Professional Documents

Culture Documents

Phillips Curve & Supply Shocks

Uploaded by

bobCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Phillips Curve & Supply Shocks

Uploaded by

bobCopyright:

Available Formats

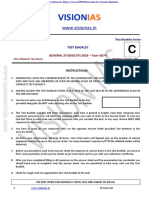

CHAPTER

35

The Short-Run Trade-off

between Inflation and

Unemployment

Goals

In this chapter you will

Learn why policymakers face a short-run trade-off between

inflation and unemployment

Consider why the inflation-unemployment trade-off disappears in

the long run

See how supply shocks can shift the inflation-unemployment

trade-off

Consider the short-run cost of reducing the rate of inflation

See how policymakers credibility affects the cost of reducing

inflation

Outcomes

Draw a graph of a short-run Phillips curve

After accomplishing

these goals, you

should be able to

Draw a graph of a long-run Phillips curve

Show the relationship between a shift in the short-run aggregatesupply curve and a shift in the short-run Phillips curve

355

356

CHAPTER 35

THE SHORT-RUN TRADE-OFF BETWEEN INFLATION AND UNEMPLOYMENT

Strive for a Five

Content from Chapter 35 will be tested on the AP macroeconomics exam. Recently, it has

been tested in the free response portion as well as the multiple-choice section.You should

be prepared to create and explain a model of the Phillips curve with the long-run Phillips

curve displayed.

� The Phillips curve

� Long-run Phillips curve

� Changes in the Philips curve as it pertains to aggregate supply and aggregate demand

� Explain the sacrifice ratio

� Explain why more than rational expectations are needed to reduce inflation without

cost

Key Terms

�

�

�

�

�

�

�

�

Misery indexThe sum of inflation and unemployment

Phillips curveThe short-run trade-off between inflation and unemployment

Natural rate of unemploymentThe normal rate of unemployment toward which the

economy gravitates

Natural-rate hypothesisThe theory that unemployment returns to its natural rate,

regardless of inflation

DisinflationA reduction in the rate of inflation

Supply shockAn event that directly alters firms costs and prices, shifting the

economys aggregate-supply curve and, thus, the Phillips curve

Sacrifice ratioThe number of percentage points of annual output that is lost in order

to reduce inflation one percentage point

Rational expectationsThe theory that suggests that people optimally use all available

information, including about government policies, when forecasting the future

Chapter Overview

Context and Purpose

Chapter 35 is the final chapter in a three-chapter sequence on the economys short-run

fluctuations around its long-term trend. Chapter 33 introduced aggregate supply and

aggregate demand. Chapter 34 developed how monetary and fiscal policy affect aggregate

demand. Both Chapters 33 and 34 addressed the relationship between the price level

and output. Chapter 35 will concentrate on a similar relationship between inflation and

unemployment.

The purpose of Chapter 35 is to trace the history of economists thinking about the

relationship between inflation and unemployment.You will see why there is a temporary

trade-off between inflation and unemployment and why there is no permanent trade-off.

This result is an extension of the results produced by the model of aggregate supply and

aggregate demand where a change in the price level induced by a change in aggregate

demand temporarily alters output but has no permanent impact on output.

Chapter Review

Introduction Since both inflation and unemployment are undesirable, the sum of inflation

and unemployment has been termed the misery index. Inflation and unemployment are

independent in the long run because unemployment is determined by features of the

labor market while inflation is determined by money growth. However, in the short

run, inflation and unemployment are related because an increase in aggregate demand

CHAPTER 35

THE SHORT-RUN TRADE-OFF BETWEEN INFLATION AND UNEMPLOYMENT

temporarily increases inflation and output while it lowers unemployment. In this chapter,

we trace the history of our understanding of the relationship between unemployment and

inflation.

The Phillips Curve

In 1958, a British economist named A. W. Phillips found a negative relationship between

inflation and unemployment. That is, years of high inflation are associated with low

unemployment. This negative relationship has been found for other countries, including

the United States, and has been termed the Phillips curve. The Phillips curve appears to

offer policymakers a menu of inflation and unemployment choices. To have lower unemployment, one need only choose a higher rate of inflation.

The model of aggregate supply and aggregate demand can explain the relationship

described by the Phillips curve. The Phillips curve shows the combinations of inflation and

unemployment that arise in the short run as shifts in the aggregate-demand curve move

along a short-run aggregate-supply curve. For example, an increase in aggregate demand

moves the economy along a short-run aggregate-supply curve to a higher price level, a

higher level of output, and a lower level of unemployment. Since prices in the previous

period are now fixed, a higher price level in the current period implies a higher rate of

inflation, which is now associated with a lower rate of unemployment. This can be seen in

Exhibit 1. An increase in aggregate demand, which moves the economy from point A to

point B in panel (a), is associated with a movement along the short-run Phillips curve from

point A to point B.

Shifts in the Phillips Curve: The Role of Expectations

In 1968, U.S. economists Friedman and Phelps argued that the Phillips curve is not a

menu policymakers can exploit. This is because, in the long run, money is neutral and has

no real effects. Money growth just causes proportional changes in prices and incomes and

should have no impact on unemployment. Therefore, the long-run Phillips curve should

be vertical at the natural rate of unemploymentthe rate of unemployment to which the

economy naturally gravitates.

A vertical long-run Phillips curve corresponds to a vertical long-run aggregate-supply

curve. As Exhibit 1 illustrates, in the long run, an increase in the money supply shifts

aggregate demand to the right and moves the economy from point A to point C in panel

(a). The corresponding Phillips curve is found in panel (b) where an increase in money

1

Long-run

Phillips Curve

Long-run

Aggregate Supply

Short-run

Aggregate

Supply

C

Inflation Rate

Price Level

EXHIBIT

C

B

B

A

AD2

Short-run

Phillips Curve

AD1

Natural

Rate of

Output

Panel (a)

Quantity

of Output

Natural Unemployment

Rate

Rate of

Unemployment

Panel (b)

357

CHAPTER 35

THE SHORT-RUN TRADE-OFF BETWEEN INFLATION AND UNEMPLOYMENT

growth increases inflation, but because money is neutral in the long run, prices and

incomes move together and inflation fails to affect unemployment. Thus, the economy

moves from point A to point C in panel (b) and traces out the long-run Phillips curve.

Friedman and Phelps used the phrase natural rate of unemployment, not because

it is either desirable or constant, but because it is beyond the influence of monetary

policy. Changes in labor market policies such as changes in minimum-wage laws and

unemployment insurance that lower the natural rate of unemployment shift the long-run

Phillips curve to the left and the long-run aggregate-supply curve to the right.

Even though Friedman and Phelps argued that the long-run Phillips curve is

vertical, they argued that, in the short run, inflation could have a substantial impact on

unemployment. Their reasoning is similar to that surrounding the short-run aggregatesupply curve in that they assume, in the short run, price expectations are fixed. If price

expectations are fixed in the short run, an increase in aggregate demand causes inflation,

temporarily increases output, and lowers unemployment below the natural rate. For

example, according to the sticky-wage theory of short-run aggregate supply, nominal

wages are set based on fixed price expectations. When actual prices exceed expected prices,

firms are more profitable, they expand output and employment, and unemployment is

reduced. In Exhibit 2, this is a movement from point A to point B. However, in the long run,

people adjust to the higher rate of inflation by raising their expectations of inflation (and demanding

higher wages) and the short-run Phillips curve shifts upward. The economy moves from point B

to point C with higher inflation but no change in unemployment. Thus, policymakers face

a short-run trade-off between inflation and unemployment, but if they attempt to exploit

it, the relationship disappears and they arrive back on the vertical long-run Phillips curve

at the natural rate of unemployment but at a higher rate of inflation.

The analysis of Friedman and Phelps can be summarized by the following equation:

Unemployment

Rate

Natural Rate of

Unemployment

Actual

Expected

Inflation

Inflation

This says that for any given expected inflation rate, if actual inflation exceeds expected

inflation, unemployment will fall below the natural rate by an amount that depends on the

parameter a. However, in the long run, people learn to expect the inflation that actually

exists, and the unemployment rate will equal the natural rate.

Friedman and Phelps proposed the natural-rate hypothesis, which states that

unemployment eventually returns to its natural rate, regardless of inflation. While

controversial, it proved to be true. During the 1960s, expansionary monetary and fiscal

EXHIBIT

Inflation Rate

358

2

Long-run

Phillips Curve

C

A

Short-run Phillips Curve with

high expected inflation

Short-run Phillips Curve with

low expected inflation

Natural Rate of Unemployment

Rate

Unemployment

CHAPTER 35

THE SHORT-RUN TRADE-OFF BETWEEN INFLATION AND UNEMPLOYMENT

policies steadily increased the rate of inflation and unemployment fell. However, in the

early 1970s, people raised their expectations of inflation and the unemployment rate

returned to the natural rateabout 5 or 6 percent.

Shifts in the Phillips Curve: The Role of Supply Shocks

The short-run Phillips curve can also shift due to a supply shock. A supply shock is an

event that directly alters firms costs and prices, shifting the economys aggregate-supply

curve and Phillips curve. A supply shock occurred in 1974 when OPEC raised oil prices.

This act raised the cost of production and shifted the U.S. short-run aggregate-supply

curve to the left, causing prices to rise and output to fall, or stagflation. Since inflation has

increased and unemployment has increased, this corresponds to a rightward (upward) shift

in the short-run Phillips curve. Policymakers now face a less favorable trade-off between

inflation and unemployment. That is, policymakers must accept a higher inflation rate

for each unemployment rate, or a higher unemployment rate for each inflation rate. Also,

policymakers now have a difficult choice because if they reduce aggregate demand to fight

inflation, they will further increase unemployment. If they increase aggregate demand to

reduce unemployment, they further increase inflation.

If the supply shock raises expected inflation, the Phillips-curve shift is permanent.

If it does not raise expected inflation, the shift is temporary. In the United States during

the 1970s, the Fed accommodated two adverse aggregate supply shocks by increasing

aggregate demand to keep output from falling. This caused expected inflation to rise, and

the rightward (upward) shift in the Phillips curve was permanent. By 1980, inflation was

9 percent and unemployment was 7 percent.

Some argue that in 2008 the Fed is not exerting its independence and is instead

repeating the mistakes of the 1970s by accommodating a negative supply shock.

The Cost of Reducing Inflation

In October 1979, Fed Chairman Paul Volcker chose to pursue a policy of disinflationa

reduction in the rate of inflation. A reduction in the money supply reduces aggregate

demand, reduces production, and increases unemployment. This is shown in Exhibit 3 as a

movement from point A to point B. Over time, expected inflation falls and the short-run

Phillips curve shifts downward and the economy moves from point B to point C.

The cost of reducing inflation is a period of unemployment and lost output. The

sacrifice ratio is the number of percentage points of annual output that is lost to reduce

3

Long-run

Phillips Curve

Inflation Rate

EXHIBIT

A

C

Short-run Phillips Curve with

high expected inflation

Short-run Phillips Curve with

low expected inflation

Natural Rate of Unemployment

Rate

Unemployment

359

360

CHAPTER 35

THE SHORT-RUN TRADE-OFF BETWEEN INFLATION AND UNEMPLOYMENT

inflation one percentage point. The amount of output lost depends on the slope of the

Phillips curve and how fast people lower their expectations of inflation.

Some economists estimated the sacrifice ratio to be about five, which is very large.

Supporters of a theory called rational expectations suggested that the cost of disinflation

could be much smaller and may be zero. Rational expectations suggest that people

optimally use all available information, including information about government policies,

when forecasting the future. Thus, an announced policy of disinflation that is credible could

move the economy from point A to point C without traveling through point B.Volcker

announced a disinflationary policy in late 1979 and reduced inflation from 10 percent to 4

percent by 1984 but at the cost of a substantial increase in unemployment. Note, however,

that the increase in unemployment was less than that predicted by the estimated sacrifice

ratio. The rational expectations theory may not be accurate, or people may not have

believed the policy announcement.

Monetary policy under Alan Greenspan did not repeat the mistakes of the 1960s

when excessive aggregate demand pushed unemployment below the natural rate. The low

inflation and low unemployment of the Greenspan era were the result of a favorable supply

shock and prudent monetary policy.

Bernanke faces the following economic challenges: A housing market bust and financial

crisis that reduced aggregate demand, and rising oil and commodity prices that reduced

aggregate supply. Thus, the economy faces rising unemployment and rising inflation.

Bernanke hopes to keep inflation expectations low so that workers wont increase wage

demands and firms wont increase prices.

Helpful Hints

1. Short-run and long-run Phillips curves are almost a mirror image of short-run and

long-run aggregate-supply curves. Look at the supply curves that appear in Exhibit 1.

Notice the aggregate-supply curves in panel (a). Compare them to the Phillips curves

in panel (b). They appear to be mirror images of each other. The long-run aggregatesupply curve is vertical because, in the long run, an increase in the price level is met

by a proportionate increase in all prices and incomes so there is no incentive to alter

production. Since an increase in prices has no effect on output in the long run, it has

no effect on unemployment, and the long-run Phillips curve is vertical in panel (b).

In the short run with price expectations fixed, an increase in the price level provides

an incentive for firms to increase production, causing the short-run aggregate-supply

curve to be positively sloped in panel (a). When output rises, unemployment tends

to fall, so the short-run Phillips curve is negatively sloped in panel (b). In summary,

since both graphs employ some measure of prices on the vertical axis, and since

each graph uses real measures of economic activity that are negatively correlated on

their respective horizontal axes (an increase in output is associated with a decrease in

unemployment), then aggregate-supply curves and Phillips curves should mirror

each other.

2. To understand the short-run Phillips curve, review short-run aggregate supply. To

gain confidence deriving and shifting short-run Phillips curves, review the sources

to the positive slope of the short-run aggregate-supply curve in Chapter 33. There

you will be reminded that there are a number of reasons why a short-run aggregatesupply curve slopes positivelymisperceptions about relative price, sticky wages, and

sticky prices. Since short-run aggregate-supply curves and Phillips curves are mirror

CHAPTER 35

THE SHORT-RUN TRADE-OFF BETWEEN INFLATION AND UNEMPLOYMENT

images of each other, the very same reasons that produce a positive slope in aggregate

supply produce a negative slope in the Phillips curve. Also, recall that all three theories

of the short-run aggregate-supply curve are based on the assumption of fixed price

expectations. When price expectations rise, the short-run aggregate-supply curve shifts

left. Correspondingly, since the short-run aggregate-supply curve and the Phillips

curve are mirror images, a rise in price expectations shifts the Phillips curve to the

right.

3. The Phillips curve establishes a relationship between inflation and unemployment, but

it does not establish causation. Reading the Phillips curve from the unemployment

axis to the inflation axis suggests that when unemployment is unusually low, the labor

market is tight and wages and prices start to rise more quickly.

4. Estimates of the natural rate of unemployment vary widely, causing policymakers to

disagree on the appropriate monetary and fiscal policies. When looking at a Phillips

curve graph or the model of aggregate supply and aggregate demand, it appears as if

policymakers should always know whether to expand or contract aggregate demand

or whether to leave aggregate demand alone. This is because we can see whether

the economy is operating above or below the long-run natural rate that we have

chosen on the graph. In reality, however, the natural rate is very difficult to measure

and policymakers are uncertain whether the economy is actually operating above

or below the natural rate. For example, if the economy is currently operating at 6

percent unemployment, the economy is operating below capacity if the natural rate

of unemployment is 5 percent, at capacity if the natural rate is 6 percent, and above

capacity if the natural rate is 7 percent. Each situation might suggest a different

stabilization policy, even though the actual rate of unemployment is unchanged at 6

percent.

Self-Test

Multiple-Choice Questions

1. In the short run

a. unemployment and inflation are positively related. In the long run, they are

largely unrelated problems.

b. and in the long run, inflation and unemployment are positively related.

c. unemployment and inflation are negatively related. In the long run, they are

largely unrelated problems.

d. and in the long run, inflation and unemployment are negatively related.

e. unemployment and inflation are negatively related. In the long run, they are

largely positively related.

361

CHAPTER 35

THE SHORT-RUN TRADE-OFF BETWEEN INFLATION AND UNEMPLOYMENT

Figure 35-1

The left-hand graph shows a short-run aggregate-supply (SRAS) curve and two aggregatedemand (AD) curves. On the right-hand diagram, U represents the unemployment rate.

P

362

Phillips Curve

SRAS

130

115

30

B

G

15

D

High AD

Low AD

6%

10%

2. Refer to Figure 35-1. If the economy starts at B, then in the short run, a decrease in

consumer confidence that decreases spending moves the economy to

a. D and G.

b. C and G.

c. A and G.

d. D and F.

e. C and F.

3. Refer to Figure 35-1. Starting at point C, which combination of points would be

correct for an economy that experienced a decrease in unemployment and a price

level increase?

a. D and G

b. D and F

c. A and F

d. A and G

e. B and F

4. In 2001, Congress and President Bush instituted tax cuts. According to the short-run

Phillips curve, in the short run this change should have

a. reduced inflation and unemployment.

b. raised inflation and unemployment.

c. reduced inflation and raised unemployment.

d. raised inflation and reduced unemployment.

e. reduced unemployment and left unemployment unchanged.

5. The current view of the Phillips curve relationship is that

a. the trade-off between inflation and unemployment does not apply in the long run.

b. the trade-off between inflation and unemployment does not apply in the short run.

c. the trade-off between inflation and unemployment does not apply in either the

short run or the long run.

d. the trade-off between inflation and unemployment applies both in the short run

and the long run.

e. the trade-off between inflation and unemployment applies only in the long run

as in the short run there is no trade-off.

6. How would a decrease in the natural rate of unemployment affect the long-run

Phillips curve?

a. It would shift the long-run Phillips curve right.

b. It would shift the long-run Phillips curve left.

c. There would be an upward movement along a given long-run Phillips curve.

d. There would be a downward movement along a given long-run Philips curve.

e. There would be no effect on the long-run Phillips curve.

CHAPTER 35

THE SHORT-RUN TRADE-OFF BETWEEN INFLATION AND UNEMPLOYMENT

Inflation

Rate

Figure 35-2

10

9

8

7

6

5

4

3

2

1

1 2 3 4 5 6 7 8 9 10

Unemployment

Rate

7. Refer to figure 35-2. In this order, which curve is a long-run Phillips curve and

which is a short-run Phillips curve?

a. A, B

b. A, D

c. C, B

d. D, A

e. A, C

8. An adverse supply shock will have which of the following combinations of events?

Aggregate Supply Price Level

Real Output

A.

shift right

increase

increase

B.

shift right

increase

decrease

C.

shift right

decrease

decrease

D.

shift left

increase

increase

E.

shift left

increase

decrease

a. A

b. B

c. C

d. D

e. E

9. An adverse supply shock causes inflation to

a. rise and the short-run Phillips curve to shift right.

b. rise and the short-run Phillips curve to shift left.

c. fall and the short-run Phillips curve to shift right.

d. fall and the short-run Phillips curve to shift left.

e. fall and the long-run Phillips curve to shift right.

10. Suppose that a small economy that produces mostly agricultural goods experiences a

year with exceptionally good conditions for growing crops. The good weather would

a. shift both the short-run aggregate supply and the short-run Phillips curve right.

b. shift both the short-run aggregate supply and the short-run Phillips curve left.

c. shift the short-run aggregate supply curve to the right, and the short-run Phillips

curve to the left.

d. shift the short-run aggregate supply curve to the left, and the short-run Phillips

curve to the right.

e. shift the short-run aggregate supply curve to the right, and cause a movement

along the existing Phillips curve downward and to the right.

363

364

CHAPTER 35

THE SHORT-RUN TRADE-OFF BETWEEN INFLATION AND UNEMPLOYMENT

11. Disinflation is defined as a

a. zero rate of inflation.

b. constant rate of inflation.

c. reduction in the rate of inflation.

d. negative rate of inflation.

e. high rate of inflation.

12. During the middle and last part of the 1990s, both inflation and unemployment were

low. In general, this could have been the result of

a. adverse supply shocks that shifted the short-run Phillips curve left.

b. adverse supply shocks that shifted the short-run Phillips curve right.

c. favorable supply shocks that shifted the short-run Phillips curve left.

d. favorable supply shocks that shifted the short-run Phillips curve right.

e. favorable supply shocks that shifted the long-run Phillips curve right.

Free Response Questions

1. In the long run, what primarily determines the natural rate of unemployment? In the

long run, what primarily determines the inflation rate?

2. Suppose that the prime minister and parliament of Veridian are disappointed with the

high inflation rates under the current system where the Veridian Ministry of Finance is

in charge of the money supply. They make reforms to lower inflation from its current

rate of 8 percent. Suppose further that the public is confident that with the reforms

in place that inflation will fall to 2 percent. Also suppose that those in control of the

money supply actually conduct monetary policy so that the actual inflation rate is 4

percent. Using long-run and short-run Phillips curves and assuming the natural rate

of unemployment is 6 percent, show the initial long-run equilibrium of Veridian and

label it A. Assuming that the government had actually set inflation at 2 percent and

that the public believed this, label the long-run equilibrium B. Now, suppose that

inflation expectations fell to 2 percent and that the government unexpectedly created

inflation of 4 percent. Show the short-run equilibrium and label it C. If the money

supply continues to grow at a rate consistent with 4 percent inflation, show where the

economy ends up and label that point D.

CHAPTER 35

THE SHORT-RUN TRADE-OFF BETWEEN INFLATION AND UNEMPLOYMENT

Solutions

Multiple-Choice Questions

1. c TOP: Phillips curve

2. b TOP: Aggregate demand and supply | Short-run Phillips curve

3. e TOP: Expansionary policy

4. d TOP: Short-run Phillips curve

5. a TOP: Phillips curve

6. b TOP: Long-run Phillips curve | Natural rate of unemployment

7. b TOP: Short-run Phillips curve | Long-run Phillips curve

8. e TOP: Supply shocks

9. a TOP: Short-run Phillips curve shifts | Supply shocks

10. c TOP: Short-run Phillips curve shifts | Supply shocks

11. c TOP: Disinflation

12. c TOP: Supply shocks | Short-run Phillips curve shifts

Inflation

Rate

Free Response Questions

1. In the long run, the natural rate of unemployment is primarily determined by labor market factors, including

government policy concerning minimum wages and unemployment benefits. In the long run, inflation is

primarily determined by money supply growth.

TOP: Inflation | Natural rate of unemployment | Classical dichotomy

2. A correctly drawn Phillips curve will have inflation on the vertical axis and unemployment on the horizontal

axis.The initial long-run equilibrium would be drawn at A where the vertical long-run Phillips curve intersects

the short-run Phillips curve at an inflation rate of 8 percent. The new long-run and short-run equilibrium

created when the government set inflation at 2 percent and the public believed this would happen is shown by

point B. If the government unexpectedly created an inflation of 4 percent, there would be a movement along

a short-run Phillips curve to point C. If the money supply grows at a rate consistent with a 4 percent inflation

rate, a new long-run equilibrium would be established at point D.

12

11

10

9

8

7

6

5

4

3

2

1

D

B

1 2 3 4 5 6 7 8 9 10 11 12 13 14

Unemployment

Rate

Veridian Phillips Curves

TOP: Short-run Phillips curve shifts | Long-run Phillips curve

365

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Intermediate Macroeconomics I Foundations of Aggregate Income DeterminationDocument3 pagesIntermediate Macroeconomics I Foundations of Aggregate Income Determinationtanishkaparate2005No ratings yet

- Draft Resolution 1.0Document4 pagesDraft Resolution 1.0JumanahRaekaNo ratings yet

- Case Econ08 PPT 20Document34 pagesCase Econ08 PPT 20Devy RamadhaniNo ratings yet

- 2021 Q3 KPI DataDocument4 pages2021 Q3 KPI DataNBC 10 WJARNo ratings yet

- English Crit EssayDocument4 pagesEnglish Crit EssayEmil ConcepcionNo ratings yet

- IELTS Writing Task 1 Tips (P6)Document49 pagesIELTS Writing Task 1 Tips (P6)Anh Ngữ Giao TiếpNo ratings yet

- Types of UnemploymentDocument2 pagesTypes of UnemploymentMati ur RehmanNo ratings yet

- The Great DepressionDocument8 pagesThe Great Depressionapi-648772994No ratings yet

- Youth Development & Training at NGODocument24 pagesYouth Development & Training at NGOHemanrocks Ambekar50% (6)

- Early Philippine Industrialization: The Social Cost of IndustralizationDocument1 pageEarly Philippine Industrialization: The Social Cost of IndustralizationTopher MendezNo ratings yet

- Lecture Notes: Chapter 5: The Keynesian System (I) : The Role of Aggregate DemandDocument14 pagesLecture Notes: Chapter 5: The Keynesian System (I) : The Role of Aggregate DemandJaveria MalikNo ratings yet

- 2023 01 13 Ny Ui Fraud Letter To Ny Dol - FinalDocument3 pages2023 01 13 Ny Ui Fraud Letter To Ny Dol - FinalAdam PenaleNo ratings yet

- Welfare StateDocument12 pagesWelfare StateAwais AbidNo ratings yet

- Voluntary Separation ProcessDocument2 pagesVoluntary Separation ProcessJayashree UNo ratings yet

- PTTT Intermediate Level Look InsideDocument37 pagesPTTT Intermediate Level Look InsideKhánh TrangNo ratings yet

- WallstreetJournalDocument28 pagesWallstreetJournalDeepti AgarwalNo ratings yet

- Skilling and Employability Solutions - Full Report - Omidyar Network IndiaDocument69 pagesSkilling and Employability Solutions - Full Report - Omidyar Network IndiabangaloretoonsNo ratings yet

- Class 12 CBSE Economics Sample Paper 2023Document8 pagesClass 12 CBSE Economics Sample Paper 2023yazhinirekha4444No ratings yet

- Gr9 - Economics - P2 - Sample PaperDocument6 pagesGr9 - Economics - P2 - Sample Paperinfuriate beNo ratings yet

- Chapter 9Document18 pagesChapter 9Karen ReasonNo ratings yet

- Why CommunismDocument47 pagesWhy CommunismAva SchneiderNo ratings yet

- Vision IAS CSP 2019 Test 24 Questions PDFDocument18 pagesVision IAS CSP 2019 Test 24 Questions PDFmanjuNo ratings yet

- Characteristics of Slum Population in IndiaDocument9 pagesCharacteristics of Slum Population in IndiaBRIJENDRA NATH SINGHNo ratings yet

- AP MACRO ECONOMICS Notes Unit 1Document11 pagesAP MACRO ECONOMICS Notes Unit 1pyoon1No ratings yet

- Economics NSS F6 Exta Mock 4 MCDocument13 pagesEconomics NSS F6 Exta Mock 4 MCJerry LeeNo ratings yet

- Unemployed GraduateDocument16 pagesUnemployed Graduatezulmd51403767% (3)

- Additional Practice Questions and AnswersDocument32 pagesAdditional Practice Questions and AnswersMonty Bansal100% (1)

- Occupations and Earnings: Factors That Impact WagesDocument6 pagesOccupations and Earnings: Factors That Impact WagesMay Ei PhyuNo ratings yet

- Fishbone Diagram ScriptDocument2 pagesFishbone Diagram ScriptSweetrose GonzalesNo ratings yet

- Gorz Andre Reclaiming Work 1999Document194 pagesGorz Andre Reclaiming Work 1999mellacrousnofNo ratings yet