Professional Documents

Culture Documents

Amendments To EAC External Tarriff

Uploaded by

adammzjinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amendments To EAC External Tarriff

Uploaded by

adammzjinCopyright:

Available Formats

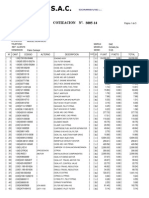

Amendments to EAC CET 2007 Version

Part I: According EAC GAZETTE n6 of 23 June 2008

1.

HS code

Description of Goods

1511.9020 Palm stearin, fractions

Decision on CET

Import duty rate 10%

2.

2707.9100 Creosote Oil

Import duty rate 0%

3.

2710.1951 Lubricating Oil

4.

2833.1900 Sodium sulfate

Deleted the description

lubricating oils and

substitute with

Lubricants in liquid

form

Import duty rate 10%

5.

2833.2200 Aluminium sulfate

Import duty rate 10%

6.

7216.3100 U sections not further worked than hotrolled, hot-drawn or extruded of a

height of 80 mm or more

7.

7216.3200 I sections not further worked than hotrolled; hot-drawn or extruded of a

height of 80 mm or more

8.

7216.3300 H sections not further worked than hotrolled, hot-drawn or extruded of a

height of 80 mm or more

9.

7216.4000 L or T sections not further worked than

hot-rolled, hot-drawn or extruded of a

height of 80 mm or more

10.

8443.3100 Machines which perform two or more of

the functions of printing, copying or

facsimile transmission, capable of

connecting to an automatic data

processing machine or to a network

11.

8443.3200 Other, capable of connecting to an

automatic data processing machine or

to a network

12.

8517.6900 Other apparatus for transmission of

voice, images or other data, including

apparatus for communication in a

wired or wireless network(such as a

local or wide area network)

Split of HS codes

13.

8309.9010 Easy opening ends in form of incised

flap and a ring pull or other easy

opening mechanism made of base

metal used for drink or food cans

8309.9090

Other

Import duty rate 0%

Import duty rate 0%

Import duty rate 0%

Import duty rate 0%

Import duty rate 0%

Import duty rate 0%

Import duty rate 0%

Import duty rate 10%

Import duty rate 25%

14.

15.

8414.8010 Fixed compressors

Import duty rate 10%

8414.8090 Other

8423.8910 Weighing machinery having a

maximum weighing capacity

exceeding 5.000 Kg

Import duty rate 25%

Import duty rate 0%

8423.8990 Other

Import duty rate 10%

Correction of HS Codes in the EAC Common External Tariff 2007 Version

16.

1102.2000 Maize (corn) flour

Delete the tariff line in

Schedule 1 and insert it in

Schedule 2 of the East

African Community

Common External Tariff

2007 Version

17.

5601.1000

Delete HS Code

5601.1000 and replace

with 5601.1010 in the

East African Community

Common External Tariff

2007 Version

18.

5601.9000

Delete HS Code

5601.9000 and replace

with 5601.1090 in the

East African Community

Common External Tariff

2007 Version

19.

9403.81

Delete HS Code 9403.81

and substitute with

9403.8100 in the East

African Community

Common External Tariff

2007 Version

20.

9403.89

Delete HS Code 9403.89

and substitute with

9403.8900 in the East

African Community

Common External Tariff

2007 Version

Part II: According Decisions of the Ministers of Finance, June 2009, Annex IV

S/N

HS CODE

DESCRIPTION OF GOODS

DECISION

1.

0403.10.00

Yoghurt

0403.90.00

Other

To be included in the

sensitive list at Import

duty rate of 60%

2.

1001.90.20

Wheat

Stay application of CET

rate for one year and

apply import duty rate of

0%.

Rice

Rwanda

to

stay

application of CET rate

for two years and apply

import duty rate of 30%

Filament yarn not put up for retail sale

Import duty 0%

Import duty $0.2 per kg

or 35% which ever is

higher for one year

1001.90.90

4.

1006.10.00

1006.20.00

1006.30.00

1006.40.00

5.

5402.62.00

5402.69.00

5403.10.00

and Yarn of

Headings

54.02 to 54.05

6309.00.00

Worn clothing and other worn articles

6812.80.00

Fabricates

crocidolite

6812.99.00

asbestos

fibres

of Import duty 0%

Other fabricated asbestos fibres

8

7321.90.00

Parts for stoves, ranges, grates and Import duty 10%

cookers, barbecues and other similar

non electric domestic appliances of

iron and steel

8525.80.00

Television cameras, digital cameras Import duty rate 0%

and video camera recorders

11

8704.22.90

Motor vehicles for the transport of

goods with gross vehicle weight

exceeding 5 tons but not exceeding

20 tonnes

12

8704.23.90

Motor vehicles for the transport of Tanzania, Rwanda and

goods with gross vehicle weight Uganda

to

stay

exceeding 20 tonnes.

application of CET rate

for one year and apply

Tanzania, Rwanda and

Uganda

to

stay

application of CET rate

for one year and apply

import duty rate of 10%.

import duty rate of 0%.

13

Ban of plastic bags for

Rwanda

You might also like

- Tariff Product ListDocument8 pagesTariff Product ListCNBC.com100% (3)

- Mercedes - Benz Vito & V-Class Petrol & Diesel Models: Workshop Manual - 2000 - 2003From EverandMercedes - Benz Vito & V-Class Petrol & Diesel Models: Workshop Manual - 2000 - 2003Rating: 5 out of 5 stars5/5 (1)

- Price List 01.12.23Document3 pagesPrice List 01.12.23laxmi.polyplastNo ratings yet

- Central Excise: Chapter 1 To 12Document17 pagesCentral Excise: Chapter 1 To 12Jitendra Suraaj TripathiNo ratings yet

- 2015 EAC Gazette 10th DecemberDocument12 pages2015 EAC Gazette 10th DecemberEmmanuel Alenga MakhetiNo ratings yet

- q3 2021 Foreign Trade Statistics - TablesDocument137 pagesq3 2021 Foreign Trade Statistics - TablesAUDU SIMONNo ratings yet

- SRO GUIDE 2010-2011: Advalorem Rate / Rate of ExemptionDocument93 pagesSRO GUIDE 2010-2011: Advalorem Rate / Rate of ExemptionmnasirmehmoodNo ratings yet

- HP Bore Description Item HSN CodeDocument4 pagesHP Bore Description Item HSN CodeAdityaNo ratings yet

- Explanatory Notes (Central Excise) General: A. Mean CENVAT RateDocument13 pagesExplanatory Notes (Central Excise) General: A. Mean CENVAT Rateselva_dxNo ratings yet

- Part B Plant & Machinery DetailsDocument2 pagesPart B Plant & Machinery Detailsskjha170No ratings yet

- So Part 3Document174 pagesSo Part 3EdwinNo ratings yet

- Hungary Midterm BudgetDocument2 pagesHungary Midterm BudgetbodnartiNo ratings yet

- Kits Árboles de Levas Marzo 12 2024Document3 pagesKits Árboles de Levas Marzo 12 2024Antonio UgartecheaNo ratings yet

- So Part 2Document62 pagesSo Part 2EdwinNo ratings yet

- Scan 0001Document1 pageScan 0001Tawanda SwansonNo ratings yet

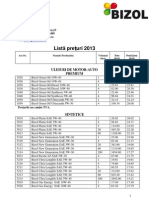

- Lista Preturi BizolDocument5 pagesLista Preturi BizolAndreea ZamfirNo ratings yet

- CV - 2020 - Price RevisionDocument61 pagesCV - 2020 - Price RevisionRavikant SainiNo ratings yet

- HPCL - Pricelist 160622Document1 pageHPCL - Pricelist 160622ashasinghNo ratings yet

- Ib RegressionDocument12 pagesIb RegressionMohammad Abu-OdehNo ratings yet

- Fendt GFV09 Service Parts GuidesDocument66 pagesFendt GFV09 Service Parts Guidesarturo91100% (1)

- F156a Parts Catalog SN 107113Document602 pagesF156a Parts Catalog SN 107113Игорь Терещенко100% (12)

- Drug Tariff July 2014 PDFDocument784 pagesDrug Tariff July 2014 PDFGisela Cristina MendesNo ratings yet

- Definition of Product Groups Used in Part A.2: Agricultural Products (Ag)Document3 pagesDefinition of Product Groups Used in Part A.2: Agricultural Products (Ag)Raymond LongNo ratings yet

- Finance Bill 2021Document318 pagesFinance Bill 2021Siddhi somaniNo ratings yet

- Ausa Forklift c500h Parts ManualDocument10 pagesAusa Forklift c500h Parts Manualruben100% (40)

- CPA Modifications June 2020 Insumbi South AfricaDocument22 pagesCPA Modifications June 2020 Insumbi South AfricarolandNo ratings yet

- C 150 H C 150 H x4 - enDocument177 pagesC 150 H C 150 H x4 - enSARAMQRNo ratings yet

- Denso Bosch Common RailDocument29 pagesDenso Bosch Common RailCiprian Albert100% (27)

- Versions: OMV Technical InformationDocument22 pagesVersions: OMV Technical InformationZoran JankovNo ratings yet

- Duty Sheet November 2019 PDFDocument111 pagesDuty Sheet November 2019 PDFjayed hasanNo ratings yet

- Operational Mu-X 4x4Document1 pageOperational Mu-X 4x4Anindito W WicaksonoNo ratings yet

- Directors Report Year End: Mar '10: Explore Tata Steel ConnectionsDocument15 pagesDirectors Report Year End: Mar '10: Explore Tata Steel ConnectionsChetan PatelNo ratings yet

- 25252525Document38 pages25252525Ivan GonzalezNo ratings yet

- Rittal Rittal Price List 2017-5-4071Document279 pagesRittal Rittal Price List 2017-5-4071Anonymous SDeSP1No ratings yet

- Air Cleaner: Reference:02T012Document2 pagesAir Cleaner: Reference:02T012Дмитрий ТуржанскийNo ratings yet

- Ausa C 150h x4 Parts ManualDocument10 pagesAusa C 150h x4 Parts Manualmichael100% (52)

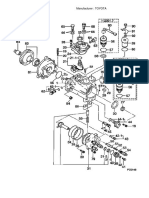

- HiNo DutRo Fuel Injection Pump DiagramDocument8 pagesHiNo DutRo Fuel Injection Pump Diagramjoe88% (16)

- Service Package ListDocument1 pageService Package ListAndrei BleojuNo ratings yet

- Quotation For One New Plant 20180128Document101 pagesQuotation For One New Plant 20180128duyen nguyen chi luongNo ratings yet

- SI159of2017 Customs&Excise Suspension Amendment RegsDocument8 pagesSI159of2017 Customs&Excise Suspension Amendment RegsInnocent MachinguraNo ratings yet

- L005 14Document5 pagesL005 14Ronald AuquiNo ratings yet

- Manitou MHT 790 - MHT-X 790 (EN)Document4 pagesManitou MHT 790 - MHT-X 790 (EN)ManitouNo ratings yet

- Ausa C 150h x4 Parts ManualDocument171 pagesAusa C 150h x4 Parts Manualstefan corjucNo ratings yet

- NotificationDocument21 pagesNotificationrakesh_pinkuNo ratings yet

- 434 459 Apb+30Document7 pages434 459 Apb+30rizki arvitaNo ratings yet

- Manaule Officina Husqvarna TE 310 2011Document366 pagesManaule Officina Husqvarna TE 310 2011Federico GaribaldiNo ratings yet

- Tractor EconomicsDocument9 pagesTractor Economics2702275No ratings yet

- Cajita CubanaDocument188 pagesCajita CubanaCarmen RomeroNo ratings yet

- Necessary Important Amendments in Tds Rates in Finance Bill 2016Document1 pageNecessary Important Amendments in Tds Rates in Finance Bill 2016CacptCoachingNo ratings yet

- Attach MfU6n4Ps1R5eakRoud5gDocument2 pagesAttach MfU6n4Ps1R5eakRoud5gEjaz Hussain HNo ratings yet

- Material PajakDocument93 pagesMaterial PajakAnggit HernowoNo ratings yet

- Central Excise & Customs: Salient Features of Budgetary ChangesDocument5 pagesCentral Excise & Customs: Salient Features of Budgetary ChangesYunus ShaikhNo ratings yet

- Ananth Assignment 2Document64 pagesAnanth Assignment 2pavan kalyanNo ratings yet

- Boeing 737 200 Maintenance ManualDocument130 pagesBoeing 737 200 Maintenance ManualAntonio Rodriguez25% (8)

- Price List (2019!03!12) - 1 Honda Phils. Inc.-2Document2,029 pagesPrice List (2019!03!12) - 1 Honda Phils. Inc.-2Cherry Lou De GuzmanNo ratings yet

- Garmin G600 TXI IM 190-01717-00 - 12Document449 pagesGarmin G600 TXI IM 190-01717-00 - 12Alfredo CastellanosNo ratings yet

- 2015 2016 Charging SystemDocument692 pages2015 2016 Charging SystemKoolkrayzeh KL100% (2)

- Bitumen Price List Wef 16-07-2016Document1 pageBitumen Price List Wef 16-07-2016Venkateswarlu DanduNo ratings yet

- Manitou MT-X 732 (EN)Document2 pagesManitou MT-X 732 (EN)ManitouNo ratings yet

- Approved List of Standards 30th March 2017Document13 pagesApproved List of Standards 30th March 2017adammzjinNo ratings yet

- Tec022 6000Document12 pagesTec022 6000nknicoNo ratings yet

- Basic of PipingDocument64 pagesBasic of Pipingparameswaran shivakumar96% (46)

- TDS 8127-Eng PDFDocument2 pagesTDS 8127-Eng PDFadammzjinNo ratings yet

- B31.3 Process Piping Course - 04 Pressure Design of MetalsDocument22 pagesB31.3 Process Piping Course - 04 Pressure Design of MetalsEryl YeongNo ratings yet

- 6005 Servo Tank GaugeDocument10 pages6005 Servo Tank GaugeadammzjinNo ratings yet

- Taper AssemblyDocument36 pagesTaper Assemblyויליאם סן מרמיגיוסNo ratings yet

- Asme Viii CalcsDocument20 pagesAsme Viii CalcsSriram VjNo ratings yet

- National Foam Fire Fighting GuideDocument22 pagesNational Foam Fire Fighting Guidefloayzav5684100% (1)

- L T Piping Engineering 3 Day ProgremmeDocument352 pagesL T Piping Engineering 3 Day ProgremmenndhoreNo ratings yet

- Report On South Sudan Market Survey PDFDocument29 pagesReport On South Sudan Market Survey PDFadammzjinNo ratings yet

- TDS - Jotamastic 80 - English (Uk) - Issued.14.11.2011 PDFDocument5 pagesTDS - Jotamastic 80 - English (Uk) - Issued.14.11.2011 PDFNPTNo ratings yet

- Analytical Comparative Transport Cost Study On The Northern Corridor PDFDocument15 pagesAnalytical Comparative Transport Cost Study On The Northern Corridor PDFadammzjinNo ratings yet

- Saturday, April 6, 2013 1330-1400 Hrs 1400-1600 Hrs. 1600-1630 Hrs. Venue: GTU Campus, Gandhinagar CampusDocument1 pageSaturday, April 6, 2013 1330-1400 Hrs 1400-1600 Hrs. 1600-1630 Hrs. Venue: GTU Campus, Gandhinagar CampusadammzjinNo ratings yet

- E194-837 - 842 Gases Conversion ChartDocument3 pagesE194-837 - 842 Gases Conversion ChartadammzjinNo ratings yet

- ANSI Flange RatingsDocument5 pagesANSI Flange Ratingssuperfly1984No ratings yet

- ANSI Flange RatingsDocument5 pagesANSI Flange Ratingssuperfly1984No ratings yet

- Clemco Clemvak III Owners ManualDocument4 pagesClemco Clemvak III Owners ManualadammzjinNo ratings yet

- Shielding Gas Brochure410 80125Document32 pagesShielding Gas Brochure410 80125shaggerukNo ratings yet

- 3LPE Coating SpecificationDocument20 pages3LPE Coating SpecificationadammzjinNo ratings yet

- Hajj Umrah ChecklistDocument5 pagesHajj Umrah ChecklistadammzjinNo ratings yet

- En Metalwork Gas Tungsten Arc WeldingDocument48 pagesEn Metalwork Gas Tungsten Arc WeldingadammzjinNo ratings yet

- Wasilatus ShafiDocument16 pagesWasilatus Shafiadammzjin100% (5)

- Argon Liquid: Specification/gradeDocument1 pageArgon Liquid: Specification/gradeadammzjinNo ratings yet

- Product Data Sheet: Argon (Ar)Document2 pagesProduct Data Sheet: Argon (Ar)adammzjin100% (1)

- Appendix G - Cryogenic Fluids-Weight and Volume EquivalentsDocument2 pagesAppendix G - Cryogenic Fluids-Weight and Volume EquivalentsadammzjinNo ratings yet

- ArgonLiquid390 29605Document1 pageArgonLiquid390 29605adammzjinNo ratings yet

- A Beginner's Guide To MIG WeldingDocument5 pagesA Beginner's Guide To MIG WeldingMIRCEA1305No ratings yet

- Appendix G - Cryogenic Fluids-Weight and Volume EquivalentsDocument2 pagesAppendix G - Cryogenic Fluids-Weight and Volume EquivalentsadammzjinNo ratings yet

- ConversionDocument2 pagesConversionadammzjinNo ratings yet

- Top 100 Companies 1969-2006Document3 pagesTop 100 Companies 1969-2006Bryan LagonoyNo ratings yet

- Managing OperationsDocument18 pagesManaging OperationsjaneNo ratings yet

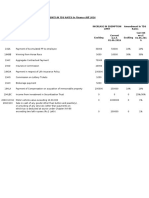

- Resolution No 003 2020 LoanDocument4 pagesResolution No 003 2020 LoanDexter Bernardo Calanoga TignoNo ratings yet

- SAP SD Interview Questions: Rajendra BabuDocument4 pagesSAP SD Interview Questions: Rajendra Babusyed hyder ALINo ratings yet

- BD 20231126Document58 pagesBD 20231126amit mathurNo ratings yet

- Icici BankDocument99 pagesIcici BankAshutoshSharmaNo ratings yet

- Notes - Exploring Labour Market TrendsDocument22 pagesNotes - Exploring Labour Market Trendsapi-263747076100% (1)

- Sample Club BudgetsDocument8 pagesSample Club BudgetsDona KaitemNo ratings yet

- 1 Electrolux CaseDocument3 pages1 Electrolux CaseAndreea Conoro0% (1)

- Supply Chain 101 - SAPDocument34 pagesSupply Chain 101 - SAPuddinn9No ratings yet

- Anastasia Chandra - .Akuntanis A 2014 - Tugas 6xDocument21 pagesAnastasia Chandra - .Akuntanis A 2014 - Tugas 6xSriNo ratings yet

- Articles of Partnership ExampleDocument4 pagesArticles of Partnership ExamplePiaMarielVillafloresNo ratings yet

- Credit Card ConfigurationDocument5 pagesCredit Card ConfigurationdaeyongNo ratings yet

- Ble Assignment 2019 21 BatchDocument2 pagesBle Assignment 2019 21 BatchRidwan MohsinNo ratings yet

- Stefan CraciunDocument9 pagesStefan CraciunRizzy PopNo ratings yet

- BSC Charting Proposal For Banglar JoyjatraDocument12 pagesBSC Charting Proposal For Banglar Joyjatrarabi4457No ratings yet

- Six Sigma Control PDFDocument74 pagesSix Sigma Control PDFnaacha457No ratings yet

- Argument On Workplace SafetyDocument2 pagesArgument On Workplace SafetyEeshan BhagwatNo ratings yet

- 51977069Document1 page51977069Beginner RanaNo ratings yet

- All Bom HC CircularsDocument55 pagesAll Bom HC CircularsSkk IrisNo ratings yet

- Fundamentals of Accounting II AssignmentDocument2 pagesFundamentals of Accounting II Assignmentbirukandualem946No ratings yet

- 1.introduction To Operations Management PDFDocument7 pages1.introduction To Operations Management PDFEmmanuel Okena67% (3)

- DBM BudgetDocument85 pagesDBM BudgetGab Pogi100% (1)

- Risk Chapter 6Document27 pagesRisk Chapter 6Wonde BiruNo ratings yet

- Deal or No Deal Tax 2 Quiz BeeDocument13 pagesDeal or No Deal Tax 2 Quiz BeeRebecca SisonNo ratings yet

- Chapter 2 Management Accounting Hansen Mowen PDFDocument28 pagesChapter 2 Management Accounting Hansen Mowen PDFidka100% (1)

- Module 12. Worksheet - Hypothesis TestingDocument3 pagesModule 12. Worksheet - Hypothesis TestingShauryaNo ratings yet

- Exemption Certificate - SalesDocument2 pagesExemption Certificate - SalesExecutive F&ADADUNo ratings yet

- Uber Final PPT - Targeting and Positioning MissingDocument14 pagesUber Final PPT - Targeting and Positioning MissingAquarius Anum0% (1)

- PARCOR-SIMILARITIESDocument2 pagesPARCOR-SIMILARITIESHoney Lizette SunthornNo ratings yet