Professional Documents

Culture Documents

Importance of Integrated Governance, Risk and Compliance Principles

Uploaded by

Vishal GargOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Importance of Integrated Governance, Risk and Compliance Principles

Uploaded by

Vishal GargCopyright:

Available Formats

C02

06/06/2011

16:47:14

Page 21

CHAPTER TWO

Importance of Governance, Risk,

and Compliance Principles

N T E R P R I S E O R G A N I Z A T I O N S A N D C O R PO R A T I O N S , in particular, have

faced governance issues since their earliest days. Someone or some group was in

charge and took a lead in setting the rules for employees and other stakeholders

to follow. While this worked with smaller single proprietorships or in the tightly

centralized corporations of eras past, todays larger and often multiunit enterprises

need broad-based units or functions for setting rules and proceduresthey need

efficient and effective governance processes.

Life would be easier for those same enterprises if they just had to rely on a central

leadership to set those governance rules. However, enterprises today of any location or

size are faced with ever increasing sets of rules and procedures ranging from local police

and public safety ordinances to national and sometimes international laws and on to

broad professional rules and standards. On a whole series of levels, an enterprise must

comply with these laws and regulations. Failure to do so can result in a variety of

penalties, and an enterprise needs processes to ensure that they are operating in

compliance with the appropriate laws and regulations.

An enterprise always faces risks that it will be found in violation of one or another of

these multiple laws and regulations. There are also risks that their own established

governance rules will not achieve their desired results or that they may face some

outside event beyond their control, such as a major weather event or a fire in a major

facility. There is a need to manage these risks at an overall enterprise level.

While enterprises have always been concerned with various governance, risk, and

compliance issues, the introduction of COSO ERM, or enterprise risk management, the

major theme of this book, has brought all three of these governance, risk, and

compliance concerns together into what has been called GRC principles. While other

21

C02

06/06/2011

16:47:14

22

Page 22

&

Importance of Governance, Risk, and Compliance Principles

chapters following discuss such issues as the importance of enterprise governance

practices, risk management fundamentals, and corporate governance practices, this

chapter looks at the importance of establishing a strong set or program of enterprise

GRC principles, important tools for enterprise management.

ROAD TO EFFECTIVE GRC PRINCIPLES

Business professionals did not even hear about the now increasingly familiar acronym

GRC until a few years after SOx. As mentioned in the introduction to this chapter, the

G stands for governance. In short, this means taking care of business, making sure that

things are done according to an enterprises standards, regulations, and board of directors

decisions. It also means setting forth clear stakeholder expectations of what should be

done so that everyone is on the same page with regard to how the enterprise is run. The R

is risk. Everything we do involves some element of risk. When it comes to running across

freeways or playing with matches, its pretty clear that certain risks are just not to be

taken. When it comes to business, however, risk becomes a way to help both protect

existing asset value and create value by strategically expanding an enterprise or adding

new products and services. The concept of risk is even more important than just the COSO

ERM we will be exploring in greater detail in the chapters to follow.

The C represents compliance with the many laws and rules affecting businesses and

citizens today. Sometimes, people will also extend that C to include controls, meaning

that it is important to put certain controls in place to ensure that compliance is

happening. This might mean monitoring a factorys emissions or ensuring that its

import and export papers are in order. Or it might just mean establishing effective

internal accounting controls, and effectively implementing legislative requirements

such as the Sarbanes-Oxley (SOx) rules discussed in Chapter 9 of this book. Put all

together, GRC is not just what you have to do to take care of an enterprise, but a

paradigm to help grow that enterprise in the best possible way.

As we stated in our introductory paragraphs, all enterprises, and corporations in

particular, historically do not think of GRC as a combined set of principles. As much as

an enterprise managed or cared about any of these areas, they were often managed as

separate areas or concerns. Risk management is a classic case here. Enterprises thought

of risk management in terms of insurance coverage and often managed their risks

through an insurance department that had little to do with other enterprise operations.

Similarly, we always had a need to comply with all levels of established rules, including

the rules that were established to help govern the enterprise, but we have not

historically combined them to form GRC concepts. Governance, risk, and compliance,

or GRC, is an increasingly recognized term that reflects a new way in which enterprises

today are adopting an integrated approach to these aspects of their businesses.

Going beyond just the acronym GRC, it is important to remember these represent

core disciplines of governance, risk management, and compliance. Each of the disciplines consists of the four basic GRC components: strategy, processes, technology, and

people.

C02

06/06/2011

16:47:15

Page 23

Importance of GRC Governance

&

23

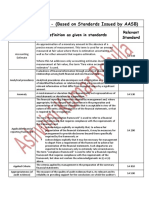

EXHIBIT 2.1 GRC Concepts

Exhibit 2.1 illustrates this GRC concept. Governance, risk management, and

compliance principles are tightly bound to tie these principles together. The diagram

also shows that internal policies are the key factors supporting governance, that

external regulations drive compliance principles, and that an enterprises risk appetite

is a key element of risk management. Within this triangle, we have the components

of strategy, effective processes, technologies, including IT, and the people in the enterprise to make all of this work. Off to the left side, the exhibit shows that an enterprise

requires management attention and support, and correct ethical behavior, organizational efficiency, and improved effectiveness are keys. The sections following will

discuss each of the GRC components further and indicate where they are discussed

in other chapters.

IMPORTANCE OF GRC GOVERNANCE

The three GRC principles should be thought of in terms of one continuous and

interconnecting flow of concepts and with neither G, R, or C more important or

significant than the others. While the preponderance of the chapters to follow cover

risk management and COSO ERM, we start our GRC discussion here with governance.

Corporate or enterprise governance is a term that refers broadly to the rules, processes, or

laws by which businesses are operated, regulated, and controlled. The term can refer to

internal factors defined by the officers, stockholders, or the charter and basic objectives

of a corporation, as well as to external forces such as consumer groups, clients, and

government regulations.

Moving down from senior corporate levels and into enterprise operations, we can

define enterprise governance as the responsibilities and practices exercised by the board,

executive management, and all levels of functional management with the goals of

C02

06/06/2011

16:47:15

24

Page 24

&

Importance of Governance, Risk, and Compliance Principles

providing strategic direction, ensuring that objectives are achieved, ascertaining that

risks are managed appropriately, and verifying that the enterprises resources are used

responsibly. Governance really refers to the process of establishing rules and procedures

within all levels of an enterprise, communicating those rules to appropriate levels of

stakeholders, monitoring performance against those rules, and administering rewards

and punishments based on the relative performance or compliance with those rules.

A well-defined and enforced set of corporate governance principles provides a

structure that, at least in theory, works for the benefit of everyone concerned by

ensuring that the enterprise adheres to accepted ethical standards and best practices as

well as to formal laws. In recent years, corporate governance has received increased

attention because of high-profile scandals involving abuse of corporate power and, in

some cases, alleged criminal activity by corporate officers. An integral part of an effective

corporate governance regime includes provisions for civil or criminal prosecution of

individuals who conduct unethical or illegal acts in the name of the enterprise.

Although it is difficult to describe all of the concepts of corporate or enterprise

governance in a few short paragraphs or a single picture, Exhibit 2.2 shows enterprise

governance concepts with an executive group in the center and their interlocking and

EXHIBIT 2.2 GRC Governance Concepts

C02

06/06/2011

16:47:15

Page 25

Risk Management Component of GRC

&

25

related responsibilities for establishing controls, a strategic framework, performance,

and accountability. Governance, a key portion of GRC principles, is embedded in many

of the chapters going forward but in particular in Chapter 6 on effective enterprise

governance practices and Chapter 10 on governance and risk portfolio management.

RISK MANAGEMENT COMPONENT OF GRC

The major objective of this book is to introduce and describe the importance of the COSO

enterprise risk management (ERM) framework and to describe how COSO ERM is a

key component of enterprise GRC principles. Chapter 3 discusses risk management

fundamentals in greater detail, but risk management should be part of the overall

enterprise culture from the board of directors and very senior officers down through the

enterprise. The chapters following emphasize that there are four interconnected steps

in effective GRC processes and in enterprise risk management as shown in Exhibit 2.3

and as follows:

1. Risk assessment and planning. An enterprise faces all levels of risks, whether

global issues based on weather or currency threats to weather-related threats at

local operations. We cannot plan or identify every type of risk that might impact an

enterprise, but there should be an ongoing analysis of these various potential risks

that may face an enterprise. These matters are discussed in Chapter 3.

2. Risk identification and analysis. Rather than just planning for the possibility of

some risk event occurring, there is a need for a more detailed analysis on the

likelihood of these risks coming to fruition as well as their potential impacts. There is

a need to quantify the impacts of the identified risks and to determine mitigation

strategies in the event the risk event occurs. Mitigation refers to assessing the best

way to manage or eliminate an identified risk. The final factors associated with these

EXHIBIT 2.3 GRC Risk Management Processes

C02

06/06/2011

16:47:15

26

Page 26

&

Importance of Governance, Risk, and Compliance Principles

risks should also be identified. An identified risk will be much more significant if

we can identify the total costs to the enterprise if the identified risk occurs.

3. Exploit and develop risk response strategies. Essentially a concept that should

be considered in parallel with risk identification, an enterprise should develop plans

and strategies to return to normal operations and then recover from the risk event.

This may include an analysis of risk-related opportunities. That is, if there is an

identified risk that some older production equipment may fail, an opportunity may

be to abandon that production line and install new equipment following a newer

technology and possibly even at a newer, more friendly location.

4. Risk monitoring. Tools and facilities should be in place to monitor for the

identified risks possibly occurring. A smoke detector fire alarm is an example

here, although most risk-related monitoring requires a wide series of special reports,

established and measurable standards, and a diligent human resources function.

The idea is to keep ahead and to reenter these prior risk management steps as

necessary.

Risk management should create value and be an integral part of organizational

processes. It should be part of decision-making processes and be tailored in a

systematic and structured manner to explicitly address the uncertainties an enterprise faces based on the best available information. In addition, risk management

processes should be dynamic, iterative, and responsive to change with the capabilities of continual improvements and enhancements. The COSO ERMrelated chapters

following look at many other aspects of risk management, a very important part of

GRC principles.

GRC AND ENTERPRISE COMPLIANCE

Compliance is the process of adhering to a set of guidelines or rules established by

government agencies, standards groups, or internal corporate policies. Adhering to

these compliance-related requirements is a challenge for an enterprise because of the

following issues:

&

&

The frequent introduction of new regulations. Using the United States as an

example, a wide swath of agencies, such as the Environmental Protection Agency

(EPA), regularly issue new rules that may have wide impacts on many enterprises,

despite their prime business purposes. Companies have a challenge to monitor these

rules and determine which apply to them.

Vaguely written regulations that require interpretation. Again using the

United States as an example, in 2010 Congress passed a massive health care

reorganization bill, which was printed on many thousands of pages, covering issues

and rules that the legislators who passed the bill never even read, let alone

understood. Even today, we are still looking at these rules and interpreting

what they mean. Compliance with those types of rules can be difficult.

C02

06/06/2011

16:47:15

Page 27

GRC and Enterprise Compliance

&

&

&

&

27

No consensus on best practices used for compliance. Rules are filled with

regulations stating such things as All transactions must be supported by a

receipt. Does such a rule require receipts for transactions less than $1.00, less

than $25.00, or some other value? There are often no guidelines here and everyone

seems to have their own interpretations.

Multiple regulations often overlap. U.S. states and local governmental units

from different geographies may issue rules that cover similar areas but may have

different requirements. These differences will be eventually resolved in court, but

compliance until matters are resolved can be a challenge.

Constantly changing regulations. Regulatory agencies in particular are often

constantly changing or reinterpreting their rules, making strict compliance

a challenge.

Therefore, compliance becomes a continuous process, not a one-time project, and

continues to drive business agendas as organizations are being held accountable for

meeting the myriad of mandates specific to their vertical markets.

In addition, enterprises might also be required to address cross-industry legislation,

such as Sarbanes-Oxley (SOx), discussed in Chapter 9, and other internal control

processes, such as ISO 9000 or Six Sigma. Simply stated, the breadth and complexity of

these laws and regulations has caused challenges for many enterprises over the years.

Enterprises need to approach their GRC compliance principles from a more strategic

perspective that could help them move beyond simply meeting individual compliance

mandates to realizing tangible business benefits from their infrastructure investments as

a whole.

The scope of compliance also permeates other aspects of an enterprise. Exhibit 2.4

illustrates some issues an enterprise should consider as it attempts to establish its

scope and approach to compliance. A consistent approach on the use of compliancedriven capabilities and supporting technologies across an enterprise can provide these

potential benefits:

&

&

&

Reduced total cost of ownership. Investments can be leveraged across multiple

regulations. For example, many regulations specify document retention requirements, which can be met by a single investment in a content and records management system.

Flexibility. One of the difficulties with compliance is that new regulations are

introduced and existing regulations are changed on a frequent basis. By centrally

managing compliance initiatives via organization-wide compliance architecture,

an enterprise can quickly adapt to these changes.

Competitive advantage. A broad and consistent compliance architecture can

allow an enterprise to better understand and control their business processes,

which allows them to respond more quickly and accurately to external or internal

pressures. Furthermore, certain regulations may contain tangible business benefits

through reduced minimum capital requirements, which could be enabled by an

enterprise-wide compliance architecture.

C02

06/06/2011

16:47:15

28

Page 28

&

Importance of Governance, Risk, and Compliance Principles

Scope of Compliance

Area for Considerations

Strategy

&

As an organization develops its strategy, it must determine which

regulations are relevant.

&

Compliance sustainability needs to be an integral part of any

compliance strategy.

Organization

&

The organizational structure must be established to meet the specific

requirements (or intent) of each regulation (e.g., Sarbanes-Oxley

recommends the Chief Executive Officer and President be two different

people).

Processes

&

Key processes must be documented and practiced.

&

Audits or reviews must take place to ensure documented processes

are effectively being used to address compliance/regulation

requirements.

&

Applications must be designed, implemented and continuously

tested to support the requirements of each regulation.

&

Data must be properly protected and handled according to each

regulation.

&

Facilities must be designed and available to meet the needs of each

regulation (i.e., some regulations may require records to be readily

available at an off-site location).

Applications and data

Facilities

EXHIBIT 2.4

Scope of Compliance Architectures Considerations

Effective GRC compliance processes help an enterprise to transform their business

operations and gain deeper insight and predictability from their business processes

as they address regulatory-driven requirements. Key business drivers here include

the ability to better manage information assets, demonstrate compliance with regulatory and legal obligations, reduce the risk of litigation, reduce cost of storage and

discovery, and demonstrate corporate accountability.

IMPORTANCE OF EFFECTIVE GRC PRACTICES

AND PRINCIPLES

In addition to effective risk management and COSO ERM processes, an enterprise needs

to adopt strong governance and compliance processes as well, with the objective of

establishing an effective GRC program. While many of the chapters going forward focus

on COSO ERM and the key elements of an effective risk management program, we

should not forget the importance of strong risk and governance processes. GRC practices

and principles will be folded into all of the following chapters, with several devoted to

specific risk and governance issues.

Chapter 6 discusses the importance of effective governance practices. It discusses

roles and responsibilities for the people and functions needed for effective governance

C02

06/06/2011

16:47:16

Page 29

Importance of Effective GRC Practices and Principles

&

29

and outlines approaches for communicating various levels of governance rules.

Similarly, Chapter 7 looks at compliance issues for todays enterprise. The chapter

outlines a framework approach for an enterprise to identify its most significant

compliance issues, to communicate those compliance rules, and then to monitor its

actual compliance performance. The chapter discusses how legal and internal audits

can help it to achieve compliance.

While enterprise risk management and COSO ERM are very important to an

enterprise, strong programs of governance and compliance are important as well.

An enterprise should focus many of its activities on following strong GRC principles.

C02

06/06/2011

16:47:16

Page 30

You might also like

- Resume SnehaDocument2 pagesResume SnehaHardik ModiNo ratings yet

- MedicalSafetyEnvironmentofCareManagementPlansforHospitals 2Document85 pagesMedicalSafetyEnvironmentofCareManagementPlansforHospitals 2ShofiaNo ratings yet

- Case 2 Nothern DigitalDocument2 pagesCase 2 Nothern Digitalzzz202xNo ratings yet

- The Three Lines of Defense Model at StudyCoDocument6 pagesThe Three Lines of Defense Model at StudyCoPintonov PutraNo ratings yet

- #3 Defining The Project WBS OBSDocument30 pages#3 Defining The Project WBS OBSKarinaNo ratings yet

- Audit Command LanguageDocument12 pagesAudit Command LanguageFrensarah RabinoNo ratings yet

- Chapter 6 - Internal ControlDocument36 pagesChapter 6 - Internal Controlsiti fatimatuzzahraNo ratings yet

- Materi Ibu Ningsih - Webinar IAPI-ACCA "Key Audit Matters in The Context of The New Audit Regulation"Document37 pagesMateri Ibu Ningsih - Webinar IAPI-ACCA "Key Audit Matters in The Context of The New Audit Regulation"sus anto100% (1)

- GRC PWC IntegritydrivenperformanceDocument52 pagesGRC PWC IntegritydrivenperformanceDeepak YakkundiNo ratings yet

- Rubric Pitch Deck-DraftDocument3 pagesRubric Pitch Deck-DraftHadii Jedank Wijaya100% (1)

- Key Audit Matters Aug 2019Document20 pagesKey Audit Matters Aug 2019ahmed naseerNo ratings yet

- CH 03Document30 pagesCH 03Mallika Grover100% (2)

- GE6757 - Total Quality Management PDFDocument31 pagesGE6757 - Total Quality Management PDFVashnavi Ruthra100% (1)

- Strategic Compensation PlannningDocument630 pagesStrategic Compensation PlannningArshdev Singh100% (1)

- Importance of Integrated Governance, Risk and Compliance PrinciplesDocument10 pagesImportance of Integrated Governance, Risk and Compliance PrinciplesVishal GargNo ratings yet

- Article-Designing Strategic Salary StructureDocument2 pagesArticle-Designing Strategic Salary StructureDaniela PopaNo ratings yet

- A Critical Look at CCPMDocument18 pagesA Critical Look at CCPMIsmael SandovalNo ratings yet

- A Critical Look at CCPMDocument18 pagesA Critical Look at CCPMIsmael SandovalNo ratings yet

- IS Auditing Creating Audit Programs - WHP - Eng - 0316.en - Id PDFDocument18 pagesIS Auditing Creating Audit Programs - WHP - Eng - 0316.en - Id PDFFachruddin FirmansyahNo ratings yet

- Minimum Viable ProductDocument4 pagesMinimum Viable ProductAdy LeeNo ratings yet

- CLV Bank customer lifetime valueDocument3 pagesCLV Bank customer lifetime valueFredie LeeNo ratings yet

- MS Project 2010 FormuleDocument31 pagesMS Project 2010 FormuleDijana Banić100% (2)

- Inventory ManagementDocument69 pagesInventory ManagementDeepika SethNo ratings yet

- Professional Due CareDocument19 pagesProfessional Due CareIqbal LhutfiNo ratings yet

- Teori Stewardship Raharjo 2007Document19 pagesTeori Stewardship Raharjo 2007arini ANo ratings yet

- Chapter 5Document56 pagesChapter 5Sugim Winata Einstein100% (1)

- Program Management Process Groups and Knowledge AreasDocument10 pagesProgram Management Process Groups and Knowledge Areaswahabot100% (1)

- CH 2 - Internal Audit's CBOK - MindmapDocument1 pageCH 2 - Internal Audit's CBOK - MindmapWenderlin KoswaraNo ratings yet

- Pertanyaan MenstraDocument5 pagesPertanyaan MenstraAGANo ratings yet

- Mayora Indah TBK PDFDocument84 pagesMayora Indah TBK PDFsherlijulianiNo ratings yet

- Case 5 LOD StudycoDocument1 pageCase 5 LOD StudycoImeldaNo ratings yet

- AKMEN CH 15 - Hansen MowenDocument29 pagesAKMEN CH 15 - Hansen MowenStella Tralalatrilili100% (1)

- Chapter 15Document12 pagesChapter 15Zack ChongNo ratings yet

- SOAL 14 - 6: Prevention Appraisal Internal Failure External FailureDocument6 pagesSOAL 14 - 6: Prevention Appraisal Internal Failure External FailureIndra YeniNo ratings yet

- Audit Intelligence and Audit Survival An Empirical Research of Tax AuditorDocument31 pagesAudit Intelligence and Audit Survival An Empirical Research of Tax AuditorDerrick RichardsonNo ratings yet

- De peres drug stores audit identifies IS control weaknessesDocument3 pagesDe peres drug stores audit identifies IS control weaknessesRahmad Bari BarrudiNo ratings yet

- Case - Ohio Rubber Works Inc PDFDocument3 pagesCase - Ohio Rubber Works Inc PDFRaviSinghNo ratings yet

- Earnings Management & Different ScandalsDocument16 pagesEarnings Management & Different ScandalsHasnain MinhasNo ratings yet

- CASE: IS Auditng: RequiredDocument1 pageCASE: IS Auditng: Requiredevel streetNo ratings yet

- Chapter 3 IT at WorkDocument19 pagesChapter 3 IT at WorkfarisNo ratings yet

- COSO Executive SummaryDocument5 pagesCOSO Executive SummaryabekaforumNo ratings yet

- Resume Chapter 1 Internal AuditDocument7 pagesResume Chapter 1 Internal AuditTommy Tia RaharjaNo ratings yet

- Reengineering Business Process To Improve Responsiveness: Accounting For TimeDocument17 pagesReengineering Business Process To Improve Responsiveness: Accounting For TimediahNo ratings yet

- Hertz Goes Wireless PG 252Document8 pagesHertz Goes Wireless PG 252Manisha PuriNo ratings yet

- Chapter 5 PPT 4th EditionDocument34 pagesChapter 5 PPT 4th EditionLê Na100% (1)

- ERP Helps Productivity at Northern Digital IncDocument10 pagesERP Helps Productivity at Northern Digital IncImeldaNo ratings yet

- Ujian Akhir Semester 2014/2015: Akuntansi InternasionalDocument5 pagesUjian Akhir Semester 2014/2015: Akuntansi InternasionalRatnaKemalaRitongaNo ratings yet

- MEF-Harry Hatry Performance MeasuremDocument36 pagesMEF-Harry Hatry Performance MeasuremDiyah CiptaNo ratings yet

- Kode QDocument11 pagesKode QatikaNo ratings yet

- Bab 12 Teknologi Informasi Meningkatkan AuditDocument28 pagesBab 12 Teknologi Informasi Meningkatkan AuditErlanggaNo ratings yet

- Chapter 11Document22 pagesChapter 11Yuxuan SongNo ratings yet

- Kasus MillerDocument3 pagesKasus MillerFirman NurzamanNo ratings yet

- Coso ErmDocument50 pagesCoso ErmBALLADINENo ratings yet

- Detect Earnings Manipulation with Discretionary Accrual ModelsDocument34 pagesDetect Earnings Manipulation with Discretionary Accrual ModelsAlmizan AbadiNo ratings yet

- Creating Journal EntriesDocument8 pagesCreating Journal EntriesBlake FryeNo ratings yet

- Iia & Rims, 2012 PDFDocument15 pagesIia & Rims, 2012 PDFsas23No ratings yet

- Kode Etik Akuntan Indonesia - SDWDocument122 pagesKode Etik Akuntan Indonesia - SDWDiah Ayu YunitasariNo ratings yet

- Merchant, Van Der Stede SLIDES - H04Document9 pagesMerchant, Van Der Stede SLIDES - H04Fitria Nur HidayahNo ratings yet

- Computer Fraud and Abuse TechniquesDocument12 pagesComputer Fraud and Abuse TechniquesSufrizal ChaniagoNo ratings yet

- 835-Article Text-3588-1-10-20210818Document15 pages835-Article Text-3588-1-10-20210818Widuri PutriNo ratings yet

- CH 14Document26 pagesCH 14Joshua JojoNo ratings yet

- Chapter 10 - Ethical Decision MakingDocument38 pagesChapter 10 - Ethical Decision MakingGraceNo ratings yet

- Measures of Financial RiskDocument18 pagesMeasures of Financial RiskshldhyNo ratings yet

- Boeing Financial Analysis PresentationDocument14 pagesBoeing Financial Analysis PresentationFranky FrankNo ratings yet

- AF201 ExamDocument14 pagesAF201 ExamShikhaNo ratings yet

- Prevention Appraisal Internal Failure External Failure: Iona CompanyDocument5 pagesPrevention Appraisal Internal Failure External Failure: Iona CompanyFrans KristianNo ratings yet

- Internal Audit Independence and ObjectivityDocument38 pagesInternal Audit Independence and ObjectivityMd Sifat KhanNo ratings yet

- Fraud Audit - Kelompok 10 - Consumen Fraud - FinalDocument56 pagesFraud Audit - Kelompok 10 - Consumen Fraud - Finalmeilisa nugrahaNo ratings yet

- Sarboox ScooterDocument6 pagesSarboox ScooterNisa SuriantoNo ratings yet

- COBIT and COSO frameworks for IT governance and ERMDocument4 pagesCOBIT and COSO frameworks for IT governance and ERMmelodie03100% (1)

- Importance of Governance, Risk, and Compliance Principles: ChaptertwoDocument10 pagesImportance of Governance, Risk, and Compliance Principles: ChaptertwoYuris ZegaNo ratings yet

- 2016 FRMPart 1 Quick SheetDocument6 pages2016 FRMPart 1 Quick SheetAman VermaNo ratings yet

- CRISC Exam QuestionsDocument261 pagesCRISC Exam QuestionsVishal Garg100% (5)

- Critical Chain ConceptsDocument16 pagesCritical Chain ConceptsPrateek GargNo ratings yet

- Critical Chain ConceptsDocument16 pagesCritical Chain ConceptsPrateek GargNo ratings yet

- CismDocument18 pagesCismJorgeNo ratings yet

- Critical ChainDocument15 pagesCritical ChainAjay KumarNo ratings yet

- Critical Chain ConceptsDocument16 pagesCritical Chain ConceptsPrateek GargNo ratings yet

- CRISC Exam Questions PDFDocument261 pagesCRISC Exam Questions PDFVishal Garg75% (12)

- Scrum Primer 20Document20 pagesScrum Primer 20Charlles PinonNo ratings yet

- Contract Management Guide - Ver 1Document101 pagesContract Management Guide - Ver 1Vishal Garg100% (2)

- Steve Jobs' 7 Principles of Breakthrough InnovationDocument10 pagesSteve Jobs' 7 Principles of Breakthrough InnovationPedro LaviNo ratings yet

- Performance Ambition - EnglishDocument1 pagePerformance Ambition - EnglishNeha SinghNo ratings yet

- CBOK TOP 10 RISKS (Navigating Technologys Top 10 Risks - Small)Document28 pagesCBOK TOP 10 RISKS (Navigating Technologys Top 10 Risks - Small)Jesus Espada FloresNo ratings yet

- PWC Kenya Graduate Recruitment 2012 BrochureDocument28 pagesPWC Kenya Graduate Recruitment 2012 BrochureJackpin Ole Ntummantan GalfenNo ratings yet

- International Business OrganizationDocument15 pagesInternational Business OrganizationHoàng Hiệp LưuNo ratings yet

- Pi-Chi Han VitaDocument24 pagesPi-Chi Han Vitaapi-561126393No ratings yet

- Usaid IndonisiaDocument191 pagesUsaid IndonisiaHany Malek100% (1)

- Key Terms of MarketingDocument8 pagesKey Terms of MarketingĐức Nguyễn Trần TríNo ratings yet

- BOODMO - Trusted Online Portal For Spare Parts For The Carmakers in Indian MarketDocument10 pagesBOODMO - Trusted Online Portal For Spare Parts For The Carmakers in Indian MarketDeepam harodeNo ratings yet

- Flow Penanganan DeviasiDocument4 pagesFlow Penanganan DeviasiGaluhNo ratings yet

- Domain 6Document70 pagesDomain 6Nagendra KrishnamurthyNo ratings yet

- 6 DragnicDocument42 pages6 DragniclengocthangNo ratings yet

- Ashish ChandrakarDocument2 pagesAshish ChandrakarKulsum ZaweriNo ratings yet

- 314 Chap 7&8Document9 pages314 Chap 7&8Jonah Marie TaghoyNo ratings yet

- Summer Internship Interim ReportDocument2 pagesSummer Internship Interim Reportbhavesh shettyNo ratings yet

- NurulhaziraResume 05072017Document3 pagesNurulhaziraResume 05072017nurulhaziraNo ratings yet

- Audit Dictionary - (Based On Standards Issued by AASB) : Definition As Given in Standards Relevant StandardDocument15 pagesAudit Dictionary - (Based On Standards Issued by AASB) : Definition As Given in Standards Relevant Standardshubham KumarNo ratings yet

- Acme Servicess HR PDFDocument2 pagesAcme Servicess HR PDF888 Abhishek RahaNo ratings yet

- Tugas ABC PDFDocument4 pagesTugas ABC PDFtutiNo ratings yet

- Devi Ahilya Vishwavidyalaya, Indore Bba (Foreign Trade) - 3 Years Fulltime Curriculum and Detailed SyllabusDocument39 pagesDevi Ahilya Vishwavidyalaya, Indore Bba (Foreign Trade) - 3 Years Fulltime Curriculum and Detailed SyllabusDrShailesh Singh ThakurNo ratings yet

- Deloitte Au Audit Chart Accounts 0812Document20 pagesDeloitte Au Audit Chart Accounts 0812rohitNo ratings yet

- Nesting ProcessDocument11 pagesNesting ProcessRajan SheikhNo ratings yet