Professional Documents

Culture Documents

ACCT 3040 Course Outline AQAC Sem2 201415

Uploaded by

AriCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACCT 3040 Course Outline AQAC Sem2 201415

Uploaded by

AriCopyright:

Available Formats

THE UNIVERSITY OF THE WEST INDIES

CAVE HILL CAMPUS

UNDERGRADUATE COURSE OUTLINE

ITEM

DESCRIPTION

Course Title

ADVANCE ACCOUNTING THEORY

Course Code

Academic Units to offer

Course

ACCT 3040

Level

Semester

Course Credit Load

Academic Staff Member

Course

Course

Course

Course

Prerequisite

Co-requisite

Post-requisite

Anti-requisite

Course Description

DEPARTMENT OF MANAGEMENT STUDIES

2

3

Name: Terry Harris, M.Phil., ACCA.

Email: terry.harris@cavehill.uwi.edu

Room # MS1

Tel: 417-4302

Office Hours: Mondays (4:00 pm 6:00 pm)

Lectures: Thursdays (10 am - 12 noon)

ACCT 2014-FINANCIAL ACCOUNTING I

This course introduces the student to the nature of the changing landscape of

accounting thought and research. It also provides a bird's eye view of research methods

in accounting as a necessary part of understanding how these alternative views

developed; questioning the criteria for determining what is acceptable knowledge in

accounting. The course aims to develop critical thinking skills in students, thereby

enabling them to assess the current accounting thought particularly as it relates to the

Caribbean environment. Debating skills, critical awareness and essay writing for

Course Rationale

academic purposes are some of the transferable skills that will be imparted to students

due to the nature of this course.

The rationale behind this course is to develop critical analysis, communication skills

and thinking about accounting issues and challenges facing the accounting profession.

To achieve this, students will be exposed to a range of theories about accounting and

accountants, thereby providing them with a deeper understanding of accounting beyond

the technical procedures. As an advance course, the main purpose is to critically

examine and discuss the role of accounting and finance theories and frameworks in

understanding the nature and form of regulated and voluntary accounting information

choices. This course integrates knowledge gleaned in earlier courses and provides a

framework for examining current accounting theories and practices.

The goals of this course are to:

General Goals/Aims

introduce learners to a range of theories about accounting and accountants;

discuss the role of accounting and finance theories and frameworks and

develop the student's understanding of the nature and form of regulated and

voluntary accounting information disclosures; and

enhance the student's understanding of the issues and controversies facing the

accountant and the accounting profession.

By the end of the course, students will be able to:

Specific Learning

Outcomes/Objectives

discuss the accounting regulatory environment;

explain and critically discuss alternative models of financial accounting and

theories of accounting;

analyse regulatory and accounting choices in practice and apply the relevant

theories to those choices;

critically explore and discuss issues which affect the accounting profession;

and

explain the role of accounting and finance professionals.

Course Content

Teaching Methodologies

Course Assessment

Methods

See page 4

This course consists of a two-hour lecture and a compulsory one-hour tutorial per

week. The teaching method will comprise of lecture/discussion and problem solving.

Students are expected to fully participate in tutorials in an effort to develop critical

thinking, problem solving and communication skills. To facilitate participation and to

receive credit for participation, each student must prepare assigned questions prior to

their respective tutorial.

Assimilating the concepts in this course depends very heavily on the level of

commitment of the student. Regular attendance at the tutorial sessions and active

participation will enhance the chance of a student achieving a good grade in this course.

A reasonable rule of thumb is to spend 23 hours outside of class time reviewing

material and attempting assigned questions. Communication for the course will be

facilitated through elearning (Moodle).

Coursework

30%

Paper review.

10%

Research paper

15%

Tutorial participation

5%

Final Examination

70%

Short answer and essay type questions. Further details will be given during the

semester.

Teaching /Learning

Resources including

internet sources

Text

Craig Deegan & Jeffrey Unerman, Financial Accounting Theory, (second

European Edition) McGrae Hill (Paper-back)

Recommended Readings

Akerlof, G. A. (1970). The market for" lemons": Quality uncertainty and the market

mechanism. The quarterly journal of economics, 488-500.

Ball, R., & Brown, P. (1968). An empirical evaluation of accounting income numbers.

Journal of accounting research, 159-178.

Basu, S. (1997). The conservatism principle and the asymmetric timeliness of earnings.

Journal of accounting and economics, 24(1), 3-37.

Fama, E. F. (1970). Efficient capital markets: A review of theory and empirical work.

The journal of Finance, 25(2), 383-417.

Jensen, M. C., & Meckling, W. H. (1979). Theory of the firm: Managerial behavior,

agency costs, and ownership structure (pp. 163-231). Springer Netherlands.

Watts, R. L., & Zimmerman, J. L. (1986). Positive accounting theory. Prentice-Hall

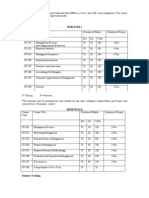

COURSE CONTENT & LECTURE SCHEDULE

WEEK

TOPIC

CHAPTER

QUESTIONS

Introduction

1

Introduction to the course

Introduction to financial accounting theory

1, 2, 4, 6, 9, 12

and 15

The financial reporting environment

The regulation of financial accounting

International accounting

1, 2, 3, 4, 5 and 6

2, 3, 4, 5, 10, 11,

and 13

1, 2, 3, 4, 7, 11

and 12

Theoretical Approaches

5

Normative theories of accounting 1: The case of accounting for changing prices and

asset values

1, 2, 5, 6, 7, 8 and

9

Normative theories of accounting 2: The case of conceptual framework projects

1, 2, 4, 5 and 9

Positive Accounting Theory

Unregulated corporate reporting decisions: Consideration of system-oriented theories

1, 2, 3, 4, 6, 13

and 14

1, 2, 3, 4, 8, 11

and 12

Contemporary Issues

9

Extended system of accounting: The incorporation of social and environmental factors

within external reporting

1, 2, 3, 4, 6, 8 and

13

10

Reaction of capital markets to financial reporting

10

1, 2, 4, 12 and 13

11

Reactions of individuals to financial reporting: An examination of behavioural

research

11

1, 2, 4, 5, 9 and

10

12

Critical perspectives of accounting

12

1, 2, 3, 4, 6 and 7

13

Revision

You might also like

- Acc602 Course OutlineDocument14 pagesAcc602 Course OutlineUshra KhanNo ratings yet

- 1 MGT Accg For MBA Course Outline KMU 2020-21 MTDocument4 pages1 MGT Accg For MBA Course Outline KMU 2020-21 MTassuluxuryapartmentsNo ratings yet

- Financial Accounting and Reporting Part I SyllabusDocument2 pagesFinancial Accounting and Reporting Part I SyllabusJay Bee SalvadorNo ratings yet

- Agw610 Course Outline Sem 1 2013-14 PDFDocument12 pagesAgw610 Course Outline Sem 1 2013-14 PDFsamhensemNo ratings yet

- 1.5.2. Module Description For Faculty Level Core CoursesDocument12 pages1.5.2. Module Description For Faculty Level Core CoursesKang Dadang SaepulohNo ratings yet

- MADS 6601 Course Outline Spring 2012Document6 pagesMADS 6601 Course Outline Spring 2012arjkt564No ratings yet

- Syllabus AmityDocument80 pagesSyllabus AmityAnukampa KhajuriaNo ratings yet

- Course Guide Sem. 1 2011Document6 pagesCourse Guide Sem. 1 2011sir bookkeeperNo ratings yet

- Faculty of Economics and Business Universitas Gadjah Mada Undergraduate Program Syllabus Aku 1601 - Introductory AccountingDocument4 pagesFaculty of Economics and Business Universitas Gadjah Mada Undergraduate Program Syllabus Aku 1601 - Introductory Accountingaurelia kaneishaNo ratings yet

- Syllabus MBA HR - 2012-14Document75 pagesSyllabus MBA HR - 2012-14Mona HablaniNo ratings yet

- ECON3119 5319 Political Economy Course Outline 2016Document19 pagesECON3119 5319 Political Economy Course Outline 2016JenniferNo ratings yet

- Econ1101 Course OutlineDocument18 pagesEcon1101 Course OutlineJoannaNo ratings yet

- BSBFIM501A - Manage Budgets and Financial PlansDocument4 pagesBSBFIM501A - Manage Budgets and Financial Plansbluemind200517% (6)

- MBA Scheme and SyllabusDocument60 pagesMBA Scheme and SyllabusSushil SainiNo ratings yet

- Managerial Economics Course SyllabusDocument6 pagesManagerial Economics Course SyllabusTimothy SungNo ratings yet

- Spring 2023 Course Outline - BUS 525Document4 pagesSpring 2023 Course Outline - BUS 525mirza.intesar01No ratings yet

- Management AccountingDocument5 pagesManagement AccountingDoni SujanaNo ratings yet

- Bba 1 2019-23Document8 pagesBba 1 2019-23abdulrab amjad100% (1)

- ECON1101 Macroeconomics 1 S22015Document18 pagesECON1101 Macroeconomics 1 S22015Allan WuNo ratings yet

- ACCT 100-Principles of Financial Accounting - Atifa Dar - Omair HaroonDocument7 pagesACCT 100-Principles of Financial Accounting - Atifa Dar - Omair HaroonAbdelmonim Awad OsmanNo ratings yet

- Cost-1 Course OutlineDocument2 pagesCost-1 Course OutlineHussen AbdulkadirNo ratings yet

- Strategies For Teaching The Accounting Theory Course:: Curriculum, Pedagogy and ResourcesDocument33 pagesStrategies For Teaching The Accounting Theory Course:: Curriculum, Pedagogy and Resourcesyenebeb tarikuNo ratings yet

- ACCT2522 Management Accounting 1 Course Outline S1 2016Document17 pagesACCT2522 Management Accounting 1 Course Outline S1 2016Anna ChenNo ratings yet

- Economics Unit OutlineDocument8 pagesEconomics Unit OutlineHaris ANo ratings yet

- Learn Advanced Finance TopicsDocument5 pagesLearn Advanced Finance TopicsBhavana KiranNo ratings yet

- Mii 103Document2 pagesMii 103Khalids MusaNo ratings yet

- Bba Syllabus Cbcs 1430361639Document124 pagesBba Syllabus Cbcs 1430361639TaherNo ratings yet

- HEC Management ControlDocument11 pagesHEC Management ControlHANNINo ratings yet

- UT Dallas Syllabus For Meco6303.pi1.11u Taught by Peter Lewin (Plewin)Document6 pagesUT Dallas Syllabus For Meco6303.pi1.11u Taught by Peter Lewin (Plewin)UT Dallas Provost's Technology GroupNo ratings yet

- Managerial Economics - RG (Me501)Document10 pagesManagerial Economics - RG (Me501)Saransh KirtiNo ratings yet

- SECTION 2 Course Outline Managerial Economics MGCR 293 002 Dr. K. Salmasi (Fall 2017)Document12 pagesSECTION 2 Course Outline Managerial Economics MGCR 293 002 Dr. K. Salmasi (Fall 2017)Hamza AeroNo ratings yet

- MBA ITB Business EconomicsDocument9 pagesMBA ITB Business Economicsyandhie57No ratings yet

- CB2200 Course OutlineDocument6 pagesCB2200 Course OutlineKenny SzeNo ratings yet

- Kathmandu University FIN 510 CourseDocument7 pagesKathmandu University FIN 510 CourseOmkar PandeyNo ratings yet

- BAC3674 - Syllabus Sem1 2013-2014Document7 pagesBAC3674 - Syllabus Sem1 2013-2014secsmyNo ratings yet

- SyllabusPublic Finance - Doc.doc 1Document3 pagesSyllabusPublic Finance - Doc.doc 1MikasaNo ratings yet

- ACCT 130-Principles of Management Accounting-Abdul Rauf-Ayesha Bhatti-Samia Kokhar-Junaid AshrafDocument7 pagesACCT 130-Principles of Management Accounting-Abdul Rauf-Ayesha Bhatti-Samia Kokhar-Junaid AshrafmuhammadmusakhanNo ratings yet

- Programme Specification - Undergraduate Programmes Key FactsDocument11 pagesProgramme Specification - Undergraduate Programmes Key FactsSonia GalliNo ratings yet

- Principles of Accounting Course OutlineDocument4 pagesPrinciples of Accounting Course OutlinefuriousTaherNo ratings yet

- 511 Ac & Finance For ManagersDocument3 pages511 Ac & Finance For ManagersMesi YE GINo ratings yet

- Gulbarga University BBM SyllabusDocument59 pagesGulbarga University BBM SyllabusNag28raj50% (6)

- Syl PGDM EvenDocument277 pagesSyl PGDM EvenPank GaurNo ratings yet

- Silabus TADocument4 pagesSilabus TAAyshabily Intifadha AprisyaNo ratings yet

- Scheme and Syllabus-MBADocument74 pagesScheme and Syllabus-MBAPankaj KumarNo ratings yet

- UM Microeconomic Theory ModuleDocument4 pagesUM Microeconomic Theory ModuleRoussety Hugue DidierNo ratings yet

- FNCE475 Management of Financial Institutions Course Outline Spring 2023Document23 pagesFNCE475 Management of Financial Institutions Course Outline Spring 2023Sashina GrantNo ratings yet

- FIN104 Public Finance Course SyllabusDocument5 pagesFIN104 Public Finance Course SyllabusSeth HughesNo ratings yet

- Name: Mrs Felicia AnsahDocument6 pagesName: Mrs Felicia Ansahsalifu yahayaNo ratings yet

- FIN 202 SyllabusDocument15 pagesFIN 202 SyllabusmadhuNo ratings yet

- Syllabus Bkam 3033Document5 pagesSyllabus Bkam 3033Yadu Priya DeviNo ratings yet

- School of Economics, Finance and Banking Uum College of BusinessDocument9 pagesSchool of Economics, Finance and Banking Uum College of BusinessSofia ArissaNo ratings yet

- Guidelines For Writing Paper 1Document31 pagesGuidelines For Writing Paper 1tyrramNo ratings yet

- Course Outline Aacsb Mba 611 Management AccountingDocument6 pagesCourse Outline Aacsb Mba 611 Management AccountingNishant TripathiNo ratings yet

- Accounting Education: A Review of the Changes That Have Occurred in the Last Five YearsFrom EverandAccounting Education: A Review of the Changes That Have Occurred in the Last Five YearsNo ratings yet

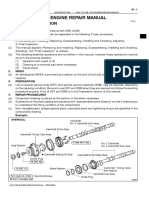

- How To Use This Engine Repair Manual: General InformationDocument3 pagesHow To Use This Engine Repair Manual: General InformationHenry SilvaNo ratings yet

- Mundane AstrologyDocument93 pagesMundane Astrologynikhil mehra100% (5)

- Earth Drill FlightsDocument2 pagesEarth Drill FlightsMMM-MMMNo ratings yet

- Otto F. Kernberg - Transtornos Graves de PersonalidadeDocument58 pagesOtto F. Kernberg - Transtornos Graves de PersonalidadePaulo F. F. Alves0% (2)

- Write a composition on tax evasionDocument7 pagesWrite a composition on tax evasionLii JaaNo ratings yet

- The Five Laws of Light - Suburban ArrowsDocument206 pagesThe Five Laws of Light - Suburban Arrowsjorge_calvo_20No ratings yet

- Pale Case Digest Batch 2 2019 2020Document26 pagesPale Case Digest Batch 2 2019 2020Carmii HoNo ratings yet

- The Neteru Gods Goddesses of The Grand EnneadDocument16 pagesThe Neteru Gods Goddesses of The Grand EnneadKirk Teasley100% (1)

- Equity Valuation Concepts and Basic Tools (CFA) CH 10Document28 pagesEquity Valuation Concepts and Basic Tools (CFA) CH 10nadeem.aftab1177No ratings yet

- List of Parts For Diy Dremel CNC by Nikodem Bartnik: Part Name Quantity BanggoodDocument6 pagesList of Parts For Diy Dremel CNC by Nikodem Bartnik: Part Name Quantity Banggoodyogesh parmarNo ratings yet

- Md. Raju Ahmed RonyDocument13 pagesMd. Raju Ahmed RonyCar UseNo ratings yet

- FSW School of Education Lesson Plan Template: E1aa06cb3dd19a3efbc0/x73134?path JavascriptDocument7 pagesFSW School of Education Lesson Plan Template: E1aa06cb3dd19a3efbc0/x73134?path Javascriptapi-594410643No ratings yet

- McLeod Architecture or RevolutionDocument17 pagesMcLeod Architecture or RevolutionBen Tucker100% (1)

- MinePlan Release NotesDocument14 pagesMinePlan Release NotesJuanJo RoblesNo ratings yet

- Economic Impact of Tourism in Greater Palm Springs 2023 CLIENT FINALDocument15 pagesEconomic Impact of Tourism in Greater Palm Springs 2023 CLIENT FINALJEAN MICHEL ALONZEAUNo ratings yet

- CH 19Document56 pagesCH 19Ahmed El KhateebNo ratings yet

- 740LIDocument13 pages740LIm FaisalNo ratings yet

- HERBAL SHAMPOO PPT by SAILI RAJPUTDocument24 pagesHERBAL SHAMPOO PPT by SAILI RAJPUTSaili Rajput100% (1)

- 2 - How To Create Business ValueDocument16 pages2 - How To Create Business ValueSorin GabrielNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pravin AwalkondeNo ratings yet

- Technical Contract for 0.5-4X1300 Slitting LineDocument12 pagesTechnical Contract for 0.5-4X1300 Slitting LineTjNo ratings yet

- LLB 1st Year 2019-20Document37 pagesLLB 1st Year 2019-20Pratibha ChoudharyNo ratings yet

- Obtaining Workplace InformationDocument4 pagesObtaining Workplace InformationJessica CarismaNo ratings yet

- 2Document5 pages2Frances CiaNo ratings yet

- BICON Prysmian Cable Cleats Selection ChartDocument1 pageBICON Prysmian Cable Cleats Selection ChartMacobNo ratings yet

- Role of Rahu and Ketu at The Time of DeathDocument7 pagesRole of Rahu and Ketu at The Time of DeathAnton Duda HerediaNo ratings yet

- Marlissa - After School SpecialDocument28 pagesMarlissa - After School SpecialDeepak Ratha50% (2)

- Building Bridges Innovation 2018Document103 pagesBuilding Bridges Innovation 2018simonyuNo ratings yet

- FCE Listening Test 1-5Document20 pagesFCE Listening Test 1-5Nguyễn Tâm Như Ý100% (2)

- HRM in A Dynamic Environment: Decenzo and Robbins HRM 7Th Edition 1Document33 pagesHRM in A Dynamic Environment: Decenzo and Robbins HRM 7Th Edition 1Amira HosnyNo ratings yet