Professional Documents

Culture Documents

Tab 6

Uploaded by

Ian Terence SheltonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tab 6

Uploaded by

Ian Terence SheltonCopyright:

Available Formats

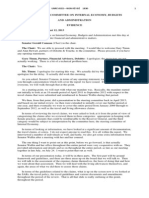

SENATE

SENAT

L'fion. :M.icfiae[1Juffy

Jlon. :M.icfiae[1Juffy

CANADA

KlA OA4

15 May 2013

Tel: (613) 947-4163

Fax: (613) 947-4157

mikeduffy@sen.parl.gc. ca

Jill Anne Joseph, CIA, CGAP

LA DIRECTION DES FINANCES

TH E SEN ATE

r::1t-/ 2 2 2013

Director Internal Audit and Strategic Planning

Room 146-N Centre Block

The Senate of Canada, Ottawa, ON KlA OA4

Dear Ms. Joseph :

I am writing in response to your recent letter. There have been some changes since my last

letter to you on this issue, which was dated Dec. 13, 2012.

Please find enclosed;

A copy of my PEI driver's licence.

Re: PEI income tax. I have retained an accountant in Charlottetown, and he will file my

2013 taxes in PEI.

In December I enclosed a letter from Health PEI acknowledging my application for a PEI

health care card. I am tracking my time on PEI to meet their qualifications, and expect to

receive the PEI Health card later this year.

I am registered with Elections Canada to vote in PEI.

I believe you have photos of my PEI residence in your files .

I trust this answers your questions.

Yours truly,

H

Senator

Protect ed when complet ed

'"'" +'"'"

LA DIRECTION DES FINANCES

THE SENATE

i::::t~

Dl::CL\ltATION OF l'Rl:\IARY AND SECON DARY RESIDENCES

Senators l.iving xpenses in the National Capital Region (NCR)

Period covered from Anril I' ' 2013 lo !\larch J I" 201-'

zz 2013

LE SENAT

IR~C'fbfqAi~

PRIMARY RESIDENCE

- ='-""---'--f>r4 -==' - - - -""''-......:.-L--'1'- - - - -'

member of the Senate for the province

:.1;;c==-"--=-Ul.--=:......,~-------------' declare that:

~y

. rcsick nce is within 100 kilometres from Parlinment Hill.

C)/cl<..

(i}ity 11!.if..t'ricsidence is more than 100 kilometres from l':trliame nt Hill .

peJ:.-.

For the purpose or the Twe111y-Seco11d Repon of the Sm11di11g Se11a1e Co111111i11ee 011 /111emal Eco110111y. Budgets a11d

Ad111i11istratio11, adopted in the Senate on June 18, 1998, the address or my p~ residence in the province or territory for

which I was appointed is the follo\\ing: 1

Address:

City:

cf:~ ~effe_x;;

Unit ff: _ _ _ _ _~--Posta l Code:C0/[-

(A/c:>

For the purpose of the Ni11etee111il Repon ofthe Sumding Se11a1e Comm I/lee 011 l111em al Eco110111y. Budgets a11d

Ad111i11istratio11. presented in the Senate on February 28. 2013:

I agree that the documents provided to the Senate lnt<'.rnal Audit in the context of the review of primary and S<'.condary

residences be forwarded to the Finance and Procurement Dir~ctorate.

or

..__ iy1 providing the foll owing documents:

0 A copy or the relevant page

()"A copy of my driver's licence

0 A copy of my health card

of my income tax form

SECONDARY llESIDENCE IN Tll E NCR (to be filled 011/y by se11ators whose primary reslde11ce' is more tlln11

100 kilometres from Pnrlim11e111 flill)

A.

0 I do not own or rent a secondary residence in the NCR.

B.

A Senator who owns a secondary resitlcnce in the NCR will be reimbursed a fla t rate. as determined by the

Slf111di11g Co111111i11ee 011 /11temal co110111y, Budgets and Ad111i11istratio11, for each tla) such residence is

available for the Senator's occup:rncy, and providing that during such time it is not rented to another person

or claimed as an expense b) another Senator. The fo llowing conditions ap11ly:

Only one claim per day for accommodation costs may be made for that dwelling: and

The Senator must submit a copy or the municipal tax statement as proof of 0\\11ership on a yearly basis

0 ryxir attached (municipal tax statement)

Own ~own a s. . . . .y residence in the NCR and meet the above conditions.

C.

A Senator who leases or rents accommodations in the NCR will be reimbursed as long as fund s for its

monthly costs remain available for this 11urpose. The following conditions apply:

The Senator must submit a copy of the lease agreement and proof or payment: 0 Lease attached

The lessor is not a fami ly member" as dclincd in the Senate Administratire Rules:

Entering into the lease wi ll not further the private interests of the Senator or those of his or her

.. fa mily member"; and

No Senator or his or her family member' ' shal l have an interest in a partnership or pri vate corporation that is a

party lo such lease under which the partnership or corporation receives a bcnclit.

Rent

I rent a secondary res idence in the NCR and meet the above conditions.

Unit 11:__________

Address:

City:

Province:

Ctt}

Postal

Coe{~' 21{~

Land lord: (ifapplicable)

SE 'ATO ti'S Dl::CLA RATION

I declare that the information provided above 1s accurate as or the date or this declaration and that all receipts or

re imbursement reques are compliant\\ ith the Senate Ad111i11is1ratio11 Rules and Senate policies and guidelines.

I will advise the Fi1 cial S

1ediatcly of a changes in the status of my residences and wi ll amend this

Da1c

Si nalnre

Dale: - - - - - - - - -

~.;-:::.-===:::::~-=...

. ...

... .: .

- ::: :. ! . : .. :~>:".;

. .

..

"....\

.....

. .

......

.,

..

'L. . . . .

\ ...

.,-

..

E'fi:~

d]slana

--....

-.;:::::

CANADA

Phone: (902) 368-4070

Email:

taxandland @gov.pe.ca

Website: www.taxandland.pe.ca

STATEMENT OF ACCOUNT

PROPERTY CHARGES

As of:

For Period:

Mailing Date:

Page:

CN-L00006-001800

HEATH ER J & MICHAEL D DUFFY

10 FRIENDLY LN

CAVENDISH PE COA 1 NO

March 3 1, 20 13

January 1 - December 3 1, 2013

May 7, 20 13

1 of 4

Property No.: 453514-000

Acreage:

0.230

GC:

Owners:

HEATHER J & MICHAEL D DUFFY

Location :

10 FRIENDLY LN, CAVENDISH

PAST DUE

Property tax past due from previous years:

Late charges as of March 31, 20 13

$0.00

$0.00

TOTAL PAST DUE:

$0.00

CURRENT

Property Tax due from prior years:

$0.00

Provincial property tax for 20 13:

$1,287.69

Municipa lity of Resort Municipality property tax for 2013:

$2 10.63

Island Waste Management Corpo ration fees for 2013:

$120.00

Less credits and payments:

$0.0 1

Less adjustments:

$0.00

TOTAL CURRENT:

$1,618.31

$1,618.31

llACCOUNT BALANCE:

PAYMENT SCHEDULE

Description

Past Due

Amount

$0.00

Due Date

Immediately (*)

2013 lnstallm ent #1

$539.43

May3 1, 2013

2013 lnstallment #2

$539.44

Aug . 31, 20 13

2013 lnstallment #3

$539.44

Nov. 30,20 13

The past due amount is due and payable immediately. Amounts past due are subject to interest at the rate of 18% per annum,

calculated daily.

II

E3ri!f~

~Island

--.....

-..:::::

C ANADA

NOTICE OF PROPERTY TAX

As of:

For Period :

Mailing Date:

Page:

March 31, 2013

January 1 - December 31, 201 3

May 7, 2013

2 of 4

Phone: (902) 368-4070

taxandland@gov.pe.ca

Email:

Website: www.taxandland.pe.ca

Property No.: 453514-000

Acreage:

0.230

GC:

Owners:

HEATHER J & MICHAEL D DUFFY

HEATHER J & MICHAEL D DUFFY

10 FRIENDLY LN

CAVEND ISH PE COA 1NO

Location:

10 FRIENDLY LN, CAVENDISH

PROVINCIAL PROPERTY TAX

Non-Commercial

Non-Commercial Farm

Commercial

Residential

Other

Residential

Other

$100,300.00

$1.50

$1,504.50

Taxable Value Assessment

Rate (per $100 taxable value)

Base Provincial Property Tax

Credits

Provincial Tax Credit

Owner Occupied Residential

Prorate tax (credit) debit

Farm assessment credit

Farm use credit

Environmental building credit

Environmental land credit

($216.81)

Adjusted Provincial Property Tax

$:1,287.69

$1,287.69

PROVINCIAL PROPERTY TAX

MUNICIPAL PROPERTY TAX

Non-Commercial

Non-Commercial Farm

Commercial

Residential

Taxable Value Assessment

Rate {per $100 taxable value)

Base Municipal Property Tax

Credits

Owner Occupied Residential

Farm assessment credit

Farm use credit

Prorate tax (credit) debit

Adjusted Municipal Property Tax

MUNICIPAL PROPERTY TAX

Other

Residential

Other

$100,300.00

$0.210

$210.63

$210.63

$210.63

NOTICE OF PROPERTY ASSESSMENT

E'!J{j:Jfit

As of:

For Period:

Mailing Date:

Page:

dJslana

--...

-..::::::

CANADA

Phone: (902) 368-4070

taxandland@gov.pe.ca

Email :

Website: www.taxand land.pe.ca

March 31, 2013

January 1 - December 31, 2013

May 7, 2013

3 of 4

Property No.: 453514-000

Acreage:

0.230

GC:

Owners:

HEATHER J & MICHAEL D DUFFY

HEATHER J & MICHAEL D DUFFY

10 FRIENDLY LN

CAVENDISH PE COA 1NO

Location:

10 FRIENDLY LN, CAVENDISH

MARKET VALUE ASSESSMENT

Date

Non-Commercial

Commercial

Residential

Dec. 31, 2012

Adjustments:

Jan. 1,2013

$11 5,400.00

Mar. 31, 2013

$114,300.00

Other

Non-Commercial Farm

Residential

Reason

Other

($1 ,100.00)

Year end adjustment

TOTAL MARKET VALUE ASSESSMENT OF PROPERTY (as of March 31, 2013)

$114,300.00

TAXABLE VALUE ASSESSMENT

Date

Commercial

Non-Commercial

Residential

Dec.31,2012

Adjustments

Jan. 1,2013

$98,300.00

Mar. 31, 2013

$100,300.00

$2,000.00

Other

Non-Commercial Farm

Residential

Reason

Other

CPI adjustment

TOTAL TAXABLE VALUE ASSESSMENT OF PROPERTY (as of March 31, 2013)

(*)

Year end adjustment may include depreciation, reappraisal, new construction and/or market growth.

$100,300.00

E3fi:Jfir

:d_]slana

--......

-...:::::

CAN A D A

Phone:

Email :

Website:

REFERRAL OF PROPERTY ASSESSMENT AND TAXES

As of:

March 3 1, 2013

For Period:

January 1 - Decembe r 31 , 2013

Mailing Date: May 7, 2013

Page :

4 of 4

(902) 368-4070

taxandland @gov.pe.ca

www.taxandland.pe.ca

Property No.: 453514-000

Acreage:

0 .230

GC :

Owners:

HEATHER J & MICHAEL DDUFFY

HEATHER J & MICHAEL D DUFFY

10 FRIENDLY LN

CAVENDIS H PE COA 1 NO

Location:

10 FRIENDLY LN, CAVENDISH

REFERRAL CLOSING DATE:

August 5, 2013

I hereby request a review of my property assessment and taxes as follows:

0

0

0

0

Address Change. I request that all correspondence related to this property be sent to the address noted below.

Inquiry. I raise the following inquiry and/or give notice of the change(s) regarding my property noted above.

Property Assessment Referral. I request reconsideration of the assessment on my property for the reasons noted below.

Property Tax Referral. I request reconsideration of the property charges on my property for the reasons noted below.

Signature:

Date:

Telephone:

Email:

Mail to:

Provincial Tax Commissioner

Taxation and Property Records

PO Box 2000

Charlottetown, PE C1A 7N8

Hand Deliver to:

OR

Provincial Tax Commissioner

Taxation and Property Records

95 Rochford Street

Charlottetown , PE

any Access PEI Centre.

APPEALS

(1)

Any person who received a notice of assessment under section 18 or an amended notice of assessment

under section 19 may refer in writing any assessment to the Minister within ninety days after the mailing of

the notice.

(2)

A ny person who refers a n assessment to the Minister under subsection (1 ), shall set out in the reference his

address and reasons for objecting to the assessment.

(3)

The Minister shall reconsider an assessment refe rred to hi m, under subsection (1 ), and shall vacate, confirm

or vary the assessment, and where the reference is under subsecti on (1 ), the Minister shall send notice to

the person of his decision and his reasons therefore, within one hundred and eighty days of receipt of the

reference.

(4)

Th e decision of the Minister shall have effect on January 1 of the year for which the assessment appealed

fro m was made, and any changes required to be made in the assessment roll as a result thereof, sha ll be

made within thirty days after the Minister has made his d ecision.

You might also like

- Tab 5Document3 pagesTab 5Ian Terence SheltonNo ratings yet

- Regina v. DUFFY Exhibit 1B, Tab 4Document12 pagesRegina v. DUFFY Exhibit 1B, Tab 4Ottawa CitizenNo ratings yet

- Michael Duffy Prince Edward Island: lES ATDocument4 pagesMichael Duffy Prince Edward Island: lES ATIan Terence SheltonNo ratings yet

- Ex-Bloc MP Maria Mourani's LetterDocument2 pagesEx-Bloc MP Maria Mourani's LetterMontreal GazetteNo ratings yet

- 2013-08-13 Transcript InCamera Eng Tabled 2013-10-28Document19 pages2013-08-13 Transcript InCamera Eng Tabled 2013-10-28Ian Terence SheltonNo ratings yet

- 2013-08-13 Transcript InCamera Eng Tabled 2013-10-28Document19 pages2013-08-13 Transcript InCamera Eng Tabled 2013-10-28Ian Terence SheltonNo ratings yet

- 2013-08-12 Transcript InCamera Eng Tabled 2013-10-28Document23 pages2013-08-12 Transcript InCamera Eng Tabled 2013-10-28Ian Terence SheltonNo ratings yet

- Farming The Mailbox PrecisDocument7 pagesFarming The Mailbox PrecisIan Terence SheltonNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- OBAT PT. Anugerah Pharmindo Lestari Agustus Akhir 2021Document1 pageOBAT PT. Anugerah Pharmindo Lestari Agustus Akhir 2021Stenris AnthonyNo ratings yet

- gb84 254Document4 pagesgb84 254kararNo ratings yet

- MBA Program Economics PG Problem Set 1 Answer KeyDocument11 pagesMBA Program Economics PG Problem Set 1 Answer KeyHuỳnh LinhNo ratings yet

- Chap-9, Math SlideDocument24 pagesChap-9, Math SlideBushra Haque100% (1)

- NUBE Kawaii CuddlerDocument4 pagesNUBE Kawaii Cuddlermareto torres100% (1)

- Files 1673253509Document150 pagesFiles 1673253509Indri Wulandari99No ratings yet

- Deliverable Shop Drawing Register: Client: Total E&P Indonesie Project: Smk3 Project - Epsc1 Job No.: 21192Document12 pagesDeliverable Shop Drawing Register: Client: Total E&P Indonesie Project: Smk3 Project - Epsc1 Job No.: 21192abdiNo ratings yet

- PT Selamat Sempurna TBK Dan Entitas Anaknya/and Its SubsidiariesDocument148 pagesPT Selamat Sempurna TBK Dan Entitas Anaknya/and Its SubsidiariesAris SetiawanNo ratings yet

- 3.8 Investment Appraisal PBP, ARR, NPVDocument56 pages3.8 Investment Appraisal PBP, ARR, NPVSneha GuptaNo ratings yet

- Activity MansuetoDocument5 pagesActivity MansuetoMansueto JreysonNo ratings yet

- Intermediate MicroeconomicsDocument3 pagesIntermediate MicroeconomicsRija TahirNo ratings yet

- Sauce & Spoon Tablet Rollout: Impact ReportDocument8 pagesSauce & Spoon Tablet Rollout: Impact ReportManoranjan87No ratings yet

- 420 Dozer Ripper Shanks V4Document4 pages420 Dozer Ripper Shanks V4Allen ChenNo ratings yet

- Correlation and Regression Notes 2.0Document6 pagesCorrelation and Regression Notes 2.0DtwaNo ratings yet

- So2306002 - Cipta Klasik SDN BHD (Unti 23-05) - 080623Document3 pagesSo2306002 - Cipta Klasik SDN BHD (Unti 23-05) - 080623Siti Nurhaslinda Bt ZakariaNo ratings yet

- Using The Envelope Budgeting Method in Today's Cashless SocietyDocument5 pagesUsing The Envelope Budgeting Method in Today's Cashless SocietyJean Marc LouisNo ratings yet

- Catalogue Daikin AHU - CA-DDMDocument27 pagesCatalogue Daikin AHU - CA-DDMPhạm ĐứcNo ratings yet

- Höegh Autoliners AS: Bill of LadingDocument2 pagesHöegh Autoliners AS: Bill of LadingkNo ratings yet

- D 6544 - 00 Rdy1ndqDocument4 pagesD 6544 - 00 Rdy1ndqJuanNo ratings yet

- Insights Ias - Insightsonindia: Series - 1: Solutions (Days 1-4)Document19 pagesInsights Ias - Insightsonindia: Series - 1: Solutions (Days 1-4)sameer bakshiNo ratings yet

- Tamil Nadul List of Doctors-2020Document83 pagesTamil Nadul List of Doctors-2020Eswaran Selvaraj50% (4)

- Ecotal V1i1 3Document12 pagesEcotal V1i1 3Riski AlfalahNo ratings yet

- City of Windhoek: Please Save Water!Document1 pageCity of Windhoek: Please Save Water!Lazarus Kadett NdivayeleNo ratings yet

- GR Exp 1Document2 pagesGR Exp 1Reddy BodhanapuNo ratings yet

- Futures Options - CME - Product Slate Export PDFDocument136 pagesFutures Options - CME - Product Slate Export PDFBerek StefaniakNo ratings yet

- Jollibee Foods Corp AnalysisDocument8 pagesJollibee Foods Corp Analysisanushyam0533% (3)

- Manual Dremel VersaflameDocument80 pagesManual Dremel VersaflamesironakirkeNo ratings yet

- Economics: The Costs of ProductionDocument36 pagesEconomics: The Costs of ProductionA-Ram KimNo ratings yet

- Exercise 3 - Aisyah - InsyirahDocument4 pagesExercise 3 - Aisyah - InsyirahNURUL INSYIRAH AHMAD TAJODINNo ratings yet

- Essential Appendices for Siomailunggay BusinessDocument16 pagesEssential Appendices for Siomailunggay BusinessWillCanuzaNo ratings yet