous les paiements cffectues.

Account Balance I Solde du Compte:

$2,019.36

~ount/Monlaf!.t

Withdrawal Date/La date du prelevement:

JUUJUIL 15, 2012

AUG/AOUT 15. 2012

SEP/SEPT 15, 2012

OCT/OCT 15, 2012

$505.00

$505.00

$505.00

$504 36

$2,019.36_....

~

Estimated 2013 Taxes / Impels estimatifs pour 2013:

2013 Pre-authorized Monthly Withdrawal s Starting JAN 1 5, 2013

Retraits m ensuels preau torises pour 2013

-$2.424.62

Rei;u A conserv; fdans vos dossiers.

SEE REVERSE I VOIR AU VERSO

Pre-Authorized Automatic Withdrawals

ROLL NUMBER I NUMERO DU ROLE

Name I

DUFFY MICHAEL

N orn

DUFFY HEATHER

$4,929.36

.J

STATEMENT ONLY I ETAT DE

STATEMENT ONLY I ETAT DE COMPTE SEULEMENT

S0.00

a compter du JAN 15, 2013:

$4 ,929.36

(SEE REVERSE)

(VOIR AU VERSO)

~ (TOTAU10 MONTHS)

(TOTAU 10 MOIS)

You might also like

- Michael Duffy Prince Edward Island: lES ATDocument4 pagesMichael Duffy Prince Edward Island: lES ATIan Terence SheltonNo ratings yet

- CMS Report PDFDocument8 pagesCMS Report PDFRecordTrac - City of OaklandNo ratings yet

- August 4, 2004 Final Tract Map 31631Document75 pagesAugust 4, 2004 Final Tract Map 31631Brian DaviesNo ratings yet

- Pembroke STM WarrantDocument5 pagesPembroke STM WarrantmarshfieldmarinerNo ratings yet

- RESOLUTION 11:19-1 OF 2010 Resolution Adopting Budget For Fiscal Year 2011 WhereasDocument4 pagesRESOLUTION 11:19-1 OF 2010 Resolution Adopting Budget For Fiscal Year 2011 Whereasapi-107641637No ratings yet

- BARANGAY FINANCIAL DOCUMENTSDocument17 pagesBARANGAY FINANCIAL DOCUMENTSCarlo Torres100% (1)

- CMS Report PDFDocument8 pagesCMS Report PDFRecordTrac - City of OaklandNo ratings yet

- Council Tax LeafletDocument2 pagesCouncil Tax LeafletabaragbcNo ratings yet

- CMS Report PDFDocument62 pagesCMS Report PDFRecordTrac - City of OaklandNo ratings yet

- 20150120-G. H. Schorel-Hlavka O.W.B. To MR TONY ABBOTT PM-Re Melbourne's East West Link-EtcDocument5 pages20150120-G. H. Schorel-Hlavka O.W.B. To MR TONY ABBOTT PM-Re Melbourne's East West Link-EtcGerrit Hendrik Schorel-HlavkaNo ratings yet

- PR Report CC Fire MeetingDocument2 pagesPR Report CC Fire MeetingdtlaurabsileoNo ratings yet

- Local Government Financial Statistics England #23-2013Document222 pagesLocal Government Financial Statistics England #23-2013Xavier Endeudado Ariztía FischerNo ratings yet

- Sullivan County Enacts Cuts, Including Staff ReductionsDocument11 pagesSullivan County Enacts Cuts, Including Staff ReductionsLissa HarrisNo ratings yet

- SBN-0591: Condonation of All Unpaid Income Taxes Due From Local Water DistrictsDocument7 pagesSBN-0591: Condonation of All Unpaid Income Taxes Due From Local Water DistrictsRalph RectoNo ratings yet

- 2004-1 CFDMinutes Formation 05192004.XxxpdfDocument30 pages2004-1 CFDMinutes Formation 05192004.XxxpdfBrian DaviesNo ratings yet

- Physics Cutnell 9th Edition Test BankDocument24 pagesPhysics Cutnell 9th Edition Test BankSamuelMcclurectgji100% (46)

- CMS Report PDFDocument8 pagesCMS Report PDFRecordTrac - City of OaklandNo ratings yet

- New - Haven - FY 2015-16 Mayors Budget1Document419 pagesNew - Haven - FY 2015-16 Mayors Budget1Helen BennettNo ratings yet

- Republic of The Philippines Office of The Regional Treasury: Autonomous Region in Muslim MindanaoDocument18 pagesRepublic of The Philippines Office of The Regional Treasury: Autonomous Region in Muslim MindanaoMaryan MokamadNo ratings yet

- Staffieri 2011 2Document41 pagesStaffieri 2011 2The Valley IndyNo ratings yet

- SALN 2024 v2 AGR PresentationDocument87 pagesSALN 2024 v2 AGR PresentationdmesteachersNo ratings yet

- Brook Voting RecordDocument585 pagesBrook Voting RecordRecordTrac - City of OaklandNo ratings yet

- Chapter 5 Governmental AccountingDocument9 pagesChapter 5 Governmental Accountingmohamad ali osmanNo ratings yet

- HB 1192, PN 1959 - PA State BudgetDocument384 pagesHB 1192, PN 1959 - PA State BudgetJim CoxNo ratings yet

- Print Preview - Final Application: Project Name and LocationDocument34 pagesPrint Preview - Final Application: Project Name and LocationRyan SloanNo ratings yet

- Article 8Document69 pagesArticle 8Jemielle Patriece NarcidaNo ratings yet

- Bill Saffo Direct TestimonyDocument21 pagesBill Saffo Direct TestimonyMichael PraatsNo ratings yet

- Fy2012 2014 PDFDocument142 pagesFy2012 2014 PDFRecordTrac - City of OaklandNo ratings yet

- Dilg Memocircular 2014724 - 235e18bc66Document17 pagesDilg Memocircular 2014724 - 235e18bc66Rg PerolaNo ratings yet

- Local Property TaxationDocument39 pagesLocal Property TaxationMadonna Claire Valdez-AguilarNo ratings yet

- ANC 8E Did Not Properly Support All Reported Expenditures: February 10, 2015Document14 pagesANC 8E Did Not Properly Support All Reported Expenditures: February 10, 2015congressheightsontheriseNo ratings yet

- A Resident's Guide To North Highline Annexation: Oskar Abian-University of WashingtonDocument33 pagesA Resident's Guide To North Highline Annexation: Oskar Abian-University of Washingtonapi-463686768No ratings yet

- January 7, 2014 - PacketDocument75 pagesJanuary 7, 2014 - PacketTimesreviewNo ratings yet

- And and And: AiftionDocument14 pagesAnd and And: AiftionBerkeleySchools2010No ratings yet

- CMS Report PDFDocument8 pagesCMS Report PDFRecordTrac - City of OaklandNo ratings yet

- SB Decision on 86 Million Highway ScamDocument31 pagesSB Decision on 86 Million Highway Scammel bNo ratings yet

- CMS PDFDocument10 pagesCMS PDFRecordTrac - City of OaklandNo ratings yet

- Filbert's CreekDocument34 pagesFilbert's CreekRyan SloanNo ratings yet

- Auditor FormsDocument10 pagesAuditor FormsRobin OdaNo ratings yet

- Local Govt ReportDocument4 pagesLocal Govt ReportHao Wei WeiNo ratings yet

- The Community Preservation Act in Northampton Summary, 11-3-11Document5 pagesThe Community Preservation Act in Northampton Summary, 11-3-11Adam Rabb CohenNo ratings yet

- CIty Ordinance 2021-012. - Amnesty To Tax PayerspdfDocument4 pagesCIty Ordinance 2021-012. - Amnesty To Tax PayerspdfEmily BondadNo ratings yet

- Regular: Republic of The PhilippinesDocument13 pagesRegular: Republic of The PhilippinesHjktdmhmNo ratings yet

- Frank H Seay Financial Disclosure Report For 2009Document8 pagesFrank H Seay Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Earmark RequestDocument1 pageEarmark RequestdjsunlightNo ratings yet

- City of Detroit 2015 CAFR FINALDocument243 pagesCity of Detroit 2015 CAFR FINALWDET 101.9 FMNo ratings yet

- 02StructureOfGovt ExecBranchDocument20 pages02StructureOfGovt ExecBranchMohd Noor FakhrullahNo ratings yet

- Tucker L Melancon Financial Disclosure Report For 2010Document7 pagesTucker L Melancon Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- 1601e Form PDFDocument3 pages1601e Form PDFLee GhaiaNo ratings yet

- Clinton Foundation Before NY StateDocument99 pagesClinton Foundation Before NY StateDaily Caller News FoundationNo ratings yet

- Exhibit E District Counsel's Opinon.Document2 pagesExhibit E District Counsel's Opinon.Brian DaviesNo ratings yet

- David C Norton Financial Disclosure Report For 2009Document19 pagesDavid C Norton Financial Disclosure Report For 2009Judicial Watch, Inc.No ratings yet

- Ginal: TRFTRDocument8 pagesGinal: TRFTRChapter 11 DocketsNo ratings yet

- Iloilo City Tax Ordinance 2007-016Document196 pagesIloilo City Tax Ordinance 2007-016Iloilo City Council88% (8)

- Stamford Water Distribution Replacement ProjectDocument81 pagesStamford Water Distribution Replacement ProjectChris BrazellNo ratings yet

- Frank H Seay Financial Disclosure Report For 2010Document25 pagesFrank H Seay Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Taxes Have Consequences: An Income Tax History of the United StatesFrom EverandTaxes Have Consequences: An Income Tax History of the United StatesRating: 5 out of 5 stars5/5 (1)

- Tab 6Document7 pagesTab 6Ian Terence SheltonNo ratings yet

- Regina v. DUFFY Exhibit 1B, Tab 4Document12 pagesRegina v. DUFFY Exhibit 1B, Tab 4Ottawa CitizenNo ratings yet

- Ex-Bloc MP Maria Mourani's LetterDocument2 pagesEx-Bloc MP Maria Mourani's LetterMontreal GazetteNo ratings yet

- 2013-08-13 Transcript InCamera Eng Tabled 2013-10-28Document19 pages2013-08-13 Transcript InCamera Eng Tabled 2013-10-28Ian Terence SheltonNo ratings yet

- 2013-08-12 Transcript InCamera Eng Tabled 2013-10-28Document23 pages2013-08-12 Transcript InCamera Eng Tabled 2013-10-28Ian Terence SheltonNo ratings yet

- 2013-08-13 Transcript InCamera Eng Tabled 2013-10-28Document19 pages2013-08-13 Transcript InCamera Eng Tabled 2013-10-28Ian Terence SheltonNo ratings yet

- Farming The Mailbox PrecisDocument7 pagesFarming The Mailbox PrecisIan Terence SheltonNo ratings yet

- History: The Origin of Kho-KhotheDocument17 pagesHistory: The Origin of Kho-KhotheIndrani BhattacharyaNo ratings yet

- Protein Synthesis: Class Notes NotesDocument2 pagesProtein Synthesis: Class Notes NotesDale HardingNo ratings yet

- General Physics 1: Activity Title: What Forces You? Activity No.: 1.3 Learning Competency: Draw Free-Body DiagramsDocument5 pagesGeneral Physics 1: Activity Title: What Forces You? Activity No.: 1.3 Learning Competency: Draw Free-Body DiagramsLeonardo PigaNo ratings yet

- Fundamentals of Financial ManagementDocument550 pagesFundamentals of Financial ManagementShivaang Maheshwari67% (3)

- History of Downtown San Diego - TimelineDocument3 pagesHistory of Downtown San Diego - Timelineapi-671103457No ratings yet

- Math 8 1 - 31Document29 pagesMath 8 1 - 31Emvie Loyd Pagunsan-ItableNo ratings yet

- WEEK 4 A. Family Background of Rizal and Its Influence On The Development of His NationalismDocument6 pagesWEEK 4 A. Family Background of Rizal and Its Influence On The Development of His NationalismVencint LaranNo ratings yet

- NAME: - CLASS: - Describing Things Size Shape Colour Taste TextureDocument1 pageNAME: - CLASS: - Describing Things Size Shape Colour Taste TextureAnny GSNo ratings yet

- Philippine Association of Service Exporters vs Drilon Guidelines on Deployment BanDocument1 pagePhilippine Association of Service Exporters vs Drilon Guidelines on Deployment BanRhev Xandra AcuñaNo ratings yet

- Lec 1 Modified 19 2 04102022 101842amDocument63 pagesLec 1 Modified 19 2 04102022 101842amnimra nazimNo ratings yet

- Ck-Nac FsDocument2 pagesCk-Nac Fsadamalay wardiwiraNo ratings yet

- Relatório ESG Air GalpDocument469 pagesRelatório ESG Air GalpIngrid Camilo dos SantosNo ratings yet

- Final Literature CircleDocument10 pagesFinal Literature Circleapi-280793165No ratings yet

- Infinitive Clauses PDFDocument3 pagesInfinitive Clauses PDFKatia LeliakhNo ratings yet

- 2020052336Document4 pages2020052336Kapil GurunathNo ratings yet

- Adjusted School Reading Program of Buneg EsDocument7 pagesAdjusted School Reading Program of Buneg EsGener Taña AntonioNo ratings yet

- Bajaj Allianz General Insurance Company LimitedDocument9 pagesBajaj Allianz General Insurance Company LimitedNaresh ChanchadNo ratings yet

- Who Are The Prosperity Gospel Adherents by Bradley A KochDocument46 pagesWho Are The Prosperity Gospel Adherents by Bradley A KochSimon DevramNo ratings yet

- The Hittite Name For GarlicDocument5 pagesThe Hittite Name For GarlictarnawtNo ratings yet

- International BankingDocument3 pagesInternational BankingSharina Mhyca SamonteNo ratings yet

- Booklet - CopyxDocument20 pagesBooklet - CopyxHåkon HallenbergNo ratings yet

- 14 Worst Breakfast FoodsDocument31 pages14 Worst Breakfast Foodscora4eva5699100% (1)

- Amadora V CA Case DigestDocument3 pagesAmadora V CA Case DigestLatjing SolimanNo ratings yet

- Bhushan ReportDocument30 pagesBhushan Report40Neha PagariyaNo ratings yet

- Unit 2 - Programming of 8085 MicroprocessorDocument32 pagesUnit 2 - Programming of 8085 MicroprocessorSathiyarajNo ratings yet

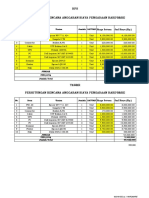

- HPS Perhitungan Rencana Anggaran Biaya Pengadaan Hardware: No. Item Uraian Jumlah SATUANDocument2 pagesHPS Perhitungan Rencana Anggaran Biaya Pengadaan Hardware: No. Item Uraian Jumlah SATUANYanto AstriNo ratings yet

- Hac 1001 NotesDocument56 pagesHac 1001 NotesMarlin MerikanNo ratings yet

- Business Beyond Profit Motivation Role of Employees As Decision-Makers in The Business EnterpriseDocument6 pagesBusiness Beyond Profit Motivation Role of Employees As Decision-Makers in The Business EnterpriseCaladhiel100% (1)

- The Role of Store LocationDocument6 pagesThe Role of Store LocationJessa La Rosa MarquezNo ratings yet

- Intermediate Unit 3bDocument2 pagesIntermediate Unit 3bgallipateroNo ratings yet