Professional Documents

Culture Documents

Bike Insurance 1021741038964946

Uploaded by

shireesh12345Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bike Insurance 1021741038964946

Uploaded by

shireesh12345Copyright:

Available Formats

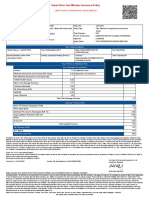

Your SmartDrive Motor Policy

Name of the Policy Holder

MR Harish Potabathula

Policy No

S8424402

Communication Address

House No 2-22-105A

Road Number 6, Vijaya Nagar Co

lony, Kukatpally Hyderabad, Andhra Pradesh - 500072

Policy Type

Total Premium

Two Wheeler-Comprehensive

Insurance Policy

1429.00

Contact No

8454940140

Policy Start Date

4/4/2015

Email ID

harish.nitw@gmail.com

Policy End Date

3/4/2016 Midnight

00:00 hrs

Agent No

Agent Name

:

:

2C000024

BHARTI AXA GENERAL

INS.CO.LTD.

Your Vehicle Details

Vehicle Reg.no.:MH03BM0494

Year of Manufacture:2013

Make / Model:BAJAJ/PULSAR

Fuel Type:Petrol

Insured Declared Value of the Vehicle

(IDV):46555

Seating Capacity(Including Driver):2

Chassis / Engine

No:MD2A36F28DCM71882/

JLZCDM67191

Cubic Capacity:200

Your Premium Details(in Rs)

Own Damage Premium(A)

Vehicle

Accessory (IMT 24) (0)

CNG/LPG (IMT 25) (0)

Basic Own Damage Premium

Voluntary Deductible

No Claim Bonus (20%)

AntiTheft

Load / Discount

834.73 Additional Cover

0.00

0.00

834.73

0.00

-166.95

0.00

0.00

Total Own Damage Premium

667.78

Liability Premium (B)

Basic TP Premium (Including TPPD)

554.00

PA to Owner Driver

50.00

Unnamed PA Cover to Passengers (IMT 16)

0.00

Legal Liability to Paid Driver (IMT 28)

0.00

Bi-Fuel Kit

0.00

Total Liability Premium

604.00

1272.00

Net Premium (A+B)

Service Tax

157.21

1,429.00

Total Premium(In Rs)

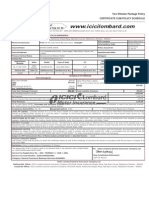

Limitations as to use: The Policy covers use of the vehicle for any purpose other than: (a) Hire or Reward (b) Carriage of goods (other than samples of personal luggage)(c) Organized

Racing (d) Pace Making (e) Speed Testing (f) Reliability Trial (g) Any purpose in connection with Motor Trade. Driver's Clause: Persons or Classes of person entitled to drive: Any

person including the insured, provided that a person driving holds an effective driving license at the time of the accident and is not disqualified from holding or obtaining such a license.

Provided also that the person holding an effective Learner's License may also drive the vehicle and that such a person satisfies the requirements of Rule 3 of the Central Motor

Vehicles Rules, 1989. Limits of Liability: Under Section II-1 (i) of the policy (Death of or bodily injury): Such amount as is necessary to meet the requirements of the Motor Vehicles Act,

1988. Under Section II-1 (ii) of the policy (Damage to Third Party Property) Rs. 7.5 lakhs. Under Section III: P.A cover to owner driver (CSI): Rs.1,00,000. PA cover to unnamed

passenger Rs. 0. Deductible under Section-I: Compulsory Deductible IMT 22: Rs. 100 . Voluntary Deductible IMT 22 (A): Rs. 0 Subject to Indian Motor Tariff Endorsement (nos.)

IMT22I/We hereby certify that the Policy to which this Certificate relates as well as this Certificate of Insurance are issued in accordance with the provisions of

Chapter X and XI of Motor Vehicles Act, 1988. In witness of this Policy has been signed at _________________

Receipt no. : CUTI3729578280

Service Tax Registration no.:AADCB2008DST001

For Bharti AXA General Insurance Co. Ltd

Authorized Signatory

Stamp duty paid to the account of The District Registrar of Stamps (Acc Head 0030-02-103-0-01), Bangalore Karnataka.

Important Notice: The insured is not indemnified if the vehicle is used or driven otherwise than in accordance with this schedule. Any payment made by the company by reason of wider terms appearing in the

certificate in order to comply with the Motor Vehicle's Act, 1988 is recoverable from the insured. See the clause headed "AVOIDANCE OF CERTAIN TERMS AND RIGHT OF RECOVERY".The Schedule, the

attached Policy and Endorsements mentioned herein above shall read together and word or expression to which a specific meaning has been attached in any part of this Policy or of the Schedule shall bear the

same meaning wherever it may appear. Any amendments/modifications/alterations made on this system generated policy document is not valid and Company shall not be liable for any liability whatsoever arising

from such changes. Any changes required to be made in the policy once issued, would be valid and effective, only after written request is made to the company and Company accepts the requested amendments/

modifications/alterations and records the same through separate endorsement to be issued by the Company.Insurance is the subject matter of solicitation.

You might also like

- New Bajaj Policies PDFDocument11 pagesNew Bajaj Policies PDFexcel.syed0% (1)

- HDFC ERGO car insurance policy detailsDocument1 pageHDFC ERGO car insurance policy detailsHarsh Sahrawat100% (3)

- InsuranceDocument1 pageInsuranceOmkar TrivediNo ratings yet

- Sunrise Logisticks - 1Document2 pagesSunrise Logisticks - 1niren4u1567100% (2)

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDocument3 pagesIffco-Tokio General Insurance Co - LTD: Servicing Officevijay_sudha50% (2)

- Harpriti PolicyDocument1 pageHarpriti PolicyIASkanhaNo ratings yet

- Tata AigDocument1 pageTata Aigsunnyb7750% (2)

- mh43x8786 Xylo E6Document4 pagesmh43x8786 Xylo E6Asif ShaikhNo ratings yet

- Shashi Kant Policy PDFDocument1 pageShashi Kant Policy PDFJamie Jordan100% (1)

- Two Wheeler PA ProposalDocument3 pagesTwo Wheeler PA Proposalmurali9026100% (1)

- Reliance Private Car Vehicle Certificate Cum Policy ScheduleDocument3 pagesReliance Private Car Vehicle Certificate Cum Policy ScheduleMatthew Smith100% (5)

- Bike Insurance PDFDocument2 pagesBike Insurance PDFChaudharyShubhamSachan46% (85)

- Innova Ranbir PDFDocument2 pagesInnova Ranbir PDFNarinder KaurNo ratings yet

- Car Insurance RenewalDocument2 pagesCar Insurance Renewalpavnishsharma33% (3)

- TW Niapolicyschedulecirtificatetw 56243094Document2 pagesTW Niapolicyschedulecirtificatetw 56243094gmsangeethNo ratings yet

- Two Wheeler Insurance Package PolicyDocument2 pagesTwo Wheeler Insurance Package PolicyJai Deep43% (21)

- Future Generali India: Insurance Company LimitedDocument2 pagesFuture Generali India: Insurance Company LimitedThe CharlieNo ratings yet

- Smart Drive Two Wheeler Insurance PolicyDocument1 pageSmart Drive Two Wheeler Insurance PolicyHungamaSurat SuratNo ratings yet

- Icici Lombard PolicyDocument2 pagesIcici Lombard Policyanon_678306604No ratings yet

- Bike Insurance PolicyDocument2 pagesBike Insurance PolicyAnaruzzaman Sheikh0% (1)

- Iffco TokioDocument2 pagesIffco Tokioneel55% (11)

- Future Generali India: IND-0208352-01-R-1Document2 pagesFuture Generali India: IND-0208352-01-R-1SamaNo ratings yet

- Reliance Private Car Vehicle Certificate Cum Policy ScheduleDocument1 pageReliance Private Car Vehicle Certificate Cum Policy ScheduleBarry Peterson100% (4)

- PolicySoftCopy 104667249Document1 pagePolicySoftCopy 104667249Masum PatthakNo ratings yet

- Car Policy InsuranceDocument2 pagesCar Policy InsurancePulkit100% (1)

- Reliance General Insurance Company LimitedDocument7 pagesReliance General Insurance Company LimitedSURESH MEHERKARNo ratings yet

- Reliance Two Wheeler Insurance Policy DetailsDocument2 pagesReliance Two Wheeler Insurance Policy DetailsRoopesh KumarNo ratings yet

- Car General Insurance LikeDocument2 pagesCar General Insurance LikeAshit Janeja67% (3)

- Bike InsuranceDocument2 pagesBike InsuranceChinnabbai ChettubathinaNo ratings yet

- Motor Insurance Package Policy for Two WheelerDocument1 pageMotor Insurance Package Policy for Two Wheelerjitendra asdeoNo ratings yet

- Two Wheeler Insurance Package PolicyDocument2 pagesTwo Wheeler Insurance Package Policy332233% (3)

- Smart Drive Two Wheeler Insurance Policy SummaryDocument1 pageSmart Drive Two Wheeler Insurance Policy SummaryVaishnavi HallikarNo ratings yet

- 2312100095928100000Document2 pages2312100095928100000Kavin Prakash100% (2)

- Comprehensive Insurance Proposal for Private CarDocument3 pagesComprehensive Insurance Proposal for Private CarAnonymous lYDz0aBTC100% (1)

- OkDocument1 pageOkAkash SinghNo ratings yet

- Bike InsuranceDocument2 pagesBike Insuranceprakash gusain60% (5)

- Two Wheeler Insurance Policy DetailsDocument2 pagesTwo Wheeler Insurance Policy DetailsAnil Kumar56% (41)

- The Oriental Insurance Company LimitedDocument3 pagesThe Oriental Insurance Company LimitedraggerloungeNo ratings yet

- Vehicle Insurance 2nd YearDocument2 pagesVehicle Insurance 2nd YearVivek KuppusamyNo ratings yet

- HDFC ERGO Two Wheeler Insurance Policy DetailsDocument2 pagesHDFC ERGO Two Wheeler Insurance Policy Detailssachinkulsh_1No ratings yet

- Car Insurance PolicyDocument1 pageCar Insurance PolicyVignesh VikiNo ratings yet

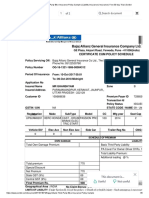

- Bajaj Allianz General Insurance CompanyDocument3 pagesBajaj Allianz General Insurance Companysarath potnuriNo ratings yet

- Two-wheeler insurance policy detailsDocument2 pagesTwo-wheeler insurance policy detailsHariharan MokkaralaNo ratings yet

- Sample Statement For Insurance CarDocument2 pagesSample Statement For Insurance CarRajesh Mukkavilli57% (14)

- Two-wheeler insurance policy detailsDocument3 pagesTwo-wheeler insurance policy detailsSureshNo ratings yet

- InsuranceDocument3 pagesInsurancePinakin Puranik0% (2)

- Oriental Insurance Motor Policy Done On PortalDocument3 pagesOriental Insurance Motor Policy Done On PortalAnkur Patil50% (2)

- Policy RiteshDocument2 pagesPolicy Riteshsmbcards50% (2)

- TN22CP5071 Insurance Liberty Videocon 08 Mar 2019 PDFDocument3 pagesTN22CP5071 Insurance Liberty Videocon 08 Mar 2019 PDFNarayanan KrishnanNo ratings yet

- Future Secure Motor InsuranceDocument2 pagesFuture Secure Motor InsurancePradeep SreedharanNo ratings yet

- Two-Wheeler Insurance Policy DetailsDocument2 pagesTwo-Wheeler Insurance Policy DetailsMukesh Manwani100% (2)

- Bajaj Allianz Third Party Bike Insurance Policy Sample - Liability Insurance - Insurance - Free 30-Day Trial - ScribdDocument6 pagesBajaj Allianz Third Party Bike Insurance Policy Sample - Liability Insurance - Insurance - Free 30-Day Trial - ScribdIshu Bisht100% (3)

- Nitin PDFDocument2 pagesNitin PDFAnonymous uHXjXqhvoL100% (1)

- Icici Lombard PDFDocument1 pageIcici Lombard PDFPawan Kumar0% (1)

- Bike Insurance PDFDocument3 pagesBike Insurance PDFSenthil KumarNo ratings yet

- Liability Only Policy for Delhi Car OwnerDocument1 pageLiability Only Policy for Delhi Car OwnerSmarttNo ratings yet

- HDFC ERGO General Insurance Certificate of InsuranceDocument2 pagesHDFC ERGO General Insurance Certificate of InsuranceKrishna Kiran VyasNo ratings yet

- Pramod Kumar PDFDocument1 pagePramod Kumar PDFMd Rashid100% (1)

- Policy ScheduleDocument1 pagePolicy ScheduleShankar Nath100% (1)

- Policy Schedule Two Wheeler-Cs2Document1 pagePolicy Schedule Two Wheeler-Cs2Sunil NaikNo ratings yet

- Nmos FabricationDocument20 pagesNmos FabricationTb ShilpaNo ratings yet

- Lect 14Document40 pagesLect 14shireesh12345No ratings yet

- Module 6: Semiconductor Memories Lecture 28: Static Random Access Memory (SRAM)Document6 pagesModule 6: Semiconductor Memories Lecture 28: Static Random Access Memory (SRAM)shireesh12345No ratings yet

- Ug Ram RomDocument57 pagesUg Ram Romshireesh12345No ratings yet

- FabricationDocument56 pagesFabricationshireesh12345No ratings yet

- Hyperion Interview Questions and AnswersDocument3 pagesHyperion Interview Questions and AnswersatoztargetNo ratings yet

- Vlsi Design & TechnolgyDocument60 pagesVlsi Design & TechnolgyDimple GalaNo ratings yet

- Calculation Scripts EssbaseDocument68 pagesCalculation Scripts EssbasePrakash AaretiNo ratings yet

- Essbase Calc ScriptDocument15 pagesEssbase Calc ScriptmrguduruNo ratings yet

- Serials 7Document3 pagesSerials 7shireesh12345No ratings yet

- Embedded Systems: Martin Schoeberl Mschoebe@mail - Tuwien.ac - atDocument27 pagesEmbedded Systems: Martin Schoeberl Mschoebe@mail - Tuwien.ac - atDhirenKumarGoleyNo ratings yet

- NDU Final Project SP23Document2 pagesNDU Final Project SP23Jeanne DaherNo ratings yet

- Payroll Canadian 1st Edition Dryden Test BankDocument38 pagesPayroll Canadian 1st Edition Dryden Test Bankriaozgas3023100% (14)

- Easyjet Group6Document11 pagesEasyjet Group6Rishabh RakhechaNo ratings yet

- Shri Siddheshwar Co-Operative BankDocument11 pagesShri Siddheshwar Co-Operative BankPrabhu Mandewali50% (2)

- WM3000U - WM3000 I: Measuring Bridges For Voltage Transformers and Current TransformersDocument4 pagesWM3000U - WM3000 I: Measuring Bridges For Voltage Transformers and Current TransformersEdgar JimenezNo ratings yet

- CLC Customer Info Update Form v3Document1 pageCLC Customer Info Update Form v3John Philip Repol LoberianoNo ratings yet

- 10 Appendix RS Means Assemblies Cost EstimationDocument12 pages10 Appendix RS Means Assemblies Cost Estimationshahbazi.amir15No ratings yet

- CELF Final ProspectusDocument265 pagesCELF Final ProspectusDealBookNo ratings yet

- MMDS Indoor/Outdoor Transmitter Manual: Chengdu Tengyue Electronics Co., LTDDocument6 pagesMMDS Indoor/Outdoor Transmitter Manual: Chengdu Tengyue Electronics Co., LTDHenry Jose OlavarrietaNo ratings yet

- Design of Shear Walls Using ETABSDocument97 pagesDesign of Shear Walls Using ETABSYeraldo Tejada Mendoza88% (8)

- Chi Square LessonDocument11 pagesChi Square LessonKaia HamadaNo ratings yet

- Blum2020 Book RationalCybersecurityForBusineDocument349 pagesBlum2020 Book RationalCybersecurityForBusineJulio Garcia GarciaNo ratings yet

- Activate Adobe Photoshop CS5 Free Using Serial KeyDocument3 pagesActivate Adobe Photoshop CS5 Free Using Serial KeyLukmanto68% (28)

- (EMERSON) Loop CheckingDocument29 pages(EMERSON) Loop CheckingDavid Chagas80% (5)

- ECED Lab ReportDocument18 pagesECED Lab ReportAvni GuptaNo ratings yet

- 01 NumberSystemsDocument49 pages01 NumberSystemsSasankNo ratings yet

- Chirala, Andhra PradeshDocument7 pagesChirala, Andhra PradeshRam KumarNo ratings yet

- Wheat as an alternative to reduce corn feed costsDocument4 pagesWheat as an alternative to reduce corn feed costsYuariza Winanda IstyanNo ratings yet

- Book Two - 2da. EdiciónDocument216 pagesBook Two - 2da. EdiciónJhoselainys PachecoNo ratings yet

- Hollow lateral extrusion process for tubular billetsDocument7 pagesHollow lateral extrusion process for tubular billetsjoaopedrosousaNo ratings yet

- How To Make Pcbat Home PDFDocument15 pagesHow To Make Pcbat Home PDFamareshwarNo ratings yet

- Role Played by Digitalization During Pandemic: A Journey of Digital India Via Digital PaymentDocument11 pagesRole Played by Digitalization During Pandemic: A Journey of Digital India Via Digital PaymentIAEME PublicationNo ratings yet

- Storage Reservior and Balancing ReservoirDocument19 pagesStorage Reservior and Balancing ReservoirNeel Kurrey0% (1)

- HW3Document3 pagesHW3Noviyanti Tri Maretta Sagala0% (1)

- C - Official Coast HandbookDocument15 pagesC - Official Coast HandbookSofia FreundNo ratings yet

- FZ16 9B 1KD2 (Patada) PDFDocument62 pagesFZ16 9B 1KD2 (Patada) PDFPanthukalathil Ram100% (1)

- PaySlip ProjectDocument2 pagesPaySlip Projectharishgogula100% (1)

- Memento Mori: March/April 2020Document109 pagesMemento Mori: March/April 2020ICCFA StaffNo ratings yet

- StrutsDocument7 pagesStrutsBatrisyialya RusliNo ratings yet